Get Nc Tax Payment Voucher Form

Taxes are a crucial aspect of financial responsibility, especially when it comes to adjustments and amendments. In North Carolina, Form NC-5X plays a significant role for businesses and individuals looking to correct previously submitted Withholding Returns. Designed to make amendments straightforward, this form requires detailed information such as the legal name, Account ID, and Federal Employer Identification Number (FEIN) or Social Security Number (SSN), ensuring that the amendments are attributed to the correct entity or individual. When completing this form, it’s essential to indicate the period covered by the return clearly, ensuring accuracy. One must enter the corrected North Carolina income tax that was required to be withheld, compare it against what was initially reported or previously adjusted, and then calculate the overpayment or additional tax due. Interestingly, if there's an overpayment, the form outlines a process for obtaining a refund, which is a relief for many. Additionally, when additional tax is owed, the calculation of accrued interest is required, following a rate set semiannually by the Secretary of Revenue. The completion instructions stress the use of blue or black ink and caution against folding, stapling, taping, or paper clipping the return or payment, which is part of ensuring the document is processed efficiently and accurately. Alongside, the guideline to make a check payable in U.S. currency to the N.C. Department of Revenue clarifies the payment process. This form, bridging the gap between inaccuracies and compliance, underscores the importance of details and precision in the realm of tax adjustments, ensuring individuals and businesses alike can correct their records with confidence.

