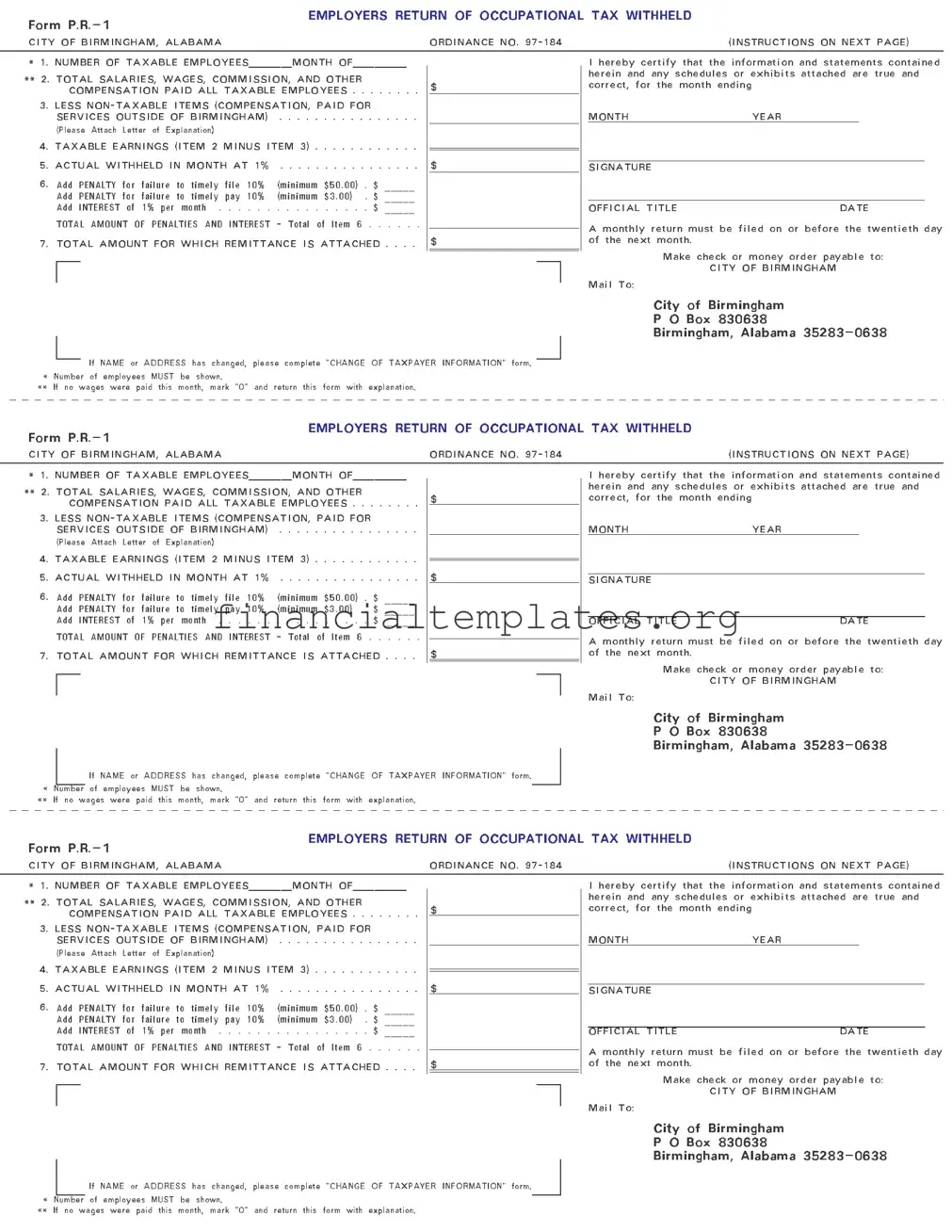

Get Occupational Tax Form

Navigating the complexities of the Occupational Tax form, formally known as Form P.R.-1, is essential for employers within the City of Birmingham, Alabama. This form embodies the city's ordinance No. 97-184, and outlines a meticulous process for reporting and remitting the occupational tax withheld from employees' earnings. Employers are tasked with detailing the number of taxable employees, total salaries, wages, commissions, and other compensations paid out, while also accounting for and subtracting non-taxable items, such as compensation for services rendered outside of Birmingham. The form further requires the calculation of taxable earnings, the actual tax withheld at the rate of 1%, and the addition of any pertinent penalties and interest for late filings or payments. To steer clear of legal repercussions, the form, along with the necessary remittance, must be filed monthly by the specified due date. With penalties for non-compliance ranging from minimum set amounts to percentage-based penalties, understanding the nuances of this process is critical. It serves not just as a legal obligation but as a testament to the rigor and attention to detail expected from businesses operating within the jurisdiction of Birmingham. This introduction sets the stage for a comprehensive exploration of the Occupational Tax form, guiding employers through its preparation, filing, and the implications of failing to meet the mandated requirements, ultimately ensuring compliance with Birmingham's local tax laws.

