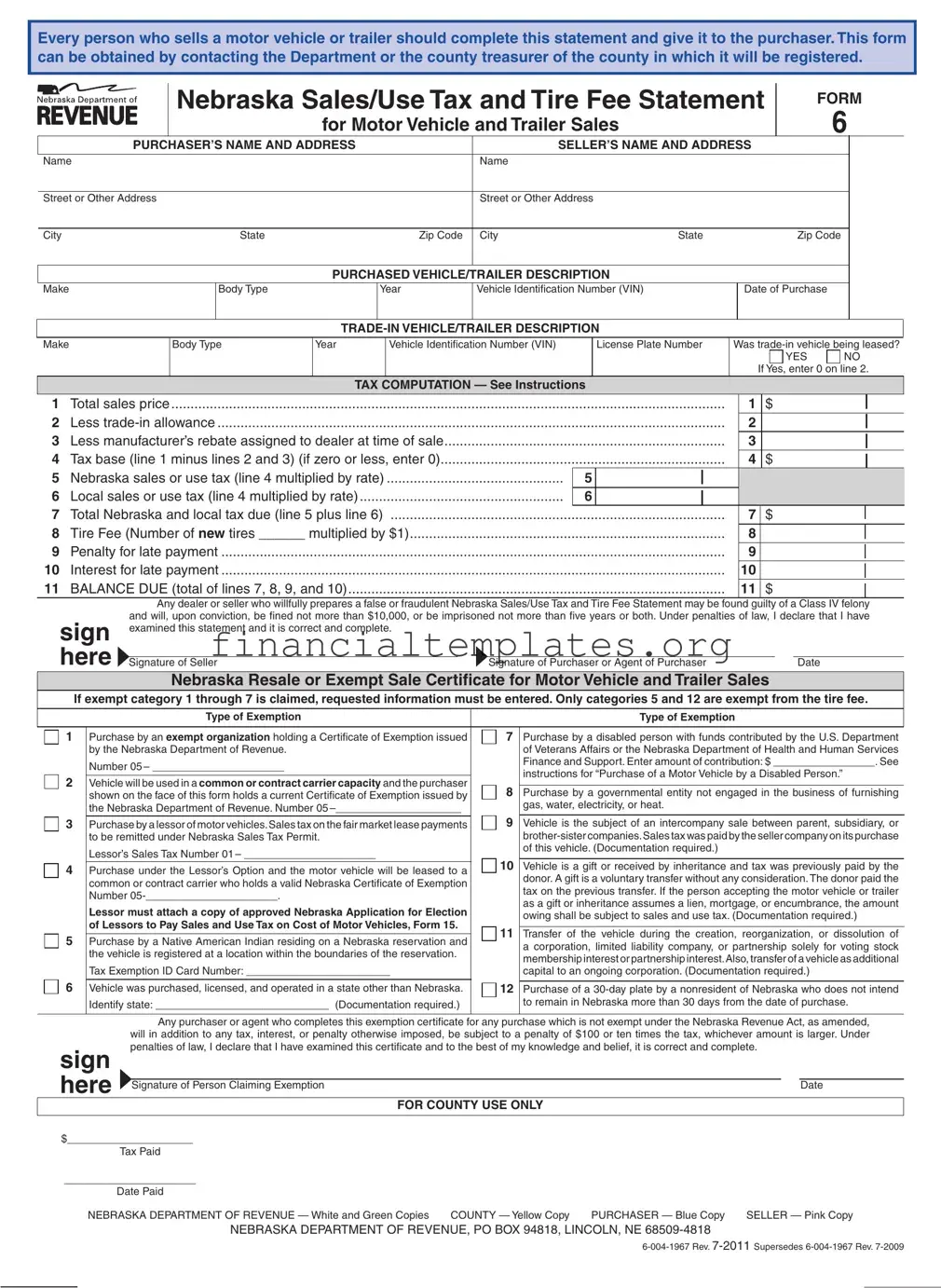

Get Nebraska Sales Tax Statement Form

The Nebraska Sales Tax Statement Form, essential for the sale of motor vehicles or trailers in the state, encapsulates a systematic procedure to ensure tax compliance and legality in private vehicle transactions. This pivotal document aids both the buyer and the seller in documenting the sale, computing applicable taxes, and fulfilling state requirements related to sales/use tax and tire fees. Accessible through the Department of Motor Vehicles (DMV) or the county treasurer of the respective county where the vehicle will be registered, the form signifies a crucial step in vehicle ownership transfer. It methodically outlines the details of the transaction, including the seller’s and purchaser’s information, vehicle description, tax calculation, trade-in considerations, and exemptions, illustrating a comprehensive guide to legally navigate the sale process. Noteworthy is the form’s emphasis on accuracy and honesty, as wilful preparation of a false or fraudulent statement could lead to severe penalties, underlining its significance in upholding the integrity of vehicle sales transactions in Nebraska.

