Get Navy Federal Payment On Death Form

Ensuring the management of your assets and the smooth transition of funds to your loved ones after your passing can be a significant concern. The Navy Federal Payable on Death (POD) Designation form serves as a vital tool in this regard, allowing members to establish, update, or remove POD designations and/or beneficiaries for accounts such as savings, checking, Money Market Savings Accounts (MMSA), or certificates. To make this request effective, it is mandatory that all account holders sign the form, indicating a thorough consensus on the future handling of the funds. Furthermore, the form enables the designation of accounts that will include the POD designation, whether all existing individual or joint accounts and those established in the future or only specific accounts identified by the member. It also offers the flexibility to appoint, replace, add, or remove beneficiaries, ensuring member's intentions are clear regarding who should benefit from their assets posthumously. The legal intricacies of the form, such as the necessity for all account holders' signatures and the detailed information required for both primary and contingent beneficiaries, underline its importance in estate planning. Additionally, it emphasizes Navy Federal's adherence to federal laws requiring identification verification for account holders, and the implications of the form's survivorship designations. This comprehensive approach underscores Navy Federal Credit Union's commitment to its members' financial security and posthumous wishes, making the POD Designation form an essential component of financial and estate planning for its members.

Navy Federal Payment On Death Example

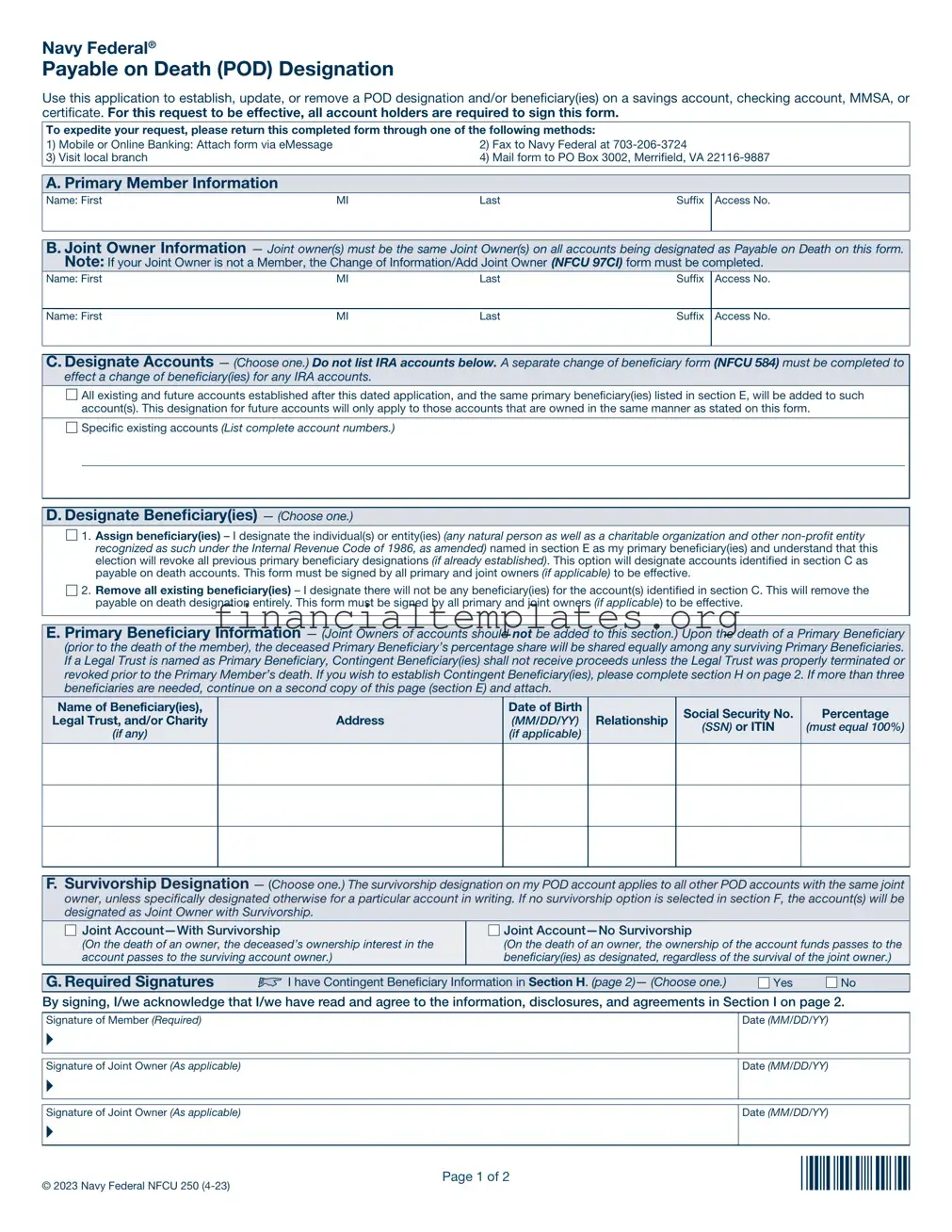

Navy Federal®

Payable on Death (POD) Designation

Use this application to establish, update, or remove a POD designation and/or beneficiary(ies) on a savings account, checking account, MMSA, or certificate. For this request to be effective, all account holders are required to sign this form.

To expedite your request, please return this completed form through one of the following methods: |

|||

1) |

Mobile or Online Banking: Attach form via eMessage |

2) |

Fax to Navy Federal at |

3) |

Visit local branch |

4) |

Mail form to PO Box 3002, Merrifield, VA |

A. Primary Member Information

Name: First |

MI |

Last |

Suffix |

Access No. |

|

|

|

|

|

B. Joint Owner Information — Joint owner(s) must be the same Joint Owner(s) on all accounts being designated as Payable on Death on this form. Note: If your Joint Owner is not a Member, the Change of Information/Add Joint Owner (NFCU 97CI) form must be completed.

Name: First |

MI |

Last |

Suffix |

Access No.

Name: First |

MI |

Last |

Suffix |

Access No.

