Get Nc Estimated Tax Payment Form

Understanding the NC Estimated Tax Payment form is crucial for those who anticipate owing $1,000 or more in taxes beyond what is covered by withholding and credits. This form, utilized by the North Carolina Department of Revenue, guides individuals in calculating and remitting their estimated income tax throughout the year to avoid penalties associated with underpayment or late payments. Taxpayers must navigate various deadlines—typically the 15th of April, June, September, and the following January—to ensure timely payments. Special considerations are provided for those with significant income from farming or fishing, allowing them to follow an adjusted payment schedule. Furthermore, the form accommodates fiscal year filers by setting specific due dates based on their unique fiscal calendars. Instructions for completing the form emphasize accuracy in estimating yearly income, adjusting withholdings as necessary, and understanding the ramifications of underpayment, including potential interest charges for late or incomplete payments. By diligently following the guidelines, taxpayers can navigate the complexities of estimated tax payments, thereby aligning with state tax requirements and minimizing financial surprises during the tax season.

Nc Estimated Tax Payment Example

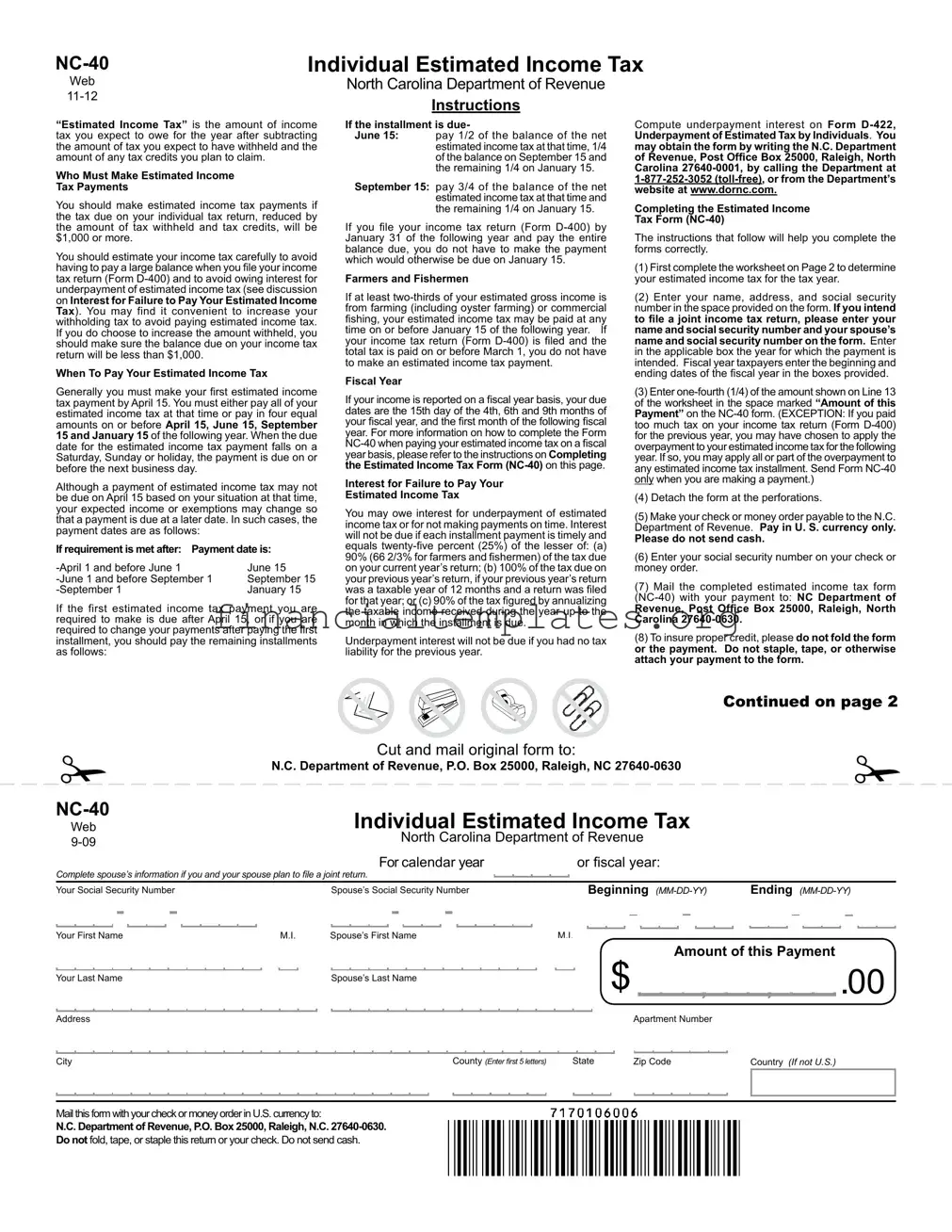

Individual Estimated Income Tax |

|

Web |

North Carolina Department of Revenue |

Instructions |

|

|

“Estimated Income Tax” is the amount of income tax you expect to owe for the year after subtracting the amount of tax you expect to have withheld and the amount of any tax credits you plan to claim.

Who Must Make Estimated Income

Tax Payments

You should make estimated income tax payments if the tax due on your individual tax return, reduced by the amount of tax withheld and tax credits, will be $1,000 or more.

You should estimate your income tax carefully to avoid having to pay a large balance when you ile your income tax return (Form

underpayment of estimated income tax (see discussion on Interest for Failure to Pay Your Estimated Income Tax). You may find it convenient to increase your withholding tax to avoid paying estimated income tax. If you do choose to increase the amount withheld, you should make sure the balance due on your income tax return will be less than $1,000.

When To Pay Your Estimated Income Tax

Generally you must make your irst estimated income tax payment by April 15. You must either pay all of your estimated income tax at that time or pay in four equal amounts on or before April 15, June 15, September 15 and January 15 of the following year. When the due date for the estimated income tax payment falls on a Saturday, Sunday or holiday, the payment is due on or before the next business day.