Nebraska Sales Tax Statement Example

Every person who sells a motor vehicle or trailer should complete this statement and give it to the purchaser. This form can be obtained by contacting the Department or the county treasurer of the county in which it will be registered.

Nebraska Sales/Use Tax and Tire Fee Statement

for Motor Vehicle and Trailer Sales

FORM

6

PURCHASER’S NAME AND ADDRESS |

|

SELLER’S NAME AND ADDRESS |

|

|

||

Name |

|

|

Name |

|

|

|

|

|

|

|

|

|

|

Street or Other Address |

|

|

Street or Other Address |

|

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

PURCHASED VEHICLE/TRAILER DESCRIPTION

Make |

Body Type |

Year |

Vehicle Identification Number (VIN) |

Date of Purchase |

|

|

|

|

|

|

|

Make

Body Type |

Year |

Vehicle Identification Number (VIN) |

License Plate Number |

Was |

|

|

|

|

|

YES |

NO |

|

|

|

|

If Yes, enter 0 on line 2. |

|

TAX COMPUTATION — See Instructions

1 |

Total sales price |

|

|

1 |

$ |

2 |

Less |

|

|

2 |

|

3 |

Less manufacturer’s rebate assigned to dealer at time of sale |

|

|

3 |

|

4 |

Tax base (line 1 minus lines 2 and 3) (if zero or less, enter 0) |

|

|

4 |

$ |

5 |

Nebraska sales or use tax (line 4 multiplied by rate) |

5 |

|

|

|

6 |

Local sales or use tax (line 4 multiplied by rate) |

6 |

|

|

|

7 |

Total Nebraska and local tax due (line 5 plus line 6) |

|

|

7 |

$ |

8 |

Tire Fee (Number of new tires ______ multiplied by $1) |

|

|

8 |

|

9 |

Penalty for late payment |

|

|

9 |

|

10 |

Interest for late payment |

|

|

10 |

|

11 |

BALANCE DUE (total of lines 7, 8, 9, and 10) |

|

|

11 |

$ |

Any dealer or seller who willfully prepares a false or fraudulent Nebraska Sales/Use Tax and Tire Fee Statement may be found guilty of a Class IV felony and will, upon conviction, be fined not more than $10,000, or be imprisoned not more than five years or both. Under penalties of law, I declare that I have

sign |

examined this statement and it is correct and complete. |

|

|

|

|

|

|

here Signature of Seller |

Signature of Purchaser or Agent of Purchaser |

Date |

|

Nebraska Resale or Exempt Sale Certificate for Motor Vehicle and Trailer Sales

If exempt category 1 through 7 is claimed, requested information must be entered. Only categories 5 and 12 are exempt from the tire fee.

|

|

|

|

|

|

Type of Exemption |

|

|

|

|

|

|

Type of Exemption |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

1 |

Purchase by an exempt organization holding a Certificate of Exemption issued |

7 |

Purchase by a disabled person with funds contributed by the U.S. Department |

|||||||||||

|

|

|

|

by the Nebraska Department of Revenue. |

|

|

|

|

|

of Veterans Affairs or the Nebraska Department of Health and Human Services |

|||||||

|

|

|

|

Number 05 – ______________________ |

|

|

|

|

|

Finance and Support. Enter amount of contribution: $ _________________. See |

|||||||

|

|

|

|

|

|

|

|

|

instructions for “Purchase of a Motor Vehicle by a Disabled Person.” |

||||||||

2 |

|

|

|

|

|

|

|

|

|||||||||

Vehicle will be used in a common or contract carrier capacity and the purchaser |