Occupational Tax Example

Document Specifics

| Fact Number | Description | Governing Law(s) |

|---|---|---|

| 1 | Employers must file Form P.R.-1 for occupational tax withheld. | Ordinance No. 97-184 |

| 2 | The form is specific to the City of Birmingham, Alabama. | Ordinance No. 97-184 |

| 3 | Employers must report the number of taxable employees. | Ordinance No. 97-184 |

| 4 | Total salaries, wages, commissions, and other compensation paid to all taxable employees must be reported. | Ordinance No. 97-184 |

| 5 | Non-taxable items, such as compensation for services outside of Birmingham, must be reported and deducted. | Ordinance No. 97-184 |

| 6 | The actual tax withheld at the rate of 1% must be reported. | Ordinance No. 97-184 |

| 7 | Penalties include a 10% penalty for failure to timely file (minimum $50.00) and a 10% penalty for failure to timely pay (minimum $3.00), plus 1% interest per month. | Ordinance No. 97-184 |

| 8 | Forms must be filed monthly, on or before the twentieth day of the following month. | Ordinance No. 97-184 |

| 9 | Payments should be made payable to: CITY OF BIRMINGHAM. | Ordinance No. 97-184 |

| 10 | If an employer's name or address changes, a "CHANGE OF TAXPAYER INFORMATION" form must be completed. | Ordinance No. 97-184 |

Guide to Writing Occupational Tax

Filling out the Occupational Tax form is a critical task for employers within the City of Birmingham, Alabama. It’s essential for accurately reporting salaries, wages, commissions, and other compensation paid to employees and ensuring the correct occupational tax is withheld and remitted. This guide will navigate the steps needed to complete the form correctly. Remember, filing accurately and on time helps avoid potential penalties and interest charges for late submissions.

- Identify the Total Number of Taxable Employees: Start by entering the total number of employees subject to the Birmingham occupational tax for the month in question.

- Report Total Salaries and Other Compensation: Calculate and enter the total amount of salaries, wages, commissions, incentive payments, bonuses, and other forms of compensation paid to taxable employees during the specified month.

- Deduct Non-Taxable Items: If any compensation was paid for services rendered outside of Birmingham, deduct these amounts from the total reported in step 2. Attach a letter of explanation detailing these non-taxable items.

- Calculate Taxable Earnings: Subtract the non-taxable items (item 3) from the total salaries and other compensation (item 2) to determine the taxable earnings.

- Determine Actual Tax Withheld: Calculate 1% of the taxable earnings determined in step 4. This is the actual occupational tax amount withheld for the month.

- Add Penalties and Interest if Applicable:

- Add a penalty for failure to file on time, which is 10% of the tax due or a minimum of $50.00, whichever is greater.

- Add a penalty for failure to pay on time, which is an additional 10% of the tax due or a minimum of $3.00, whichever is greater.

- Calculate interest of 1% per month on any unpaid tax and add this to the penalties.

- Complete Payment Information: Enter the total amount being remitted with the form, which includes the tax withheld plus any applicable penalties and interest.

- Sign and Date the Form: The employer or authorized representative must sign and date the form, attesting to its accuracy.

- Mail the Form and Payment: Make a check or money order payable to the City of Birmingham and mail it, along with the completed form, to the specified address. If there has been a change in the employer's name or address, complete the “CHANGE OF TAXPAYER INFORMATION” form.

Accurately completing and promptly submitting the Occupational Tax form ensures compliance and supports the smooth operation of your business in Birmingham. Careful attention to detail and adherence to the submission guidelines will help avoid unnecessary fines and keep your operations running smoothly.

Understanding Occupational Tax

Frequently Asked Questions about the Occupational Tax Form

-

What is the Occupational Tax Form P.R.-1?

The Occupational Tax Form P.R.-1 is a document that employers in Birmingham, Alabama, must fill out and submit to report and pay an occupational tax withheld from their employees’ earnings. This tax is set at a rate of 1% of gross salaries, wages, and commissions for work performed within the City of Birmingham.