Although a payment of estimated income tax may not be due on April 15 based on your situation at that time, your expected income or exemptions may change so that a payment is due at a later date. In such cases, the payment dates are as follows:

If requirement is met after: Payment date is:

June 15 |

|

September 15 |

|

January 15 |

If the first estimated income tax payment you are

required to make is due after April 15, or if you are required to change your payments after paying the irst installment, you should pay the remaining installments

as follows:

If the installment is due-

June 15: pay 1/2 of the balance of the net estimated income tax at that time, 1/4 of the balance on September 15 and the remaining 1/4 on January 15.

September 15: pay 3/4 of the balance of the net estimated income tax at that time and the remaining 1/4 on January 15.

If you ile your income tax return (Form

Farmers and Fishermen

If at least

from farming (including oyster farming) or commercial ishing, your estimated income tax may be paid at any time on or before January 15 of the following year. If your income tax return (Form

to make an estimated income tax payment.

Fiscal Year

If your income is reported on a iscal year basis, your due dates are the 15th day of the 4th, 6th and 9th months of your iscal year, and the irst month of the following iscal year. For more information on how to complete the Form

Interest for Failure to Pay Your

Estimated Income Tax

You may owe interest for underpayment of estimated income tax or for not making payments on time. Interest

will not be due if each installment payment is timely and equals

month in which the installment is due.

Underpayment interest will not be due if you had no tax liability for the previous year.

Compute underpayment interest on Form

may obtain the form by writing the N.C. Department of Revenue, Post Ofice Box 25000, Raleigh, North Carolina

Completing the Estimated Income

Tax Form

The instructions that follow will help you complete the forms correctly.

(1)First complete the worksheet on Page 2 to determine your estimated income tax for the tax year.

(2)Enter your name, address, and social security

number in the space provided on the form. If you intend to ile a joint income tax return, please enter your name and social security number and your spouse’s

name and social security number on the form. Enter in the applicable box the year for which the payment is

intended. Fiscal year taxpayers enter the beginning and ending dates of the iscal year in the boxes provided.

(3)Enter

(4)Detach the form at the perforations.

(5)Make your check or money order payable to the N.C. Department of Revenue. Pay in U. S. currency only.

Please do not send cash.

