Get New York Hotel Tax Exempt Form

In the bustling state of New York, an essential document for government officials on official duty is the New York Hotel Tax Exempt form, officially known as ST-129. This form serves as a bridge between government employees and tax exemption on hotel or motel room occupancies, ensuring that state and local sales taxes, including specific fees like the $1.50 hotel unit fee in New York City, are not levied on these stays. Designed exclusively for employees of the United States, New York State, or its political subdivisions, the form requires detailed information including the name and address of the hotel, dates of occupancy, and the governmental entity paying for the accommodation. Its strict eligibility criteria underscore its purpose: to facilitate duty-related travels by providing tax relief. However, it's not merely a procedural formality; it embodies a legal declaration attesting to the tax-exempt status of the occupancy under precise conditions. The form necessitates accuracy and truthfulness, with penalties for misuse including substantial fines and possibly jail time. It also mandates that the hotel or motel operator retain the certificate and verify the government official's identification, ensuring that the tax exemption is granted correctly. Failure to comply with these requirements could lead to a thorough investigation by the Tax Department, aimed at validating exemptions and safeguarding against fraud. For government employees, understanding the nuances of this form is crucial to ensure compliance and benefit from tax exemptions during work-related hotel stays in New York.

New York Hotel Tax Exempt Example

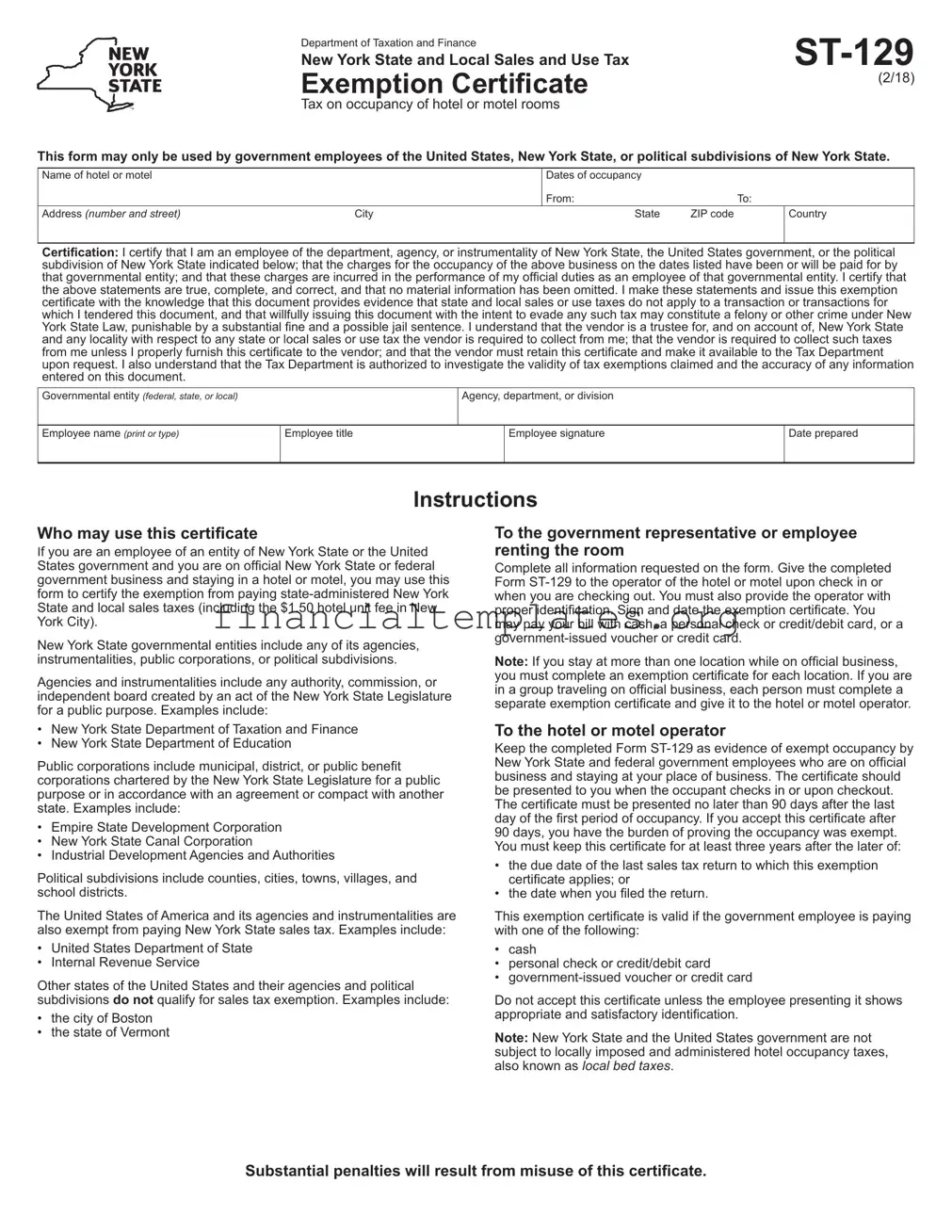

Department of Taxation and Finance |

|

New York State and Local Sales and Use Tax |

|

Exemption Certificate |

(2/18) |

|

Tax on occupancy of hotel or motel rooms

This form may only be used by government employees of the United States, New York State, or political subdivisions of New York State.

Name of hotel or motel |

|

Dates of occupancy |

|

|

|

|

|

|

|

|

From: |

|

|

|

To: |

|

|

Address (number and street) |

City |

|

State |

ZIP code |

|

|

Country |

|

|

|

|

|

|

|

|

|

|

Certification: I certify that I am an employee of the department, agency, or instrumentality of New York State, the United States government, or the political subdivision of New York State indicated below; that the charges for the occupancy of the above business on the dates listed have been or will be paid for by that governmental entity; and that these charges are incurred in the performance of my official duties as an employee of that governmental entity. I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make these statements and issue this exemption certificate with the knowledge that this document provides evidence that state and local sales or use taxes do not apply to a transaction or transactions for which I tendered this document, and that willfully issuing this document with the intent to evade any such tax may constitute a felony or other crime under New York State Law, punishable by a substantial fine and a possible jail sentence. I understand that the vendor is a trustee for, and on account of, New York State and any locality with respect to any state or local sales or use tax the vendor is required to collect from me; that the vendor is required to collect such taxes from me unless I properly furnish this certificate to the vendor; and that the vendor must retain this certificate and make it available to the Tax Department upon request. I also understand that the Tax Department is authorized to investigate the validity of tax exemptions claimed and the accuracy of any information entered on this document.

