Get Nebraska Sales Tax Form

Navigating through the Nebraska Sales Tax form, particularly Form 13, is a crucial step for businesses and organizations aiming to comply with state tax regulations while benefiting from exemptions. This form is designed to cater to various entities, including those making purchases for resale, those qualifying for exempt purchases, and contractors handling building materials or fixtures. It demands detailed information from both the purchaser and seller, including full names, mailing addresses, and specifics about the nature of the tax-exempt transaction. Importantly, the form allows for categorization of the exemption reason, whether for resale, exempt status based on specific criteria, or contractor-related exemptions. The document also emphasizes the importance of accuracy and honesty, highlighting penalties for misuse. Additionally, the provision for blanket certificates simplifies ongoing transactions by remaining valid until formally revoked. Through clear instructions and specific sections tailored to different exemption categories, Form 13 streamlines the process of claiming sales tax exemptions in Nebraska, ensuring businesses and exempt entities can navigate tax requirements efficiently while maintaining compliance.

Nebraska Sales Tax Example

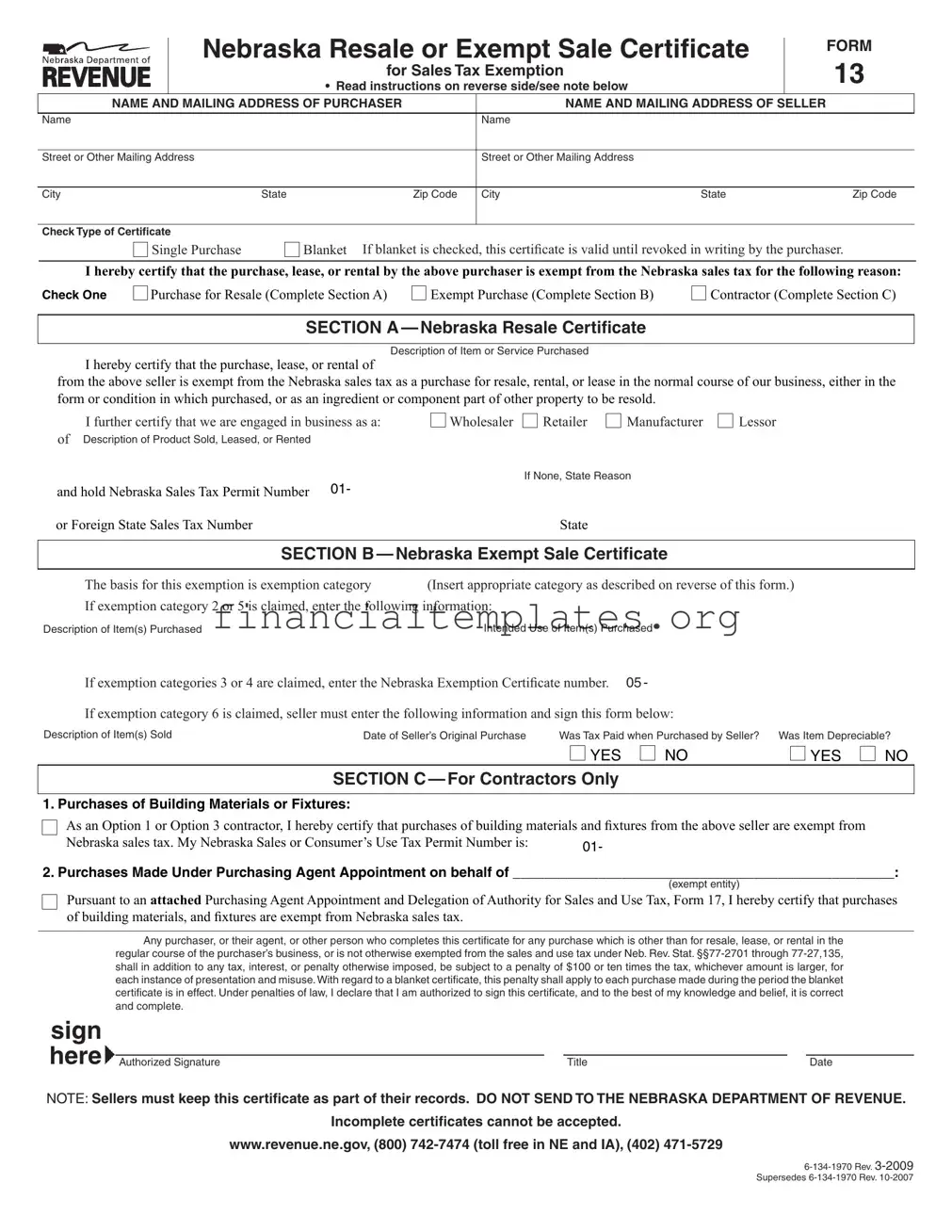

Nebraska Resale or Exempt Sale Certificate

for Sales Tax Exemption

• Readinstructionsonreverseside/seenotebelow

FORM

13

NAME AND MAILING ADDRESS OF PURCHASER |

NAME AND MAILING ADDRESS OF SELLER |

|

|

Name |

Name |

Street or Other Mailing Address

Street or Other Mailing Address

City |

State |

Zip Code |

City |

State |

Zip Code |

Check Type of Certificate

Single Purchase

Blanket If blanket is checked, this certiicate is valid until revoked in writing by the purchaser.

Blanket If blanket is checked, this certiicate is valid until revoked in writing by the purchaser.

I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the Nebraska sales tax for the following reason:

Check One |

Purchase for Resale (Complete Section A) |

Exempt Purchase (Complete Section B) |

Contractor (Complete Section C) |

SECTION A — Nebraska Resale Certificate

Description of Item or Service Purchased

I hereby certify that the purchase, lease, or rental of

