Get New Jersey Estate Tax Return Form

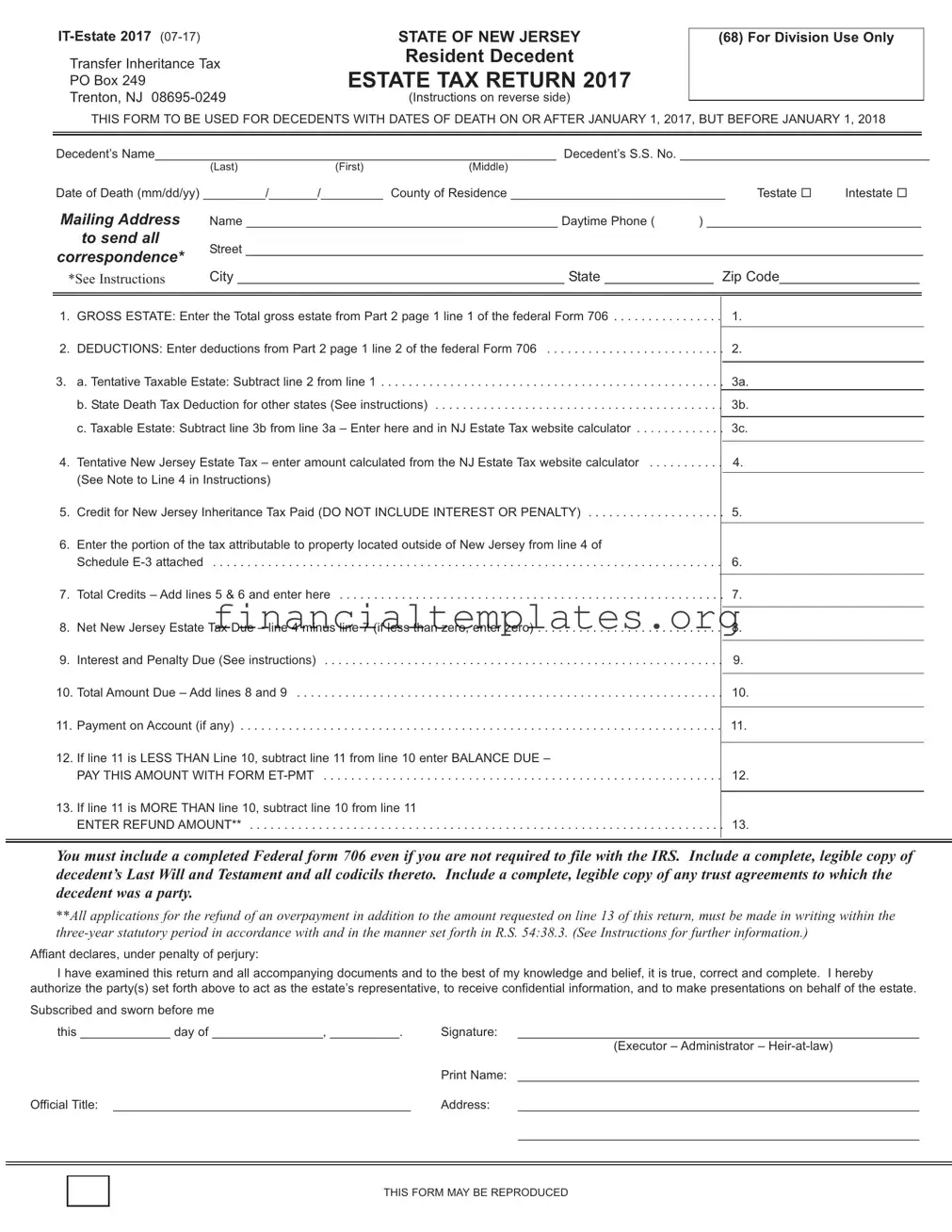

When managing the affairs of a resident decedent in New Jersey, the completion of the New Jersey Estate Tax Return form, officially designated as IT-Estate 2017, becomes a pivotal step in the process of estate administration. This form encompasses the necessary details and calculations to ascertain the estate tax due to the state, building upon the gross estate value as determined by federal standards. It obliges the executor or administrator to furnish a comprehensive account, including the decedent’s personal particulars, details of the estate's assets, and deductions sought. Specific schedules within the form guide the submission for deductible expenses, tax computations, and any credits against the estate tax, including those for state death taxes paid or inheritance taxes previously settled within New Jersey. A crucial requirement alongside the form is a completed Federal form 706, regardless of the necessity to file it federally, serving to align state tax determinations with federal estate tax computations. Additionally, legible copies of the decedent’s Last Will and Testament, any codicils, and trust agreements where applicable, are mandated for a full perspective on the dispensation of the estate. Executors are further tasked with navigating through waivers, accurately calculating interest and penalties due, and ensuring proper submission protocols to prevent processing delays. This document encapsulates the structured approach New Jersey mandates for the transparent and fair taxation of estates, embedding directives for refunds or payments on account, while emphasizing accurate, timely filings to uphold statutory obligations and minimize financial liabilities of the estate.