C. Designate Accounts — (Choose one.) Do not list IRA accounts below. A separate change of beneficiary form (NFCU 584) must be completed to effect a change of beneficiary(ies) for any IRA accounts.

☐All existing and future accounts established after this dated application, and the same primary beneficiary(ies) listed in section E, will be added to such account(s). This designation for future accounts will only apply to those accounts that are owned in the same manner as stated on this form.

☐Specific existing accounts (List complete account numbers.)

D.Designate Beneficiary(ies) — (Choose one.)

☐1. Assign beneficiary(ies) – I designate the individual(s) or entity(ies) (any natural person as well as a charitable organization and other

election will revoke all previous primary beneficiary designations (if already established). This option will designate accounts identified in section C as payable on death accounts. This form must be signed by all primary and joint owners (if applicable) to be effective.

☐2. Remove all existing beneficiary(ies) – I designate there will not be any beneficiary(ies) for the account(s) identified in section C. This will remove the payable on death designation entirely. This form must be signed by all primary and joint owners (if applicable) to be effective.

E.Primary Beneficiary Information — (Joint Owners of accounts should not be added to this section.) Upon the death of a Primary Beneficiary (prior to the death of the member), the deceased Primary Beneficiary’s percentage share will be shared equally among any surviving Primary Beneficiaries. If a Legal Trust is named as Primary Beneficiary, Contingent Beneficiary(ies) shall not receive proceeds unless the Legal Trust was properly terminated or revoked prior to the Primary Member’s death. If you wish to establish Contingent Beneficiary(ies), please complete section H on page 2. If more than three beneficiaries are needed, continue on a second copy of this page (section E) and attach.

Name of Beneficiary(ies), Legal Trust, and/or Charity

(if any)

Address

Date of Birth

(MM/DD/YY) (if applicable)

Relationship

Social Security No.

(SSN) or ITIN

Percentage

(must equal 100%)

F.Survivorship Designation — (Choose one.) The survivorship designation on my POD account applies to all other POD accounts with the same joint owner, unless specifically designated otherwise for a particular account in writing. If no survivorship option is selected in section F, the account(s) will be designated as Joint Owner with Survivorship.

Joint

Joint

(On the death of an owner, the deceased’s ownership interest in the account passes to the surviving account owner.)

Joint

Joint

(On the death of an owner, the ownership of the account funds passes to the beneficiary(ies) as designated, regardless of the survival of the joint owner.)