Nc Tax Payment Voucher Example

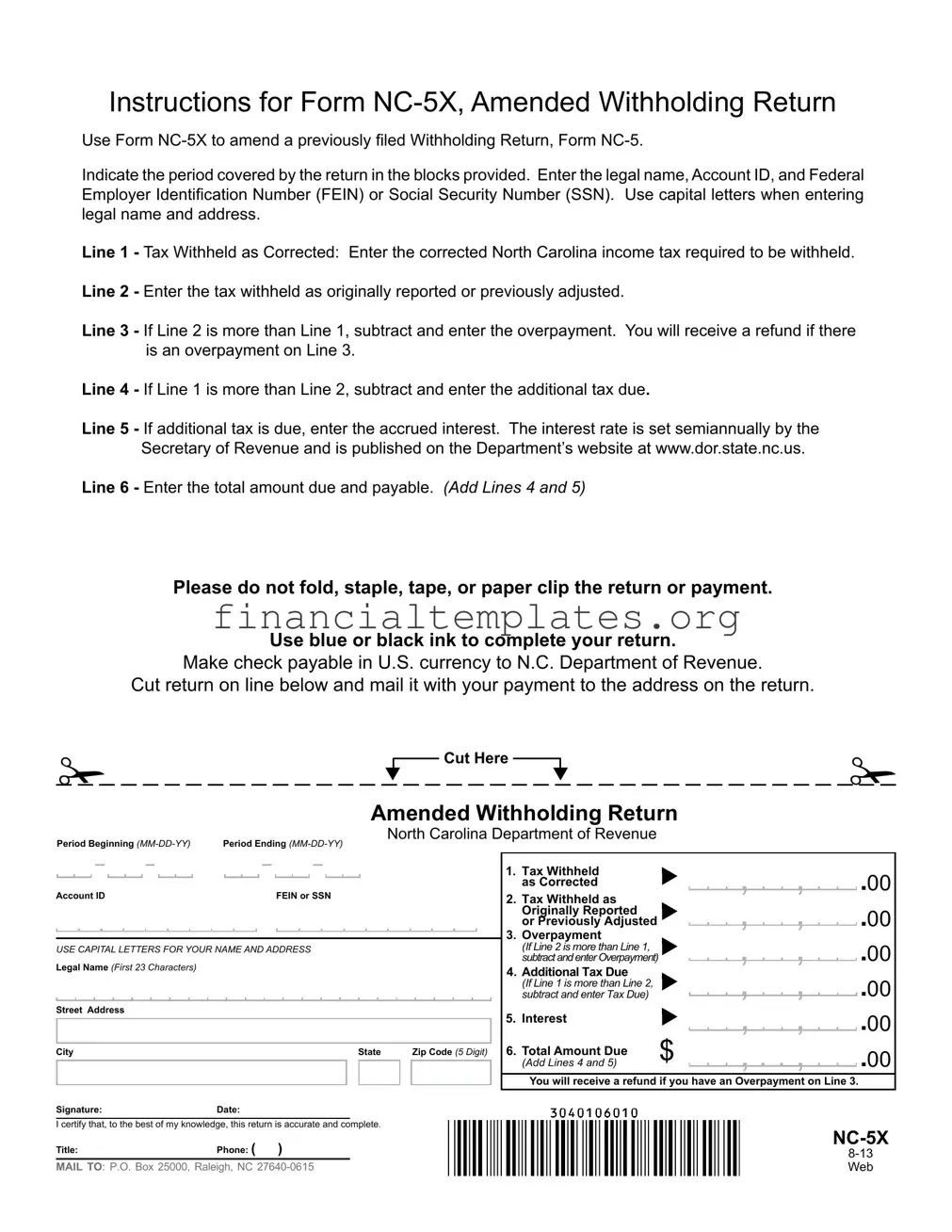

Instructions for Form

Use Form

Indicate the period covered by the return in the blocks provided. Enter the legal name, Account ID, and Federal

Employer Identiication Number (FEIN) or Social Security Number (SSN). Use capital letters when entering legal name and address.

Line 1 - Tax Withheld as Corrected: Enter the corrected North Carolina income tax required to be withheld. Line 2 - Enter the tax withheld as originally reported or previously adjusted.

Line 3 - If Line 2 is more than Line 1, subtract and enter the overpayment. You will receive a refund if there is an overpayment on Line 3.

Line 4 - If Line 1 is more than Line 2, subtract and enter the additional tax due.

Line 5 - If additional tax is due, enter the accrued interest. The interest rate is set semiannually by the

Secretary of Revenue and is published on the Department’s website at www.dor.state.nc.us.

Line 6 - Enter the total amount due and payable. (Add Lines 4 and 5)

Please do not fold, staple, tape, or paper clip the return or payment.

Use blue or black ink to complete your return.

Make check payable in U.S. currency to N.C. Department of Revenue.

Cut return on line below and mail it with your payment to the address on the return.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cut Here |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amended Withholding Return |

|

|

|

|

|

|

|

|||||||||||||||

|

|

Period Beginning |

|

Period Ending |

North Carolina Department of Revenue |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Tax Withheld |

|

|

, |

, |

|

|

.00 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Account ID |

|

|

|

|

|

|

|

|

|

|

FEIN or SSN |

|

|

|

|

|

|

|

|

|

|

|

as Corrected |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Tax Withheld as |

|

|

, |

, |

|

.00 |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Originally Reported |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or Previously Adjusted |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Overpayment |

|

|

, |

, |

|

.00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

(If Line 2 is more than Line 1, |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

Legal Name (First 23 Characters) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

subtractandenterOverpayment) |

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Additional Tax Due |

|

|

|

, |

|

|

.00 |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If Line 1 is more than Line 2, |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

subtract and enter Tax Due) |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Interest |

|

|

, |

, |

.00 |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Total Amount Due |

$ |

|

, |

, |

|

|

||||||

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

Zip Code (5 Digit) |

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Add Lines 4 and 5) |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You will receive a refund if you have an Overpayment on Line 3. |

||||||||||

|

|

Signature: |

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I certify that, to the best of my knowledge, this return is accurate and complete. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

Title: |

|

Phone: ( ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

MAIL TO: P.O. Box 25000, Raleigh, NC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Web |

||||||||||||||||||||||||||||||||||||||||

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form NC-5X | This form is used to amend a previously filed Withholding Return, Form NC-5, to correct the amount of North Carolina income tax required to be withheld. |

| Amendment Details | Taxpayers must indicate the period covered by the return, and compare the corrected tax withheld to the amount originally reported or previously adjusted to determine if there is additional tax due or an overpayment. |

| Interest on Additional Tax | If there is additional tax due, interest must be calculated and added. The interest rate is set by the Secretary of Revenue semiannually and available on the Department's website. |

| Payment Instructions | The total amount due, including any additional tax and applicable interest, should be paid in U.S. currency to the N.C. Department of Revenue without folding, stapling, taping, or using paper clips on the return or payment. |

| Governing Law | The form and its instructions are governed by North Carolina tax laws and regulations, administered by the North Carolina Department of Revenue. |

Guide to Writing Nc Tax Payment Voucher

Filling out the NC Tax Payment Voucher form, known as Form NC-5X, is a crucial task for those needing to amend a previously filed Withholding Return, Form NC-5. This process requires precision and attention to detail, ensuring that all amendments accurately reflect any changes in withheld North Carolina income tax. With this form, it's possible to correct discrepancies, ensuring compliance and rectitude in tax affairs. By following the steps listed below, one can navigate the form confidently, making necessary adjustments to previously reported tax withholdings.

