Get Nyc Commercial Rents Tax Return Form

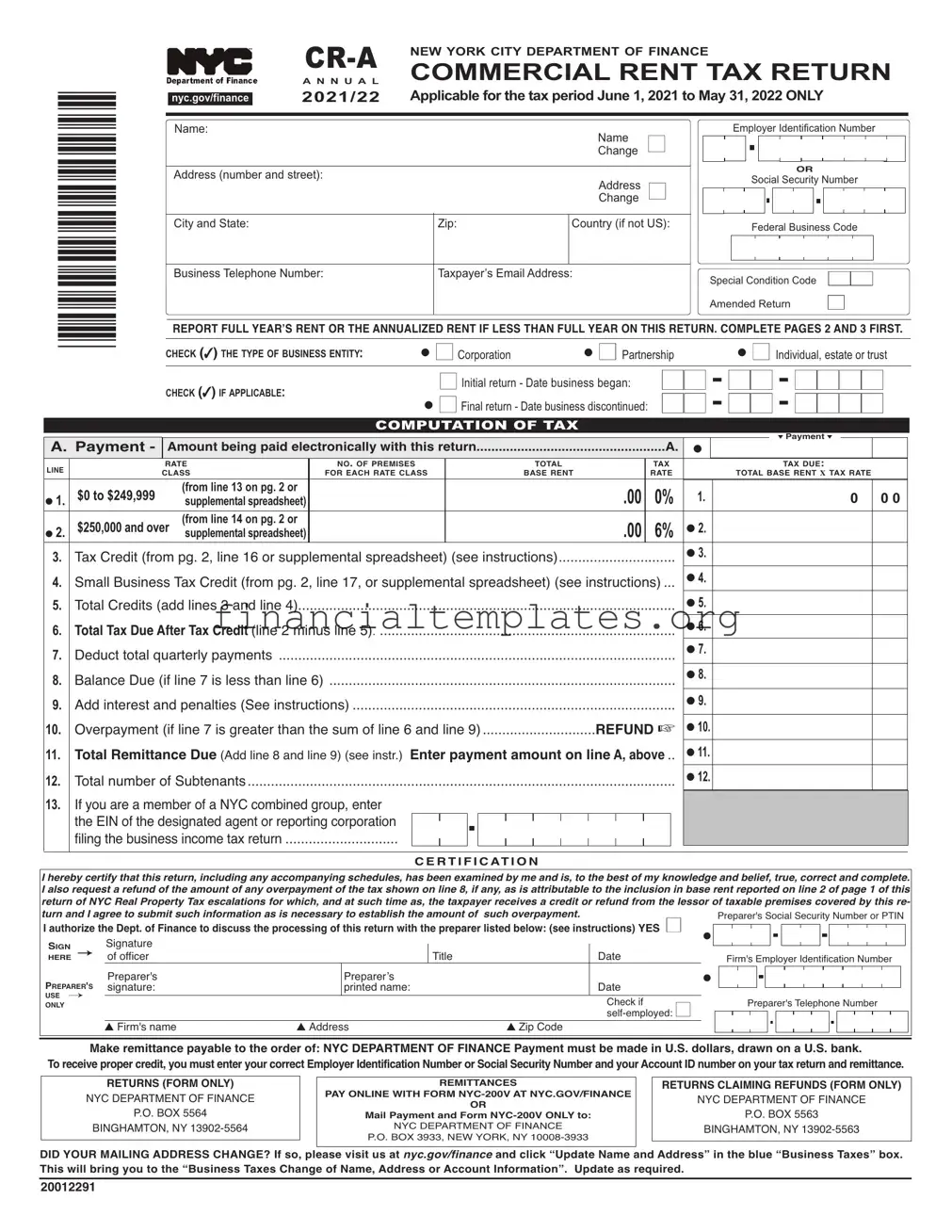

The Annual Commercial Rent Tax Return for the fiscal year 2020/21, denoted as Form CR-A, is a necessary document for businesses operating within New York City boundaries that remit rent for their commercial spaces. Formulated by the New York City Department of Finance, this return is crucial for firms with rented premises used for business purposes, as it calculates the tax due based on the annual or annualized rent payments exceeding certain thresholds. Notably, the form encompasses various segments including the firm's and preparer's identification details, the computation of the tax owed, and potential tax credits, with distinct sections dedicated to outlining the information for up to three rental premises. It serves as a comprehensive tool for reporting a full year's rent— or the annualized rent for shorter tenancy periods—while also accommodating alterations like name and address changes. Small businesses may find the small business tax credit section particularly relevant, as it provides a means to diminish their tax burden based on specific qualifying criteria. Additionally, the document provides avenues for electronic filing and payment, underscoring the city's effort to streamline tax compliance processes for commercial renters.

Nyc Commercial Rents Tax Return Example

*20012291*

|

|

NEW YORK CITY DEPARTMENT OF FINANCE |

|

|

|

A N N U A L |

COMMERCIAL RENT TAX RETURN |

|

|

2021/22 |

ApplicableforthetaxperiodJune1,2021toMay31,2022ONLY |

|

nyc.gov/finance |

||

|

|

|

|

Name: |

Employer Identification Number |

|

ChangeName |

■ |

|

Address (number and street): |

OR |

|

Social Security Number |

||

ChangeAddress |

||

■ |

City and State: |

Zip: |

Country (if not US): |

|

Federal Business Code |

||||||

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Telephone Number: |

Taxpayer’s Email Address: |

Special Condition Code |

■■ |

|||||||

|

|

|

||||||||

|

|

|

Amended Return |

■ |

||||||

|

|

|

|

|

|

|

|

|

|

|

REPORT FULL YEAR’S RENT OR THE ANNUALIZED RENT IF LESS THAN FULL YEAR ON THIS RETURN. COMPLETE PAGES 2 AND 3 FIRST.

