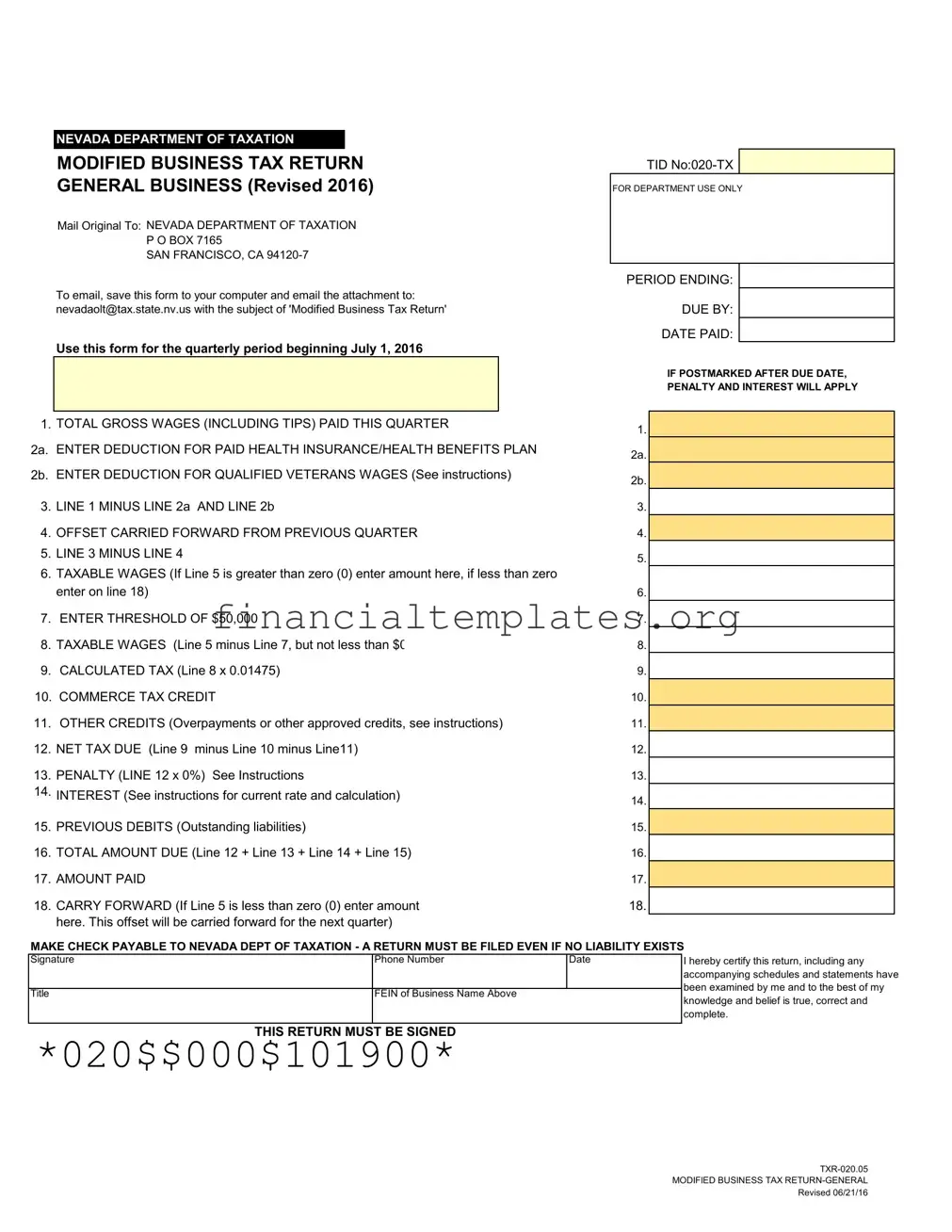

Get Modified Business Tax Form

Navigating the complexities of Nevada's Modified Business Tax (MBT) form is crucial for businesses operating within the state. Introduced by the Nevada Department of Taxation, this form serves as a quarterly tax return for general businesses, distinct from those tailored for financial institutions. It mandates detailed reporting including the total gross wages paid within the quarter, adjustments for employer-provided health insurance, and deductions for wages paid to qualified veterans. Furthermore, the form accommodates adjustments via offsets for previous quarters and specifies the computation of taxable wages after factoring in deductions and offsets. A notable feature is the allowance for a Commerce Tax Credit, aimed at reducing the MBT liability for businesses that have also paid the Commerce Tax. Other credits might apply, contingent on prior approval and specific qualifications. Penalties and interest are imposed for late submissions, calculated based on the extent of the delay. Additionally, provisions are made for carrying forward negative amounts to subsequent quarters, underscoring the importance of accuracy and timeliness in submissions. With a strategic structure designed to align with state tax legislation, the MBT form underscores Nevada's approach to business taxation, highlighting specified deductions, credits, and compliance protocols.

Modified Business Tax Example

|

NEVADA DEPARTMENT OF TAXATION |

