Get Notice Of Right To Cure Auto Loan Letter Form

In the ever-evolving landscape of auto financing, staying informed about the rights and responsibilities of both borrowers and lenders is crucial. Among the myriad documents and notices that govern these financial interactions, the Notice of Right to Cure Auto Loan Letter stands out as a significant piece of communication. This document, sanctioned under the Neb. Rev. Stat. § 45-1050 (Reissue 2010), serves a vital function in the process of addressing a loan default. It notifies the borrower of their default status, having failed to meet loan obligations for at least ten days. More importantly, it delineates a specific timeframe—twenty days following the notice—during which the borrower can rectify this default, thereby averting further repercussions. The Notice provides all necessary details for making the required payment to remedy the situation, including the lender’s contact information and the exact amount due. Additionally, it alerts the borrower to the potential consequences of inaction, such as the cancellation of any credit insurance tied to the loan and the lender's right to forgo subsequent notices before exercising their rights in the event of future defaults. Clear, direct communication from the lender, as per the format approved by the Nebraska Department of Banking and Finance, is crucial in ensuring the borrower fully understands their options and the steps needed to maintain their financial health and the status of their loan.

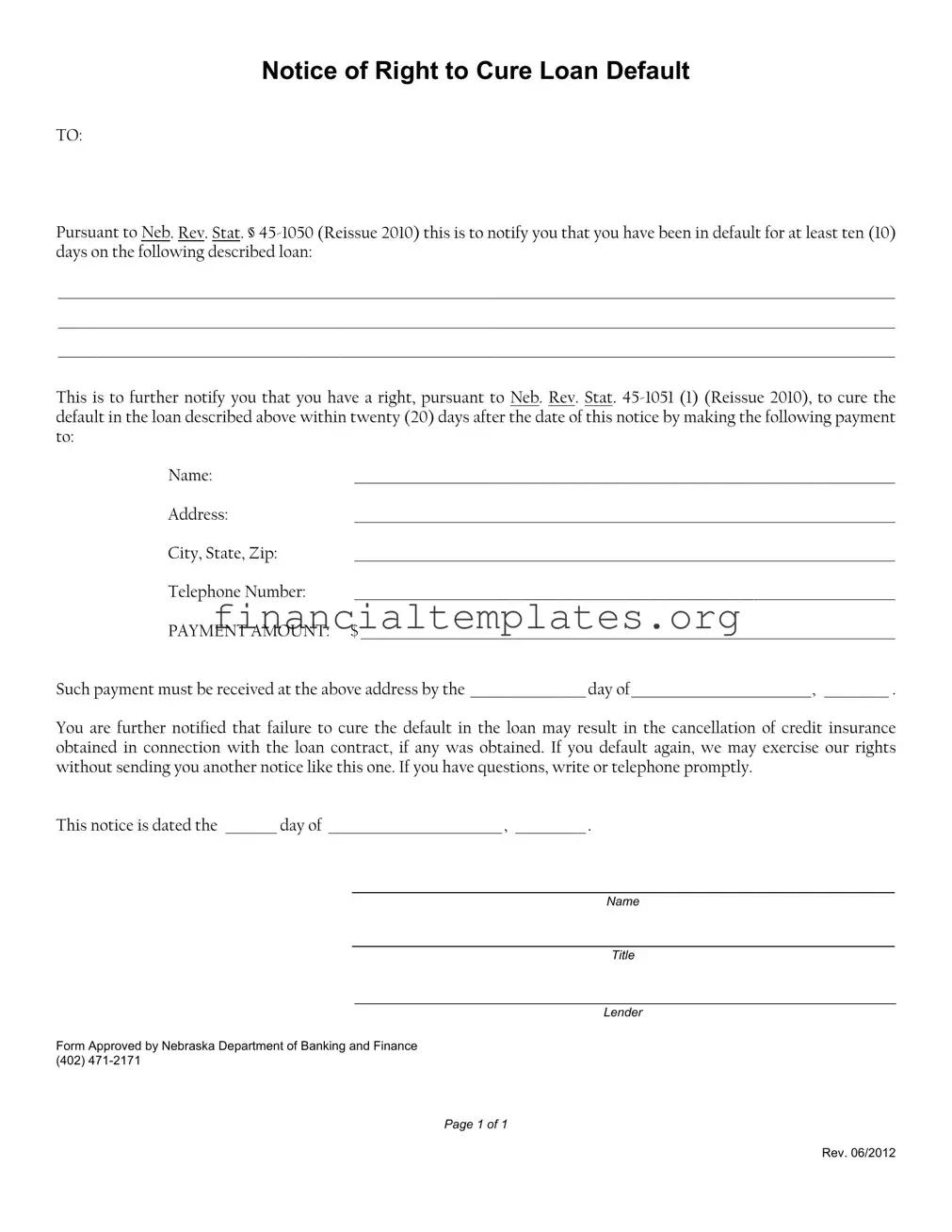

Notice Of Right To Cure Auto Loan Letter Example

Notice of Right to Cure Loan Default

TO:

Pursuant to Neb. Rev. Stat. §

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

This is to further notify you that you have a right, pursuant to Neb. Rev. Stat.

Name: |

____________________________________________________________________________________ |

Address: |

____________________________________________________________________________________ |

City, State, Zip: |

____________________________________________________________________________________ |

Telephone Number: |

____________________________________________________________________________________ |

PAYMENT AMOUNT: |

$ ___________________________________________________________________________________ |

Such payment must be received at the above address by the __________________ day of____________________________, __________ .

You are further notified that failure to cure the default in the loan may result in the cancellation of credit insurance obtained in connection with the loan contract, if any was obtained. If you default again, we may exercise our rights without sending you another notice like this one. If you have questions, write or telephone promptly.