CHECK (✓)THE TYPE OF BUSINESS ENTITY: |

● ■Corporation |

● ■ Partnership |

● ■ Individual, estate or trust |

CHECK (✓)IF APPLICABLE:

■Initial return - Date business began:

● ■Final return - Date business discontinued:

COMPUTATION OF TAX

|

|

|

|

|

|

|

|

|

|

|

|

|

▼ Payment ▼ |

|

|

A. Payment - |

Amount being paid electronically with this return |

|

A. |

● |

|

|

|

|

|||||||

LINE |

|

RATE |

|

NO. OF PREMISES |

|

TOTAL |

|

TAX |

|

|

|

TAX DUE: |

|||

|

CLASS |

|

FOR EACH RATE CLASS |

|

BASE RENT |

|

RATE |

|

|

TOTAL BASE RENT X TAX RATE |

|||||

|

$0 to $249,999 |

|

(from line 13 on pg. 2 or |

|

|

|

|

.00 |

0% |

|

1. |

0 |

0 0 |

||

● 1. |

|

supplemental spreadsheet) |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$250,000 and over |

(from line 14 on pg. 2 or |

|

|

|

|

.00 |

6% |

● |

2. |

|

|

|

|

|

● 2. |

supplemental spreadsheet) |

|

|

|

|

|

|

|

|

||||||

3. |

Tax Credit (from pg. 2, line 16 or supplemental spreadsheet) (see instructions) |

|

|

● |

3. |

|

|

|

|

||||||

|

|

|

|

|

|

|

|||||||||

4. |

Small Business Tax Credit (from pg. 2, line 17, or supplemental spreadsheet) (see instructions) |

● |

4. |

|

|

|

|

||||||||

|

|

|

|

|

|

||||||||||

5. |

Total Credits (add lines 3 and line 4) |

|

|

|

|

|

● |

5. |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||||||

6. |

Total Tax DueAfter Tax Credit(line 2 minus line 5) |

|

|

|

● |

6. |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||||||

7. |

Deduct total quarterly payments |

|

|

|

|

|

● |

7. |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||||

8. |

Balance Due (if line 7 is less than line 6) |

|

|

|

|

|

● |

8. |

|

|

|

|

|||

......................................................................................... |

|

|

|

|

|

|

|

|

|

|

|||||

9. |

Add interest and penalties (See instructions) |

|

|

|

● |

9. |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||||||

10. |

Overpayment (if line 7 is greater than the sum of line 6 and line 9) |

REFUND ☞ |

● 10. |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||

11. |

Total Remittance Due (Add line 8 and line 9) (see instr.) Enter payment amount on lineA, above.. |

● 11. |

|

|

|

|

|||||||||

12. |

Total number of Subtenants |

|

|

|

|

|

● |

12. |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||||

13.If you are a member of a NYC combined group, enter the EIN of the designated agent or reporting corporation filing the business income tax return .............................

CERTIFICATION

I hereby certify that this return, including any accompanying schedules, has been examined by me and is, to the best of my knowledge and belief, true, correct and complete. I also request a refund of the amount of any overpayment of the tax shown on line 8, if any, as is attributable to the inclusion in base rent reported on line 2 of page 1 of this return of NYC Real Property Tax escalations for which, and at such time as, the taxpayer receives a credit or refund from the lessor of taxable premises covered by this re- turn and I agree to submit such information as is necessary to establish the amount of such overpayment.

I authorize the Dept. of Finance to discuss the processing of this return with the preparer listed below: (see instructions) YES ■

HERESIGN |

Signature |

→ of officer |

Preparer's PREPARER'S signature:

USE →

ONLY

|

Title |

Date |

Preparer’s |

|

|

printed name: |

Date |

|

|

|

|

Check if

▲ Firm's name |

▲ Address |

▲ Zip Code |

Make remittance payable to the order of: NYC DEPARTMENT OF FINANCE Payment must be made in U.S. dollars, drawn on a U.S. bank.

Toreceivepropercredit,youmustenteryourcorrectEmployerIdentificationNumberorSocialSecurityNumberandyourAccountIDnumberonyourtaxreturnandremittance.

RETURNS (FORM ONLY)

NYC DEPARTMENT OF FINANCE

P.O. BOX 5564

BINGHAMTON, NY

REMITTANCES

PAY ONLINE WITH FORM

OR

Mail Payment and Form

NYC DEPARTMENT OF FINANCE

P.O. BOX 3933, NEW YORK, NY

RETURNS CLAIMING REFUNDS (FORM ONLY)

NYC DEPARTMENT OF FINANCE

P.O. BOX 5563

BINGHAMTON, NY

DID YOUR MAILING ADDRESS CHANGE? If so, please visit us at nyc.gov/finance and click “Update Name and Address” in the blue “Business Taxes” box. This will bring you to the “Business Taxes Change of Name, Address or Account Information”. Update as required.