(6)Enter your social security number on your check or money order.

(7)Mail the completed estimated income tax form

Revenue, Post Ofice Box 25000, Raleigh, North

Carolina

(8)To insure proper credit, please do not fold the form or the payment. Do not staple, tape, or otherwise attach your payment to the form.

|

|

|

Continued on page 2 |

|

|

Cut and mail original form to: |

|

|

|

N.C. Department of Revenue, P.O. Box 25000, Raleigh, NC |

||||

|

|

|||

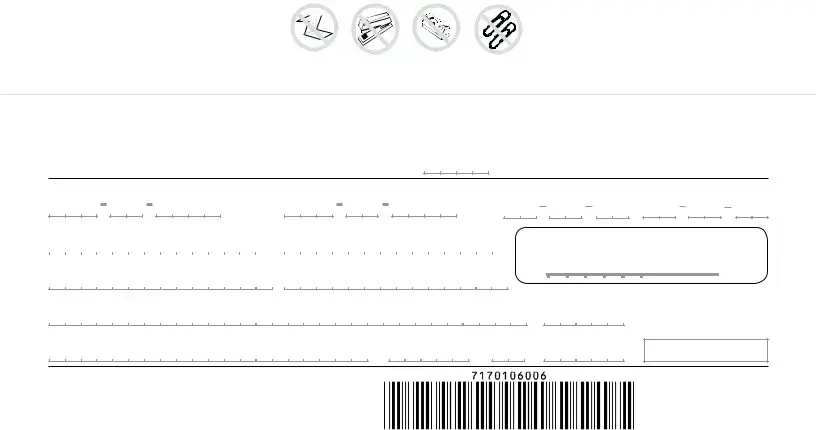

Individual Estimated Income Tax |

|

|||

Web |

|

|||

North Carolina Department of Revenue |

|

|||

|

|

|

||

|

For calendar year |

or iscal year: |

|

|

Complete spouse’s information if you and your spouse plan to ile a joint return. |

|

|

||

Your Social Security Number |

Spouse’s Social Security Number |

Beginning |

Ending |

|

|

Your First Name |

|

M.I. |

Spouse’s First Name |

|

M.I. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Last Name |

|

|

|

Spouse’s Last Name |

|

|

|

$

Amount of this Payment

, ,

.00

.00

Address |

Apartment Number |

City |

County (Enter irst 5 letters) |

State |

Zip Code |

Country (If not U.S.)

Mail this form with your check or money order in U.S. currency to:

N.C. Department of Revenue, P.O. Box 25000, Raleigh, N.C.

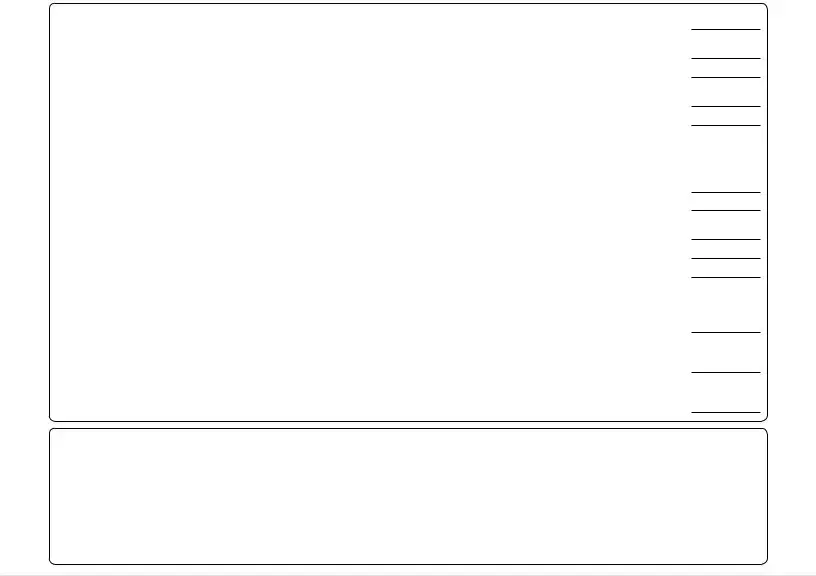

Page 2

Web

Worksheet for Computation of Estimated N.C. Income Tax

1. Estimated Federal Adjusted Gross Income |

1. |

2.Estimated Additions to Federal Adjusted Gross Income

(See Individual Income Tax Instructions for Form |

2. |

3. Add Lines 1 and 2 and enter the total |

3. |

4.Estimated Deductions from Federal Adjusted Gross Income

(See Individual Income Tax Instructions for Form |

4. |

5. Subtract Line 4 from Line 3 and enter the total |

5. |

6.• If you plan to itemize deductions, enter the estimated total of your itemized deductions.