-

Who needs to file this form?

Any employer with one or more employees working within the City of Birmingham needs to file this form. This includes payments to employees for services such as salaries, wages, commissions, incentive payments, bonuses, and other compensation.

-

Are there any exceptions to who is subject to this tax?

Yes, domestic servants employed in private homes are exempt from the Birmingham occupational tax and therefore are not reported on this form.

-

How often do I need to file this form?

Employers are required to file the Occupational Tax Form P.R.-1 monthly. The due date for submission is on or before the twentieth day of the month following the close of the calendar month being reported.

-

What happens if I file or pay late?

Late filings or payments are subject to penalties and interest. A 10% penalty (minimum $50) is added for failure to timely file, and a 10% penalty (minimum $3) is added for failure to timely pay. Additionally, interest at a rate of 1% per month is applied to late payments.

-

How do I calculate the taxable earnings?

Taxable earnings are calculated by subtracting non-taxable items (such as compensation for services performed outside of Birmingham) from the total salaries, wages, commissions, and other compensation paid to all taxable employees.

-

What should I do if no wages were paid in a month?

If no wages were paid during the month, indicate “0” on the form and return it with an explanation for the absence of payment.

-

Where do I mail the completed form and payment?

The completed form and any remittance should be mailed to: City of Birmingham, P.O. Box 830638, Birmingham, Alabama, 35283-0638. Acceptable forms of payment include check or money order made payable to the CITY OF BIRMINGHAM.

-

What if I need to update the employer's name or address?

If there has been a change in the employer’s name or address, please complete a "CHANGE OF TAXPAYER INFORMATION" form to ensure records are current and accurate.

Common mistakes

Filling out the Occupational Tax form can be a detailed process that demands close attention to instructions and specific guidelines. Quite often, individuals make errors that can lead to unnecessary delays, penalties, or legal complications. Understanding and avoiding these mistakes is crucial for employers tasked with this responsibility. Here are four common pitfalls encountered when completing the Occupational Tax form:

-

Incorrect Number of Taxable Employees: A critical step involves accurately reporting the number of taxable employees. This figure is essential for ensuring the correct amount of tax is calculated and withheld. Failing to include all taxable employees or incorrectly counting them can lead to discrepancies in the tax amount due, resulting in potential fines or penalties.

-

Failure to Accurately Report Total Salaries and Wages: All salaries, wages, commissions, and other forms of compensation paid to taxable employees must be meticulously reported. Errors in this area can significantly affect the tax withheld and remitted, leading to underpayments or overpayments. Employers must diligently aggregate and report these figures to avoid complications.

-

Omitting Non-Taxable Items: Not all compensation is subject to occupational tax. Compensation for services rendered outside of Birmingham, for instance, should be subtracted from the total salaries and wages paid. Neglecting to deduct these non-taxable items can inflate the taxable earnings figure, resulting in overpayment of taxes. Additionally, forgetting to attach the required letter of explanation for these deductions can raise red flags, prompting further scrutiny or audits.

-

Errors in Penalty and Interest Calculations: Late filings or payments trigger penalties and interest, which must be accurately calculated and added to the total tax due. Misunderstanding the penalty percentages or incorrectly calculating the accrued interest can lead to further financial discrepancies. Both underestimating and overestimating these amounts can have negative consequences, either by straining financial resources or by complicating reconciliations and audits.

To ensure compliance and accuracy while dealing with Occupational Tax forms, employers are urged to thoroughly review all instructions, double-check their calculations, and keep meticulous records of all taxable and non-taxable compensation. When in doubt, seeking professional advice or assistance can help avoid these common mistakes, ensuring timely and accurate tax reporting.

Documents used along the form

When filing the Occupational Tax form, businesses must sometimes submit additional documents to ensure all employee compensation and business activities are accurately reported and taxed. This ensures the city has a full picture of taxable activities within its jurisdiction.

- Employer Identification Number (EIN) Confirmation Letter: This letter from the IRS confirms the business's EIN, a necessary number for all tax-related filings.

- Business License Application: Used to apply for or renew a business license, this form must be in good standing to engage in business activities legally.

- W-2 Forms: Issued to employees annually, these forms report an employee's annual wages and the amount of taxes withheld from their paycheck.

- W-4 Forms: Completed by employees to indicate their tax situation to the employer, helping to determine how much should be withheld from their paychecks for taxes.