G. Required Signatures |

I have Contingent Beneficiary Information in Section H. (page 2)— (Choose one.) |

|

Yes |

|

No |

|

|

||||

|

|

|

|

|

|

By signing, I/we acknowledge that I/we have read and agree to the information, disclosures, and agreements in Section I on page 2.

Signature of Member (Required)

▸

Signature of Joint Owner (As applicable)

▸

Signature of Joint Owner (As applicable)

▸

Date (MM/DD/YY)

Date (MM/DD/YY)

Date (MM/DD/YY)

© 2023 Navy Federal NFCU 250

Page 1 of 2

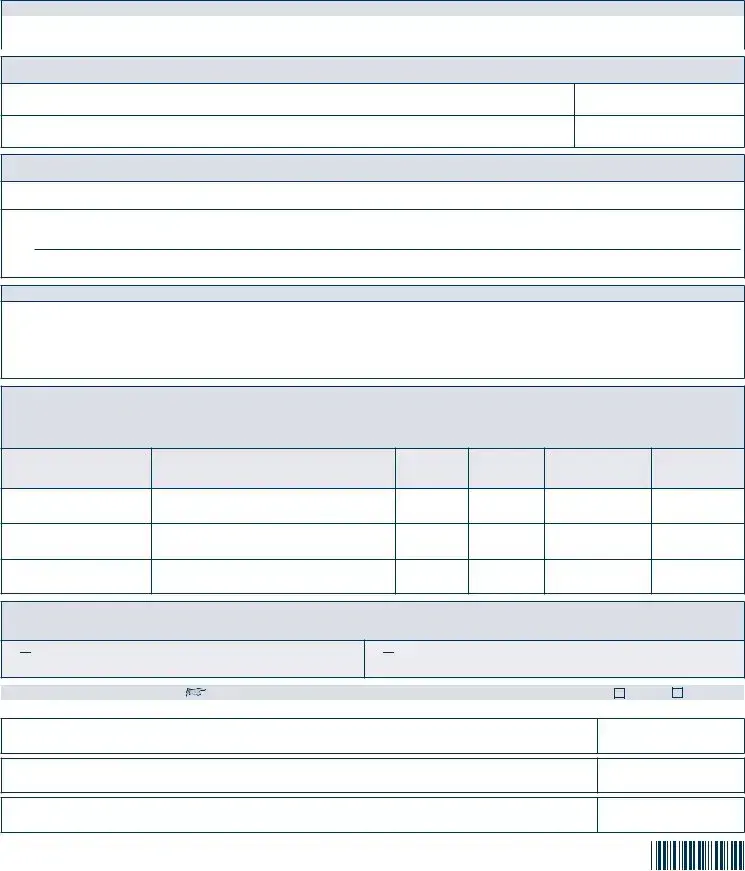

H. Contingent Beneficiary Information — (Optional) Distributions will be made to Contingent Beneficiary(ies), only if all Primary Beneficiary(ies) is/are deceased. (Upon the death of a Contingent Beneficiary, the deceased Contingent Beneficiary’s percentage share will be shared equally among any surviving Contingent Beneficiaries.) If a Legal Trust is named as Primary Beneficiary, Contingent Beneficiary(ies) shall not receive proceeds unless the Legal Trust was properly terminated or revoked prior to the Primary Member’s death.

Name of Beneficiary(ies), Legal Trust, and/or Charity

(if any)

Address

Date of Birth

(MM/DD/YY) (if applicable)

Relationship

Social Security No.

(SSN) or ITIN

Percentage

(must equal 100%)

I.SurvivorshipSurvivorshipDesignationDesignationandandDisclosureDisclosureAgreementAgreement

I/We hereby request a Payable on Death (POD) designation for the beneficiary(ies) listed for the account(s) designated in this application, and I/we agree to the designations, beneficiary(ies), and survivorship designation on this form, and the terms of this Disclosure, as amended from time to time by Navy Federal Credit Union (Navy Federal) in its sole discretion.

It is understood and agreed that subject to the credit union’s bylaws and applicable state and federal laws, rules, and regulations, all sums paid into the account(s) may be pledged to the credit union as security for a loan by me, the joint owner, or both, if applicable, and further that all account funds may be withdrawn in whole or in part by any account holder.