- Start by indicating the period covered by the return in the designated blocks for the beginning and ending date.

- Enter the legal name using capital letters. This step is crucial for maintaining consistency and ease of identification in official records.

- Provide the Account ID, which is essential for associating the amendment with the correct account.

- Input the Federal Employer Identification Number (FEIN) or Social Security Number (SSN), ensuring accurate and traceable reporting to the individual or entity’s tax records.

- On Line 1, enter the corrected North Carolina income tax that should have been withheld, using the precise figures.

- In Line 2, indicate the tax amount withheld as originally reported or as previously adjusted, providing a basis for comparison.

- If Line 2 exceeds Line 1, calculate the overpayment and record this amount on Line 3. An overpayment indicates eligibility for a refund.

- Should Line 1 exceed Line 2, subtract these values and enter the resulting additional tax due on Line 4.

- For any additional tax due, calculate and input the accrued interest on Line 5. Note that interest rates are subject to semiannual adjustments by the Secretary of Revenue and can be found on the Department’s website.

- Add the amounts from Lines 4 and 5 to determine the total amount due, and enter this sum on Line 6.

- Complete the form using blue or black ink, ensuring clarity and legibility for processing. Avoid folding, stapling, taping, or using paper clips with the return or payment.

- Prepare a check payable in U.S. currency to "N.C. Department of Revenue" for any amount due. Ensuring the correct sum is critical for proper processing and to avoid discrepancies.

- Carefully cut along the designated line below the form, separating it for mailing.

- Sign and date the form, certifying the accuracy and completeness of the information provided. Include the title and a contact phone number for potential queries.

- Mail the completed form and payment to P.O. Box 25000, Raleigh, NC 27640-0615, adhering to the provided address for correct routing and processing.

By meticulously following these steps, individuals and entities can accurately amend their previously filed withholding returns, ensuring their tax affairs are up-to-date and correctly recorded. It is essential to review all entries for accuracy before submission, ensuring every amendment thoroughly matches the required adjustments. Timely and accurate completion of Form NC-5X facilitates smooth processing and reinforces compliance with tax obligations.

Understanding Nc Tax Payment Voucher

What is the purpose of Form NC-5X?

Form NC-5X is used to amend a previously filed North Carolina Withholding Return, Form NC-5. This form allows businesses to correct the amount of North Carolina income tax they have previously reported as withheld from their employees' wages.

When should I use Form NC-5X?

You should use Form NC-5X if you need to make corrections to a Withholding Return you have already submitted. Whether you've withheld too much or too little from your employees, this form will help you report and rectify the difference.

How do I fill out the period covered by the amended return on Form NC-5X?

Indicate the period covered by the return in the spaces provided for the beginning and ending dates. Use the format MM-DD-YY for both the period's start and end dates to ensure clarity.

What information do I need to include for identification on Form NC-5X?

Make sure to enter the legal name of your business, your Account ID, and your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) for identification. Remember to use capital letters for your name and address.

How is the corrected tax withheld calculated on Form NC-5X?

On Line 1, enter the corrected amount of North Carolina income tax you are required to withhold. This figure replaces the original amount you reported or any prior adjustments made.

What should I do if I find out I have withheld more tax than required?

If you've overestimated the tax withheld, indicate the overpayment on Line 3. An overpayment occurs when the amount on Line 2 (the tax withheld as originally reported or previously adjusted) is more than the corrected tax on Line 1. You are eligible for a refund for the overpayment amount.

What steps should be taken if additional tax is due?

If you have withheld less tax than required, calculate the additional tax due and enter this amount on Line 4. If applicable, Line 5 requires you to enter the accrued interest on the additional tax due. The total amount due, which is the sum of Lines 4 and 5, should be entered on Line 6.

