Get Ny Commercial Rent Tax Form

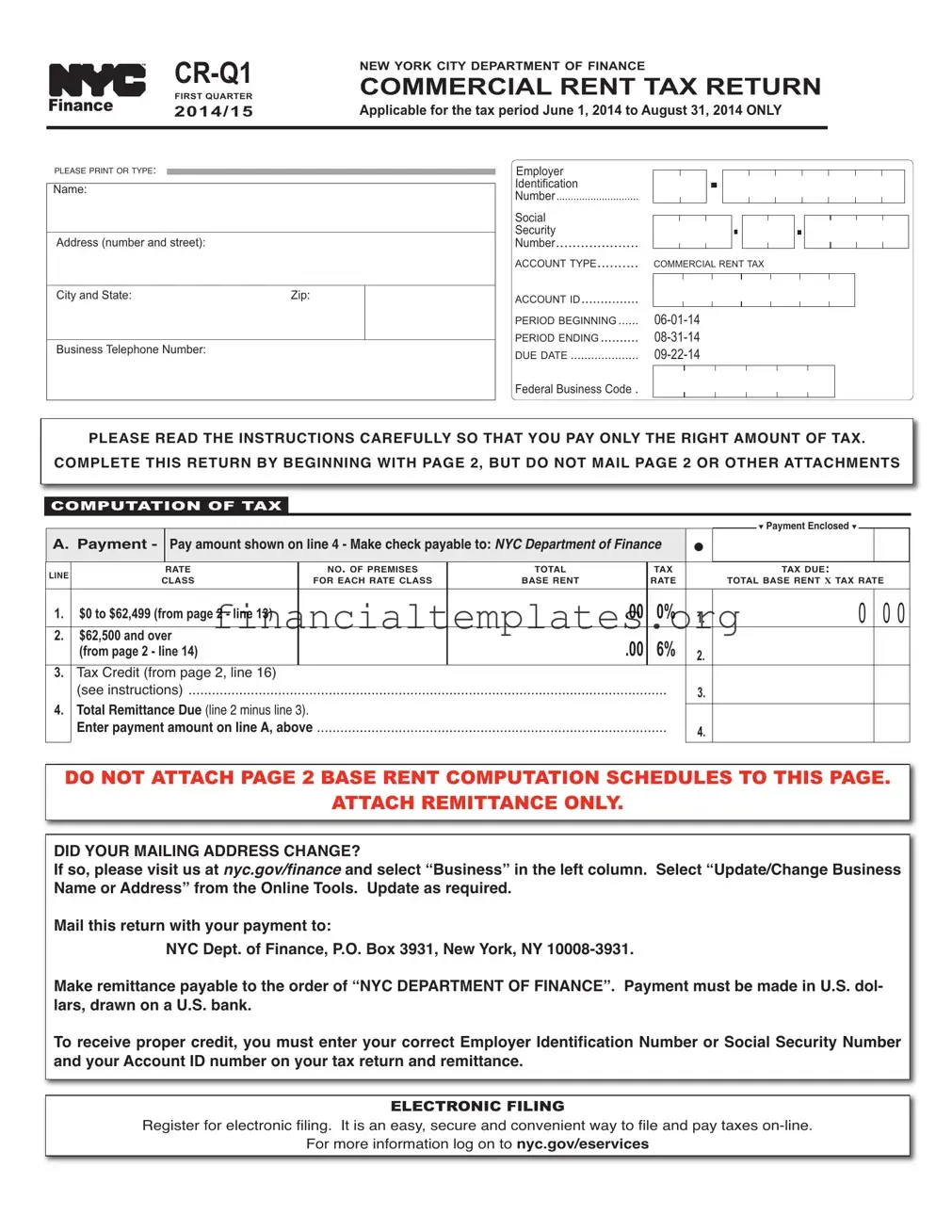

Navigating the complexities of the New York City Commercial Rent Tax (CRT) can be challenging for businesses operating within the designated geographical areas of Manhattan. The CRT form CR-Q1, specifically for the tax period ranging from June 1, 2014, to August 31, 2014, serves as a critical document for businesses required to file this tax. This form requires detailed information about the taxpayer, including name, address, contact number, and identification numbers like the Employer Identification Number or Social Security Number. Furthermore, it mandates the disclosure of the commercial rent amounts paid, tax rate applicable based on the rent bracket, deductions applicable, and the resultant tax due. The form is also structured to assist taxpayers in computing their tax liabilities correctly by providing a section for calculating base rent subject to tax, with specific guidelines on handling premises rented for less than the full tax period. This detailed form, underlined by the necessity to follow instructions carefully to ensure accurate tax payment, is a testament to the NYC Department of Finance's efforts in streamlining tax processes. However, it also underscores the intricate nature of tax obligations for businesses, emphasizing the importance of meticulous attention to detail in compliance efforts.

Ny Commercial Rent Tax Example

|

NEW YORK CITY DEPARTMENT OF FINANCE |

||

|

|

||

FINANCE |

FIRST QUARTER |

COMMERCIAL RENT TAX RETURN |

|

2014/15 |

ApplicableforthetaxperiodJune1,2014toAugust31,2014ONLY |

||

|

|||

|

|

|

PLEASE PRINT OR TYPE:

Name:

_________________________________________________________________________________

Address (number and street):

_________________________________________________________________________________

City and State: |

Zip: |

_________________________________________________________________________________ |

|

Business Telephone Number: |

|

Employer

Identification

Number .............................

Social

Security

Number....................

ACCOUNT TYPE |

COMMERCIAL RENT TAX |