from the above seller is exempt from the Nebraska sales tax as a purchase for resale, rental, or lease in the normal course of our business, either in the form or condition in which purchased, or as an ingredient or component part of other property to be resold.

I further certify that we are engaged in business as a:

of Description of Product Sold, Leased, or Rented

Wholesaler

Retailer

Manufacturer

Lessor

|

If None, State Reason |

and hold Nebraska Sales Tax Permit Number 01- |

|

or Foreign State Sales Tax Number |

State |

|

|

SECTION B — Nebraska Exempt Sale Certificate |

|

|

|

The basis for this exemption is exemption category |

(Insert appropriate category as described on reverse of this form.) |

If exemption category 2 or 5 is claimed, enter the following information:

Description of Item(s) Purchased |

Intended Use of Item(s) Purchased |

If exemption categories 3 or 4 are claimed, enter the Nebraska Exemption Certiicate number. 05 -

If exemption category 6 is claimed, seller must enter the following information and sign this form below:

Description of Item(s) Sold |

Date of Seller’s Original Purchase |

Was Tax Paid when Purchased by Seller? |

Was Item Depreciable? |

YES

YES

NO |

YES |

NO

SECTION C — For Contractors Only

1.purchasesofbuildingmaterialsorfixtures:

As an Option 1 or Option 3 contractor, I hereby certify that purchases of building materials and ixtures from the above seller are exempt from

Nebraska sales tax. My Nebraska Sales or Consumer’s Use Tax Permit Number is: |

01- |

2.purchasesmadeunderpurchasingagentappointmentonbehalfof_________________________________________________:

(exempt entity)

Pursuant to an attached Purchasing Agent Appointment and Delegation of Authority for Sales and Use Tax, Form 17, I hereby certify that purchases of building materials, and ixtures are exempt from Nebraska sales tax.

Any purchaser, or their agent, or other person who completes this certificate for any purchase which is other than for resale, lease, or rental in the regular course of the purchaser’s business, or is not otherwise exempted from the sales and use tax under Neb. Rev. Stat.

sign

here |

|

|

|

|

|

Authorized Signature |

|

Title |

|

Date |

NOTE: Sellersmustkeepthiscertiicateaspartoftheirrecords. DonotSenDtothenebRaSkaDepaRtmentofRevenue.

Incompletecertiicatescannotbeaccepted.

