Get Nevada Modified Tax Return Form

Navigating the intricacies of tax forms can often feel like an overwhelming task, but understanding them is essential for businesses to ensure compliance and optimize financial outcomes. Among these forms, the Nevada Modified Business Tax Return, as revised in 2016, stands out for businesses operating within the state. Designed for quarterly reporting, this form is crucial for employers subject to the Nevada Unemployment Compensation Law, excluding specific entities such as non-profit organizations, Indian tribes, and political subdivisions. The form encompasses various segments, including the calculation of total gross wages, deductions for paid health insurance, benefits, and qualified veterans' wages, and the offset carried forward from previous quarters, allowing businesses to accurately determine their taxable wages. Additionally, it accommodates the application of the Commerce Tax Credit and other pertinent credits, fine-tuning the net tax due. With penalties and interest applied to late submissions or payments, the form underscores the importance of timeliness in compliance. Furthermore, it facilitates carry-forward provisions for cases where deductions exceed gross wages, ensuring businesses can manage their financial obligations effectively. As such, mastering the Nevada Modified Business Tax Return form is a stepping stone towards sound financial management for businesses in Nevada, providing a structured approach to fulfilling tax obligations while capitalizing on available credits and deductions.

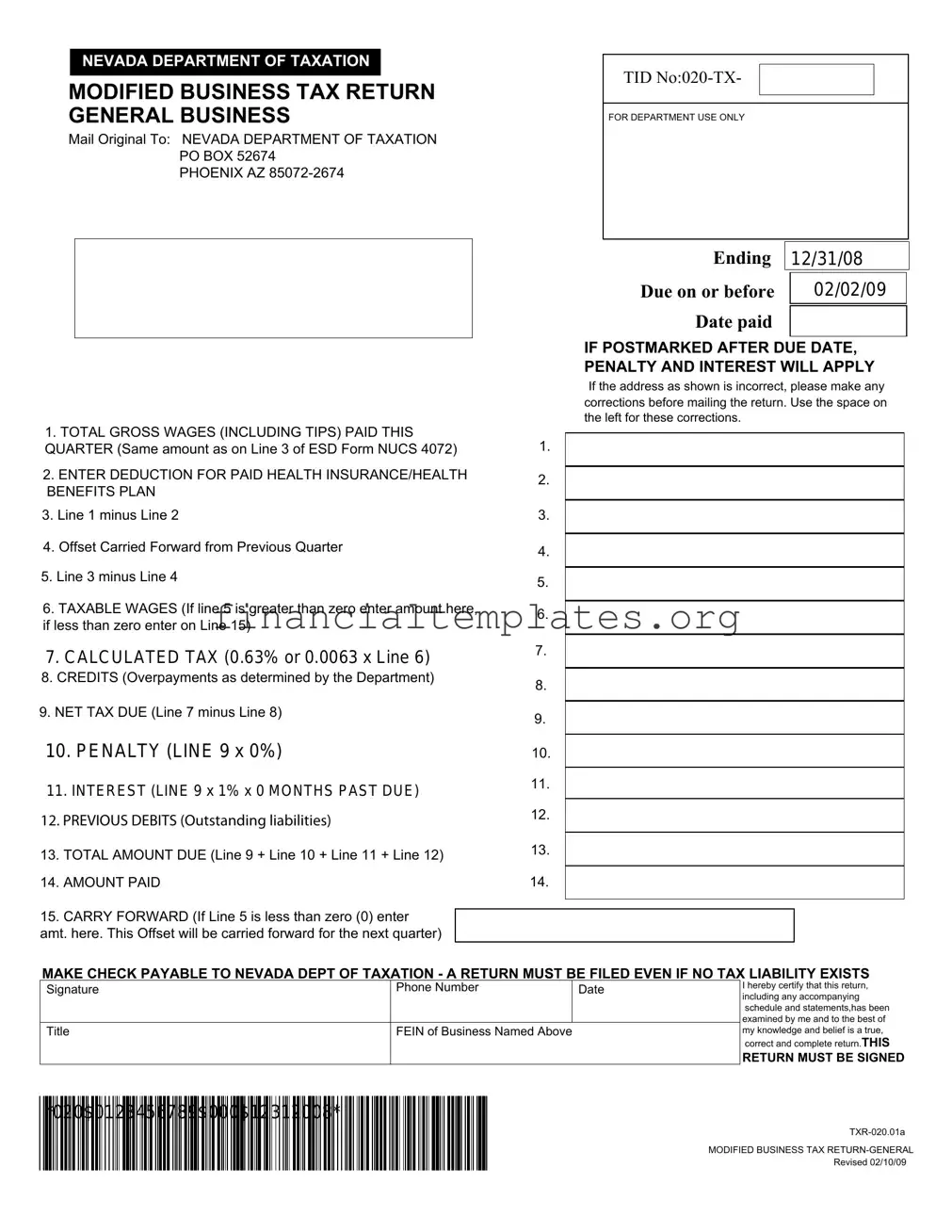

Nevada Modified Tax Return Example

NEVADA DEPARTMENT OF TAXATION

MODIFIED BUSINESS TAX RETURN GENERAL BUSINESS

Mail Original To: NEVADA DEPARTMENT OF TAXATION PO BOX 52674

PHOENIX AZ

TID

FOR DEPARTMENT USE ONLY

Ending |

12/31/08 |

|

|

|

|

Due on or before |

|

02/02/09 |

Date paid |

|

|

|

|

|

|

|

|

IF POSTMARKED AFTER DUE DATE, PENALTY AND INTEREST WILL APPLY

If the address as shown is incorrect, please make any corrections before mailing the return. Use the space on the left for these corrections.

