Get Maryland Tax 766 Form

Understanding the nuances of retirement and tax planning is crucial for anyone approaching or navigating through their golden years. The Maryland Tax 766 form plays a pivotal role in this process for retirees of the Maryland State Retirement and Pension System. This document, essentially a Federal and Maryland State Tax Withholding Request for Pension Allowance, is a bridge connecting retirees with the state's tax regulations, ensuring their pension allowances are correctly taxed according to both federal and state laws. It revokes any prior withholding elections, allowing retirees to make fresh declarations about their preferences for federal and state tax deductions from their periodic pension payments. Whether opting for federal tax withholdings based on marital status and allowances, specifying additional amounts, or deciding on state tax withholdings – the form caters to Maryland residents and non-residents alike, presenting an array of options. It plays a critical role in managing the financial aspects of retirement payouts, directly affecting the retiree's net income. The importance of this form transcends mere tax documentation; it is an essential tool for financial planning and stability in retirement, requiring careful consideration and timely updates to mirror any changes in the retiree's tax status or personal preferences. As deadlines and tax laws evolve, staying informed and compliant becomes a key aspect of a hassle-free retirement, making the Maryland Tax 766 form more than just paperwork – it is a cornerstone of retirement strategy for those under the Maryland State Retirement and Pension System.

Maryland Tax 766 Example

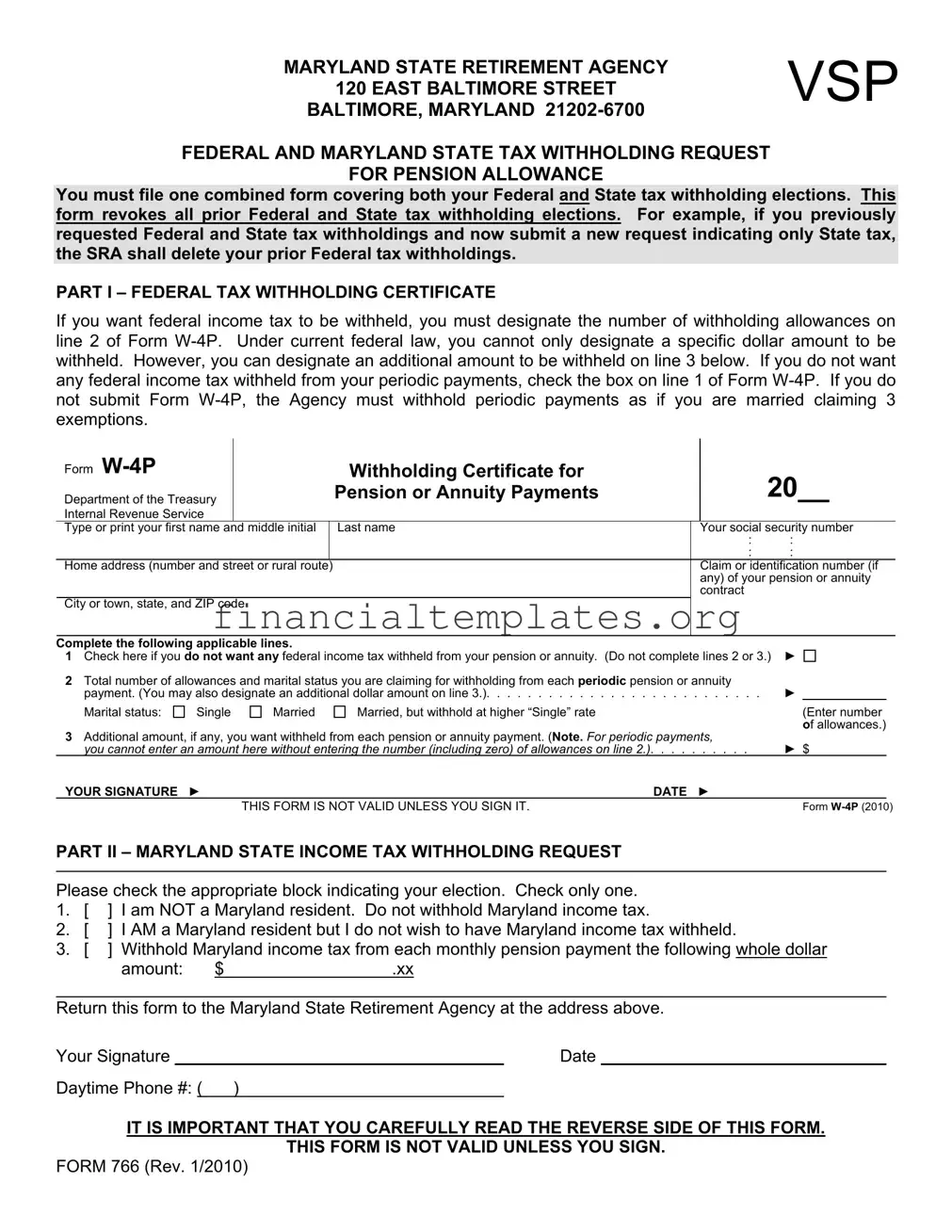

MARYLAND STATE RETIREMENT AGENCY |

VSP |

|

|

120 EAST BALTIMORE STREET |

|

BALTIMORE, MARYLAND |

|

FEDERAL AND MARYLAND STATE TAX WITHHOLDING REQUEST

FOR PENSION ALLOWANCE

You must file one combined form covering both your Federal and State tax withholding elections. This form revokes all prior Federal and State tax withholding elections. For example, if you previously requested Federal and State tax withholdings and now submit a new request indicating only State tax, the SRA shall delete your prior Federal tax withholdings.

PART I – FEDERAL TAX WITHHOLDING CERTIFICATE

If you want federal income tax to be withheld, you must designate the number of withholding allowances on line 2 of Form

Form |

|

|

|

Withholding Certificate for |

|

20__ |

|

||

Department of the Treasury |

|

|

Pension or Annuity Payments |

|

|

||||