I acknowledge that membership at Navy Federal comes with certain ongoing responsibilities. By signing this document, my joint owner(s), if any, and I agree to abide by the terms and conditions of all accounts or services that I/we receive at Navy Federal. These terms and conditions are disclosed in accordance with applicable state and federal laws and are provided in the disclosure and agreement forms. If “Joint Account with Survivorship” is selected, then upon the death of either account holder, Navy Federal reserves the right to

Upon the death of all the account holders, if the designation is “With Survivorship,” or upon the death of the primary member if the designation is “No Survivorship,” funds in the account(s) shall be made payable and distributed to the surviving primary beneficiary, or if more than one beneficiary, to the surviving primary beneficiaries equally (including any named Legal Trust) unless a percentage designation is indicated (Section E). If a designated primary beneficiary predeceases the member, then the deceased primary beneficiary’s percentage share (including the proper termination or revocation of a legal trust) will be shared equally among any surviving primary beneficiaries. If a member’s Legal Trust is a named primary beneficiary, then any contingent beneficiary(ies) named in Section H shall not receive proceeds unless the Legal Trust was properly terminated or revoked prior to the primary member’s death. Distributions will be made to contingent beneficiary(ies) named in Section H, only if all primary beneficiary(ies) is/are deceased or, if applicable, a member’s Legal Trust was properly terminated or revoked. Further, upon the death of a contingent beneficiary (including the proper termination or revocation of a legal trust), the deceased contingent beneficiary’s percentage share will be shared equally among any surviving contingent beneficiaries.

I/We understand and agree that I/we am/are responsible for properly designating the respective percentage shares for the respective beneficiaries so that the total percentage equals 100%. If there is a discrepancy in the percentage shares and the total does not equal 100%, then I/we agree that the designation shall automatically be determined for the surviving beneficiaries to share the distribution equally.

I/We have read and agree to the terms and conditions of the Important Disclosure Booklet (NFCU 606). Property may be transferred to the appropriate state if there has been no activity within the time period specified by state law. I/We understand that Navy Federal reserves the right

to enforce a statutory lien against any savings and dividends I/we have individually or jointly on deposit at Navy Federal if I/we fail to satisfy any financial obligation I/we have with Navy Federal. Navy Federal may enforce this right without prior notice.

I/We understand and agree that I/we must notify the credit union if any new account should not be included under this POD designation if I/we have requested that all existing and any future account(s) be included in the POD designation.

The beneficiary designation above shall not apply to any type of Individual Retirement Account (IRA) that I have now or in the future, including savings, money market savings, and certificate IRA accounts. I understand that a separate change of beneficiary form (NFCU 584) must be completed to effect a change of beneficiary(ies) for any IRA account.

Beneficiary(ies) may be changed at any time by submitting a new POD Designation form (NFCU 250), signed by all account holders, as applicable, to be effective.

I agree and understand that if I desire a voluntary closure or shutdown of my POD account(s), then my accounts will not have a POD designation or any beneficiary(ies), and that I must further complete and submit a new POD Designation form (NFCU 250) to establish a POD account with new designation, beneficiary(ies), and survivorship designation for any desired account(s).

I agree that if there is a security compromise of my POD account(s), then my POD account(s) may be closed and new POD account(s) will be established for administrative purposes. I agree and understand the new POD account(s) established by Navy Federal will have the same designations, beneficiary(ies), and survivorship designations as this current POD form. If any changes or additions to the newly established POD account(s) are desired, then a new POD Designation form (NFCU 250) must be completed, signed by all account holders (as applicable), and submitted to be effective.

The survivorship designation on this form shall supersede the designation on all accounts included with this form.

Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account, including joint owners and authorized signers. What this means for you: When you open an account, we will ask you for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents. It may be necessary for Navy Federal to restrict account access or delay the approval of loans pending further verification.

Notice of Claim: Neither you nor Navy Federal may commence, join, or be joined to any judicial action (as either an individual litigant or the member of a class) that arises from the other party’s actions pursuant to this Agreement or that alleges that the other party has breached any provision of, or any duty owed by reason of, this Agreement, until such party has notified the other party of such alleged breach and afforded the other party a reasonable period after the giving of such notice to take corrective action.