New Jersey Estate Tax Return Example

STATE OF NEW JERSEY |

|

TrasferIheritaceTax |

Resident Decedent |

|

|

PO x |

ESTATE TAX RETURN 2017 |

TretN |

structisreverseside |

TISORTO USORTSWITTOTONORT |

UYTORUY |

(68) For Division Use Only

ecedet’sNa_______________________________________ |

___________________ecedet’sSSN______________ |

______________________ |

||||||

|

ast |

irst |

dde |

|

|

|

|

|

atefeathddyy_________________________u |

|

tyfResidece__________________ |

_____________ |

Testate |

Itestate |

|||

MailingAddress |

Na_____________________________________________ |

aytiPhe |

_______________________________ |

|

||||

to send all |

Street _______________________________________________________________________________________ |

|||||||

correspondence* |

||||||||

*SeeInstructions |

ity __________________________________________Stat e______________Zide__________________ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ROSSTtertheTtagrssestatefrPartagei |

efthefederar |

|

UTIONSterdeductisfrPartageieft |

hefederar |

|

aTetativeTaxabeateSubtractiefrie |

a |

|

bStateeathTaxeductifrtherstateseistructi |

s |

b |

cTaxabeateSubtractiebfriea– terherea |

diNateTaxwebsitecacuatr |

|

TetativeNewrseyateTax– eterautcacuatedfrt |

heNateTaxwebsitecacuatr |

|

eNtetieiIstructis |

|

|

reditfrNewrseyIheritaceTaxPaidONOTINUIN |

TORPTY |

|

terthertifthetaxattributabetrertyca |

tedutsidefNewrseyfrief |

|

Schedueattached |

|

|

Ttaredits– diesadeterhere |

|

|

NetNewrseyateTaxue– ieusiefesst |

hazereterzer |

|

IterestadPeatyueeistructis |

|

|

Ttautue– diesad |

|

|

Paytutfay |

|

|

IfieisTiesubtractiefri |

eeterU– |

|

PYTISUNTWITOR |

|

|

IfieisRTiesubtractiefri |

e |

|

TRUNUNT |

|

|

c

You must include a completed Federal form 706 even if you are not required to file with the IRS. Include a complete, legible copy of decedent’s LastWill and Testament and all codicils thereto. Include a complete, legible copy of any trust agreements to whichthe decedent was a party.

**Allapplicationsfor therefundofan overpayment in additiontothe amountrequested online 13 ofthis return, must be madein writingwithinthe

fiatdecaresudereatyferjury |

|

|

|

|

|

Ihaveexaedthisreturadaaccayigdcutsadt |

|

thebestfwedgeadbeiefitistruecrrecta |

dceteIhereby |

||

authrizetheartysetfrthabvetactastheestate’srere |

setativetreceivecfidetiaifrtiadt |

resetatisbehafftheestate |

|||

Subscribedadswrbefre |

|

|

|

|

|

this_____________dayf_________________________ |

_ |

Sigature |

_________________________________________ |

_________________ |

|

|

|

|

cutr– istratr– eirtaw |

|

|

|

|

PritNa |

___________________________________________ |

_______________ |

|

OfficiaTite _____________________________________ |

______ |

dress |

_________________________________________ |

_________________ |

|

|

|

|

__________________________________________________________ |

||

|

|

|

|

|

|

|

|

|

|

|

|

TISORYROU

Estate Tax Return 2017 Instructions

Thisfristbeusedyfrtheestatefaresidetdece |

dethavigadatefdeathrafteruary |

butbefreuary |

__________________________________________________________________________________________ |

||

TheNateTaxisiadditittheNIheritaceTax |

taxisisedutheestatefeveryresidetdecedetha |

vigadatefdeathrafter |

uarybutbefreuarywhsetaxabee |

stateexceeds$iasdeteredursuattsecti |

ftheederaItera |

ReveuedeUSsieffectuary |

|

|

Filing Requirements |

|

|

rdecedetsdyigrafteruarybutbefre |

uaryaNewrseyestatetaxreturstbefiedif |

thedecedet’sgrssestate |

exceeds$iasdeterediaccrdacewiththervisi |

sftheIteraReveuedeieffectuary |

|

Completing the Return

Mailing Address – Complete the Mailing Address section with the name and address of the person or firm that will be authorized to receive all

communications from the Division of Taxation. NteTheivisiisrequiredtdeaywiththisers |

rfiruesstheestatereresetativehas |

|

|

ascetedr ittfTaxayerReresetative |

|

|

|

Complete Federal Form 706* icudigascheduesadsurtigdcutsThisstbe |

cetedeveifyuweretrequiredtfiewiththe |

|

|

federaIteraReveueServiceRSIfyuarerequiredtf |

ierdidfierwiththeIRSsubtacyfw |

hatwasactuayfied |

NOTE: Be |

sure to answer question 2(c) on Schedule M to avoid processing delays.

*Refers to the (Rev. August 2013) version of Form 706.