20012291

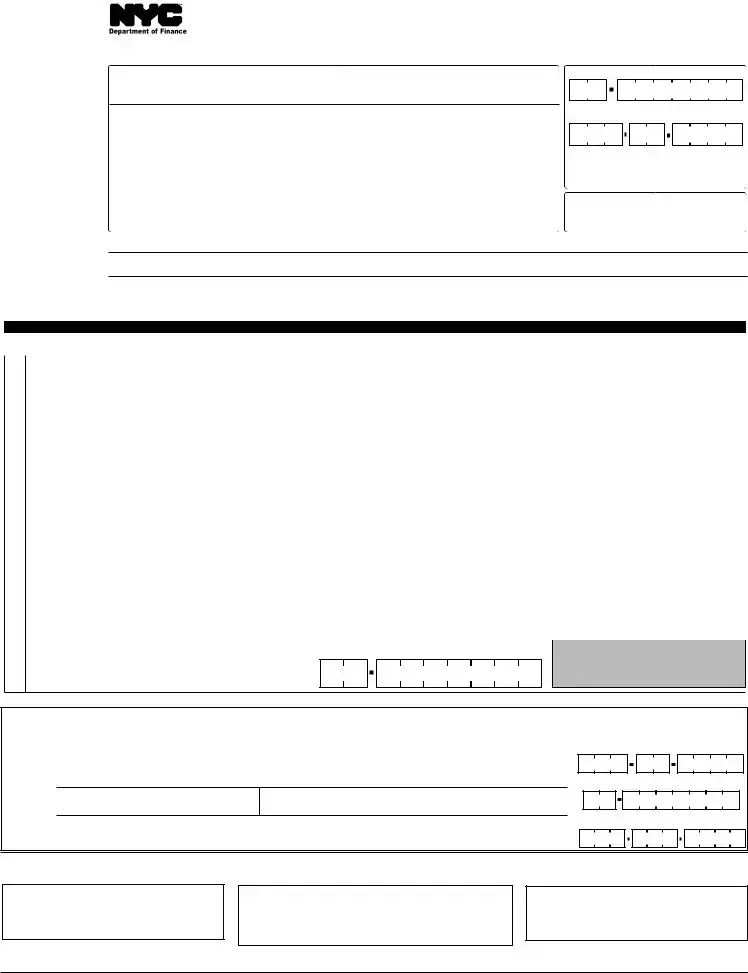

Form |

Page 2 |

YOU MAY FILE ELECTRONICALLY AT NYC.GOV/ESERVICES. IF YOU ARE FILING ON PAPER, USE THIS PAGE IF YOU HAVE THREE OR LESS PREM- ISES/SUBTENANTS OR MAKE COPIES OF THIS PAGE IF YOU HAVE ADDITIONAL PREMISES/SUBTENANTS. IF YOU CHOOSE TO USE A SPREADSHEET, YOU MUST USE THE CRA.FINANCE SUPPLEMENTAL SPREADSHEET WHICH YOU CAN DOWNLOAD FROM OUR WEBSITE AT WWW.NYC.GOV/CRTINFO.

EACH LINE MUST BE ACCURATELY COMPLETED. YOUR DEDUCTION WILL BE DISALLOWED IF INACCURATE INFORMATION IS SUBMITTED.

LINE |

DESCRIPTION |

PREMISES 1 |

PREMISES 2 |

PREMISES 3 |

||||

● 1a. |

Street Address ................................................................ 1a. |

|

|

|

|

|

|

|

1b. |

Zip Code ..........................................................................1b. |

________________________________________________________________________________________ |

||||||

1c/d. Block and Lot Number ...............................................1c/1d. ________________________________________________________________________________________ |

||||||||

|

|

|

1c. BLOCK |

1d. LOT |

1c. BLOCK |

1d. LOT |

1c. BLOCK |

1d. LOT |

● 2. |

Gross Rent Paid (see instructions) |

2. |

________________________________________________________________________________________ |

3. |

Rent Applied to Residential Use |

3. |

________________________________________________________________________________________ |

4a1. |

SUBTENANT'S NameifPartnershiporCorporation |

|

|

|

(if more than one subtenant, see instructions) |

4a1. |

________________________________________________________________________________________ |

●4a2. Employer Identification Number (EIN) for

|

partnerships or corporations |

4a2. |

● EIN ________________________ ● EIN ________________________ ● EIN _______________________ |

|||||

4b1. |

SUBTENANT'S NameifIndividual |

4b1. |

________________________________________________________________________________________ |

|||||

4b2. |

Social Security Number (SSN) for individuals |

4b2. |

● SSN _______________________ ● SSN _______________________ ● SSN _______________________ |

|||||

4c. |

RentreceivedfromSUBTENANT |

|

|

|

|

|

|

|

|

(if more than one subtenant, see instructions) |

4c. |

___________________________________________________________________________________________________ |

|||||

4d1. |

Is this rent paid for a period less than 12 months? .. |

4d1. |

YES ■ |

NO ■ |

YES ■ |

NO ■ |

YES ■ |

NO ■ |

4d2. |

If YES, how many months? |

4d2. |

Total number of months:_______________ |

Total number of months:_______________ |

Total number of months:_______________ |

|||

5a. |

Other Deductions (attach schedule) |

5a. |

________________________________________________________________________________________ |

|||||

5b. |

Commercial Revitalization Program |

|

|

|

|

|

|

|

|

special reduction (see instructions) |

5b. |

________________________________________________________________________________________ |

|||||

6. |

Total Deductions (add lines 3, 4c, 5a and 5b) |

6. |

________________________________________________________________________________________ |

|||||

7.Base Rent Before Rent Reduction (line 2 minus line 6)...7. ________________________________________________________________________________________