|

|

|

|

|

|

|

|

||

Internal Revenue Service |

|

|

|

|

|

|

|

|

|

Type or print your first name and middle initial |

|

Last name |

|

Your social security number |

|||||

|

|

|

|

|

: |

: |

|

|

|

|

|

|

|

|

: |

: |

|

|

|

Home address (number and street or rural route) |

|

|

Claim or identification number (if |

||||||

|

|

|

|

|

|

any) of your pension or annuity |

|||

|

|

|

|

|

|

contract |

|

|

|

City or town, state, and ZIP code |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

Complete the following applicable lines. |

|

|

|

► |

|||||

1 Check here if you do not want any federal income tax withheld from your pension or annuity. (Do not complete lines 2 or 3.) |

|||||||||

2 Total number of allowances and marital status you are claiming for withholding from each periodic pension or annuity |

► |

|

|

||||||

payment. (You may also designate an additional dollar amount on line 3.) |

|||||||||

Marital status: |

Single |

Married |

Married, but withhold at higher “Single” rate |

|

|

(Enter number |

|||

|

|

|

|

|

|

|

|

of allowances.) |

|

3 Additional amount, if any, you want withheld from each pension or annuity payment. (Note. For periodic payments, |

► $ |

||||||||

you cannot enter an amount here without entering the number (including zero) of allowances on line 2.). . . . |

. . . . . . |

||||||||

YOUR SIGNATURE |

► |

|

|

DATE |

► |

|

|

|

|

|

|

THIS FORM IS NOT VALID UNLESS YOU SIGN IT. |

|

|

|

Form |

|||

PART II – MARYLAND STATE INCOME TAX WITHHOLDING REQUEST

Please check the appropriate block indicating your election. Check only one.

1.[ ] I am NOT a Maryland resident. Do not withhold Maryland income tax.

2.[ ] I AM a Maryland resident but I do not wish to have Maryland income tax withheld.

3.[ ] Withhold Maryland income tax from each monthly pension payment the following whole dollar

amount: |

$ |

.xx |

Return this form to the Maryland State Retirement Agency at the address above.

Your Signature |

|

|

Date |

|

Daytime Phone #: ( |

) |

|

||

|

|

|

|

|

IT IS IMPORTANT THAT YOU CAREFULLY READ THE REVERSE SIDE OF THIS FORM.

THIS FORM IS NOT VALID UNLESS YOU SIGN.

FORM 766 (Rev. 1/2010)

2

Part I

FEDERAL INCOME TAX WITHHOLDING

The monthly retirement payments you receive from the Maryland State Retirement and Pension System may be subject to Federal income tax withholding. For further information, please refer to Internal Revenue Service Publication 575 regarding the taxability of pension and annuity income.