- 1099-NEC Forms: Used for reporting payments to independent contractors, these are necessary when businesses pay non-employees for services.

- Change of Taxpayer Information Form: If a business's address or other significant details change, this form updates the city's records to ensure all correspondence and filings are properly directed.

- Quarterly Payroll Tax Reports: These forms report the total earnings, taxes withheld, and final tax amounts for all employees on a quarterly basis.

- Application for Tax Certificate of Compliance: For businesses closing or moving out of the area, this form certifies that all local taxes have been paid to date.

Together, these forms and documents maintain the integrity of the tax system and support the accurate reporting and collection of occupational taxes. By keeping these documents in order and up-to-date, businesses contribute to their local community's financial health and ensure compliance with local regulations.

Similar forms

The Occupational Tax form, particularly seen in the context of the City of Birmingham, bears similarities to other tax-related documents and forms used in various jurisdictions and for different purposes. One such form is the Federal Income Tax Withholding Form W-4. Like the Occupational Tax form, the W-4 is used by employers to determine the amount of federal income tax to withhold from employees' wages. Both forms require information about the income level and, indirectly or directly, the employee's status that influences the amount of tax withheld. However, while the W-4 focuses on federal income tax, the Occupational Tax form is specific to local occupational taxes.

Another related document is the State Income Tax Withholding Form. Similar to the Occupational Tax form, this state-level equivalent mandates employers to withhold state income tax from their employees' earnings. Both forms are instrumental in ensuring compliance with local and state tax obligations by calculating tax based on wages, salaries, and other compensation. The main difference lies in the jurisdiction: state versus municipal, emphasizing the multi-layered tax obligations employers and employees face.

The Quarterly Federal Tax Return, Form 941, also shares similarities with the Occupational Tax form. This form is used by employers to report income taxes, social security tax, or Medicare tax withheld from employee's paychecks. Both forms play a critical role in the tax collection system, ensuring that taxes withheld from employees' earnings are duly reported and paid to the respective tax authorities on a periodic basis.

The Sales Tax Return is another document that, while differing in its focus on sales rather than income, aligns with the Occupational Tax form in its purpose of collecting taxes for goods and services. Businesses are responsible for calculating the tax owed, similar to how employers calculate tax withholdings for the Occupational Tax. Both forms serve to fund municipal services and infrastructure, illustrating the broader role of tax collection in public finance.

Business License Renewal forms, which businesses must file to maintain active licenses, share a connection with the Occupational Tax form in regulating and funding municipal operations. These forms require businesses to report earnings or other metrics that determine the license fee, akin to how the Occupational Tax form bases tax on employees' compensation. This illustrates the intertwining of tax and regulatory compliance in business operations.

The Unemployment Insurance Tax Filing forms, required by states from employers, are another parallel. These forms calculate contributions based on the wages paid to employees, similar to the Occupational Tax's focus on employees' earnings. The purpose here extends beyond revenue collection to providing a safety net for the unemployed, indicating the multifaceted purposes of various tax and contribution forms employers must manage.

Lastly, the Annual Information Return forms, such as the 1099 or W-2, although primarily informational and at the annual rather than monthly level, relate closely to the Occupational Tax form. They report the total compensation paid to employees or independent contractors over the year, impacting income and other tax calculations. This demonstrates how documentation and reporting requirements across different tax types are interconnected, contributing to a comprehensive taxation system.

Dos and Don'ts

Handling the Occupational Tax form requires careful attention to detail and adherence to specific guidelines. Below is a list of practices to follow and pitfalls to avoid in order to ensure the form is filled out accurately and in compliance with the requirements.

- Do ensure to read all instructions provided on the form before beginning to fill it out. This step is crucial for a clear understanding of each requirement.

- Do verify the total number of taxable employees and ensure it is accurately entered in the designated space on the form.

- Do accurately calculate the total salaries, wages, commissions, and other compensations paid to all taxable employees within the month and report it correctly.

- Do deduct non-taxable items with precision, including compensation paid for services performed outside of Birmingham, and attach a letter of explanation as required.

- Do review the calculations for taxable earnings, actual tax withheld, and the total amount of remittance attached to avoid any errors.

- Don't ignore the deadlines for filing and payment. The form must be filed and the occupational tax paid by the twentieth day of the month following the close of the calendar month to avoid any penalties.

- Don't forget to sign the form. An unsigned form may be considered incomplete and can result in a delay or penalty.

