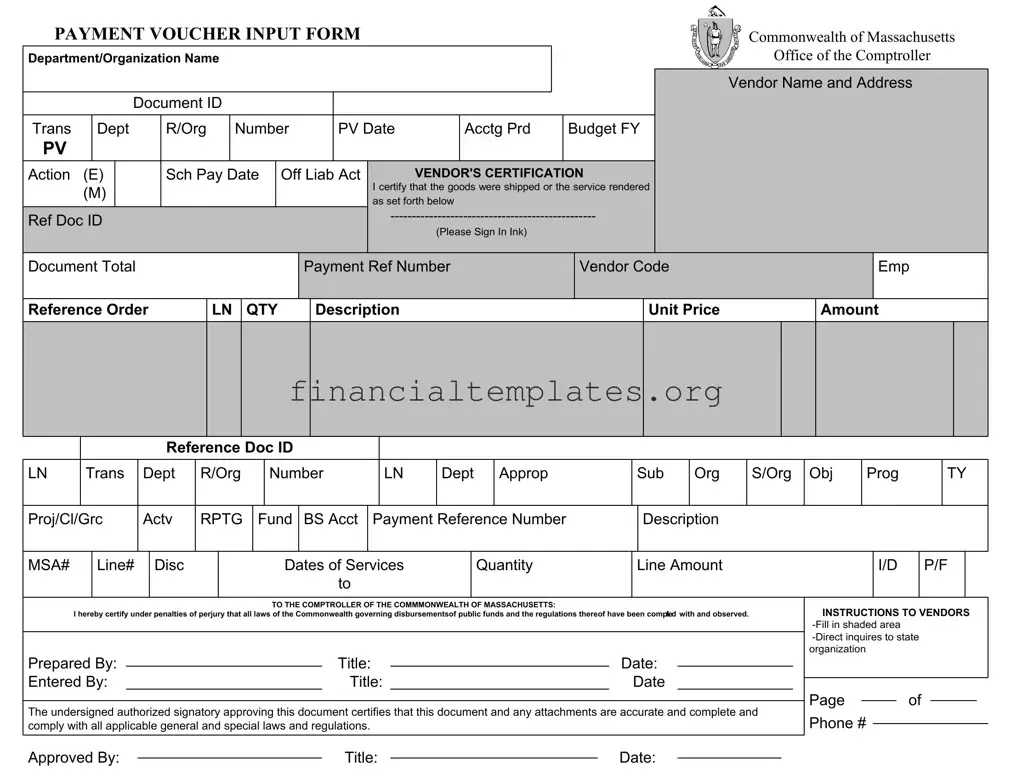

Get Massachusetts Payment Voucher Form

In the Commonwealth of Massachusetts, the effective management of public funds is a priority, ensuring transparency, accountability, and efficiency in governmental transactions. The Massachusetts Payment Voucher form serves as a fundamental tool in this mission, facilitating the disbursement of payments from state departments to vendors for goods delivered or services rendered. This meticulously structured document requires the input of key data such as the vendor's name and address, document and payment reference numbers, detailed descriptions of the transactions including quantities, unit prices, and total amounts. It mandates vendor certification to confirm that the services or goods were indeed provided, alongside various codes and identifiers that help categorize and track state expenditures. Compliance with all related laws and regulation is a critical aspect, highlighted by the vendor's and preparer's certifications that all disbursement requirements have been met. This comprehensive approach is designed to streamline payment processes while upholding rigorous standards to prevent errors and ensure accountability in the use of public funds. The inclusion of instructions to vendors and multiple levels of approval underscores the form's role in maintaining the integrity of state financial operations.