8 |

||||||||||||||||

|

|

|

|

|

|||||||||||||

Purchase by a governmental entity not engaged in the business of furnishing |

|||||||||||||||||

|

|

|

|

shown on the face of this form holds a current Certificate of Exemption issued by |

|||||||||||||

|

|

|

|

|

|

|

|

gas, water, electricity, or heat. |

|

|

|

||||||

|

|

|

|

the Nebraska Department of Revenue. Number 05 |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

3 |

Purchase by a lessor of motor vehicles. Sales tax on the fair market lease payments |

9 |

Vehicle is the subject of an intercompany sale between parent, subsidiary, or |

||||||||||||||

|

|

|

|

to be remitted under Nebraska Sales Tax Permit. |

|

|

|

|

|

||||||||

|

|

|

|

Lessor’s Sales Tax Number 01 – ______________________ |

|

|

|

|

|

of this vehicle. (Documentation required.) |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

4 |

|

|

|

|

|

10 |

Vehicle is a gift or received by inheritance and tax was previously paid by the |

||||||||||

Purchase under the Lessor’s Option and the motor vehicle will be leased to a |

|

||||||||||||||||

|

|

|

|

donor. A gift is a voluntary transfer without any consideration. The donor paid the |

|||||||||||||

|

|

|

|

common or contract carrier who holds a valid Nebraska Certificate of Exemption |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

tax on the previous transfer. If the person accepting the motor vehicle or trailer |

|||||||||

|

|

|

|

Number |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

as a gift or inheritance assumes a lien, mortgage, or encumbrance, the amount |

||||||||

|

|

|

|

Lessor must attach a copy of approved Nebraska Application for Election |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

owing shall be subject to sales and use tax. (Documentation required.) |

|||||||||

|

|

|

|

of Lessors to Pay Sales and Use Tax on Cost of Motor Vehicles, Form 15. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|||||

|

|

|

5 |

|

|

|

|

|

|

Transfer of |

the vehicle during the creation, |

reorganization, or dissolution of |

|||||

|

|

|

Purchase by a Native American Indian residing on a Nebraska reservation and |

||||||||||||||

|

|

|

|

|

|

|

a corporation, limited liability company, or partnership solely for voting stock |

||||||||||

|

|

|

|

the vehicle is registered at a location within the boundaries of the reservation. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

membership interest or partnership interest.Also, transfer of a vehicle as additional |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

Tax Exemption ID Card Number: ________________________ |

|

|

|

|

|

capital to an ongoing corporation. (Documentation required.) |

|||||||

|

|

|

6 |

Vehicle was purchased, licensed, and operated in a state other than Nebraska. |

12 |

Purchase of a |

|||||||||||

|

|

|

|

Identify state: _____________________________ (Documentation required.) |

|

|

|

|

to remain in Nebraska more than 30 days from the date of purchase. |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

Any purchaser or agent who completes this exemption certificate for any purchase which is not exempt under the Nebraska Revenue Act, as amended, |

|||||||||||

|

|

|

|

|

|

will in addition to any tax, interest, or penalty otherwise imposed, be subject to a penalty of $100 or ten times the tax, whichever amount is larger. Under |

|||||||||||

|

|

|

sign |

|

penalties of law, I declare that I have examined this certificate and to the best of my knowledge and belief, it is correct and complete. |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

here |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Signature of Person Claiming Exemption |

|

|

|

|

|

|

|

|

|

Date |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

FOR COUNTY USE ONLY |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

$_____________________ |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

Tax Paid |

|

|

|

|

|

|

|

|

|

|

||

______________________ |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

Date Paid |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

NEBRASKA DEPARTMENT OF REVENUE — White and Green Copies |

COUNTY — Yellow Copy |

PURCHASER — Blue Copy |

SELLER — Pink Copy |

||||||||||

NEBRASKA DEPARTMENT OF REVENUE, PO BOX 94818, LINCOLN, NE

INSTRUCTIONS FOR PURCHASER

PAYMENT OF TAX AND TIRE FEE. The purchaser of a motor vehicle or trailer must present the white, yellow, and blue copies of this statement to the county treasurer, the Department of Motor Vehicles (DMV), or other designated county oficial within 30 days from the date of purchase, and pay the Nebraska and local sales and use tax, and the tire fee. The date of purchase is the earlier of two dates: the date on the motor vehicle title; or the date of possession, as evidenced by the Nebraska Sales/Use Tax and Tire Fee Statement, Form 6. The purchaser should retain their copy of this statement for a period of at least ive years.