• If you do not plan to itemize, enter your standard deduction.

|

IMPORTANT: Do not enter the amount from your federal return. |

|

|

|

|

(You must refer to the Individual Income Tax Instructions for Form |

|

6. |

|

7. |

Subtract Line 6 from Line 5 and enter the total |

|

7. |

|

8. |

N.C. personal exemption (Multiply $2,500 or $2,000 by the number of exemptions) |

|

|

|

|

(You must refer to the Individual Income Tax Instructions for Form |

8. |

||

9. |

Estimated North Carolina Taxable Income (Subtract Line 8 from Line 7) |

|

9. |

|

10. |

Amount of Tax - Use the Tax Rates shown below |

|

10. |

|

11. |

A. Estimated N. C. Tax to be withheld |

A. |

|

|

|

B. Estimated Tax Credits |

B. |

|

|

12. |

Add Lines 11A and 11B |

|

12. |

|

13.Estimated Income Tax (Subtract Line 12 from Line 10) If $1,000 or more, ill out and mail the estimated income tax form along with your payment; if less than $1,000, no payment is

required at this time |

.......................................................................................................................................................................13. |

14.If the irst payment you are required to make is due April 15, enter 1/4 of Line 13 here and in the space marked “Amount of this Payment” on Form

whole dollar |

...................................................................................................................................................................................14. |

Tax Rates

Single |

|

|

|

Head of Household |

|

|

|||

$ |

0 |

$ 12,750 |

6% |

$ |

0 |

$ 17,000 |

6% |

|

|

|

12,750 |

60,000 |

$ |

765 + 7% of the amount over $12,750 |

|

17,000 |

80,000 |

$ 1,020 |

+ 7% of the amount over $17,000 |

|

60,000 |

$ |

4,072.50 + 7.75% of the amount over $60,000 |

|

80,000 |

$ 5,430 |

+ 7.75% of the amount over $80,000 |

||

Married Filing Jointly / Qualifying Widow(er) |

Married Filing Separately |

||||||

$ |

0 |

$ 21,250 |

6% |

$ |

0 |

$ 10,625 |

6% |

|

21,250 |

100,000 |

$ 1,275 + 7% of the amount over $21,250 |

|

10,625 |

50,000 |

$ 637.50 + 7% of the amount over $10,625 |

100,000 |

$ 6,787.50 + 7.75% of the amount over $100,000 |

|

50,000 |

$ 3,393.75 + 7.75% of the amount over $50,000 |

|||

Document Specifics

| Fact Name | Description |

|---|---|

| Eligibility to Make Estimated Income Tax Payments | Individuals are required to make estimated income tax payments if they anticipate the tax due on their return, minus withholdings and credits, to be $1,000 or more. |

| Payment Schedule | First estimated payment is due by April 15, with subsequent payments due quarterly on June 15, September 15, and January 15 of the following year, or the next business day if these dates fall on a weekend or holiday. |

| Special Considerations for Farmers and Fishermen | If at least two-thirds of estimated gross income is from farming or commercial fishing, the estimated tax may be paid in full by January 15 of the following year without penalty. |

| Interest for Failure to Pay Estimated Tax on Time | Interest may be owed for underpayment of estimated tax or late payments, except when each installment is timely and equals at least 25% of the lesser of 90% of the current year's tax, 100% of the previous year's tax, or 90% of the annualized taxable income. |

Guide to Writing Nc Estimated Tax Payment

Before diving into filling out the NC Estimated Tax Payment Form (NC-40), it's essential to understand the significance of this step in managing your financial responsibilities. Making estimated income tax payments ensures you're covering the expected tax liability for the year, thus avoiding any surprises during tax season. Careful estimation can help avoid owing a large sum when filing your annual income tax return and potential interest charges for underpayment. This guide is designed to make the process straightforward.

