Get Metlife Annuity Loan Application Form

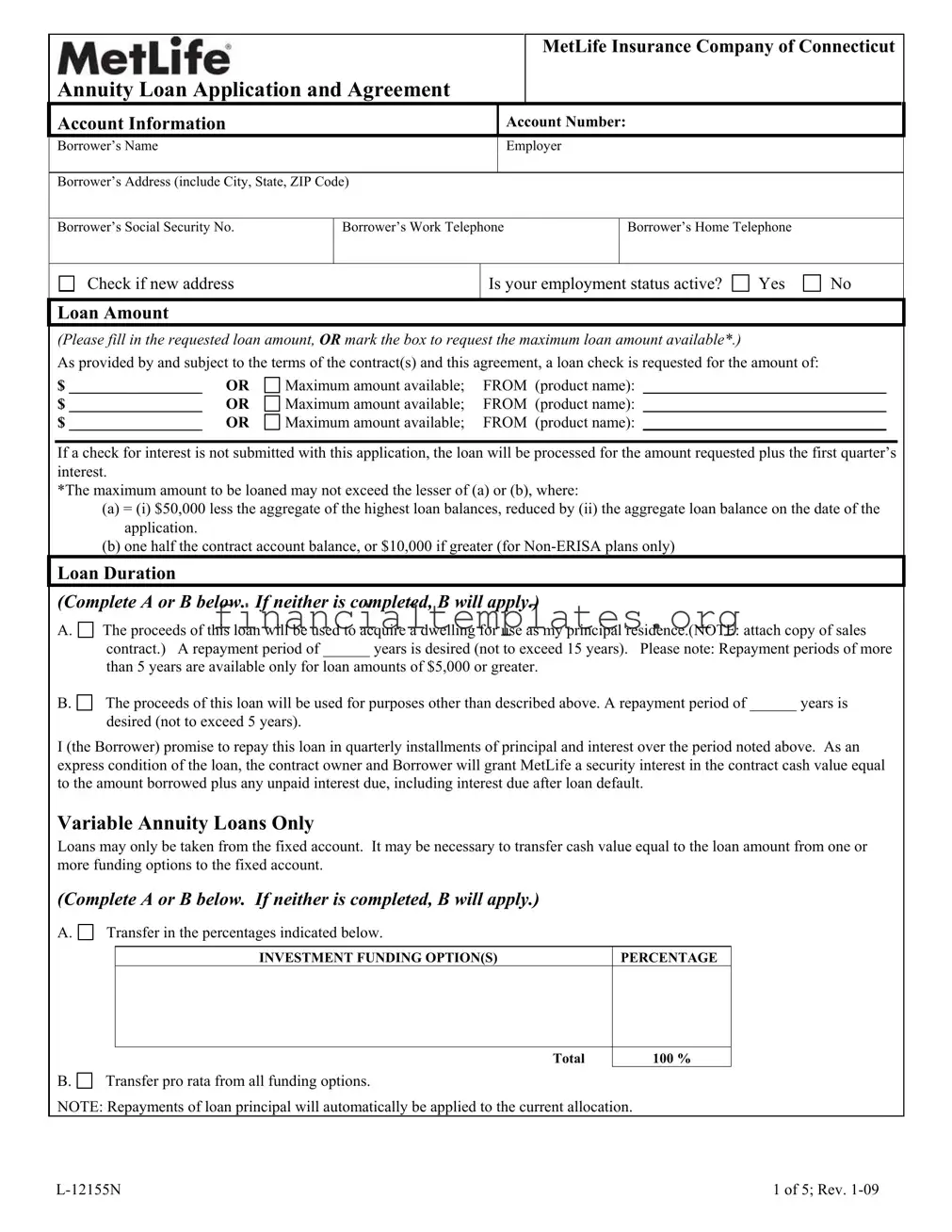

The MetLife Insurance Company of Connecticut Annuity Loan Application form is a comprehensive document designed to facilitate the borrowing of funds by the annuity contract holder. It revolves around the structured process of applying for a loan against an annuity contract, detailing the necessary borrower information including but not limited to the borrower’s name, address, employment status, and social security number. Additionally, it specifies the loan amount, either a specified amount or the maximum available, and outlines the terms of the loan duration, which varies based on the purpose of the loan. Significantly, the form requires acknowledgment and signatures from both the borrower and, in the case of ERISA (Employee Retirement Income Security Act) plans, the borrower’s spouse, underscoring the legal and financial implications of such a loan. The agreement also meticulously details the conditions under which the loan operates, including minimum and maximum loan amounts, interest rates, repayment schedules, and the consequences of default or insufficient repayment. Furthermore, it addresses the special considerations for loans against variable annuities and contains specific provisions for group plans, illustrating the loan’s adaptability to different contract types and regulations. Through providing this information, the form ensures transparency and clarity for all parties involved, establishing a contractual agreement that is underpinned by both MetLife's policy terms and applicable laws and regulations.

