Get Mp Commercial Tax 49 Form

Since July 7, 2011, the process of acquiring Form-49 through the Madhya Pradesh Commercial Tax Department's online portal, mptax.mp.gov.in, underwent significant updates to enhance efficiency and security for dealers. This form plays a crucial role for businesses in the state, necessitating a clear understanding of the updated procedure to download it. The outlined steps begin with the dealer logging in using their unique credentials, followed by navigating through the portal's options to request Form-49. A notable addition to the process is the implementation of a monthly limit on the number of Form-49s a dealer can download, a measure to ensure fair access and prevent misuse. Upon reaching the request page, dealers are informed of their remaining quota for the month. If the account indicates a zero balance, it suggests a restriction placed by the Commercial Tax Officer (CTO), necessitating direct contact for resolution. Conversely, when downloads are still available, filling out the required information and submitting the request leads to a prompt confirmation and instructions for retrieving the form's password. This streamlined, secure process exemplifies the department's commitment to leveraging technology for better service delivery, albeit with safeguards to monitor and control the distribution of Form-49 amongst registered dealers.

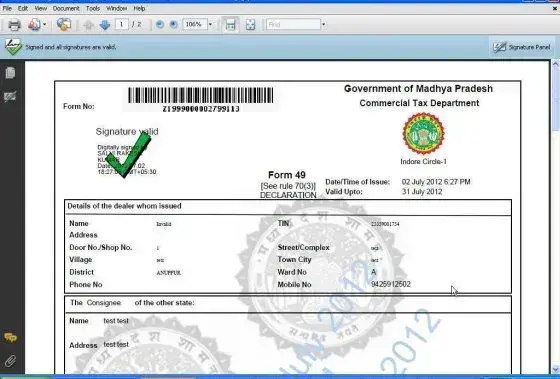

Mp Commercial Tax 49 Example

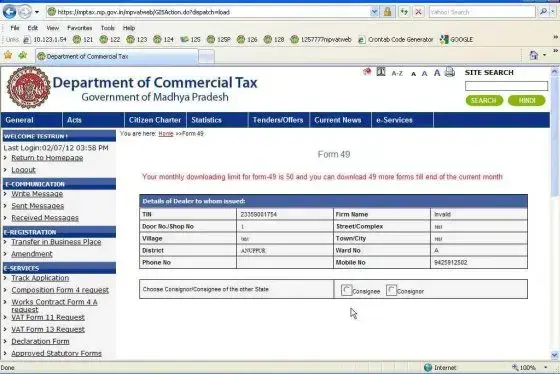

How to Download

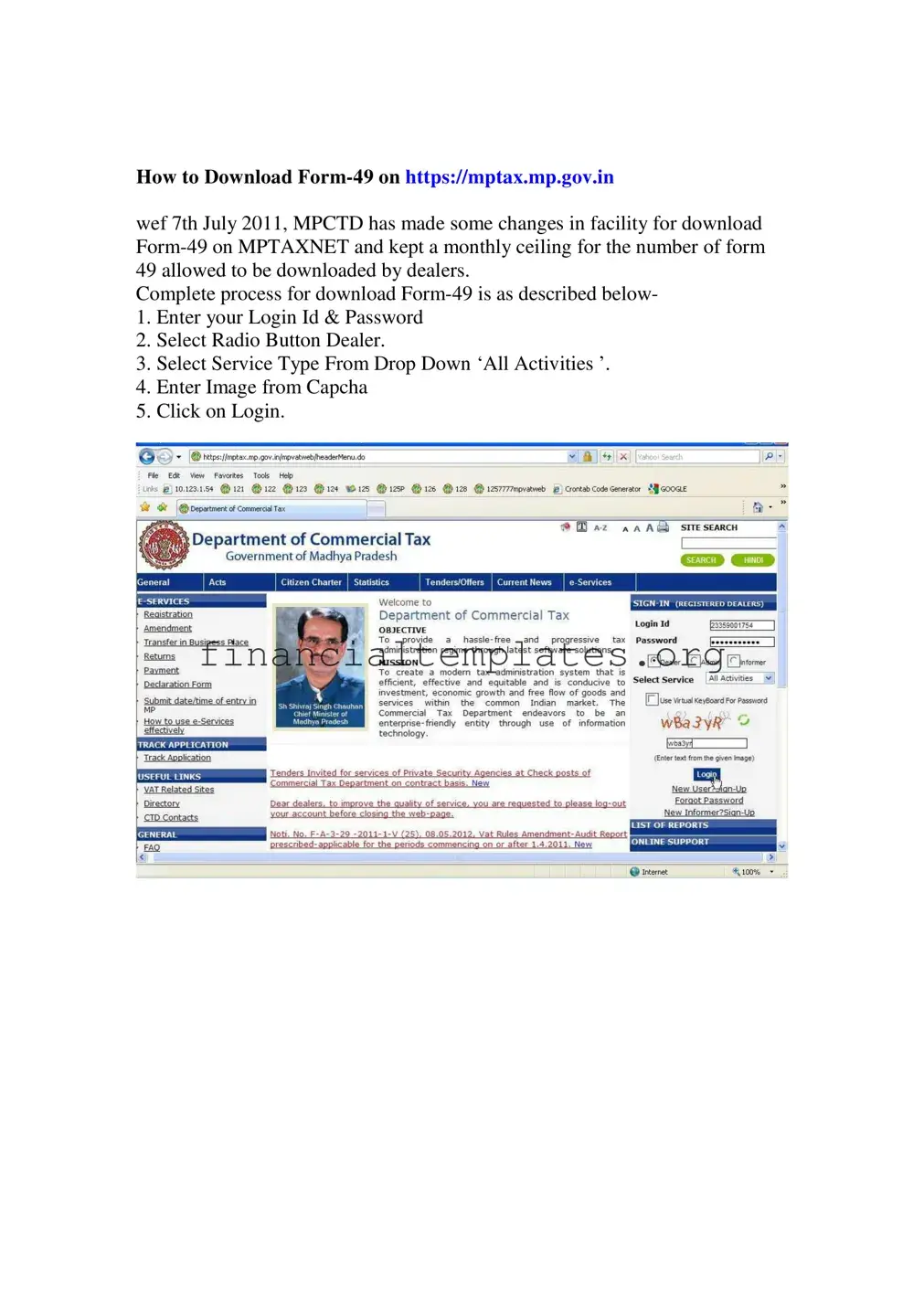

wef 7th July 2011, MPCTD has made some changes in facility for download

Complete process for download

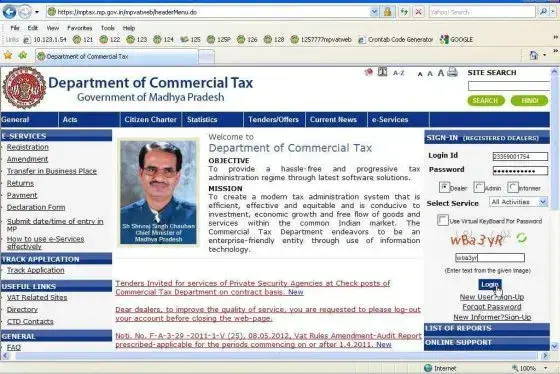

1.Enter your Login Id & Password

2.Select Radio Button Dealer.

3.Select Service Type From Drop Down ‘All Activities ’.

4.Enter Image from Capcha

5.Click on Login.