|

|

|

|

|

|

|

|

|

|

|

MODIFIED BUSINESS TAX RETURN |

|

TID |

|

|

||||||

|

GENERAL BUSINESS (Revised 2016) |

|

FOR DEPARTMENT USE ONLY |

|

|||||||

|

Mail Original To: NEVADA DEPARTMENT OF TAXATION |

|

|

|

|

|

|

||||

|

P O BOX 7165 |

|

|

|

|

|

|

|

|

|

|

|

SAN FRANCISCO, CA |

|

|

|

|

|

|

|

|

|

|

|

To email, save this form to your computer and email the attachment to: |

|

PERIOD ENDING: |

|

|

||||||

|

|

|

|

DUE BY: |

|

|

|||||

|

nevadaolt@tax.state.nv.us with the subject of 'Modified Business Tax Return' |

|

|

|

|

|

|||||

|

Use this form for the quarterly period beginning July 1, 2016 |

|

|

DATE PAID: |

|

|

|||||

|

|

|

IF POSTMARKED AFTER DUE DATE, |

||||||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

PENALTY AND INTEREST WILL APPLY |

|||

|

|

|

|

|

|

|

|

|

|

||

1. |

TOTAL GROSS WAGES (INCLUDING TIPS) PAID THIS QUARTER |

|

1. |

|

|

|

|

||||

2a. |

ENTER DEDUCTION FOR PAID HEALTH INSURANCE/HEALTH BENEFITS PLAN |

|

2a. |

|

|

|

|

||||

2b. |

ENTER DEDUCTION FOR QUALIFIED VETERANS WAGES (See instructions) |

|

2b. |

|

|

|

|

||||

3. |

LINE 1 MINUS LINE 2a AND LINE 2b |

|

|

|

|

|

3. |

|

|

|

|

4. |

OFFSET CARRIED FORWARD FROM PREVIOUS QUARTER |

|

4. |

|

|

|

|

||||

5. |

LINE 3 MINUS LINE 4 |

|

|

|

|

|

5. |

|

|

|

|

6. |

TAXABLE WAGES (If Line 5 is greater than zero (0) enter amount here, if less than zero |