As a retiree, the following Federal income tax withholding alternatives are available to you:

1.You may elect not to have Federal income tax deducted from your monthly retirement payment, or

2.You may claim a certain number of exemptions and have the Maryland State Retirement and Pension System deduct the appropriate amount, if any, in accordance with the Federal income tax tables and you may designate an additional specific whole dollar amount to be withheld from your monthly retirement payment.

If you elect not to have Federal withholding apply to your monthly retirement payments, or if you do not have enough Federal income tax withheld, you may be responsible for payment of estimated tax. You may incur penalties under the Internal Revenue Service estimated tax rules if your withholding and estimated tax payment are not sufficient. New retirees, especially, should see IRS Publication 505.

Part II

MARYLAND STATE INCOME TAX WITHHOLDING

The monthly retirement payments you receive from the Maryland State Retirement and Pension System may be subject to Maryland income tax withholding.

As a retiree and a Maryland resident, the following Maryland income tax withholding alternatives are available to you:

1.You may elect not to have Maryland income tax deducted from your monthly retirement payment, or

2.You may designate a specific whole dollar amount to be withheld from your monthly retirement payment.

If you elect not to have Maryland withholding apply to your monthly retirement payments, or if you do not have enough Maryland income tax withheld, you may be responsible for payment of estimated tax.

An election of any one of the alternatives will remain in effect until you revoke it. You may revoke or change your election at any time by filing a new Federal and Maryland State Tax Withholding Request.

The Maryland State Retirement Agency can not assist you in the preparation of tax returns. Please contact the Internal Revenue Service at

To receive additional copies of the Federal and Maryland State Tax Withholding Request form, or for other information concerning your retirement benefits, call

SEE REVERSE SIDE FOR FEDERAL AND MARYLAND STATE TAX WITHHOLDING REQUEST

FORM 766 (Rev. 1/2010)

Additional Instructions:

Section references are to the Internal Revenue Code. Agency refers to the Maryland State Retirement Agency.

When should I complete the form? Complete Form

Other income. If you have a large amount of income from other sources not subject to withholding (such as interest, dividends, or capital gains), consider making estimated tax payments using Form

Withholding From Pensions and Annuities

Generally, federal income tax withholding applies to the taxable part of payments made from pension,

Because your tax situation may change from year to year, you may want to refigure your withholding each year. You can change the amount to be withheld by using lines 2 and 3 of Form

Choosing not to have income tax withheld. You (or in the event of death, your beneficiary or estate) can choose not to have federal income tax withheld from your payments by using line 1 of Form

Caution. There are penalties for not paying enough federal income tax during the year, either through withholding or estimated tax payments. New retirees, especially, should see Pub. 505. It explains your estimated tax requirements and describes penalties in detail. You may be able to avoid quarterly estimated tax payments by having enough tax withheld from your pension or annuity using Form

Periodic payments. Withholding from periodic payments of a pension or annuity is figured in the same manner as withholding from wages. Periodic payments are made in installments at regular intervals over a period of more than 1 year. They may be paid annually, quarterly, monthly, etc.

If you want federal income tax to be withheld, you must designate the number of withholding allowances on line 2 of Form

3

designate an additional amount to be withheld on line 3. If you do not want any federal income tax withheld from your periodic payments, check the box on line 1 of Form

Caution. If you do not submit Form

If you submit a Form

taxpayer identification number (TIN), the payer must withhold as if you are single claiming zero withholding allowances even if you choose not to have federal income tax withheld.

There are some kinds of periodic payments for which you cannot use Form

For periodic payments, your Form

Changing Your “No Withholding” Choice

Periodic Payments. If you previously chose not to have federal income tax withheld and you now want withholding, complete another Form

Payments to Foreign Persons and

Payments Outside the United States

Unless you are a nonresident alien, withholding (in the manner described above) is required on any periodic or nonperiodic payments that are delivered to you outside the United States or its possessions. You cannot choose not to have federal income tax withheld on line 1 of Form

In the absence of a tax treaty exemption, nonresident aliens, nonresident alien beneficiaries, and foreign estates generally are subject to a 30% federal withholding tax under section 1441 on the taxable portion of a periodic or nonperiodic pension or annuity payment that is from U.S. sources. However, most tax treaties provide that private pensions and annuities are exempt from withholding and tax. Also, payments from certain pension plans are exempt from withholding even if no tax treaty applies. See Pub.

