Get Massachusetts Certificate Tax Form

In Massachusetts, businesses and individuals engaged in professional activities are sometimes required to present proof of their tax status and compliance to the state's Department of Revenue. The Massachusetts Certificate Tax Form, aimed at facilitating such requests, serves a critical function in certifying the good standing of businesses with respect to state tax obligations. It caters to a diverse audience, including entities classified under various taxpayer identifications—ranging from corporations, limited liability companies (LLCs), partnerships, trusts, estates, to individual sole proprietors. Applicants are asked to detail their taxpayer classification, legal form of organization, purpose for the application, which can vary from seeking a Certificate of Good Standing to a waiver of Corporate Tax Lien, among other reasons. This document is not only pertinent for entities directly engaging in business within the state but also extends to those involved in activities such as cannabis, gaming, liquor licensing, and more, capturing a broad spectrum of the state's economic activities. Moreover, the form outlines several specific scenarios requiring such certification, including corporate reinstatement after administrative dissolution and sales of business, highlighting its significance in ensuring that businesses remain compliant with Massachusetts' tax laws and regulations.

Massachusetts Certificate Tax Example

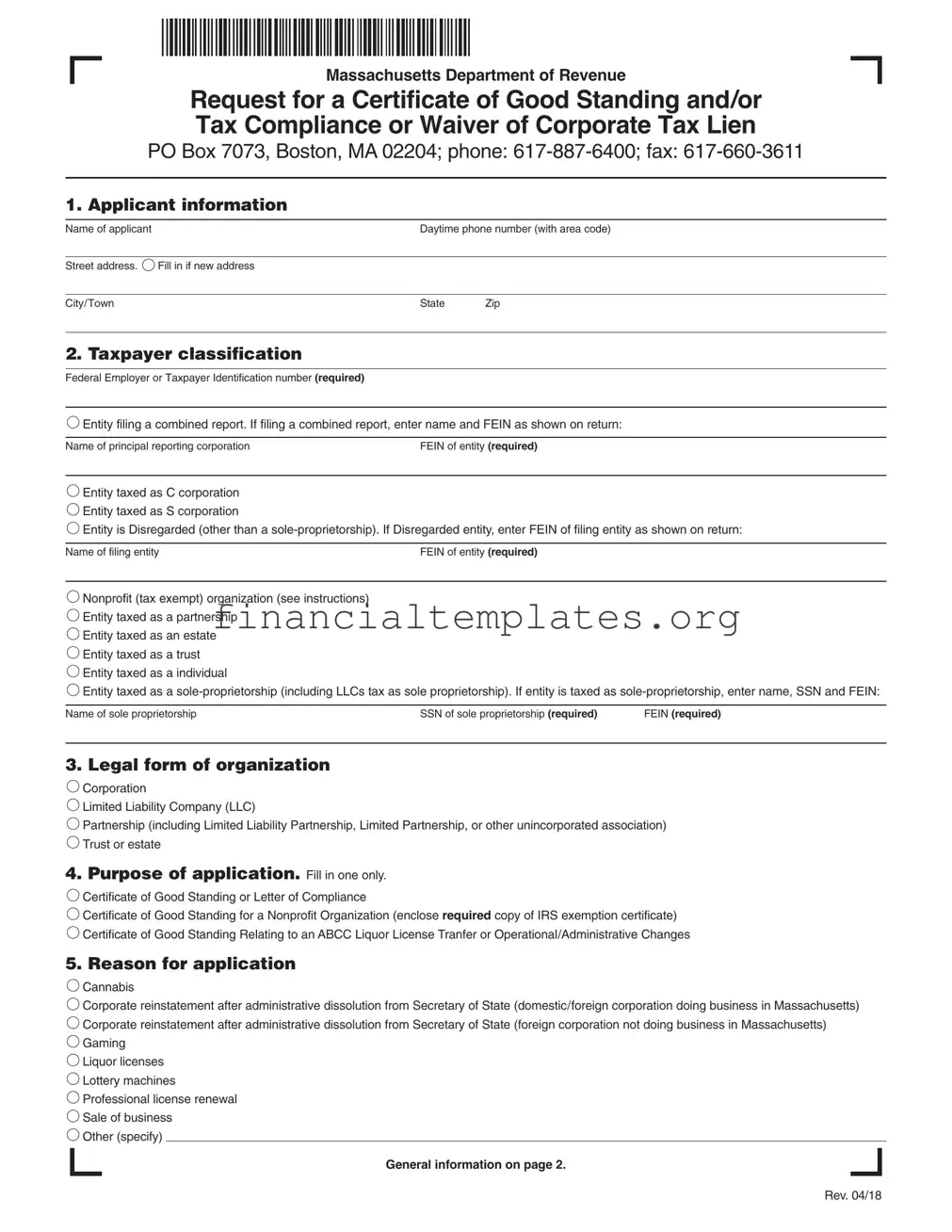

Massachusetts Department of Revenue

Request for a Certificate of Good Standing and/or

Tax Compliance or Waiver of Corporate Tax Lien

PO Box 7073, Boston, MA 02204; phone:

1. Applicant information

Name of applicant |

Daytime phone number (with area code) |

|

|

|

|

Street address. |

Fill in if new address |

|

|

|

|

City/Town |

State |

Zip |

2. Taxpayer classification

Federal Employer or Taxpayer Identification number (required)

Entity filing a combined report. If filing a combined report, enter name and FEIN as shown on return:

Entity filing a combined report. If filing a combined report, enter name and FEIN as shown on return:

Name of principal reporting corporationFEIN of entity (required)

Entity taxed as C corporation

Entity taxed as C corporation

Entity taxed as S corporation

Entity taxed as S corporation

Entity is Disregarded (other than a

