Get Nj Sales Tax St 50 Form

In the realm of business operations within New Jersey, accurately managing and submitting sales and use tax is a critical aspect that ensures compliance with state regulations. The New Jersey Sales Tax ST-50 form plays a pivotal role in this process, serving as a worksheet for businesses to prepare their quarterly sales and use tax returns before filing them online. This exclusive online worksheet guides businesses through several crucial steps, starting from documenting gross receipts from all sales, distinguishing between taxable and non-taxable receipts, and calculating the sales tax owed based on applicable tax rates that have seen changes over the years. Additionally, the form allows for the recording of sales tax collected, use tax due, and total tax due, while also accounting for previous payments made within the quarter. The completion of this process culminates in the determination of the quarterly amount due, along with any penalties and interest applied, leading to the adjusted amount owed to the state. Payment methods are conveniently integrated into the system, supporting various options including e-check and EFT debit, with notable restrictions on accounts funded outside the United States. Moreover, the provision to print a confirmation page upon filing offers businesses a record of compliance. This meticulous approach to tax filing underscored by the ST-50 form highlights the importance of accuracy and timeliness in adhering to New Jersey’s tax laws, ultimately contributing to the seamless operation of businesses within the state.

Nj Sales Tax St 50 Example

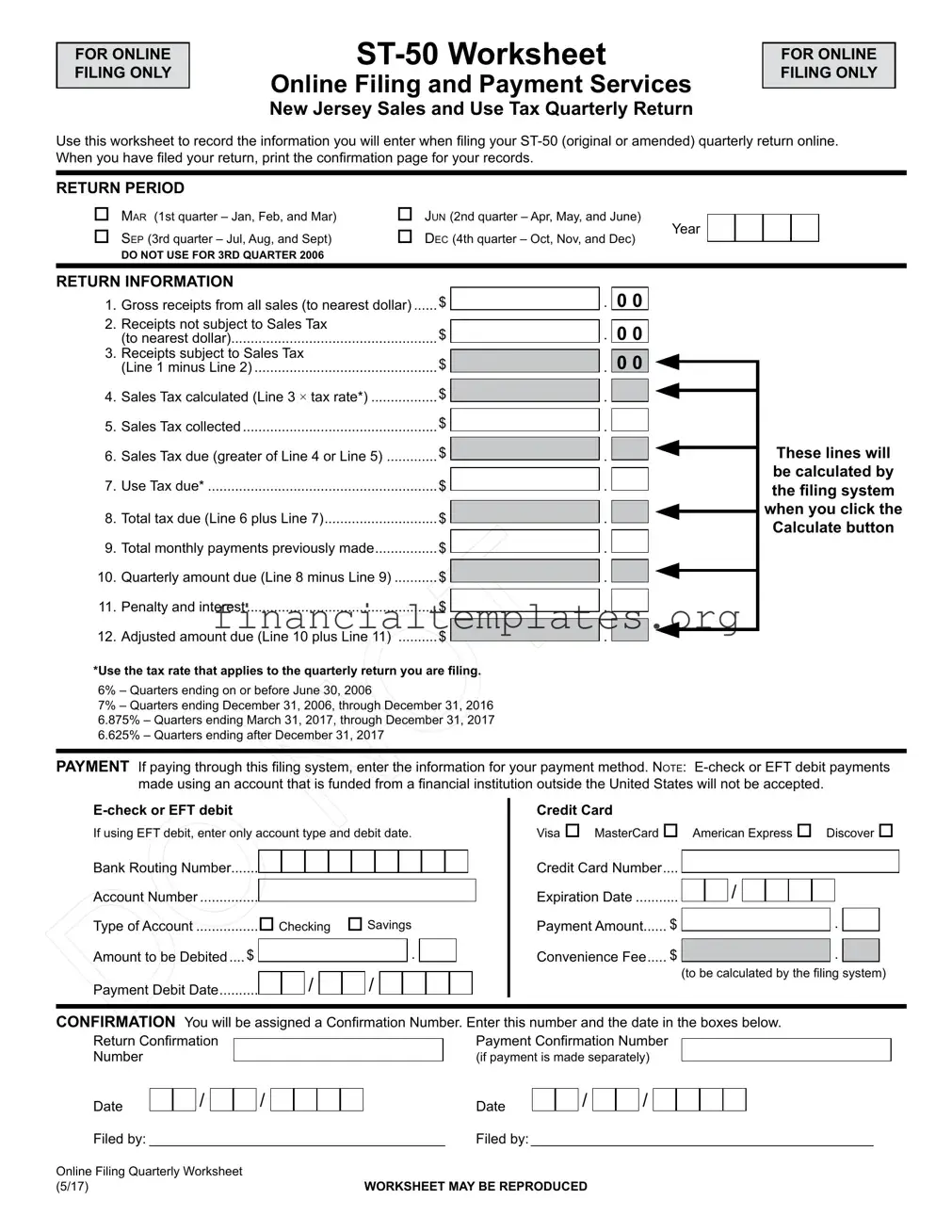

FOR ONLINE FILING ONLY

Online Filing and Payment Services

New Jersey Sales and Use Tax Quarterly Return

FOR ONLINE FILING ONLY

Use this worksheet to record the information you will enter when filing your

RETURN PERIOD

|

Mar (1st quarter – Jan, Feb, and Mar) |

|

Sep (3rd quarter – Jul, Aug, and Sept) |

|

|

|

DO NOT USE FOR 3RD QUARTER 2006 |

|

Jun (2nd quarter – Apr, May, and June) |

Year |

|

Dec (4th quarter – Oct, Nov, and Dec) |