Statement of Federal Income Tax Withheld From Your Pension or Annuity

By January 31 of next year, your payer will furnish a statement to you on Form

Document Specifics

| Fact | Description |

|---|---|

| Form Purpose | This form is used for both Federal and Maryland State tax withholding elections on pension allowance. |

| Revocation of Prior Elections | Submitting this form revokes all previous Federal and State tax withholding choices. |

| Part I – Federal Tax Withholding Certificate | For federal income tax to be withheld, election of the number of withholding allowances must be made on Form W-4P. |

| Specific Dollar Withholding | Specific dollar amount can be designated for additional withholding, however, the number of allowances must also be entered. |

| No Federal Tax Withholding | If no federal income tax is desired to be withheld, a designated box on Form W-4P must be checked. |

| Part II – Maryland State Income Tax Withholding Request | For Maryland residents, state income tax withholding can be elected not to be deducted or a specific amount can be designated. |

| Governing Law(s) | Federal and state income tax withholdings are governed by the Internal Revenue Code and Maryland State laws. |

| Form Submission | The completed form should be returned to the Maryland State Retirement Agency. |

| Availability of Assistance | The Maryland State Retirement Agency does not assist in tax return preparation but provides contacts for assistance. |

Guide to Writing Maryland Tax 766

When managing your retirement payments, it's essential to understand how your decisions on tax withholding will affect your finances. The Maryland Tax 766 form is a critical tool for indicating your choices regarding both Federal and Maryland State income tax withholdings from your pension allowance. Whether you're adjusting your withholdings or setting them for the first time, properly completing this form ensures that your tax obligations are handled according to your current needs and preferences.

- Start by reading the instructions on the Maryland Tax 766 form carefully to understand the requirements and implications of your choices for both federal and state tax withholdings.

- Fill out the top section of the form with your personal details, including your name, social security number, home address, and any claim or identification number associated with your pension or annuity contract.

- In Part I – Federal Tax Withholding Certificate:

- Check the box on line 1 of Form W-4P if you choose not to have any federal income tax withheld from your pension or annuity. (Skip lines 2 and 3 if you select this option.)

- On line 2, indicate your marital status and the total number of allowances you're claiming for federal withholding. This information is used to determine the amount, if any, to be withheld from your pension or annuity payments based on federal tax tables.

- For an additional amount to be withheld from each payment, specify this figure on line 3.

- Sign and date the federal tax withholding section to make it valid.

- In Part II – Maryland State Income Tax Withholding Request, choose one of the three options provided to indicate your preference for state tax withholding by checking the appropriate box:

- If you are not a Maryland resident and do not want Maryland income tax withheld, select the first option.

- As a Maryland resident who chooses not to have state income tax withheld, select the second option.

- To have a specific whole dollar amount withheld from each monthly pension payment, indicate this amount and select the third option.

- Ensure you sign and date this section of the form as well, and provide your daytime phone number for any necessary follow-up.

- Review the form to make sure all information is accurate and complete. Any missing or incorrect information can delay processing.

- Submit the completed form to the Maryland State Retirement Agency at the address provided on the form. Do this as soon as possible to update your withholding preferences in a timely manner.

By following these steps carefully, you can effectively manage your tax withholdings on your pension or annuity payments. Keep a copy of the completed form for your records. If your financial situation changes, remember that you can submit a new form at any time to adjust your withholdings accordingly.

Understanding Maryland Tax 766

What is the Maryland Tax 766 form used for?

The Maryland Tax 766 form is used by retirees to request the withholding of federal and Maryland state taxes from their pension allowances. It combines elections for both tax withholdings into one form, making it simpler for retirees to manage their tax obligations.

Can I choose not to have federal or Maryland state tax withheld from my pension?

Yes, you can choose not to have either federal or Maryland state income tax withheld from your pension. For federal tax, you would indicate this preference on line 1 of Form W-4P, which is part of the document. For Maryland state tax, you would select the appropriate option in Part II of the Maryland Tax Withholding Request section.

How do I change my withholding preferences?

To change your withholding preferences for either federal or Maryland state tax, or both, you must submit a new Maryland Tax 766 form. This new submission will revoke all prior withholding elections, allowing you to update your preferences as needed.