How should I submit my payment and Form NC-5X to the North Carolina Department of Revenue?

Complete your return using blue or black ink, and make your check payable in U.S. currency to N.C. Department of Revenue. Do not fold, staple, tape, or paper clip the return or payment. After separating the return at the indicated line, mail it with your payment to the P.O. Box 25000, Raleigh, NC 27640-0615. Ensure your check and the form are properly filled out to facilitate processing.

Common mistakes

Filling out tax forms accurately is essential to ensure compliance with state regulations and to avoid any unnecessary delays or penalties. The North Carolina Tax Payment Voucher form, known as Form NC-5X, is used to amend a previously filed Withholding Return, Form NC-5. Common mistakes can occur during this process, leading to errors that could have been avoided with careful attention to detail. Here are six mistakes often made:

Incorrect Entry of Tax Withheld: One of the most critical errors involves incorrect entries on Line 1, where the corrected North Carolina income tax required to be withheld is reported. Ensuring accuracy in this step is paramount, as it impacts subsequent calculations and determinations of overpayment or additional tax due.

Failure to Report Original or Previously Adjusted Tax Withheld: Line 2 requires entering the tax withheld as originally reported or previously adjusted. Overlooking or inaccurately reporting this figure can result in considerable discrepancies in calculating overpayments or additional taxes required.

Miscalculating the Overpayment or Additional Tax Due: Lines 3 and 4 involve subtractive calculations to determine if there is an overpayment or additional tax due. Simple arithmetic errors here can lead to incorrect refund claims or underpayments.

Omitting Accrued Interest on Additional Tax Due: If there is additional tax owed, accrued interest should be entered on Line 5. Missing this detail can lead to underestimating the total amount due, as the final payment should include this interest calculation.

Errors in Totalling Amount Due: Line 6 requires adding Lines 4 and 5 to determine the total amount due and payable. Incorrectly adding these amounts can either result in overpayment or underpayment to the Department of Revenue.

Administrative Errors: Beyond numerical entries, there are several administrative errors often made, such as folding, stapling, taping, or paper clipping the return or payment, which are expressly advised against in the form instructions. Additionally, not using blue or black ink, or failing to make the check payable in U.S. currency to N.C. Department of Revenue, can cause processing delays or returned payments.

It is crucial that individuals take their time when filling out Form NC-5X, paying close attention to every detail to avoid these common mistakes. Preparing tax documents can be complicated, but understanding and avoiding these errors can make the process smoother and ensure that one remains in good standing with tax obligations.

Documents used along the form

When managing taxes in North Carolina, individuals and businesses often need to complete and submit several forms in addition to the NC Tax Payment Voucher form. These documents are designed to ensure accurate reporting and timely payment of taxes. Below is a list of other forms and documents frequently used alongside the NC Tax Payment Voucher form, each serving a unique purpose in the tax filing and payment process.

- Form NC-4: Employee’s Withholding Allowance Certificate. This form is filled out by employees to determine the amount of state income tax to withhold from their paychecks. It helps employers calculate the correct amount of tax to withhold from their employees' wages.

- Form D-400: Individual Income Tax Return. Used by individuals to file their annual state income tax return. This form is crucial for reporting yearly income, calculating taxes owed, or determining any refund due.

- Form NC-3: Annual Withholding Reconciliation. Employers use this form to report the total income tax withheld from all employees' wages throughout the tax year. It ensures that the amount withheld matches the state’s records.

- Form NC-5P: Withholding Payment Voucher. Employers required to remit withheld state income taxes electronically use this form if they need to make a payment by check or money order instead. It accompanies the payment to ensure it's applied correctly to the employer's account.

- Form E-500: Sales and Use Tax Return. Businesses that collect sales tax from customers file this form to report and pay the collected taxes. It's a crucial document for businesses to remain compliant with state sales tax regulations.

Completing and submitting the correct forms is an essential part of complying with North Carolina's tax regulations. Each form has its specific instructions and requirements, which guide individuals and businesses through the process of accurate reporting and payment. It's important to stay informed about which documents are necessary for your particular tax situation to ensure compliance and avoid any potential penalties or audits.