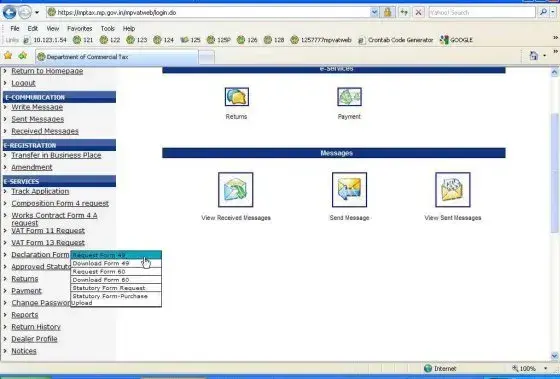

Click On

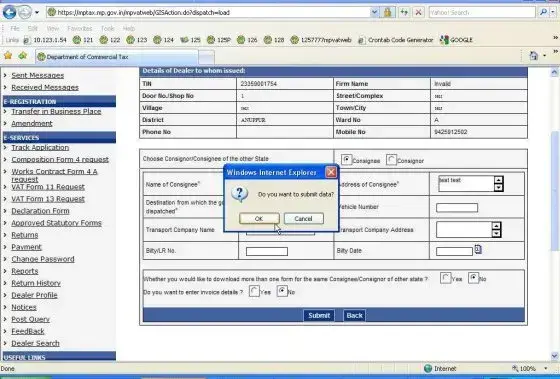

After Click On link Request

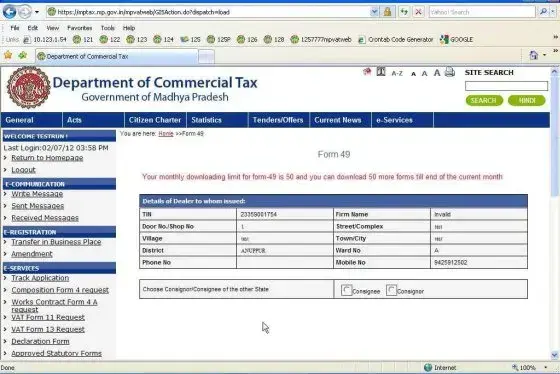

Also one message will display like “Your monthly Downloading limit for

If it is not 0 you can fill

If it is not 0 you can fill

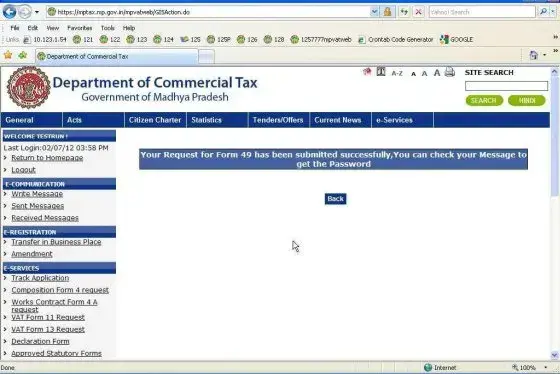

After Click on Ok Button Message will be display ON Your Screen “Your Request for

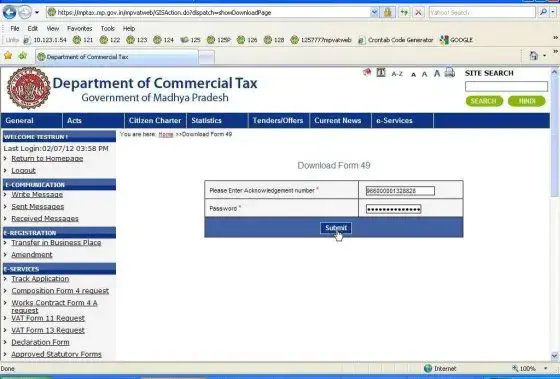

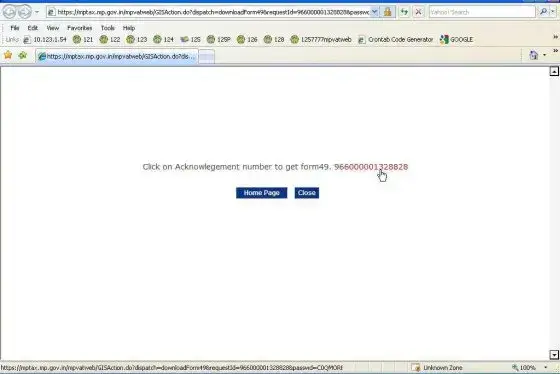

After downloading one

Document Specifics

| Fact Number | Detail |

|---|---|

| 1 | Form-49 is available for download on the Madhya Pradesh Commercial Tax Department's website, accessible via https://mptax.mp.gov.in starting from 7th July 2011. |