PENALTY AND INTEREST. If the total taxes and tire fee are not paid within 30 days of the purchase date, the county treasurer, DMV, or designated county oficial will assess and collect penalty and interest at the statutory rate. If you have any questions regarding the due date, or penalty and interest rates, please contact your local county treasurer’s ofice or call the Nebraska Department of Revenue (Department),

SALES TAX PAID TO ANOTHER STATE. A motor vehicle purchased in another state, with sales tax properly paid to the other state, but registered for the irst time in Nebraska, is subject to sales or use tax at the time of registration. If the state the vehicle was purchased in has reciprocity with Nebraska, the total sales tax paid in that state will be credited toward the total state and local sales tax due in Nebraska. No refund will be made if the other state’s tax rate exceeds the total Nebraska and local option sales tax rate.

LINE 4. No refund will be made if the tax base results in a negative amount.

EXEMPTIONS. If the transfer of title to the motor vehicle or trailer described on this statement is exempt from sales and use tax, the Nebraska Resale or Exempt Sale Certiicate, located on the front of this statement, must be completed prior to registration.

The purchaser must present documentation that supports the exemption. If the documentation is not suficient, the county treasurer, DMV, or other designated county oficial is authorized to collect the tax. The purchaser may submit a claim to the Department requesting that the taxes and fees paid be refunded.

PURCHASE OF A MOTOR VEHICLE BY A DISABLED PERSON. If the amount contributed by the U.S. Department of VeteransAdministration (VA) or the Nebraska Department of Health and Human Services (DHHS) is the maximum amount allowed by law, the entire purchase price of the motor vehicle is exempt from sales tax. The entire purchase price is exempt, even if the purchase price is greater than the maximum amount contributed. If the contributed amount is less than the maximum amount allowed by law, only the amount contributed is exempt from sales tax. If there is a question as to whether the maximum amount was received, Form

MOBILITY ENHANCING EQUIPMENT. Any disabled or handicapped person who is required to use durable medical equipment or prosthetics for moving from one place to another place, may purchase mobility enhancing equipment with a motor vehicle exempt from sales tax. Please refer to the Nebraska Certiicate of Exemption for Mobility Enhancing Equipment on a Motor Vehicle, Form 13ME.

UNDERPAYMENT OF TAX. Underpayment of sales and use tax or tire fee on this statement must be reported on an Amended Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales, Form 6XN. Form 6XN is available at each county treasurer’s ofice and the Department.

INSTRUCTIONS FOR SELLER

LICENSED MOTOR VEHICLE DEALER OR LICENSED PERMIT HOLDER. A motor vehicle dealer, or sales tax permit holder, must complete this statement for every sale of a motor vehicle or trailer. The colored copies should be distributed in the following manner:

1.The pink copy must be retained with your business records;

2.The green copy must be mailed with the Nebraska and Local Sales and Use Tax Return, Form 10; and

3.The white, yellow, and blue copies must be given to the purchaser.

The sales price on line 1 shall include charges for items such as destination charges, import custom fees, surcharges, service and maintenance agreements, document processing charges, charges for warranty transfers, and

INDIVIDUAL WITHOUT A SALESTAX PERMIT. An individual, who is not licensed to collect sales tax, must complete this statement

for every sale of a motor vehicle or trailer. The colored copies should be distributed in the following manner:

1.The pink copy must be retained with your records; and

2.The white, yellow, and blue copies must be given to the purchaser.

An individual can only accept another motor vehicle or trailer as a

LEASED VEHICLES. A lessee cannot use the

TIRE FEE. Motor vehicle dealers selling new motor vehicles, trailers, or

the number of new tires on a

Individuals selling used motor vehicles are not required to indicate the number of tires.

INSTRUCTIONS FOR COUNTY TREASURERS, DMV,

AND OTHER DESIGNATED COUNTY OFFICIALS

COLLECTION OF TAX AND TIRE FEE. The county treasurer,

DMV, or other designated county oficial must collect the state and applicable local sales and use tax, and the tire fee, prior to registering the motor vehicle or trailer.