© 2023 Navy Federal NFCU 250

Page 2 of 2

Document Specifics

| Fact Name | Fact Detail |

|---|---|

| Form Purpose | Used to establish, update, or remove a Payable on Death (POD) designation and/or beneficiary(ies) on designated Navy Federal accounts. |

| Requirement for Effectiveness | Must be signed by all account holders to be effective. |

| Applicable Accounts | Includes savings, checking, Money Market Savings Accounts (MMSA), or certificates. Separate form required for IRA accounts. |

| Beneficiary Designation Options | Options to assign, replace, add, or remove beneficiaries. |

| Beneficiary Information | Beneficiary designation does not apply to IRA accounts; requires form NFCU 584 for IRA beneficiary changes. |

| Survivorship Designation | Allows for either "Joint Account with Survivorship" or "No Survivorship," determining how account funds are distributed upon death of the owner(s). |

| Navy Federal Contact Information | Phone number: 1-888-842-6328, Fax number: 703-206-3724, Address: PO Box 3002, Merrifield, VA 22116-9887 |

| Impact of Legal Trust as Beneficiary | If a Legal Trust is named as beneficiary, it supersedes any individually named beneficiaries, with payment made in full to the Trust. |

| Disclosure Agreement | Signatories agree to Navy Federal Credit Union's terms, acknowledge ongoing responsibilities, and understand the statutory lien rights of Navy Federal against deposits for unsatisfied financial obligations. |

Guide to Writing Navy Federal Payment On Death

Filling out the Navy Federal Payment On Death (POD) form is important for designating beneficiaries for your accounts in the unfortunate event of your death. This ensures your savings, checking, MMSA, or certificate account(s) are distributed according to your wishes. Here are the steps you'll need to follow to complete the form correctly.

- Start with Section A: Primary Member Information. Enter your full name, including first name, middle initial (MI), last name, and any suffix. Also, provide your Access Number.

- In Section B: Joint Owner Information, indicate whether the joint owner is a current member by checking the appropriate box. If yes, only the name and Access Number are required. If no, fill out the entire section including name, social security number, address details, date of birth, ID information, and Access Number.

- For Section C: Designated Accounts, choose the appropriate option regarding your POD designation. Whether you want to add or remove a POD designation to all accounts, only existing accounts, or specific account numbers. Check the corresponding box and list any relevant account numbers if necessary.

- Move on to Section D: Designate Beneficiary(ies). Select whether you're assigning, replacing, adding, or removing beneficiaries. Fill out the beneficiary details as instructed, including name(s), address, date of birth, relationship, Social Security number or ITIN, and the percentage of the benefit (if applicable). Make sure the combined percentages total 100% to avoid an equal distribution by default.

- Complete Section E: Beneficiary Information based on your selection in Section D. If naming a Legal Trust as the beneficiary, complete Part I. Otherwise, for individual beneficiaries, skip to Part II intending to designate primary and, optionally, contingent beneficiaries with their details and shares.

- In Section F: Survivorship Designation and Disclosure Agreement, read carefully and understand the survivorship designations. Choose between "Joint Account with Survivorship" or "Joint Account - No Survivorship" and acknowledge the terms around account pledging, membership responsibilities, rights upon death of account holders, and the distribution of funds to beneficiaries.

- Review the information on the bottom of page 2 and page 3 meticulously, understanding the requirements about the POD designation, account access, financial obligations, and the legal ID verification process.

- Lastly, in Section G: Required Signatures, ensure that all account holders sign and date the form. This includes the primary member and, where applicable, the joint owner(s).

After completing all steps, verify your form for accuracy and completeness. Submit it to Navy Federal Credit Union as directed to ensure your POD designations are recorded according to your wishes.

Understanding Navy Federal Payment On Death

What is the purpose of the Navy Federal Payment On Death (POD) form?

The Navy Federal Payment On Death (POD) form serves as a tool for account holders to establish, update, or remove a POD designation and/or beneficiary(ies) on their savings, checking, MMSA, or certificate account(s). By completing this form, an account holder directs Navy Federal Credit Union on how to distribute the account's funds upon the account holder's death, ensuring that assets are passed to the intended individuals or entities without the need for probate.

Who needs to sign the POD designation form for it to be effective?