| 2 | The Madhya Pradesh Commercial Tax Department (MPCTD) introduced modifications to the download facility for Form-49, imposing a monthly limit on the number of forms a dealer can download. |

| 3 | To download Form-49, users must log in with their ID and password, select "Dealer" under the service type, and navigate through the site's options to request Form-49. |

| 4 | Upon attempting to download Form-49, a message will display indicating the user's monthly downloading limit for the form and how many more forms they can download before the end of the month. |

| 5 | If a user's account shows that they cannot download any more Form-49s, it suggests that the Commercial Tax Officer (CTO) has restricted their access, and they must contact the CTO of their registered circle for further assistance. |

Guide to Writing Mp Commercial Tax 49

Getting ready to download the Form-49 from the Madhya Pradesh Commercial Tax website can seem a bit daunting at first, but it's really straightforward once you know the steps. Whether you're doing this for the first time or need a quick refresher, these instructions will guide you through the process from start to finish. Just remember, the ability to download Form-49 is capped monthly, so be sure to check your limit before you start.

- Go to https://mptax.mp.gov.in.

- Enter your Login Id & Password.

- Select Dealer as your role by clicking the corresponding radio button.

- From the Service Type drop-down menu, choose ‘All Activities’.

- Type the characters you see in the Captcha image into the designated box.

- Click on the Login button to access your account.

- Once logged in, navigate to E-services > Declaration Form > Request Form-49.

- Upon clicking Request Form-49, a screen will appear along with a message indicating your monthly download limit for Form-49. If the message shows you have remaining downloads available, proceed to fill in the required information. If it shows 0, this means your ability to download has been restricted. In this case, contact the CTO of your registered circle for assistance.

- After entering all the required information, click on the Submit Button.

- Press the Ok Button when prompted. A confirmation message will then be displayed on your screen, indicating that your request for Form-49 has been submitted successfully. This message will also contain instructions on how to retrieve your password.

Once these steps are completed, you'll be all set with your Form-49 submission request. Just make sure to keep an eye on your download limit to avoid any potential hiccups in the future. Should you encounter any issues or see that your download limit reads zero when it shouldn't, reaching out to your CTO for support is the best next step. Happy filing!

Understanding Mp Commercial Tax 49

-

How can I download Form-49 from the MP Commercial Tax website?

To download Form-49, you need to follow these steps:

- Go to https://mptax.mp.gov.in.

- Enter your Login Id & Password.

- Select the Radio Button for Dealer.

- Choose 'All Activities' from the Service Type drop-down menu.

- Enter the captcha image shown.

- Click on Login, then navigate to E-services > Declaration Form > Request Form-49.

- After clicking on Request Form-49, fill in the required information and click on the Submit Button.

- Upon clicking the OK button, a message will be displayed on your screen indicating that "Your Request for Form-49 has been submitted successfully." Further instructions to access your form, including a password, will be sent to your message inbox on the website.

-

What is the monthly limit for downloading Form-49, and what should I do if I reach this limit?

As of 7th July 2011, there is a monthly ceiling on the number of Form 49s that a dealer can download - for instance, a message may inform that "Your monthly Downloading limit for form-49 is 65 and you can download 16 more form till the end of the month." If you see a message that you have reached a limit of 0, it indicates that the CTO has restricted further downloads of Form 49 for your account. In such cases, it's essential to contact the CTO of the circle where you are registered to resolve the issue and get guidance on further steps.

-

What to do if I encounter an error or need help with downloading Form-49?