The white, yellow, and blue copies of this statement must be receipted in the space provided for validation. The blue copy must be returned to the purchaser. The yellow copy must be retained in your iles, and the white copy must be submitted with your monthly returns.

COLLECTION OF PENALTY AND INTEREST. If the appropriate taxes and fees are not paid within 30 days of the purchase date, penalty and interest must be collected at the statutory rate from the due date through the date of payment. If the due date falls on a Saturday, Sunday, or a holiday, the purchaser may still pay the amount due on the next business day without incurring penalty and interest.

NEBRASKA DEPARTMENT OF REVENUE, PO BOX 94818, LINCOLN, NE

Document Specifics

| Fact Name | Description |

|---|---|

| Form Utilization | The form is used by sellers of motor vehicles or trailers in Nebraska to declare sales/use tax and tire fees. |

| Form Availability | It can be obtained from the Nebraska Department of Revenue or the county treasurer's office. |

| Form Identification | Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales, formally known as FORM 6. |

| Purchaser and Seller Information | The form requires basic information from both the purchaser and seller, including names and addresses. |

| Vehicle Details | Details such as make, body type, year, and VIN of the purchased and trade-in vehicle (if any) must be provided. |

| Tax Computation | The form includes a section for calculating the tax base, Nebraska and local sales/use tax, and total tax due, including tire fee. |

| Legal Implications | Willful preparation of a false statement may result in Class IV felony charges, with potential fines or imprisonment. |

| Exemptions | Lists specific conditions under which the sale may be exempt from taxes and the tire fee, e.g., disabled person purchases with certain funds. |

Guide to Writing Nebraska Sales Tax Statement

When purchasing a motor vehicle or trailer in Nebraska, it's required to complete and submit the Nebraska Sales/Use Tax and Tire Fee Statement. This procedure is not only crucial for the legal transfer of the vehicle but also for ensuring that the appropriate taxes and fees are accounted for in the state’s records. By following these instructions carefully, both the seller and the purchaser can ensure compliance with Nebraska tax laws and avoid potential legal issues or penalties.

- Obtain the form either from the Nebraska Department of Revenue or the county treasurer of the county where the vehicle will be registered.

- Start by entering the purchaser’s name and address in the designated area. Include the name, street address, city, state, and zip code.

- Fill in the seller’s name and address section with similar details—name, street address, city, state, and zip code.

- In the purchased vehicle/trailer description area, specify the make, body type, year, Vehicle Identification Number (VIN), and the date of purchase of the vehicle being sold.

- For a vehicle that's being traded in, provide its description including make, body type, year, VIN, and license plate number. Answer whether the trade-in vehicle was being leased by marking "YES" or "NO". If "YES", enter 0 on line 2 of the tax computation section.

- Under tax computation, calculate and enter the total sales price in line 1, subtract any trade-in allowance in line 2, and any manufacturer's rebate in line 3. Determine the tax base on line 4 by subtracting the values of lines 2 and 3 from line 1.

- Compute the Nebraska sales or use tax on line 5 and any local sales or use tax on line 6 by applying the appropriate rates to the tax base. Add these figures to get the total Nebraska and local tax due on line 7.

- For the tire fee, count all new tires (including the spare) and multiply by $1 to fill in line 8.

- Fill in the penalty for late payment on line 9 and interest for late payment on line 10, if applicable.

- Calculate the balance due by adding lines 7, 8, 9, and 10. Enter this amount on line 11.

- The seller and purchaser (or their agent) must sign and date the form at the bottom, indicating that the information provided is accurate and complete.

- If the vehicle purchase qualifies for an exemption, complete the Nebraska Resale or Exempt Sale Certificate section by providing the appropriate type of exemption and any requested details.

- Finally, distribute the copies of the completed form as indicated: the seller retains the pink copy; submit the green copy with tax returns to the state; and give the white, yellow, and blue copies to the purchaser for presenting to the county treasurer, DMV, or designated county official.

Remember, providing accurate and truthful information on this form is critical. Misrepresentation can lead to severe penalties, including fines or imprisonment. Should questions arise during this process, contacting the Nebraska Department of Revenue or a legal advisor familiar with state tax laws is advisable.

Understanding Nebraska Sales Tax Statement

Who needs to complete the Nebraska Sales Tax Statement form?

