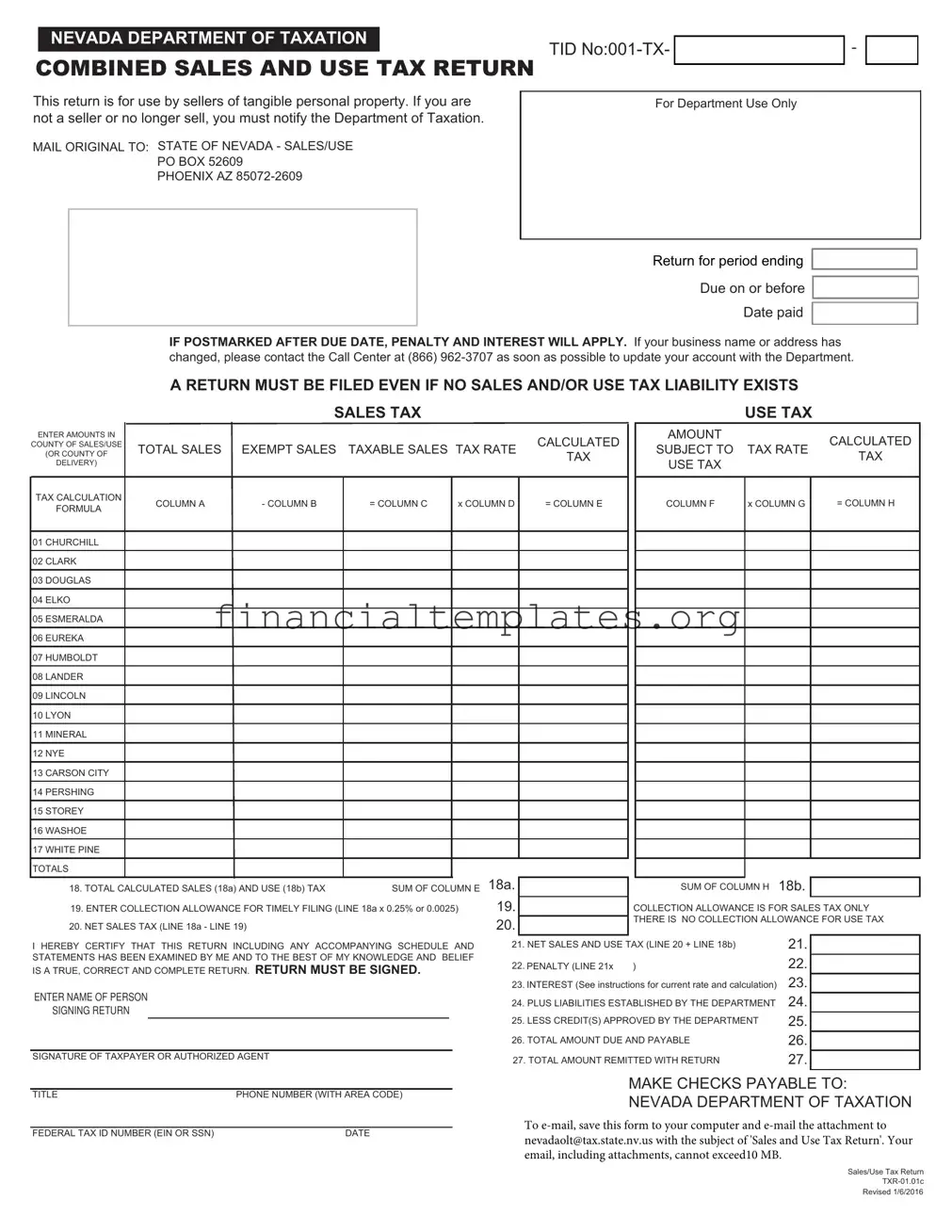

Get Nevada Sales Tax Form

The Nevada Sales Tax Form, issued by the Nevada Department of Taxation, stands as an essential document for sellers of tangible personal property within the state. This comprehensive form must be utilized by such sellers to report and remit both sales and use taxes. Importantly, irrespective of whether a business records any sales or use tax liability during the reporting period, the submission of this return remains mandatory. The form meticulously delineates between sales for varying counties, requiring sellers to itemize total sales, exempt sales, and, consequently, taxable sales. Following this, the form guides the computation of taxes owed, incorporating specific tax rates applicable to each county. Additionally, it addresses the purchase price of tangible personal property bought without paying Nevada tax which is then used, stored, or consumed rather than resold, thereby subjecting it to use tax. To encourage timely filings, the form offers a collection allowance—a percentage of the sales tax due—granted only when submissions are postmarked by the due date. Failure to comply with the filing deadline triggers penalties and interest based on a tiered late submission framework. Beyond tax calculations, the document stipulates the inclusion of liabilities established by the Department, credits approved, and the total amount payable or remitted. Finally, it underscores the necessity of maintaining comprehensive sales and transaction records to facilitate audits and verify the accuracy of reported figures, while also outlining procedures for updates in business information, document submission, and avenues for seeking assistance or further information.

Nevada Sales Tax Example

NEVADA DEPARTMENT OF TAXATION

TID

COMBINED SALES AND USE TAX RETURN

-

This return is for use by sellers of tangible personal property. If you are not a seller or no longer sell, you must notify the Department of Taxation.

MAIL ORIGINAL TO: STATE OF NEVADA - SALES/USE

PO BOX 52609

PHOENIX AZ

For Department Use Only

Return for period ending

Due on or before

Date paid

IF POSTMARKED AFTER DUE DATE, PENALTY AND INTEREST WILL APPLY. If your business name or address has changed, please contact the Call Center at (866)

|

|

|

A RETURN MUST BE FILED EVEN IF NO SALES AND/OR USE TAX LIABILITY EXISTS |

|

|||||||||||||

|

|

|

|

SALES TAX |

|

|

|

|

|

|

|

USE TAX |

|

||||

ENTER AMOUNTS IN |

|

|

|

|

|

|

|

|

|

CALCULATED |

|

|

AMOUNT |

|

|

|

CALCULATED |

COUNTY OF SALES/USE |

|

TOTAL SALES |

EXEMPT SALES |

TAXABLE SALES TAX RATE |

|

|

SUBJECT TO |

TAX RATE |

|||||||||

(OR COUNTY OF |

|

TAX |

|

|

TAX |

||||||||||||

DELIVERY) |

|

|

|

|

|

|

|

|

|

|

|

USE TAX |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX CALCULATION |

|

|

COLUMN A |

- COLUMN B |