Massachusetts Payment Voucher Example

PAYMENT VOUCHER INPUT FORM

Department/Organization Name

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trans |

|

Dept |

|

R/Org |

Number |

PV Date |

|

Acctg Prd |

|

Budget FY |

|||

PV |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Action |

(E) |

|

|

Sch Pay Date |

Off Liab Act |

|

VENDOR'S CERTIFICATION |

||||||

|

(M) |

|

|

|

|

|

|

I certify that the goods were shipped or the service rendered |

|||||

|

|

|

|

|

|

|

as set forth below |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||

Ref Doc ID |

|

|

|

|

|

||||||||

|

|

|

|

|

|

(Please Sign In Ink) |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commonwealth of Massachusetts

Office of the Comptroller

Vendor Name and Address

Document Total

Payment Ref Number

Vendor Code

Emp

Reference Order

LN QTY

Description

Unit Price

Amount

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reference Doc ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LN |

Trans |

Dept |

R/Org |

|

Number |

|

LN |

Dept |

Approp |

Sub |

Org |

S/Org |

Obj |

Prog |

|

TY |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proj/Cl/Grc |

Actv |

RPTG |

Fund |

BS Acct |

Payment Reference Number |

|

Description |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

MSA# |

|

Line# |

|

Disc |

|

|

|

Dates of Services |

|

Quantity |

Line Amount |

|

|

|

I/D |

P/F |

|

|||||||

|

|

|

|

|

|

|

|

|

to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TO THE COMPTROLLER OF THE COMMMONWEALTH OF MASSACHUSETTS:

I hereby certify under penalties of perjury that all laws of the Commonwealth governing disbursementsof public funds and the regulations thereof have been compLIED with and observed.

Prepared By: |

|

Title: |

|

Date: |

|

|

|

|

|

||||

Entered By: |

|

Title: |

|

Date |

||

|

|

|

|

|

|

|

The undersigned authorized signatory approving this document certifies that this document and any attachments are accurate and complete and comply with all applicable general and special laws and regulations.

INSTRUCTIONS TO VENDORS

Page of

Phone #

Approved By: |

|

Title: |

|

Date: |

|

|

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Purpose | The Massachusetts Payment Voucher Form is used for processing payments for goods shipped or services rendered to the Commonwealth of Massachusetts. |

| Department/Organization Identification | Includes fields for the Department/Organization Name, Document ID, and relevant transaction numbers for organizational tracking. |

| Payment Scheduling | Provides fields for PV Date, Accounting Period, Budget Fiscal Year, and Scheduled Payment Date for financial planning and record-keeping. |

| Vendor Certification | Vendors must certify that goods or services were shipped or rendered, with mandatory signature in ink to validate the form. |

| Vendor Information | Includes detailed sections for Vendor Name, Address, Payment Reference Number, and Vendor Code for accurate payment processing. |

| Financial Details | Enables detailed listing of orders including Dates of Services, Quantity, Unit Price, and Line Amount for financial accuracy. |

| Legal Compliance Certification | Requires certification by the preparer that all transactions comply with Commonwealth laws governing disbursement of public funds. |

| Governing Law | Governed by the laws and regulations of the Commonwealth of Massachusetts regarding the disbursement of public funds. |

| Instructions to Vendors | Provides specific instructions for filling out the form, including contact information for state organization inquiries. |

Guide to Writing Massachusetts Payment Voucher

When it's time to handle financial transactions with the Commonwealth of Massachusetts, many find themselves needing to fill out a Massachusetts Payment Voucher Form. This form is essential for vendors who have provided goods or services and are seeking payment. The process can seem daunting at first, but by breaking it down into a series of steps, one can make sure that the form is completed accurately, ensuring a smoother transaction process.

Here are the steps to fill out the Massachusetts Payment Voucher form:

- List the Department/Organization Name that is making the payment alongside the Document ID.

- Input the Transaction Department R/Org Number, which identifies your department within the state system.

- Fill in the PV Date (Payment Voucher Date) and the Accounting Period.

- Specify the Budget Fiscal Year (FY) that this payment is being applied to.

- Choose the PV Action by marking "E" for entries that need to be executed.

- Indicate the Scheduled Payment Date and the Office Liability Account.

- Complete the Vendor’s Certification section, certifying the delivery of goods or services with a signature in ink.

- Provide the Vendor Name and Address, ensuring accuracy for payment processing.

- Detail the Document Total Payment, Reference Number, and Vendor Code.

