Get Mn Tax Return Payment Form

The Minnesota Tax Return Payment form M60 plays a crucial role in the process of fulfilling state income tax obligations. As with any official document, accuracy and adherence to guidelines are paramount. This form enables individuals to provide the necessary information to ensure their payment is accurately credited to their respective accounts. The built-in feature to type information directly onto the screen, followed by printing, introduces a level of convenience and precision, especially given the inclusion of a personalized scan line based on the entered information. It’s important that filers verify critical details such as the tax-year end date and Social Security numbers to avoid processing errors. Additionally, the form outlines various payment methods, including free electronic payments, credit card payments subject to fees, and traditional check payments, each with specific instructions to safeguard the transaction's integrity. For those opting to pay by check, understanding the electronic fund transfer process and the fact that the physical check will not be returned is important. Also noteworthy are the sections detailing the computation of penalties and interest for late payments, underscoring the importance of meeting tax deadlines to avoid unnecessary additional charges. These details underscore the form's role not just as a payment voucher, but as a guide to ensure compliance with tax payment protocols in Minnesota.

Mn Tax Return Payment Example

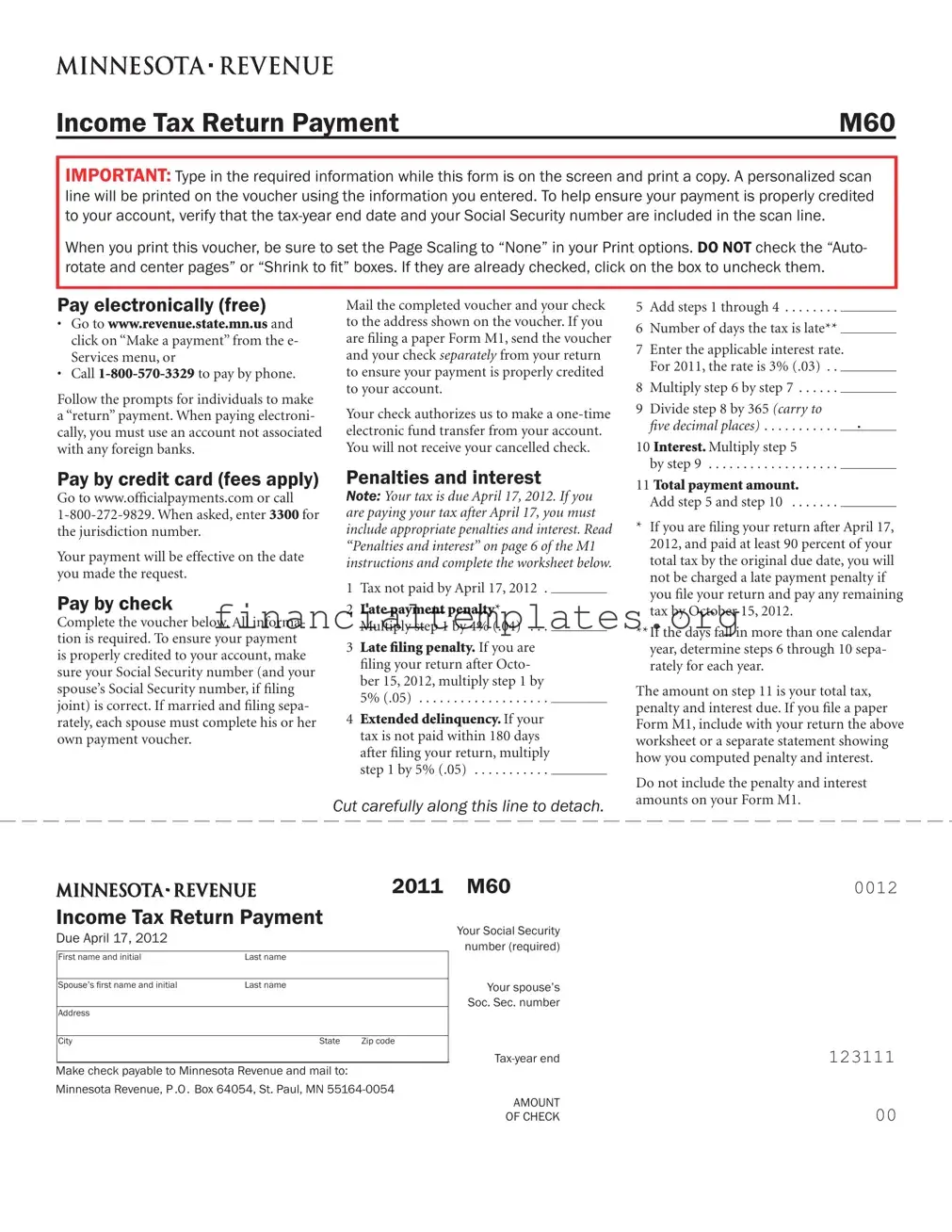

Income Tax Return Payment |

M60 |

IMPORTANT: Type in the required information while this form is on the screen and print a copy. A personalized scan line will be printed on the voucher using the information you entered. To help ensure your payment is properly credited to your account, verify that the

When you print this voucher, be sure to set the Page Scaling to “None” in your Print options. DO NOT check the “Auto- rotate and center pages” or “Shrink to it” boxes. If they are already checked, click on the box to uncheck them.

Pay electronically (free)

• Gotowww.revenue.state.mn.us and click on “Make a payment” from the e- Services menu, or

•

Follow the prompts for individuals to make a “return” payment. When paying electroni- cally, you must use an account not associated with any foreign banks.

Pay by credit card (fees apply)

Gotowww.oficialpayments.comorcall

Your payment will be effective on the date you made the request.

Pay by check