= COLUMN C |

x COLUMN D |

|

= COLUMN E |

|

|

COLUMN F |

x COLUMN G |

|

= COLUMN H |

|||

FORMULA |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

01 CHURCHILL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

02 CLARK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

03 DOUGLAS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

04 ELKO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

05 ESMERALDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

06 EUREKA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

07 HUMBOLDT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

08 LANDER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

09 LINCOLN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 LYON |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 MINERAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 NYE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 CARSON CITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 PERSHING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 STOREY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 WASHOE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 WHITE PINE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18a. |

|

|

|

|

|

|

18b. |

|

|

||

18. TOTAL CALCULATED SALES (18a) AND USE (18b) TAX |

SUM OF COLUMN E |

|

|

|

|

SUM OF COLUMN H |

|

|

|||||||||

|

|

|

|

|

|

19. |

|

|

|

|

|

|

|||||

19. ENTER COLLECTION ALLOWANCE FOR TIMELY FILING (LINE 18a x 0.25% or 0.0025) |

|

|

|

COLLECTION ALLOWANCE IS FOR SALES TAX ONLY |

|||||||||||||

20. NET SALES TAX (LINE 18a - LINE 19) |

|

|

|

20. |

|

|

|

THERE IS NO COLLECTION ALLOWANCE FOR USE TAX |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

I HEREBY CERTIFY THAT THIS RETURN INCLUDING ANY ACCOMPANYING SCHEDULE AND |

21. NET SALES AND USE TAX (LINE 20 + LINE 18b) |

|

21. |

|

|

||||||||||||

STATEMENTS HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE AND BELIEF |

22. |

PENALTY (LINE 21x |

) |

|

|

22. |

|

|

|||||||||

IS A TRUE, CORRECT AND COMPLETE RETURN. RETURN MUST BE SIGNED. |

|

|

|

|

|

||||||||||||

|

23. INTEREST (See instructions for current rate and calculation) |

23. |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

ENTER NAME OF PERSON |

|

|

|

|

24. PLUS LIABILITIES ESTABLISHED BY THE DEPARTMENT |

24. |

|

|

|||||||||

SIGNING RETURN |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

25. LESS CREDIT(S) APPROVED BY THE DEPARTMENT |

25. |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

26. TOTAL AMOUNT DUE AND PAYABLE |

|

26. |

|

|

|||||

SIGNATURE OF TAXPAYER OR AUTHORIZED AGENT |

|

|

|

27. TOTAL AMOUNT REMITTED WITH RETURN |

|

27. |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

TITLE |

PHONE NUMBER (WITH AREA CODE) |

|

|

FEDERAL TAX ID NUMBER (EIN OR SSN) |

DATE |

MAKE CHECKS PAYABLE TO:

NEVADA DEPARTMENT OF TAXATION

To

Sales/Use Tax Return

Revised 1/6/2016

COMBINED SALES AND USE TAX RETURN INSTRUCTIONS

This return is for use by sellers of tangible personal property registered with the Department

A RETURN MUST BE FILED EVEN IF NO TAX LIABILITY EXISTS

LINES 1 THROUGH 17

COLUMN A: TOTAL SALES - On the appropriate county line, enter the amount of all sales (excluding the sales tax collected) related to Nevada business including (a) cash sales; (b) conditional sales; (c) sales exempt from tax.

COLUMN B: EXEMPT SALES - Enter that portion of your sales not subject to tax, i.e., sales (a) for which you receive a resale certificate; (b) to Federal Government, State of Nevada, its agencies, cities or counties and school districts; (c) to religious or charitable organizations for which you have copies of exemption letters on file; (d) newspapers of general circulation published at least once a week; (e) animals, seeds, annual plants and fertilizer, the end product of which is food for human consumption; (f) motor vehicle or special fuels used in internal combustion or diesel engines; (g) wood, presto logs, pellets, petroleum, gas and any other matter used to produce domestic heat and sold for home or household use; (h) prescription medicines dispensed pursuant to a prescription by a licensed physician, dentist or chiropodist; (i) food products sold for home preparation and consumption; (j)

.

COLUMN C: TAXABLE SALES - Total Sales (Column A) - Exempt Sales (Column B) = Taxable Sales (Column C).

COLUMN E: CALCULATED TAX - Taxable Sales (Column C) × Tax Rate (Column D) = Calculated Tax (Column E).

COLUMN F: AMOUNT SUBJECT TO USE TAX - On the appropriate county line, enter (a) the purchase price of merchandise, equipment or other tangible personal property purchased without payment of Nevada tax (by use of your resale certificate, or any other reason) and that was stored, used or consumed by you rather than being resold. NOTE: If you have a contract exemption, give contract exemption number.

COLUMN H: CALCULATED TAX - Amount Subject to Use Tax (Column F) × Tax Rate (Column G) = Calculated Tax (Column H).

LINE 18A Enter the total of Column E.

LINE 18B Enter the total of Column H.

LINE 19 Take the Collection Allowance only if the return and taxes are postmarked on or before the due date as shown on the face of this return. If not postmarked by the due date, the Collection Allowance is not allowed. To calculate the Collection Allowance multiply Line 18a × 0.25% (or .0025). NOTE: Pursuant to NRS 372.370, the Collection Allowance is applicable to Sales Tax only.

LINE 20 Subtract Line 19 from Line 18a and enter the result.

LINE 21 Add Line 20 to Line 18b and enter the result.

LINE 22 If this return is not submitted/postmarked and taxes are not paid on or before the due date as shown on the face of this return, the amount of penalty due is based on the number of days the payment is late per NAC 360.395 (see table below). The maximum penalty amount is 10%.

Number of days late |

Penalty Percentage |

Multiply by: |

|

|

|

1 - 10 |

2% |

0.02 |

|

|

|

11 - 15 |

4% |

0.04 |

|

|

|

16 - 20 |

6% |

0.06 |

|

|

|

21- 30 |

8% |

0.08 |

|

|

|

31 + |

10% |

0.10 |

|

|

|

Determine the number of days late the payment is, and multiply the net tax owed (Line 21) by the appropriate rate based on the table to the left. The result is the amount of penalty that should be entered. For example, if the taxes were due January 31, but not paid until February 15. The number of days late is 15 so the penalty is 4%. The penalty and interest amounts are automatically calculated for you if this form is completed on your computer.

LINE 23 To calculate interest, multiply Line 21 x 0.75% (or .0075) for each month payment is late.

LINE 24 Enter any amount due for prior reporting periods for which you have received a Department of Taxation billing notice.