- Under the section for services rendered, list each item or service provided including the Order Line Number, Quantity, Description, Unit Price, and Total Amount.

- For each listed item/service, also fill in the corresponding Reference Doc ID and all other related account and line specifics such as Transaction Dept R/Org Number, Department Appropriation Sub Org, and so forth as required.

- Complete the certification at the bottom of the form, declaring that all laws and regulations governing disbursement of public funds have been followed. This section is to be signed by the preparer and the approver, each stating their Title and the Date of signing.

- Ensure that all the required inquiries and contact details are directed to the correct state organization, as indicated on the form, including the Page and Phone #.

After completing these steps, double-check the form for accuracy and completeness. This meticulous approach not only aligns with the regulations set forth by the Commonwealth of Massachusetts but also facilitates a more efficient processing of your payment. Making sure each field is filled out correctly will help avoid delays or issues in the payment process. Once finalized, submit the form as directed by the Commonwealth's procedures to ensure the swift processing of your payment.

Understanding Massachusetts Payment Voucher

- What is a Massachusetts Payment Voucher form?

A Massachusetts Payment Voucher form is a document used by the state to facilitate the processing of payments to vendors for goods or services provided. This form helps in detailing the transaction between a vendor and a state department or organization, ensuring all necessary information is captured for accounting and compliance purposes.

- Who needs to fill out the Payment Voucher form?

Any vendor providing goods or services to a Massachusetts state department or organization must complete the Payment Voucher form. This is a mandatory step for vendors to ensure that they receive payment for their services or products.

- What are the critical sections of the Payment Voucher form?

The essential sections of the Payment Voucher form include:

- Department/Organization Name and Document ID

- Vendor’s Certification

- Vendor Name and Address

- Payment Reference Number, Description, and Total

- Dates of Services Provided

- Lined items detailing Quantity, Description, and Amount

- Authorization and Compliance Certification

Each section is vital for accurately processing and auditing transactions.

- How does a vendor certify the Payment Voucher form?

For the Payment Voucher to be certified, the vendor must sign the "Vendor's Certification" section, attesting that the goods were shipped or the services rendered as described in the document. This signature is required to be done in ink, signifying the vendor’s agreement and validation of the information provided.

- What does the "Prepared By," "Entered By," and "Approved By" sections entail?

These sections are for internal use by the state department or organization processing the payment. "Prepared By" is filled by the person who compiled the voucher, "Entered By" is for the individual who input the voucher into the system, and "Approved By" is the final authorization from the responsible authority confirming that the voucher meets all requirements and regulations for payment.

- Why is the Payment Voucher form important?

The Payment Voucher form is important for several reasons: it ensures accurate payment for goods or services provided, aids in financial record-keeping and auditing, and ensures compliance with state regulations. It serves as a vital document for accountability and transparency in transactions involving public funds.

- How can vendors submit the Payment Voucher form?

Vendors should follow specific instructions provided by the requesting state department or organization regarding how to submit the Payment Voucher form. Typically, it could involve mailing a physical copy to the designated address or submitting it through an online portal if available.

- What happens if there are errors in the Payment Voucher form?

If errors are found in the Payment Voucher form, it may delay payment processing. The state department or organization may return the form to the vendor for correction. Therefore, it’s crucial for vendors to review all entries for accuracy before submission.

- Can vendors inquire about the status of a submitted Payment Voucher?

Yes, vendors can and should direct inquiries regarding the status of a submitted Payment Voucher to the state organization they are dealing with. Contact details are typically provided with the instructions for submitting the form. Prompt communication can help resolve any issues or delays in processing.

- Are there penalties for incorrect or fraudulent information on a Payment Voucher?

Yes, there are penalties for providing incorrect or fraudulent information on a Payment Voucher. The document contains a certification section that must be signed under the penalty of perjury, affirming that all laws governing disbursements of public funds have been complied with. Misrepresentations can lead to legal actions and penalties.

Common mistakes

When filling out the Massachusetts Payment Voucher form, individuals often make the following mistakes that can lead to delays or errors in processing payments:

- Incorrectly completing the Department/Organization Name. This section is crucial for ensuring the form is directed to the correct department for processing.