||

|

RETURN INFORMATION

1. |

Gross receipts from all sales (to nearest dollar) |

$ |

2. |

Receipts not subject to Sales Tax |

$ |

|

(to nearest dollar) |

|

3. |

Receipts subject to Sales Tax |

$ |

|

(Line 1 minus Line 2) |

|

4. |

Sales Tax calculated (Line 3 × tax rate*) |

$ |

5. |

Sales Tax collected |

$ |

6. |

Sales Tax due (greater of Line 4 or Line 5) |

$ |

7. |

Use Tax due* |

$ |

8. |

Total tax due (Line 6 plus Line 7) |

$ |

9. |

Total monthly payments previously made |

$ |

10. |

Quarterly amount due (Line 8 minus Line 9) |

$ |

11. |

Penalty and interest |

$ |

12. |

Adjusted amount due (Line 10 plus Line 11) |

$ |

. 0 0

. 0 0

. 0 0

. 0 0

.

.

.

.

.

.

.

.

.

.

.

.

.

.

These lines will be calculated by the filing system when you click the Calculate button

*Use the tax rate that applies to the quarterly return you are filing.

6% – Quarters ending on or before June 30, 2006

7% – Quarters ending December 31, 2006, through December 31, 2016 6.875% – Quarters ending March 31, 2017, through December 31, 2017 6.625% – Quarters ending after December 31, 2017

PAYMENT If paying through this filing system, enter the information for your payment method. Note:

If using EFT debit, enter only account type and debit date.

Bank Routing Number.......

Account Number................

Type of Account |

Checking |

Savings |

||||||||||||

Amount to be Debited..... $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

Payment Debit Date |

|

/ |

|

|

/ |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit Card

Visa MasterCard American Express Discover

Credit Card Number.... |

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

Expiration Date |

|

|

|

|

|

|

|

|

|

|

|

Payment Amount...... $ |

|

|

|

|

|||||||

|

. |

|

|

||||||||

Convenience Fee..... $ |

|

|

|

||||||||

|

|

|

|

|

|

|

. |

|

|

||

|

(to be calculated by the filing system) |

||||||||||

CONFIRMATION You will be assigned a Confirmation Number. Enter this number and the date in the boxes below.