Entity is Disregarded (other than a

Name of filing entityFEIN of entity (required)

Nonprofit (tax exempt) organization (see instructions)

Nonprofit (tax exempt) organization (see instructions)

Entity taxed as a partnership

Entity taxed as a partnership

Entity taxed as an estate

Entity taxed as an estate

Entity taxed as a trust

Entity taxed as a trust

Entity taxed as a individual

Entity taxed as a individual

Entity taxed as a

Entity taxed as a

Name of sole proprietorshipSSN of sole proprietorship (required) FEIN (required)

3. Legal form of organization

Corporation

Corporation

Limited Liability Company (LLC)

Limited Liability Company (LLC)

Partnership (including Limited Liability Partnership, Limited Partnership, or other unincorporated association)

Partnership (including Limited Liability Partnership, Limited Partnership, or other unincorporated association)

Trust or estate

Trust or estate

4. Purpose of application. Fill in one only.

Certificate of Good Standing or Letter of Compliance

Certificate of Good Standing or Letter of Compliance

Certificate of Good Standing for a Nonprofit Organization (enclose required copy of IRS exemption certificate)

Certificate of Good Standing for a Nonprofit Organization (enclose required copy of IRS exemption certificate)  Certificate of Good Standing Relating to an ABCC Liquor License Tranfer or Operational/Administrative Changes

Certificate of Good Standing Relating to an ABCC Liquor License Tranfer or Operational/Administrative Changes

5. Reason for application

Cannabis

Cannabis

Corporate reinstatement after administrative dissolution from Secretary of State (domestic/foreign corporation doing business in Massachusetts)

Corporate reinstatement after administrative dissolution from Secretary of State (domestic/foreign corporation doing business in Massachusetts)

Corporate reinstatement after administrative dissolution from Secretary of State (foreign corporation not doing business in Massachusetts)

Corporate reinstatement after administrative dissolution from Secretary of State (foreign corporation not doing business in Massachusetts)

Gaming

Gaming

Liquor licenses

Liquor licenses

Lottery machines

Lottery machines

Professional license renewal

Professional license renewal

Sale of business

Sale of business  Other (specify)

Other (specify)

General information on page 2.