1.TOTAL GROSS WAGES (INCLUDING TIPS) PAID THIS QUARTER (Same amount as on Line 3 of ESD Form NUCS 4072)

2.ENTER DEDUCTION FOR PAID HEALTH INSURANCE/HEALTH BENEFITS PLAN

3.Line 1 minus Line 2

4.Offset Carried Forward from Previous Quarter

5.Line 3 minus Line 4

6.TAXABLE WAGES (If line 5 is greater than zero enter amount here, if less than zero enter on Line 15)

7.CALCULATED TAX (0.63% or 0.0063 x Line 6)

8.CREDITS (Overpayments as determined by the Department)

9.NET TAX DUE (Line 7 minus Line 8)

10.PENALTY (LINE 9 x 0%)

11.INTEREST (LINE 9 x 1% x 0 MONTHS PAST DUE)

12.PREVIOUS DEBITS (Outstanding liabilities)

13.TOTAL AMOUNT DUE (Line 9 + Line 10 + Line 11 + Line 12)

14.AMOUNT PAID

15.CARRY FORWARD (If Line 5 is less than zero (0) enter

amt. here. This Offset will be carried forward for the next quarter)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

MAKE CHECK PAYABLE TO NEVADA DEPT OF TAXATION - A RETURN MUST BE FILED EVEN IF NO TAX LIABILITY EXISTS

Signature

Title

Phone Number |

Date |

|

|

FEIN of Business Named Above

I hereby certify that this return, including any accompanying schedule and statements,has been examined by me and to the best of my knowledge and belief is a true,

correct and complete return.THIS

RETURN MUST BE SIGNED

*020$0123456789$000$12312008*

MODIFIED BUSINESS TAX

Revised 02/10/09

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY (Financial

Institutions need to use the form developed specifically for them,

Line 1. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter. (Same amount as on Line 3 of ESD Form NUCS 4072.) DO NOT include a copy of NUCS 4072 with this return.

Line 2. Employer paid health care costs, paid this calendar quarter, as described in NRS 363B.110. Line 3. Line 1 minus Line 2.

Line 4. Offsets carried forward are created when allowable health care costs exceed gross wages in the previous quarter. If applicable, enter the previous quarter's offset here. This is not a credit against any tax due. This reduces the wage base upon which the tax is calculated.