4If the line 7 amount represents rent for less than the full year, proceed to line 10, or

NOTE 4If the line 7 amount plus the line 5b amount is $249,999 or less and represents rent for a full year, transfer line 9 to line 13, or 4If the line 7 amount plus the line 5b amount is $250,000 or more and represents rent for a full year, transfer line 9 to line 14

8. |

35% Rent Reduction (35% X line 7) |

8. |

________________________________________________________________________________________ |

||||||

9. |

Base Rent Subject to Tax (line 7 minus line 8) |

9. |

________________________________________________________________________________________ |

||||||

|

|

|

|

|

|

|

|

|

|

|

COMPLETE LINES 10 THROUGH 12 ONLY IF YOU RENTED PREMISES FOR LESS THAN THE FULL YEAR |

||||||||

10. |

Tenants whose rent is not paid on a monthly basis, check box |

|

■ |

■ |

■ |

||||

|

and see instructions. Others complete lines 10a through12. ... |

10. |

__________________________________________________________________________________________ |

||||||

10a. |

Number of Months at Premises during the tax period |

10a. # of months |

10b. From: |

10a. # of months |

10b. From: |

10a. # of months |

10b. From: |

||

|

|

|

|

10c. To: |

|

10c. To: |

|

|

10c. To: |

|

|

|

|

_________________________________________________________________________________________________________________ |

|

||||

11.Monthly Base Rent before rent reduction

(line 7 plus line 5b divided by line 10a) |

11. ________________________________________________________________________________________ |

12.Annualized Base Rent before rent reduction

(line 11 X 12 months or line 4 from worksheet on page 3) .12. ________________________________________________________________________________________

■If the line 12 amount is $249,999 or less, transfer the line 9 amount (not the line 12 amount) to line 13

■If the line 12 amount is $250,000 or more, transfer the line 9 amount (not the line 12 amount) to line 14

*20022291*

|

RATE CLASS |

|

TAX RATE |

|

TRANSFER THE AMOUNTS FROM LINES 13 THROUGH 16 TO THE CORRESPONDING LINES ON PAGE 1 |

|

|

|

|

|

|

13.($0 - 249,999) .........0%.......13.________________________________________________________________________________________

14.($250,000 or more)... 6%.......14.________________________________________________________________________________________

15.Tax Due before credit

(line 14 multiplied by 6%) ........15.________________________________________________________________________________________

16.Tax Credit (see worksheet below) .16.________________________________________________________________________________________

17.Small Business Tax Credit (from pg. 3, or supplemental

spreadsheet) (see instructions)....17.________________________________________________________________________________________

Note: The tax credit only applies if line 7 plus line 5b (or line 12, if applicable) is at least $250,000, but is less than $300,000. All others enter zero.

|

|

TAX CREDIT COMPUTATION WORKSHEET |

|

■ If the line 7 amount represents rent for the full 12 month period, your credit is calculated as follows: |

|

|

Amount on line 15 |

X ($300,000 minus the sum of lines 7 and 5b) = ___________________= your credit |

|

|

$50,000 |

|

■ If the line 7 amount represents rent for less than the full 12 month period, your credit is calculated as follows: |

|

20022291 |

Amount on line 15 |

X ($300,000 minus line 12) = ___________________ = your credit |

|

||

|

|

$50,000 |

|

|

|

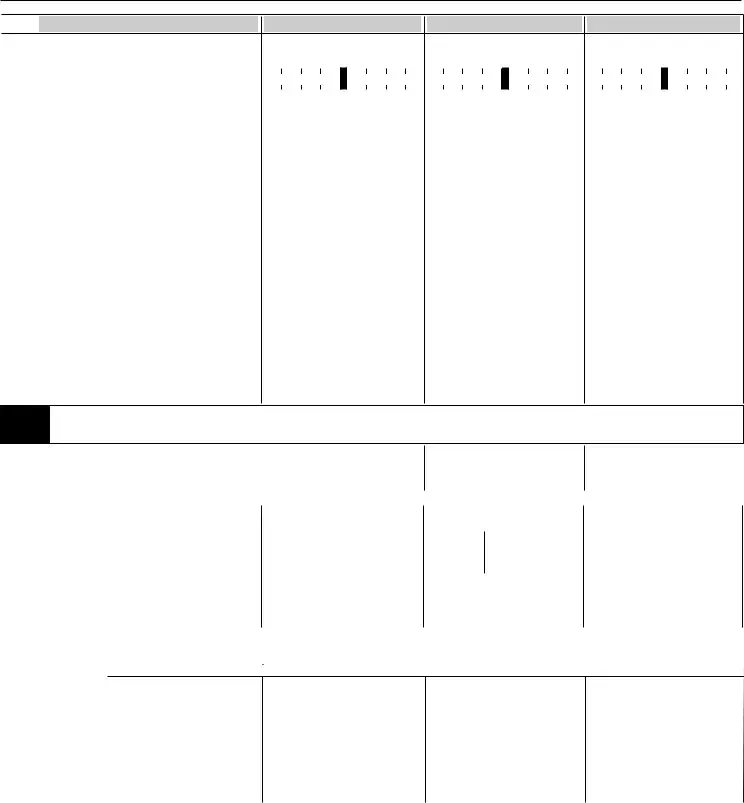

Form |

Page 3 |

IF YOU ARE FILING ON PAPER, USE THIS PAGE IF YOU HAVE THREE OR LESS PREMISES OR MAKE COPIES IF YOU HAVE ADDITIONAL PREMISES. IF YOU CHOOSE TO USE A SPREADSHEET, YOU MUST USE THE SUPPLEMENTAL SMALL BUSI- NESS TAX CREDIT WORKSHEET WHICH YOU CAN DOWNLOAD FROM OUR WEBSITE AT WWW.NYC.GOV/CRTINFO.