Governmental entity (federal, state, or local)

Agency, department, or division

Employee name (print or type)

Employee title

Employee signature

Date prepared

Instructions

Who may use this certificate

If you are an employee of an entity of New York State or the United States government and you are on official New York State or federal government business and staying in a hotel or motel, you may use this form to certify the exemption from paying

New York State governmental entities include any of its agencies, instrumentalities, public corporations, or political subdivisions.

Agencies and instrumentalities include any authority, commission, or independent board created by an act of the New York State Legislature for a public purpose. Examples include:

•New York State Department of Taxation and Finance

•New York State Department of Education

Public corporations include municipal, district, or public benefit corporations chartered by the New York State Legislature for a public purpose or in accordance with an agreement or compact with another state. Examples include:

•Empire State Development Corporation

•New York State Canal Corporation

•Industrial Development Agencies and Authorities

Political subdivisions include counties, cities, towns, villages, and school districts.

The United States of America and its agencies and instrumentalities are also exempt from paying New York State sales tax. Examples include:

•United States Department of State

•Internal Revenue Service

Other states of the United States and their agencies and political subdivisions do not qualify for sales tax exemption. Examples include:

•the city of Boston

•the state of Vermont

To the government representative or employee renting the room

Complete all information requested on the form. Give the completed Form

Note: If you stay at more than one location while on official business, you must complete an exemption certificate for each location. If you are in a group traveling on official business, each person must complete a separate exemption certificate and give it to the hotel or motel operator.

To the hotel or motel operator

Keep the completed Form

90 days, you have the burden of proving the occupancy was exempt. You must keep this certificate for at least three years after the later of:

•the due date of the last sales tax return to which this exemption certificate applies; or

•the date when you filed the return.

This exemption certificate is valid if the government employee is paying with one of the following:

•cash

•personal check or credit/debit card

•

Do not accept this certificate unless the employee presenting it shows appropriate and satisfactory identification.

Note: New York State and the United States government are not subject to locally imposed and administered hotel occupancy taxes, also known as local bed taxes.

Substantial penalties will result from misuse of this certificate.