This notice is dated the ________ day of ___________________________, ___________ .

_________________________________________________________

Name

_________________________________________________________

Title

__________________________________________________________

Lender

Form Approved by Nebraska Department of Banking and Finance (402)

Page 1 of 1

Rev. 06/2012

Document Specifics

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Form Purpose | This form serves as a notification that the borrower has been in default on their auto loan for at least ten days. |

| 2 | Governing Law | The notice is governed by Neb. Rev. Stat. § 45-1050 and § 45-1051 (1) (Reissue 2010). |

| 3 | Right to Cure | Borrowers are given the right to cure the default on their loan within twenty days of receiving this notice. |

| 4 | Required Payment Information | The notice must include the payment amount required to cure the default. |

| 5 | Contact Information | Lender's name, address, city, state, zip, and telephone number must be clearly stated for the borrower's reference. |

| 6 | Deadline for Cure | Specific deadline by which the curing payment must be received is provided, ensuring transparency and urgency in resolution. |

| 7 | Consequences of Non-Compliance | Failure to cure the default may result in the cancellation of credit insurance obtained with the loan. |

| 8 | Repeat Defaults | If the borrower defaults again, the lender may exercise rights without sending another notice. |

| 9 | Communication Encouraged | Borrowers are encouraged to write or call promptly if they have questions regarding the notice. |

Guide to Writing Notice Of Right To Cure Auto Loan Letter

Filling out a Notice of Right to Cure Auto Loan Letter form is a meticulous task that demands attention to detail. Once completed and sent, this form initiates a process to potentially resolve a loan default situation. It is essential to accurately enter all the required information, as it provides the recipient with a clear understanding of their default status and outlines the steps necessary for rectification. Below is a guide to assist in filling out the form correctly.

- Start by entering the date at the top of the form where it is designated.

- In the "TO:" section, write the full name of the person who has defaulted on the loan.

- Complete the detailed description of the loan. Include all pertinent information such as the loan number, the original amount of the loan, and the specific nature of the default.