All account holders must sign the POD designation form for it to be effective. This requirement ensures that all parties with an interest in the account have agreed to the designation of beneficiaries and the distribution of the account's funds upon the death of one or more of the account holders.

Can the POD designation be applied to all types of Navy Federal accounts?

The POD designation can be applied to individual and joint savings, checking, Money Market Savings Accounts (MMSA), and certificate accounts. However, it cannot be applied directly to Individual Retirement Arrangement (IRA) accounts through this form. For IRA accounts, a separate change of beneficiary form (NFCU 584) must be completed to effectuate a change of beneficiary(ies).

How does one add or change beneficiaries on a Navy Federal account using the POD form?

To add or change beneficiaries on a Navy Federal account, account holders must complete the designated section of the POD form. This section allows for the assignment of new beneficiary(ies), replacement of existing ones, addition of beneficiaries to supplement existing designations, or removal of existing beneficiaries. Account holders must clearly indicate the change they intend to make and specify the share percentages for each beneficiary if not distributing equally. Form completion and signatures from all account holders are required for these changes to take effect.

What happens if the designated beneficiaries on the POD form do not add up to 100%?

If the distribution percentages assigned to the designated beneficiaries do not add up to 100%, or if there is a discrepancy that results in the total not being exactly 100%, then the funds in the account will be distributed equally among the surviving beneficiaries. This automatic equal distribution ensures that all designated beneficiaries receive a share of the account funds, even if the account holder's designation instructions were unclear or incomplete.

Common mistakes

When filling out the Navy Federal Payment on Death (POD) form, it's crucial to avoid common mistakes that could impact the execution of your wishes. The following list highlights nine common errors individuals make:

- Not signing the form: For the POD designation to be effective, the form must be signed by all account holders. An unsigned form cannot be processed.

- Failing to designate a beneficiary: Neglecting to name a beneficiary means no individual or entity is specified to receive the account's funds upon the account holder's death.

- Incomplete beneficiary information: Only including partial information for beneficiaries (e.g., missing Social Security Number or date of birth) can delay or prevent the distribution of funds.

- Incorrectly assigning percentage shares: If percentages for beneficiaries don’t total 100% or are left blank, this can lead to unintended equal distribution among surviving beneficiaries.

- Using a Post Office Box for addresses: The form expressly requires physical addresses for both account holders and beneficiaries and will not accept a P.O. Box.

- Not updating beneficiary information: Changes in personal circumstances (e.g., marriage, divorce) may necessitate updates to beneficiaries that are often overlooked.

- Misunderstanding the survivorship designation: Failing to clearly understand or correctly indicate the desired option for survivorship can lead to assets being distributed in a manner contrary to the account holder's wishes.

- Overlooking the necessity to use a separate form for IRA accounts: Beneficiary designations for IRA accounts require a different form (NFCU 584) and are not covered by the POD designation form.

- Excluding future accounts or failing to notify Navy Federal of exceptions: If account holders want all existing and future accounts to carry the same POD designation, or if there are exceptions, this must be clearly communicated and documented.

While filling the Navy Federal POD form, individuals should:

- Review all sections thoroughly to ensure accuracy and completeness.

- Ensure that all required signatures are obtained and properly documented.

- Keep a personal copy of the form once submitted for record-keeping and future reference.

By avoiding these common errors, individuals can help ensure their intentions are clearly communicated and effectively executed with Navy Federal Credit Union.

Documents used along the form

When establishing a Payable on Death (POD) designation with Navy Federal Credit Union, it's important to consider other legal documents and forms that may complement or necessitate completion in conjunction to ensure all aspects of one's financial and estate planning are fully addressed. These documents play a critical role in delineating the disposition of assets and specifying wishes in various scenarios, far beyond the scope of a POD designation. Understanding these forms can provide a comprehensive approach to financial planning and estate management.

- Will: This legal document outlines how one's assets and estate will be distributed upon their death. It specifies executors, guardians for minors, and directions for payment of taxes and debts.

- Durable Power of Attorney: Authorizes a trusted person to manage financial and legal affairs on one's behalf in the event they become incapacitated.

- Healthcare Proxy or Medical Power of Attorney: Designates an individual to make healthcare decisions if one is unable to communicate their wishes due to illness or incapacitation.