If you experience difficulties or encounter an error while attempting to download Form-49, the first course of action is to check your internet connection and ensure that all the details entered are correct, paying close attention to the captcha image and the information required on the form. If problems persist, it's advisable to reach out to the customer support or the CTO of your circle for assistance. They can provide you with guidance or resolve any issues that might be preventing you from downloading the form.

-

Is there any way to track the status of my Form-49 request after submission?

Yes, after submitting your request for Form-49, a message that your request has been successfully submitted is displayed. To track the status of your request, you should check your message inbox on the MPTAX website regularly. The detailed message you receive after submitting the form will include valuable information, such as a password and possibly a link or further instructions on how to access or track the status of your Form-49 request. Keeping an eye on your inbox will help you stay updated on the progress of your request.

Common mistakes

Filling out forms, especially ones related to tax, can often be daunting and confusing. This could lead to mistakes that may complicate the process. Here are nine common mistakes people make when filling out the MP Commercial Tax 49 form. Understanding these can help avoid errors and ensure a smoother experience.

Not checking the download limit: Users often miss checking their monthly download limit for Form-49, which can lead to confusion if the allowed number has been exceeded. Remember, the number of forms you can download is capped monthly.

Incorrectly entering login details: A simple yet common mistake is inaccurately entering the Login ID and Password. This can prevent access to the form, delaying the entire process.

Overlooking the correct selection on the radio button: Failing to select the "Dealer" option can lead to the wrong form being filled out or submitted, creating delays and potential issues with tax submissions.

Choosing the wrong service type: Not selecting the correct option from the ‘All Activities’ drop-down menu can result in processing the wrong request.

Misreading the CAPTCHA image: Though it might seem minor, entering the CAPTCHA image incorrectly can block your access to downloading the form, requiring additional time to retry.

Ignoring the message on monthly limits: There's a specific message that shows your remaining download limit for the month. Overlooking this message can result in failed attempts to download, particularly if no downloads remain for the month.

Failure to contact CTO when required: If the message indicates a restriction on your account, contacting the CTO is mandatory. Some people postpone this, which only delays resolution.

Omitting required information before submission: It's crucial to fill in all required fields with correct information. Missing or incorrect information can lead to the rejection of the form submission.

Not checking the confirmation message: After submitting the form, a confirmation message is displayed. Not noting this message and the provided password for future reference is a common oversight.

Addressing these points can significantly reduce errors and ensure that the process of downloading and submitting the MP Commercial Tax 49 form is as error-free as possible.

Documents used along the form

When dealing with business transactions and tax obligations in Madhya Pradesh, leveraging the MP Commercial Tax Form 49 is crucial for tracking and management purposes. However, this form does not stand alone in the realm of commercial documentation. Various other forms and documents also play vital roles in ensuring the seamless operation of businesses, compliance with state laws, and the facilitation of tax-related processes. Below is a concise list of other essential forms and documents that are often used alongside MP Commercial Tax Form 49, each serving a specific purpose in the business and taxation landscape.

- Form 26AS: This is a tax credit statement that consolidates details of taxes deducted on behalf of the taxpayer and taxes directly paid by them. It serves as an important document for verifying tax credit when filing annual returns.

- GST Registration Certificate: A legal document that serves as proof of being registered under the GST law. It's necessary for all entities involved in the buying or selling of goods and services in India.

- Income Tax Returns (ITR) forms: Various ITR forms are available depending on the nature of income of the taxpayer. These forms are essential for individuals and businesses to report their income and claim applicable deductions.

- Audited Financial Statements: These include the balance sheet, profit and loss account, and cash flow statement, audited by a certified accountant. They provide insights into the financial health of a business.

- Partnership Deed: In the case of partnership firms, a partnership deed outlines the terms of the partnership agreement and is crucial for defining the relationship between partners, including their liabilities and profit-sharing ratios.

- Company Incorporation Certificate: This document is a validation of the company’s legal existence and includes details like the company name, date of incorporation, and corporate identity number (CIN).