|

|

|

|

|||

ACCOUNT ID |

|

|

|

|

|

|

|

|

PERIOD BEGINNING |

|

|

|

|

|

|

||

PERIOD ENDING |

|

|

|

|

|

|

||

DUE DATE |

|

|

|

|

|

|

||

Federal Business Code .

PLEASE READ THE INSTRUCTIONS CAREFULLY SO THAT YOU PAY ONLY THE RIGHT AMOUNT OF TAX. COMPLETE THIS RETURN BY BEGINNING WITH PAGE 2, BUT DO NOT MAIL PAGE 2 OR OTHER ATTACHMENTS

COMPUTATION OF TAX

|

|

|

|

|

|

|

|

|

|

▼ Payment Enclosed ▼ |

|

|

|

A. Payment - |

Payamountshown online4- Makecheck payableto:NYCDepartmentofFinance |

● |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINE |

|

RATE |

|

NO. OF PREMISES |

TOTAL |

TAX |

|

|

TAX DUE: |

||

|

CLASS |

|

FOR EACH RATE CLASS |

BASE RENT |

RATE |

|

TOTAL BASE RENT X TAX RATE |

|||||

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

$0 to $62,499 (from page 2 - line 13) |

|

|

.00 |

0% |

1. |

0 |

0 0 |

|||

|

2. |

$62,500 and over |

|

|

.00 |

6% |

|

|

|

|

|

|

|

|

(from page 2 - line 14) |

|

|

2. |

|

|

|

|

|||

|

3. |

Tax Credit (from page 2, line 16) |

|

|

|

|

|

|

|

|

||

|

|

(see instructions) |

|

|

3. |

|

|

|

|

|||

|

4. |

TotalRemittanceDue(line 2 minus line 3). |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

|

Enter paymentamounton lineA,above |

.......................................................................................... |

|

|

4. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DO NOT ATTACH PAGE 2 BASE RENT COMPUTATION SCHEDULES TO THIS PAGE.

ATTACH REMITTANCE ONLY.

DID YOUR MAILINGADDRESS CHANGE?

If so, please visit us at nyc.gov/financeand select “Business” in the left column. Select “Update/Change Business

Name orAddress” from the Online Tools. Update as required.

Mail this return with your payment to:

NYC Dept. of Finance, P.O. Box 3931, New York, NY

Make remittance payable to the order of “NYC DEPARTMENT OF FINANCE”. Payment must be made in U.S. dol- lars, drawn on a U.S. bank.

To receive proper credit, you must enter your correct Employer Identification Number or Social Security Number and yourAccount ID number on your tax return and remittance.