INSTRUCTIONS

Who maY ISSue a ReSaLe CeRtIfICate. Form 13, |

(3) a statement of basis for exemption including completion of all |

||

Section A, is to be issued by persons or organizations making |

information for the basis chosen, (4) the signature of an authorized |

||

purchases of property or taxable services in the normal course of |

person, and (5) the date the certiicate was issued. |

||

their business for the purpose of resale either in the form or condition |

penaLtIeS.Any purchaser who gives a Form 13 to a seller for |

||

in which it was purchased, or as an ingredient or component part of |

|||

any purchase which is other than for resale, lease, or rental in the |

|||

other property. |

|||

normal course of the purchaser’s business, or is not otherwise |

|||

Who maY ISSue an eXempt SaLe CeRtIfICate. |

exempted from sales and use tax under the Nebraska Revenue Act, |

||

Form 13, Section B can only be issued by persons or organizations |

shall be subject to a penalty of $100 or ten times the tax, whichever |

||

exempt from payment of the Nebraska sales tax by qualifying for |

amount is larger, for each instance of presentation and misuse. |

||

one of the six enumerated Categories of Exemption (see below). |

Any purchaser, or their agent, who fraudulently signs a Form 13 |

||

Nonprofit organizations that have a 501(c) designation and are |

may be found guilty of a Class IV misdemeanor. |

||

exempt from federal and state income tax are not automatically |

|

CATEGORIES OF EXEMPTION |

|

exempt from sales tax. Only the entities listed in the referenced |

|

||

1. Purchases made directly by certain governmental agencies |

|||

regulations are exempt from paying Nebraska sales tax on their |

|||

purchases when the exemption certiicate is properly completed and |

identiied in Nebraska Sales and Use Tax |

||

provided to the seller. Organizations claiming a sales tax exemption |

|||

may do so only on items purchased for their own use. For health care |

and |

||

organizations, the exemption is limited to the speciic level of health |

A list of speciic governmental units are provided in the above |

||

care they are licensed for. The exemption is not issued to the entire |

regulations. Governmental units are not assigned exemption |

||

organization when multiple levels of health care or other activities are |

numbers. |

|

|

provided or owned by the organization. Items purchased by an exempt |

Sales to the United States government, its agencies, and |

||

organization that will be resold must be supported by a properly |

corporations wholly owned by the United States government are |

||

completed Nebraska Resale Certiicate, Form 13, Section A. |

exempt from sales tax. However, sales to institutions chartered |

||

Indicate the category which properly relects the basis for your |

or created under federal authority, but which are not directly |

||

exemption. Place the corresponding number in the space provided |

operated and controlled by the United States government for the |

||

in Section B. If category 2 through 6 is the basis for exemption, you |

beneit of the public, generally are taxable. Construction projects |

||

must complete the information requested in Section B. |

for federal agencies have speciic requirements, see |

||

Nebraska Sales and Use Tax |

Contractors. |

||

Purchases that are not exempt from Nebraska sales and use tax |

|||

Certificate, and |

|||

include, but are not limited to, governmental units of other states, |

|||

additional information on the proper issuance and use of this |

|||

sanitary and improvement districts, urban renewal authorities, |

|||

certificate. These and other regulations referred to in these |

|||

rural water districts, railroad transportation safety districts, and |

|||

instructions are available on our Web site: www.revenue.ne.gov/ |

|||

county historical or agricultural societies. |

|||

legal/regs/slstaxregs. |

|||

2. Purchases when the intended use renders it exempt as set out |

|||

Use Form 13E for purchases of energy sources which qualify for |

|||

in paragraph 012.02D of |

|||

exemption. Use Form 13ME for purchases of mobility enhancing |

|||

the description of the item purchased and the intended use as |

|||

equipment on a motor vehicle. |

|||

required on the front of Form 13. Sellers of repair parts for |

|||

ContRaCtoRS.Form 13, Section C, Part 1, must be completed |

|||

agricultural machinery and equipment cannot accept a Form 13 |

|||

by contractors operating under Option 1 or Option 3 to document |