Document Specifics

| Fact | Detail |

|---|---|

| Eligibility | Only government employees of the United States, New York State, or political subdivisions of New York State can use this form. |

| Purpose | The form is designed to certify exemption from state-administered New York State and local sales taxes, and the $1.50 hotel unit fee in New York City, for hotel or motel room occupancy. |

| Usage Conditions | Eligible employees must be on official New York State or federal government business to use the form. |

| Documentation Requirement | Government representatives or employees must complete all requested information on the form and present it to the hotel or motel operator along with proper identification at check-in or check-out. |

| Payment Methods | Government employees may pay their bill with cash, a personal check or credit/debit card, or a government-issued voucher or credit card. |

| Retention Requirement for Operators | Hotel or motel operators must keep the completed Form ST-129 for at least three years after the later of the tax return due date it applies to or the date the return was filed. |

| Penalty for Misuse | Misuse of the exemption certificate to evade tax may constitute a felony or other crime under New York State Law, resulting in substantial fines and possible jail time. |

| Governing Laws | This exemption process and its requirements are governed by New York State tax laws and regulations. |

Guide to Writing New York Hotel Tax Exempt

When government employees of the United States, New York State, or its political subdivisions stay in hotels or motels for official duties, they are exempt from paying certain state and local sales taxes, including a specific hotel unit fee in New York City. To avail of this exemption, the New York Hotel Tax Exempt Form ST-129 must be filled out correctly and presented at the appropriate time. This process is crucial for ensuring compliance and securing the benefits entitled to government representatives on official business. Below are the detailed steps to complete this form.

- At the top of the form, enter the Name of the hotel or motel where you are staying.

- Specify the Dates of occupancy, including both the 'From' and 'To' dates.

- Fill out the hotel or motel’s Address, including the number and street, City, State, ZIP code, and Country.

- In the section labeled Certification, indicate your employment status by writing the name of the department, agency, or instrumentality of New York State, the United States government, or the political subdivision of New York State you work for. This confirms the official nature of your trip and that the charges for the stay are being paid for by the governmental entity.

- Under Governmental entity, specify whether your employer is federal, state, or local.

- Provide the Name of the agency, department, or division you are currently employed with.

- Enter your Employee name, clearly printed or typed.

- Include your official Employee title.

- Sign the form to certify that the information provided is true, complete, and correct, and then Date it on the line provided for the date prepared.

- Before visiting the hotel or motel, ensure that you have proper identification to present alongside this exemption certificate.

- Upon checking in or at the time of checkout, hand the completed Form ST-129 to the operator of the hotel or motel.

Remember, if you are part of a group of government employees traveling on official business, each member needs to complete and submit a separate exemption certificate. Properly filling out this form helps to streamline the exemption process, ensuring that eligible government employees can focus on their official duties without undue financial or bureaucratic burden.

Understanding New York Hotel Tax Exempt

Frequently Asked Questions About the New York Hotel Tax Exempt Form

- Who is eligible to use the New York Hotel Tax Exempt Form?

- What does this form exempt you from?

- How should this form be used?

- What are the responsibilities of the hotel or motel operator regarding this form?

- What are the consequences of misusing this certificate?

- Can the form be presented after the period of stay?

Government employees of the United States, New York State, or political subdivisions of New York State are eligible. This includes employees on official business from various New York State agencies, public corporations, political subdivisions such as counties, cities, towns, and school districts, as well as federal agencies and instrumentalities. Representatives or employees from other states or their political subdivisions do not qualify for this exemption.

By using this form, eligible government employees are certified exempt from paying state-administered New York State and local sales taxes on hotel or motel rooms, including the $1.50 hotel unit fee in New York City. However, they are not exempt from locally imposed and administered hotel occupancy taxes, also known as local bed taxes.

Government representatives or employees should complete all requested information on the form and provide it to the hotel or motel operator upon check-in or checkout, along with proper identification. The form is valid for payments made with cash, personal check, or credit/debit card, including government-issued vouchers or credit cards. If staying in multiple locations or traveling in a group on official business, a separate exemption certificate is required for each person and location.

Operators must retain the completed form ST-129 to document the tax-exempt occupancy. The form should be retained for at least three years after the later of the due date of the last sales tax return to which the exemption applies, or the date when the return was filed. They must also ensure the certificate is presented within 90 days after the last day of the first period of occupancy to accept it without bearing the burden of proving the occupancy was exempt. Proper and satisfactory identification from the employee must be verified before accepting the certificate.

Willfully issuing or misusing this document to evade taxes is a violation of New York State Law, potentially resulting in a felony or other crime. Consequences may include substantial fines and possible jail sentences. Both government employees and hotel or motel operators must ensure the legality and correctness of the form's usage.