- Start by calculating your estimated income tax for the year using the worksheet provided on Page 2 of the instructions. This will help you figure out how much you need to pay.

- Fill out your personal information on the form, including your name, address, and social security number. If you are filing jointly, include your spouse's name and social security number as well.

- Specify the year for which the payment is intended in the designated box. Fiscal year taxpayers should enter the starting and ending dates of their fiscal year in the corresponding fields.

- Determine one-fourth (1/4) of the amount from Line 13 of your worksheet. Enter this amount in the "Amount of this Payment" section on the NC-40 form. Note: If you have applied an overpayment from the previous year towards this year's estimated tax, adjust the payment amount accordingly.

- Detach the form carefully along the perforations to prepare it for mailing.

- Make your check or money order payable to the "N.C. Department of Revenue". Ensure that the payment is in U.S. currency, and remember, cash should not be sent through the mail.

- Write your social security number on your check or money order to ensure the payment is credited to the right account.

- Mail your completed estimated income tax form (NC-40) and payment to the following address: NC Department of Revenue, P.O. Box 25000, Raleigh, North Carolina 27640-0630. To ensure proper processing, do not fold, staple, tape, or attach your payment to the form in any way.

By following these steps, you can confidently submit your NC Estimated Tax Payment, keeping you compliant with state tax regulations and helping you manage your tax liability throughout the year. Remember, timely and accurate payments can prevent potential penalties and interest charges, making tax season more predictable and less stressful.

Understanding Nc Estimated Tax Payment

-

Who needs to make estimated tax payments in North Carolina?

Individuals should make estimated income tax payments if they anticipate the tax due on their return, after deductions and credits, to be $1,000 or more. To avoid interest for underpayment, it's essential to accurately estimate this amount.

-

When are the estimated tax payments due?

Payments are typically due in four equal installments on April 15, June 15, September 15, and January 15 of the following year. If these dates fall on a weekend or holiday, the due date is the next business day. Changes in income or exemptions may alter the required installment amounts or due dates throughout the year.

-

What if my income changes after making the first payment?

If income or exemptions change after the first payment, adjust the remaining payments to reflect the new estimate. If the first payment is due after April 15, follow the specific instructions provided for splitting the remaining estimated tax into the required installments.

-

What are the specific rules for farmers and fishermen?

If two-thirds of your estimated gross income comes from farming or commercial fishing, you may pay your entire estimated tax by January 15 of the following year or file and pay the total tax by March 1 to avoid making estimated payments.

-

How do fiscal year filers make estimated payments?

If you report income on a fiscal year basis, your payment due dates are the 15th day of the 4th, 6th, 9th month of your fiscal year, and the first month of the following fiscal year. Refer to the instructions on completing the NC-40 form for fiscal year filers for more details.

-

What happens if I don't pay or underpay my estimated tax?

You may owe interest for underpayment or late payment of estimated tax. To avoid interest, each installment must be at least 25% of the lesser of 90% (or 66⅔% for farmers and fishermen) of the current year's tax or 100% of the previous year's tax, provided you filed a return for a 12-month period. Interest is not due if there was no tax liability in the previous year.

-

How do I complete the NC-40 form?

- Start with the worksheet to calculate your estimated tax for the year.

- Fill out your personal information and the amount of each payment.

- Detach the form and mail it with your payment to the specified address. Do not send cash or staple your payment to the form.

-

How and where do I mail my estimated tax payment?

Make your check or money order payable to the N.C. Department of Revenue and mail it along with your completed NC-40 form to: North Carolina Department of Revenue, P.O. Box 25000, Raleigh, NC 27640-0630. Ensure your social security number is on your payment for proper credit. To ensure proper processing, do not fold, staple, or tape your payment and form together.