Rev. 04/18

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REQUEST FOR CERTIFICATE, PAGE 2 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade name or DBA |

Federal ID or Social Security number (REQUIRED) |

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Sale/transfer of license |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fill in if transferring liquor license |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of buyer |

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of DBA location |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City/Town |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

Zip |

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List all tax identification numbers filed for this entity (e.g., meals, sales, withholding, room occupancy or income) |

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fill in if Waiver of Corporate Tax Lien has been acquired (does not apply to entities not taxed as corporation) |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If requesting Waiver of Corporate Tax Lien, attach price and legal description of assets to be sold and complete the following(REQUIRED). |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of transferee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of transfer or sale (mm/dd/yyyy) |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City/Town |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

Zip |

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

7. Person to receive response. Fill in applicable ovals.

Send results to taxpayer

Send results to taxpayer

Send results to person named below only if taxpayer is in compliance and Power of Attorney is attached

Send results to person named below only if taxpayer is in compliance and Power of Attorney is attached

Send results to person named below, even if taxpayer is not in compliance and Power of Attorney is attached

Send results to person named below, even if taxpayer is not in compliance and Power of Attorney is attached

If information is to be mailed to someone other than taxpayer, provide party’s name and mailing address.

Name |

Phone number |

Fax number |

|

|

|

|

|

Address |

|

|

|

|

|

|

|

City/Town |

State |

Zip |

|

Affidavit

Under the penalties of perjury, I declare that my company is responsible for the following taxes (REQUIRED; fill in all that apply).

Withholding

Withholding  Sales/Use

Sales/Use  Meals

Meals  Room occupancy

Room occupancy  Corporate

Corporate  Other (specify)

Other (specify)

Signature of taxpayer or corporate officer (REQUIRED) |

Date |

General information

The fastest and easiest way to obtain a Certificate is via our online application:

Businesses: https://mtc.dor.state.ma.us/mtc/_/?Link=COGS

Individuals: https://mtc.dor.state.ma.us/mtc/_/?Link=COGSIND

If the applicant is a partnership and has not filed a Form 3, Partnership Return of Income, for the last two years, submit complete copies of Form 3 with this application.

Any missing “required” information will delay the processing of your claim.

If a professional license renewal application, all returns must be filed and paid. If in a valid payment agreement, all required payments must be made.

Document Specifics

| Fact Name | Description |

|---|---|

| Governing Body | Massachusetts Department of Revenue |

| Contact Information | PO Box 7073, Boston, MA 02204; phone: 617-887-6400; fax: 617-660-3611 |

| Form Purpose | Request for a Certificate of Good Standing, Tax Compliance or Waiver of Corporate Tax Lien |

| Application Types | Certificate of Good Standing, Letter of Compliance, Certificate for Nonprofit, Certificate related to ABCC Liquor License Transfer |

| Taxpayer Classification | Includes C corporation, S corporation, Disregarded entity, Nonprofit, Partnership, Estate, Trust, Individual, Sole-proprietorship |

| Legal Form of Organization | Corporation, LLC, Partnership, Trust or Estate |

| Online Application Availability | Available for both businesses and individuals via Massachusetts Department of Revenue online portal |

Guide to Writing Massachusetts Certificate Tax

Filling out the Massachusetts Certificate Tax form is a structured process that requires attention to detail. This documentation is vital for various applications, including but not limited to corporate reinstatement, professional license renewals, and business transactions. Following the steps below will ensure that your application is complete and submitted correctly. It's important that all provided information is accurate and up-to-date to avoid delays in the processing of your request. Whether you're seeking a Certificate of Good Standing or need to waive a Corporate Tax Lien, these guidelines will assist you in completing the form efficiently.

- Under "Applicant information", provide the name of the applicant, a daytime phone number including the area code, and the street address. If this is a new address, ensure it's filled in along with the city or town, state, and zip code.

- For "Taxpayer classification", enter the Federal Employer or Taxpayer Identification number. Choose the entity type that applies to you (e.g., C corporation, S corporation, Disregarded entity, Nonprofit organization, Partnership, Estate, Trust, Individual, Sole-proprietorship) and provide the respective information needed based on the selection.

- Select the "Legal form of organization" that accurately represents the applicant's structure (Corporation, LLC, Partnership, Trust or estate).

- Identify the "Purpose of application" by selecting the appropriate option (Certificate of Good Standing, Letter of Compliance, etc.) that fits your requirement.