Line 5. Line 3 minus Line 4.

Line 6. Taxable wages is the amount that will be used in the calculation of the tax. If line 5 is greater than zero, this is the taxable wages. If line 5 is less than zero, then no tax is due. (This amount will be entered on line 15 as the offset carried forward for the next quarter.)

Line 7. Calculate Tax Due - Taxable wages x (rate shown on line 7) = the tax due. (Rate Varies by Period End Date according to Tax Laws)

Line 8. Credits - Enter amount of overpayment of Modified Business Tax made in prior reporting periods for which you have received a Department of Taxation credit notice. Do not take the credit if you have applied for a refund. NOTE: Only credits established by the Department may be used.

Line 9. Net Tax Due - Line 7 minus Line 8. This amount is due and payable by the due date; the last day of the month following the applicable quarter. If payment of the tax is late, penalty and interest (as calculated below) are applicable.

LINE 10- If this return is not submitted/postmarked and taxes are not paid on or before the due date as shown on the face of this return, the amount of penalty due is: a) For returns with Period(s) Ending prior to and including 3/31/07 the Penalty is 10%; b) For returns with Period(s) Ending 4/30/07 and after; the amount of penalty due is based on the number of days the payment is late per NAC 360.395 (see table below). The maximum penalty amount is 10%.

Number of days late |

Penalty Percentage |

Multiply by: |

1 - 10 |

2% |

0.02 |

11 - 15 |

4% |

0.04 |

16 - 20 |

6% |

0.06 |

21- 30 |

8% |

0.08 |

31 + |

10% |

0.10 |

Line 11. Interest - If this return will not be postmarked and the taxes paid on or before the applicable due date, enter 1% (0.01) x (times) line 9 for each month or fraction of a month late.

Line 12. Previous Debits - Enter only those liabilities that have been established for prior quarters by the Department and for which you have received a liability notice.

Line 13. Total Amount Due

Line 14. Amount Paid - Enter the amount remitted with return.

Line 15. Carry Forward - If line 5 is less than zero enter figure here. This amount will be carried forward to the next quarter (offset).

GENERAL INFORMATION:

GENERAL BUSINESSES MUST USE FORM

Who Must File: Every employer who is subject to the Nevada Unemployment Compensation Law (NRS 612) except for

A copy of the form NUCS 4072, as filed with Nevada Employment Security Division, does not need to be included with the original return, but should be available upon request by the Department.

Businesses that have ceased doing business (gone out of business) in Nevada must notify the Employment Security Division and the Department of Taxation in writing, the date the business ceased doing business.

AMENDING RETURN(S):

1.Copy of the original return.

2.The word "AMENDED" written in black in the upper

3.

4.Enter corrected figures, in black, next to/above

5. Enter amount of credit claimed (if any) or amount due.

6.Include a WRITTEN EXPLANATION AND DOCUMENTATION (credit memos, exemption certificates, adjustments to gross wages or health care deductions, etc.) substantiating the basis of the amendment(s).

7.If the amended return results in a credit, a credit will be issued to satisfy current /future liabilities unless a refund is specifically requested.

8.If additional tax is due, please remit payment along with applicable penalty and interest.

The Department will send written notice when a credit request has been processed and the credit is available for use/refund.

Please do not use/apply a credit prior to receiving Departmental notification that it is available.

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The form is designed for the use of general businesses under the revised version dated June 21, 2016. |

| 2 | It is used to report total gross wages, including tips, paid within the calendar quarter. |

| 3 | Employers can deduct paid health insurance benefits and qualified veterans' wages to lower taxable wages. |

| 4 | Taxable wages are calculated as gross wages minus allowable deductions and offsets. |

| 5 | A threshold of $50,000 is applied to determine taxable wages, as set by SB483. |

| 6 | The form allows for credits such as the Commerce Tax credit and adjustments for overpayments or other approved credits. |

| 7 | Governing laws include NRS 363B.115 for employer-paid health care costs deductions and various provisions from the 78th (2015) legislative session for other deductions and credits. |

Guide to Writing Nevada Modified Tax Return

Filing the Nevada Modified Tax Return form requires precision and attention to detail. This form is used by businesses in Nevada to report and calculate the Modified Business Tax based on wages paid. Ensuring accurate data entry is imperative to comply with state tax regulations and to potentially avoid penalties and interest for late or incorrect submissions. Below are the steps that guide you through filling out the form.