Complete lines 1 through 13 of the 2017 New Jersey Estate Tax Return. |

|

|

|

|||

Instructions for Line 3b. State Death Tax Deduction for Other States: tertheautfayestateiheritaceegacyrsuccessi |

|

taxesactuay |

||||

aidtaytherStateNOTicudeNewrseyrthei |

|

|

strictfuiaayrertyicudedithegrssestate |

|

|

iefthisretur |

Note to Line 4: Thewebsiteestatetaxcacuatricrratesacreditf$ |

whichisequatthetaxduethe$iexc |

|

usiautfr |

|||

Itaserfrthecircuarcacuaticreatedbyaica |

|

|

tiftheNewrseyrtifthefederaStateeath |

|

|

Taxeductitthetaxabe |

estateiaccrdacewithSectiftheederaIte |

|

raReveuede |

|

|

|

|

Waiver Request Schedules: Complete Schedules |

uesfthe |

|||||

aretsufficietfrwaiverurses |

Only list those assets which require waivers. See instructions on each schedule for guidance. |

|||||

Required Documents |

|

|

|

|

|

|

cyfaycicatifrtheIRSregardigtheateTa |

|

x |

|

|

|

|

ceteegibecyfthedecedet’sastWiad |

|

Testatadacdicistheret |

|

|

|

|

cyfaytrustagreetstwhichthedecedetwasaa |

rtyad |

|

|

|

||

cyfthedecedet’sastfuarfederaictaxretu |

|

rfiedrirtdeath |

|

|

|

|

Interest Rates and Payment Due Date |

|

|

|

|

|

|

IterestaccruesattherateferauayNateT |

|

|

axtaidwithiiethsfthedecedetsdatef |

|

deathIfaextesiftit |

|

fiethefederaestatetaxreturisgratedtheirectr |

|

yreduceiterestterauutitheearierfthee |

|

xiratifthefederaextesir |

||

thedatefthefiigfthefederareturwiththe |

IRS |

|

|

|

|

|

Requestsfraiterestreductistbeaccaiedbyacy |

|

|

ftherequestdettheIteraReveueServicefraexte |

|

sitfiethefedera |

|

estatetaxreturagwithacyfayrequiredarvaa |

|

|

dverificatiastthedatewhichthefederaestate |

|

taxreturwasactuayfied |

|

Paytsarefirstaiedttheiterestifaywhichhas |

|

accruedtthedatefayt |

|

|

|

|

Payments on Account / Refund Requests |

|

|

|

|

|

|

Paytsaccutybedeataytitavidfurtheraccrua |

|

|

fiteresttheautaidIaycasewherethea |

|

|

utaidaccut |

frNewrseyIheritaceratetaxesexceedstheautfta |

|

xdueafterthefiaassessthasbeedetheveraida |

|

utwiberefuded |

||

itheduecursefbusiess |

|

|

|

|

|

|

rtectiverefudcaishudbederITwithi |

|

|

threeyearsfrthedatefaytrtectiverefudcaii |

|

|

sacaifiedtrtect |

ataxayer’srighttatetiarefudbasedacti |

|

getevetfrwhichthestatutefitatisisabutt |

exire |

rtectivecaiisusuaybased |

||

ctigeciessuchasedigitigatiragig |

|

federaestatetaxaudit |

|

|

|

|

Lien |

|

|

|

|

|

|

rresidetdecedetsdyigaftereceertheN |

|

|

ateTaxreisaiearertyfthedecedetasf |

|

|

thedatefdeathutiaid |

Nrertyybetrasferredwithutthewrittecsetft |

|

|

heirectrftheivisifTaxati |

|

|

|

NEW JERSEY INHERITANCE AND ESTATE TAX:

RETURN PROCESSING INSTRUCTIONS

Follow these procedures to avoid delays in processing returns, waivers, and refunds:

DO NOT enclose returns in any kind of BINDER, SEALED FOLDER or

NOTEBOOK.

DO NOT use STAPLES (especially

OIt is OK to use rubber bands or clips to keep the file together.

O

DO NOT enclose DUPLICATE COPIES of returns or duplicates of other documents.

OWhen filing both Inheritance and Estate Tax, include only ONE copy of the will, trusts, income tax return, 706, appraisals, and any other attachments.

A few things to DO:

STAPLE checks to the completed payment voucher, and put voucher on

TOP.

OMake sure checks are signed, and made payable to “New Jersey Inheritance and Estate Tax”

OInclude the Decedent’s name and SS# on the check.

Place the return and schedules on top (if no payment), with the will and other supporting documents beneath.

Check that returns are SIGNED by the legal representative of the estate and NOTARIZED.

OThe representative’s name should be printed clearly beneath the signature

VERIFY the decedent’s social security number and date of death.

Make sure the MAILING ADDRESS on the return is correct – and indicates the person who you want to receive ALL correspondence (letters, bills, waivers, etc).

OThe Division cannot correspond with your attorney or CPA unless they are listed on the front page of the return.

Clearly mark amended returns as “Amended” along the

BOTTOM of the return.

File Inheritance Tax and Estate Tax returns together when

possible.

OKeep the two returns separate within the same envelope or box.

OKeep in mind the two taxes have separate due dates for payment of the tax.

OInclude separate checks and vouchers for each tax.

