Get Newark Payroll Tax Statement Form

Navigating the intricacies of tax obligations marks a critical component of running a business, and in the city of Newark, this includes understanding and accurately completing the Newark Payroll Tax Statement. This form, designated for the first quarter of 2014 and due by April 30th of the same year, plays a vital role in ensuring businesses meet their local tax requirements. It encompasses several key areas: the basic identification information of the business, including the Business Tax ID Number, start date, name, address, and contact details, coupled with the number of employees and any significant changes such as business closure or sale. Importantly, the form requires a detailed accounting of total wages, tips, and other compensations, alongside an apportionment section for those businesses it applies to, ultimately determining the total taxable payroll. The calculated tax, based on a 1% rate, along with any interest and penalties for late payment, forms the crux of the financial reporting on this document. The insistence on using black ink and remaining within the lines underscores the formal nature of this obligation. Furthermore, the declaration under penalty of perjury emphasizes the seriousness with which this document must be regarded, underscoring its importance in maintaining compliance with state laws. The process, while straightforward for those familiar with tax documentation, underscores the necessity of careful attention to deadlines, details, and the proper calculation and reporting of payroll taxes to avoid financial penalties.

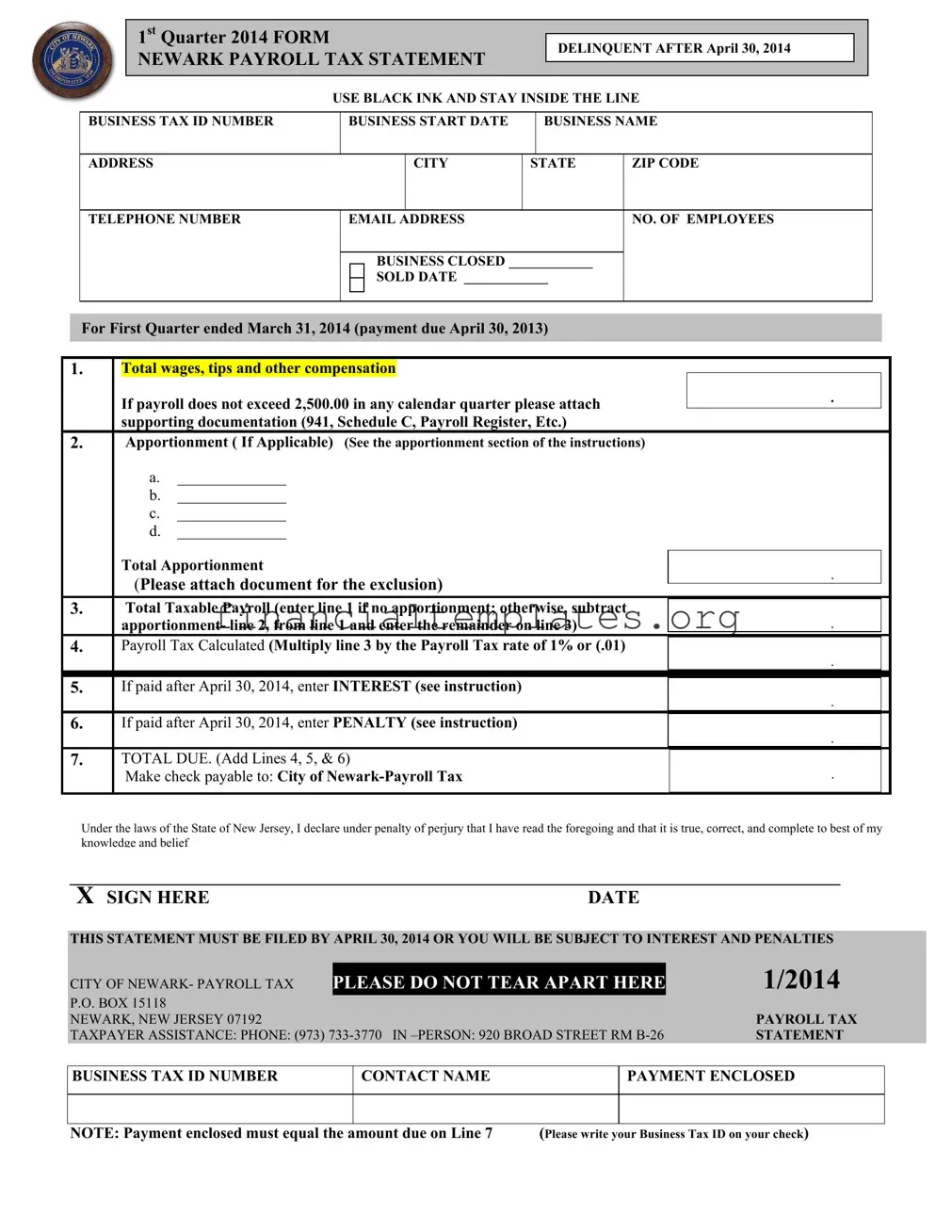

Newark Payroll Tax Statement Example

1st Quarter 2014 FORM

NEWARK PAYROLL TAX STATEMENT

DELINQUENT AFTER April 30, 2014

USE BLACK INK AND STAY INSIDE THE LINE

BUSINESS TAX ID NUMBER |

BUSINESS START DATE |

|

BUSINESS NAME |

||||

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

CITY |

STATE |

ZIP CODE |

|

|

|

|

|

|

|

|

|

TELEPHONE NUMBER |

EMAIL ADDRESS |

|

|

NO. OF EMPLOYEES |

|||

|

|

|

|

|

|||

|

|

|

BUSINESS CLOSED ____________ |

|

|||

|

|

|

SOLD DATE ____________ |

|

|||

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For First Quarter ended March 31, 2014 (payment due April 30, 2013)

1. |

|

Total wages, tips and other compensation |

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