Similar forms

The Federal 1040X Amended U.S. Individual Income Tax Return form is quite similar to the NC Tax Payment Voucher form, especially in its purpose and structure. Like the NC-5X, the 1040X is used to make corrections to a previously filed income tax return. Taxpayers must detail the original amounts reported, the adjustments being made, and the corrected totals, paralleling the process of reporting corrected tax withheld, original amounts, and any differences in tax due or overpaid as outlined in the NC-5X form. Both forms require the calculation of additional taxes owed or refunds due, ensuring that taxpayers accurately report and amend their tax responsibilities.

The State Business Tax Amendment forms, available in various states, share a common goal with the NC Tax Payment Voucher form: adjusting previously filed tax returns. These forms are used by businesses to amend income, sales, or other types of state tax returns. Similar to the NC-5X, these documents include sections for the original reported amounts, any corrections, and the calculation of additional taxes due or refunds owed. The procedure ensures that businesses correct inaccuracies in past filings and comply with state tax laws, reflecting a similar correction process albeit for different types of taxes.

The IRS Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund, parallels the NC Tax Payment Voucher form in its functionality for adjusting tax obligations. Specifically designed for employers to correct errors on previously filed Form 941s, the 941-X requires details of the original tax reported, corrections being made, and total amounts due or refunds claimed. This mirrors the NC-5X's process for correcting withholding tax, addressing the necessity for accuracy and compliance in reporting to tax authorities. Both forms play critical roles in ensuring that tax liabilities are correctly settled with the government.

The Form W-2c, Corrected Wage and Tax Statement, although primarily for reporting corrected information to employees and the Social Security Administration, shares similarities with the NC Tax Payment Voucher form in the perspective of correction and accuracy in tax documentation. It allows employers to correct errors in previously issued W-2 forms, such as incorrect employee income, tax withholdings, or personal information. This corrective process aligns with the NC-5X's objective of amending errors in withholding tax returns, underlining the importance of precise tax reporting and the mechanisms available for rectification.

Lastly, the Sales and Use Tax Amendment forms, used in multiple jurisdictions, have functionalities akin to the NC Tax Payment Voucher form regarding their amendment features. These forms are utilized by retailers and businesses to correct previously filed sales and use tax returns. Like the NC-5X, they include sections for reporting original amounts, the necessary corrections, and any resulting balances due to or refunds from the tax authority. The process ensures businesses maintain accurate records of their sales and use tax liabilities, mirroring the correction process evident in withholding tax adjustments through the NC Tax Payment Voucher form.

Dos and Don'ts

When dealing with taxes, accuracy, and thoroughness are paramount, especially when amending a previously filed return. If you're filling out the NC Tax Payment Voucher form, here are a few essential dos and don'ts to keep in mind:

Do:

- Double-check the period covered by the return. Ensure that the beginning and ending dates are accurately reflected in the spaces provided.

- Use capital letters when entering your legal name and address. This makes your information clear and helps prevent any processing delays due to illegibility.

- Enter the correct amounts in each line. For example, on Line 1, accurately enter the corrected North Carolina income tax that needs to be withheld. Making sure these numbers are right the first time can save you from future headaches.

- Calculate your overpayment or additional tax due carefully. Pay special attention to Lines 3 and 4 to ensure that any subtraction or addition is done correctly.

- Sign and date the form before mailing. Your signature certifies that, to the best of your knowledge, the information provided on the form is accurate and complete.

- Write your check payable in U.S. currency to the N.C. Department of Revenue and do not forget to mail it to the address provided on the return.

Don't:

- Don't rush through filling out the form. Errors can lead to delays in processing or incorrect tax assessments.

- Don't use any ink color other than blue or black when completing your return. This ensures the legibility and proper scanning of your documents.

- Don't fold, staple, tape, or paper clip the return or payment. These actions can damage the documents or interfere with processing.

- Don't forget to include accrued interest on Line 5 if additional tax is due. This is often overlooked and can result in inaccuracies in your total amount due.

- Don't disregard the website provided for checking the interest rate set by the Secretary of Revenue. This information is crucial for calculating the accurate amount on Line 5.

- Don't leave any fields blank. If a particular line does not apply to you, make sure to write "N/A" or "0" as appropriate to signify this to the Department of Revenue.