Metlife Annuity Loan Application Example

MetLife Insurance Company of Connecticut

Annuity Loan Application and Agreement

Account Information |

|

|

|

Account Number: |

|

|

|

Borrower’s Name |

|

|

|

Employer |

|

|

|

|

|

|

|

|

|

|

|

Borrower’s Address (include City, State, ZIP Code) |

|

|

|

|

|||

|

|

|

|

|

|

||

Borrower’s Social Security No. |

Borrower’s Work Telephone |

|

Borrower’s Home Telephone |

|

|||

|

|

|

|

|

|

||

Check if new address |

|

Is your employment status active? |

Yes |

No |

|||

|

|

|

|

|

|

|

|

Loan Amount

(Please fill in the requested loan amount, OR mark the box to request the maximum loan amount available*.)

As provided by and subject to the terms of the contract(s) and this agreement, a loan check is requested for the amount of:

$ _________________ |

OR |

Maximum amount available; |

FROM (product name): |

|

$ _________________ |

OR |

Maximum amount available; |

FROM |

(product name): |

$ _________________ |

OR |

Maximum amount available; |

FROM |

(product name): |

If a check for interest is not submitted with this application, the loan will be processed for the amount requested plus the first quarter’s interest.

*The maximum amount to be loaned may not exceed the lesser of (a) or (b), where:

(a) = (i) $50,000 less the aggregate of the highest loan balances, reduced by (ii) the aggregate loan balance on the date of the application.

(b) one half the contract account balance, or $10,000 if greater (for

Loan Duration

(Complete A or B below. If neither is completed, B will apply.)

A.

The proceeds of this loan will be used to acquire a dwelling for use as my principal residence.(NOTE: attach copy of sales

contract.) A repayment period of ______ years is desired (not to exceed 15 years). Please note: Repayment periods of more

than 5 years are available only for loan amounts of $5,000 or greater.

B.

The proceeds of this loan will be used for purposes other than described above. A repayment period of ______ years is

desired (not to exceed 5 years).

I (the Borrower) promise to repay this loan in quarterly installments of principal and interest over the period noted above. As an express condition of the loan, the contract owner and Borrower will grant MetLife a security interest in the contract cash value equal to the amount borrowed plus any unpaid interest due, including interest due after loan default.

Variable Annuity Loans Only

Loans may only be taken from the fixed account. It may be necessary to transfer cash value equal to the loan amount from one or more funding options to the fixed account.

(Complete A or B below. If neither is completed, B will apply.)

A.

Transfer in the percentages indicated below.

INVESTMENT FUNDING OPTION(S)

PERCENTAGE

Total

100 %

B. |

Transfer pro rata from all funding options. |

NOTE: Repayments of loan principal will automatically be applied to the current allocation.

1 of 5; Rev. |

Group Plans Only

(Check A or B below. If neither is completed, B will apply.)

A.

B.

Cash Value attributable to employer contributions (other than contributions derived from salary reduction) may be used to secure this loan.

Cash Value attributable to employer contributions (other than contributions derived from salary reduction) may not be used to secure this loan.

Loan Request Information

List all outstanding loans from any retirement plan of the employer (or related employer) during the previous 12 months, including defaulted loans which have not been repaid or offset.* A loan will not be processed if the participant has an outstanding loan

under any retirement plan of the employer (or related employer) which has defaulted, but not been repaid or offset.

Company Name

Certificate or

Contract Number

Current Vested

Account Balance

Current Loan

Balance

Highest Loan Balance

During Past 12

Months

In Default But Not Yet Offset?

Acknowledgement and Signatures

I authorize the loan check and bills to be sent to this billing address:

Street |

City, State, Zip Code |

I (the borrower) understand that federal income tax loan regulations will be enforced to the extent necessary to keep the annuity contract qualified under applicable Internal Revenue Code provisions and under other applicable tax and benefits plan laws and regulations. I understand that I may have only one loan at a time from this contract or certificate. I may not have another loan from this contract or certificate until the outstanding loan and interest are repaid in full.