Common mistakes

When it comes to managing taxes, individuals often find navigating the waters of estimated tax payments particularly challenging. The North Carolina Estimated Tax Payment Form NC-40 is a critical document for those who anticipate owing $1,000 or more in taxes beyond their withholdings and credits. However, errors can occur that lead to unnecessary stress or financial penalties. Here are five common mistakes to avoid:

-

Incorrect Calculation of Estimated Tax: The Amount of Estimated Income Tax is the tax expected to be owed for the year after deductions for withholdings and tax credits. A miscalculation here can lead to underpayment or overpayment of taxes. It's essential to carefully complete the worksheet on page 2 of the NC-40 instructions to accurately calculate this figure.

-

Failure to Adjust for Changes in Income or Exemptions: The initial estimation may change due to fluctuations in income or exemptions throughout the year. This necessitates adjustments in the amount of estimated tax payments later in the year, following the outlined schedule for payment dates after significant changes.

-

Incorrect Personal Information: Filling in one's name, address, and Social Security number accurately on the form is vital. For joint returns, ensure both spouses' names and Social Security numbers are correctly entered. Any error can cause delays or misapplied payments.

-

Not Following Payment Submission Instructions: Payments must be made in U.S. currency, and the check or money order should be payable to the N.C. Department of Revenue. Including the social security number on the payment instrument is crucial. It's also important to mail the form and payment to the correct address without folding, stapling, or taping them together.

-

Misunderstanding Payment Deadlines: Estimated income tax payments have specific due dates—typically April 15, June 15, September 15, and January 15 of the following year. Failure to meet these deadlines can lead to underpayment interest. However, exceptions exist for farmers, fishermen, and those with fiscal year incomes, which offer different schedules and requirements.

Avoiding these mistakes not only ensures compliance with North Carolina's tax laws but also can prevent the accrual of interest from underpayment of estimated taxes. It's always advisable to consult the detailed instructions provided by the North Carolina Department of Revenue or seek professional tax advice to navigate these responsibilities effectively.

Documents used along the form

When managing taxes, especially estimated tax payments, it's not just the NC-40 Individual Estimated Income Tax form you need to be familiar with. There are several other documents and forms that play a critical role throughout the process. Understanding each of these documents will ensure a smoother tax handling experience.

- Form D-400: North Carolina Individual Income Tax Return. This is the primary tax return form for individuals, where you report your annual income, calculate the tax due, and subtract credits and payments.

- Form D-422: Underpayment of Estimated Tax by Individuals. If you didn't pay enough tax throughout the year either through withholding or by making estimated tax payments, this form helps calculate any interest due.

- Form NC-4: Employee’s Withholding Allowance Certificate. This form is used to determine the amount of state tax withholding from an employee's paycheck. Adjustments made here can influence whether you owe or receive a refund during tax season.

- Form NC-4 EZ: Very similar to Form NC-4, but simpler for individuals with straightforward tax situations, aiming to have their tax withheld as closely to their tax liability as possible.

- Form D-400V: Payment Voucher for Individual Income Tax. If you owe tax with your Form D-400, this voucher is used to make a payment. It ensures that your payment is credited correctly to your account.

- Form NC-40 Worksheet: A crucial part of the NC-40 instructions, this worksheet helps estimate the amount of tax you should pay for the year. It's a good starting point before filling out the NC-40 form itself.

- Form NC-3: Annual Withholding Reconciliation. Employers use this form to report the total income taxes withheld from all employees. While not used by individual taxpayers, it's an important part of overall tax reporting.

It's important to accurately complete and properly use each of these forms in conjunction with the NC Estimated Tax Payment form to avoid penalties, ensure correct payment or refund, and maintain compliance with North Carolina tax laws. Ensuring that all your tax documents are in order can prevent unnecessary stress and financial strain down the line.

Similar forms

The NC Estimated Tax Payment form, or Form NC-40, is a critical tool for individuals to manage their tax obligations in anticipation of their annual filings. It closely resembles the Federal Form 1040-ES, "Estimated Tax for Individuals," in purpose and structure. Like the NC-40, Federal 1040-ES provides a means for individuals, whether self-employed or earners with other sources of income not subject to withholding, to calculate and pay their estimated taxes quarterly. This process involves estimating annual income, subtracting any deductions and credits, and calculating the tax owed.