By following these guidelines, you're ensuring that your amended withholding return is filled out correctly and clearly, which aids the North Carolina Department of Revenue in processing your documents efficiently. Remember, taking the time to double-check your work can prevent potential issues down the line.

Misconceptions

There are common misconceptions about the NC Tax Payment Voucher form, specifically Form NC-5X, which is designed to amend previously filed Withholding Returns. Clearing up these misconceptions ensures that individuals and businesses can file their tax amendments accurately and efficiently. Here are ten misconceptions and clarifications:

Form NC-5X is only for reporting new withholding taxes. In reality, Form NC-5X is used to amend a previously filed Withholding Return. It corrects amounts previously reported, rather than reporting new withholding taxes.

The form can be completed and submitted online. As of the last update, Form NC-5X requires a physical submission. Filers should use blue or black ink, avoid folding, stapling, taping, or using paper clips, and mail it to the provided address.

There's no need to compare previous submissions. The form requires you to enter both the corrected amount of tax withheld and the amount originally reported or previously adjusted to calculate the difference accurately.

Interest on additional tax due does not need to be calculated. If additional tax is due, accrued interest must be calculated and included. The interest rate is set semiannually and available on the Department of Revenue's website.

Overpayments automatically result in refunds. While overpayments generally do lead to refunds, it requires line 3 to show an overpayment after subtracting the corrected tax from the original or previously adjusted tax reported.

SSN is optional when FEIN is provided. Form NC-5X requires both the Federal Employer Identification Number (FEIN) and the Social Security Number (SSN) if applicable, ensuring that the filing is accurately associated with the correct entity or individual.

It's acceptable to fold the form when mailing. The instructions specifically advise against folding, stapling, taping, or using paper clips on the return or payment to ensure that the document is processed correctly and efficiently.

Payments can be made in any currency. Payments must be made in U.S. currency, and checks should be payable to the N.C. Department of Revenue, emphasizing the importance of following these guidelines to avoid payment issues.

Any color ink is acceptable for completing the form. Only blue or black ink should be used to complete the form. This requirement helps ensure that the information is legible and can be processed without errors.

Electronic signatures are accepted on the form. As per the instructions, the form requires a physical signature. This ensures the authenticity of the filing and the accountability of the filer or the entity's representative.

Understanding these aspects of Form NC-5X helps filers amend their Withholding Returns correctly, ensuring compliance with North Carolina's tax regulations while avoiding common pitfalls and misunderstandings.

Key takeaways

Filling out the NC Tax Payment Voucher form, officially known as Form NC-5X, Amended Withholding Return, requires careful attention to detail. Here are key takeaways to ensure accuracy and compliance:

- Use Form NC-5X for amendments: When you need to make changes to a previously filed Withholding Return, specifically Form NC-5, Form NC-5X is the form to use.

- Correctly identify the period: The form requires you to specify the period your amendment covers. This is crucial for the Department of Revenue to apply changes to the correct filing period.

- Provide accurate identification information: Enter your legal name, Account ID, and either your Federal Employer Identification Number (FEIN) or Social Security Number (SSN), using capital letters for names and addresses to ensure clarity.

- Detail tax withheld: Line 1 should reflect the corrected amount of North Carolina income tax that was required to be withheld.

- Report original or adjusted tax withheld: Line 2 is for entering the tax amount as initially reported or as previously adjusted, establishing a baseline for determining overpayment or additional tax due.

- Calculate overpayment or additional tax: Compare lines 1 and 2 to determine whether there's an overpayment (resulting in a refund) or additional tax due.

- Accrued interest on additional tax: If additional tax is owed, Line 5 must include the accrued interest, calculated based on rates published semiannually by the Secretary of Revenue.

- Total amount due: Sum up the additional tax and accrued interest to find the total amount payable, as indicated on Line 6.

- Physical submission details: It's important not to fold, staple, tape, or use paper clips on the return or payment. Complete the form in blue or black ink, cut along the indicated line, and mail it with your payment to the specified address, making checks payable in U.S. currency to the N.C. Department of Revenue.

Adhering to these guidelines will help ensure that your Amended Withholding Return is properly filled out and submitted, facilitating a smoother process with the North Carolina Department of Revenue.