If payroll does not exceed 2,500.00 in any calendar quarter please attach |

|

|||||

|

|

|

|

|||||

|

|

|

|

|||||

|

|

supporting documentation (941, Schedule C, Payroll Register, Etc.) |

|

|

||||

2. |

|

Apportionment ( If Applicable) (See the apportionment section of the instructions) |

|

|

||||

|

|

a. |

______________ |

|

|

|

|

|

|

|

b. |

______________ |

|

|

|

|

|

|

|

c. |

______________ |

|

|

|

|

|

|

|

d. |

______________ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Total Apportionment |

|

|

. |

|

||

|

|

(Please attach document for the exclusion) |

|

|

|

|||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||

3. |

|

Total Taxable Payroll (enter line 1 if no apportionment; otherwise, subtract |

|

|

|

|

||

|

|

apportionment- line 2, from line 1 and enter the remainder on line 3) |

|

|

. |

|

||

|

|

|

|

|

|

|||

4. |

|

Payroll Tax Calculated (Multiply line 3 by the Payroll Tax rate of 1% or (.01) |

|

|

|

|

||

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

||

5. |

|

If paid after April 30, 2014, enter INTEREST (see instruction) |

|

|

|

|

||

|

|

|

|

|

|

|

. |

|

6. |

|

If paid after April 30, 2014, enter PENALTY (see instruction) |

|

|

|

|

||

|

|

|

|

|

|

|

. |

|

7. |

|

TOTAL DUE. (Add Lines 4, 5, & 6) |

|

|

|

|||

|

|

Make check payable to: City of |

|

. |

|

|||

|

|

|

|

|

|

|

|

|

Under the laws of the State of New Jersey, I declare under penalty of perjury that I have read the foregoing and that it is true, correct, and complete to best of my knowledge and belief

|

X SIGN HERE |

DATE |

|

|

|

|

|

|

|

||

|

THIS STATEMENT MUST BE FILED BY APRIL 30, 2014 OR YOU WILL BE SUBJECT TO INTEREST AND PENALTIES |

||||

|

|

1/2014 |

|||

|

CITY OF NEWARK- PAYROLL TAX |

PLEASE DO NOT TEAR APART HERE |

|||

|

P.O. BOX 15118 |

|

|

|

|

|

NEWARK, NEW JERSEY 07192 |

|

PAYROLL TAX |

||

|

TAXPAYER ASSISTANCE: PHONE: (973) |

IN |

STATEMENT |

||

BUSINESS TAX ID NUMBER

CONTACT NAME

PAYMENT ENCLOSED

NOTE: Payment enclosed must equal the amount due on Line 7 |

(Please write your Business Tax ID on your check) |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Title and Purpose | The document is titled "Newark Payroll Tax Statement" for the first quarter of 2014, intended for businesses to report and pay payroll taxes to the City of Newark. |