Thisageitetiayeftba

( |

T |

|

rnsernheritnx |

TT |

|

TTT |

||

x |

||

ttTxynt |

||

renton |

||

|

||

TTTT |

|

oiisionsnly

T

edentsme_______________________________________ |

_____________________________________________ |

|||||

|

(st |

(irst |

|

(ddle |

|

|

edentso_________________________________ |

|

_ |

|

|

|

|

teoeth(mmdd_________________________ou |

|

ntoResiden__________________ |

_______________ |

|||

MailingAddress |

me_____________________________________imeone |

(_____________________ |

||||

tosendall |

treet______________________________________________ |

_______________________________ |

||||

correspondence |

||||||

|

it______________________________________ |

tte____ |

________ |

ipode________ |

||

|

|

|

|

|

|

|

TToTTin)

(ode |

tex(totloeremittedwiththisorm |

____________________________ |

TT

ntsonuntmemdetntimetovoidurtherl orthereundonoverpntmustemdeinwritinwith themnnersetorthinR(texndR

ointerestonthemountsopidlpplitions inthethreersttutorperiodinrdnwithndin (nheritnx

kcckspyltonitncndttTx oxTnton

ncluddcdntsnndsocilscuitynuon cck)

remittinmorethnoneelisteeindividullelow

olle(teronineove

Thisageitetiayeftba

T’SN

T’SSOISURITYNU

|

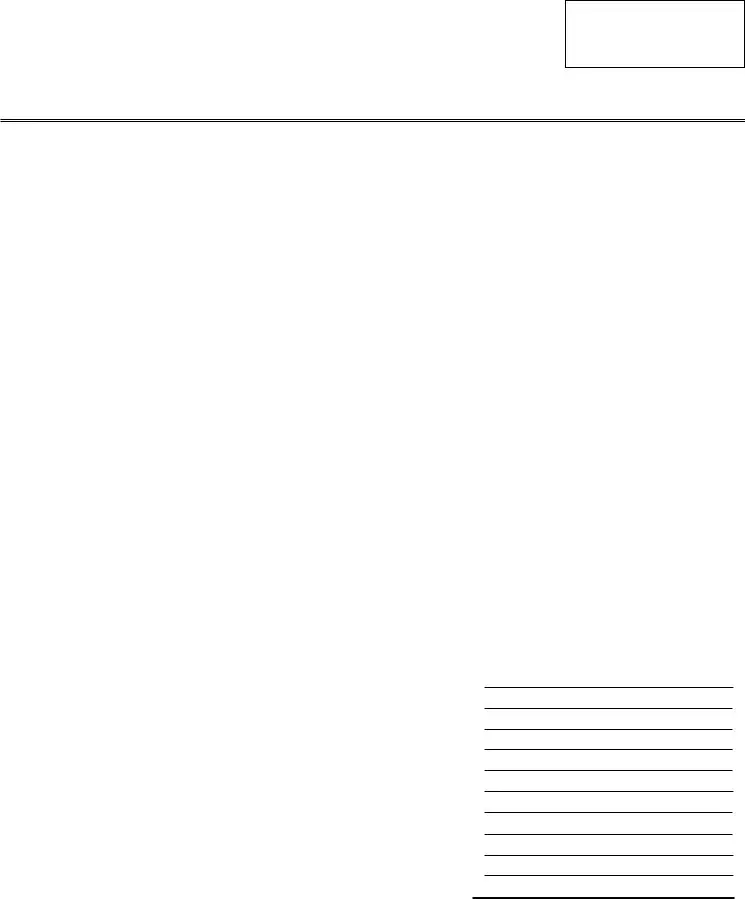

SCHEDULE |

reditfrrtiftaxattributabetrertycated |

utsideNewrsey |

|

||

|

|

|

|

|

||

|

Igeeraitagibeersarertyiscsideredtbe |

catediNewrseyregardessfwhereityactuaybecat |

ed |

|||

|

|

|

|

|

||

|

rssvauefrertycatedutsideNewrseyicuded |

iefthefirstagef |

|

|

||

|

thisretur |

|

|

|

|

|

|

|

Prerty |

|

aue |

|

|

|

|

|

|

|

||

|

___________________________________________________________ |

_______________________ |

|

|

||

|

___________________________________________________________ |

_______________________ |

|

|

||

|

___________________________________________________________ |

_______________________ |

|

|

||

|

___________________________________________________________ |

_______________________ |

|

|

||

|

___________________________________________________________ |

_______________________ |

|

|

||

|

___________________________________________________________ |

_______________________ |

|

|

||

|

Usesearatesheetifecessary |

|

|

|

|

|

|

Newrseygrssestatewherevercatedutistedie |

|

fthefirstagefthisretur |

|

|

|

|

TetativeNewrseyateTaxutistedief |

thefirstagefthisretur |

|

|

||

|

|

|

||||

|

wabecreditivideiebyieadtiyby |

ieterhereadiefthefirst |

|

|

||

|

|

|

||||

|

agefthisretur |

|

|

|

|

|

|

|

|

|

|

|

|

T’SN

T’SSOISURITYNU

SCHEDULE

WAIVER REQUEST SCHEDULE

NEW JERSEY REAL PROPERTY

Note: All items on this schedule must be reported on the Form 706

istaNSRPROPTYiwhichthedecedetheda |

|

iterest |

|

|

|

Rertfractiashares |

only iftherertywashedasteats |

|

|

|

|

trertrertyhedasteatsyhetiretyifsuseci |

viuiarterissurvivig |

|

|||

Taxwaiverswitbeissuedfrassetstistedthissche |

due |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

ecedet’sShare

uty

StreetadNuer

iciaity

t

c

TiteOwerfRecrd

ecedet’sShare

uty

StreetadNuer

iciaity

t

c

TiteOwerfRecrd

ecedet’sShare

uty

StreetadNuer

iciaity

t

c

TiteOwerfRecrd

fadditiasaceisrequiredattachridersfthesasize frybererduced

T’SN

T’SSOISURITYNU

SCHEDULE

WAIVER REQUEST SCHEDULE

NEW JERSEY BANK ACCOUNTS/CREDIT UNIONS/BROKERAGE ACCOUNTS

Note: All items on this schedule must be reported on the Form 706

istaassetshedi |

New Jersey bagistitutiswhichdecedet’saisisted |

|

|

||||

hisyicudechecgaccutssavigsaccutseyrts’s |

|

adIR’s |

|

||||

Icudetheafeachbaristitutiadaccut |

uertieaccutsi |

||||||

ebaybegruedtgetherbuteachaccutstbe |

istedsearatey |

||||||

Stateaas |

|

|

registeredeachaccut |

|