What happens if I don't submit the Maryland Tax 766 form?

If you do not submit the Maryland Tax 766 form, the Maryland State Retirement Agency is required to withhold periodic payments as if you are married claiming three exemptions for federal tax. The implication for Maryland state tax was not specified, suggesting you may need to consult with a tax professional or the Agency for clarification.

Am I able to designate a specific dollar amount for federal tax withholding?

For federal tax, you cannot designate a specific dollar amount to be withheld without first indicating the number (including zero) of allowances on line 2. However, you can specify an additional dollar amount to be withheld on line 3.

What should I do if I have other sources of income not subject to withholding?

If you have significant other sources of income not subject to withholding (e.g., interest, dividends, capital gains), it might be advisable to make estimated tax payments using Form 1040-ES to avoid underpayment penalties. This is particularly important if opting out of withholding on your pension.

Where can I find more information or get another copy of the form?

For additional copies of the Maryland Tax 766 form or for more information on your retirement benefits, you can call the Maryland State Retirement Agency or visit their website. Remember, the Agency cannot assist in preparing tax returns, so for detailed guidance, contacting the IRS or a professional tax consultant is recommended.

Common mistakes

When individuals fill out the Maryland Tax 766 form, they often make mistakes that can lead to delays in processing and potentially incorrect withholding amounts. Below are five common errors:

- Not specifying withholding amounts: Many individuals fail to designate the number of allowances for federal tax withholding on line 2 of Form W-4P, or they incorrectly believe they can designate a specific dollar amount without specifying allowances.

- Incorrect marital status: The form allows individuals to indicate their marital status and choose a withholding rate accordingly. A common mistake is selecting the wrong status or not understanding the implications of choosing "Married, but withhold at higher 'Single' rate."

- Leaving sections blank: For those who want federal income tax withheld, it is necessary to complete both lines 2 and 3 of Form W-4P. Leaving these lines blank or only partially filled can lead to incorrect withholding.

- Failure to sign the form: The form is not valid unless it is signed. This oversight is a simple but critical mistake that prevents the form from being processed.

- Not updating the form for significant life changes: Individuals often neglect to update their withholding preferences after major life events like marriage, divorce, or the birth of a child, which can affect their tax liabilities.

Furthermore, supplemental errors frequently occur, such as:

- Entering an incorrect Social Security Number, leading to issues in tax identification and potential delays in the processing of the form.

- Choosing not to have state income tax withheld without understanding the potential implications for their Maryland state income tax obligations.

- Failing to update their Maryland residency status, which can affect the appropriate withholding for Maryland state income tax.

- Incorrectly believing that completing the federal withholding section exempts them from state tax obligations or vice versa.

- Not carefully reading the instructions or neglecting to seek guidance from a tax professional when unsure about how to complete the form accurately.

Avoiding these mistakes can help ensure the correct amount of taxes are withheld, avoiding underpayment penalties, and ensuring compliance with both federal and state tax laws.

Documents used along the form

When dealing with the Maryland Tax 766 form for pension allowance requests, retirees or their advisors must often consider additional documentation and forms to ensure comprehensive tax compliance and financial planning. These documents support or supplement the information required by the Maryland Tax 766 form. Understanding each can simplify the submission process and ensure accurate withholding on pension distributions.

- Form W-4P: This "Withholding Certificate for Pension or Annuity Payments" allows individuals to dictate how much federal tax should be withheld from their pension payments. It's crucial for adjusting withholdings to avoid owing taxes at the end of the year.

- IRS Publication 575: Offers detailed information on the taxation of pension and annuity income, helping retirees understand their federal tax obligations and make informed decisions on withholding.

- Form 1040-ES: "Estimated Tax for Individuals" is used to pay estimated tax on income that is not subject to withholding, including some pension and annuity payments, especially when withholding is not desired or sufficient.

- IRS Publication 505: Guides taxpayers on tax withholding and estimated tax payments, which is beneficial for new retirees figuring out their tax responsibilities on pension income.

- Form W-8BEN: "Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding" is used by foreign individuals receiving pension payments from the U.S. to claim tax treaty benefits and reduce withholding rates.