- Under "Reason for application", mark the reason that applies to you, such as Cannabis, Corporate reinstatement, Gaming, Liquor licenses, among others. If your reason is not listed, use the "Other" option and specify.

- In section 6, if transferring a liquor license, fill in the "Sale/transfer of license" section with the name of the buyer and the address of the DBA location, including city or town, state, and zip code. List all tax identification numbers filed for the entity.

- If requesting a "Waiver of Corporate Tax Lien," provide the necessary information about the transferee, date of transfer or sale, address, and list of assets.

- Specify the "Person to receive response" by choosing one of the options provided. If the information is to be sent to someone other than the taxpayer, complete the section with the party’s name, phone number, fax number, and mailing address.

- Under the affidavit section, declare the taxes the company is responsible for by marking all that apply. This section is a declaration under the penalties of perjury.

- Sign the form and date it in the space provided for the "Signature of taxpayer or corporate officer". This indicates your affirmation of the information provided and its accuracy.

Once you've completed all the steps and ensured that your form is filled out correctly, review the general information for additional guidance on submitting your application. The Massachusetts Department of Revenue offers online applications which can be a faster and easier way to obtain your Certificate. Remember, any missing "required" information can delay the processing of your application, so it's crucial to double-check your entries before submission.

Understanding Massachusetts Certificate Tax

What is the purpose of the Massachusetts Certificate of Good Standing and/or Tax Compliance form?

This form serves as a request to the Massachusetts Department of Revenue to issue a Certificate of Good Standing or a Tax Compliance Certificate. It is used by businesses and individuals to demonstrate their compliance with state tax obligations. This proof is often required for various business activities like applying for loans, renewing professional licenses, transferring liquor licenses, corporate reinstatement, or selling a business.

Who needs to fill out the Massachusetts Certificate of Good Standing and/or Tax Compliance form?

Entities such as corporations, limited liability companies (LLCs), partnerships, trusts, estates, and sole proprietors seeking to prove their tax compliance or good standing with the Massachusetts Department of Revenue need to complete this form. It's also applicable for nonprofits seeking a Certificate of Good Standing.

What information is required on the form?

Applicants must provide detailed information including the name, daytime phone number, and address of the applicant (if new), taxpayer classification, legal form of organization, purpose and reason for the application, and, if applicable, details about the sale/transfer of a license or waiver of corporate tax lien. An affidavit declaring the company's responsibility for specified taxes must also be signed under the penalties of perjury.

How can I submit the Massachusetts Certificate of Good Standing/Tax Compliance form?

The form can be submitted by mail to the address provided on the form or through fax. However, for a faster and more convenient process, the Massachusetts Department of Revenue encourages applicants to submit their request via the online application portal for businesses or individuals, as applicable.

What happens if I don't provide all the required information on the form?

Failure to provide all the required information can delay the processing of your application. It's important to thoroughly review the form to ensure that all necessary fields are completed, and any applicable additional documents are attached to avoid such delays.

Are there any specific instructions for partnerships applying for the Certificate?

For partnerships that have not filed a Form 3, Partnership Return of Income, for the last two years, they must submit complete copies of Form 3 along with this application. This additional documentation is necessary to establish tax compliance.

Can the results be sent to someone other than the taxpayer?

Yes, the form allows for the results to be sent to a person other than the taxpayer. This option requires the provision of the recipient's name, phone number, fax number, and mailing address. However, it is important to note that this option is only available if the taxpayer is in compliance and a Power of Attorney is attached, or if the applicant specifically allows for results to be shared irrespective of compliance status.

Is there a fee associated with this request?

The form and accompanying details do not specify a fee for the processing of the request. However, applicants are encouraged to check the Massachusetts Department of Revenue's website or contact the department directly for the most current information regarding any potential fees.

What are the common reasons for requesting a Certificate of Good Standing or Tax Compliance?

Businesses and individuals often require these certificates for reasons such as corporate reinstatement, applying for or renewing professional licenses, transferring or renewing liquor licenses, selling a business, or entering into agreements that require proof of compliance with state tax obligations.