|

|

|

|

|

|||||

|

|

|

|

|

|

||||||

|

enter on line 18) |

|

|

|

|

|

6. |

|

|

|

|

7. |

ENTER THRESHOLD OF $50,000 |

|

|

|

|

|

7. |

|

|

|

|

8. |

TAXABLE WAGES (Line 5 minus Line 7, but not less than $0 |

|

8. |

|

|

|

|

||||

9. |

CALCULATED TAX (Line 8 x 0.01475) |

|

|

|

|

|

9. |

|

|

|

|

10. COMMERCE TAX CREDIT |

|

|

|

|

|

10. |

|

|

|

|

|

11. |

OTHER CREDITS (Overpayments or other approved credits, see instructions) |

|

11. |

|

|

|

|

||||

12. |

NET TAX DUE (Line 9 minus Line 10 minus Line11) |

|

12. |

|

|

|

|

||||

13. |

PENALTY (LINE 12 x 0%) See Instructions |

0 |

|

|

|

|

13. |

|

|

|

|

14. |

INTEREST (See instructions for current rate and calculation) |

|

14. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

15. |

PREVIOUS DEBITS (Outstanding liabilities) |

|

|

|

|

|

15. |

|

|

|

|

16. |

TOTAL AMOUNT DUE (Line 12 + Line 13 + Line 14 + Line 15) |

|

16. |

|

|

|

|

||||

17. |

AMOUNT PAID |

|

|

|

|

|

17. |

|

|

|

|

18. |

CARRY FORWARD (If Line 5 is less than zero (0) enter amount |

|

18. |

|

|

|

|

||||

|

here. This offset will be carried forward for the next quarter) |

|

|

|

|

|

|

||||

MAKE CHECK PAYABLE TO NEVADA DEPT OF TAXATION - A RETURN MUST BE FILED EVEN IF NO LIABILITY EXISTS |

|||||||||||

Signature |

|

|

Phone Number |

Date |

|

|

I hereby certify this return, including any |

||||

|

|

|

|

|

|

|

|

|

accompanying schedules and statements have |

||

|

|

|

|

|

|

|

|

|

been examined by me and to the best of my |

||

Title |

|

|

|

FEIN of Business Name Above |

|

|

|

||||

|

|

|

|

|

|

knowledge and belief is true, correct and |

|||||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

complete. |

||

|

THIS RETURN MUST |

BE SIGNED |

|

|

|

|

|

|

|||

*020$$000$101900* |

|

|

101900 |

|

|||||||

|

|

|

|

|

|

|

|||||

MODIFIED BUSINESS TAX

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY

(Financial Institutions need to use the form developed specifically for them,

IF YOU COMPLETE THIS FORM ONLINE THE CALCULATIONS WILL BE MADE FOR YOU

Line 1. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter Line 2a. Employer paid health care costs, paid this calendar quarter, as described in NRS 363B.115.

Line 2b. Enter deduction for qualified Veterans wages. Attach employee verification of Unemployment Benefits and signed affidavit that employee meets the requirements pursuant to AB71 of the 78th (2015) legislative session.

Line 3. Net taxable wages. Add Line 2a and Line 2b. Subtract this sum from Line 1.

Line 4. Offsets carried forward are created when allowable health care costs exceed gross wages in the previous quarter. If applicable, enter the previous quarter's offset here. This is not a credit against any tax due. This reduces the wage base upon which the tax is calculated.

Line 5. Line 3 minus Line 4.

Line 6. Net taxable wages is the amount that will be used in the calculation of the tax. If line 5 is greater than zero, this is the taxable wages. If line 5 is less than zero, then no tax is due. (This amount will be entered on line 18 as the offset carried forward for the next quarter. The offset carried forward is only limited to the health care deduction. This excludes the deduction for veteran wages.)

Line 7. Enter the threshold of $50,000.00. SB483 set the threshold to $50,000.00 for quarterly wages. Tax is calculated on wages over this threshold. Line 8. Taxable wages. The threshold in Line 7 is subtracted from Line 5 to calculate taxable wages; do not enter an amount if less than 0.

Line 9. Calculated Tax. Multiply Line 8 x .01475, the rate established by SB483.

Line 10. Commerce Tax Credit – Enter 50% of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed. Do not enter an amount less than zero. If the credit amount is higher than the MBT tax owed it may be carried forward up to the fourth quarter immediately following the end of the Commerce Tax year for which Commerce Tax is paid.

Line 11. Other Credits - Enter amount of overpayment of Modified Business Tax (MBT) made in prior reporting periods for which you have received a Department of Taxation credit notice. Credit notices received from the Department are not cumulative. Do not take the credit if you have applied for a refund. NOTE: Only credits established by the Department may be used. The 78th (2015) legislative session enacted several Bills that created credits towards the MBT that may be taken on this tax return if qualified. These credits except for the college savings plan contributions require prior approval by the Department and a credit notice. Please attach credit notice and/or College Savings Plan Contributions Form to this return.