Yes, but the exemption certificate must be presented no later than 90 days after the last day of the first period of occupancy. If accepted after this period, the hotel or motel operator takes on the responsibility of proving that the occupancy was exempt from tax.

Common mistakes

Filling out the New York Hotel Tax Exempt form can be tricky, and mistakes might lead to your exemption being declined. Here are 10 common errors to avoid when completing this form:

- Not being eligible: Only employees of certain governmental entities can use this form. Ensure you are an employee of the United States, New York State, or a political subdivision of New York State and on official business.

- Incorrect dates of occupancy: Misrecording the from and to dates can invalidate your exemption.

- Incomplete hotel information: Failing to provide full details of the hotel or motel, including address, city, state, ZIP code, and country, may lead to processing delays or denial.

- Missing government entity details: Not specifying the federal, state, or local government entity you are representing could make your form incomplete.

- Lack of personal details: Omitting your full name, title, and contact information could result in the form being rejected.

- Forgetting to sign and date the certificate: An unsigned or undated form is considered incomplete and invalid.

- Failing to provide proper identification at the hotel: The form alone is not enough; proper ID must also be shown to the hotel operator upon check-in or checkout.

- Payment method issues: The exemption only applies if you pay with cash, a personal check, a credit/debit card, or a government-issued voucher or credit card. Ensure your payment method aligns with these options.

- Not completing separate forms for each location: If you're staying at multiple locations on official business, you need to fill out a form for each one.

- Group travel confusion: Each member of a group traveling on official business must complete their own exemption certificate. Failing to do so can lead to misunderstandings or exemption refusals.

Remember, the form must be presented to the hotel or motel operator within 90 days after your stay. Keeping these points in mind will help ensure your form is correctly submitted and accepted, allowing you to benefit from the tax exemption.

Documents used along the form

When using the New York Hotel Tax Exempt form, it's crucial to have all necessary documents and forms ready to ensure a smooth transaction and compliance with all tax exemption conditions. Below is a list of other forms and documents often used alongside the New York Hotel Tax Exempt form. These documents not only support the validity of the tax exemption claim but also help in maintaining clear and organized records for both the government employee and the hotel operator.

- Official Identification: Government employees must present valid identification to verify their employment status with a government entity. This could be a government-issued ID card.

- Government-Issued Credit Card or Voucher: To pay for the hotel expenses, a government-issued credit card or a financial voucher demonstrates that the payment is officially sanctioned by a government body.

- Travel Orders or Assignment Letter: Documentation that outlines the official business or purpose of the trip can support the claim that the stay is for government business.

- Receipts for Accommodation Expenses: Detailed receipts from the hotel or motel for the duration of the stay are important for reimbursement and record-keeping purposes.

- Expense Report Forms: These are used by government employees to report their travel expenses for reimbursement. The forms must be filled out accurately and submitted to the appropriate department within their organization.

- Direct Billing Authorization: For cases where the government entity directly pays the hotel, a direct billing authorization form allows charges to be invoiced to and paid by the government agency.

- Proof of Payment: After settling the bill, proof of payment confirms that the hotel stay has been paid for, which is useful for personal records and in cases where reimbursement from the government entity is required.

The list above serves as a useful guide for government employees seeking a tax exemption for hotel stays in New York State. Proper organization and preparation of these documents and forms can lead to a hassle-free exemption process, ensuring compliance with state regulations while fulfilling official duties. Always remember to provide the necessary documentation promptly to the hotel or motel operator and to retain copies for your records to facilitate any future inquiries or audits.

Similar forms

The Federal Tax Exemption Certificate is a pivotal document that parallels the New York Hotel Tax Exempt form in its essence. Both documents serve government employees seeking exemption from certain taxes while on official duties. The Federal Tax Exemption Certificate is commonly used by federal employees to obtain a waiver from federal taxes on purchases related to official federal government activities. Similarly, the New York Hotel Tax Exempt form is specifically designed for state or federal employees on official business to avoid state and local hotel occupancy taxes. Each serves to relieve official duties from specific tax burdens, emphasizing the government's recognition of the importance of such activities being conducted without the added financial strain of taxes.

The Certificate of Exempt Income closely mirrors the objectives of the New York Hotel Tax Exempt form, albeit in a different context. This document is utilized by entities or individuals to declare certain incomes as exempt from taxation under specific provisions. Just as the New York form carves out an exemption for hotel occupancy charges for government employees, the Certificate of Exempt Income highlights various income streams that are not subject to tax, based on qualifying criteria. Both documents function under the principle that certain conditions or activities merit a departure from standard taxation practices to support broader objectives.