- Under the section that notifies the recipient of their right to cure the loan default, fill in the necessary payment amount to cure the default, ensuring to double-check the figure for accuracy.

- Enter your name or the name of the representative handling the case in the "Name" field under the payment instructions.

- Fill in the complete address, city, state, and zip code where the payment is to be sent under the corresponding fields.

- Provide a telephone number in the designated area, ensuring it is a number where inquiries can be directed for further clarification or questions.

- In the "PAYMENT AMOUNT" section, specify the exact amount required to cure the default. Be sure this amount matches the figure previously mentioned in the document.

- State the deadline by which the payment must be received. Clearly fill in the day, month, and year to prevent any confusion.

- Notify the recipient that failure to cure the default could lead to further actions, such as the cancellation of any credit insurance associated with the loan agreement.

- Repeat the caution that another default could trigger rights and actions without additional notices being sent.

- At the bottom, date the letter with the day, month, and year to officially document when the notice was issued.

- Sign the form under the "Name" with the signature of the lender or authorized representative, then print the name right below the signature line. Finally, insert the title of the individual signing off on this form and the lender’s name in the designated spaces.

Once the form is completely filled out, review it for accuracy, ensuring all the details are correct and match the loan documents. After verification, send the form to the designated recipient using a reliable method that provides a record of delivery, such as certified mail. Timely and accurate completion of this form is crucial in providing the recipient every opportunity to address the loan default within the stipulated timeframe.

Understanding Notice Of Right To Cure Auto Loan Letter

What is a Notice of Right to Cure Auto Loan Letter?

A Notice of Right to Cure Auto Loan Letter is a formal communication from a lender to a borrower who has defaulted on their auto loan. Pursuant to the Nebraska Revised Statute § 45-1050 (Reissue 2010), this notice informs the borrower that they have been in default for at least ten days and outlines their legal right to rectify this default by making the overdue payment within a specified period, typically 20 days after the date of the notice.

Who should receive this notice?

This notice is intended for borrowers who have failed to make their scheduled loan payments as agreed upon in their auto loan contract. It serves as a formal reminder that the lender is aware of the default and provides the borrower with a chance to correct it.

What should I do if I receive a Notice of Right to Cure Auto Loan Letter?

If you receive this notice, it's essential to act promptly. Review the specifics of the notice, including the amount due and the deadline for curing the default. Payment must be submitted by the specified date to prevent further action from the lender. If you have any questions or concerns, contact the lender immediately using the provided contact information.

What happens if I fail to cure the default by the deadline?

Failure to cure the default within the given timeframe can have serious consequences. The lender might cancel any credit insurance associated with the loan contract, and in severe cases, move forward with repossession of the vehicle. Additionally, it may negatively impact your credit score and future borrowing ability.

Can I negotiate the payment amount or deadline?

While the notice specifies a payment amount and deadline, lenders may be open to negotiation, especially if the borrower communicates their situation promptly and expresses a desire to resolve the default. It's worth reaching out to the lender to discuss any possible adjustments or payment plans.

What should I do if I can't make the full payment by the deadline?

If making the full payment by the deadline is not feasible, contact the lender immediately. Lenders often prefer to work out a solution rather than proceed with repossession. You may be able to arrange a modified payment plan that fits your current financial situation.

Is it possible to receive another notice like this in the future?

Yes, if the default is cured but you fail to maintain your payment obligations in the future, the lender retains the right to issue another notice. However, the letter warns that if you default again, the lender may enforce their rights without providing another notice.

What are the legal implications of receiving this notice?

Receiving a Notice of Right to Cure Auto Loan Letter indicates that you are legally in default of your auto loan agreement. It triggers a formal process allowing you the opportunity to rectify the situation. Ignoring this notice can lead to legal actions from the lender, including repossession of the vehicle and negative impacts on your credit report. It's crucial to address the notice seriously and take immediate steps to resolve the default.