LINE 25 Enter amount due to you for overpayment made in prior reporting periods for which you have received a Department of Taxation credit notice. Do not take the credit if you have applied for a refund. NOTE: Only credits established by the Department may be used.

LINE 26 Add Lines 21, 22, 23, 24 and then subtract Line 25 and enter the result.

LINE 27 Enter the total amount paid with this return.

Complete and detailed records of all sales, as well as income from all sources and expenditures for all purposes, must be kept so your return can be verified by a Department auditor.

YOU MUST COMPLETE THE SIGNATURE PORTION BY TYPING IN THE NAME OF THE PERSON SIGNING THE RETURN AND MAIL TO: Nevada Department of Taxation, PO Box 52609, Phoenix, AZ

local office.

DO NOT SUBMIT A PHOTOCOPY OF A PRIOR PERIOD FORM, YOUR FILING WILL POST INCORRECTLY.

If you have questions concerning this return, please call our Department's Call Center at (866)

SALES/USE TAX RETURN INSTRUCTIONS

Revised 01/04/2016

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The Nevada Combined Sales and Use Tax Return is designed for sellers of tangible personal property registered with the Nevada Department of Taxation. |

| 2 | Businesses must notify the Department of Taxation if they are not sellers or have ceased selling tangible personal property. |

| 3 | The form requires details on total sales, exempt sales, and taxable sales, along with the calculation of sales and use tax owed. |

| 4 | Filers must calculate the sales tax based on taxable sales multiplied by the applicable tax rate for the county of sale/use. |

| 5 | A collection allowance for timely filing is provided, calculated as 0.25% of the total calculated sales tax owed if the return and payment are postmarked by the due date. |

| 6 | Penalties for late submission/payment are calculated based on the number of days late and can reach up to 10% of the owed tax. |

| 7 | Interest is charged on late payments at a rate of 0.75% per month. |

| 8 | The form must be signed by the taxpayer or an authorized agent, indicating certification that the return is true, correct, and complete to the best of the preparer's knowledge and belief. |

| 9 | The governing laws for the penalties and collection allowance are NRS 372.370 and NAC 360.395, respectively. |

Guide to Writing Nevada Sales Tax

Filing the Nevada Sales and Use Tax Return is a necessary task for sellers of tangible personal property in Nevada, ensuring compliance with state tax regulations. The process requires careful attention to detail as you report your sales and calculate the taxes due accurately. Whether you're a seasoned business owner or new to the task, this guide aims to simplify the steps for you, making sure you complete your tax return correctly and efficiently. Follow these steps to ensure your return is properly filled out and submitted on time.

- Identify the period your tax return covers and write it at the top of the form where it says "Return for period ending."

- Check the due date for submission on the top right corner of the form to ensure timely filing.

- Fill in your TID (Taxpayer Identification) Number at the top left corner of the form.

- If there have been changes to your business name or address, contact the Department of Taxation Call Center at (866) 962-3707 before filing the return.

- For each county where you made sales, enter the total sales amount (excluding sales tax) in Column A.

- In Column B, list any exempt sales, including sales to government entities, charitable organizations, and out-of-state sales.

- Subtract Column B from Column A and record the taxable sales amount in Column C for each county.

- Using the tax rate provided for each county in Column D, multiply by the taxable sales amount in Column C to calculate the sales tax due in Column E.

- For any merchandise or tangible personal property used or consumed rather than resold, enter the purchase price in Column F.

- Calculate the use tax due by multiplying the amount in Column F by the tax rate in Column G and record in Column H.

- Sum the amounts in Column E and enter the total in Line 18a. Do the same for Column H and enter the total in Line 18b.

- If eligible, calculate your Collection Allowance in Line 19 by multiplying Line 18a by 0.25% (or 0.0025).

- Subtract Line 19 from Line 18a to determine the net sales tax in Line 20. Add Line 18b to get the net sales and use tax due on Line 21.

- If your payment is late, calculate the penalty based on the number of days late and the corresponding percentage, and record this amount on Line 22.

- Calculate the interest due if applicable, using the current rate, and enter this in Line 23.

- Add any amounts due from previous periods as indicated in Department notices in Line 24.

- If you have credits as approved by the Department, subtract these from the total amount due and enter the result in Line 26.

- Write the total amount you are remitting with your return in Line 27.