- Leaving the Document ID blank. The Document ID is essential for tracking purposes and must be accurately filled in.

- Failing to provide the correct Transaction Department R/Org Number. This number is necessary for the proper routing of the voucher within the system.

- Entering the wrong PV Date or Accounting Period. These dates must be accurate to ensure the payment is processed in the correct fiscal period.

- Misunderstanding the PV Action field. Selecting the wrong action can lead to processing errors or delays.

- Omitting Vendor's Certification. The vendor's signature is mandatory to confirm delivery of goods or services.

- Errors in the Vendor Name and Address section. For successful payment, accurate vendor details are crucial.

- Forgetting to include the Payment Reference Number. Without this, it’s challenging to match the payment with the correct transaction.

- Improper use of the Description, Unit Price, and Amount sections under the line item details. Accurate descriptions and financial information ensure correct payment calculation.

Additionally, here are some general tips to avoid these common errors:

- Always double-check that all required fields have been completed before submission.

- Ensure that all numerical information is accurate and aligns with the associated documentation.

- Review the vendor's information for accuracy to avoid payment delays.

- Keep a copy of the completed form and any attachments for your records.

By paying close attention to these details and avoiding these mistakes, individuals can improve the efficiency and accuracy of processing Massachusetts Payment Voucher forms.

Documents used along the form

When managing financial transactions and documentation in Massachusetts, especially for businesses or governmental organizations, the Massachusetts Payment Voucher form is often accompanied by several other important forms and documents. These documents serve various purposes, from authorizing transactions to providing detailed accounting of expenditures. Here is a list of other forms and documents frequently used along with the Massachusetts Payment Voucher form:

- W-9 Form: Required by the IRS, this form is used to provide a taxpayer identification number and certification. Vendors must often submit this form to verify their tax status and ensure accurate reporting of income and deductions.

- Purchase Order: This document authorizes a purchase transaction. It details the items or services bought, quantities, and agreed-upon prices, and it often precedes the need for a payment voucher as it initiates vendor contracts.

- Invoice: An invoice is presented by vendors to request payment for goods or services. It specifies the transaction details, including dates, item descriptions, quantities, prices, and total charges, aligning with the payment voucher's data.

- Contract Agreement: For transactions requiring detailed terms, conditions, and obligations, a contract agreement spells out the specifics of the relationship between the vendor and the purchasing entity.

- Direct Deposit Authorization Form: Vendors preferring electronic fund transfers instead of traditional checks must complete this form to provide banking details for depositing payments directly into their bank accounts.

- IRS Form 1099-MISC: This document is necessary for reporting vendor payments that exceed a certain threshold within a fiscal year, typically used for tax reporting purposes concerning contractors or freelancers.

- Receipts and Proof of Delivery: To corroborate the receipt of goods or completion of services, vendors often must submit supporting documentation such as signed receipts or delivery confirmations.

- Adjustment Request Form: If discrepancies occur or modifications are needed after the initial transaction, an adjustment request form is submitted to document and authorize these changes.

- Annual Vendor Certification: Some organizations require vendors to submit an annual certification, verifying their compliance with relevant laws, policies, and ethical standards applicable to their business dealings with the organization.

Together, these forms and documents provide a structured and compliant framework for managing payments and vendor relationships in Massachusetts. This system ensures accuracy, accountability, and legal compliance in financial transactions and reporting, essential for both public and private sector operations.

Similar forms

The Federal Tax Payment Voucher is a document similar to the Massachusetts Payment Voucher form, primarily used by individuals or businesses to remit payment to the federal government for taxes owed. Both vouchers serve as a method to facilitate payment transactions, ensuring that the payments are properly credited to the appropriate accounts. Each document typically includes information about the payer, the amount being paid, and specific details related to the payment's purpose, ensuring accurate processing and record-keeping by the respective tax authority.

The Invoice Payment Form used by many companies to process payments to their vendors or suppliers shares similarities with the Massachusetts Payment Voucher form. This form typically collects information about the vendor, the goods or services provided, and the payment to be made, mirroring the structure that includes details such as vendor name, address, document total, and payment reference number. Both forms facilitate the accurate and timely compensation for goods or services rendered within their respective frameworks.