Line 12. Net Tax Due - Line 9 minus Line 10. This amount is due and payable by the due date; the last day of the month following the applicable quarter. If payment of the tax is late, penalty and interest (as calculated below) are applicable.

Line 13. Penalty - If this return will not be submitted/postmarked and the taxes paid on or before the due date as shown on the face of this return, the amount of penalty due is based on the number of days late payment is made per NAC 360.395. Determine the number of days the payments is late and multiply the net tax owed by the appropriate rate based on the table below. The result is the amount of penalty that should be entered. For example, if the taxes were due January 31, but not paid until February 15. The number of days late is 15 so the penalty is 4%. The maximum penalty amount is 10%.

|

Number of days late |

Penalty Percentage |

Multiply By |

|

|||

|

|

|

|

|

2% |

0.02 |

|

4% |

0.04 |

||

|

16 - 20 |

6% |

0.06 |

21- 30 |

8% |

0.08 |

|

|

31 + |

10% |

0.1 |

Line 14. Interest: To calculate interest for each month late, multiply Line 11 x 0.75% (or .0075).

Line 15. Previous Debits - Enter only those liabilities that have been established for prior quarters by the Department and for which you have received a liability notice.

Line 16. Total Amount Due

Line 18. Carry Forward - If line 5 is less than zero enter figure here. This amount will be carried forward to the next quarter (offset)

GENERAL INFORMATION:

GENERAL BUSINESSES MUST USE FORM

Who Must File: Every employer who is subject to the Nevada Unemployment Compensation Law (NRS 612) except for

Businesses that have ceased doing business (gone out of business) in Nevada must notify the Employment Security Division and the Department of Taxation in writing, the date the business ceased doing business. The Department will send written notice when a credit request has been processed and the credit is available for use/refund.

Please do not use/apply a credit prior to receiving Departmental notification that it is available.

** For up to date information on tax issues, be sure to check our website

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Implemented By | NEVADA DEPARTMENT OF TAXATION |

| Use Period | Quarterly, beginning July 1, 2016 |

| Tax Calculation Base | Gross wages minus deductions for health insurance and qualified veterans' wages |

| Tax Rate | 0.01475 on taxable wages over $50,000 threshold |

| Penalty for Late Submission | Varies based on the number of days late, up to a maximum of 10% |

| Governing Law | NRS 363B.115, AB71 of the 78th (2015) legislative session, SB483 |

Guide to Writing Modified Business Tax

Filling out the Modified Business Tax form is a crucial part of ensuring your business complies with Nevada’s tax regulations. Below are the steps you need to follow to accurately complete and submit your form. Remember, this process helps maintain your business's good standing and contributes to the state's fiscal health.

- Identify the period ending and the due date for submission at the top of the form to ensure timely filing.

- Enter your TID No. in the designated space to correctly associate your tax return with your business account.

- Under TOTAL GROSS WAGES (INCLUDING TIPS) PAID THIS QUARTER, input the sum total of all wages and tips paid to employees during the calendar quarter.

- For the ENTER DEDUCTION FOR PAID HEALTH INSURANCE/HEALTH BENEFITS PLAN section, input the amount of employer-paid health care costs for the quarter.

- In ENTER DEDUCTION FOR QUALIFIED VETERANS WAGES, input the total of any wages paid to qualified veterans as per the guidelines provided.

- Subtract the sum of lines 2a and 2b from line 1 to calculate NET TAXABLE WAGES and enter this on line 3.

- If you have an OFFSET CARRIED FORWARD FROM PREVIOUS QUARTER, enter this amount in line 4.

- Subtract line 4 from line 3 to find the total on line 5. If this amount is greater than zero, note it as TAXABLE WAGES on line 6; otherwise, proceed to line 18.

- Insert the $50,000.00 THRESHOLD on line 7, reflecting the minimum amount before tax applies as per SB483.

- Calculate the TAXABLE WAGES by subtracting line 7 from line 5 and enter the result on line 8.