- TDS Certificates: Certificates such as Form 16 or Form 16A are essential for taxpayers as proof of tax deducted at source on their behalf and are crucial when filing tax returns.

- GST Returns: Various GST returns filings, such as GSTR-1, GSTR-2A, and GSTR-3B, are necessary for businesses to report transactions and pay the due taxes under the GST regime.

- Professional Tax Registration Certificate: Relevant for businesses employing staff, this certificate is a compliance document for the deduction and payment of professional tax to the state government.

- Import Export Code (IEC): A business identification number mandatory for companies involved in the import and export of goods. This document facilitates trade and ensures compliance with the Directorate General of Foreign Trade.

In conclusion, navigating the complex landscape of commercial taxation and regulatory compliance requires not only a good understanding of the MP Commercial Tax Form 49 but also familiarity with a suite of other documents. From tax payment proofs like the Form 26AS to business registration certificates and compliance filings like GST returns, each document interweaves seamlessly to support a business's operational, legal, and financial responsibilities. Proper management and timely submission of these documents underpin the successful and lawful conduct of business activities.

Similar forms

The MP Commercial Tax Form 49 shares similarities with the Sales Tax Exemption Certificate. Both documents are integral for dealers, facilitating tax-related processes. The Sales Tax Exemption Certificate allows businesses to purchase goods without paying sales tax if those goods are to be resold. Similarly, Form 49 is used in the jurisdiction of Madhya Pradesh, India, for the movement of goods under specific tax exemptions. Both forms necessitate accurate business information and the purpose of the transaction, establishing a clear parallel in their utilization for tax exemption purposes.

Another document akin to the MP Commercial Tax Form 49 is the Waybill. Typically used for the movement of goods across various regions, the Waybill accompanies goods in transit, detailing the nature, destination, and quantity of goods being transported. Like Form 49, which is necessitated for the intrastate movement of goods within Madhya Pradesh, the Waybill serves a similar regulatory purpose, ensuring compliance with tax regulations and facilitating the monitoring of goods movement. Both documents are essential for logistics and compliance with respective tax authorities.

The Uniform Commercial Code (UCC) Filing is also similar to the MP Commercial Tax Form 49, though the UCC Filing spans a broader spectrum, dealing with securing transactions across the United States. Despite their differing scopes, both documents play a crucial role in commercial activities within their jurisdictions. The MP Commercial Tax Form 49 is required for the movement and regulation of goods in Madhya Pradesh, while the UCC Filing is instrumental in registering and publicizing interests in personal property to secure debt. Both forms ensure legal compliance and protect parties' interests in commercial transactions.

Lastly, the Import Declaration Form mirrors the functionality of the MP Commercial Tax Form 49 but in the context of international trade. This form is essential for customs clearance, providing authorities with details about the imported goods, their value, and the nature of their entry into a country. Similar to Form 49, which is used for tax compliance and the regulation of goods within a specific region, the Import Declaration Form ensures that all imports meet a country's legal and regulatory standards before entry. Both forms are vital in maintaining the integrity of trade and taxation systems within their respective domains.

Dos and Don'ts

When filling out the MP Commercial Tax Form 49, it is crucial to adhere to specific guidelines to ensure the process is completed correctly and efficiently. Below is a list of dos and don'ts that individuals should follow:

Do:Visit the official website https://mptax.mp.gov.in as the first step to ensure you are accessing the correct form.

Enter your Login Id & Password accurately to access the downloading facility.

Select "Dealer" from the radio button options for accurate form customization based on your status.

Choose "All Activities" from the drop-down under Service Type for a broad range of services.

Correctly enter the Image from Capcha to verify you are not a robot and enhance security.

Click on Login, navigate to E-services, then go to Declaration Form, and finally click on Request Form-49 to initiate the download process.

Pay close attention to the message showing your monthly download limit and the remaining number of Form 49 you can download.

Fill up all required information accurately in the request Form-49 screen.

Click the Submit button once all information is filled to finalize the request process.