Anyone selling a motor vehicle or trailer should complete this form and provide it to the purchaser. This ensures that the sales and use tax, as well as any tire fees related to the transaction, are properly documented and processed.

How can I obtain the Nebraska Sales Tax Statement form?

The form can be obtained by contacting either the Department of Revenue directly or the county treasurer's office in the county where the vehicle will be registered. This provides flexibility for sellers to access the form through various channels.

What information is required on the form?

The form requires detailed information about both the purchaser and the seller, including names and addresses. It also asks for a thorough description of the purchased and trade-in vehicles, such as make, body type, year, and Vehicle Identification Number (VIN). Additionally, tax computation details and any applicable exemptions must be completed on the form.

What happens if a seller prepares a false or fraudulent statement?

A seller who willfully prepares a false or fraudulent statement may be found guilty of a Class IV felony. This could result in a fine of not more than $10,000, imprisonment for not more than five years, or both. Thus, it's crucial for sellers to ensure the accuracy and completeness of the form.

Is there a penalty for late payment of taxes or tire fee?

Yes, if the total taxes and the tire fee are not paid within 30 days of the purchase date, penalty and interest at the statutory rate will be assessed and collected by the county treasurer, DMV, or designated county official. This emphasizes the importance of timely payment to avoid additional charges.

Can sales tax paid to another state be credited against Nebraska sales tax?

If a motor vehicle was purchased in another state with sales tax properly paid, and if that state has reciprocity with Nebraska, the amount of sales tax paid can be credited toward the total Nebraska and local sales tax due. It's important to note that no refund will be issued if the other state's tax rate exceeds the Nebraska rate.

How are exemptions handled?

If the transfer of title is exempt from sales and use tax, the Nebraska Resale or Exempt Sale Certificate section of the form must be completed and the proper documentation presented at the time of registration. If documentation is insufficient, tax will be collected, but the purchaser may subsequently file a claim for refund with the Department.

What should be done in the case of underpayment of tax?

Any underpayment of sales and use tax or tire fee must be reported on an Amended Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales, Form 6XN. This form is available at county treasurers’ offices and the Department, ensuring taxpayers have a means to correct any mistakes made during the initial filing.

Common mistakes

-

One common mistake involves inaccurately filling out the purchaser’s name and address. This section requires careful attention to detail as errors here can create complications in the registration and legal ownership of the vehicle.

-

Incorrectly inputting the vehicle identification number (VIN) is another frequent oversight. Given that the VIN is a unique identifier for each vehicle, any mistake in this field can lead to significant legal and registration issues.

-

Failing to properly document the trade-in vehicle's details, including its VIN and license plate number, is yet another error. This information is crucial for accurately determining the sales tax owed after accounting for the trade-in allowance.

-

Not correctly applying the tax computation process can lead to errors in the calculation of the tax base and the amount of sales or use tax owed. Understanding each line item's impact on the final tax calculation is vital.

-

Misunderstanding the eligibility for exemptions leads to mistakes on the form. Each exemption category has specific criteria, and erroneously claiming an exemption can lead to penalties or additional taxes owed.

-

Overlooking the tire fee calculation is another common error. Whether selling new or used vehicles, the accurate number of tires, including the spare, must be documented correctly to determine the tire fee.

-

Finally, a significant mistake is not signing the statement or incorrectly completing the certification section. The integrity of the information provided on the form is affirmed by the signatures, making them a crucial part of the process.

In conclusion, when filling out the Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales, attention to detail in every section is critical. Mistakes can lead to penalties, delayed registrations, or other legal complications. Understanding each part of the form and seeking clarification when needed ensures compliance with the state's tax laws.

Documents used along the form

When handling vehicle sales and the associated paperwork in Nebraska, it's important to be familiar with not only the Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales (Form 6), but also other documents that are often used in conjunction. These documents ensure that all the necessary information and fees are correctly processed, providing a smooth transaction process for both the buyer and the seller.

- Title Application: This form is necessary for the legal transfer of a vehicle's ownership. The application contains details about the buyer, seller, and the vehicle itself, ensuring the new owner is recorded in the state’s database.

- Odometer Disclosure Statement: Federally required for most vehicle sales, this document records the vehicle’s mileage at the time of sale. It is crucial for informing the buyer about the vehicle's condition and for preventing odometer fraud.