| Submission Deadline | It was delinquent after April 30, 2014, indicating that this was the last day for businesses to submit the form without facing late penalties. |

| Ink and Filing Instructions | Businesses were required to use black ink and stay within the form's lines to ensure readability and accuracy in processing. |

| Required Information | Businesses needed to provide detailed information, including Tax ID, start date, name, address, contact details, number of employees, and total wages, along with apportionment details if applicable. |

| Tax Calculation and Documentation | The form required the calculation of taxable payroll, application of a 1% tax rate, and inclusion of supporting documentation for verification purposes. |

| Governing Law and Certification | Under New Jersey state law, the form must be signed under penalty of perjury, certifying the information provided is accurate and complete. |

Guide to Writing Newark Payroll Tax Statement

Filling out the Newark Payroll Tax Statement form accurately and on time is vital for businesses operating within Newark. This process helps ensure that your business complies with local tax regulations. The form is due by April 30th for the first quarter, and failure to submit by this date could result in interest and penalties. Here's a detailed guide on how to complete this form correctly:

- Begin with the company's basic information. Fill in the BUSINESS TAX ID NUMBER, the date your business started (BUSINESS START DATE), the full BUSINESS NAME, your business ADDRESS, CITY, STATE, ZIP CODE, TELEPHONE NUMBER, and EMAIL ADDRESS.

- Enter the NO. OF EMPLOYEES currently in your company.

- If your business was closed or sold, indicate the date in the BUSINESS CLOSED or SOLD DATE field, respectively.

- Under Total wages, tips, and other compensation, enter the total remuneration paid to your employees during the first quarter. If your payroll does not exceed $2,500.00 in the quarter, attach supporting documents like the 941 form, Schedule C, Payroll Register, etc.

- For Apportionment (if applicable), fill in parts a, b, c, and d based on the instructions provided, and attach any necessary documentation for exclusions. The total apportionment should be entered as the sum of these four parts.

- Calculate your Total Taxable Payroll on line 3. Enter the amount from line 1 if there is no apportionment. If there is apportionment, subtract line 2 from line 1 and enter the remainder.

- On line 4, calculate the Payroll Tax Calculated by multiplying the Total Taxable Payroll by the payroll tax rate of 1% (or .01).

- If applicable, enter any INTEREST and PENALTY amounts on lines 5 and 6, respectively, for payments made after April 30, 2014. Refer to the instructions provided to calculate these amounts.

- Add lines 4, 5, and 6 to find the TOTAL DUE and write this amount on line 7. Ensure your check payable to City of Newark-Payroll Tax matches this amount.

- Sign and date the form where indicated. Your signature declares that the information provided is correct to the best of your knowledge under penalty of perjury.

- Lastly, remember to write your Business Tax ID on your check for easy identification, and include a contact name if payment is enclosed.

After completing the form and attaching any necessary documentation, mail your statement and payment to the address provided on the form before the due date to avoid interest and penalties. For any questions or assistance, there are resources and contact information available directly on the form should you need them.

Understanding Newark Payroll Tax Statement

What is the Newark Payroll Tax Statement form?

The Newark Payroll Tax Statement is a required document for businesses in Newark, New Jersey, detailing the total wages, tips, and other compensations paid during a specific quarter. Businesses must calculate the amount of payroll tax owed to the City of Newark based on their payroll expenses. It's a way for the city to collect taxes on wages paid by employers within its jurisdiction.

When is the Newark Payroll Tax Statement due?

For the first quarter, which ends on March 31, the due date for the Newark Payroll Tax Statement is April 30. It’s crucial to submit the form and any payments by this date to avoid incurring interest and penalties for late payment.