ELECTRONIC FILING

Register for electronic filing. It is an easy, secure and convenient way to file and pay taxes

For more information log on to nyc.gov/eservices

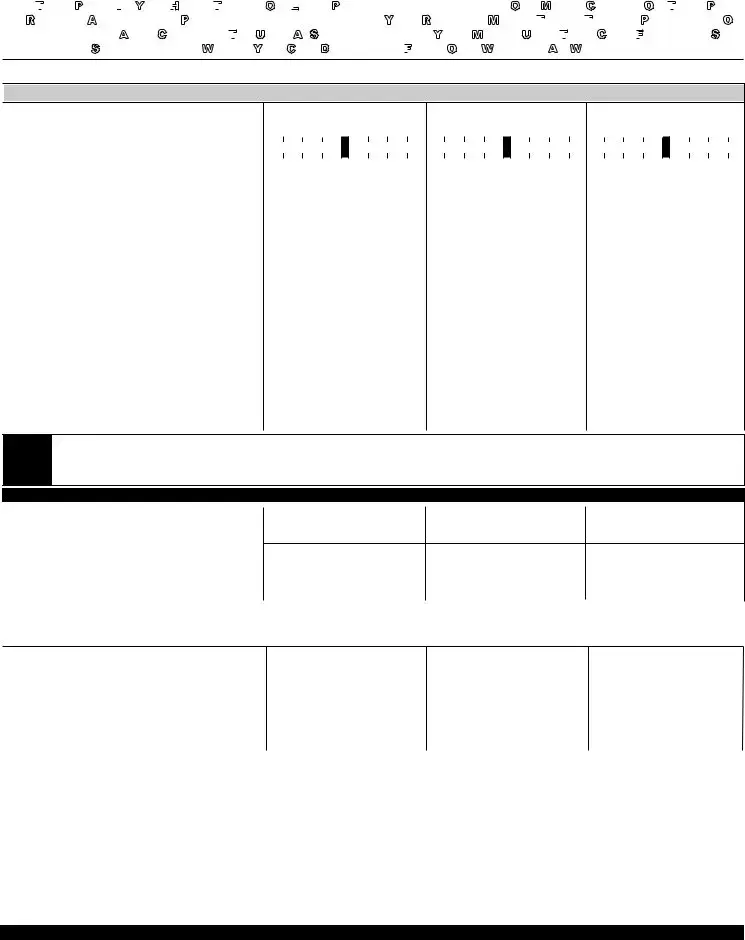

Form |

Page 2 |

USE THIS

PAGE IF

PAGE IF YOU HAVE

YOU HAVE

THREE

THREE

OR LESS

OR LESS

PREMISES/SUBTENANTS OR, MAKE COPIES OF THIS

PREMISES/SUBTENANTS OR, MAKE COPIES OF THIS

PAGE TO REPORT ADDITIONAL PREMISES/SUBTENANTS. IF YOU REPORT MORE THAN

PAGE TO REPORT ADDITIONAL PREMISES/SUBTENANTS. IF YOU REPORT MORE THAN

THREE

THREE

PREMISES OR SUBTENANTS, AND CHOOSE TO

PREMISES OR SUBTENANTS, AND CHOOSE TO

USE A SPREADSHEET, YOU MUST USE THE

USE A SPREADSHEET, YOU MUST USE THE

CRQ FINANCE

CRQ FINANCE

SUP- PLEMENTAL SPREADSHEET, WHICH YOU CAN DOWNLOAD FROM

SUP- PLEMENTAL SPREADSHEET, WHICH YOU CAN DOWNLOAD FROM

OUR WEBSITE AT WWW.NYC.GOV/CRTINFO.

OUR WEBSITE AT WWW.NYC.GOV/CRTINFO.

EACH LINE MUST BEACCURATELYCOMPLETED. YOUR DEDUCTION WILLBE DISALLOWED IF INACCURATE INFORMATION IS SUBMITTED.