Common mistakes

Filling out a Notice Of Right To Cure Auto Loan Letter can be a critical step in addressing a loan default. It is a legal document that informs a borrower of their right to fix (or "cure") a default on their auto loan before further actions, such as repossession, are taken. Since this document plays a significant role in the financial and legal realms, ensuring accuracy and completeness when filling it out is paramount. However, individuals often make mistakes in this process. Below are ten such errors to watch out for.

- Not reading the statute first: Skipping over the details of Neb. Rev. Stat. § 45-1050 and § 45-1051 (Reissue 2010) can lead to misunderstandings about the rights and obligations involved.

- Incorrect loan details: Failing to accurately describe the loan in question. This includes not providing complete information or making typographical errors in the loan description.

- Misidentifying the borrower: Inputting incorrect information for the borrower or not using the legal name that matches the loan documents.

- Inaccurate lender information: Similar to borrower details, providing incorrect information for the lender, such as the wrong name or address, can derail the process.

- Omitting the payment amount: Not specifying the exact payment amount needed to cure the default. This is essential for the borrower to know how much to pay.

- Setting unrealistic deadlines: Miscalculating the 20-day period for curing the default or providing incorrect dates can create legal issues and confusion.

- Forgetting to include contact information: Failure to provide a telephone number or correct address for payment can prevent or delay the curing of the default.

- Ignoring additional obligations: Not addressing other aspects related to curing the default, such as the potential cancellation of credit insurance, can lead to further complications.

- Reusing old forms without checking for updates: Using an outdated form without verifying it meets the current legal requirements can invalidate the notice.

- Delay in sending the notice: Waiting too long to issue the notice after the default has occurred might strip the borrower of the opportunity to cure the default, leading to unnecessary legal and financial ramifications.

Correcting these mistakes can streamline the process, reducing stress and potential legal challenges for both the lender and borrower. Always verify each section of the Notice of Right to Cure Auto Loan Letter for accuracy and completeness before submission. In matters of financial distress, the clarity and correctness of such documents can significantly impact the outcome. When in doubt, consulting with a legal advisor can provide guidance tailored to the specific circumstances.

Documents used along the form

When managing an auto loan, especially when addressing a default, the Notice of Right to Cure Auto Loan Letter is critical, but it is just one of several important documents that parties involved might need. Understanding these associated documents can ensure a comprehensive approach to managing and rectifying loan default situations.

- Loan Agreement: This is the original agreement between the lender and borrower, outlining the loan amount, repayment schedule, interest rate, and other terms and conditions.

- Bill of Sale: Document proving the transaction and transfer of ownership of the vehicle from the seller to the buyer. It often includes details like the make, model, year, and VIN of the vehicle.

- Payment History: A record of all payments made on the auto loan, indicating the date, amount, and method of each payment. This can be crucial for identifying the specifics of the default.

- Amortization Schedule: A detailed table showing the loan balance, interest and principal components of each payment over the life of the loan. It helps in understanding how payments are applied.

- Late Payment Notices: Notices sent by the lender to the borrower for any payments that were made late. These can establish a pattern of behavior and serve as a precursor to the Notice of Right to Cure.

- Vehicle Insurance Policy: Documents proving that the vehicle is insured, which may be a requirement of the loan agreement. Loss of insurance can also constitute a default on some loan agreements.

- Default Notice: Formal notification from the lender to the borrower that the loan is in default before the Notice of Right to Cure Auto Loan Letter is issued. It may detail the nature of the default.

- Reinstatement Quote: A document provided by the lender detailing the amount necessary to bring the loan current, which may include past due payments, late fees, and any other charges.

Together, these documents form a comprehensive dossier to effectively manage the auto loan lifecycle, especially in default situations. Lenders and borrowers alike benefit from understanding and properly leveraging these documents to ensure transparent, fair, and efficient resolution of any issues that arise during the course of the loan.