Return Confirmation Number

Date/

/

Payment Confirmation Number

(if payment is made separately)

Date |

|

|

/ |

|

|

/ |

Filed by:_______________________________________ Filed by:_____________________________________________

Online Filing Quarterly Worksheet |

WORKSHEET MAY BE REPRODUCED |

(5/17) |

Document Specifics

| Fact Name | Fact Detail |

|---|---|

| Purpose | The NJ Sales Tax ST-50 Form is used for online filing of quarterly sales and use tax returns in New Jersey. |

| Use Period | It covers quarterly periods: Mar (Q1), Jun (Q2), Sep (Q3), and Dec (Q4). |

| Exclusion | The form explicitly states not to use it for the third quarter of 2006. |

| Content | It includes gross receipts, taxable and nontaxable sales, sales tax collected, and due, along with use tax due. |

| Varying Tax Rates | Tax rates vary depending on the quarter: 6% (before July 1, 2006), 7% (until Dec 31, 2016), 6.875% (until Dec 31, 2017), and 6.625% (afterward). |

| Payment Options | Payments can be made via e-check, EFT debit, or credit card but not with foreign-funded accounts. |

| Confirmation | A confirmation number is provided upon successful filing and payment. |

| Governing Law | Governed by New Jersey state law regarding the collection and remittance of sales and use taxes. |

Guide to Writing Nj Sales Tax St 50

Filing the New Jersey Sales and Use Tax Quarterly Return, known as the ST-50 form, is a critical task for many businesses across the state. This form helps track the sales and use tax collected by businesses over the quarter and ensures that the correct amount is remitted to the state. The process, designed for online filing, is streamlined to assist taxpayers in meeting their tax obligations accurately and efficiently. With the steps outlined below, you'll find that completing the ST-50 form can be a straightforward task, ensuring you stay compliant with New Jersey tax laws.

- Access the online filing system for the New Jersey Division of Taxation to begin your ST-50 quarterly return.

- Select the correct return period from the options provided: March (1st quarter), June (2nd quarter), September (3rd quarter), or December (4th quarter).

- Input your gross receipts from all sales to the nearest dollar in the space provided.

- Enter the receipts not subject to sales tax, again rounding to the nearest dollar.

- Calculate the receipts subject to sales tax by subtracting line 2 from line 1. Enter this amount.

- Apply the appropriate tax rate to the taxable receipts to calculate the sales tax. The rate you use will depend on the return's quarter.

- Enter the amount of sales tax collected during the period.

- Determine the sales tax due, which is the greater amount between the sales tax calculated and the sales tax collected, and enter it.

- For any use tax due, calculate this amount and input it into the form.

- Add together the sales tax due and use tax due to find the total tax due and enter this amount.

- Include the total of monthly payments previously made towards this quarter's tax liability.

- Subtract the total monthly payments from the total tax due to determine the quarterly amount due.

- If applicable, add any penalty and interest to the quarterly amount due to find the adjusted amount due. Enter this final amount.

- For payment, choose between using an e-check or EFT debit and fill out the necessary banking information, or select a credit card payment option and provide the required details.

- After submission, a confirmation number and the date of filing will be assigned. Be sure to record these for your records.

By following these steps, you can smoothly file your ST-50 form, thereby fulfilling your tax responsibilities for the quarter. Always ensure that the information entered matches your financial records to avoid discrepancies and potential penalties. This methodical approach not only keeps your business in good standing with New Jersey's tax regulations but also provides a clear record of your sales and use tax commitments throughout the year.

Understanding Nj Sales Tax St 50

What is the ST-50 form used for in New Jersey?

The ST-50 form is utilized for reporting and paying the sales and use tax on a quarterly basis in New Jersey. Businesses file this form to report gross receipts, calculate the sales tax due based on taxable receipts, include any use tax, and reconcile these amounts with tax collected and any prior payments. This form is essential for businesses to comply with New Jersey's tax laws.

How do I file the ST-50 form?

The ST-50 form is filed exclusively online through New Jersey's filing and payment services. Businesses should prepare their sales data and follow the online system prompts to enter required information, calculate taxes due, and submit payment. Upon completion, it's important to print the confirmation page for record-keeping purposes.

What are the quarterly return periods for the ST-50 form?

The quarterly return periods for the ST-50 form are: January through March (1st quarter), April through June (2nd quarter), July through September (3rd quarter), and October through December (4th quarter). Businesses must file their quarterly returns following these periods to ensure timely compliance.