How long does it take to process the request for a Certificate of Good Standing or Tax Compliance?

The processing time can vary depending on the method of submission and the completeness of the application. Using the online portal may expedite the process, while submissions via mail or fax might take longer. Applicants should also ensure that all required information is accurately provided to avoid delays.

Common mistakes

Filling out the Massachusetts Certificate Tax form can be a daunting task. There are several common pitfalls applicants often encounter. Understanding these mistakes can help ensure the process is smoother and reduces the chance of delays or rejections.

Not providing complete applicant information: It's essential to fill out the entire section dedicated to applicant information accurately. This includes the name of the applicant, daytime phone number (with area code), street address if it's new, city or town, state, and zip code. Missing details in this section can lead to processing delays.

Omitting Taxpayer classification details: Each entity must identify its classification correctly, such as whether it's taxed as a C corporation, S corporation, partnership, nonprofit, etc. Failure to include the Federal Employer or Taxpayer Identification Number (FEIN) or, for sole proprietorships, both the SSN and FEIN if applicable, is a common oversight that can cause unnecessary setbacks.

Incorrect or incomplete Legal form of organization selection: The form requires applicants to specify the legal form of their organization, such as a corporation, partnership, LLC, trust, or estate. Failing to mark the correct box or providing incomplete information can lead to confusion and delays in the form's processing.

Choosing the wrong purpose for the application: There are various reasons for applying, including getting a Certificate of Good Standing or a Letter of Compliance, among others. Selecting the wrong purpose or not clearly specifying why the application is being submitted can slow down the verification process by the Department of Revenue.

Leaving the reason for application section blank: Applicants must indicate the reason for their application, such as for a cannabis business, corporate reinstatement, gaming, etc. A common mistake is not specifying or choosing the correct reason which is crucial for the application's approval process.

Overall, attention to detail is critical when filling out the Massachusetts Certificate Tax form. Ensuring all sections are completed accurately and thoroughly can prevent common mistakes that lead to processing delays or even the rejection of the application.

Documents used along the form

In addition to the Massachusetts Certificate Tax form, entities engaging in business within the state may often find themselves needing to complete and submit several other forms and documents to ensure full compliance with the state's regulatory and tax requirements. These documents serve various purposes, from reporting income to registering for specific types of tax. Here's a brief overview of four such documents:

- Form 3: Partnership Return of Income - This form is specifically designed for partnerships operating in Massachusetts. It's used to report the income, gains, losses, deductions, and credits from the partnership's operations. If a partnership has not filed a Form 3 for the last two years, they must submit complete copies with their Certificate Tax form application.

- Form ST-12: Exempt Use Certificate - Businesses purchasing goods or services for use in production, manufacture, or other qualifying exempt purposes may use this form to certify that the purchase is exempt from the state sales tax.

- Form 355: Corporate Excise Tax Return - This form is essential for corporations operating within Massachusetts. It's used to calculate and pay the corporate excise tax, which combines elements of both income and capital tax.

- Form 990: Return of Organization Exempt from Income Tax - Required for nonprofit organizations, this federal form is used to provide the IRS with the annual financial information of the entity. Nonprofits in Massachusetts need to attach a copy of their IRS exemption certificate when applying for a Certificate of Good Standing.

Understanding and properly filling out these forms, along with the Massachusetts Certificate Tax form, is crucial for entities to maintain good standing, ensure tax compliance, and possibly avoid penalties. Whether it's for renewing professional licenses, transferring liquor licenses, or simply part of annual tax reporting, these documents play a significant role in an entity's interaction with state tax authorities.

Similar forms

The Uniform Commercial Code (UCC) Financing Statement is quite similar to the Massachusetts Certificate Tax form in its purpose of establishing legal standings. Both documents serve to document and confirm the status of an entity or individual in relation to regulatory or legal requirements. For the UCC, it's about asserting a security interest in collateral to secure loan payments, while the Certificate Tax form ensures tax compliance or good standing for businesses, which is crucial for transactions like sales of businesses or licensures.