Adherence to these guidelines not only ensures compliance but also helps avoid unnecessary penalties or legal action. Precision and attention to detail when completing the Occupational Tax form can significantly ease the process for employers within the City of Birmingham.

Misconceptions

When it comes to filing the Occupational Tax form in Birmingham, Alabama, several misconceptions can lead to confusion or even incorrect filing. It's crucial for employers to understand the specifics of this obligation to ensure compliance and avoid penalties. Here are four common misconceptions explained:

- Only full-time employees are subject to occupational tax. This is inaccurate. The occupational tax applies to all employees, including part-time and temporary workers, earning a salary, wage, commission, or other forms of compensation for services performed within the City of Birmingham. The only exception to this rule pertains to domestic servants employed in private homes.

- Compensation paid for services outside of Birmingham is taxable. Many employers mistakenly believe all compensation paid to their employees, regardless of where the services are performed, is subject to Birmingham's occupational tax. However, compensation paid for services rendered outside of Birmingham should be deducted from the total salaries and wages when calculating the taxable amount.

- Filing and payment deadlines are flexible. Some employers might think that deadlines for filing the Occupational Tax form and making payments are suggestions rather than requirements. According to city ordinance, however, a monthly return must be filed, and the associated tax paid by the twentieth day of the month following the close of the calendar month for which the return is prepared. Failure to meet these deadlines results in penalties and interest charges.

- The penalty for late filing or payment is negotiable. The penalties for failing to file the Occupational Tax form on time or for late payment are predefined and non-negotiable. A minimum penalty of $50.00 is applied for failure to timely file, and a minimum of $3.00 for failure to timely pay, with an additional interest of 1% per month on the overdue amount. Employers cannot negotiate these penalties and interest charges.

Understanding these aspects of the Occupational Tax form is vital for employers in Birmingham, Alabama, to ensure compliance and avoid unnecessary penalties. Clearing up these misconceptions can save time, resources, and legal complications in managing occupational tax obligations.

Key takeaways

Filling out and using the Occupational Tax form is a critical task for employers within the City of Birmingham, Alabama. This guide aims to unpack the essentials, ensuring compliance and understanding of the process.

Understand Who is Subject: Every employer with one or more employees must withhold an occupational tax of 1% from gross salaries, wages, and commissions for work done within the City of Birmingham. It's important to note that all employees are subject to this tax, with the exception of domestic servants employed in private homes.

Monthly Return Requirement: A crucial aspect of compliance is the monthly return submission. Employers must file this return and pay the taxes due by the twentieth day of the month following the close of the calendar month. This routine ensures timely compliance and avoids potential legal complications.

Reporting Total Number of Employees: Item 1 on the form requires the entry of the total number of employees subject to the Birmingham occupational tax. This figure should reflect the full count of taxable employees for that particular month.

Reporting Total Compensation: Item 2 should include the total of salaries, wages, commissions, incentive payments, bonuses, and other forms of compensation paid to taxable employees during the month. If no compensation was paid during the month, employers should mark "0" and return the form with an explanation.

Deducting Non-Taxable Items: Item 3 allows for the deduction of compensation paid for services rendered outside the City of Birmingham. Employers must attach a letter of explanation for these deductions to ensure accuracy and transparency in their reporting.

Calculation of Taxable Earnings: The form requires employers to calculate taxable earnings by deducting the non-taxable items (Item 3) from the total compensation (Item 2). This figure represents the baseline for tax withholding.

Accurate Withholding and Penalties: Employers must accurately withhold the 1% tax (Item 5) and be mindful of penalties for failure to timely file or pay. Penalties include a minimum of $50 for late filing and a minimum of $3 for late payment, plus an interest of 1% per month.

Change of Information: Lastly, it is crucial for employers to update the City of Birmingham in case of any changes to their name or address, using the "CHANGE OF TAXPAYER INFORMATION" form. This ensures that all communications and responsibilities are accurately directed and fulfilled.

In summary, the Occupational Tax form is a vital document for employers in Birmingham, Alabama, ensuring compliance with local tax obligations. By adhering to these key takeaways, employers can navigate the process efficiently, ensuring their contributions support the city's infrastructure and services.

Popular PDF Documents

W8 Ben E Form 2023 - Necessary documentation for foreign entities to avoid being overtaxed on U.S. income.

IRS 4137 - By facilitating the accurate reporting of tips, this form helps define the scope of taxable income within the service industry.