- Start with the Period Ending and Due By dates at the top of the form to ensure you're filing for the correct quarter.

- Enter the Total Gross Wages (including tips) Paid This Quarter on line 1.

- For line 2a, Enter Deduction for Paid Health Insurance/Health Benefits Plan paid this calendar quarter as outlined in NRS 363B.115.

- On line 2b, Enter Deduction for Qualified Veterans Wages. Attach necessary employee verification and signed affidavit as required.

- Calculate Line 1 minus Line 2a and Line 2b for the net taxable wages on line 3.

- If applicable, Enter the Offset Carried Forward From Previous Quarter on line 4. This is relevant only if allowable healthcare costs exceeded gross wages in the previous quarter.

- Subtract the amount on line 4 from line 3 to get the result on line 5.

- Determine Net Taxable Wages on line 6. If the result on line 5 is greater than zero, enter the amount. If less, you'll carry this forward and enter it on line 18 as an offset for the next quarter.

- On line 7, Enter the Threshold of $50,000, which is the set threshold for quarterly wages before tax is applied.

- Calculate Taxable Wages on line 8 by subtracting the threshold from your net taxable wages.

- On line 9, Calculate the Tax due by multiplying line 8 by 0.01475, the tax rate.

- For line 10, Enter the Commerce Tax Credit, if applicable, up to 50% of the Commerce Tax paid in the prior tax year.

- Enter Other Credits on line 11 for any overpayments or approved credits from prior periods. Attach any relevant credit notice from the Department of Taxation.

- Calculate the Net Tax Due on line 12 by subtracting the amounts on line 10 and line 11 from line 9.

- For lines 13 and 14, calculate the Penalty and Interest due if applicable, based on the instructions provided.

- Enter any Previous Debits from outstanding liabilities on line 15.

- Sum up the total amount due on line 16 by adding lines 12 through 15.

- Specify the Amount Paid with the return on line 17.

- If applicable, calculate and enter the Carry Forward amount on line 18.

- Complete the form by signing and dating at the bottom, making sure to include your phone number and title.

Be sure to review the form thoroughly for accuracy before submission. Submit the completed form by mail to the Nevada Department of Taxation or via email as specified on the form. Keeping a copy for your records is highly recommended for future reference or in case the Department requests additional information.

Understanding Nevada Modified Tax Return

FAQ on the Nevada Modified Tax Return Form

-

Who needs to file the Nevada Modified Business Tax Return?

This form must be filed by any employer who is subject to the Nevada Unemployment Compensation Law, with exceptions for non-profit organizations under 501(c), Indian tribes, and political subdivisions. Essentially, if you run a general business that pays wages, you likely need to file this return.

-

What wages are considered taxable for the purpose of this form?

Taxable wages include the total gross wages paid within the calendar quarter, which covers all earning types, including tips. However, taxable wages can be reduced by subtracting specific allowed deductions such as employer-paid health care costs and qualified veterans’ wages. If the net taxable wages after deductions are less than zero, they can be carried forward to offset future liabilities but are not considered taxable for the current period.

-

How is the tax calculated on the Nevada Modified Business Tax Return?

Tax calculation starts by determining the taxable wages, which is the gross wages after allowed deductions and adjustments. For any amount over the $50,000 threshold per quarter, tax is calculated at a rate of 0.01475. Remember, the Commerce Tax Credit and other approved credits can further reduce the net tax due.

-

What happens if the tax return is filed or paid late?

If the return is not submitted and paid by the due date, penalties and interest will apply. The penalty is calculated based on the number of days late, with the percentage increasing the longer the payment is delayed, up to a maximum of 10%. Interest is then added, calculated at a rate of 0.75% per month on the unpaid tax. It's important to submit and pay on time to avoid these additional costs.