The Secretary of State's Certificate of Existence (or Good Standing) for businesses shares common ground with the Massachusetts Certificate Tax form in both intent and function. They each aim to confirm the legal and regulatory compliance of an entity, which is necessary for various business operations, including but not limited to, expanding to other states, obtaining financing, and renewing licenses. The Certificate of Good Standing ensures that a company is properly registered and up-to-date with state filings, mirroring the tax compliance check provided by the Massachusetts tax form.

IRS Form 4506-T, Request for Transcript of Tax Return, is utilized when individuals and businesses need to prove their income and tax filing status to lenders or other interested parties. This requirement closely aligns with the Massachusetts Certificate Tax form, which also serves as a verification tool, in this case, verifying tax compliance or good standing with the state's Department of Revenue. Both forms are fundamental in transactions that require validation of financial and tax handling responsibilities.

The Business License, Permits, and Registration forms that various municipalities and states require for operating businesses within their jurisdictions have functionalities similar to the aspects found in the Massachusetts Certificate Tax form. Just like those local permits ensure compliance with specific operational, health, safety, and zoning standards, the Certificate Tax form verifies compliance with tax obligations necessary for legal operation within Massachusetts. It is another layer of assurance for regulatory adherence.

Franchise Tax Board (FTB) Clearance Certificate, found in states like California, closely matches the tax clearance aspect of the Massachusetts Certificate Tax form. This certificate is vital for dissolving, withdrawing, or surrendering the right to conduct business in a state, ensuring that all tax liabilities are settled before the closure or exit is formalized. The Massachusetts form plays a similar role by issuing a tax compliance certificate, indicating all tax responsibilities have been met.

Federal Employer Identification Number (FEIN) Verification Letter (also known as an EIN Confirmation Letter) from the IRS is essential for businesses as proof of their tax ID number and entity status. This document, while primarily focused on federal identification, complements the state-level validations performed by the Massachusetts Certificate Tax form. Both are indispensable for business operations, financial transactions, and compliance reporting, ensuring entities are recognized legally and correctly for tax purposes.

The Sales Tax License or Permit issued by state Departments of Revenue, analogous to Massachusetts' document, verifies a business's authority to collect sales tax on goods and services sold. Much like the Certificate Tax form ensures tax compliance, the sales tax license proves adherence to state sales tax regulations, a critical requirement for retail and service-oriented businesses. Both documents affirm the legitimacy and regulatory compliance of businesses in their respective scopes.

The Department of Labor (DOL) Certification often required for businesses to prove compliance with labor laws and regulations, shares a similar compliance verification purpose with the Massachusetts Certificate Tax form. While the DOL Certification focuses on employment practices, workers' compensation, and similar labor concerns, the Certificate Tax form centers on tax obligations. Both types of certification are crucial for businesses to operate within their legal and regulatory frameworks, supporting transparent and lawful business conduct.

Dos and Don'ts

When filling out the Massachusetts Certificate Tax form, ensuring accuracy and thoroughness is crucial for the smooth processing of your request. Here are guidelines to follow:

- Do fill out all required fields accurately. Missing information can delay the processing of your form.

- Do include your Federal Employer or Taxpayer Identification Number as it is essential for tax purposes.

- Do specify the type of entity you are filing for (e.g., Corporation, LLC, Partnership) clearly to avoid confusion.

- Do clearly state the purpose of the application by selecting the appropriate option. This helps in processing your form for the correct certificate or waiver.

- Do ensure that if you are applying for a Certificate of Good Standing for a Nonprofit Organization, you enclose the required copy of your IRS exemption certificate.

- Do not leave the affidavit section at the end of the form blank. Completing this section under the penalties of perjury is mandatory.

- Do not forget to sign and date the form. An unsigned form is considered incomplete and will not be processed.

- Do not overlook the instructions to include Form 3 if you are a partnership that has not submitted a Partnership Return of Income for the last two years. This is crucial for partnerships to remember.

- Do utilize the online application links provided for faster and easier submission, especially if immediacy is a concern for you.

Adhering to these do's and don'ts will expedite the processing of your Massachusetts Certificate Tax form, avoiding unnecessary delays and complications. Always review your form for completeness and accuracy before submission.