I understand that a loan is not permitted if I have a loan from 1) any of my employer’s retirement plans or 2) from retirement plans of a related employer, that is in default and is still outstanding due to tax law restrictions on offset; and I certify that I do not have any such previously defaulted loans.

I understand that I am responsible for ensuring that I do not borrow an amount in excess of the loan amount permitted under section 72(p) of the Internal Revenue Code of 1986, as amended ( the “Code”); and that adverse tax consequences, including treatment of such excess amounts as deemed distributions, will result in such case.

I (borrower and/or contract owner) understand and accept the terms and conditions applicable to this loan, including the special terms and conditions described in the "Contract Loan Terms and Conditions" section of this agreement, and accept full responsibility for compliance with these requirements. I/we also understand that MetLife accepts no responsibility concerning adherence to these requirements and that contract values are assigned to MetLife as sole security of the loan.

I acknowledge that I have read and understood the terms and conditions of this loan agreement:

I certify this withdrawal is permissible under the terms of the Plan.

Signature of Plan Administrator/Authorized Representative |

Date |

|

|

Borrower’s Signature

Date

*A loan offset occurs when your accrued plan benefit is reduced (offset) in order to repay the loan (including the enforcement of our security interest in your accrued benefit).

2 of 5; Rev. |

Spousal Consent – ERISA Plans Only

I hereby consent to the loan request by the contract owner as set forth above. I understand that if I am married, I must obtain my spouse's consent to this loan. I understand that a spouse is guaranteed certain rights to assets in this retirement account by federal law and these rights include the right to a preretirement survivor's annuity and the right to a joint and survivor annuity and these rights could be diminished by an annuity loan which is not repaid. This consent cannot be revoked once given.

__ I certify that I am not married and therefore spousal consent to this loan is not required __ I am married and my spouse's consent to this loan is provided below

__ I am married and certify my spouse's consent cannot be obtained or is not required because: (Check only one box below) __ My spouse cannot be found

__ My spouse is legally incompetent to give consent (spouse's legal guardian may give consent)

__ I am legally separated from or have been abandoned by my spouse (within the meaning of local law) and have a court order to such effect and no qualified domestic relations order exists that requires spousal consent to this loan.

Borrower’s Signature

Date

Spouse’s Name (Please print)

Spouse’s Signature

Date

I certify that the

Notary Public’s Signature

Date

Plan Administrator’s Signature

Date

|

Mailing Instructions |

|

Mail this form to: |

Overnight mail only: |

Fax to: |

MetLife |

MetLife |

|

P.O. Box 572 |

4700 Westown Parkway, Ste. 200 |

|

Des Moines, IA |

West Des Moines, IA 50266 |

|

SEE NEXT TWO PAGES FOR LOAN TERMS AND CONDITIONS

3 of 5; Rev. |

MetLife Insurance Company of Connecticut

Annuity Contract

Loan Terms and Conditions

Minimum and Maximum Loan Amounts

•Minimum: $1,000*

•Maximum:

The maximum amount that can be borrowed is an amount which when added to the other outstanding loan balances under plans of the same or related employer ( the “Plan”) does not exceed the lesser of:

1.$50,000 reduced by the excess ( if any) of :(a) the highest total amount of the Plan loans outstanding during the twelve

month period ending on the day before this loan over (b) the outstanding plan loan amount on the date of this loan.

2.

In addition to the above limits, in no event may the loan amount under this Contract exceed :

Vested Contract Cash Value |

Additional loan limitation under this Contract |

$1,250 - $12,500 |

80 % of vested Contract cash value for |

|

50% of vested Contract cash value for ERISA Plan |

Over $12,500 - $20,000 |

$10,000 for |

|

50%of vested Contract cash value for ERISA Plan |

Over $20,000 |

Lesser of |

|

(a)50% of the vested contract cash value or (b) $50,000.reduced by the highest Plan loan balance |

|

during the previous 12 nmonths |

|

|

*For the following contract holders in the state of New Jersey, the minimum loan amount is $500.00 - PrimElite II; Portfolio Architect 3; Universal Annuity (Individual); Vintage; Vintage II; Vintage II Series II; Vintage 3

Loan Duration

Repayments of principal and interest must be made in quarterly installments from one to five years. If the proceeds of the loan are used to acquire the Borrower’s principal residence, the loan repayment period may be extended to fifteen (15) years. Repayment periods of more than five (5) years are available only for loan amounts of $5,000 or greater.