Similar forms

The "Notice of Intent to Foreclose" is a document that bears resemblance to the "Notice of Right to Cure Auto Loan Letter" because both serve as preliminary warnings to recipients about pending legal action due to a breach, such as a default on payments. This notice specifically warns homeowners that they are at risk of losing their home due to missed mortgage payments and offers a similar opportunity to cure the default within a specific timeframe, mirroring the auto loan notice's intent to give one last chance to rectify the situation before more severe consequences are enacted.

The "Demand Letter for Payment" is another document that shares characteristics with the notice. This letter is typically sent out to request payment of debts or damages and outlines what is owed, why, and by when, similar to how the auto loan letter specifies the amount and deadline for curing the loan default. Both documents aim to resolve the issue outside of court by providing the recipient with the opportunity to fulfill their financial obligation within a set period.

A "Notice of Default on a Mortgage" is closely related to the auto loan notice in its function and consequences. It alerts borrowers that they have not met their mortgage payment obligations, similar to how the auto loan notice addresses missed loan payments. This document also lays out the steps and timeframe for the borrower to become current on their payments to avoid foreclosure, paralleling the process of curing a default outlined in the auto loan letter.

The "Rent Demand Letter" functions similarly to the auto loan notice but in the context of leasing agreements. It notifies tenants that they are in arrears with their rent, specifies the amount owed, and provides a deadline for payment before further action is taken, such as eviction proceedings. This parallel structure helps ensure that tenants have a clear opportunity to remedy their default, akin to how an auto loan holder is given a chance to cure their loan default.

A "Student Loan Default Notice" shares commonalities with the auto loan notice, as it informs borrowers that they have failed to make required payments on their student loans. This document usually outlines the consequences of remaining in default and offers options for getting back into good standing, which may include a period during which the borrower can cure their default, similar to the timeline provided in the auto loan letter.

The "Credit Card Default Notice" is another similar document that informs cardholders of their failure to make minimum payments. Like the auto loan notice, it often outlines the consequences of continued non-payment, such as increased interest rates or cancellation of the credit line, and offers a cure period during which the cardholder can pay the overdue amount to avoid further penalties.

A "Final Notice Before Legal Action" is often sent as a last attempt to collect a debt before the creditor proceeds with legal action. This notice makes it clear that the recipient has one final opportunity to settle their debt, mirroring the auto loan letter's final warning about curing a default before more drastic measures are taken. Both documents are designed to prompt action by underlining the seriousness of the situation and the impending consequences of inaction.

The "Eviction Notice for Non-Payment of Rent" parallels the auto loan document by providing a legal warning to tenants that they must pay overdue rent or face eviction. It stipulates the amount owed and the timeframe for payment, similar to how the auto loan letter specifies the payment required to cure the default. This document serves as a final alert that failure to act will result in significant legal repercussions.

Dos and Don'ts

When filling out the Notice of Right to Cure Auto Loan Letter form, it's important to remember the following dos and don'ts to ensure accuracy and compliance with relevant laws and regulations.

Do:

- Ensure all the loan details are accurate, including the loan amount, the nature of the default, and the specific terms of the loan as initially agreed upon.

- Provide a clear deadline by which the default must be cured, adhering to the minimum days of notice required by law.

- Include all relevant contact information where payments should be sent, including the name, address, city, state, zip, and telephone number.

- Use the date format specified in the template and ensure the notice date is correct, as this establishes the timeline for the borrower to act.

Don't:

- Leave blank spaces in the loan description area. Provide a full description of the loan in default to avoid any ambiguities about which loan the notice pertains to.

- Forget to fill out the payment amount required to cure the default. This figure should be precise and include any applicable charges or fees.

- Ignore state-specific legal requirements or statutes that might dictate additional information or wording must be included in the notice.

- Provide inaccurate or incomplete contact information, thereby potentially preventing the borrower from making the necessary payment to cure the default.