TO QUALIFY FOR SMALL BUSINESS TAX CREDIT

A. Is your "total income" as defined by Ad. Code Section |

■ YES |

■ NO |

If your answer to Question A is NO, you are not eligible for this credit. |

|

|

B. Is your "Base Rent Before Rent Reduction" (page 2, line 7) for any premises at least $250,000 but less than $550,000?...... ■ YES ■ NO

If the answer to this Question is NO for any of the premises, you are not eligible for this credit for those premises whose Base Rent

BeforeReductioniseitherlessthan$250,000 orequaltoorgreaterthan$550,000 andyoushouldnotcompletethisworksheetforthosepremises.

INCOME FACTOR CALCULATIONS - Complete either lines 1a and 1b OR lines 2a and 2b |

||||||||||||||||

1a. Enter amount of total income, if total income is $5,000,000 or less (see instructions) |

|

1a. |

______________________________________ |

|||||||||||||

1b. Income factor (see instructions) |

|

|

|

|

|

|

1b. |

______________________________________ |

||||||||

2a. Enter amount of total income if total income is more than $5,000,000 |

|

|

|

|

|

|

|

|

|

|||||||

but less than $10,000,000 (see instructions) |

|

|

|

|

|

|

2a. |

______________________________________ |

||||||||

2b. If total income is more than $5,000,000 but less than $10,000,000: |

|

|

|

|

|

|

|

|

|

|||||||

Income Factor is (10,000,000 - line 2a) / 5,000,000 |

|

2b. |

______________________________________ |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RENT FACTOR CALCULATIONS - Complete either lines 3a and 3b OR lines 4a and 4b |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3a. Enter amount of base rent, if base |

|

PREMISES |

|

|

|

|

PREMISES |

|

|

|

|

PREMISES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

rent from Page 2, line 7 is less |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

than $500,000 |

|

3a. |

_________________________________________________________________________________________ |

|||||||||||||

3b. Rent factor (see instructions) |

3b. |

_________________________________________________________________________________________ |

||||||||||||||

4a. Enter amount of base rent if base rent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

from Page 2, line 7 is at least |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$500,000 but less than $550,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(see instructions) |

4a. |

_________________________________________________________________________________________ |

||||||||||||||

4b. If base rent from Page 2, line 7 is at least |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$500,000 but less than $550,000: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rent Factor is ($550,000 - line 4a) / 50,000 |

4b. |

_________________________________________________________________________________________ |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CREDIT CALCULATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5a. Page 2, line 15 (Tax at 6%) |

5a. |

_________________________________________________________________________________________ |

||||||||||||||

5b. Page 2, line 16 (Tax Credit from Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit Computation Worksheet on Page 2) |

5b. |

_________________________________________________________________________________________ |

||||||||||||||

5c. (line 5a - line 5b) X (line 1b or 2b) X (line 3b or 4b). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter here and on Page 2, line 17 |

5c. |

_________________________________________________________________________________________ |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WORKSHEET FOR TENANTS WHO PAY RENT FOR A PERIOD OTHER THAN ONE MONTH |

|||||||||||||||

|

To determine the annualized rent, divide the rent paid during the tax period by the number of days for which the rent was paid and multiply |

|||||||||||||||

|

the result by the number of days in the tax year. Enter the result on line 4 here and on Form |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PREMISES |

|

|

PREMISES |

|

|

|

|

PREMISES |

|

||||

*20032291* |

1. Amount of rent paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for the period ................... 1. |

_____________________________________________________________________________________ |

||||||||||||||

|

2. Number of days in the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

rental period for which |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

rent was paid................... 2. |

_____________________________________________________________________________________ |

||||||||||||||

|

3. Rent per day (divide |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

line 1 by line 2. Round to |

|

|

|

|

|

|

|

|

|

|

|||||

|

the nearest whole dollar). 3. |

_____________________________________________________________________________________ |

||||||||||||||

|

4. Annualized rent (multiply |

|

|

|

|

|

|

|

|

|

|

|||||

|

rent per day, line 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

by 365. In case of a leap |

|

|

|

|

|

|

|

|

|

|

|||||

|

year, multiply by 366. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Round to the nearest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

whole dollar).................... 4. |

_____________________________________________________________________________________ |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20032291 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document Specifics

| Fact Name | Description |

|---|---|

| Governing Law | New York City Department of Finance |

| Form Identifier | CR-A Annual Commercial Rent Tax Return |

| Tax Period | June 1, 2020 to May 31, 2021 |

| Filing Entity Types | Corporation, Partnership, Individual, Estate, or Trust |

| Special Features | Options for Amended Return, Initial or Final Return, and Small Business Tax Credit |

| Electronic Payment Requirement | Amount being paid electronically with this return |

| Supplemental Documents | Option to use CRA.Finance supplemental spreadsheet for reporting |

Guide to Writing Nyc Commercial Rents Tax Return

Before beginning to fill out the NYC Commercial Rents Tax Return form for the tax period covering June 1, 2020, to May 31, 2021, it's important to gather all the required information. This comprehensive form is designed to calculate and report the commercial rent tax owed by businesses operating within New York City. Given the nuances involved, understanding each step is crucial to ensure accuracy, which further aids in avoiding potential penalties and maximizing applicable credits.