A Utility Bill Payment Slip, provided by utility companies, allows consumers to make payments for services such as electricity, water, or gas. Like the Massachusetts Payment Voucher form, it contains specific details about the account being paid, the amount due, and sometimes, the method of payment. Both documents play crucial roles in ensuring that payments are correctly applied to the accounts, reducing errors and improving efficiency in financial transactions between parties.

The Purchase Order (PO) Form, which organizations use to authorize the purchase of goods or services, has features in common with the Massachusetts Payment Voucher form. Though one authorizes a transaction and the other confirms payment, both include detailed information about the transaction, such as descriptions of the goods or services, quantities, and prices, ensuring both parties have a record of the agreed terms for auditing and confirmation purposes.

Charitable Donation Receipts, issued by non-profit organizations to acknowledge donations, share some similarities with the Massachusetts Payment Voucher form. Both documents provide a record of a transaction, noting the donor or payer's details, the amount, and the purpose of the payment or donation. This documentation is crucial for financial record-keeping and may be necessary for tax deduction purposes for the donor or payer.

The Payroll Remittance Form, used by employers to remit employee deductions to government agencies, is another document resembling the Massachusetts Payment Voucher form. It includes detailed information about the payer (employer), the payees (employees or agencies), amounts, and the purpose of the payment. Both documents ensure compliance with financial regulations and proper allocation of funds to the intended recipients.

College or University Tuition Payment Forms, which students use to pay for their education, also resemble the Massachusetts Payment Voucher form. These forms typically gather details about the payer, such as name and student ID, alongside the payment amount and purpose, ensuring that payments are correctly applied to students' accounts for tuition and fees.

The Court Filing Fee Voucher, required for processing legal document submissions in court, shares characteristics with the Massachusetts Payment Voucher form. Both documents facilitate the payment process for a specific service or requirement, detailing the payer’s information, payment amount, and purpose, ensuring proper record-keeping and compliance with procedural requirements.

Mortgage Payment Slips, used by borrowers to make payments on their loans, are similar to the Massachusetts Payment Voucher form in function. These slips typically detail the borrower's information, the amount paid, and the payment period, ensuring that the payment is correctly attributed to the borrower's account, much like how the voucher ensures payments are properly credited to vendors.

Insurance Premium Payment Slips, provided by insurance companies for policyholders to make premium payments, also share similarities with the Massachusetts Payment Voucher form. Both documents facilitate a financial transaction for a specific purpose, detailing the payer’s information, the payment amount, and what the payment is for, ensuring accurate and efficient processing of payments within their respective systems.

Dos and Don'ts

When completing the Massachusetts Payment Voucher form, it is essential to follow specific guidelines to ensure the process is done accurately and efficiently. Here are six things you should and shouldn't do:

Do:- Ensure all information is accurate and complete, including vendor name, address, and payment details. Mistakes can delay the payment process.

- Sign the Vendor's Certification in ink to validate the form. An electronic or stamped signature might not be accepted, depending on the department's requirements.

- Fill in all shaded areas as instructed, since these are typically the sections required for processing.

- Leave any of the shaded areas blank. If a section does not apply to your situation, mark it as N/A (Not Applicable) instead of leaving it empty.

- Use pencil or erasable ink. All entries should be made in permanent ink to prevent alterations after submission.

- Forget to attach any required documentation such as invoices, contracts, or service agreements that support your payment request. Missing documents can cause delays or rejection of the voucher.

By following these guidelines, you can help ensure that your payment process goes smoothly and efficiently, minimizing errors and delays.

Misconceptions

There are several common misconceptions about the Massachusetts Payment Voucher form that can confuse first-time and even seasoned users. Here's a look at some of these misunderstandings and the realities behind them.

- Misconception 1: The payment voucher is only for state employees. The truth is, this form is actually designed for vendors who provide goods or services to the Commonwealth of Massachusetts. It facilitates payment processing for these external entities, not just internal state employees.