LINE |

DESCRIPTION |

PREMISES 1 |

PREMISES 2 |

PREMISES 3 |

||||

● 1a. |

Street Address ......................................................... 1a. |

|

|

|

|

|

|

|

1b. Zip Code ..................................................................1b. |

________________________________________________________________________________________ |

|||||||

1c. |

Block and 1d. Lot Number...................................1c/1d. ________________________________________________________________________________________ |

|||||||

|

|

|

1c. BLOCK |

1d. LOT |

1c. BLOCK |

1d. LOT |

1c. BLOCK |

1d. LOT |

● 2. |

Gross Rent Paid (see instructions) |

2. |

________________________________________________________________________________________ |

3. |

Rent Applied to Residential Use |

3. |

________________________________________________________________________________________ |

|

............................................. |

4a. |

________________________________________________________________________________________ |

●4b. Employer Identification Number (EIN) forKEEP THIS PAGE partnerships or corporations .....................................4b. ● 4b. EIN _____________________ ● 4b. EIN_____________________ ● 4b. EIN ____________________4a. SUBTENANT'S NAME

4c. Social Security Number for individuals |

4c. |

● 4c. SSN_____________________ ● 4c. SSN ____________________ ● 4c. SSN ____________________ |

|

4d. RENT RECEIVED FROM SUBTENANT |

|

|

|

|

(see instructions if more than one subtenant) |

4d. ___________________________________________________________________________________________________ |

|

5b. |

Commercial RevitalizationFORProgram |

YOUR RECORDS. |

|

5a. |

Other Deductions (attach schedule) |

5a. |

________________________________________________________________________________________ |

|

special reduction (see instructions) |

5b. |

________________________________________________________________________________________ |

6. |

Total Deductions (add lines 3, 4d, 5a and 5b) |

6. |

________________________________________________________________________________________ |

7.Base Rent Before Rent Reduction (line 2 minus line 6) ....7DO. ________________________________________________________________________________________NOT FILE

8.35% Rent Reduction (35% X line 7) ...........................8. ________________________________________________________________________________________

9. Base Rent Subject to Tax (line 7 minus line 8) ...........9. ________________________________________________________________________________________

If the line 7 amount represents rent for less than the full 3 month period, proceed to line 10a, or

NOTE If the line 7 amount plus the line 5b amount is $62,499 or less and represents rent for a full 3 month period, transfer line 9 to line 13, or If the line 7 amount plus the line 5b amount is $62,500 or more and represents rent for a full 3 month period, transfer line 9 to line 14

COMPLETE LINES 10 - 12 ONLY IF YOU RENTED PREMISES FOR LESS THAN THE FULL

........10a. Number of Months at Premises during the tax period |

10a. # of months |

10b. From: |

10a. # of months |

10b. From: |

10a. # of months |

10b. From: |

|

|

|

10c. To: |

|

10c. To: |

|

|

10c. To: |

11.Monthly Base Rent before rent reduction

(line 7 plus line 5b divided by line 10a) |

11. ________________________________________________________________________________________ |

12.Quarterly Base Rent before rent reduction

(line 11 X 3 months) |

12. ________________________________________________________________________________________ |

■If the line 12 amount is $62,499 or less, transfer the line 9 amount (NOT THE LINE 12AMOUNT) to line 13

■If the line 12 amount is $62,500 or more, transfer the line 9 amount (NOT THE LINE 12AMOUNT) to line 14

|

RATE CLASS |

TAX RATE |

|

|

|

13. |

($0 - 62,499) |

0% |

13. |

_______________________________________________________________________________________ |

|

14. |

($62,500 or more) |

6% |

14. |

_______________________________________________________________________________________ |

|

15.Tax Due before credit

(line 14 multiplied by 6%) |

15. |

|

16. Tax Credit (see worksheet below) |

16. |

_______________________________________________________________________________________ |

Note: The tax credit only applies if line 7 plus line 5b (or line 12, if applicable) is at least $62,500, but is less than $75,000. All others enter zero.

Tax Credit Computation Worksheet

■If the line 7 amount represents rent for the full 3 month period, your credit is calculated as follows:

Amount on line 15 X ($75,000 minus the sum of lines 7 and 5b) = _____________ = your credit

$12,500

■If the line 7 amount represents rent for less than the full 3 month period, your credit is calculated as follows:

Amount on line 15 X ($75,000$12,500minus line 12) = _____________ = your credit

TRANSFER THE AMOUNTS FROM LINES 13, 14 AND 16 TO THE CORRESPONDING LINES ON PAGE 1

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identification | CR-Q1 NEW YORK CITY DEPARTMENT OF FINANCE FINANCE FIRST QUARTER COMMERCIAL RENT TAX RETURN 2014/15 |

| Tax Period Applicability | For the tax period from June 1, 2014, to August 31, 2014, ONLY |

| Due Date | September 22, 2014 |

| Payment Instructions | Payment should be made online or by check payable to: NYC Department of Finance |

| Electronic Filing | Registration for electronic filing is recommended for a secure and convenient way to file and pay taxes online |

| Governing Law | New York City regulations on Commercial Rent Tax (CRT) |

Guide to Writing Ny Commercial Rent Tax

Filling out the New York City Commercial Rent Tax (CRT) Form for the first quarter of 2014/15 requires attention to detail and understanding of your rental situation in the specified period. This process might seem cumbersome, but with the right approach, it can be handled smoothly. The form targets businesses operating within certain areas of Manhattan and is meant to calculate the tax owed based on commercial rent paid. Here are steps to complete this form effectively:

- Review Page 1: Before you dive into filling out the form, review the first page to understand the broad components–including the due date, and what attachments you should not mail.

- Start with Your Basic Information: Enter your Name, Address (including the city, state, and zip code), Business Telephone Number, Employer Identification Number (EIN), and Social Security Number (if applicable).

- Enter Account Details: Specify your Commercial Rent Tax Account ID, along with the period beginning and ending dates reflected at the top of the form.

- Calculate Your Tax: Start with completing Page 2 for accurate computation of base rate rent and applicable deductions. This page is critical if you have multiple premises/subtenants or need to itemize deductions.

- Fill Out the Computation of Tax Section: On Page 1, under the 'Computation of Tax' section, enter the total base rent, classify it by rate (using information from Page 2), and deduct any applicable tax credits to ascertain your total remittance due.

- Payment Information: Indicate the amount of payment enclosed in the designated section. Payments should be made to the NYC Department of Finance and include your correct EIN or Social Security Number, alongside your Account ID, to ensure your payment is properly credited.

- Address Change Notification: If your mailing address has changed, utilize the provided link to update your information on the NYC Finance website, ensuring your records are up-to-date.

- Submit the Form: Double-check that only the required pages and remittance are included in your envelope. Mail your completed form and payment to the address provided, making sure it complies with the submission guidelines.

- Consider Electronic Filing: Finally, consider registering for electronic filing for future returns. It’s an efficient and secure method to manage your tax filings.

Accurately filling out and promptly submitting the New York City Commercial Rent Tax form ensures compliance with local tax regulations while avoiding potential penalties. Remember to keep copies of all submitted documents for your records.

Understanding Ny Commercial Rent Tax

Frequently Asked Questions about New York City Commercial Rent Tax (CRT) Form

- What is the Commercial Rent Tax (CRT)?

The Commercial Rent Tax is a tax applied to commercial properties located in certain areas of Manhattan. It is charged to tenants who occupy or use a property for commercial purposes, based on the rent they pay.

- Who needs to file the CRT form?

Businesses that rent or lease space in Manhattan, south of 96th Street, and pay an annual rent of more than $250,000 are required to file the CRT form. This applies to tenants of commercial spaces such as stores, offices, and other business premises.

- What period does the CR-Q1 form cover?

The CR-Q1 form covers the first quarter of the tax year. For the 2014/15 period, it encompasses June 1, 2014, to August 31, 2014. This form is specifically for those months only.

- When is the CR-Q1 form due?

The due date for the CR-Q1 form is September 22, 2014. It's important to submit the form and any payment due by this date to avoid any potential penalties or interest charges for late submission.

- How is the tax calculated?

The tax is calculated based on the rent paid by the tenant. The first step is to determine the base rent, which might be reduced by certain deductions. The base rent is then subjected to a tax rate, which depends on the total amount of rent. For rents up to $62,499, the tax rate is 0%, and for rents of $62,500 and over, the tax rate is 6%. A tax credit is available for rents between $62,500 and $75,000.

- How can I submit the CR-Q1 form?

You can submit the CR-Q1 form by mail to the NYC Department of Finance at the address provided on the form. Additionally, the Department of Finance encourages electronic filing, which is a convenient, secure, and easy way to file and pay taxes online. Visit nyc.gov/eservices for more information on electronic filing.