- Start with the basic information about your business. Enter your firm's name and check the box if there are any changes to your name since the last filing. Similarly, update your address, city, state, and zip code details and check the box if there have been any changes.

- Provide your Employer Identification Number (EIN) or Social Security Number if you’re an individual, estate, or trust. Include your federal business code, business telephone number, and email address to ensure the Department of Finance can reach you for any queries.

- Indicate whether this return is an amendment to a previous filing by checking the "Amended Return" box. If this is your first time filing or if it's the final return due to the discontinuation of business, mark the respective box and include the date business began or ended.

- Under "Computation of Tax," start by completing PAGE 2 and PAGE 3 or the supplemental spreadsheet, if applicable, before proceeding to the main form.

- Enter the full year’s rent or the annualized rent for the period June 1, 2020, to May 31, 2021, in the dedicated section for tax computation.

- Calculate the tax due based on your base rent, using the specified rate classes. If your annual rent exceeds certain thresholds, apply the appropriate tax rate to determine the preliminary tax due.

- Subtract any tax credits you are eligible for, including the Small Business Tax Credit if applicable, from the preliminary tax to calculate the total tax due after credits.

- Deduct any quarterly payments you’ve made throughout the fiscal year from the total tax due to find out the balance.

- Include any interest and penalties if your tax payments are late.

- Should there be an overpayment, note the amount, which could result in a refund or be applied to future tax liabilities.

- Finally, total the remittance due, ensuring to add any balance due and interest or penalties. Enter this amount in the payment section at the top of the form.

- Sign and date the form, certifying that the information provided is accurate to the best of your knowledge. If a preparer assisted with completing the form, their information should also be included.

After completing the form, make sure to double-check all entries for accuracy. If you’re submitting a payment with your return, write a check payable to the NYC Department of Finance, including your correct EIN or Social Security Number and the Account ID number on your tax return and remittance. Mail the payment alongside Form NYC-200V to the specific address provided for payments or submit it online at the NYC government finance website. Returns claiming refunds should be sent through the specified address for such claims. Remember, properly filling this form is essential for compliance with local tax laws and for supporting the fair assessment and collection process.

Understanding Nyc Commercial Rents Tax Return

- What is the New York City Annual Commercial Rent Tax Return (Form CR-A)?

- Who needs to file the NYC Commercial Rent Tax Return?

- How is the tax calculated on the form?

- What are the available tax credits and how can I claim them?

- What should I do if my business started or stopped operations during the tax year?

- How do I report subtenants?

- Can I file this form electronically?

- What should I do if my mailing address has changed?

- Where do I send my payment or form?

The New York City Annual Commercial Rent Tax Return (Form CR-A) is a document businesses must complete for the tax period June 1, 2020 to May 31, 2021, if they rent space within New York City. This form is used to calculate the commercial rent tax (CRT) owed based on the rent paid for commercial premises.

Any business renting space in New York City where the annual or annualized rent is more than $250,000 has to file this form. This includes corporations, partnerships, individuals, estates, and trusts engaging in commercial activities within the city.

The tax is calculated by applying a tax rate to your base rent amount. For rents between $0 to $249,999, the tax rate applied is 0%. For annual rents $250,000 and over, the tax rate is 6%. Before calculating the tax, you can deduct certain amounts, including rent for residential use, subtenant rents, and other eligible deductions.

Two main types of tax credits are available: the Tax Credit and the Small Business Tax Credit. Eligibility depends on your total rent amount and, for the Small Business Tax Credit, your total income. These credits are computed on the form and deducted from the total tax due.

If you began or discontinued your business within the tax year, you should mark the appropriate box ('Initial return' or 'Final return') on the form and provide the relevant dates. This information helps to properly assess your tax liability for the part of the year your business was operational.

If you have subtenants, you must report the rent received from them on the form. Subtenant information includes names, identification numbers (EIN or SSN), and the portion of rent they contribute. Rent from subtenants can be deducted from your total gross rent to determine the base rent subject to CRT.

Yes, electronic filing is available and encouraged for faster processing. Visit the NYC.gov/eServices to file electronically. If you choose to file on paper, specific mailing addresses are provided depending on whether you're also making a payment or claiming a refund.

If your mailing address has changed, update your information by visiting nyc.gov/finance and clicking "Update Name and Address" under the "Business Taxes" section. Keeping your address current ensures you receive all relevant tax correspondence.

Payments should be made online or mailed to the NYC Department of Finance at the address provided for Form NYC-200V. For filing the returns or claims for refunds, separate addresses are provided. Ensure you select the correct address to avoid processing delays.

Common mistakes

Not entering the Firm's Employer Identification Number (EIN) correctly: This key piece of information is vital for the tax return's processing. Mistakes here could mean the return is attributed to the wrong entity.

Using an incorrect Preparer's Social Security Number or PTIN: Such inaccuracies can lead to issues with who is recognized as the preparer of the document, affecting accountability and possibly delaying processing.