to exempt such sales from tax. |

||

their |

3. Purchases made by organizations that have been issued a |

||

suppliers. Section C, Part 2, may be completed to exempt the |

|||

Nebraska |

Exempt Organization - Certiicate of Exemption are |

||

purchase of building materials or ixtures pursuant to a Purchasing |

|||

exempt from sales tax. |

|||

Agent Appointment, Form 17. See the contractor information guides |

|||

on our Web site www.revenue.ne.gov for additional information. |

|||

Institutions, identify such organizations. These organizations will |

|||

|

|||

WheReto fILe. Form 13 is given to the seller at the time of |

be issued a Nebraska state exemption identiication number. This |

||

the purchase of the property or service or when sales tax is due. |

exemption number must be entered in Section B of the Form 13. |

||

The certiicate must be retained with the seller’s records for audit |

4. Purchases of common or contract carrier vehicles and repair and |

||

purposes. Do not send to the Department of Revenue. |

replacement parts for such vehicles. |

||

SALES TAX NUMBER. A purchaser who completes Section A |

5. Purchases |

of manufacturing machinery or equipment by |

|

and is engaged in business as a wholesaler or manufacturer is |

a taxpayer engaged in business as a manufacturer for use |

||

not required to provide an identification number. |

predominantly in manufacturing. This includes the installation, |

||

purchasers can provide their home state sales tax number. Section B |

repair, or maintenance of such qualiied manufacturing machinery |

||

does not require an identification number when exemption |

or equipment (see Revenue Ruling |

||

category 1, 2, or 5 is indicated. |

6. A sale that qualiies as an occasional sale, such as a sale of |

||

pRopeRLY CompLeteD CeRtIfICate. A purchaser |

|||

depreciable machinery and equipment productively used by the |

|||

must complete a certificate before issuing it to the seller. To |

seller for more than one year and the seller previously paid tax on |

||

properly complete the certificate, the purchaser must include: |

the item. The seller must sign and give the exemption certiicate |

||

(1) identiication of the purchaser and seller, (2) a statement whether |

to the purchaser. The certiicate must be retained by the purchaser |

||

the certiicate is for a single purchase or is a blanket certiicate, |

for audit purposes (see |

||

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Type | Nebraska Resale or Exempt Sale Certificate for Sales Tax Exemption |

| Form Number | Form 13 |

| Usage | Used for certifying purchases as exempt from Nebraska sales tax |

| Applicability | To purchases made for resale, for exempt reasons, or by contractors for building materials |

| Penalty for Misuse | Purchasers face a penalty of $100 or ten times the tax, whichever is larger, for improper use |

| Governing Laws | Neb. Rev. Stat. §§77-2701 through 77-27,135 |

Guide to Writing Nebraska Sales Tax

Filling out the Nebraska Sales Tax Form, also known as Form 13, is a straightforward process essential for businesses making exempt purchases or sales in Nebraska. Whether acquiring goods for resale, making tax-exempt purchases, or buying specific items as a contractor, it's crucial to complete this form accurately to ensure compliance with Nebraska tax laws. The instructions below will guide you through each step of filling out Form 13, ensuring your transaction is properly documented and tax-exempt where applicable.

- Begin by reading the instructions provided on the reverse side of Form 13 to understand the requirements and exemptions available.

- Enter the NAME AND MAILING ADDRESS OF PURCHASER in the designated section, including the full name, street address, city, state, and zip code.

- Fulfill the NAME AND MAILING ADDRESS OF SELLER section with the seller's information, similar to step 2.

- Under Check Type of Certificate, choose between Single Purchase or Blanket by checking the appropriate box. If "Blanket" is checked, note that the certificate will remain valid until it's revoked in writing by the purchaser.

- For SECTION A — Nebraska Resale Certificate, describe the item or service purchased and check off whether you're a wholesaler, retailer, manufacturer, lessor, or if none, state the reason. Include your Nebraska Sales Tax Permit Number or Foreign State Sales Tax Number as applicable.

- In SECTION B — Nebraska Exempt Sale Certificate, specify the basis for the exemption by entering the exemption category number and providing additional information as required for the exemption claimed.