Common mistakes

People often make several common mistakes when filling out the Nevada Modified Tax Return form. Recognizing and avoiding these mistakes can ensure the process is smoother and may help avoid unnecessary delays or penalties.

- Incorrect Gross Wages: A frequent oversight is not accurately reporting the total gross wages, including tips, paid during the quarter. This figure is crucial as it impacts the calculation of taxable wages and subsequently, the tax owed.

- Misunderstanding Deductions: Deductions for employer-paid health insurance and qualified veterans' wages can lower the taxable income, but they must be correctly calculated and entered in sections 2a and 2b, respectively. Failing to attach the required documentation or incorrectly calculating these amounts can lead to errors in the net taxable wages.

- Carry Forward Errors: The amount carried forward from previous quarters can help reduce the current quarter's taxable wage base, but it's only applicable under certain conditions, specifically with allowances for health care costs exceeding gross wages. Misapplying this offset or carrying forward incorrect amounts results in inaccurate taxable wage calculations.

- Threshold Misapplication: Every taxpayer must apply the $50,000 threshold correctly before calculating taxable wages. Neglecting to subtract this threshold from Line 5, or incorrectly calculating the taxable wages as a result, will lead to an incorrect tax calculation.

- Commerce Tax Credit Misuse: Taxpayers who are eligible for the Commerce Tax credit can reduce their Modified Business Tax owed by up to 50% of the Commerce Tax paid in the prior tax year. However, the credit is often either not utilized properly or miscalculated. Furthermore, if the credit amount is larger than the MBT tax owed, the excess may be carried forward but must not exceed the fourth quarter following the end of the Commerce Tax year for which the Commerce Tax was paid.

Ensuring accuracy in these areas not only facilitates compliance with Nevada tax regulations but also optimizes the tax benefits available to businesses.

Documents used along the form

When filing a Nevada Modified Business Tax Return, businesses are often required to accompany this form with various other forms and documents to ensure compliance with state tax regulations and to streamline the tax preparation process. Understanding these additional documents can help businesses accurately complete their tax returns while maximizing deductions, credits, and accurately reporting their liabilities.

- NUCS 4072: This form, required by the Nevada Employment Security Division, reports wages and tax contributions for unemployment insurance. Although it does not accompany the tax return, it should be readily available if requested by the Department of Taxation.

- Commerce Tax Return: Businesses must submit this return if their gross revenue exceeds the threshold set by the state. A credit from the Commerce Tax paid can be applied to the Modified Business Tax, and documentation of the Commerce Tax paid is necessary to claim this credit.

- Evidence of Paid Health Insurance: If claiming deductions for employer-paid health insurance, documentation such as insurance statements or invoices must be kept on file. These documents support the deductions entered on the Modified Business Tax Return.

- Veteran Wages Deduction Documentation: For employers claiming deductions for hiring qualified veterans, documentation verifying the veteran's employment status and eligibility is required. This may include copies of the veteran's discharge papers and an affidavit confirming the veteran meets the conditions set forth by the state legislation.

- College Savings Plan Contributions Form: If taking advantage of credits for contributions to Nevada's college savings plans, contributors must complete and attach the relevant form. This document is necessary for the Department of Taxation to verify the claim and apply the appropriate credit to the Modified Business Tax.

In summary, while the Nevada Modified Business Tax Return is a critical document for businesses operating within the state, it often doesn't stand alone in the tax filing process. The inclusion and accurate completion of supplementary forms and documents play a vital role in ensuring businesses meet their tax obligations efficiently. Keeping these documents organized and accessible not only facilitates a smoother filing process but also prepares businesses for potential audits or inquiries from the Nevada Department of Taxation.

Similar forms

The Federal Tax Return form shares similarities with the Nevada Modified Business Tax Return form, primarily in how they both calculate taxes owed based on specific financial inputs. The Federal Tax Return requires reporting of income, deductions, and applicable credits to arrive at the net tax due, similar to how the Nevada form calculates tax based on gross wages, deductions for health benefits, and credits like the Commerce Tax Credit.