- Misconception 2: Signing in ink isn't necessary. Contrary to this belief, the Vendor's Certification section clearly requires a signature in ink. This physical signature is a crucial component for validating the authenticity of the goods shipped or services rendered.

- Misconception 3: Any part of the form can be filled out. The form stipulates that vendors should only fill in shaded areas. This instruction is meant to streamline the processing of the form by ensuring only the essential information needed from the vendor is provided, reducing errors and omissions.

- Misconception 4: It's exclusively a digital document. While the form may be available in a digital format, the requirement for an ink signature suggests that at some point, a printed version of this document is necessary. This integration of digital and physical processes reflects the hybrid nature of administrative procedures.

- Misconception 5: The form is complicated and requires legal assistance to complete. Actually, the Massachusetts Payment Voucher form, while detailed, includes instructions for each section. These guidelines are designed to make the completion process straightforward for vendors without necessitating legal help.

- Misconception 6: It's only relevant at the end of a financial transaction. In reality, this form plays a crucial role throughout the transaction process. It accompanies the shipment of goods or rendering of services and is essential for initiating the payment process, not just concluding it.

- Misconception 7: Information about the budget or accounting period isn't important. This couldn't be further from the truth; these details are vital for aligning payments with the correct fiscal period and ensuring proper allocation of funds within state budget parameters.

- Misconception 8: There's no need to direct inquiries to the stated organization. This advice is given on the form for a reason. Directing inquiries to the appropriate state organization can clarify uncertainties and facilitate a smoother transaction process for both parties involved.

Understanding the correct uses and requirements of the Massachusetts Payment Voucher form is imperative for vendors doing business with the state. Dispelling these misconceptions can help ensure that the payment process is conducted smoothly and efficiently, benefiting both the state and its vendors.

Key takeaways

Understanding the Massachusetts Payment Voucher form is crucial for smooth transactions with the state's finance department. Here are key takeaways to guide you:

- The Department/Organization Name and Vendor Name and Address sections are vital for ensuring the payment is processed to the correct entity. Accuracy here cannot be overstated.

- The Document ID, Trans Dept R/Org Number, and Vendor Code act as unique identifiers, serving to link the payment to the correct transaction and entity within the system.

- Understanding the schedule and process indicated by the PV Date, Acctg Prd, Budget FY, and Sch Pay Date helps vendors know when to expect payment and how it relates to fiscal periods.

- Filling out the Vendor's Certification section correctly and signing it is not just procedural but a legal assurance that the goods or services were delivered as agreed, adhering to the Commonwealth's requirements.

- The Ref Doc ID is essential for referencing back to initial agreements or orders, ensuring that what was agreed upon is what's being invoiced for.

- Accuracy in the Line Quantity, Unit Price, and Line Amount sections is crucial for financial accuracy and to prevent delays in payment processing due to discrepancies.

- The Prepared By, Entered By, and Approved By sections are not merely formalities; they are critical checks in the system, ensuring that the voucher has been correctly filled out and reviewed at multiple stages.

- The statement addressed "TO THE COMPTROLLER OF THE COMMONWEALTH OF MASSACHUSETTS" underscores the formal and legal nature of the document, reminding all parties of the context in which they are operating.

- The INSTRUCTIONS TO VENDORS section is a handy reference that provides guidance on how to accurately fill out the form and who to contact with questions, emphasizing the importance of correct and clear communication.

- The format and fields such as MSA#, Line#, Disc Dates, I/D P/F to, and others, while might seem technical, are designed to provide detailed and unambiguous information about the transactions, facilitating a smoother process for all parties involved.

Proper attention to detail when completing the Massachusetts Payment Voucher form ensures timely and accurate payments, fosters trust between vendors and the state, and maintains compliance with the laws governing public funds disbursement.

Popular PDF Documents

Saanich School First Aid Record - Includes specific fields for documenting the timing of the incident and any follow-up actions, encouraging meticulous record-keeping.

Ut Sales Tax - TC-69C is designed for Utah businesses to close tax accounts or report crucial changes officially.