What information do I need to fill out the form?

To complete the Newark Payroll Tax Statement, you'll need your business tax ID number, business start date, business name, address, telephone number, email address, and the number of employees. Additionally, you'll need to report total wages, tips, and other compensation, details on apportionment if applicable, and calculate your total taxable payroll and payroll tax due.

How do I calculate the payroll tax due?

Calculate the payroll tax by multiplying your total taxable payroll (found on line 3) by the payroll tax rate of 1% (or .01). This calculation will give you the amount of payroll tax you owe to the city.

What if my payroll does not exceed $2,500 in any calendar quarter?

If your payroll expenses don't exceed $2,500 in any calendar quarter, you're required to attach supporting documentation to your Newark Payroll Tax Statement. Acceptable documents include Form 941, Schedule C, Payroll Registers, or equivalent documentation showcasing your payroll expenses for the quarter.

What should I do if my business closed or was sold?

If your business was closed or sold, indicate this by filling in the applicable section of the Newark Payroll Tax Statement with the date of closure or sale. This information helps the City of Newark update their records and determine any final tax obligations.

What happens if I pay after the deadline?

Paying your payroll tax after the April 30 deadline will result in additional interest and penalties. The specific amounts depend on how late the payment is made. Refer to the instructions on the Newark Payroll Tax Statement form to calculate any interest or penalties due for late payment.

Where and to whom do I make the check payable?

Make your check payable to "City of Newark-Payroll Tax". Ensure your Business Tax ID is written on your check to avoid processing delays.

How can I get assistance with the Newark Payroll Tax Statement?

If you need help or have questions about the Newark Payroll Tax Statement, you can contact taxpayer assistance by phone at (973) 733-3770 or in person at 920 Broad Street, Room B-26, Newark, New Jersey.

What is the penalty for perjury on the Newark Payroll Tax Statement?

By signing the Newark Payroll Tax Statement, you declare under penalty of perjury that the information provided is true, correct, and complete to the best of your knowledge. Falsifying this document can lead to legal action, including fines and potential criminal charges, under the laws of the State of New Jersey.

Common mistakes

Filling out the Newark Payroll Tax Statement form accurately is crucial for any business. However, mistakes can happen. Here are seven common errors to avoid:

- Not using black ink or going outside the lines: It's important to follow these instructions for the form to be processed correctly.

- Incorrect or missing Business Tax ID Number: This is a crucial identifier for your business. Ensure it's accurate and present.

- Omitting the business start date: This information is required to understand your business's duration and eligibility for certain tax conditions.

- Leaving out contact information: Providing a telephone number and email address ensures the tax office can reach you if there are any issues.

- Failing to report the total wages, tips, and other compensation accurately: If your payroll does not exceed $2,500 in any calendar quarter, remember to attach supporting documentation like Form 941, Schedule C, or payroll registers.

- Incorrectly calculating or forgetting to include apportionment: This step is necessary if applicable to your business. Also, remember to attach any documents for exclusions.

- Errors in calculating total taxable payroll, payroll tax, interest, or penalties: Double-check your math and the requirement to add the interest and penalty if payment is made after April 30, 2014.

Here are additional tips to ensure your Newark Payroll Tax Statement form is filled out correctly:

- Ensure all required fields are completed. Leaving sections blank can result in processing delays or penalties.

- Sign and date the form. An unsigned form is considered incomplete and will not be processed.

- File on time. Late filings are subject to interest and penalties which increase the total due.

- Write your Business Tax ID on your check, if you are mailing payment. This helps in quick and accurate recording of your payment.

- Verify all entered information before submission. Simple mistakes can lead to unnecessary complications.

Documents used along the form

The Newark Payroll Tax Statement form is a crucial document for businesses in Newark, detailing their payroll tax obligations for a specific quarter. However, completing this form often requires the support of additional documents and forms to ensure accuracy and compliance. Below, we outline several important forms and documents that businesses might need to use alongside the Newark Payroll Tax Statement form.