The Borrower may have only one outstanding loan per contract.

Loan Billing and Repayment

Loan proceeds and bills will be mailed to the billing address noted in this agreement. If no address is specified, the check and all correspondence will be mailed to the most current address on our records for the Borrower.

A bill in the amount of the quarterly repayment due (to include principal and interest) will be mailed 45 days prior to the repayment due date. Repayments will be applied first to unpaid interest due, then to loan principal. If the repayment amount exceeds the total amount billed, the excess money will be applied towards the outstanding loan principal, not to future quarterly repayments.

Acceptable methods for repayment are personal checks or bank checks.

Interest Charged

Quarterly loan interest must be paid in advance. Interest charged will be at the rate in effect at the time the request is received in good order at MetLife Home Office. The loan’s first quarter interest may be paid from the loan proceeds, or by check at the time the loan is made.

If the original loan check is returned within twenty (20) days of the date of the loan check, loan interest will be waived.

The loan interest rate is determined by whether the plan or contract is subject to ERISA.

4 of 5; Rev. |

ERISA Loans:

The interest rate charged at the inception of the loan will remain in effect for one year from the loan effective date. The interest rate may change annually. Notification of any change in the interest rate charged will be made at least thirty (30) days prior to its taking effect. If the interest rate changes, required quarterly repayments will change.

The interest rate charged at the loan’s effective date will remain in effect for the duration of the loan.

Current loan interest rates can be obtained by contacting your MetLife representative directly or by calling our Annuity Customer Service Center.

Loan Default and Taxation

You may repay amounts after a loan default. Such repayments will prevent any additional interest from accruing on the repaid amounts and will reduce the amount of your outstanding loan balance for purposes of determining the amount of any additional loans you may have under retirement plans of your employer. However, such repayments after the administrative grace period will not reverse the default or the deemed distribution of the unpaid loan balance that is reportable for federal income tax purposes. (See below.)

If a quarterly repayment has not been received

If a repayment is not received within ninety (90) days of its due date and the billed amount has not been paid as described in the previous paragraph, the entire loan will be placed in default. A tax report will be produced for the calendar year the loan was placed in default, reporting to the IRS as a deemed distribution the outstanding loan amount. Interest will be charged on the defaulted loan amount until it is repaid. The defaulted loan can be repaid at any time to avoid the interest charge accrual. At the time the contract cash value becomes available for loan repayment under federal tax law or regulation, and to the extent permissible under applicable state regulations, the cash value will be reduced by the amount of the loan outstanding and any unpaid interest due. Any applicable deferred sales charges or surrender penalties will be taken. The loan will no longer be outstanding.

The loan plus any unpaid interest due must be repaid in full at the time of an allowable full surrender, including a direct rollover or transfer. Amounts available for partial surrender , including a direct rollover or transfer, will be limited to the cash surrender value of the contract minus the loan amount outstanding, including amounts in default, minus unpaid interest due.

In the event the Borrower files a bankruptcy petition while the loan remains in effect, an exemption will be elected for the annuity contract, including but not limited to its cash value, pursuant to Section 522 of Federal Bankruptcy Code or under a state law exemption at least as broad in scope as Section 522.

PLEASE RETAIN THIS COPY FOR YOUR RECORDS

5 of 5; Rev. |

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The MetLife Insurance Company of Connecticut Annuity Loan Application allows for the borrowing of funds based on the value of the annuity contract. |

| 2 | Minimum loan amount is set at $1,000, with a specific exception for certain contract holders in New Jersey, where it's $500. |

| 3 | Maximum loan amount is determined by the lesser of two calculations: $50,000 minus any prior loan balances or one-half of the contract account balance (subject to specific conditions for ERISA and Non-ERISA plans). |

| 4 | Loan duration can extend up to five years, or fifteen years if the proceeds are used for acquiring the borrower's principal residence. |

| 5 | Variable Annuity Loans can only be taken from the fixed account, requiring a transfer of funds if necessary. |

| 6 | Loan interest rate varies based on whether the plan or contract is subject to ERISA, with ERISA loans having potentially annually changing rates. |

| 7 | In case of loan default, the outstanding loan amount becomes a deemed distribution, reported to the IRS for federal income tax purposes. |

| 8 | Specific state laws, such as for New Jersey residents, can modify the terms of the annuity loan, indicating the importance of understanding the governing law(s) applicable to the borrower's situation. |

Guide to Writing Metlife Annuity Loan Application

Taking out a loan using your MetLife annuity can be a streamlined process when you know the steps to follow. Below is a guide to help you complete the MetLife Annuity Loan Application, setting you on a clear path towards accessing the funds you might need for a pressing financial requirement or a significant life event. Whether you're borrowing for a new home or have other financial goals, completing your application accurately is the first step toward obtaining your loan.