How is the sales tax calculated on the ST-50 form?

Sales tax on the ST-50 form is calculated by subtracting non-taxable receipts from the gross receipts, then multiplying the result by the applicable tax rate for the quarter. The correct tax rate depends on the period in question, with historical rates provided for reference. It's crucial to use the rate corresponding to the quarter for which you are filing.

Can I use the ST-50 form to report sales from any quarter?

Yes, but with a specific note to not use it for the 3rd quarter of 2006. For all other periods, you can use the ST-50 form to report quarterly sales, provided you select the correct return period when filing.

What payment methods are accepted when filing the ST-50 form?

Payment can be made through E-check or EFT (Electronic Funds Transfer) debit from a checking or savings account. Credit card payments are also accepted, with options including Visa, MasterCard, American Express, and Discover. Note that E-check or EFT debit payments from accounts funded outside the United States are not accepted.

What happens after I file the ST-50 form?

After filing the ST-50 form, you will be assigned a confirmation number. This confirmation number, along with the filing date, should be recorded and retained for your records. If payment is made separately, a separate payment confirmation number will be provided, which should also be documented.

Are there any penalties for late filing or payment of the ST-50 form?

Yes, businesses that file or pay after the due date may incur penalties and interest charges. These charges will be calculated based on the amount due and the time elapsed since the payment or filing due date. It's important to file and pay on time to avoid these additional costs.

Common mistakes

Filling out the New Jersey Sales and Use Tax Quarterly Return (ST-50) form accurately is crucial for businesses to comply with state tax regulations and avoid potential penalties. Despite the form's straightforward nature, mistakes can occur. Here are ten common errors made when completing the ST-50 form:

Not updating the form for the correct filing year or quarter: Businesses must ensure they are using the form for the appropriate year and quarter, as tax rates and regulations may change.

Incorrect gross receipt reporting: It’s essential to report gross receipts to the nearest dollar, including all sales before deductions.

Failing to properly subtract non-taxable receipts from gross receipts: This calculation ensures the correct taxable amount is reported and taxes are not overpaid.

Miscalculating the sales tax: Applying the correct tax rate to the taxable receipts is vital. Remember, the tax rate can change, so use the rate that corresponds to the return’s period.

Reporting inaccurately the sales tax collected: This figure should match the actual amount collected during the quarter and needs to be accurate.

Overlooking the sales tax due calculation: It is the greater of line 4 or line 5 amounts. Misunderstanding this line can lead to reporting errors.

Ignoring or incorrectly calculating use tax due: This requires attention to detail for transactions subject to use tax, not just sales tax.

Omitting previous payments: If monthly payments were made, these must be deducted from the total tax due to avoid overpayment.

Entering incorrect payment details: For electronic payments, ensure that the bank routing number, account number, and payment amount are entered correctly. Remember, payments from accounts outside the United States are not accepted.

Forgetting to print or save the confirmation page: Once the return is filed online, printing or saving the confirmation page for your records is crucial for future reference or in case of an audit.

Avoiding these mistakes requires attention to detail and a thorough understanding of the tax return's requirements. By taking the time to double-check each entry and ensuring the form's completeness and accuracy, businesses can better comply with New Jersey's tax laws and avoid unnecessary fines or penalties.

Documents used along the form

When managing sales and use tax in New Jersey, the ST-50 Worksheet serves as a crucial tool for online filing of quarterly returns. However, to ensure comprehensive compliance and efficient tax administration, it may be necessary to familiarize oneself with additional forms and documents that often complement the ST-50. Below is an outline of up to five such forms, each addressing distinct aspects of tax filing and business operation requirements.

- ST-51: This form is a monthly remittance statement for sales and use tax, used by businesses that are required to make monthly payments in advance of their quarterly returns. It helps manage cash flow and compliance by breaking down the quarterly obligation into manageable monthly payments.

- Form NJ-REG: Essential for new businesses or those undergoing changes, this form enables the registration for tax and employer purposes. It's a critical step for entities to become recognized taxpayers, ensuring they can legally operate and be compliant from the outset.