Failure to accurately report the full year’s rent or the annualized rent if the premises were rented for less than a full year: This misstep can lead to an incorrect tax calculation, affecting the total tax due.

Incorrectly checking the type of business entity: The tax implications can vary significantly between corporations, partnerships, and individuals. An error here could lead to the wrong tax calculations and legal implications.

Forgetting to mark the return as initial, final, or amended: This information gives the Department of Finance context regarding the stage or change in your business status, affecting how your return is processed.

Omitting or inaccurately entering the payment amount being paid electronically: This mistake could affect your financial records and lead to discrepancies in the amount of tax owed versus the amount paid.

Inaccurate calculation of the tax due, including overlooking deductions for which the business may qualify: This could either lead to overpaying tax or underpaying and facing penalties.

Not accurately reporting the total number of subtenants or incorrectly calculating rent received from subtenants: This information is crucial for determining the correct tax rate and total tax due.

Misinterpreting or incorrectly applying the small business tax credit: This mistake can result in a business not taking full advantage of available credits, leading to unnecessarily high tax payments.

Common oversights like these not only delay the processing of the tax return but may also lead to financial penalties. Carefully reviewing the form before submission can help avoid these pitfalls.

Documents used along the form

Filing the New York City Annual Commercial Rent Tax Return, known as Form CR-A, requires thorough preparation and attention to detail. To assist businesses in navigating through the complexities of this process, it's invaluable to be aware of the additional forms and documents that are often required alongside the main return form. Understanding these additional requirements can ensure a smoother filing experience and help uphold compliance with city regulations.

- Form NYC-200V Payment Voucher: This is used for making electronic payments. It accompanies the main tax return when payments are not made online.

- Supplemental Spreadsheet for CR-A: For businesses with more than three premises or subtenants, this spreadsheet helps detail each premise or subtenant's rent contributions, ensuring accurate rent computations and deductions.

- Change of Name/Address Form: If there has been a change in the business name or address since the last filing, this form notifies the Department of Finance to update their records.

- Commercial Revitalization Program Deduction Schedule: Businesses located in specific revitalization areas may be eligible for tax deductions. Detailed information on reductions must be attached separately.

- Small Business Tax Credit Worksheet: Qualifying small businesses can calculate their eligibility for tax credits. This detailed worksheet helps determine the applicable credit amount.

- Rent Paid Affidavit: For businesses that do not have formal lease agreements or whose rent payments vary, this affidavit provides a sworn statement detailing rent arrangements to support the amounts reported.

- Annualized Rent Calculation Worksheet: This assists in computing the correct rent amount for tax purposes, especially useful for premises rented for less than a full year or on non-standard lease terms.

Each document plays a crucial role in the accurate and compliant filing of the NYC Commercial Rent Tax Return. Proper preparation and understanding of these forms can significantly ease the reporting burden and help businesses meet their obligations with confidence. It's also advisable to keep updated records and consult with a professional if uncertainties arise during the preparation of these documents.

Similar forms

The New York City (NYC) Commercial Rent Tax (CRT) Return Form bears resemblance to the U.S. Internal Revenue Service (IRS) Form 1120, U.S. Corporation Income Tax Return, in several ways. Both forms require identification details such as the Employer Identification Number (EIN) and the business address. They also necessitate detailed financial computations to determine the entity's tax obligations based on income or, in the case of the CRT, based on rent paid. These forms guide taxpayers through a series of calculations to arrive at the total tax due, taking into account allowances, deductions, and applicable tax rates. Additionally, they both offer sections for tax credits that can reduce the overall tax liability.

Similarly, the Form 1065, U.S. Return of Partnership Income, shares common elements with the NYC CRT Form. Both documents are designed for specific types of business entities, with the Form 1065 catering to partnerships, mirroring the section in the CRT form where the taxpayer must identify the type of business entity. The information required includes basic entity identification, financial details for the period covered, and specialized schedules for deductions and credits. Just as the CRT form calculates tax based on rents, Form 1065 focuses on the income and deductions pertinent to partnership operations, aiming to establish the tax responsibility distributed among the partners.

The Schedule C (Form 1040), Profit or Loss from Business, is another document with parallels to the NYC CRT Form. This form is used by sole proprietors, similar to how individual landlords might file the CRT form. Both demand detailed reporting of financial activity—Schedule C for business income and expenses, and the CRT form for rent-related revenues and deductions. Each form serves to calculate the net amount subject to taxation, reflecting the taxpayer's obligation to the relevant authority. They also contain sections for adjustments that impact the financial outcome, such as deductions for specific expenditures or credits.

The NYC Property Tax Return shares similarities with the CRT Form, primarily in their focus on real estate and premises. Both forms require detailed descriptions of the property, including addresses and additional identifying details. The purpose of both documents is to assess tax based on real estate usage, though the criteria and calculations differ—property value and usage for Property Tax versus rent amounts for the CRT. They include mechanisms for adjustments to the taxable amount based on various factors, including credits or specific conditions affecting tax liability.

Finally, the Sales and Use Tax Return, another commonly filed tax document, also echoes aspects of the NYC CRT Form. This return calculates tax due based on sales revenue, comparable to the CRT's focus on rent income. Both forms cater to business activities within specific jurisdictions and require detailed accounting of business transactions over a defined period. Additionally, they allow for deductions, exemptions, and tax credits that mitigate the total tax due. The emphasis on declaring gross amounts followed by adjustments leading to a net taxable figure is a core similarity between the two forms.