- Bill of Sale: Although not always legally required, a bill of sale acts as a receipt for the transaction. It includes information about the buyer, seller, and the vehicle, along with the sale price. It can be essential for tax purposes or to resolve any future disputes.

- Nebraska Resale or Exempt Sale Certificate for Motor Vehicle and Trailer Sales: This form is used when the vehicle being sold is exempt from sales tax. The seller needs to complete this certificate, detailing the nature of the exemption.

- Loan Agreement or Promissory Note: If the vehicle is being purchased with financing or through a private loan, a formal agreement outlining the terms of repayment, the interest rate, and any collateral (often the vehicle itself) is necessary. This document protects both the lender and the borrower’s interests.

Completing the sale and registration of a vehicle involves careful attention to detail and making sure all required documents are in order. The additional documents listed above, when used alongside the Nebraska Sales Tax Statement form, help ensure compliance with legal requirements and facilitate a transparent and fair vehicle transaction.

Similar forms

The Federal Tax Return forms, such as the IRS Form 1040 used for individual income tax filings, share similarities with the Nebraska Sales Tax Statement form. Both documents are designed to calculate and report taxes due to government agencies, with sections dedicated to personal information, financial details, and specific computations related to tax obligations. They require the taxpayer's signature, attesting to the accuracy and completeness of the information provided, under penalties of law. However, while the Federal Tax Return forms cover a broad spectrum of income sources, deductions, and credits applicable at a national level, the Nebraska Sales Tax Statement form specifically addresses the sales and use tax liability, and the tire fee for motor vehicle and trailer transactions within the state of Nebraska.

The Vehicle Registration Application forms, found in Departments of Motor Vehicles (DMVs) across various states, also parallel the Nebraska Sales Tax Statement form in purpose and content. These forms gather particulars about the vehicle and its owner for registration and legal operation purposes, similar to how the Nebraska form collects details about the vehicle sale for tax calculation. Both set of documents are integral to legal compliance in vehicle transactions—albeit focusing on different aspects, with one concentrating on tax collection and the other on registration and lawful use on public roads. Furthermore, each necessitates documentation attesting to the truthfulness and accuracy of the information provided, under penalty of perjury or similar legal repercussions.

Business License Application forms, required for the legal operation of businesses within various jurisdictions, bear resemblance to the Nebraska Sales Tax Statement form in their function of facilitating compliance with local regulations. These forms ensure that businesses remit the appropriate taxes and fees relevant to their operation, comparable to how the Nebraska form ensures motor vehicle and trailer sales are taxed correctly. Though the Business License Applications cater to a broader range of activities and are more varied in terms of the specifics, depending on the nature of the business and local law, both types of documents play crucial roles in maintaining the tax revenue systems that support public and governmental services.

The Property Tax Declaration forms, used by property owners to report the value of their real estate and personal property for tax purposes, share a foundational objective with the Nebraska Sales Tax Statement form, in that they both are tools for calculating tax liabilities owed to a government entity. While Property Tax Declarations typically encompass annual declarations on a wide range of owned assets to determine property taxes, the Nebraska Sales Tax Statement form is transactional, focusing on the specific event of selling a motor vehicle or trailer. Nonetheless, both demand detailed descriptions of the taxable item or property, an assessment of value or price, and applicable deductions or exemptions, ensuring accurate tax computation and compliance with the law.

Dos and Don'ts

Filling out the Nebraska Sales Tax Statement form correctly is crucial to ensure compliance with state tax laws when selling a motor vehicle or trailer. Here's a guide on what sellers and purchasers should and shouldn't do:

Do's

Ensure you have the most current form by contacting the Nebraska Department of Revenue or the county treasurer.

Accurately complete all sections, including the seller’s and purchaser’s name and address, vehicle description, and tax computation.

Include all necessary details about the purchased and trade-in vehicle or trailer, such as make, year, body type, and Vehicle Identification Number (VIN).

Calculate the taxes owed accurately, making sure to subtract any trade-in allowances, rebates, or other deductions properly.

Sign and date the form as the seller, indicating that the information provided is accurate and complete.

Don'ts

Don’t overlook the requirement to register and pay the tax on a buy-out amount before using a previously-leased vehicle as a trade-in.

Don’t leave any fields blank. If certain sections or calculations result in a zero, enter “0” instead of leaving it empty.