Completethevoucherbelow.Allinforma- tion is required. To ensure your payment is properly credited to your account, make sure your Social Security number (and your spouse’s Social Security number, if filing joint) is correct. If married and filing sepa- rately, each spouse must complete his or her own payment voucher.

Mail the completed voucher and your check to the address shown on the voucher. If you are filing a paper Form M1, send the voucher and your check separately from your return to ensure your payment is properly credited to your account.

Your check authorizes us to make a

Penalties and interest

NOTE: Your tax is due April 17, 2012. If you are paying your tax after April 17, you must include appropriate penalties and interest. Read “Penalties and interest” on page 6 of the M1 instructions and complete the worksheet below.

1 Tax not paid by April 17, 2012 .

2Late payment penalty* Multiply step 1 by 4% (.04) . . .

3Late filing penalty. If you are filing your return after Octo- ber 15, 2012, multiply step 1 by 5% (.05) . . . . . . . . . . . . . . . . . . .

4Extended delinquency. If your tax is not paid within 180 days after filing your return, multiply step 1 by 5% (.05) . . . . . . . . . . .

5Add steps 1 through 4 . . . . . . . .

6 Number of days the tax is late**

7Enter the applicable interest rate. For 2011, the rate is 3% (.03) . .

8 Multiply step 6 by step 7 . . . . . .

9Divide step 8 by 365 (carry to

five decimal places) . . . . . . . . . . . .

10 Interest. Multiply step 5

by step 9 . . . . . . . . . . . . . . . . . . .

11 Total payment amount.

Add step 5 and step 10 . . . . . . .

*If you are filing your return after April 17, 2012, and paid at least 90 percent of your total tax by the original due date, you will not be charged a late payment penalty if you file your return and pay any remaining tax by October 15, 2012.

**If the days fall in more than one calendar year, determine steps 6 through 10 sepa- rately for each year.

The amount on step 11 is your total tax, penalty and interest due. If you file a paper Form M1, include with your return the above worksheet or a separate statement showing how you computed penalty and interest.

Cut carefully along this line to detach.

Do not include the penalty and interest amounts on your Form M1.

2011 Income Tax Return Payment

2011 Income Tax Return Payment

Due April 17, 2012

First name and initial |

Last name |

|

|

|

|

Spouse’s irst name and initial |

Last name |

|

|

|

|

Address |

|

|

|

|

|

City |

State |

Zip code |

|

|

|

Make check payable to Minnesota Revenue and mail to:

Minnesota Revenue, P.O. Box 64054, St. Paul, MN

M60 |

0012 |

Your Social Security |

|

number (required) |

|

Your spouse’s |

|

Soc. Sec. number |

|

123111 |

|

AMOUNT |

|

OF CHECK |

00 |

Document Specifics

| Fact | Description |

|---|---|

| Form Type | Mn Tax Return Payment form M60 |

| Information Entry | Type in required information on screen, then print a copy. |

| Personalized Scan Line | A personalized scan line is printed on the voucher using entered information to ensure correct account crediting. |

| Print Settings | Set Page Scaling to "None" and do not select "Auto-rotate and center pages" or "Shrink to it". |

| Electronic Payment Option | Payment can be made electronically through the website or by phone, excluding accounts associated with foreign banks. |

| Credit Card Payment | Credit card payments are accepted with applicable fees through a designated website or phone number. |

| Payment by Check | Complete the voucher and mail with a check to Minnesota Revenue, ensuring correct Social Security number(s) are provided. |

| Penalties and Interest | If tax is paid after April 17, 2012, penalties and interest must be calculated and included with the payment. |

| Governing Law | Payments and calculations must comply with Minnesota state tax laws and regulations. |

Guide to Writing Mn Tax Return Payment

Filling out the Mn Tax Return Payment form, known as form M60, is a straightforward process designed to ensure your tax payments are accurately processed. This guide will walk you through the steps to complete the form correctly, whether you choose to pay electronically or by check. Paying attention to each step will help avoid common mistakes that can lead to processing delays.

- Begin by deciding your payment method. If paying electronically, visit www.revenue.state.mn.us and select “Make a payment” from the e-Services menu, or call 1-800-570-3329. For credit card payments, go to www.officialpayments.com or call 1-800-272-9829, using 3300 as the jurisdiction number.

- If choosing to pay by check, ensure all required fields on the voucher are filled. Start by typing your information directly on the form while it is displayed on your screen, then print a copy.

- Confirm the printing options. Set the Page Scaling to “None” and ensure that “Auto-rotate and center pages” or “Shrink to fit” boxes are unchecked. This step is crucial for generating a personalized scan line that helps in correctly crediting your payment to your account.

- Fill in your first name, initial, and last name. If filing jointly, also include your spouse’s first name, initial, and last name.

- Enter your complete address, including the city, state, and ZIP code.

- Input your Social Security number and, if applicable, your spouse’s Social Security number in the designated fields. These are required to ensure the correct attribution of your payment.

- Specify the tax-year end date as indicated on the form, which in this instance should be 123111 to reflect the end of the tax year on December 31, 2011.

- Enter the AMOUNT OF CHECK you are paying. This amount should reflect your total tax payment due, including any calculated penalties and interest if applicable.

- Make your check payable to Minnesota Revenue and mail it along with the completed voucher to: Minnesota Revenue, P.O. Box 64054, St. Paul, MN 55164-0054.

When including penalties and interest due to late payment, refer to the instructions provided on the form to calculate these amounts correctly. Add the calculated penalty and interest to your payment, ensuring the total amount reflects both your tax due and any additional charges incurred. Remember, accurate and timely payment is important to avoid further penalties and interest.

Understanding Mn Tax Return Payment

How can I make a payment for my Minnesota tax return?

There are three main ways to make a payment for your Minnesota tax return. First, you can pay electronically for free by visiting the Minnesota Department of Revenue website at www.revenue.state.mn.us and selecting "Make a payment" from the e-Services menu, or by calling 1-800-570-3329 and following the prompts for individuals to make a "return" payment. Remember, if paying electronically, the account used must not be associated with any foreign banks. Second, you can pay by credit card through www.officialpayments.com or by calling 1-800-272-9829, but be aware that fees may apply. When prompted, the jurisdiction number to enter is 3300. Lastly, you can pay by check by completing the M60 payment voucher. Make sure all required information is provided, including your correct Social Security number, to ensure proper credit to your account. Mail the completed voucher and check to the designated address. If submitting a paper Form M1, send the voucher and check separately from your return.

Do I need to include my Social Security number on the payment form?

Yes, it is essential to include your Social Security number on the payment form. If you are filing jointly, ensure to include your spouse's Social Security number as well. This information is necessary to correctly credit the payment to your account.

Can I submit the payment voucher and Form M1 together?

If you are filing a paper Form M1, you should send the payment voucher and your check separately from your tax return. This ensures that your payment is accurately processed and credited to your account without delay.

What happens to the check once it is used for payment?

Once you make a payment using a check, the Minnesota Department of Revenue will process it as a one-time electronic fund transfer from your account. You will not receive your canceled check back. This process helps in efficiently handling and crediting your payment.

What if I am paying my tax after April 17, 2012?