- Annual Resale Certificate (Form ST-3): Issued by the New Jersey Division of Taxation, this certificate allows businesses to purchase goods tax-free that will later be resold. It plays a pivotal role in the supply chain, preventing the cascading effect of sales tax through the resale process.

- Form NJ-927: The NJ-927 form is used to report and pay withheld payroll taxes on a quarterly basis. It covers state income tax, unemployment insurance, workforce development partnership fund, and family leave insurance. It is vital for employers to accurately report and contribute to these programs.

- Form WR-30: Employment reports are filed using Form WR-30, which details wages paid to employees. This information is essential for the administration of unemployment and disability insurance programs, providing a snapshot of employment levels and payroll expenses.

Understanding and utilizing these forms in conjunction with the ST-50 Worksheet can significantly enhance a business's ability to maintain tax compliance and financial health in New Jersey. Each document supports various operational and regulatory aspects, from payroll and employment to purchasing and sales activities. Together, they form a comprehensive toolkit for effectively managing tax-related responsibilities.

Similar forms

The ST-50 Worksheet for New Jersey Sales and Use Tax Quarterly Return bears resemblance to the Form 941, Employer's Quarterly Federal Tax Return. Both require the business or the filer to compile and calculate taxes due for a specific reporting period. In the case of the ST-50, it focuses on sales and use tax collected from customers, while the Form 941 deals with payroll taxes, including federal income tax withheld from employees, Social Security, and Medicare taxes. Each form serves as a record of the business's tax liability for the quarter and helps in maintaining compliance with state and federal tax laws.

Similarly, the Form 1040-ES, Estimated Tax for Individuals, aligns with aspects of the ST-50 Worksheet, particularly in how they both involve the calculation of taxes due for a specific period. The ST-50 Worksheet aids businesses in calculating sales tax owed to the state, while the Form 1040-ES is used by individuals to estimate the taxes they owe on income not subject to withholding. Both documents require the filer to project or calculate their tax liability and make appropriate payments to avoid penalties.

The Sales and Use Tax Return form used in various states, such as California's BOE-401-EZ, also shares functionalities with New Jersey's ST-50 Worksheet. Each is tailored to collect sales and use tax and necessitates the reporting of gross receipts, taxable sales, and the amount of tax due. The primary difference lies in their state-specific tax rates and rules, but the underlying purpose of collecting taxes on the sale of goods and services remains consistent across these forms. They serve as vital components in the state's ability to fund public services and infrastructure.

Last, the UCC Financing Statement (Form UCC1) parallels the ST-50 Worksheet in its role of declaration, even though it pertains to a different aspect of commerce. Instead of tax collection, the UCC1 form is utilized to declare a secured interest in a borrower's personal property to the public and creditors. Like the ST-50, which ensures businesses accurately report and remit their sales and use taxes, the UCC Financing Statement secures the lender's interest and priority in the collateral offered by a debtor. Both documents play crucial roles in their respective domains, ensuring financial transparency and compliance.

Dos and Don'ts

When you're getting ready to fill out the NJ Sales Tax ST-50 form, it's crucial to keep a few dos and don'ts in mind to ensure the process goes smoothly. Here's a guide to help you along:

- Do ensure you're filing for the correct quarter. The form has specific checkboxes for each quarter - March, June, September, and December - so double-check you're working on the right one.

- Do round all your receipts to the nearest dollar. This keeps your form neat and aligns with the instructions for reporting gross receipts and those not subject to sales tax.

- Do use the correct sales tax rate for your filing period. The rates have changed over the years, so it’s critical to apply the rate that corresponds to the quarter you are reporting.

- Do keep a printed confirmation page after filing online. This is your proof of filing, which might come in handy if there are any discrepancies or queries from the tax department.

- Don’t attempt to use the worksheet for a quarter that it specifies not to use it for, such as the 3rd quarter of 2006. This instruction is clearly marked on the form and doing so could result in errors or rejection of your filing.

- Don’t input your payment method details until you’re ready to submit. Entering these too early could lead to a risk of misplacement or having to redo it if changes are made to the form before submission.