Misconceptions

Only borrowers in Nebraska need to worry about this form. This misconception arises because the form references Nebraska statutes. While this specific form cites Nebraska law, many states have similar laws in place to protect consumers by giving them the right to cure a default on a loan. It’s essential to understand your state’s laws regarding auto loans and default notices.

The notice gives you 20 days to cure the default. While the form does mention a 20-day period to cure the loan default, this timeframe starts after the date of the notice. Borrowers often misunderstand this and believe they have 20 days from receiving the notice, which could lead to missed deadlines. Ensure you understand when your countdown starts.

You can only cure the default once. This letter states, “If you default again, we may exercise our rights without sending you another notice like this one.” However, this doesn’t mean you're forbidden from curing a future default. What it does mean is the lender may not be obligated to offer the same notice or opportunity before taking action on the subsequent default.

Making the cure payment resets the loan as if no default occurred. Paying the specified amount to cure your default doesn’t erase the fact a default occurred. It simply brings the loan current. Lenders may still consider the history of the default in dealings with you, and it might impact your ability to modify the loan or obtain new credit.

The notice only concerns the missed payments. While the cure payment often relates primarily to missed payments, it might also include late fees, interest, and other charges accumulated due to the default. Always confirm the breakdown of the cure payment to understand fully what you are paying.

Failure to cure the default will automatically lead to repossession of the vehicle. While repossession is a potential consequence of not curing the default, lenders may pursue other options first, such as restructuring the loan or offering a payment plan. The notice itself is a means to avoid such severe outcomes by providing an opportunity to address the default.

Once you receive this notice, it’s too late to negotiate with your lender. Receiving a Notice of Right to Cure does not mean all hope is lost. On the contrary, it should serve as a prompt to contact your lender immediately. Many lenders prefer to work with borrowers to resolve issues since repossession and loan defaults are costly and time-consuming for both parties involved. Communication is key.

Key takeaways

Filling out and using the Notice Of Right To Cure Auto Loan Letter form is a crucial step in the process of managing loan defaults. Understanding your rights and responsibilities can help take the right actions to address financial issues efficiently and legally. Here are key takeaways from this form:

- Timeliness matters: It alerts the recipient that they have been in default for a minimum of ten days, spotlighting the importance of promptly addressing the issue.

- Clear opportunity to rectify: The notice provides a specific timeframe—20 days—within which the default can be cured, emphasizing the borrower's right to rectify the situation before further actions are taken.

- Detailed information is essential: For both parties, specificity in the loan description, including the terms and amount outstanding, is crucial to ensure clarity and prevent misunderstandings.

- Payment instructions: Clear instructions on where and to whom the payment should be made reinforce the importance of following the correct procedure to cure the default.

- Consequences of inaction: The notice outlines the repercussions of not curing the default, such as the potential cancellation of credit insurance, underlining the stakes involved.

- A final warning: It serves as a caution that future defaults may lead to actions without further notice, stressing the importance of maintaining timely payments after curing the default.

- Communication is key: Encouraging borrowers to reach out if they have questions fosters an environment where issues can be resolved through dialogue.

- Officiality and authority: The form is approved by the Nebraska Department of Banking and Finance, lending it legal credibility and reassuring recipients of the formal nature of the notice.

Understanding and acting according to the Notice Of Right To Cure Auto Loan Letter form can significantly impact individuals facing financial difficulties. By providing a structured path for resolution, it offers a lifeline that can help avoid more drastic measures like repossession. Whether you're a borrower or a lender, recognizing the importance of this notice ensures a smoother resolution process, benefiting all parties involved.

Popular PDF Documents

Budget Loan - Preconditions like the absence of high outstanding Social Fund debts for new loan consideration are made clear.

Dwc 25 - A form that aids both employer and employee in documenting and beginning the process for workers' compensation in Florida.

Form 1013 - The robust information provided by form 3010 aids in fostering a proactive approach to managing tax responsibilities.