If your payment is made after April 17, 2012, you are required to include appropriate penalties and interest with your tax payment. To calculate the correct amounts, refer to the "Penalties and interest" section on page 6 of the M1 instructions, and follow the steps provided in the worksheet. It is important to calculate these amounts accurately to avoid underpayment of your tax dues.

How is the total payment amount calculated if payment is late?

If your payment is late, the total payment amount is calculated by first adding up the tax not paid by the due date, the late payment penalty, the late filing penalty if applicable, and any extended delinquency charges. Then, calculate the interest by determining the number of days the tax is late, applying the correct interest rate, and dividing the result by 365. The final step involves adding the calculated interest to the sum of steps 1 through 4 to get the total payment amount. This total includes your tax, penalty, and interest due.

What is the penalty for late payment?

The late payment penalty is calculated as 4% of the tax not paid by the due date. However, if you have paid at least 90% of your total tax by the original due date, you will not be charged a late payment penalty provided you file your return and pay any remaining tax by October 15, 2012.

How do I know if I've correctly set up my printed payment voucher?

To ensure your printed payment voucher is set up correctly, set the Page Scaling option to "None" in your Print options. Do not select “Auto-rotate and center pages” or “Shrink to fit.” If those options are checked, unclick them before printing. This step is crucial to ensure that the personalized scan line, which includes the tax-year end date and your Social Security number, is printed correctly for accurate processing of your payment.

What address should I mail my completed voucher and check to?

Mail your completed payment voucher and check to: Minnesota Revenue, P.O. Box 64054, St. Paul, MN 55164-0054. Ensure that your check is payable to Minnesota Revenue and that you have correctly filled out all required information on the voucher for proper processing.

Common mistakes

Not setting the Page Scaling to “None” in the print options before printing - This seemingly small detail is crucial for ensuring the printed voucher maintains the correct format. Not following this instruction can lead to a misinterpretation of the information you entered, potentially causing issues with your payment being properly credited.

Entering inaccurate Social Security numbers - It’s vital to double-check that both your Social Security number and, if applicable, your spouse’s are entered correctly. Any discrepancy in these numbers could misdirect the payment or delay the processing of your tax return, leading to unnecessary stress and potentially even penalties.

Choosing to pay electronically using an account associated with foreign banks - The form clearly states that for electronic payments, the chosen account must not be associated with any foreign banks. This mistake can prevent the transaction from being processed properly, causing delays or additional complications.

Forgetting to include penalties and interest if paying after the due date - Tax obligations do not end with the principal amount; penalties and interest accrue from the day after the due date. Neglecting to calculate and include these amounts can result in an underpayment, attracting more penalties.

Mailing the payment voucher and check with the paper Form M1, if applicable - This form advises that if you’re filing a paper Form M1, you should send the voucher and your check separately from your return. Ignoring this advice could lead to misprocessing or delays in crediting your payment since different departments or sections likely handle payments and process returns.

Here are some additional missteps often made but not mentioned directly in the form contents:

- Omitting necessary details on the check - It’s essential to ensure that all required information is written correctly on the check. This includes the payable order to Minnesota Revenue and mentioning the correct tax year end.

- Failing to detach the payment voucher correctly - The instruction to "Cut carefully along this line to detach" isn’t just for aesthetics; it ensures that the payment voucher maintains its integrity, facilitating smoother processing.

- Ignoring the print instructions regarding the “Auto-rotate and center pages” and “Shrink to fit” options - As with the Page Scaling setting, these options are crucial for preserving the voucher's format and ensuring the information is printed exactly as entered.

Documents used along the form

Filing tax returns and ensuring the correct payment of taxes in Minnesota involves the use of several documents besides the Mn Tax Return Payment Form M60. Each of these documents serves a specific purpose and aids in thoroughly completing the tax filing process. A brief overview of these documents will help taxpayers understand their roles and significance.

- Form M1, Individual Income Tax Return: This is the primary form used by residents to file their state income taxes in Minnesota. It collects information on the filer's income, deductions, and credits to calculate the state tax owed.

- W-2, Wage and Tax Statement: Employers issue this form to employees. It shows the amount of taxes withheld from the employee's paycheck for the year and is essential for completing Form M1.

- 1099 Forms: These forms report various types of income other than wages, such as independent contractor income (1099-NEC), interest and dividends (1099-INT and 1099-DIV), and retirement distributions (1099-R). Taxpayers need this information to accurately report their income.