|

||

isty |

|

|

the full datefdeathbaacefeachaccutthisschedue |

|

|

||

Taxwaiverswitbeissuedfrassetstistedthissche |

due |

||||||

Brokerage Accounts must list total valueof account, rather than individual assets.

(A)

New Jersey Accounts

(B)

Registered Name(s)

(C)

Full Date of Death Value

fadditiasaceisrequiredattachridersfthesasize frybererduced

T’SN

T’SSOISURITYNU

SCHEDULE

WAIVER REQUEST SCHEDULE

NEW JERSEY STOCK ONLY

Note: All items on this schedule must be reported on the Form 706

istONYstcicrrateditheStatefNewrseywhi chdecedet’saisisted

Rerttheuerfshareswedfeachstc

isttheafthecayadaas |

|

registeredeachstc |

|

Taxwaiverswitbeissuedfrassetstistedthissche |

due |

||

Stocks held in a Brokerage Account should notbe listed on this schedule – include them in Account Total on Schedule

(A)

Number of Shares

(B)

Name of Stock

(C)

Registered Names

fadditiasaceisrequiredattachridersfthesasize frybererduced

Document Specifics

| Fact | Detail |

|---|---|

| Governing Law | The New Jersey Estate Tax Return is guided by R.S. 54:38.3, specific to tax overpayment refunds and related requests. |

| Form Name and Year | The form is titled "IT-Estate 2017 State of New Jersey Transfer Inheritance Tax Resident Decedent." |

| Inclusion of Federal Form 706 | Filers must include a complete Federal Form 706 even if they are not required to file it with the IRS, ensuring all documents related to the decedent's taxes are accounted for. |

| Requirements for Completing the Return | The executor or legal representative must carefully complete lines 1 through 13, include all necessary documents, and follow specific instructions to avoid delays in processing. |

Guide to Writing New Jersey Estate Tax Return

Filing a New Jersey Estate Tax Return is a necessary step for settling a resident decedent’s estate when the estate exceeds certain value thresholds as per state laws. To ensure the process is carried out efficiently, closely follow the specified instructions. Completing this form accurately and thoroughly will aid in the proper assessment of the estate tax due and facilitate timely processing by the Division of Taxation.

Here are the steps to complete the New Jersey Estate Tax Return form:

- Start by clearly writing the decedent's name and Social Security Number in the designated spaces at the top of the form.

- Enter the decedent’s date of death and county of residence in New Jersey. Mark whether the estate is Testate (with a will) or Intestate (without a will).

- Fill in the mailing address. This address will receive all correspondence from the Division of Taxation regarding the estate tax return. Make sure this information is accurate and complete.

- Go to the "Gross Estate" section of the form and report the total values according to the categories listed. This includes real estate, personal property, and any other relevant assets.

- In the sections that follow, you will calculate deductions, including state death taxes and other allowable expenses, to arrive at the tentative taxable estate.

- Apply the appropriate tax rates to calculate the tentative New Jersey estate tax due.

- Factor in any credits, including payments already made towards New Jersey Inheritance Tax, if applicable.

- Calculate the net New Jersey Estate Tax due. This is done by subtracting any credits from the tentative tax calculated earlier.

- If applicable, calculate interest and penalties due for late filing or payment.

- Total the amount due, including taxes, interest, and penalties.

- Ensure you include the required documentation:

- A completed Federal Form 706, even if not required to file with the IRS.

- A legible copy of the decedent’s Last Will and Testament and all codicils.

- A complete copy of any trust agreements the decedent was a part of.