Misconceptions

Understanding the Massachusetts Certificate Tax form can sometimes be confusing, leading to several common misconceptions. Here are nine that stand out:

- Only corporations need to apply. This is not true. The form accommodates various types of entities, including LLCs, partnerships, trusts, estates, and even individuals acting as sole proprietors. Each entity type has specific sections to fill out.

- The form is exclusively for obtaining a Certificate of Good Standing. While the Certificate of Good Standing is a primary reason for the request, the form also covers applications for Tax Compliance Certificates, Nonprofit Organization Certification, and Waivers of Corporate Tax Lien among others.

- Nonprofits are exempt from using this form. Nonprofit organizations still need to use this form to obtain a Certificate of Good Standing, particularly if they are required to show evidence of tax compliance or exemption.

- It's only for businesses with tax issues. While the form is often used to resolve or waive specific tax liens or compliance issues, it also serves broader purposes like corporate reinstatement, professional license renewal, and certain transactions requiring proof of good tax standing.

- Applications must be submitted by mail. Although mailing is an option, the fastest and easiest way to apply for a Certificate is through the provided online platforms for both businesses and individuals. This misconception might delay some applicants who are not aware of the online services.

- Partnerships without recent income returns cannot apply. Partnerships that haven't filed a Form 3 for the last two years can still apply, provided they submit complete copies of Form 3 with their application. This ensures all entities are able to comply, regardless of their filing history.

- The form is long and complicated. The form is designed to be comprehensive to cater to various applicant needs, but it includes clear instructions for each section. With focused reading, applicants can accurately complete the required information.

- Any missing information will cause a minor delay. Missing information labeled as "required" can significantly delay the processing of your claim, not just cause a minor inconvenience. Ensuring all essential fields are filled in is crucial for a timely process.

- Personal information is not necessary for entity applications. Even when applying on behalf of an entity, personal information such as a signature and date from an authorized individual is mandatory to validate the application under penalty of perjury.

By clarifying these misconceptions, applicants can better understand how to complete the Massachusetts Certificate Tax form accurately and efficiently, ensuring their business or personal affairs are in compliance with state requirements.

Key takeaways

Filling out and using the Massachusetts Certificate Tax form properly is essential for different types of entities that require proof of tax compliance or specific tax statuses. Here are key takeaways to consider:

- Ensure you have the correct taxpayer identification number ready. Whether you are an individual, a corporation, an LLC, or any other entity, you'll need your Federal Employer or Taxpayer Identification number (FEIN), or your Social Security number (SSN) if you're a sole proprietorship.

- Be clear about your entity's tax classification. The form requires you to specify how your entity is taxed—this could be as a C corporation, S corporation, partnership, nonprofit, estate, trust, individual, or sole proprietorship.

- Specify the purpose of your application accurately. The form has options for different needs, like obtaining a Certificate of Good Standing, a Letter of Compliance, or specifically for nonprofit organizations, among others.

- Understand the importance of legal form organization designation. Whether your entity is a corporation, an LLC, a partnership, trust, estate, or other, correctly indicating this on the form will affect the processing of your request.

- If transferring a liquor license, detailed information about the sale/transfer, including the name of the buyer and the address of the business location, must be provided.

- The affidavit at the end of the application is crucial. Here, the applicant must declare responsibility for the taxes listed, and the form must be signed under the penalties of perjury. This part confirms the accuracy of the information provided and the tax obligations of the entity.

It's also essential to note that applications for a Certificate can be made faster and easier through the Massachusetts Department of Revenue's online application system. And if you're a partnership that hasn't filed a Form 3 for the last two years, you'll need to submit complete copies of Form 3 with your application. Missing required information or failing to submit necessary supplementary documents can delay the processing of your request.

Popular PDF Documents

What Is Amt Depreciation - This form reflects the IRS's attempts to prevent taxpayers from exploiting loopholes to reduce their tax liability significantly.

Form 5060 - The meticulous design of the form addresses the specificities of tax exemption eligibility, safeguarding against wrongful claims.

Colorado State Tax Form - Advice for accurately reporting business income and losses assists self-employed individuals and business owners with their tax filings.