- Start by locating the section titled Account Information. Here, you'll need to fill in your Account Number and all the personal identification information it asks for, like your Borrower's Name, Employer, Borrower's Address (including city, state, and ZIP code), Borrower's Social Security Number, and both Work and Home Telephone numbers. If you have recently changed your address, make sure to tick the box that indicates a new address.

- Specify your employment status by checking either Yes or No to reflect whether you are currently active in your employment.

- In the Loan Amount section, enter the specific dollar amount you wish to borrow in the provided space. If you prefer to borrow the maximum amount available, simply check the box marked for that option. Ensure to specify from which product name you are requesting the loan, if applicable.

- For the Loan Duration, decide between option A or B based on the purpose of your loan, and fill in the desired repayment period in years. Attach a copy of the sales contract if the loan is for acquiring a principal residence.

- If your loan involves a Variable Annuity, choose between transferring a specified percentage of your cash value or a pro-rata distribution from all funding options, under the Variable Annuity Loans Only section.

- For Group Plans Only, indicate whether the cash value attributable to employer contributions will be used to secure this loan by selecting either option A or B.

- Under Loan Request Information, list any outstanding loans from any employer's retirement plan, including those in default but not offset.

- In the Acknowledgement and Signatures section, authorize the loan check and bills to be sent to the specified billing address, and confirm your understanding of the tax implications and terms associated with this loan. This includes acknowledging the contract's loan terms and conditions, as well as certifying the withdrawal's permissibility under the plan.

- Sign and date the form as the borrower. The Plan Administrator/Authorized Representative must also sign and date the application. If applicable, ensure the Spousal Consent section is completed, acknowledging the loan's effect on spousal rights under ERISA plans.

- For mailing, choose the appropriate address provided for either standard or overnight mail, or use the provided fax number for a quicker submission.

Once you've completed these steps, your application will be on its way to being processed by MetLife. Remember, accuracy in filling out the application is critical to ensure there are no delays in processing your request. Good luck with your loan application!

Understanding Metlife Annuity Loan Application

-

How do I determine the loan amount I can request from my MetLife Annuity?

The amount you can borrow is subject to certain limits. Firstly, it can't exceed $50,000 minus the highest total of Plan loans you had in the past 12 months, or one-half of your nonforfeitable accrued benefit in the Plan, whichever is less, with a minimum threshold of $10,000 for non-ERISA plans. Additionally, the amount under this specific contract is constrained by the vested Contract Cash Value, with further limitations based on the contract cash value tiers provided. It's crucial to fill in your desired loan amount on the application form, or mark the box if you wish to request the maximum allowed.

-

What are the repayment terms for a MetLife Annuity loan?

You have the flexibility to set your repayment period within a certain range. If the loan is used to acquire a principal residence, you may opt for a repayment period up to 15 years, provided the loan amount is $5,000 or more. For other purposes, the loan must be repaid within 5 years. Repayments are due quarterly, beginning from the loan issuance date. Remember, you can only have one outstanding loan per contract at any time.

-

How is interest charged on a MetLife Annuity loan?

Interest on your loan must be paid quarterly, in advance. The interest rate is fixed at the inception of the loan and will remain static for Non-ERISA loans for the loan's duration. For ERISA-regulated loans, the rate is fixed for one year and may then be adjusted annually. If the loan proceeds are returned within 20 days from the distribution date, the interest for that period is waived. Your loan agreement details will specify the precise rate and it's always a good idea to confirm the current rates either by contacting a MetLife representative or through customer service.

-

What happens if I default on my loan?

In the event of a default, which is triggered if a quarterly repayment is missing 90 days past its due date, the outstanding loan balance becomes a deemed distribution and will be reported to the IRS as such, incurring potential tax liabilities. However, should you repay the defaulted amount, while it eliminates future interest accumulation, it doesn't undo the default status or the tax event that has been reported. Any loan balance, including defaulted loans and interest due, must be fully repaid upon the contract's full surrender or when becoming eligible for withdrawal under applicable tax laws. Be aware that defaulting on your loan has serious financial consequences, including impact on your retirement savings and tax liabilities.