- Schedule M1W, Minnesota Income Tax Withheld: This schedule is for listing the Minnesota tax withheld as reported on W-2s and 1099s. It ensures that taxpayers receive credit for any taxes already paid to the state.

- Schedule M1CD, Child and Dependent Care Credit: Taxpayers who paid for child or dependent care to allow them to work or look for work may be eligible to claim this credit. This schedule helps in calculating the allowable credit amount.

- Schedule M1ED, K-12 Education Subtraction and Credit: This form is used to claim deductions or credits for K-12 education expenses, offering benefits to parents investing in their child’s education.

- Schedule M1M, Income Additions and Subtractions: This schedule is utilized to adjust the taxpayer’s federal taxable income to reflect additions or subtractions specific to Minnesota state tax laws.

Accurately completing and including all related forms and documents is crucial for a smooth tax process. These documents facilitate a comprehensive overview of an individual's fiscal responsibilities and entitlements. Understanding each document's purpose ensures taxpayers can navigate the tax filing process more effectively, possibly reducing their taxable income or increasing their refund through various credits and deductions.

Similar forms

The Federal Income Tax Payment Voucher is quite similar to the Minnesota (MN) Tax Return Payment form in that both serve as means to facilitate the payment process for taxpayers. These vouchers require essential information like the taxpayer's Social Security number and the tax year to ensure accurate processing. Each one directs the user on how to complete the payment, whether electronically or by check, and outlines specific instructions for mailing if a physical check is used. They play a key role in helping taxpayers correctly address their payments to the respective tax authorities.

Another document sharing similarities with the MN Tax Return Payment form is the State Sales Tax Payment Voucher found in some states. Like the income tax payment forms, sales tax vouchers direct businesses on how to remit taxes they've collected. Both forms require identifying details such as a tax identification number or a Social Security number and include instructions for electronic or check payments. The purpose behind both is to funnel tax payments correctly to the state’s treasury, thereby ensuring that tax liabilities are settled appropriately.

The Estimated Tax Payment Voucher, used by individuals and businesses to pay their estimated taxes quarterly, also shares similarities with the MN Tax Return Payment form. These vouchers are critical for taxpayers who need to pay taxes on income not subject to withholding, such as earnings from self-employment, interest, dividends, and rent. Each form includes instructions on where and how to make payments, emphasizing timely remittance to avoid penalties and interest for late payments, much like the process outlined in the MN Tax Return Payment form.

Lastly, the Property Tax Payment Slip closely resembles the MN Tax Return Payment form in its function and purpose. Property tax slips are issued by local tax authorities and include specific details about the property, the owner, and the amount due. Similar to tax return payment forms, they provide options for payment methods, including checks and electronic transfers, and contain essential instructions on how to ensure the payment is correctly attributed to the taxpayer’s account. Both documents play a crucial role in the collection and processing of taxes due to government entities.

Dos and Don'ts

When preparing to fill out the Minnesota Tax Return Payment form, it's crucial to follow specific guidelines to ensure the payment process is smooth and errors are minimized. Below are some recommended do's and don’ts:

- Do ensure you type in the required information while the form is displayed on your screen before printing it out to capture the personalized scan line accurately.

- Do set the Page Scaling to "None" in your print options to ensure the voucher prints correctly, thus preventing any issues with processing your payment.

- Do not select "Auto-rotate and center pages" or "Shrink to fit" printing options as these settings may alter the layout or size of the payment voucher, potentially causing problems with scanning and processing the payment.

- Do verify that both your tax-year end date and Social Security number are correctly included in the scan line to help ensure your payment is properly credited to your account.

It's also important to consider the method you choose for payment:

- If paying electronically, use the website or phone number provided, and make sure to use an account not associated with any foreign banks.

- When paying by check, it's crucial to complete the voucher with all the required information, including the correct Social Security numbers for you and your spouse if filing jointly. Then, mail the voucher and your check to the address indicated on the voucher.

For those who may owe penalties and interest due to late payment:

- Calculate the amount not paid by the due date and follow the steps outlined to compute any late payment penalties, late filing penalties, extended delinquency charges, and interest.

- Add these amounts to determine your total payment due.

Adherence to these guidelines will help in avoiding common mistakes and ensure that your Minnesota Tax Return Payment is processed without unnecessary delays.