- Multiply the result on line 8 by 0.01475 to get your CALCULATED TAX, and input this on line 9.

- If applicable, enter any COMMERCE TAX CREDIT on line 10 and OTHER CREDITS on line 11 as per the instructions provided.

- Calculate your NET TAX DUE by subtracting the sums of lines 10 and 11 from line 9, and enter this on line 12.

- For late payments, calculate the PENALTY and INTEREST as per the guides and input these on lines 13 and 14, respectively.

- Add any PREVIOUS DEBITS on line 15 and then total lines 12 through 15 to find the TOTAL AMOUNT DUE and enter this on line 16.

- Indicate the AMOUNT PAID with this return on line 17.

- If applicable, calculate and enter any CARRY FORWARD amount on line 18, which will be applied to the next quarter.

- Ensure the form is signed and dated at the bottom, indicating your certification that the information provided is accurate and complete.

Once completed, review the form for accuracy before mailing it to the Nevada Department of Taxation or submitting it via email as directed. This careful attention to detail ensures your business remains in compliance with state tax obligations.

Understanding Modified Business Tax

Below are frequently asked questions regarding the Modified Business Tax form for general businesses in Nevada:

What is the Modified Business Tax (MBT) in Nevada?

The MBT is a quarterly tax imposed on employers who are subject to Nevada's Unemployment Compensation Law. It's calculated based on the total gross wages paid by the employer, including tips, with specific deductions for health care and qualified veterans' wages.

Who needs to file the Modified Business Tax Return?

Any business operating in Nevada and subject to Nevada Unemployment Compensation Law, excluding 501(c) non-profit organizations, Indian tribes, and political subdivisions, is required to file the MBT return. This ensures compliance with state tax obligations.

How do I calculate the tax due on the MBT return?

The tax due is calculated by first subtracting any deductions for employer-paid health benefits and qualified veterans' wages from total gross wages. The net amount, after adjusting for any carryover offsets and applying the $50,000 threshold, is then multiplied by the tax rate of 0.01475 to determine the tax owed.

Are there any credits available that can reduce my tax liability?

Yes, the Commerce Tax Credit and other approved credits, such as overpayments from prior periods or specific tax credits approved by the Department, can reduce the tax due. The Commerce Tax Credit equals 50% of the Commerce Tax paid in the prior year, up to the amount of MBT owed.

What happens if I file or pay the MBT late?

Late filings or payments incur both penalties and interest. The penalty rate increases with the number of days payment is late, starting at 2% for 1-10 days late and capping at 10% for payments made 31 or more days after the due date. Interest is calculated at a rate of 0.75% (or .0075) for each month the payment is late.

Can I carry forward a negative amount on the MBT return?

Yes, if the calculation of net taxable wages results in a negative amount, this can be carried forward as an offset to the next quarter. However, this offset is limited to the deduction amounts for health care and does not include the deduction for veteran wages.

What should I do if my business stops operating in Nevada?

If your business ceases operations, you must notify both the Employment Security Division and the Department of Taxation in writing with the date business operations ended. This notification is crucial to prevent unnecessary tax liabilities and filings.

For detailed instructions and updates regarding the MBT, visiting the Nevada Department of Taxation's website is highly recommended.

Common mistakes

Not reporting all gross wages, including tips, paid during the quarter is a common error. It's pivotal to include every dollar paid to employees to ensure accurate tax calculation.

Failing to properly deduct health care costs for employees can lead to inaccuracies. These costs, when paid during the calendar quarter, must be deducted from total wages to find the net taxable wage base.

Omitting the deduction for qualified veterans' wages is another oversight. Employers should always attach the necessary employee verification and signed affidavit to benefit from this deduction.

Incorrectly carrying forward offsets from previous quarters can skew the calculation. This error primarily occurs when adjustments for allowable health care costs from prior periods are misapplied.

Miscalculating taxable wages by either not subtracting the $50,000 threshold properly or entering an amount when the result is less than zero can lead to a faulty tax amount.