- If you're filling the form as a contractor, complete SECTION C by indicating if the purchase is for building materials or fixtures as an Option 1 or Option 3 contractor. Provide your Nebraska Sales or Consumer’s Use Tax Permit Number. If purchasing under a Purchasing Agent Appointment, attach Form 17 and specify the exempt entity on behalf of whom the purchase is made.

- Review the penalization warnings to ensure the purchase is eligible for tax exemption. Misuse of the certificate can result in significant penalties.

- Sign the form at the designated sign here section, providing your authorized signature, title, and the date, to confirm the accuracy and completeness of the information provided.

- Remember, the completed certificate must be retained by the seller for their records and should not be sent to the Nebraska Department of Revenue.

Once Form 13 is fully completed and signed, it serves as documentation that the purchase, lease, or rental is exempt from Nebraska sales tax under the specified conditions. Handling this form with accuracy and thoroughness is critical for both buyer and seller to ensure compliance with state tax regulations.

Understanding Nebraska Sales Tax

-

Who can issue a Nebraska Sales Tax Exemption Certificate?

Nebraska Sales Tax Exemption Certificates can be issued by entities or individuals who are purchasing property or taxable services for the purpose of resale in the normal course of business. This includes resale as is, or as an ingredient or component part of other property. To issue this certificate, one must complete Section A for resale activities. Additionally, entities or organizations that qualify for one of the six enumerated categories of exemption, as outlined on the form, can issue an Exempt Sale Certificate (Section B), but must meet specific requirements and provide relevant information on the form.

-

What is the difference between a single purchase certificate and a blanket certificate?

A single purchase certificate applies to one specific purchase, lease, or rental transaction from the seller. It is used when the transaction is clearly defined and is not part of ongoing transactions. Conversely, a blanket certificate is valid for all purchases made by the purchaser from the seller until it is revoked. The purchaser opts for a blanket certificate if they have a continuing business relationship with the seller, eliminating the need to provide a new certificate for each transaction.

-

What penalties are associated with the misuse of the Nebraska Sales Tax Exemption Certificate?

If an individual or entity misuses the Nebraska Sales Tax Exemption Certificate, such as claiming exemption for transactions not covered by the certificate, they are subject to a penalty. This can be either $100 or ten times the tax that would have been applied, whichever amount is larger. Each instance of misuse, including each transaction under a blanket certificate, is subject to this penalty. This underscores the importance of ensuring that all claims for sales tax exemption are properly substantiated.

-

Are out-of-state purchasers required to provide their identification number?

Yes, out-of-state purchasers who complete Section A of the certificate for the purpose of resale and are engaged in business as a wholesaler or manufacturer need to provide their home state sales tax number. This aids in verifying the legitimacy of the exemption claim. However, for certain exemptions under Section B (for example, exemption categories 1, 2, or 5), an identification number is not mandatorily required.

-

How should the Nebraska Sales Tax Exemption Certificate be completed and maintained?

To properly complete the Nebraska Sales Tax Exemption Certificate, a purchaser must accurately fill out all relevant sections, including the identification of both the purchaser and the seller, the type of certificate (single purchase or blanket), the basis for the exemption, and the purchaser's certification with an authorized signature and date. Importantly, the completed certificate should not be sent to the Nebraska Department of Revenue but rather retained by the seller for audit purposes. Being meticulous in completing and retaining the certificate is crucial for both parties to comply with tax laws and avoid potential penalties.

Common mistakes

When filling out the Nebraska Sales Tax form, commonly known as Form 13, individuals frequently make several mistakes that can lead to issues with their exemptions. Understanding these common errors can help ensure the form is completed correctly, supporting a smooth transaction process. Here are eight common mistakes:

- Not reading the instructions carefully. The reverse side of the form contains important instructions that are often overlooked, leading to incomplete or incorrect filings.

- Incorrectly choosing the type of certificate. The form distinguishes between a 'Single Purchase' and a 'Blanket' certificate. Misidentifying the certificate type can invalidate the form for the intended transaction.

- Failing to complete the required sections based on the exemption reason. Depending on the reason for exemption - resale, exempt purchase, or contractor purchase - different sections of the form (A, B, or C) must be completed. Skipping or incorrectly filling these sections can lead to a rejection of the exemption claim.