Another document similar to the NC-40 is the Form W-4, "Employee's Withholding Certificate," which is used at the federal level. Though the W-4 is primarily intended for new employees to determine the amount of money withheld from their paychecks for federal taxes, it shares the concept of planning ahead for tax obligations. Both forms aim to balance the year-end tax liability, but the W-4 focuses on adjusting withholdings directly through employment, whereas the NC-40 is for making estimated payments directly to the state treasury.

Form D-400, "North Carolina Individual Income Tax Return," is the end-of-year filing document that reconciles the actual income earned and taxes owed against the estimated payments made using the NC-40. This document represents the culmination of the estimated tax process, where individuals report their total yearly income, tax deductions, credits, and payments. Taxpayers use it to determine whether they have overpaid (and are due a refund) or underpaid their taxes (owing more).

The Form NC-4, "Employee's Withholding Allowance Certificate," is the state counterpart to the federal W-4 form and is akin to the NC-40 in its purpose to manage tax withholding. While the NC-4 affects how much state income tax is withheld from an employee's paycheck throughout the year, the NC-40 is for individuals who may not have taxes withheld or need to make adjustments to cover their tax liability adequately. Both forms ensure taxpayers meet their state tax obligations efficiently.

Form 1099, particularly the 1099-MISC, is used to report miscellaneous income that might not be subject to regular withholding, similar to situations necessitating the use of Form NC-40. Independent contractors, freelancers, and others who receive non-employee compensation use the 1099-MISC to report their earnings. Individuals receiving this form often need to make estimated tax payments using the NC-40 if the tax due on their income, after deductions and credits, is expected to be $1,000 or more.

Form D-422, "Underpayment of Estimated Tax by Individuals," is directly related to the NC-40, offering a method to calculate interest due on underpayments of estimated tax. If individuals do not make estimated payments as required or underpay, they must calculate the interest on these underpayments using D-422. This form underscores the importance of accurately calculating and making estimated tax payments on time to avoid additional interest charges.

The Schedule SE (Form 1040), "Self-Employment Tax," is primarily a federal form used by individuals to calculate the tax due on net earnings from self-employment. While it's for federal tax purposes, it parallels the NC-40's objective by addressing a specific taxpayer group—those whose income sources do not have taxes automatically withheld. Self-employed individuals may use the Schedule SE to determine their federal self-employment tax liabilities and then make estimated tax payments accordingly, similar to how the NC-40 is used for state tax obligations.

Each of these documents serves to facilitate tax compliance through estimation, withholding adjustments, or annual reconciliation. While their applications may vary, from adjusting withholdings directly from paychecks to making estimated payments for anticipated tax liabilities, their collective goal is to aid taxpayers in meeting their tax obligations accurately and on time.

Dos and Don'ts

When filling out the NC Estimated Tax Payment form (NC-40), there are several dos and don'ts to keep in mind:

- Do carefully estimate your income tax to prevent underpayment or overpayment. This calculation incorporates your expected annual income minus any withholdings and applicable tax credits.

- Do not assume the amount of estimated tax you need to pay remains constant if your financial situation changes. Update your estimates as needed.

- Do make your first estimated income tax payment by April 15, following either the lump sum or quarterly payment options as detailed in the guidelines.

- Do not ignore the due dates for each payment. If a due date falls on a weekend or holiday, remember the payment is due the next business day.

- Do consider adjusting your withholding taxes instead of making estimated payments if it will eliminate the risk of owing $1,000 or more at tax time.

- Do not send cash. Make your check or money order payable to the NC Department of Revenue and ensure U.S. currency is used.

- Do include your social security number on your check or money order for identification and processing accuracy.

- Do not staple, tape, or otherwise attach your payment to the submission form to ensure proper handling and credit to your account.

Following these guidelines will help ensure that your NC Estimated Tax Payment process is smooth and correct, potentially avoiding penalties for underpayment or late payments. Always keep abreast of changes in tax legislation and adjust your payments accordingly to reflect your current financial situation.