Errors in applying the Commerce Tax Credit can result from not understanding that only 50% of the Commerce Tax paid can be credited against MBT owed, and it should not exceed the MBT due.

Lastly, inaccurately calculating the net tax due—by failing to correctly deduct the Commerce Tax Credit and other credits from the calculated tax—results in either underpayment or overpayment of taxes.

Individuals must be diligent in understanding and applying the instructions provided by the Nevada Department of Taxation. Errors not only complicate the tax filing process but can also result in penalties and interest charges. Ensuring accuracy in every line item of the Modified Business Tax form is crucial for compliance and to avoid unnecessary financial repercussions.

Documents used along the form

When dealing with the complexities of filing the Nevada Department of Taxation Modified Business Tax Return, businesses often need to prepare and submit additional forms and documents. The purpose of these documents ranges from detailing financial transactions to substantiating credits or deductions claimed on the Modified Business Tax (MBT) form. Understanding each document's role can ensure that businesses comply with Nevada's tax regulations efficiently and effectively.

- Nevada Unemployment Compensation Declaration (Form NUCS 4072): This form is filed with the Nevada Employment Security Division and verifies the business's compliance with state unemployment insurance requirements. While not submitted with the MBT, it must be available upon request.

- Employer Paid Health Care Costs Documentation: Provides proof of the health care costs paid by an employer, deductible under the MBT. It must detail payments made during the calendar quarter.

- Veterans Employment Documentation: Supports the deduction for qualified veterans' wages and includes verification of unemployment benefits and a signed affidavit confirming the employee's eligibility under specified legislation.

- Commerce Tax Return: Required for businesses to calculate their Commerce Tax Credit, which affects the MBT owed. This return documents the payment of the Commerce Tax in the preceding tax year.

- Credit Notice from Department of Taxation: Official notice received from the Department indicating the approval of credits towards the MBT, which could include overpayments from previous periods or specific legislative credits.

- College Savings Plan Contributions Form: Document used to claim a credit for contributions made to Nevada’s college savings plans, as allowed under recent legislation.

- Written Notification of Business Closure: To cease MBT obligations, businesses that have stopped operating in Nevada must formally notify both the Employment Security Division and the Department of Taxation, detailing the cessation date.

- Liability Notice from Department of Taxation: A notification of established liabilities from previous quarters for which the business owes taxes, penalties, or interest. This document helps in calculating any amounts due or offsets carry forward on the MBT return.

To ensure accuracy and compliance, these documents facilitate a smoother process for reporting and paying taxes. By maintaining thorough records and understanding the relevance of each form, businesses can navigate the tax landscape with confidence. This comprehensive approach not only supports legal compliance but also optimizes potential credits and deductions that can benefit the business financially.

Similar forms

The Modified Business Tax form shares similarities with the federal 941 Form, Employer's Quarterly Federal Tax Return. Both forms require employers to report wages, tips, and other compensation paid to employees within a specific quarter. The calculation of taxes due includes allowances for deductions and adjustments, such as health insurance premiums in the Modified Business Tax form and social security and Medicare taxes in the 941 Form. These documents serve to reconcile payroll expenses and tax liabilities with the respective tax authorities, ensuring compliance with employment and tax regulations.

Similar to the Modified Business Tax form, the W-2 Form, Wage and Tax Statement, is concerned with reporting wages paid to employees and taxes withheld from those wages. However, the W-2 is an annual report provided by employers to both employees and the Social Security Administration. It details the total annual wages and the amounts of various taxes withheld from the employee’s paycheck, enabling employees to file their personal income tax returns. This form complements the Modified Business Tax form by providing a detailed breakdown of individual employee earnings and withholdings, whereas the Modified Business Tax form summarizes total wages paid by the business.

The Unemployment Insurance Tax and Wage Report, similar to the Modified Business Tax form, focuses on employer contributions based on employee wages. This report is filed with state unemployment insurance programs and calculates taxes due to fund unemployment compensation for workers who have lost their jobs. Like the Modified Business Tax form, employers must report total wages paid and may be subject to deductions or credits that influence the final tax liability. These forms ensure that employers contribute to both state revenues and social safety nets based on payroll expenses.