- What should I do if my mailing address has changed?

If your mailing address has changed, please update your information with the NYC Department of Finance. You can do this by visiting nyc.gov/finance, selecting “Business” in the left column, and then choosing “Update/Change Business Name or Address” from the Online Tools. Updating your address ensures that you will receive all tax-related correspondence at the correct location.

For additional information and assistance, please visit the NYC Department of Finance website or contact their office directly.

Common mistakes

When completing the New York City Department of Finance Commercial Rent Tax Return for the First Quarter of 2014/15, individuals and businesses commonly encounter several pitfalls. Understanding these mistakes can help ensure the accuracy of the submission, potentially saving time and avoiding penalties. Here are seven common errors:

- Incorrectly calculating base rent. Many filers struggle with accurately determining their base rent, often because they misunderstand which expenses or deductions are allowed to be subtracted from the gross rent.

- Overlooking tax credits. The form allows for tax credits under certain conditions, but filers frequently miss or incorrectly calculate these credits, leading to overpayment of the tax.

- Failure to report all premises or subtenants. If a business rents out space to subtenants or operates across multiple premises, each location and subtenant must be reported. Missing this detail can result in incomplete reporting and possible fines.

- Misidentifying the rental period. The form requires clarification on whether the rent reported covers the full three-month period. An incorrect indication can affect the computation of the tax due.

- Not applying for the Commercial Revitalization Program deduction properly. Eligible filers can receive significant deductions under this program but often fail to apply correctly or miss it altogether due to lack of awareness or misunderstanding of the eligibility criteria.

- Entering incorrect identifying information. Whether it's the Employer Identification Number (EIN), Social Security Number (SSN), or property identifiers like block and lot numbers, inaccuracies here can lead to processing delays or misapplied payments.

- Misunderstanding the rate classes and applicable tax rates. The tax rate applied varies depending on the base rent amount. Filers sometimes apply the wrong tax rate to their base rent, either overestimating or underestimating their tax responsibility.

Beyond these specific mistakes, overall diligence in reading instructions, double-checking calculations, and ensuring complete and accurate documentation can greatly reduce errors and streamline the tax return process.

Documents used along the form

Businesses within New York City navigating the complexities of local tax obligations often need to manage multiple forms and documents beyond the Commercial Rent Tax (CR-Q1) form. This necessity arises due to the intricate nature of city taxes, aimed at ensuring businesses contribute fairly to municipal revenues. This list encompasses forms frequently required in conjunction with the CR-Q1 to provide a comprehensive overview of potential document requirements.

- Form NYC-2 - Business Corporation Tax Return: Required for corporations to report their income, calculate and pay their city taxes.

- Form NYC-202 - Unincorporated Business Tax Return: Used by unincorporated businesses to report their earnings and tax liabilities to the city.

- Form NYC-204 - Unincorporated Business Tax Return for Partnerships: This form is specifically for partnerships, detailing income and losses for accurate tax reporting.

- Form NYC-3L - General Corporation Tax Return: A comprehensive form for larger corporations, detailing income, deductions, and tax obligations.

- SCHE-1 - Schedule of New York City Base Rent: This schedule is part of the CR-Q1 and allows for detailed reporting of premises and subtenants, crucial for accurate tax calculation.

- Form ST-330 - Sales Tax Record of Advance Payment: Some businesses may be subject to advance sales tax payments, requiring this form to document such transactions accurately.

- Form 1099 - Miscellaneous Income: Often necessary for businesses that hire independent contractors, to report payments made to them throughout the fiscal year.

- Form W-9 - Request for Taxpayer Identification Number and Certification: Required to gather information from vendors or contractors for accurate tax reporting and withholding.

- Lease Agreement - Official document detailing rental agreements between landlords and commercial tenants, essential for substantiating rent payments declared on the CR-Q1.

These documents, each serving a unique purpose in the financial management and reporting of a business, collectively ensure compliance with New York City’s taxing authorities. They play crucial roles in clarifying the financial responsibilities of businesses, aiding in the accurate calculation and payment of taxes due. It is advisable for businesses to maintain meticulous records and consult with tax professionals to ensure compliance and optimize their tax positions.