Common mistakes

Filling out the MetLife Annuity Loan Application form is a crucial step for borrowers looking to secure a loan against their annuity contract. However, mistakes during this process can lead to delays, rejection, or unfavorable loan terms. Here are seven common errors people make when completing this form:

- Not providing complete Account Information, such as the Account Number or Borrower’s Social Security Number. This foundational data is critical for the application's processing and verification of the borrower’s identity and account status.

- Choosing the incorrect loan amount by either not specifying the requested amount or not marking the box to request the maximum loan amount available. It's essential to be clear about how much financing is being sought to ensure the application aligns with the borrower's financial needs.

- Failing to indicate the Loan Duration correctly. Applicants must select either option A or B to clarify the loan's purpose and desired repayment period. Misunderstanding or overlooking this section can result in a loan term that doesn't match the borrower's intentions or capabilities.

- Incorrect handling of the section regarding loans from Variable Annuity accounts. Not specifying whether to transfer from specific investment funding options or pro-rata from all funding options can cause processing delays or incorrect loan funding.

- Omitting information about other outstanding loans from any retirement plan of the employer or related employer in the previous 12 months, including defaulted loans. Transparency about existing debts ensures compliance with federal income tax loan regulations and avoids potential legal issues.

- Providing an incorrect billing address or not acknowledging that the loan check and bills will be sent to the specified address. This mistake can lead to missed payments or other communication issues between MetLife and the borrower.

- Forgetting to secure Spousal Consent in ERISA plans, where applicable. This oversight can invalidate the loan application, as federal law requires such consent to ensure spouses are aware of and agree to the financial obligations being undertaken.

By avoiding these common mistakes and providing accurate, complete information, borrowers can streamline their loan application process with MetLife.

Documents used along the form

When submitting a MetLife Annuity Loan Application, applicants often need to prepare and include additional forms and documents. These documents are essential for the processing and approval of the loan application. They provide detailed information about the applicant's financial status, the purpose of the loan, and legal acknowledgments.

- Proof of Identity: A government-issued photo ID, such as a driver’s license or passport, is required to verify the identity of the borrower.

- Proof of Income: Recent pay stubs, tax returns, or other official documents may be necessary to establish the borrower's ability to repay the loan. This ensures that the borrower has a reliable source of income.

- Beneficiary Designation Form: If the annuity contract requires updating beneficiaries as part of the loan process, a completed beneficiary designation form must be provided. This document specifies who will receive benefits from the annuity in the event of the borrower’s death.

- Spousal Consent Form: For plans subject to the Employee Retirement Income Security Act (ERISA), a spouse's consent may be needed if the withdrawal or loan could affect the spouse's rights to benefits. This form is a legal acknowledgment from the spouse regarding the loan application.

- Direct Deposit Authorization Form: If the borrower opts to receive the loan proceeds via direct deposit, a form authorizing this transaction must be completed. This form includes bank routing and account numbers where the loan amount will be deposited.

Providing complete and accurate documents alongside the MetLife Annuity Loan Application helps ensure a smooth process. It enables the lender to assess the application accurately and make informed decisions regarding the loan approval. Always double-check the application and supporting documentation for completeness before submission to avoid unnecessary delays.

Similar forms

A 401(k) Loan Application exhibits similarities with the MetLife Annuity Loan Application in terms of borrowing procedures from a retirement account. Both forms necessitate the borrower's information, such as account details and employment status, to evaluate the eligibility for the loan. Furthermore, each document outlines loan terms, including minimum and maximum borrowing amounts, loan duration, and repayment expectations. They also share a common focus on the legal implications of the loan, particularly regarding tax consequences and restrictions under applicable laws.

The Home Mortgage Application shares characteristics with the MetLife Annuity Loan Application, especially when the proceeds are used for purchasing a principal residence. Both require detailed personal and financial information from the applicant to assess their loan qualification. They also provide options for the loan's purpose, specifying different repayment terms based on whether the loan is for a primary residence or other uses. Additionally, both forms might necessitate spousal consent in certain situations, reflecting the need to consider family rights and implications in financial decisions.