- Omitting the name and mailing address. Both the purchaser's and seller's details are crucial, and leaving these fields incomplete can make the certificate invalid.

- Forgetting to check the appropriate exemption category in Section B. Each exemption category has specific requirements, and not clearly indicating the correct category or failing to provide the required additional information can cause complications.

- Leaving signature and title fields blank. The form must be signed by an authorized individual, and their title should also be provided. An unsigned form is not valid and will not be accepted.

- Not providing a valid sales tax permit number when required. If the purchase is for resale, rental, or lease, the purchaser must include their Nebraska Sales Tax Permit Number or, for out-of-state purchasers, their Foreign State Sales Tax Number.

- Improper use of the certificate for non-qualifying purchases. Utilizing the certificate for purchases that do not qualify for sales tax exemption under Nebraska law can lead to penalties, including fines.

Avoiding these mistakes ensures that the Nebraska Sales Tax exemption form is filled out correctly, facilitating a smoother process for both the purchaser and the seller. Keeping these points in mind can help prevent the common pitfalls associated with this form.

Documents used along the form

When handling business transactions in Nebraska, particularly those qualifying for sales tax exemptions, the Nebraska Sales Tax Form is crucial. However, to ensure full compliance and to streamline the process, several other forms and documents may frequently accompany this form. Understanding these additional forms will help businesses operate more smoothly and maintain accurate records for tax purposes.

- Nebraska Resale Certificate Form 13: This document is essential for businesses purchasing goods for resale. It certifies that the items bought are intended for resale and not personal use, exempting the purchase from sales tax.

- Form 17 - Purchasing Agent Appointment and Delegation of Authority for Sales and Use Tax: Used by businesses to authorize purchasing agents to buy goods or services on their behalf, ensuring that sales tax is handled correctly pursuant to the Nebraska Sales Tax Form requirements.

- Nebraska Exempt Organization Certificate of Exemption: Non-profit organizations, educational institutions, and religious groups must provide this certificate to purchase items tax-free for their organization's use.

- Form 10 - Nebraska Tax Application: Required for all businesses operating in Nebraska, this form registers the business for a sales tax permit, allowing them to collect and remit sales tax as necessary.

- Streamlined Sales Tax Agreement Certificate of Exemption: For businesses operating in multiple states, this form allows them to claim exemptions broadly across states that have adopted the Streamlined Sales and Use Tax Agreement.

- Nebraska Use Tax Payment Form: Used by businesses and individuals to report and pay use tax on items purchased tax-free for use, storage, or consumption in Nebraska when sales tax has not been collected by the seller.

- Nebraska Employee Withholding Certificate: Although not directly related to sales tax, businesses must ensure that they withhold state income tax appropriately from their employees’ wages.

- Nebraska Schedule I — Adjustments to Income: Used for detailing certain adjustments to business income that may also affect tax liability, including sales tax from out-of-state purchases.

- Local Sales and Use Tax Form: Required for businesses operating in regions with local sales tax rates in addition to the state sales tax, helping ensure accurate local tax collections and remittances.

Navigating the complexities of Nebraska's tax system can be challenging, but understanding these forms and documents can help businesses maintain compliance with state tax laws. Keeping accurate and up-to-date records, including all relevant forms related to sales tax exemptions, purchases, and resales, is vital for any business operating within the state. Adopting a meticulous approach to tax documentation will undoubtedly aid in smooth business operations, helping prevent potential penalties or issues with the Nebraska Department of Revenue.

Similar forms

The Uniform Sales & Use Tax Certificate – Multijurisdiction form shares similarities with the Nebraska Sales Tax form, particularly in its function to certify tax-exempt purchases. Both serve as proof that a transaction is exempt from sales tax under specific conditions. They require information about the buyer and seller, the reason for exemption, and a declaration that the purchase is for resale or falls under one of the exempt categories. Each form must be retained by the seller for record-keeping and audit purposes.