- Complete the signature portion by typing the name, title, and contact information of the person responsible for filing this return.

- Review the entire form to ensure all calculations are correct and all necessary information has been included.

- Mail the original form to the Nevada Department of Taxation at the address provided, or submit electronically if this option is available and preferred.

Ensure your return is filed and any taxes due are paid on or before the due date to avoid penalties and interest. Keep a copy of the completed form and any correspondence with the Department of Taxation for your records. If you encounter any uncertainties or require clarification as you fill out the form, do not hesitate to contact the Nevada Department of Taxation for assistance.

Understanding Nevada Sales Tax

Who needs to file a Nevada Sales and Use Tax Return?

Any seller of tangible personal property registered with the Nevada Department of Taxation must file the Nevada Sales and Use Tax Return. This includes businesses engaged in sales that result in the transfer of ownership of tangible goods to a buyer. Regardless of whether there's a tax liability for a given period, a return must be filed.

What should I do if my business name or address has changed?

If there has been a change in your business name or address, it's important to contact the Department of Taxation's Call Center at (866) 962-3707 as soon as possible. Updating your account with the current information ensures that all correspondence and necessary documents reach you in a timely manner.

How is the Collection Allowance calculated on the Nevada Sales and Use Tax Return?

The Collection Allowance is a benefit given to businesses that file their Sales and Use Tax Return on time. To calculate the Collection Allowance, multiply the total calculated sales tax (line 18a) by 0.25% (or .0025). It's crucial to note that the Collection Allowance applies only to the sales tax portion and is not granted if the return is postmarked after the due date.

What are the penalties for late filing or payment?

Penalties for late filing or payment depend on the number of days the payment is overdue. The amount of penalty is calculated by multiplying the net tax owed (Line 21) by the appropriate percentage based on the late period, which can range from 2% to 10%. Additionally, interest is charged at a rate of 0.75% (or .0075) for each month the payment is late. It’s beneficial to file and pay on time to avoid these extra charges.

Common mistakes

-

Failing to accurately differentiate between taxable and exempt sales is a common mistake. When filling out the Nevada Sales Tax form, sellers must carefully separate their total sales between those that are taxable and those that are exempt from taxation. This requires a clear understanding of what qualifies as an exempt sale under Nevada law, such as sales to governmental agencies or for certain agricultural purposes. Incorrect reporting in this area can lead to inaccuracies in the amount of tax owed, potentially resulting in penalties and interest.

-

Not updating business information can lead to complications with the Nevada Department of Taxation. Sellers have an obligation to inform the Department of Taxation immediately if there are any changes to their business name or address. Failure to do so can hinder communication, delay the processing of returns, and may lead to misplaced tax documents or notices, all of which could complicate tax filing and payment procedures.

-

Incorrectly calculating the tax due is another frequent issue. The Nevada Sales Tax form requires sellers to apply specific tax rates, which vary by county, to their taxable sales and purchases subject to use tax. Mistakes in applying these rates, or errors in basic arithmetic, can result in either underpayment or overpayment of taxes. The former may incur penalties and interest, while the latter could leave the business waiting for a refund or credit.

-

Overlooking the collection allowance is a mistake that directly impacts the financial benefits entitled to the taxpayer. Sellers who file their taxes on or before the due date are eligible for a collection allowance, calculated as 0.25% of the total sales tax due. This allowance is meant to somewhat compensate for the costs associated with collecting the tax. However, this benefit is often missed by those who either are unaware of it or forget to claim it on their return.

In summary, when sellers are completing the Nevada Sales Tax form, paying attention to these details is crucial. Ensuring accurate reporting of taxable versus exempt sales, keeping business information current, accurately calculating taxes owed, and claiming eligible allowances can significantly streamline the tax filing process, minimize errors, and possibly reduce the amount of tax payable by taking advantage of available credits and allowances.

Documents used along the form

When managing a business in Nevada, particularly one that deals in tangible personal property, it's crucial to stay on top of the required paperwork for taxation. Besides the main Nevada Sales Tax form, several other documents typically play a vital role in ensuring that a business complies with state tax regulations. These documents are often used to support, explain, or expand the information provided on the main tax form.

- Resale Certificate: Businesses use this form to purchase goods they intend to resell, without paying sales tax at the point of purchase. It's essential for documenting tax-exempt transactions reported on the Nevada Sales Tax form.