- Sign and date the return. The executor or administrator must sign the form. A Notary Public must also witness the signing of the form.

- Print the name and title of the executor/administrator and provide their address.

- Submit the completed form, along with any payment due, to the address as instructed on the form. Remember not to use staples, binders, or sealed folders, and to include all required attachments.

Before submission, double-check that all necessary parts of the form are completed and that the supporting documents are attached. Once submitted, you should await communication from the Division of Taxation regarding any additional requirements or the completion of the estate's tax assessment.

Understanding New Jersey Estate Tax Return

-

Who is required to file a New Jersey Estate Tax Return?

A New Jersey Estate Tax Return must be filed for a resident decedent whose date of death is after December 31, 2016, but before January 1, 2018, if the decedent's gross estate exceeds $2 million as determined in accordance with the provisions of the Federal Internal Revenue Code in effect on January 1, 2017. This requirement applies regardless of whether a federal estate tax return (Form 706) is mandated.

-

What documents must be included with the New Jersey Estate Tax Return?

Alongside the completed New Jersey Estate Tax Return form, the following documents are necessary: a complete and legible copy of the decedent's last will and testament along with any codicils, any trust agreements to which the decedent was a party, and a completed federal form 706 (even if filing with the IRS isn’t required). Additionally, applications for a refund of an overpayment must be submitted in writing within three years, as dictated by the statutory period, with the specifics laid out in R.S. 54:38.3.

-

What are the instructions for mailing and filing the New Jersey Estate Tax Return to avoid processing delays?

- Avoid enclosing returns in binders, sealed folders, or notebooks.

- Do not use staples (especially long ones); rubber bands, clips, or two-hole ATCO fasteners at the top are acceptable.

- Ensure that only one copy of the will, any trusts, the income tax return, Form 706, appraisals, and other attachments are included when filing both Inheritance and Estate Tax returns.

- Staple checks to the completed payment voucher, ensuring they're signed and payable to “New Jersey Inheritance and Estate Tax” with the decedent's name and SS# on each check.

- Ensure the return is signed by the legal representative of the estate and notarized, with all relevant details accurately filled in.

Following these instructions meticulously ensures the return is processed efficiently without unnecessary delays.

-

Can I request a waiver for New Jersey Estate Tax, and if so, how?

Waivers may be required for certain New Jersey assets held by the decedent. To request waivers, complete Schedules E-4 through E-7 as part of the New Jersey Estate Tax Return. These schedules are critical for identifying the assets for which waivers are sought. It's important to only list assets that require waivers and to follow the specific guidance provided in each schedule carefully. Proper completion of these schedules is necessary for the prompt and accurate processing of waiver requests.

Common mistakes

-

Not including all required documents: Filling out the New Jersey Estate Tax Return form requires the inclusion of several critical documents to ensure a smooth processing of the return. These documents include a completed Federal form 706, even if the estate is not required to file with the IRS, and a complete, legible copy of the decedent’s Last Will and Testament along with any codicils. In addition, any trust agreements the decedent was a party to must also be provided. Failure to include these documents can result in significant processing delays and possibly the imposition of penalties and interest.

-

Overlooking specific instructions on deductions and taxes paid: A common mistake is improperly declaring the deduction for State Death Taxes on Line 3b for other states and not accurately reporting New Jersey Inheritance Tax already paid. The form distinctly requires estate representatives to enter the amount of any estate, inheritance, legacy, or succession taxes actually paid to any other State NOT including New Jersey. Proper attention to these details can save time and prevent financial discrepancies in the final tax calculations.

-

Misunderstanding the waiver request process: The New Jersey Estate Tax Return form stipulates the completion of Schedules E-4 through E-7 for the request of necessary waivers for New Jersey assets. An oversight occurs when estate representatives either omit necessary information on these schedules or fail to include them entirely. These waivers are crucial for the legal transfer of certain assets, underscoring the importance of completing them with due diligence and care.

-

Improper submission or preparation of the return: According to the return processing instructions provided, several do’s and don’ts are clearly listed to avoid delays. Key mistakes include using staples (aside from attaching checks to the payment voucher), enclosing the return in binders, sealed folders, or notebooks, and submitting duplicate copies of the return or other documents. Adherence to these submission guidelines ensures that the estate tax return is processed efficiently and without unnecessary delays.

Documents used along the form

When managing the estate of a deceased New Jersey resident, dealing with tax returns is a crucial component of the process. Specifically, the New Jersey Estate Tax Return (Form IT-Estate) requires thorough documentation for a comprehensive evaluation of the estate’s financial responsibilities to the state. Alongside this form, several other documents are routinely necessary to ensure the estate's tax matters are handled accurately and efficiently. Identifying and preparing these additional forms and documents is vital for a smooth process. Here is a list of documents often used alongside the New Jersey Estate Tax Return form:

- 1. Federal Estate Tax Return (Form 706): Even if not mandated by the IRS, a complete copy of this form is required for all New Jersey Estate Tax Returns. It provides a detailed account of the deceased’s federal tax liabilities.

- 2. Last Will and Testament: This includes a complete, legible copy of the decedent’s will and any amendments or codicils. It is essential for understanding the distribution of the estate.