Affidavit forms, used in various legal settings to swear to the veracity of certain pieces of information, bear resemblance to the Nebraska Sales Tax form in their formal acknowledgment aspect. While serving different purposes, both types require a signature under penalty, asserting that the provided information is accurate and complete to the best of the signer’s knowledge. This legal affirmation helps prevent fraud and ensures compliance with regulations.

The State Resale Certificate is another form closely related to the Nebraska Sales Tax form, designed specifically for purchase-for-resale transactions. Like the Nebraska form, it helps businesses purchase goods tax-free that will later be resold to customers. It includes similar declarations about the nature of the purchase, business details, and tax exemption justifications, requiring accurate completion to avoid penalties.

Business License Application forms, while primarily used for obtaining a license to operate a business legally in a specific jurisdiction, share the need for detailed business information similar to the Nebraska Sales Tax form. Both demand the business's name, address, type of business operation, and identification numbers, though for different end goals—one for operational legality and the other for tax exemption on purchases.

W-9 forms, requested by entities that make payments to vendors or independent contractors, connect to the Nebraska Sales Tax form through the requirement of taxpayer identification numbers and certifications. Both involve declarations meant to ensure tax compliance, though the W-9 focuses on income tax and the Nebraska form on sales tax exemptions.

The Exemption Certificate for Energy or Utility Use often parallels the Nebraska Sales Tax exemption certificate in its specificity for exempting certain types of purchases from sales tax, in this case, energy or utility-related. Users must provide reasons for exemption and detailed purchaser and seller information, akin to the process of documenting tax-exempt transactions with the Nebraska Sales Tax form.

Lastly, Contractor’s Exempt Purchase Certificate forms, needed for tax-exempt purchases related to certain construction projects, share features with Section C of the Nebraska Sales Tax form. Both require detailed explanations of the exemption basis and are specific to the construction industry, signifying the purchase is not subject to sales tax if it qualifies under specified conditions.

Dos and Don'ts

When filling out the Nebraska Sales Tax Form, it’s essential to pay attention to accuracy and details to ensure compliance and avoid penalties. Here are some guidelines:

Things You Should Do:

- Read the instructions carefully before beginning to fill out the form. The instructions on the reverse side contain valuable information that will guide you in correctly completing the form.

- Check the appropriate type of certificate (Single Purchase or Blanket) at the top of the form. If "Blanket" is selected, remember that this certificate remains valid until revoked in writing by the purchaser.

- Provide accurate and complete information about the purchaser and seller, including names, mailing addresses, and the Nebraska Sales Tax Permit Number if applicable. Incomplete certificates cannot be accepted.

- Select the correct reason for exemption and complete the section that corresponds with the type of purchase (Section A for resale, Section B for exempt purchase, or Section C for contractors).

Things You Shouldn't Do:

- Do not leave any required fields blank. Ensure all applicable sections of the form are filled out. Incomplete certificates can lead to processing delays or outright rejection.

- Avoid making assumptions about the exemption categories without verifying. Incorrectly claiming an exemption could lead to penalties, so review the listed categories and their requirements carefully.

- Do not forget to sign the certificate. The form requires the signature of an authorized individual to declare that the information provided is correct and complete. An unsigned certificate is considered invalid.

- Do not send the certificate to the Nebraska Department of Revenue. This document must be retained by the seller for their records and for audit purposes. Sending it to the Department of Revenue is unnecessary and not in compliance with instructions.

Misconceptions

When it comes to filling out the Nebraska Sales Tax form, there are several misconceptions that can lead to confusion. Here's a list of common misunderstandings and clarifications:

- Misconception 1: Nonprofit organizations are automatically exempt from sales tax.

In reality, nonprofit organizations need to qualify for one of the six categories of exemption and provide the necessary documentation to be exempt from paying sales tax.

- Misconception 2: The sales tax exemption applies to all purchases made by a qualified exempt entity.

However, the exemption only applies to purchases made for the entity's own use. Items bought for resale must be supported by a completed Nebraska Resale Certificate (Form 13, Section A).

- Misconception 3: A completed Form 13 is to be sent to the Nebraska Department of Revenue.