Misconceptions

There are several misconceptions about the North Carolina Estimated Tax Payment form (NC-40) that individuals may have. Understanding these misconceptions can help taxpayers avoid making errors when fulfilling their tax obligations. Below are six common misconceptions clarified:

- Everyone must make estimated tax payments. Not all individuals are required to make estimated tax payments. Only those who expect to owe $1,000 or more in taxes for the year, after accounting for withholdings and tax credits, need to do so.

- Payments are only due on April 15. While the first payment is generally due by April 15, taxpayers can choose to pay all their estimated tax at once or make four equal payments by April 15, June 15, September 15, and January 15 of the following year. Payment deadlines adjusted for weekends or holidays extend to the next business day.

- Estimated payments are calculated based on the current year’s tax rate only. Taxpayers have options when calculating their payments: they can base their estimated payments on 100% of the tax shown on the prior year’s return, 90% of the current year’s tax, or, for farmers and fishermen, 66 2/3% of the current year's tax.

- Underpayment or late payments always result in interest charges. Interest charges for underpayment or late payments do not apply if each installment is paid on time and is at least 25% of the due taxes for the year. Additionally, if there was no tax liability in the previous year, underpayment interest will not be charged.

- Filing an income tax return by January 31 eliminates the need for the last estimated tax payment. Taxpayers who file their income tax return (Form D-400) by January 31 of the following year and pay the entire balance due may avoid the final installment due on January 15. This offers a way to settle any remaining tax debt without adhering strictly to the estimated payment schedule.

- Overpaying in one year complicates the process for the next year. If taxpayers overpay their taxes in one year, they can choose to apply the overpayment to the estimated taxes for the following year. This can simplify the estimated tax payment process and reduce the amount required for future installments.

Understanding these aspects of the NC-40 form can assist taxpayers in making accurate and timely payments, potentially avoiding unnecessary penalties and interest charges. It’s also important to consult with a tax professional or the NC Department of Revenue for personalized advice and guidance.

Key takeaways

When you need to make estimated income tax payments in North Carolina, it's crucial to understand the process to avoid any potential penalties. Here are five key takeaways to guide you through using the NC Estimated Tax Payment form (NC-40):

- Determine If You Must Pay: You are required to make estimated income tax payments if the tax you owe, minus withholdings and credits, is $1,000 or more. Calculate your estimated income to avoid large payments when filing your return and to prevent interest charges for underpayment.

- Payment Schedule: Estimated tax payments are typically due in four equal installments on April 15, June 15, September 15, and January 15 of the following year. If these dates fall on a weekend or holiday, payments are due the next business day. Your situation may alter these dates, so stay informed on specific deadlines applicable to you.

- Farmers and Fishermen Special Rules: If two-thirds of your gross income comes from farming or commercial fishing, you have the option to pay your estimated tax in full by January 15 of the following year or file and pay with Form D-400 by March 1, thereby skipping estimated payments.

- Avoiding Interest Charges: Interest charges for underpayment can be avoided if each of your four installment payments is at least 25% of the required annual amount, based on accurate income predictions. This percentage differs for farmers and fishermen (66 2/3%) and is determined against either 90% of the current year's tax, 100% of the previous year's tax (if it was a 12-month return), or 90% of the tax calculated by annualizing your income to the month prior to the installment.

- Completing and Submitting Form NC-40: To complete the form, first use the worksheet provided to calculate your estimated tax. Then, fill out the form with your personal details, enter the amount of your payment, and make your check or money order payable to the N.C. Department of Revenue. Ensure your social security number is on the check or money order. Finally, mail the form and payment without folding, stapling, or attaching them together to ensure proper credit.

Understanding these key points helps in managing your income tax effectively, avoiding underpayment penalties, and ensuring smooth processing of your payments.

Popular PDF Documents

Rushmore Loss Mitigation - A change in circumstances leading to reapplication requires a detailed letter of explanation and corresponding documentation to outline the change.

Efile W2c - Filing a W-2c is necessary when errors are discovered on the employee's income or tax information.

1120s K1 - The document includes sections for deductions such as salaries, business expenses, and other operational costs to calculate taxable income accurately.