Similar forms

The New York Commercial Rent Tax (CRT) form finds similarities with various other tax and financial documents, each designed to capture specific data for regulatory, reporting, or financial analysis purposes. One such example is the Sales and Use Tax Return commonly filed by businesses. This document, though focused on the collection of tax on sales, services, and purchases, similarly requires detailed reporting of amounts due and deductions applicable, offering a structured method for businesses to account for their taxable activities within a specific period, much like the CRT form.

Another similar document is the Property Tax Statement, which owners of real property receive. This statement outlines the assessed value of the property, tax rate applied, and total tax due. Much like the CRT form, it provides a detailed breakdown of tax calculations and any credits or deductions the taxpayer is entitled to, ensuring transparency and clarity in the taxation process.

The Payroll Tax Return is also akin to the CRT form in several respects. This document requires employers to report wages paid to employees, calculate withholdings for state and federal income taxes, and determine the employer's contribution to payroll taxes. Both forms are essential for compliance with tax regulations and help in the accurate remittance of taxes to government authorities.

The Income Tax Return for businesses, which outlines revenue, expenses, and the resulting taxable income, shares commonalities with the CRT form. Both require detailed financial data and support calculations with schedules or additional forms, making them comprehensive tools for reporting key financial figures to tax authorities.

Corporation Franchise Tax Returns, required from businesses operating within certain jurisdictions, parallel the CRT form. They detail the earnings, activities, and other tax-base information of corporations, calculating tax obligations based on business presence or revenue within a state. The structure of these documents ensures that businesses accurately report and pay their fair share of taxes.

The Excise Tax Return, which taxes specific goods, services, and activities, bears resemblance to the CRT form. This document requires the taxpayer to detail quantities subject to tax, apply the correct tax rates, and calculate the total tax due, much like how commercial rent spaces are taxed under the CRT form.

Lastly, the Business License Renewal forms that municipalities require for operational compliance share a functional similarity. Though not strictly tax forms, they often base renewal fees on business size, location, or revenue, necessitating accurate financial reporting by the business, akin to the financial declarations found in the CRT form.

In essence, while each of these documents serves a unique tax or regulatory purpose, they all share the common goal of capturing specific, detailed financial information from businesses. This ensures compliance with tax laws and supports the accurate calculation and collection of taxes or fees due, highlighting the importance of clear and precise financial reporting across various forms of tax documents.

Dos and Don'ts

When it comes to filling out the New York Commercial Rent Tax form, navigating through the documentation can seem daunting at first glance. However, by keeping a few essential dos and don'ts in mind, you can simplify the process, ensuring accuracy and compliance. Here's a helpful guide to assist you along the way.

What to Do:

- Read the instructions carefully before starting. The form contains specific guidelines that can help prevent common mistakes, ensuring you pay the right amount of tax.

- Gather all necessary documentation, including details about your premises, subtenants if any, and accurate rent payments, before beginning. This preparation will streamline the process.

- Double-check your Employer Identification Number (EIN) or Social Security Number, and the Commercial Rent Tax Account ID, as these are crucial for proper tax identification and processing.

- Utilize the electronic filing system if available. E-filing can be more secure, convenient, and can help you avoid late submissions due to postal delays.

- Update your mailing address if it has recently changed. This ensures that all correspondence and necessary tax documents reach you promptly, keeping you informed and up-to-date.

What Not to Do:

- Do not ignore the base rent computation schedules. These attachments are essential for accurate tax calculation and must be completed with attention to detail.

- Do not attach unnecessary pages when mailing your tax form. Only the required pages and remittance should be included to prevent processing errors.

- Avoid making your payment in non-U.S. currency. Payments must be in U.S. dollars drawn on a U.S. bank to be processed correctly.

- Do not wait until the last minute to file. Submitting your form close to the deadline may lead to rushed errors or late submissions, which could incur penalties.

- Avoid estimating numbers. Ensure all reported figures, from rent payments to tax deductions, are accurate and supported by documentation to avoid discrepancies and possible audits.

By adhering to these guidelines, you can navigate filling out the New York Commercial Rent Tax form with confidence, avoiding common pitfalls and ensuring your tax obligations are met accurately and efficiently.