The Commerce Tax Return, specific to Nevada, resembles the Modified Business Tax form in that it applies to businesses operating within the state and calculates taxes based on business revenue with allowances for various deductions and credits. However, the Commerce Tax targets gross revenue as its tax base, rather than payroll expenses. Both forms include mechanisms for reducing tax liability through credits, such as the Commerce Tax Credit on the Modified Business Tax form, highlighting the interconnectedness of Nevada’s tax structures for businesses.

The Quarterly Contribution and Wage Report, filed with state employment departments, is akin to the Modified Business Tax form in its requirement for employers to report wages paid to employees. It contributes to the determination of unemployment insurance benefits for employees. The report’s focus on payroll and employment aligns with the Modified Business Tax form's goal of assessing tax based on employment costs, encapsulating the employer's role in supporting state employment initiatives through accurate reporting of wages.

The Employer’s Annual Information Return of Tip Income and Allocated Tips, similar to section 1 of the Modified Business Tax form that requires reporting of tips paid to employees, centers around the detailed accounting of tip income. This IRS form, used mainly in the hospitality industry, ensures that employees’ tip earnings are reported and taxed appropriately. It reflects the broader objective, shared with the Modified Business Tax form, of transparently reporting employee compensation to ascertain tax obligations related to employment.

The 1099 Form series, particularly the 1099-MISC and 1099-NEC forms for reporting miscellaneous income and non-employee compensation, respectively, share a fundamental connection with the Modified Business Tax form through their focus on payments made in the course of business. While these 1099 forms are utilized for reporting payments to non-employees, they complement the Modified Business Tax form by covering a broader scope of business payments subject to tax consideration, reinforcing the comprehensive reporting of financial activities within a business setting.

The State Disability Insurance (SDI) reporting forms, mandatory in certain states, require employers to report wages for the calculation of disability insurance contributions. Like the Modified Business Tax form, these contributions are based on payroll, although they specifically fund state disability insurance programs. Both sets of forms underline the employer's duty to support state-managed employee benefit programs through accurate payroll reporting, reflecting the broader responsibility of businesses to contribute to employee well-being and state fiscal health.

Dos and Don'ts

Filling out the Modified Business Tax form requires careful attention to detail and adherence to specific guidelines to ensure accurate reporting and compliance with Nevada Department of Taxation requirements. Here is a list of dos and don'ts to assist in the process:

- Do ensure that all necessary information is accurate and complete before submitting the form.

- Do calculate the total gross wages, including tips, paid during the calendar quarter accurately to avoid discrepancies.

- Do include deductions for paid health insurance/health benefits plan and for qualified veterans' wages correctly to benefit from allowable deductions.

- Do subtract any applicable deductions from the total gross wages to determine net taxable wages properly.

- Do accurately calculate the taxable wages after applying the threshold of $50,000 as stipulated by SB483.

- Do make use of the Commerce Tax Credit if applicable, ensuring it does not exceed the Modified Business Tax owed.

- Do apply for any other credits for which your business is eligible and attach necessary documentation or credit notices.

- Do sign and date the form, certifying the accuracy and completeness of the information provided.

- Do email or mail the original form to the designated address or email provided by the Nevada Department of Taxation on time.

- Do check for any updates on tax issues or changes in guidelines by visiting the Nevada Department of Taxation website regularly.

- Don't underestimate the importance of reviewing the entire form for errors before submission.

- Don't overlook the inclusion of documentation for deductions claimed, such as employee verification for veterans' wages.

- Don't neglect to calculate and include the correct amount of tax due based on taxable wages and the current rate.

- Don't fail to calculate penalties or interest due if the form is submitted or payment is made after the due date.

- Don't ignore any outstanding liabilities or previous debits that need to be included in the current tax return.

- Don't enter incorrect information regarding the threshold or taxable wages that could result in an inaccurate tax calculation.

- Don't forget to include the Commerce Tax Credit incorrectly or omit eligible other credits that could lower the net tax due.