Check your messages for the password after clicking the Ok button as prompted for successful submission.

Do not use unofficial websites to download Form-49, as this could lead to obtaining incorrect or outdated forms.

Avoid entering incorrect Login Id & Password, as this will prevent access to the form download facility.

Do not ignore the specific user status; always select the correct radio button to ensure you get the right form.

Avoid skipping the Service Type selection or choosing the wrong option, as it might limit the services available to you.

Do not enter the CAPTCHA code incorrectly; it is essential for security verification.

Avoid bypassing the message that details your monthly download limit for Form 49; it's crucial for tracking your usage.

Do not hurry through filling required fields on the Form-49 request page; inaccurate information can lead to submission errors.

Avoid pressing back or refreshing the page after clicking the submit button to prevent disrupting the submission process.

Do not forget to check your messages for the password after submission; this is necessary to complete the process.

Never share your login credentials or the password received after submission, keeping your data security in mind.

Misconceptions

When it comes to the MP Commercial Tax Form 49, there are a few misconceptions that often arise. Understanding these misconceptions is crucial for dealers who are looking to download Form 49 from the Madhya Pradesh Commercial Tax Department's website.

- The process is complicated and inaccessible: Many people believe the process of downloading Form 49 is complicated and hard to navigate. However, the steps are quite straightforward. By logging in with your ID and password, selecting the relevant options, and following the prompts, dealers can easily request and download Form 49.

- Unlimited downloads are available: Another common misconception is that dealers can download an unlimited number of Form 49 copies. In reality, there is a monthly limit on how many forms can be downloaded. This limit is crucial to ensure fair access for all dealers registered in the system.

- Any dealer can download Form 49 at any time: Some dealers might think that they can download Form 49 regardless of their account status. However, if a dealer's account shows a message indicating zero downloadable forms left for the month or a restriction has been placed by the CTO (Commercial Tax Officer), they will need to contact their local CTO office for resolution. Access to downloads is contingent upon adherence to certain criteria set by the MPCTD (Madhya Pradesh Commercial Tax Department).

- Contacting the CTO is unnecessary: If a dealer finds they are unable to download Form 49 due to restrictions or they have reached their monthly limit, they might assume waiting for the next month is the only option. However, contacting the CTO can provide clarity on the restriction reasons and ways to resolve the issue, ensuring continued business operations without unnecessary delays.

Understanding these misconceptions can significantly smooth the process of obtaining Form 49, ensuring compliance with the Madhya Pradesh Commercial Tax Department's regulations and facilitating smoother business operations.

Key takeaways

Understanding the MP Commercial Tax Form 49 process is essential for dealers who need to comply with local tax regulations. The following key takeaways provide a clear guide to navigate the downloading process effectively:

- Access to Form 49 is available through the official portal at https://mptax.mp.gov.in starting July 7th, 2011. Dealers are required to log in using their specific credentials to proceed with the download process.

- Upon logging in, selecting the 'Dealer' radio button and choosing 'All Activities' from the service type dropdown menu are mandatory steps. A CAPTCHA image will be presented for verification to enhance security.

- The system imposes a monthly limit on the number of Form 49s a dealer can download. A crucial step involves checking the remaining quota for the month. If the quota shows zero, reaching out to the Circle's CTO is necessary to address any restrictions.

- Submitting a request for Form 49 is straightforward but requires filling out necessary information accurately. Once submitted, a confirmation message along with instructions to obtain the password for the form will be displayed, signaling the completion of the process.

Adhering to these guidelines ensures that dealers can request and obtain Form 49 without unnecessary delays, maintaining compliance with MP Commercial Tax Department regulations.

Popular PDF Documents

IRS 990-T - The IRS periodically updates Form 990-T and its instructions, so reviewing the latest version before filing is important.

Idaho Poa - Enables seamless communication between Idaho tax officials and a designated representative.

1099 and 1096 Forms - Primarily, this form details the total amount of reports sent to the IRS, serving as an acknowledgment of the information provided.