Dos and Don'ts

When completing the New York City Commercial Rents Tax Return form, certain practices should be adhered to, ensuring accuracy and compliance. Here are key dos and don'ts to keep in mind:

- Do ensure you have the correct tax period for the form, which in this instance is June 1, 2020, to May 31, 2021.

- Do check off the appropriate boxes under "Type of Business Entity" and any other applicable sections such as "Initial return" or "Final return" to accurately represent your business status.

- Do report the full year's rent or the annualized rent if the premises were rented for less than a full year, following the instructions provided.

- Do calculate the tax due accurately, applying any relevant tax credits or deductions according to the instructions.

- Don't leave out the Employer Identification Number (EIN) or Social Security Number (SSN), as these are crucial for identification.

- Don't forget to complete the certification section with the signature of the officer and preparer (if applicable), ensuring the form is legally attested.

- Don't ignore any requests for additional information regarding tax credits, such as the Small Business Tax Credit; fill in and attach relevant supplemental worksheets or documents.

- Don't overlook the option to file electronically via the designated NYC.gov eService, which might streamline the process and reduce errors.

Following these guidelines will facilitate a smoother process in completing and submitting the NYC Commercial Rents Tax Return form, potentially reducing the risk of errors or compliance issues.

Misconceptions

When navigating the complexities of the New York City Commercial Rent Tax (CRT) Return, business owners and their preparers often encounter a range of misconceptions. Unpacking these misunderstandings is crucial for accurate compliance and optimizing potential tax benefits.

- Only large businesses need to file a CRT Return: Many assume that the CRT is exclusive to major corporations. However, any business, including small ones, renting a space in Manhattan (south of 96th street) and paying more than a certain amount in annual rent needs to assess their obligation to file a CRT return. The threshold for the tax year June 1, 2020, to May 31, 2021, is annual rent of more than $250,000. This includes partnerships, corporations, and individuals engaged in business activities.

- All rented spaces are subject to the same tax rate: The form outlines different tax rates based on the base rent amount. Misunderstanding this can lead to incorrect tax calculations. For rents up to $249,999, there is no tax, but rents over $250,000 are taxed at a 6% rate. This tiered approach is designed to shield smaller businesses from the tax burden.

- Subtenants don’t affect the CRT: The presence of subtenants and their rent contributions can significantly impact the primary tenant’s CRT liability. Deductions are available for rents paid to the primary tenant, which can lower the base rent subject to the CRT. Ignoring or inaccurately reporting subtenant information can lead to errors in tax computation.

- There's no benefit in reporting if my business is selling or discontinuing: Indicating that a return is either an initial or a final return holds significance; it signals the commencement or cessation of business operations within the tax year. This information can impact tax obligations and eligibility for certain credits or pro-rated tax calculations, particularly for businesses that didn't operate for the full tax year or are undergoing significant changes.

- The tax credit is automatically calculated or not worth the effort: There’s a misconception that the small business tax credit either doesn’t apply to many businesses or is too complex to warrant the effort of calculation. However, businesses with incomes below certain thresholds may be eligible for significant tax relief through these credits, especially if their base rent before reduction is within specified ranges. Overlooking this section can result in overpaying tax.

Properly understanding the nuances of the CRT Return can lead to considerable tax savings and compliance peace of mind. Each section of the form plays a critical role in determining the accurate tax obligation of a business, emphasizing the importance of thorough and informed completion of the CRT Return.

Key takeaways

When filling out the NYC Commercial Rents Tax Return form for the tax period June 1, 2020, to May 31, 2021, several key points should be noted:

- Ensure that the firm's Employer Identification Number (EIN) or, if applicable, the preparer's Social Security Number (SSN) or Preparer Tax Identification Number (PTIN) is correctly entered to avoid processing errors.

- It is crucial to report the full year's rent or the annualized rent if the premises were leased for less than a full year, ensuring that deductions are accurately calculated.

- Indicate the type of business entity accurately—corporation, partnership, individual, estate, or trust—to comply with tax regulations specific to each category.

- If this is the initial or final return due to the beginning or discontinuation of a business, make sure to check the appropriate box and provide the relevant dates to inform the NYC Department of Finance.

- Based on the provided rent and deduction information, compute the tax due carefully, utilizing the specified tax rates and applying any eligible small business tax credits to determine the total tax liability or credit.

- For accurate processing and to ensure proper credit for payments made, include the correct Employer Identification Number or Social Security Number and the Account ID number on the tax return and remittance.

The form also reminds filers that they can choose between paper filing and electronic submission, with supplemental worksheets available on the website to assist with detailed calculations, such as deductions and tax credits specific to small businesses. When claiming a refund or reporting subtenants, ensure all sections are completed accurately to prevent disallowed deductions or delays in the processing of the return.

Lastly, the certification section at the end of the form must be signed by an authorized officer of the company and the preparer, if applicable. This certifies the accuracy of the information provided and authorizes discussions regarding the return's processing with the Department of Finance.

Popular PDF Documents

Utah Sales Tax License - Electronic payment services providers can use this form to certify tax exemption on long-term machinery and equipment, fostering advancements in financial transactions.

How to Fill Out W4 Married Filing Jointly No Dependents - Exemptions from withholding can be claimed on the W-4, but eligibility requirements must be met to avoid underpayment penalties.