- 3. Trust Agreements: Any trust documents that involve the decedent must be included. These documents outline specific financial and estate arrangements that affect the estate's valuation.

- 4. Waiver Request Schedules (E-4 through E-7): Necessary for requesting waivers for New Jersey assets, these schedules detail assets requiring waivers and guide how to request them.

- 5. Appraisals: Real estate, valuable personal property, and business interests often require professional appraisals to establish their fair market value at the date of the decedent’s death.

- 6. Death Certificate: A certified copy of the death certificate verifies the date and location of death, crucial for tax purposes.

- 7. Federal Income Tax Return (Final): The decedent’s final personal income tax return provides insight into their financial affairs and may affect estate valuations.

- 8. Inheritance and Estate Tax payments and vouchers: If payments are being made towards the estate’s tax liabilities, include the appropriate vouchers for tracking and acknowledgment.

- 9. Documentation for Deductions: This may include receipts, statements, and other documentation for funeral expenses, administrative costs, debts, and any other deductions claimed on the estate tax return.

- 10. IRS Communications: Any correspondence with the IRS regarding the estate, especially matters related to tax filings, assessments, or determinations that affect the estate's tax liability.

Compiling and submitting these documents in conjunction with the New Jersey Estate Tax Return form is key to ensuring the estate is evaluated accurately and taxed accordingly. Properly managing these documents helps to mitigate delays, reduce the potential for errors, and ensure compliance with state and federal tax laws. It’s a task that requires attention to detail and an understanding of the legal and financial implications of each document involved.

Similar forms

The Federal Form 706, an estate tax form required by the Internal Revenue Service, bears a striking resemblance to the New Jersey Estate Tax Return form. Both documents are essential for reporting the value of an estate for taxation purposes after someone has passed away. They require detailed information about the deceased, the estate's assets, and deductions. While the Federal Form 706 applies nationally, the New Jersey form is for state-specific estate tax obligations.

A Last Will and Testament is another document similar to the New Jersey Estate Tax Return form. It details a deceased person’s final wishes regarding the distribution of their estate. In the context of estate planning and tax submissions, a will is crucial for identifying the assets and intentions of the deceased, information that is also needed when filling out estate tax return forms.

Trust agreements share common aspects with the New Jersey Estate Tax Return form, mainly through their role in managing and disbursing an individual's assets. Trust agreements outline how assets placed in trust should be handled, which directly affects the estate's value and the corresponding taxes reported on estate tax returns.

Refund request letters for overpayments on estate taxes are closely related to the New Jersey Estate Tax Return form in their financial implications for the estate. Both documents deal with the financial aspects of settling an estate’s tax obligations, and a refund request letter may follow the filing of an estate tax return if overpayment is identified.

The Decedent’s Income Tax Return, which reports the deceased's income up to the date of death, parallels the New Jersey Estate Tax Return form by dealing with fiscal responsibilities after death. Though one focuses on income and the other on the estate's value, both require thorough documentation of the deceased's financial matters.

The Waiver Request Schedule E-4 through E-7, specifically for New Jersey estate processing, has similarities to the estate tax return form in function. It lists assets that necessitate clearance from state tax obligations before transfer, an essential step in aligning the estate's reported value with actual disbursements.

Death certificates are indispensable in the process surrounding the New Jersey Estate Tax Return form, primarily serving as official proof of death. This document is fundamental in initiating the legal and financial actions required after death, including the filing of estate tax returns.

Amendment documents for previously filed estate tax returns are closely related to the initial New Jersey Estate Tax Return. They are necessary when modifications are required after discovering discrepancies or omissions in the originally reported estate information, affecting the estate’s tax assessment.

Payment vouchers for estate tax, used to accompany checks or money orders for tax payments, function in conjunction with the New Jersey Estate Tax Return form. They ensure that payments are accurately applied to the correct estate account, mirroring the form’s role in reporting the tax due.

Letters of authorization, allowing representatives to act on behalf of the estate, share a connection with the New Jersey Estate Tax Return form through the management of the estate. These letters empower individuals to handle tax-related matters, including the submission of estate tax returns and managing communications with tax authorities.

Dos and Don'ts

When preparing the New Jersey Estate Tax Return form, it is essential to follow these guidelines to ensure accuracy and compliance with state regulations:

Do:Ensure all documents, including Federal Form 706, the decedent's Last Will and Testament, any codicils, and trust agreements, are complete and legible. These documents are critical for accurately assessing the estate.

Accurately complete the Mailing Address section to designate the correct recipient for all communications from the Division of Taxation. This ensures that important notices and documents reach the intended party.

Answer question 2(c) on Schedule M thoroughly to prevent processing delays. This question is crucial for the Division of Taxation to process the estate tax return properly.

Include accurate calculations, especially for deductions and credits. Mistakes here can lead to incorrect tax liabilities or delays in processing.

Check the return is signed by the legal representative of the estate and notarized as required, confirming the authenticity and accuracy of the information provided.

Verify the decedent’s social security number and date of death are correctly listed, as these are key identifiers for the estate.