Misconceptions

When understanding the nuances of filing and paying income tax, particularly with the Minnesota Tax Return Payment form M60, individuals often encounter misconceptions. Here's a closer look at seven common misunderstandings and the truths behind them.

- Electronic Payment Requires a U.S. Bank Account: A common misconception is that payments must be made from a U.S. bank account when paying electronically. In reality, the requirement is that the account must not be associated with foreign banks, meaning it can be a U.S. account of an international bank, as long as it’s not a direct foreign bank account.

- Printing Adjustments are Optional: Some filers might think that the recommendations to adjust print settings, like setting Page Scaling to “None,” are optional. However, these settings are crucial to ensure that the personalized scan line, which is vital for correctly crediting your payment, is accurately printed.

- Payment Voucher is Unnecessary with Electronic Filing: There's a misconception that if you pay online, you don't need to bother with the payment voucher. This is not true; the payment voucher serves as a crucial backup and record-keeping tool, ensuring that payments are correctly linked to your account.

- Credit Card Payments are Prohibited: Contrary to some beliefs, making a payment with a credit card is allowed but comes with applicable fees. This method is facilitated through an official payments website or a dedicated phone line, providing a convenient, though more costly, payment option.

- Check Payments Don’t Require Precision: The detail that while paying by check, all information is required and must be accurate, especially concerning Social Security numbers, is sometimes overlooked. Incorrect information can lead to miscredited payments or processing delays.

- Late Payment Penalties are Negotiable: Many people mistakenly believe that penalties and interest for late payments are negotiable or can be waived upon request. The calculation of these fees follows strict guidelines detailed in the form, and they are applied uniformly without room for negotiation.

- Separated Filings for Married Couples Filing Jointly: There’s a misbelief that married couples filing jointly should fill out separate payment vouchers. However, the instruction specifies that for those married and filing separately, each spouse needs to complete his or her own voucher; this does not apply to joint filings.

Clearing up these misconceptions is essential for a smooth and accurate tax return and payment process. Ensuring that filers understand the specific requirements and regulations of the Minnesota Tax Return Payment form M60 can help avoid common errors and ensure payments are credited promptly and accurately.

Key takeaways

Filling out the Minnesota (MN) Tax Return Payment form accurately is crucial. The form requires specific details such as your correct Social Security number, and if applicable, your spouse's Social Security number. This ensures that your payment is correctly credited to your account.

Before printing the payment voucher, you must enter the required information directly on the screen. Once filled, a personalized scan line that uses the information you provided will be printed on the voucher, aiding in the correct processing of your payment.

When printing the voucher, it’s important to select the 'Page Scaling' to “None” under Print options and ensure that options like “Auto-rotate and center pages” or “Shrink to fit” checkboxes are not selected. If they are, they should be unchecked to ensure the voucher prints correctly.

Electronic payments are encouraged and can be freely made through the state's e-Service at www.revenue.state.mn.us or by calling a dedicated phone line. This method is quick and secure, reducing the potential for errors associated with paper submissions.

If you choose to pay by check, complete the voucher with all the required information. It’s critical to mail this voucher along with your check to the specified address to ensure proper crediting. Each spouse must complete a separate voucher if married and filing separately.

Payments can also be made using a credit card through an official payment portal or by calling a designated number. However, fees apply to this payment method. Remember, the effective date of payment is the date you make the request.

If filing a paper Form M1 (the state income tax return form), send the payment voucher and check separately from your return. This separation ensures your payment is processed timely and correlated with your account correctly.

Paying your tax after the due date necessitates the inclusion of penalties and interest. The form provides a guide for calculating these additional amounts, which include late payment penalties, late filing penalties, extended delinquency charges, and interest on the overdue tax.

If you’re able to pay at least 90% of your total tax liability by the original due date, you may not be charged a late payment penalty, provided you file your return and pay any remaining balance by October 15. Penalties and interest calculations need to be attached separately if filing a paper return.

Popular PDF Documents

IRS 4868 - Understanding the implications of Form 4868 can help taxpayers make informed decisions about their tax obligations.

W8 Bene - It can provide clarity on whether a worker is entitled to employee benefits and protections under labor laws.

What Is Power of Attorney California - Users can tailor the powers given to their agent, making it flexible for different needs.