A Government Purchase Order can be likened to the New York Hotel Tax Exempt form in its function and utility. While the purchase order is an authorization for government departments to procure goods and services needed for public service delivery, it implicitly carries the authority for tax exemption on such purchases, similar to how the New York form offers tax relief for hotel stays under specific conditions. Both documents underline the government's prerogative to facilitate its operations, including the exemption from taxes that would otherwise be levied on such transactions.

The Government Travel Charge Card is another document that shares similarities with the New York Hotel Tax Exempt form, particularly in facilitating duty-related expenses. This card allows government employees to pay for travel expenses, including lodging, without incurring personal costs. While the tax exemption process differs — the New York form requires an exemption certificate whereas the travel card may automatically apply exemptions or rebates — both mechanisms ensure that employees are not personally burdened by expenses incurred in the line of duty.

The Non-Profit Tax Exemption Certificate, although primarily serving non-profit organizations, shares a foundational resemblance with the New York Hotel Tax Exempt form in offering tax relief. This certificate allows non-profits to make purchases or conduct activities without being charged sales tax, similar to how government employees are exempt from hotel taxes when on official business. Each document underscores the societal value of the activities conducted by these entities, warranting a departure from the usual tax obligations.

The Sales Tax Exemption Certificate operates alongside similar lines to the New York Hotel Tax Exempt form but in a broader commercial context. Businesses use this certificate to buy goods without paying sales tax when those goods are intended for resale or for producing other goods for sale. Like the hotel tax exemption for government employees, this document exists to streamline financial operations for specific purposes, in this case, facilitating commerce and production.

A Diplomatic Tax Exemption Card is a unique document that provides tax relief to eligible foreign diplomats in the United States, analogous in its purpose to the New York Hotel Tax Exempt form. While the latter caters to domestic governmental employees, the Diplomatic Tax Exemption Card allows foreign officials to engage in their duties without the added concern of taxes on their personal and official purchases, including hotel stays, furthering international diplomatic relations and activities.

The Veteran Sales Tax Exemption Card reflects a specific exemption similar to the New York Hotel Tax Exempt form but tailored for veterans. It allows U.S. veterans to receive exemptions from sales tax on certain purchases, appreciating their service and facilitating their access to goods and services. Both documents symbolize a recognition of service — whether it's the public duty of government employees or the military service of veterans — warranting financial considerations.

An Educational Institution Tax Exemption Certificate, utilized by schools, colleges, and universities, is paralleled with the New York Hotel Tax Exempt form through its specific tax exemption purpose. This certificate allows educational institutions to purchase goods and services without sales tax, facilitating their educational operations. Similar to how the New York form aids government employees in official capacities, this certificate supports the educational sector's function without the hindrance of sales tax.

Lastly, the Resale Certificate shares its core rationale with the New York Hotel Tax Exempt form. Retailers use the Resale Certificate to buy products without sales tax, given those products will be sold in the business. This parallels the hotel tax exemption provided to government employees while on sanctioned duties, in that both documents prevent unnecessary financial burdens that could impede the intended activities or operations, thereby streamlining procedural efficiencies.

Dos and Don'ts

When filling out the New York Hotel Tax Exempt Form, it’s essential to ensure all the information you provide is accurate and valid. Here's a guide that highlights the steps you should take and those you should avoid to ensure the process goes smoothly:

Do:- Verify your eligibility - Prior to filling out the form, ensure you are a government employee of the United States, New York State, or its political subdivisions, as the form is exclusively for such individuals.

- Complete all required fields - Make sure every requested detail on the form is filled out, including the hotel or motel name, dates of occupancy, and your government entity’s details.

- Provide accurate information - The details you enter, especially regarding your employment and the purpose of your stay, must be truthful and correct.

- Sign and date the form - Your signature is required to attest to the accuracy of the information provided and your eligibility for tax exemption.

- Present proper identification at check-in or check-out - Alongside the exemption form, showing valid identification is usually required to verify your government employment.

- Be prepared with an alternate payment method - Although the form allows for payment via cash, personal check, or government-issued credit card, always have a secondary payment method ready.

- Supply the form promptly - Hand the completed form to the hotel or motel operator upon check-in or at checkout to ensure the exemption is applied to your stay.