- Living Will: Documents one's wishes regarding medical treatment in terminal conditions or persistent vegetative states when they can no longer make decisions for themselves.

- Revocable Living Trust: Allows for the management and distribution of one's assets during their lifetime, and after death, while potentially avoiding probate.

- Beneficiary Designations for IRAs and Retirement Plans: Specifies beneficiaries for retirement accounts, which supersede instructions in a will.

- Financial Information Sheet: Contains a comprehensive list of accounts, account numbers, and contact information for financial institutions, assisting executors or family members in managing financial affairs.

- Digital Asset Management Plan: Provides instructions and permissions for dealing with digital assets, including social media accounts, digital files, and online banking accounts, upon one’s demise.

Incorporating these forms into one's estate planning can ensure a well-rounded strategy that addresses various aspects of personal and financial well-being. Each document serves a unique purpose, collectively contributing to a detailed and effective estate plan. Proper completion and regular updating of these forms, in consultation with legal and financial professionals, can offer peace of mind and security for both the individual and their loved ones.

Similar forms

The Navy Federal Payable on Death (POD) designation form shares similarities with a Last Will and Testament, in that both documents specify beneficiaries who are to receive assets upon the death of the individual making the designation. A Last Will and Testament is a legal document that communicates a person's final wishes pertaining to possessions and dependents. Like the Navy Federal POD form, the will names beneficiaries who will inherit the assets, though a will can encompass a wider range of assets and complex arrangements, and generally requires legal and often judicial oversight to enforce.

Similarly, a Transfer on Death (TOD) account registration allows account holders to designate beneficiaries to receive assets at the time of their death, without the assets having to pass through probate. This is akin to the Navy Federal POD form’s objective for designated accounts. Both TOD and POD designations aim to streamline the transfer of assets upon death, making them immediately accessible to named beneficiaries without the need for court intervention, which can be both time-consuming and costly.

The designation of a beneficiary on insurance policies is another document type that resembles the Navy Federal POD form. Insurance policies, such as life insurance, allow the policyholder to name one or more beneficiaries to receive the policy’s benefits upon the policyholder’s death. This direct designation ensures the benefits bypass the probate process, directly aiding the beneficiaries similarly to how the POD designation allows for the swift transfer of account funds to the named beneficiaries.

Retirement accounts, such as 401(k)s and Individual Retirement Accounts (IRAs), often include a beneficiary designation form. This form enables the account holder to name who will inherit the account's assets upon their death. Much like the Navy Federal POD form, these beneficiary designations facilitate the transfer of the account’s assets directly to the named beneficiaries, avoiding probate and ensuring the intended parties receive the assets in a more expedited manner.

A Living Trust is a legal document that allows for the management of an individual's assets during their lifetime and specifies how those assets are distributed upon death. While more comprehensive and versatile than a Navy Federal POD form, which strictly deals with specific account designations, a Living Trust serves a similar purpose in ensuring assets are transferred to beneficiaries as intended by the trust creator, without the need for probate proceedings.

Automobile or real estate titles that include a TOD or beneficiary deed work under similar principles to the Navy Federal POD form. These titles allow the property owner to name a beneficiary who will inherit the asset upon the owner’s death. Just like the POD account designation, TOD registrations and beneficiary deeds help avoid the probate process for these assets, making the transfer straightforward and efficient.

Finally, similar to a Payable on Death designation form, a Joint Tenancy with Rights of Survivorship (JTWROS) agreement allows owners of property to ensure that upon the death of one owner, the surviving owner(s) automatically assume the deceased owner's share of the property. While this arrangement is typically used for real estate, the concept of bypassing probate and instantly transferring ownership aligns with the purpose behind the Navy Federal’s POD designation, which similarly aims to immediately transfer financial assets to designated survivors.

Dos and Don'ts

When filling out the Navy Federal Payment On Death (POD) form, it's essential to follow specific guidelines to ensure your instructions are accurately recorded and legally binding. Here are six do's and don'ts to consider:

- Do read the entire form before starting. This helps you understand what information you need and avoid any mistakes.

- Do use black or blue ink when filling out the form. These colors are preferred because they are easier to read and photocopy.

- Do ensure all account holders sign the form where required. The form is not valid unless signed by everyone involved, making it a critical step.