Don’t guess on tax rates or exemptions. Refer to the instructions or contact the Nebraska Department of Revenue for clarification.

Don’t forget to distribute the colored copies of the form as directed: keep the pink copy for your records, give the white, yellow, and blue copies to the purchaser, and the green copy should accompany your tax return if you are a dealer.

Don’t forge or alter information on the form. The act of willfully preparing a false or fraudulent statement may result in severe penalties, including being found guilty of a Class IV felony.

Adhering to these guidelines will help ensure that the sales tax statement process is completed correctly and smoothly, and will aid in avoiding any legal or financial penalties.

Misconceptions

Misunderstandings about the Nebraska Sales Tax Statement form can lead to mistakes and potential penalties. Here's a breakdown of common misconceptions:

- The form is only for dealers. Incorrect—both licensed dealers and private sellers need to complete the form for the sale of a motor vehicle or trailer.

- Trade-ins can't reduce taxable sales price. Not true. A trade-in vehicle can indeed lower the total sales price, impacting the taxable amount.

- Sales tax is the only tax computed on the form. Misleading, as both Nebraska sales or use tax and local sales or use tax, along with a tire fee and any penalties for late payment, are calculated.

- The form isn't necessary for exempt sales. False. Even for exempt transactions, the form must be used to document the exemption, such as sales to exempt organizations or for vehicles transferred as a gift or inheritance.

- Tire fees are optional. Incorrect. Dealers are required to indicate and collect a tire fee for every new tire, including spares, on new and used vehicles sold.

- Filling out the form exempts you from further taxation. Not accurate. If the total taxes and tire fee are not paid within 30 days, penalty and interest may be assessed.

- Only physical copies are accepted. While the form is often distributed in color-coded physical copies for various uses, contacting the Department or county treasurer for the form might also lead to digital submission alternatives, though less common.

- The form doesn't apply to vehicle trades. False. The form must be completed even if a vehicle or trailer is traded, not sold outright.

- The seller's declaration of accuracy exempts them from legal consequences. Wrong. Sellers must be careful; knowingly providing false information can result in significant fines or even imprisonment.

Understanding the requirements and uses of the Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales can save both sellers and buyers from unnecessary headaches and financial penalties.

Key takeaways

When dealing with the Nebraska Sales Tax Statement form for motor vehicle and trailer sales, there are several critical takeaways to keep in mind to ensure compliance and accuracy in reporting:

- The form is required for every person selling a motor vehicle or trailer, and must be completed and handed over to the purchaser.

- Forms can be acquired either through the Department of Revenue or the county treasurer of the county where the vehicle will be registered.

- A key part of the form includes providing details about both the seller and purchaser, including names and addresses, along with comprehensive information about the vehicle sold, such as make, body type, year, and VIN (Vehicle Identification Number).

- Trade-in credits are applicable and should be indicated on the form, including details of the traded-in vehicle and whether it was being leased.

- All calculation of taxes due incorporates the total sales price, trade-in allowances, and any manufacturer’s rebates given at the time of sale, with space to document the Nebraska and local sales taxes, as well as any tire fees applicable.

- The form also acts as a declaration with potential legal implications. Incorrect or fraudulent completion can lead to serious penalties, including a Class IV felony charge for willfully false statements, attracting fines up to $10,000 or imprisonment.

- There are also provisions for claiming exemptions on the tax and tire fees due. Various categories allow for exemption, including purchases by exempt organizations, vehicles gifted or inherited where tax was previously paid, and purchases by or for disabled persons under certain conditions.

- Administration of the tax, tyre fee, penalties, and interest rates for late payments are comprehensively outlined, urging timely submission within 30 days from purchase to avoid additional charges.

This form plays a crucial role in the legal transfer and registration process of motor vehicles and trailers in Nebraska, ensuring both state and local revenues are collected correctly, while offering a structured way to account for taxes and fees due or exempted during such transactions.

Popular PDF Documents

Nevada Taxation Department - Review the necessity of attaching employee verification for veteran wage deductions on your Nevada business's tax return.

940 Taxes - Employers benefit from mindful review of Schedule A’s instructions to avoid common pitfalls in state-specific unemployment tax reporting.

What Kind of Power of Attorneys Are There - An officially stamped paper allowing an individual to engage in matters of tax on behalf of another.