- Retain a copy for your records - Keeping a copy of the filled-out form can be helpful if there are any questions or issues regarding your tax exemption claim later on.

- Fill out the form if you are not eligible - Attempting to claim exemption through this form if you are not a qualifying government employee is prohibited.

- Leave sections incomplete - Omitting required information can lead to the rejection of your tax exemption request.

- Provide false information - Misrepresentation of your role, purpose of stay, or any other detail on the form is a serious offense that can result in penalties.

- Forget to sign and date - An unsigned or undated form is considered incomplete and will not be accepted.

- Assume identification won’t be checked - Proper ID is a crucial part of the validation process for tax exemption eligibility.

- Rely solely on the exemption form for payment - The form exempts you from certain taxes, but you still need to settle any other applicable charges for your stay.

- Delay in submitting the form - Timing is important. Submit the form timely to the hotel or motel operator to ensure your exemption is processed.

- Lose your copy of the form - Keeping a personal record of your exemption claim is important for future reference.

Misconceptions

Understanding the nuances of the New York Hotel Tax Exempt form can sometimes be challenging, especially when common misconceptions cloud its actual application and usage. Let's clear up some of these widespread misunderstandings:

- Only federal employees are eligible. This is a misunderstanding. Not just federal employees, but also employees of New York State, and its political subdivisions are eligible to use this exemption certificate. This includes employees from various New York State agencies, public corporations, and even local government entities such as counties and school districts.

- Any government-related travel qualifies for exemption. This is not accurate. The travel must be strictly for official government business. Personal or leisure trips, even if partially combined with government work, do not qualify. The form specifically requires that the occupancy charges are to be paid by the governmental entity and incurred in the performance of official duties.

- It exempts you from all taxes and fees associated with hotel stays. This is a common misconception. The exemption applies to New York State and local sales taxes, including the $1.50 hotel unit fee in New York City. However, it does not exempt individuals from other charges that might be applied, such as fees for amenities or services that are not covered under the room's occupancy tax.

- Out-of-state government employees can use the form for tax exemption. This is incorrect. The exemption is specifically for employees of the United States government, New York State, or its political subdivisions. Employees of other states or their political subdivisions do not qualify for this exemption. For instance, a city employee from Boston or a state employee from Vermont would not be exempt under this certificate when staying at a New York hotel.

The proper use of the New York Hotel Tax Exempt form ensures compliance with state laws while providing eligible government employees with significant savings on their official travels. It's crucial to fully understand the eligibility and restrictions to avoid any misuse or errors that could lead to penalties or the denial of exemptions.

Key takeaways

Filling out and using the New York Hotel Tax Exempt form requires attention to detail and an understanding of eligibility. Here are four key takeaways that you should keep in mind:

- Eligibility is Limited: The ST-129 form is specifically designed for government employees of the United States, New York State, or political subdivisions of New York State. This includes employees from agencies, instrumentalities, public corporations, or political subdivisions created by an act of the New York State Legislature for a public purpose.

- Complete Information is Crucial: When using this form, it's important to fill out all requested information accurately. This includes details about the hotel or motel, dates of occupancy, and the governmental entity you are representing. Remember to provide proper identification upon check-in or checkout at the hotel or motel, alongside your completed ST-129 form.

- Payment Methods Do Not Affect Exempt Status: Whether you are paying with cash, a personal check, a credit/debit card, or a government-issued voucher or credit card, the tax exemption status does not change. However, to claim this exemption, presenting the ST-129 form properly is necessary.

- Operators Must Retain the Form: For hotel or motel operators, accepting the ST-129 form comes with the responsibility of retaining it as evidence of exempt occupancy. The form should be kept for at least three years after the last sales tax return date it applies to or the date the return was filed. This is integral in proving the occupancy was exempt, especially if the certificate is accepted after 90 days from the last day of the first period of occupancy.

Using the New York Hotel Tax Exempt form properly ensures that eligible government employees on official business can benefit from tax exemptions while also fulfilling legal obligations. Both the entity claiming the exemption and the hotel or motel operator must adhere to specific guidelines to ensure compliance and avoid penalties.

Popular PDF Documents

Mp Commercial Tax 49 - Ensuring successful Form 49 submission: What to do after clicking the ‘Ok’ button for prompt processing.

Sch F - Facilitates a structured reporting mechanism for nonprofit organizations involved in international activities.

Ut Sales Tax - If your business operates in Utah and has undergone significant changes, file a TC-69C form to update your tax account.