- Don't leave any sections blank that apply to you. Incomplete information could lead to processing delays or the form being returned to you.

- Don't use a post office box address for the home addresses of the beneficiaries. The form specifically requires a physical address.

- Don't forget to accurately allocate the percentage shares among your beneficiaries to ensure the total equals 100%. If the percentages do not add up correctly, it could cause confusion or unintended distribution of your assets.

Following these guidelines will help ensure that your POD designation is processed smoothly and reflects your wishes correctly. Always double-check your entries and consult with Navy Federal Credit Union if you have any questions.

Misconceptions

When discussing the Navy Federal Payable on Death (POD) designation, several misconceptions often arise. It's important to clarify these inaccuracies to ensure that members accurately understand how to manage their accounts in the context of estate planning and beneficiary designations.

- Misconception 1: Adding a POD designation requires legal assistance. In reality, Navy Federal members can easily establish, update, or remove a POD designation by completing the designated form and obtaining the required signatures without the need for a lawyer.

- Misconception 2: A POD designation only applies to individual accounts. The form allows for POD designations on a range of account types including savings, checking, Money Market Savings Accounts (MMSA), and certificates, for both individual and joint accounts.

- Misconception 3: Only family members can be named as beneficiaries. Members have the flexibility to designate any individual(s) or entity, such as a legal trust, as a beneficiary, not just family members.

- Misconception 4: You cannot have multiple beneficiaries. The form permits members to assign, replace, add, or remove beneficiaries, allowing for the designation of multiple beneficiaries with specified percentage shares.

- Misconception 5: POD designations can also cover IRA accounts. Members must complete a separate form (NFCU 584) to change beneficiaries for any IRA account, as the POD designation form does not apply to IRA accounts.

- Misconception 6: Account holders do not have to sign the POD designation form for it to be effective. The form must be signed by all account holders, as applicable, to be valid and enforceable.

- Misconception 7: A POD designation guarantees immediate access to funds by beneficiaries upon the account holder's death. While it is designed to streamline the process, the distribution of funds may still require the submission of documentation and follow certain procedures as outlined by Navy Federal and applicable laws.

- Misconception 8: Once submitted, a POD designation cannot be changed. Account holders can change beneficiaries at any time by submitting a new POD Designation form, signed by all required parties, to Navy Federal.

Understanding these aspects of the Navy Federal POD designation form is crucial for making informed decisions about your account beneficiaries, ensuring your wishes are clearly communicated and can be more easily executed in the event of your passing.

Key takeaways

Filling out the Navy Federal Payment On Death (POD) form is essential for ensuring that your assets are distributed according to your wishes upon your passing. It allows Navy Federal Credit Union members to designate beneficiaries for their savings, checking, MMSA, or certificate accounts. This process can significantly simplify the management of your estate for your loved ones. Here are four key takeaways to consider when completing this form:

- To have the form be effective, it is mandatory that all account holders sign the POD Designation form. This requirement reinforces the importance of mutual agreement among all parties involved in the account, ensuring that the designations reflect the current intentions of all owners.

- The ability to add or remove a POD designation or beneficiaries provides flexibility for account holders. This feature allows for changes in the designation as personal circumstances evolve, such as marriage, divorce, births, and deaths within a family.

- For those with Individual Retirement Accounts (IRAs), a separate form (NFCU 584) must be completed. This distinction highlights the unique treatment and regulations surrounding retirement accounts, which often have different beneficiary implications and tax treatments compared to other account types.

- The designation options, including "Joint Account with Survivorship" and "Joint Account – No Survivorship," offer account holders nuanced choices in how their accounts are managed after their death. These options can affect how smoothly assets are transferred to the surviving account holders or beneficiaries, which can affect the financial well-being of survivors.

Understanding these key aspects of the Navy Federal POD form can greatly aid in effective estate planning. Proper completion and periodic review of this document ensure your assets are distributed as intended, providing peace of mind to both the account holders and their beneficiaries.

Popular PDF Documents

1120s K1 - This filing helps shareholders of S corporations understand their tax obligations based on the corporation's financial activities.

Does the Irs Accept Electronic Signatures on Form 1040 - For complex tax situations, the form allows taxpayers to appoint specialists, ensuring expert handling of specific tax-related issues.