- Form 941, Employer's Quarterly Federal Tax Return: This form is used to report federal withholdings from employee wages, including federal income tax, Social Security, and Medicare taxes. It offers necessary details to fill out the total wages section of the Newark Payroll Tax Statement.

- Schedule C, Profit or Loss from Business (Sole Proprietorship): Sole proprietors use this form to report their business income and expenses. The information from Schedule C can help in determining the payroll amount for businesses structured as sole proprietorships.

- Payroll Register: A detailed document that records all payroll activities for a company's employees. It includes wages, deductions, and net pay, serving as a supporting document to validate entries on the Newark Payroll Tax Statement.

- State Unemployment Tax Forms: Businesses are required to file state-specific unemployment tax forms, which report the total payroll expenses and taxes paid into the state's unemployment fund. This information is relevant when completing the Newark Payroll Tax Statement for businesses operating in New Jersey.

- W-2 Forms: At the end of the fiscal year, employers issue W-2 forms to employees to report annual wages and taxes withheld. These forms can provide a comprehensive year-end summary that aids in verifying quarterly payroll data.

- W-4 Forms: When employees are hired, they fill out W-4 forms to indicate their tax withholding preferences. Employers use this information to determine how much federal income tax to withhold, affecting payroll tax calculations.

- State Wage Reporting Forms: Similar to federal requirements, states may have specific wage reporting forms that employers must complete. These forms detail the total wages paid and taxes withheld on a state level, which is crucial for completing the Newark Payroll Tax Statement accurately.

- Business Formation Documents: For new businesses, the initial business formation documents, including articles of incorporation or partnership agreements, may be required to verify the business start date and legal structure as part of the payroll tax filing process.

- Notice of Business Closure or Sale: If a business is sold or closed, documentation detailing the sale or closure date is necessary. This helps in finalizing payroll tax responsibilities and ensuring that the Newark Payroll Tax Statement reflects the correct period of the business operation.

Understanding and gathering the appropriate documents to accompany the Newark Payroll Tax Statement form is a vital part of fulfilling tax obligations accurately and efficiently. Employers should ensure they maintain comprehensive records and consult with tax professionals to navigate the complexities of payroll and tax reporting requirements successfully.

Similar forms

The Internal Revenue Service (IRS) Form 941, Employer's Quarterly Federal Tax Return, shares similarities with the Newark Payroll Tax Statement form in that both are used to report wages paid, tips, and other compensation. Form 941 is a federal requirement for employers to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks. It also reports the employer's portion of Social Security or Medicare tax. Like the Newark form, it must be filed quarterly and requires identification and business information, making it a fundamental document for payroll reporting at the federal level.

Form W-2, Wage and Tax Statement, is another document that bears resemblance to the Newark Payroll Tax Statement form. The W-2 is used by employers to report the amount of wages paid and taxes withheld for each employee annually. It includes similar information, such as business name, address, and employee compensation. Although the W-2 is an annual requirement and serves a different primary purpose—to provide information to employees for their personal tax returns—it likewise plays a crucial role in reporting compensation and deductions.

The Schedule C (Form 1040), Profit or Loss from Business, is akin to the Newark Payroll Tax Statement form in its relevance to businesses. Specifically utilized by sole proprietors, Schedule C documents the income and expenses of the business, impacting the calculation of taxable payroll. Even though it's more focused on business profitability than payroll taxes per se, the information about compensations and deductions can be intertwined with payroll tax calculations, similar to how businesses must report total wages on the Newark form.

The State Unemployment Tax Act (SUTA) filing that businesses must complete in their respective states parallels the Newark Payroll Tax Statement. While SUTA filings are focused on unemployment tax contributions at the state level, both require information on wages paid to employees. They are periodical (usually quarterly) filings crucial for compliance with state labor and tax laws. The need to detail total wages and taxes calculated makes them similarly essential for payroll administration.

Form W-3, Transmittal of Wage and Tax Statements, works in concert with Form W-2 by summarizing total earnings, tax withholdings, and Social Security and Medicare taxes for all employees of a business. It needs to be filed to the Social Security Administration along with copies of Form W-2. This form parallels the Newark Payroll Tax Statement's role in aggregating payroll data, though the W-3 is focused on annual transmission of employee wage and tax information to federal authorities.

The Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, is also similar to the Newark Payroll Tax Statement in its function of reporting on behalf of employees, albeit specifically for unemployment taxes at the federal level. Like the Newark form, it calculates taxes owed based on employee wages but for FUTA rather than local payroll taxes. Both forms are integral in ensuring employers fulfill their tax obligations related to employment.

Payroll Registers, while not an official tax form, are company records that track the detailed wages and deductions for each pay period. This document has a practical resemblance to the Newark Payroll Tax Statement as it serves as a foundational record from which the summary totals on the tax statement are derived. Maintaining an accurate payroll register is essential for completing the Newark form accurately and for internal audits and financial planning.

Form 1099-NEC, Nonemployee Compensation, shares a connection with the Newark Payroll Tax Statement through its role in reporting payments made to non-employee service providers or independent contractors. Although the 1099-NEC is for non-employees and the Newark form is for employees, both are used to report payments that contribute to the total compensation paid by the business. This impacts the total tax reporting and financial assessments within a business context.

The Local Earned Income Tax Return is a document required by many municipalities and localities, similar in purpose to the Newark Payroll Tax Statement. It reports earnings of employees within a specific jurisdiction, highlighting the locality-specific nature of some tax obligations. Though the specific name and requirements may vary by jurisdiction, the underlying purpose aligns closely with Newark's payroll tax statement by focusing on locally earned income and taxes due.

The Business Privilege Tax Return, required in some municipalities, is another form related to the Newark Payroll Tax Statement, as it often considers payroll expenses in the calculation of the tax owed by a business to the local government. However, this form extends beyond payroll to encompass various aspects of business revenue and activity, illustrating the broader scope of business tax liabilities beyond payroll taxes alone. Despite this broader focus, the inclusion of payroll-related data links it to the purpose of the Newark Payroll Tax Statement.

Dos and Don'ts

When completing the Newark Payroll Tax Statement form, attention to detail and accuracy is paramount to ensure compliance and avoid penalties. Here are essential dos and don'ts to keep in mind:

- Do use black ink for clarity and to maintain the legibility of your entries.

- Do ensure all information stays within the designated lines to prevent any data from being missed during processing.

- Do include all necessary documentation, such as Form 941 or Schedule C, especially if your payroll does not exceed $2,500.00 in any calendar quarter, to substantiate your tax filing.

- Do accurately calculate the apportionment if applicable, attach supporting documents for exclusions, and ensure that the total tax due is correctly computed.

- Do sign the form and include the date to affirm that the information provided is true, correct, and complete to the best of your knowledge and belief. Ensuring the form is signed prevents delays in processing.

- Do file the form by the due date, April 30, to avoid interest and penalties, demonstrating diligence and adherence to compliance requirements.

- Don't use ink colors other than black, as this could affect the form's readability and scanning.

- Don't exceed the lines provided; cramped or overlapping entries can lead to processing errors or misinterpretation.

- Don't forget to attach all required documentation for verification purposes; missing paperwork can lead to discrepancies or requests for additional information, delaying processing.

- Don't neglect to compute the apportionment correctly or omit any supporting documentation for exclusions; inaccuracies can result in incorrect tax calculations.

- Don't leave the signature and date fields blank; an unsigned form may be considered invalid, causing unnecessary setbacks.

- Don't miss the filing deadline; failing to submit the form by April 30 can result in financial penalties that could have been easily avoided.

In conclusion, adhering to these guidelines when completing the Newark Payroll Tax Statement form will help ensure that your submission is compliant, accurate, and processed in a timely manner. It's a reflection of your business's commitment to fulfilling its tax obligations thoroughly and efficiently.

Misconceptions

Understanding the Newark Payroll Tax Statement form is crucial for all business owners and managers within the city. However, several misconceptions exist regarding its completion and submission, which can lead to errors and potential penalties. Here are six common misconceptions and the realities behind them:

- Misconception 1: All businesses, regardless of their payroll size, must file the Newark Payroll Tax Statement. Reality: Only businesses whose payroll exceeds $2,500 in any calendar quarter are required to file. It is important for businesses not meeting this threshold to attach supporting documentation, such as Form 941 or Schedule C, to clarify their exemption from the tax.