- Don’t forget to calculate the convenience fee if you're paying by credit card. This fee isn't automatically calculated until the end, so you need to be aware of the additional charge.

- Don’t leave the confirmation number fields blank. Once you receive these numbers after filing, enter them immediately to ensure your records are complete and accurate.

Abiding by these simple guidelines can make your NJ Sales Tax ST-50 form filing a smooth and error-free process. Remember, accurate and timely filing is not just about complying with tax laws—it’s also about ensuring the financial health and compliance of your business.

Misconceptions

There are several misconceptions about the New Jersey Sales Tax ST-50 form that are important to clear up for businesses and tax preparers alike. Understanding these can help avoid errors and ensure compliance with state tax regulations.

- It's only for traditional businesses: The belief that the ST-50 form is only for brick-and-mortar businesses is a common misconception. In reality, it applies to all entities that collect sales tax, including online retailers.

- Paper filing is an option: Despite what some might think, the ST-50 must be filed online. The form explicitly states "FOR ONLINE FILING ONLY," emphasizing the state's move towards digital submission methods.

- It can be used for any quarter: A specific version of the ST-50 form was not to be used for the 3rd quarter of 2006, which underscores that not all versions are applicable for every quarter. Always ensure the version you're using is correct for the period you're filing.

- Use Tax is always calculated separately: The ST-50 form requires the filer to report Use Tax due, which might lead some to think it's always a separate calculation. However, this amount can often be directly related to the sales activities and is calculated within the form's process.

- Sales tax rates are constant: The sales tax rate changes are a common source of confusion. The rate can and has changed over time, as noted within the form referencing various rates for different periods. Users must apply the correct tax rate for the quarter they are filing.

- Any bank account can be used for payment: The ST-50 form specifies that E-check or EFT debit payments from accounts funded by financial institutions outside the United States will not be accepted. This detail is crucial for ensuring payment methods comply with state requirements.

- Sales and Use Tax are the same: Some might incorrectly believe that Sales Tax and Use Tax are interchangeable. The ST-50 form requires separate calculations for each, highlighting their distinct roles in state tax legislation.

- Convenience fees do not apply: When making payments with a credit card, a convenience fee will be calculated by the filing system. This additional cost may be overlooked by filers who are not aware of or forget about these applicable fees.

Correcting these misconceptions about the ST-50 form can lead to a smoother filing process and help avoid potential penalties. Always read the form instructions thoroughly and consult the latest state tax guidelines to ensure compliance.

Key takeaways

Understanding the filing requirements for the New Jersey Sales and Use Tax Quarterly Return (ST-50) is crucial for business owners in NJ. This form is designed exclusively for online filing, urging businesses to embrace digital submissions for their sales and use tax declarations.

The ST-50 worksheet provides a streamlined approach to record transactions over the quarter. Businesses must accurately report their gross receipts, differentiate between taxable and non-taxable sales, and calculate the tax due based on the appropriate tax rate for that quarter.

It's essential to be aware of the changing sales tax rates over time, as reflected on the ST-50 form. For instance, the sales tax rates have evolved from 6% to 6.625% after December 31, 2017. This variation in tax rates underscores the importance of using the correct rate when calculating taxes due.

The form emphasizes the importance of distinguishing between sales tax collected and sales tax due. The amount of sales tax owed to the state may differ from the amount collected from customers, which is a critical distinction for accurate tax reporting.

Compatibility with different payment methods enhances the convenience of submitting the ST-50 form. Whether opting to pay via e-check, EFT debit, or credit card, it is critical to ensure that the chosen account is U.S.-based, as foreign-funded accounts are not accepted.

After filing the return online, receiving a confirmation number serves as proof of submission. It is a vital record for businesses, verifying that they have met their filing obligation for that quarter. Keeping a printed or digital copy of the confirmation page is recommended for future reference.

Popular PDF Documents

Form 843 Irs - IRS 843 is used to make claims for relief regarding specific taxes, including income, estate, gift, and certain excise taxes.

Tax Form 1040 - Adjustments to income, such as contributions to traditional IRAs or student loan interest paid, are reported here too.