File Inheritance Tax and Estate Tax returns together when possible, but keep payments and documentation for each distinct within the same envelope or box. This helps streamline processing while respecting the different aspects and due dates of each tax.

Enclose returns in binders, sealed folders, or notebooks. This makes it more difficult for the processing team to access and review the documents.

Use staples, especially extra-long ones, as they can damage documents. Rubber bands or clips are preferred for keeping files together without causing harm.

Include duplicate copies of returns or other documents. Duplicates can lead to confusion and processing delays. Stick to submitting only one copy of each required document.

Forget to staple checks to the completed payment voucher and place it on top for easy processing. Ensure checks are correctly signed and made payable to "New Jersey Inheritance and Estate Tax."

Omit the decedent's name and SS# on the check. This information is crucial for associating the payment with the correct estate.

Leave out ensuring the MAILING ADDRESS on the return is correct and specifies the individual authorized to receive all correspondence. This helps avoid miscommunication and ensures that all notifications reach the right person.

Fail to mark amended returns clearly as “Amended” at the bottom. This distinction is important for processing staff to approach the return with the right context.

Misconceptions

Misconceptions about the New Jersey Estate Tax Return form can lead to confusion and errors when filing. Understanding these common misunderstandings can help ensure the process is handled correctly.

Every estate must file an Estate Tax Return in New Jersey. This is not true. Only estates exceeding a certain value threshold are required to file, specifically those with a gross estate value that exceeds the limit set for the year of the decedent's death.

The Federal Form 706 is only necessary if filing with the IRS. Actually, the New Jersey Estate Tax Return requires a completed Federal Form 706 even if the estate isn't large enough to require federal filing. This form is used to help determine the New Jersey estate tax liability.

All assets transfer without New Jersey estate tax if the decedent has a will. The existence of a will does not affect the New Jersey estate tax. Tax is determined by the value and type of assets within the estate, not by the presence of a will.

Only real estate and bank accounts are taxable. Many different types of assets, including investments, business interests, and even certain types of trust assets, can be subject to the New Jersey estate tax, not just real estate and bank accounts.

Refunds for overpayments are automatically issued. To receive a refund for an overpayment, a specific request must be made in writing within three years of the payment, as detailed in the instructions for the form. It is not an automatic process.

Tax payments are due immediately upon the death of the decedent. While it's true that the tax liability arises at death, the actual due date for the tax payment can vary. Usually, payments are due nine months after the decedent's date of death, with the possibility of extensions under certain circumstances.

Inheritance and Estate Taxes are the same thing. New Jersey has two separate taxes: the Inheritance Tax and the Estate Tax. They are applied differently, depending on the relationship of the inheritor to the decedent and the size of the estate.

Only New Jersey real estate is subject to New Jersey estate tax. The New Jersey estate tax applies to all assets owned by the decedent, not just those located in New Jersey. This can include out-of-state real estate, as well as intangible assets.

Filing an Amended Return is prohibited. Amended returns are allowed if mistakes need to be corrected after the initial filing. Such returns must be clearly marked as “Amended” to indicate the revision.

By clearing up these misconceptions, those dealing with an estate can more accurately navigate the tax filing process, potentially avoiding common mistakes that could result in unnecessary tax liability or delays.

Key takeaways

When approaching the responsibility of filling out the New Jersey Estate Tax Return form, there are key takeaways to ensure a smooth process and compliance with state requirements. Understanding these pointers can help executors, attorneys, or representatives of a deceased's estate navigate through the tax filing terrain more effectively.

- Include Essential Documents: A complete Federal Form 706 needs to be included even if the estate was not required to file a return with the IRS. This should be accompanied by a legible copy of the decedent's Last Will and Testament and any trust agreements the decedent was a part of. These documents provide a basis for the estate's tax obligations and exemptions.

- Accurate Mailing Address: The form requires the designation of a mailing address where all communications from the Division of Taxation will be sent. This address should belong to the person or entity authorized to handle estate matters, ensuring that all correspondence, including bills and waivers, reach the right hands promptly.

- Payment and Refund Instructions: Understanding the specifics of making payments towards the estate tax and requesting refunds for overpayments is crucial. Payments are prioritized to cover any accrued interest before applying to the tax due, and refund requests for overpayments must be made in writing within a specified three-year statutory period following specific guidelines.

- Procedural Compliance: To avoid delays in return processing, waivers, and refunds, adherence to the New Jersey instructions regarding the physical submission of the return is imperative. This includes avoiding the use of binders, excessive staples, and providing duplicate copies of documents. Also, ensuring checks are stapled to the payment voucher and placing documents in the prescribed order can expedite processing.

By meticulously following these guidelines, executors or representatives can effectively manage the estate tax obligations of a decedent in New Jersey, ensuring compliance and minimizing the potential for delays or complications in the administration of the estate's tax responsibilities.

Popular PDF Documents

Form 8949 Exception Reporting Statement - Filing this form is a critical step in advocating for proper employment classification and the associated tax treatment.

Proof of Payment Letter - Includes options for document delivery, either through a scanned copy via email or direct pickup at the LPCI office.