The State Unemployment Tax Act (SUTA) filings are akin to the Nevada Modified Business Tax Return in that they both deal with employment-related taxes. SUTA requires employers to report wages paid to employees, mirroring the Nevada form’s requirement to report gross wages including tips. Both forms can lead to tax liabilities based on the wages paid by the business to its employees.

Quarterly Federal Excise Tax Return forms resemble the Nevada Modified Business Tax Return because they both are periodic filings that address the tax responsibilities of businesses within a specific timeframe. While the Federal Excise Tax focuses on the sale of specific goods and services, the Nevada form targets the overall gross wages paid by businesses, both aiming to collect taxes for government funding.

Sales and Use Tax Returns have similarities with the Nevada Modified Business Tax Return as each involves the reporting of gross proceeds and the applicable deductions or exemptions. However, while Sales and Use Tax Returns focus on sales transactions within a state, the Nevada Modified Tax Return centers on employment wages and benefits.

The Business License Renewal forms that many states require annually parallel the Nevada Modified Business Tax Return in the context of operational compliance. Both types of documents ensure businesses are up-to-date with their financial obligations to the state, whether in the form of a license fee or calculated taxes based on wages paid.

Worker’s Compensation Insurance forms also share common ground with the Nevada Modified Business Tax Return because they both deal with employee welfare and associated costs. Worker’s Compensation forms calculate premiums based upon payroll and job classifications, similar to how the Nevada tax form computes tax liabilities considering gross wages and deductions for health insurance and veteran wages.

The 1099 Forms required by the IRS for reporting payments made to independent contractors are somewhat similar to the Nevada Modified Business Tax Return in terms of reporting payments. While 1099s focus on non-employee compensation, the Nevada form reports employee wages, both fulfilling tax reporting obligations.

Finally, the W-2 Form process echoes elements of the Nevada Modified Business Tax Return due to its focus on reporting wages and taxes withheld from employees’ paychecks. Both forms are crucial for tax compliance, ensuring accurate reporting of compensation and the appropriate taxes that have been deducted or calculated.

Dos and Don'ts

When filling out the Nevada Modified Tax Return form, it's important to get things right from the start to avoid penalties, interest, or errors that could delay processing. Here are some dos and don'ts to consider:

- Do ensure you have all the necessary information before starting, including total gross wages and details of any deductions such as health insurance costs and qualified veterans' wages.

- Do carefully read the instructions for each line to make sure you understand what is required. This will help in accurately completing the form.

- Do use a calculator to double-check your math, especially for calculations like the net tax due and any deductions or credits you're claiming.

- Do take advantage of the Commerce Tax Credit if applicable to your business, making sure to enter only 50% of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed.

- Don't forget to sign and date the form. An unsigned return is considered incomplete and will not be processed.

- Don't miss the deadline for submitting your return. Late submissions can result in penalties and interest charges.

- Don't overlook the need to attach any required documentation, such as employee verification for qualified veterans' wages or credit notices for other approved credits.

- Don't enter more than the maximum allowable amounts for penalties and interests. Ensure you follow the guidelines provided in the instructions when calculating these figures.

By following these do's and don'ts, you'll be better prepared to fill out the Nevada Modified Tax Return form accurately and efficiently, ensuring compliance with state tax laws and minimizing the risk of errors.

Misconceptions

There are several misconceptions regarding the Nevada Modified Business Tax Return form that can lead to confusion for businesses trying to navigate their tax obligations. Below are seven common misunderstandings and clarifications to help ensure compliance and accurate filing.

- Misconception 1: All businesses must file a Nevada Modified Business Tax Return.

This is not accurate. Only employers subject to the Nevada Unemployment Compensation Law, excluding specific exempt entities like non-profit 501(c) organizations, Indian tribes, and political subdivisions, are required to file.

- Misconception 2: Gross wages do not include tips.