- Exemption Certificate: Similar to the Resale Certificate, this document is used by entities such as nonprofits, government agencies, and certain other organizations to purchase goods tax-free, which must be documented in tax filings.

- Use Tax Payment Form: If a business purchases goods without paying Nevada sales tax (typically from out-of-state vendors), this form is used to report and pay use tax on those goods, complementing the Nevada Sales Tax form.

- Tax Refund Request Form: When a business believes it has overpaid taxes or filed taxes in error, this form is necessary to request a refund from the Nevada Department of Taxation.

- Business Registration Application: Before a business can file any sales or use tax returns, it must first be registered with the Nevada Department of Taxation. This is the form used to initiate that process.

- Change of Address Form: It's necessary to update the Nevada Department of Taxation with any changes to a business's mailing address to ensure all correspondences, including those regarding sales and use tax, are properly received.

- Auditor's Verification Form: If a business is audited, this form may be used by the auditor to verify the accuracy of sales, use, and exemption reporting on the Nevada Sales Tax form.

Understanding and properly using these documents in conjunction with the Nevada Sales Tax form can significantly ease the process of sales and use tax compliance for businesses. Each serves a unique purpose in the broader framework of tax reporting and payment, ensuring businesses can effectively meet their legal obligations while also taking advantage of allowable exemptions and credits.

Similar forms

One comparable document to the Nevada Sales and Use Tax Return is the Federal Employer's Quarterly Federal Tax Return, known as Form 941. This document is used by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks, and to pay the employer's portion of social security or Medicare tax. Similar to the Nevada Sales and Use Tax Return, Form 941 necessitates detailed calculations and reporting on a periodic basis (quarterly). Both forms require employers or sellers to report amounts related to their business activities, deduct exemptions or credits as applicable, calculate the taxes due, and submit the form by a specific deadline to avoid penalties and interest.

Another document with notable similarities is the State Unemployment Tax Act (SUTA) tax filing. This filing is required from employers at the state level and involves reporting wages paid to employees to determine state unemployment insurance tax obligations. Like the Nevada Sales and Use Tax Return, SUTA filings involve periodic submissions (typically quarterly) and entail precise calculations based on wages and tax rates. Both require the filer to adhere to deadlines and provide detailed employment records to calculate the tax due correctly.

The Corporate Income Tax Return, often referenced by its federal form number 1120, also shares similarities with the Nevada Sales and Use Tax Return. Corporations use Form 1120 to report their income, gains, losses, deductions, and credits and to calculate their federal income tax liability. Both forms are essential for compliance with tax laws, involve itemized reporting based on business operations, and include deductions or credits before determining the net tax due. Additionally, both necessitate the submission of accurate and complete documentation to respective tax authorities to remain in compliance.

A personal Income Tax Return, such as the federal IRS Form 1040, while focused on individual income rather than business sales or operations, shares a procedural resemblance to the Nevada Sales and Use Tax Return. Taxpayers use Form 1040 to report their annual income, claim deductions, and determine the amount of tax owed to or refunded by the federal government. Similarities include the requirement for detailed financial reporting, calculation of tax liability after deductions and exemptions, and adherence to filing deadlines to avoid penalties. Both forms play critical roles in financial accountability and contribute to the administration of tax systems at different levels.

Dos and Don'ts

When completing the Nevada Sales Tax form, certain practices should be adhered to for accuracy and compliance. Here are five dos and don'ts to consider:

Do:- Ensure accuracy in reporting total sales and exempt sales in Columns A and B, respectively, to accurately calculate taxable sales in Column C.

- Apply the correct tax rate for each county when calculating the sales tax (Column E) and use tax (Column H) to ensure the correct tax amounts are reported.

- File on time to take advantage of the Collection Allowance (Line 19), which is only allowable if the return is postmarked by the due date.

- Sign the return by typing the name of the authorized person in the signature section, as an unsigned return may not be considered valid.

- Keep detailed records of all sales, income, and expenditures, as these records are critical for verification in case of an audit by the Department of Taxation.

- Ignore the filing requirement, even if no sales and/or use tax liability exists. A return must be filed for every period.

- Forget to update your account information if your business name or address has changed. Contact the Call Center at (866) 962-3707 as soon as possible.

- Overlook penalties and interest for late submission or payment. Be aware of the due date to avoid additional charges.

- Misapply the Collection Allowance by calculating it for use tax. It is applicable to sales tax only.