Contrary to this belief, the form should not be sent to the Department but retained by the seller for audit purposes.

- Misconception 4: Any purchase that an organization deems necessary is exempt from sales tax.

Only purchases that fit into the specific exemption categories and are for the organization's own use are exempt.

- Misconception 5: If you are a wholesaler or manufacturer, you do not need to provide a sales tax number when completing Form 13.

Wholesalers and manufacturers are indeed required to provide their Nebraska Sales Tax Permit Number or their home state's sales tax number if they are from out of state.

- Misconception 6: The exemption certificate is valid indefinitely.

If the "Blanket" option is selected, the certificate remains valid until revoked in writing by the purchaser. It is not indefinite and requires the purchaser's action to change its status.

- Misconception 7: A single Form 13 covers all types of exemptions.

Different sections of the Form 13 must be completed based on the type of exemption being claimed (Resale, Exempt Purchase, Contractor, etc.).

- Misconception 8: The seller is responsible for determining the exemption eligibility of a purchase.

While sellers must keep the certificate for audit purposes, it is the purchaser’s responsibility to ensure they qualify for the exemption and correctly complete the form.

- Misconception 9: All governmental purchases are exempt from sales tax.

Governmental units, other than specific exemptions mentioned in Nebraska regulations, are not automatically exempt from sales tax. They must qualify and provide appropriate exemption certificates.

- Misconception 10: Form 13 is optional for qualified purchases.

To claim an exemption from Nebraska sales tax, completing and providing Form 13 is a strict requirement, not an option, for eligible purchases.

It's essential to thoroughly understand the exemptions and requirements of the Nebraska Sales Tax form to ensure compliance and avoid any penalties or misunderstandings.

Key takeaways

Filling out and using the Nebraska Sales Tax form, specifically Form 13, requires attention to detail and an understanding of the various exemptions available. It is an essential document for businesses and organizations operating within Nebraska, facilitating tax-exempt purchases when applicable. Here are five key takeaways to ensure compliance and maximization of benefits under the law.

- Understanding the Certificates: Form 13 can be used under three different circumstances— for resale purposes, exempt purchases, or by contractors. Knowing which section to complete, based on the purchase's intent, is crucial. Resale certificates are issued by businesses buying goods to resell them. Exempt purchase certificates apply to specific organizations or situations defined by Nebraska tax laws. Contractors have a distinct section, contingent on their project's nature.

- Accuracy is Key: Completeness and accuracy when filling out the form cannot be overstated. Every section of the form demands specific information, ranging from the identification of both the purchaser and the seller to the exact nature of the exemption claimed. Errors or omissions can invalidate the certificate, leading to the potential assessment of taxes, interest, or penalties.

- Penalties for Misuse: Utilizing Form 13 improperly, such as claiming exemptions for non-qualifying purchases, triggers significant penalties. The Nebraska Department of Revenue imposes a fine of either $100 or ten times the tax amount due for each misuse instance, underscoring the importance of issuing and accepting these certificates with due diligence.

- Retention for Record-Keeping: Sellers are mandated to retain completed forms as part of their records but should not send them to the state tax department. This requirement serves as a safeguard, ensuring that evidence is available to substantiate tax-exempt sales during audits or reviews by tax authorities.

- Evolving Categories of Exemption: The form delineates specific categories qualifying for tax exemption, from governmental bodies to manufacturing equipment purchases. Practitioners must stay abreast of changes or reinterpretations in these categories, as this could impact the applicability of exemptions for future transactions.

By meticulously complying with the directives for completing and utilizing the Nebraska Sales Tax form, businesses and organizations can navigate the complexities of tax-exempt purchasing in Nebraska efficiently. This adherence not only minimizes the risk of financial penalties but also ensures that eligible entities fully leverage the tax benefits available to them.

Popular PDF Documents

Nj St-50 - By separating gross receipts from non-taxable and taxable sales, the form simplifies the process of determining tax obligations.

Political Form - Clarification on what constitutes taxable income for political organizations and how to report it.

8814 Instructions - The IRS provides detailed instructions for form 8814 to assist taxpayers in its completion and ensure correct reporting.