A Personal Loan Application from a bank or credit union is quite similar to the MetLife Annuity Loan Application. Each document gathers comprehensive personal and financial information, including employment status and contact details, to determine the borrower's capacity to repay the loan. Both forms inquire about the loan amount desired and specify the repayment period, offering a structured repayment plan. They also contain sections on the terms and conditions of the loan, clearly outlining the borrower's obligations and the lender's rights.

The Student Loan Application form mirrors several aspects of the MetLife Annuity Loan Application. It collects detailed personal information, education expenses, and desired loan amount to evaluate eligibility. Both forms address the purpose of the loan and establish specific conditions for loan approval and disbursement. Importantly, they stress understanding the loan's terms, including repayment obligations and the effects of default, emphasizing the borrower's responsibility to comply with the agreed terms.

The Credit Card Application process shares some procedural parallels with the MetLife Annuity Loan Application, notably in the examination of the applicant's financial stability and creditworthiness. While the purposes of borrowing differ, both require the applicant's detailed personal and financial data. They include provisions regarding the management of outstanding debts and emphasize the legal responsibilities attached to the borrowing agreement. Moreover, both applications make it clear that failure to adhere to repayment terms can have significant financial consequences.

The Business Loan Application, much like the MetLife Annuity Loan Application, caters to specific financial needs but requires a thorough examination of the borrower's ability to repay. Each form requests detailed financial information, including current debts and assets. They outline the terms under which the loan is granted and detail the repayment plan. Both documents highlight the importance of compliance with the loan terms and the potential repercussions of defaulting on the loan.

The Payday Loan Agreement, while generally for smaller amounts and shorter terms compared to the MetLife Annuity Loan Application, still bears similarity in the need for borrower information, loan amount specifications, and repayment terms. Each emphasizes the borrower's understanding of and agreement to the loan conditions, including interest rates and the consequence of non-repayment. Additionally, they caution about the legal implications of failure to repay according to the agreed terms.

The Auto Loan Application bears resemblance to the MetLife Annuity Loan Application through its requirement for detailed personal, employment, and financial information to assess loan eligibility. Both delineate loan terms, including amount, purpose, and repayment schedule. Importantly, they ensure the borrower is aware of the consequences of defaulting on the loan, including repossession of assets or adverse impacts on credit scores. The consideration of collateral—whether it's a vehicle or an annuity contract—further links these two document types.

The Home Equity Line of Credit (HELOC) Application has similarities with the MetLife Annuity Loan Application, particularly because both forms of borrowing leverage the borrower’s existing assets to secure the loan. Information on the borrower's financial standing, including outstanding debts and creditworthiness, is crucial in both applications. They also define how the borrowed funds can be used, detail the repayment expectations, and stress the legalities of the loan agreement, including the implications of failing to meet repayment obligations.

Dos and Don'ts

When applying for a MetLife Annuity Loan, there are certain practices to follow and to avoid ensuring your application is smoothly processed. Here are seven do's and don'ts:

Do's:

- Review the entire form first : Before starting, read through the application to understand all the required information and instructions.

- Use black or blue ink when filling out the application if you are submitting a hard copy. This ensures that all the information is legible and can be processed without delay.

- Ensure accuracy in all provided information such as your Account Number, Borrower’s Name, Employer, and Borrower’s Social Security No. Mistakes can lead to processing delays or rejection of your application.

- Check the box if you have a new address or your employment status has changed to keep your records updated.

- Attach additional documentation if required, for example, a copy of the sales contract if the loan proceeds will be used to acquire a dwelling.

- Clearly specify the loan amount you wish to borrow, or mark the box to request the maximum loan amount available, ensuring it adheres to the limits set by the plan’s terms.

- Sign and date the form. Your application won’t be processed without your signature and that of any required parties, such as a plan administrator or spouse for spousal consent in ERISA plans.

Don'ts:

- Do not leave fields blank that are applicable to your loan request. Incomplete applications can lead to processing delays.

- Avoid guessing on details like your account balance or loan maximums; verify all information for accuracy before submission.

- Do not ignore the spousal consent section if you are married and your plan is subject to ERISA. Failing to obtain and document this consent can invalidate your loan request.

- Refrain from requesting more than the maximum allowed amount . The application clearly states the maximum loan amounts permissible under federal guidelines and the terms of your contract.

- Avoid submitting the application without ensuring all parts are complete , including the choice of loan duration and repayment plan.

- Do not forget to include the check for interest if you choose to pay the loan's first quarter interest upfront instead of having it deducted from the loan amount.