- Don't submit the form without ensuring all calculations are done, especially tax calculations, carry-forwards, and credits.

- Don't disregard the need to check for the latest tax notes or updates that may impact how the form should be filled out.

- Don't hesitate to consult with a tax professional if there are any questions or uncertainties about how to fill out the form or about eligibility for credits.

Misconceptions

Many businesses have misconceptions about the Modified Business Tax form in Nevada, which can lead to errors in filing or missed opportunities for deductions. Let's clear up some of the most common misunderstandings:

- Gross Wages Include Tips: Some employers might not realize that the total gross wages reported on the Modified Business Tax form should include tips that their employees earn. This is crucial because underreporting income can result in penalties.

- Health Insurance Deductions: There's a notion that all health insurance or benefits plan expenses paid by the employer can be deducted. However, only those health care costs as described in NRS 363B.115 qualify for a deduction on the form.

- Veteran Wages Deduction: The form allows for a deduction of wages paid to qualified veterans. Some employers may be unaware of this benefit or may not understand the documentation needed to support this deduction, such as employee verification and a signed affidavit.

- Threshold Misunderstanding: A common misconception is how the $50,000 threshold works. The tax is calculated on the wages over this threshold amount. Some businesses might incorrectly think this threshold negates the need to file if their payroll is under a certain amount, but a return must be filed regardless.

- Commerce Tax Credit: Businesses often overlook the opportunity to claim a Commerce Tax Credit, which is 50% of the Commerce Tax paid in the prior tax year, up to the amount of Modified Business Tax owed. This credit can also be carried forward, which some businesses might not realize.

- Carry Forward Mechanism: If the net taxable wages line is less than zero, the business doesn't owe taxes for that quarter and can carry forward the negative amount to the next quarter. Some employers might misunderstand the application of this offset, thinking it's lost if not used within the current quarter.

Understanding these aspects of the Modified Business Tax form can help businesses accurately complete their tax responsibilities and maximize potential benefits. It's always beneficial to thoroughly review the instructions provided by the Nevada Department of Taxation and consult with a tax professional if there are uncertainties.

Key takeaways

- To accurately complete the Modified Business Tax (MBT) form, employers must enter the total amount of gross wages, including tips, paid within the calendar quarter under Line 1, ensuring accuracy and compliance with Nevada's taxation requirements.

- Deductions for employer-paid health care and qualified veterans' wages are permissible and must be documented under Lines 2a and 2b respectively, following specific guidelines and legislative provisions to optimize the taxable wages calculation.

- The net taxable wages, calculated by subtracting health care and veterans' wage deductions from the gross wages, form the basis of the tax calculation, emphasizing the importance of precise deductions documentation.

- Offsets that reduce the wage base for tax calculations, leading to potentially lower tax obligations, can be carried forward from previous quarters, underscoring strategic importance for financial planning.

- The taxable wages threshold is set at $50,000 as per SB483, indicating that tax calculations only apply to wages above this amount, thereby affecting the overall tax liability of the business.

- The calculated tax is derived by multiplying taxable wages exceeding the threshold by a specific rate (0.01475), as delineated by existing legislation, pinpointing the pivotal role of thorough wage reporting.

- Commerce Tax Credit allows businesses to offset up to 50% of their MBT liability with the amount of Commerce Tax paid in the prior tax year, offering a notable opportunity for tax savings.

- Additional credits, including overpayments or other approved credits, can further reduce the net tax due, underscoring the necessity of keeping abreast with tax notices and credits approved by the Department of Taxation.

- Late submissions of the MBT form incur penalties and interest, calculated based on the number of days past the due date, highlighting the critical importance of adhering to submission deadlines to avoid additional charges.

Popular PDF Documents

Irs Form 12256 - Withdrawal through Form 12256 means giving up the opportunity for the Appeals office to verify legal and procedural compliance by the IRS.

Irs Form 1042 - It is a key document for researchers and professionals temporarily in the U.S. for educational or business purposes to maintain their nonresident tax status.