- Misconception 2: The payroll tax rate is variable. Reality: The tax rate for the Newark Payroll Tax is fixed at 1%. This constant rate simplifies the calculation process, requiring businesses to multiply their total taxable payroll by 0.01 to ascertain their tax obligation.

- Misconception 3: Apportionment is optional for all businesses. Reality: Apportionment applies only in specific scenarios and is not universally optional. Businesses should refer to the form's apportionment section for guidance and, if applicable, subtract the apportioned amount from their total wages to find their taxable payroll.

- Misconception 4: Interest and penalties apply immediately after the due date. Reality: While the due date for the submission of the form and payment is April 30th following the end of the first quarter, businesses that miss this deadline are subject to interest and penalties. However, these charges are calculated based on the instructions provided in the tax statement guide, implying a structured approach to their application.

- Misconception 5: The form is complicated and requires professional accounting help to complete. Reality: While the form does involve financial calculations and understanding specific requirements, it is designed to be straightforward for businesses to complete. There is taxpayer assistance available by phone or in-person for those needing help or clarification on how to properly fill out the form.

- Misconception 6: Electronic submissions are accepted just like paper forms. Reality: As of the information available up to 2023, businesses are required to mail their completed forms and payment to a specified P.O. Box address. While this might change in the future, it's crucial to follow the submission guidelines as stipulated on the form to avoid filing errors.

Correcting these misconceptions is vital for compliance and ensuring that businesses in Newark properly fulfill their payroll tax obligations. Staying informed about the requirements can save businesses from unnecessary penalties and interest charges due to misunderstandings or errors in filling out the Newark Payroll Tax Statement form.

Key takeaways

When preparing and submitting the Newark Payroll Tax Statement form, it's essential to grasp the following key points to ensure compliance and accuracy in the filing process:

- Use black ink and ensure all entries are within the designated lines to maintain clarity and legibility of the information provided.

- It's mandatory to include your Business Tax ID Number, which serves as a unique identifier for your business within tax documents and communications.

- Clearly state the start date of your business, which helps in correlating the given payroll data with the specific tax period in question.

- Ensure the business name and contact details, including address, telephone number, and email address, are up-to-date to facilitate straightforward communication regarding your payroll tax statements.

- The number of employees should be accurately reported, as this can affect various tax considerations and eligibility for potential deductions or obligations.

- For businesses that have ceased operations or been sold, indicate the closure or sale date, which is critical for tax liability purposes.

- Complete all sections related to wages, tips, and other compensation accurately. If your payroll does not exceed $2,500.00 in any calendar quarter, supporting documentation must be attached.

- Pay close attention to the apportionment section if it applies to your business operations. This can significantly impact the total taxable payroll figure.

- Calculate the payroll tax due by applying the specified payroll tax rate to your total taxable payroll. Be precise in your calculations to avoid discrepancies.

- Understand that payments made after April 30, 2014, are subject to interest and penalties, which must be calculated and included in the total amount due.

All businesses must sign and date the form to attest to the accuracy and completeness of the information under penalty of perjury. This declaration reinforces the seriousness of the tax filing process.

Before mailing your payment, ensure that your Business Tax ID is written on your check. This crucial step links your payment directly to your filed Newark Payroll Tax Statement, preventing processing errors.

Keep in mind the filing deadline. Statements must be filed by April 30 to avoid interest and penalties. Late submissions can lead to unnecessary charges accruing on your account.

For additional assistance or clarification on filling out the Newark Payroll Tax Statement, contact the taxpayer assistance provided by the city. This resource is invaluable for addressing any uncertainties or specific concerns related to your payroll tax obligations.

Popular PDF Documents

Power of Attorney New Jersey Requirements - Accurately completing and submitting the M-5008-R form is the first step towards securing competent tax representation in New Jersey.

Irs Form 3911 Instructions - Activates a process aimed at uncovering the reasons behind the non-receipt of IRS payments and rectifies the situation.