- Do not disregard the loan terms and conditions provided. These include important details about minimum and maximum loan amounts, repayment requirements, and potential tax implications in case of default.

Misconceptions

When navigating through the process of applying for a loan through MetLife's Annuity Loan Application form, it is important to address common misconceptions. These misunderstandings can lead to confusion and potentially impact the decision-making of potential borrowers. Here are six key misconceptions, explained to provide clarity:

- Misconception 1: You can borrow any amount, as long as it's under $50,000. The reality is that the maximum loan amount is subject to the lesser of $50,000 reduced by certain adjustments or one half of the contract account balance (or $10,000 if greater for Non-ERISA plans only). This means there's a calculated limit on how much one can borrow, taking into account previous loans and the current value of the annuity contract.

- Misconception 2: Loan proceeds can be used for any purpose without affecting the repayment terms. In truth, the use of the loan proceeds can influence the repayment period. For loans used to acquire a principal residence, a longer repayment period of up to 15 years is available. However, for other purposes, the maximum repayment period is five years. The purpose of the loan directly impacts its terms.

- Misconception 3: Interest rates for ERISA and Non-ERISA loans are static and unchanging. Interest rates for ERISA loans may change annually, while Non-ERISA loan rates remain fixed for the duration of the loan. Borrowers must stay informed about the specific characteristics of their loan, particularly with ERISA loans where periodic adjustments may occur.

- Misconception 4: Spousal consent is not a significant part of the application process. For ERISA plans, obtaining spousal consent is a critical step that ensures compliance with federal laws regarding retirement assets. This consent gives protections to spouses by acknowledging their rights to certain benefits, which might be affected by the loan if not repaid.

- Misconception 5: You can have multiple loans from the same contract simultaneously. Individuals are allowed only one loan at a time per contract. An existing loan must be fully repaid, including interest, before another loan can be considered. This rule ensures that loans are managed responsibly and aligns with tax laws and regulations.

- Misconception 6: Defaulted loans can be easily rectified without consequences. Loans in default have significant repercussions, including the accrual of additional interest and potential tax liabilities. While repayments can be made post-default to stop further interest charges and reduce the outstanding balance, the original default and its deemed distribution for tax purposes cannot be reversed. This emphasizes the importance of timely repayments.

Understanding these key points regarding MetLife's Annuity Loan Application helps clarify the borrowing process, ensuring individuals are well-informed and can make decisions that align with their financial goals and requirements.

Key takeaways

Filling out and using the MetLife Annuity Loan Application form involves several critical steps and considerations to ensure compliance and to make informed decisions about your annuity loan. Here are four key takeaways:

- Understanding loan limits: The application requires you to specify the loan amount you're requesting. You can ask for a specific dollar amount or for the maximum available. It's important to note that there are limits on how much you can borrow. The maximum loan amount is the lesser of $50,000 minus the highest loan balance in the last 12 months, or one-half of the contract account balance (or $10,000, if greater, for Non-ERISA plans).

- Loan duration and repayment: The application distinguishes between loans used to purchase a principal residence, which can have repayment periods up to 15 years, and all other loans, which are limited to a 5-year repayment period. Borrowers must indicate their desired repayment term and promise to repay the loan in quarterly installments. This choice affects how long you'll be in debt and the size of your repayment installments.

- Security interest: By signing the loan agreement, you grant MetLife a security interest in the cash value of your annuity contract equal to the amount borrowed plus any unpaid interest. This means that should you default on the loan, MetLife has a claim to a portion of your annuity’s cash value as collateral for the loan.

- Tax implications and defaults: If a loan repayment is late or the loan defaults, it can trigger adverse tax consequences, such as the loan amount being treated as a deemed distribution, which is taxable. The application warns borrowers about the tax regulations enforced and the importance of repaying the loan as agreed to avoid unwanted tax implications.

Properly completing the MetLife Annuity Loan Application form and understanding the implications of taking out a loan against your annuity are imperative to managing your financial future. Paying attention to the details in the application can help avoid potential financial pitfalls associated with such loans.

Popular PDF Documents

Fire Tcc - To revise your TCC details, Form 4419 requires the current TCC number for reference and processing.

Minnesota No Sales Tax - Organizations using the ST3 form must regularly review and update their exemption status to ensure ongoing compliance.

Notice to Pay Rent or Quit California - A procedural document that kickstarts the eviction process for tenants who have failed to pay rent, detailing next legal steps.