- Submit a photocopy of a prior period form, as it may lead to incorrect posting of your filing.

Misconceptions

Discussing the Nevada Sales and Use Tax Return form can bring numerous misconceptions to light. Here, we aim to clarify these inaccuracies to provide a better understanding of the tax obligations for businesses in Nevada.

All businesses do not need to file: A common mistake is thinking that if your business did not make any sales during the reporting period, you do not need to file a return. However, the state mandates that a return must be filed even if no sales or use tax liability exists. This ensures your records with the Department of Taxation are kept current.

The form is too complicated: While it may appear daunting at first, the Nevada Sales and Use Tax Return form is structured logically. Each section and line are designed to account for different types of transactions, from total sales to exemptions and taxable amounts. Understanding the purpose of each line can simplify the process.

Exempt sales need not be reported: This is incorrect. The form requires that you report exempt sales separately from taxable sales. This differentiation ensures accurate reporting and allows for proper state oversight on exemptions.

Online businesses are exempt: Another misconception is that businesses operating exclusively online do not have to collect or report sales tax. If you're selling to Nevada customers, you're likely required to comply with Nevada's sales and use tax regulations.

Use tax is only for large purchases: In fact, use tax applies to all applicable purchases where Nevada sales tax was not collected, regardless of size. This includes both merchandise and equipment used in your business.

Penalties are negotiable: Some believe penalties for late filing or payment can be negotiated or waived easily. While there are provisions for relief from penalties, they are typically applied under strict conditions and criteria.

The collection allowance applies to both sales and use taxes: The collection allowance, a small percentage retention allowed for timely filers to cover the costs of collecting the tax, applies to sales tax only, not to use tax.

One tax rate fits all: The belief that one tax rate applies statewide ignores the reality that Nevada's sales and use tax rates vary by county. It’s crucial to apply the correct rate when calculating what you owe.

Electronic filing is optional: Nowadays, with advancements in digital governance, electronic filing is strongly encouraged and, in some cases, required. It streamlines the process for both businesses and the tax authority.

Creatively, businesses must approach tax obligations with a clear understanding and up-to-date knowledge. By dispelling myths and assumptions about the Nevada Sales and Use Tax Return form, businesses can ensure they remain compliant and avoid potential penalties.

Key takeaways

Filing a Nevada Sales Tax return is a critical process for sellers of tangible personal property in Nevada. Here are eight key takeaways to understand when completing and utilizing the Nevada Sales Tax form:

- Who Should File: This form is specifically designed for sellers of tangible personal property registered with the Nevada Department of Taxation.

- Filing Requirement: A return must be submitted every period, even if the seller does not engage in any taxable sales or accrue any use tax liability during that period.

- Determination of Taxable Sales: The form requires sellers to distinguish between total sales, exempt sales, and taxable sales, with taxable sales being the total sales minus exempt sales.

- Calculation of Sales and Use Tax: Sales tax is calculated by applying the tax rate for the relevant county to the taxable sales, while use tax is calculated separately for goods that were purchased without Nevada tax and used or stored within the state.

- An incentive for Timely Filing: A collection allowance is offered for sales tax only, calculated as 0.25% (or 0.0025) of the total calculated sales tax, but it's only available if the return and payment are postmarked by the due date.

- Penalties for Late Filing: Penalties are imposed for late submissions and are based on the duration of the delay, up to a maximum of 10%. The exact penalty rate increases with the number of days the payment is late.

- Interest on Late Payments: In addition to penalties, interest is calculated for late payments at a rate of 0.75% per month on the outstanding tax due.

- Completeness and Accuracy: The form must be signed by an authorized individual, asserting that the information provided is complete and accurate to the best of their knowledge. Furthermore, records of all sales and transactions need to be kept meticulously for verification by Department auditors.

Understanding these key aspects can help ensure compliance with the Nevada Department of Taxation's requirements, avoid penalties, and potentially benefit from allowances for timely filing. For detailed guidance or clarification, contacting the Nevada Department of Taxation directly or consulting a tax professional is advisable.

Popular PDF Documents

IRS 2441 - Assists in understanding the limit on the amount of credit that can be claimed per dependent or total.

Is Shipping Taxable - Using the DR-15EZ form, businesses must separately calculate and report any discretionary sales surtax owed.

I-9 Verification - The I-9 Tax Form is a mandatory document for verifying the legal employment eligibility of workers in the United States.