Actually, total gross wages reported on the form must include all compensation paid to employees during the quarter, including reported tips.

- Misconception 3: Health benefits and veterans' wages deductions directly reduce the tax owed.

The deductions for employer-paid health care costs and qualified veterans' wages reduce the taxable wage base, not the tax owed directly. This, in effect, can lower the overall tax liability by reducing the amount of wages subject to tax.

- Misconception 4: The threshold for taxable wages is universally set and unchanging.

The $50,000 threshold mentioned on the form is specifically set by legislation and reflects the wages over which tax is calculated quarterly. It's crucial to stay updated as legislative changes could adjust this threshold.

- Misconception 5: Any overpayment can be deducted in the next tax period.

While overpayments can lead to credits, only those approved and notified by the Department of Taxation can be deducted in subsequent filings. Businesses should not automatically deduct overpayments without Departmental confirmation.

- Misconception 6: The Commerce Tax Credit is limited to the amount of Modified Business Tax owed.

The Commerce Tax Credit can indeed be applied up to 50% of the Commerce Tax paid in the prior tax year against the Modified Business Tax owed. However, if this credit exceeds the MBT liability, the excess may be carried forward to offset future liabilities, within the specified carryforward period.

- Misconception 7: Penalties are a flat rate, not dependent on the amount of days late.

Penalties for late payment are calculated based on the number of days the payment is overdue, progressively increasing the longer the delay. Understanding this can help businesses anticipate potential costs associated with late payments.

Understanding these nuances is crucial for businesses to meet their tax obligations accurately and efficiently. Misunderstandings can lead to unintended noncompliance or overpayment of taxes. When filing the Nevada Modified Business Tax Return, attention to detail and awareness of the specific requirements will help ensure that businesses comply with Nevada's tax statutes correctly.

Key takeaways

Filling out the Nevada Modified Tax Return form accurately is vital for businesses in complying with state tax obligations. Here are some key takeaways to help guide the process:

- The form is specifically designed for general businesses to report and calculate their Modified Business Tax (MBT) on a quarterly basis.

- Gross wages, including tips paid within the quarter, should be reported in total on Line 1 of the form.

- Employers can deduct health insurance/benefits paid (Line 2a) and qualified veterans' wages (Line 2b) from the gross wages to calculate the net taxable wages.

- An offset carried forward from a previous quarter (Line 4) can reduce the wage base, which in turn may affect the calculation of taxable wages. This offset is particularly relevant when health care costs exceed gross wages in a previous period.

- The form includes a threshold of $50,000 (Line 7), established to calculate taxable wages over this amount for tax purposes.

- Tax is computed by applying a fixed rate of 0.01475 to the taxable wages as derived after considering the threshold and any offsets (Line 9).

- Businesses can utilize a Commerce Tax Credit (Line 10), which allows for 50% of the Commerce Tax paid in the prior tax year to be credited against the MBT owed.

- Any other credits, such as overpayments or credits approved by the Department of Taxation, must be documented and validated (Line 11).

- Penalties and interest are applicable for late submissions or payments, with the amounts calculated based on specific guidelines detailed in the form's instructions (Lines 13 and 14).

- For businesses with no tax due, a return must still be filed to comply with state regulations. This may involve carrying forward a negative taxable wage figure to the next quarter (Line 18).

- Always sign and date the return to certify its accuracy and completeness.

- Stay informed on tax issues by checking the Nevada Department of Taxation website periodically for updates and Tax Notes articles.

By understanding these essentials, businesses can navigate the complexities of the Nevada Modified Tax Return form more effectively, ensuring compliance and optimizing potential deductions and credits.

Popular PDF Documents

8814 Instructions - It is crucial for parents to assess whether the standard deduction for dependents covers their child's income before using form 8814.

IRS 8949 - Form 8949 allows for the differentiation of covered and non-covered securities, which helps in determining the responsibility for reporting cost basis information.

Tax POA 774 - This form allows taxpayers to appoint a representative to interact with tax authorities, making tax-related processes more manageable.