Misconceptions

Navigating through the labyrinth of tax forms can sometimes feel like deciphering an ancient script. The New York City Commercial Rent Tax (CRT) Return is no exception, especially with the myriad of misconceptions that surround it. Let's clear up four common misunderstandings.

- Misconception 1: The Commercial Rent Tax is applicable to all businesses in New York City.

Many assume that if you're running a business in New York City, the Commercial Rent Tax automatically applies to you. However, this tax is location-specific, primarily affecting commercial tenants in Manhattan south of 96th Street. Furthermore, not all businesses in this area are subject to the tax; it only applies to tenants paying more than a certain amount in annual rent. - Misconception 2: The tax rate is flat for all businesses.

The assumption might be that there's a one-size-fits-all tax rate for all businesses subject to the CRT. In reality, the rate varies depending on specific factors, including the amount of rent paid. For example, there's a progressive structure in place, where businesses paying rent above a certain threshold are taxed at a higher rate, as indicated by the $0 to $62,499 rate class at 0% and the $62,500 and over rate class at 6%. - Misconception 3: All subtenants' rents add to the total taxable rent.

Subleasing space can add complexity to how the CRT is calculated. It's a common misconception that rent received from all subtenants should be added to the total taxable rent. While subtenant rent can contribute to the tax base, specific deductions and rent applied toward residential use must be factored in, potentially lowering the taxable amount. - Misconception 4: Electronic filing is optional. While the form suggests registering for electronic filing as an easy, secure, and convenient option, it may be perceived as a mere suggestion rather than a necessity. With the city's push towards efficiency and environmental sustainability, transitioning to electronic filings is becoming increasingly encouraged and might become mandatory for most tax forms in the near future. It's a step towards simplifying the process, potentially leading to quicker processing times and better record-keeping.

Understanding the CRT and its nuances can save businesses a significant amount of time and money. It's always recommended to consult with a tax professional to navigate the specifics of your situation, ensuring compliance while optimizing your tax liabilities.

Key takeaways

Businesses operating within New York City may be subject to the Commercial Rent Tax (CRT), which is applicable to certain premises rented for commercial activities. Understanding and correctly filling out the CRT return is crucial for compliance and to avoid potential penalties. Here are key takeaways about completing the New York Commercial Rent Tax form for the first quarter of the 2014/15 tax period:

- Ensure that the form is applicable to your tax period, indicated as June 1, 2014, to August 31, 2014, for the CR-Q1 return.

- Fill out your business information accurately, including name, address, telephone number, Employer Identification Number (EIN), or Social Security Number (SSN) if applicable.

- Identify the correct account type and Commercial Rent Tax Account ID specific to your business.

- Be mindful of the due date, listed as September 22, 2014, for the CR-Q1 return to avoid late fees.

- The form categorizes rental amounts into two tax rate classes - $0 to $62,499 at 0% and $62,500 and over at 6% - requiring accurate reporting of base rent.

- Include details of any tax credits as outlined on the form, which can reduce the total amount due.

- Understand the significance of the base rent computation schedules and attach only the remittance when mailing the return.

- For changes in mailing address, use the indicated website to update the business information promptly.

- Payments must be made in U.S. dollars, drawn on a U.S. bank, and the correct identifiers (EIN or SSN and Account ID) must accompany your remittance for proper credit.

- Electronic filing is encouraged as an easy, secure, and convenient option for filing and paying taxes, accessible through the NYC.gov/eservices portal.

- If reporting more than three premises or subtenants, utilize the CRQ Finance Supplemental Spreadsheet available for download from the specified website.

- Documentation of gross rent paid along with specific deductions allowed, such as those applied to residential use, other applicable deductions, and the Commercial Revitalization Program reduction must be accurately reported to determine the base rent subject to tax.

Correctly capturing all required details ensures that businesses only pay the right amount of tax and comply with New York City's Commercial Rent Tax regulations.

Popular PDF Documents

2848 Poa - The D-2848 form empowers taxpayers to confront tax challenges more effectively through delegated professional representation.

California Stop Payment - Enables stakeholders to leverage legal mechanisms to secure their financial interests in construction projects, promoting accountability.