- Form 1099-R: Issued by the payer of the pension or annuity, this form reports the total distribution of the pension or annuity over the tax year and the amount of federal tax withheld, essential for accurate tax return filing.

- Form 1042-S: "Foreign Person’s U.S. Source Income Subject to Withholding" is used for foreign individuals to report pension income and withholding executed under U.S. tax law agreements, crucial for non-resident alien retirees.

- IRS Publication 919: Helps individuals adjust their tax withholding correctly to avoid surprises at tax time. It's particularly useful for retirees needing to refine their withholding preferences after initial setup.

Collectively, these documents and resources enable retirees and their tax advisors to navigate the complexities of federal and state tax withholdings for pension incomes effectively. By understanding and utilizing these forms, retirees can better manage their tax obligations and potentially optimize their financial situation in retirement.

Similar forms

The Maryland Tax 766 form is similar to the Federal Form W-4P, "Withholding Certificate for Pension or Annuity Payments," in its purpose and functionality. Both forms are used by recipients of pension or annuity payments to instruct payers on how much federal income tax to withhold from their distributions. The Maryland form extends this instruction to include state tax withholdings, but at its core, it operates under the same premise as the W-4P: providing a means for retirees to manage tax liability on their retirement income. This includes options to opt-out of withholding entirely or to specify a desired amount, aligning closely with the way the W-4P sets out federal withholding preferences.

Another document that bears similarity to the Maryland Tax 766 form is Form 1040-ES, "Estimated Tax for Individuals." This form is for taxpayers, including retirees, who need to pay estimated taxes on income that is not subject to withholding, a category that can include certain types of retirement income. Like the Maryland Tax 766, Form 1040-ES is about managing tax obligations, giving individuals a way to comply with tax laws by estimating and paying taxes directly to the IRS, thus avoiding underpayment penalties. The connection with the Maryland form is the underlying intention: to prevent retirees from facing unexpected tax bills.

Form 1099-R, "Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.," is closely related to the Maryland Tax 766 form in its relevance to retirees. The 1099-R is issued to report the distribution of retirement benefits and the amount of federal income tax withheld from these distributions. It directly relates to the information retirees provide on forms like the Maryland Tax 766, which helps determine the withholding rate. By completing the Maryland Tax 766 form, retirees are effectively influencing the federal and state tax information that will later appear on their 1099-R forms, providing a cohesive link between pre-payment instructions and post-payment reporting.

The Form W-8BEN, "Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding," shares a connection with the Maryland Tax 766 form in its focus on tax withholding; however, it serves a unique demographic. Form W-8BEN is used by foreign individuals to claim exemption from or a reduction in U.S. tax withholding on income associated with U.S. sources, including pensions or annuities. Although it serves nonresident aliens rather than U.S. citizens or residents, the conceptual link to the Maryland Tax 766 lies in its purpose of establishing a taxpayer's withholding preferences based on their unique tax situation, highlighting the universal need among taxpayers to manage withholding to comply with tax laws while avoiding over- or under-payment.

Dos and Don'ts

Understanding the proper way to fill out the Maryland Tax 766 form is crucial for ensuring the accuracy of your federal and state tax withholdings from your pension allowance. Here are some key dos and don'ts to guide you through this process:

Do:- Review the instructions carefully. Before filling out the form, take time to read the instructions provided. This ensures you understand each part and how it applies to your personal situation.

- Check your marital status and allowances accurately. On Part I for Federal Tax Withholding, make sure to accurately report your marital status and the total number of allowances you’re claiming. This information significantly affects how much tax is withheld from your pension.

- Specify an additional amount if needed. If you want an additional amount withheld from your pension or annuity payment, clearly indicate this on line 3 of Form W-4P in Part I.

- Choose your Maryland state income tax withholding option. In Part II, select the appropriate option that reflects your desire for Maryland state income tax withholding from each monthly pension payment.

- Sign and date the form. Your submission is not considered valid unless you sign and date both the Federal and Maryland State Tax Withholding Request sections of the form.

- Consult a professional if needed. If you’re unsure about any aspect of the form or your specific tax situation, consider seeking advice from a tax consultant or financial advisor.

- Forget to submit Form W-4P for federal withholdings. Failing to specify your withholding preferences can result in the Maryland State Retirement Agency withholding taxes as if you are married claiming three exemptions, which might not suit your tax situation.

- Overlook additional income sources. If you receive income from other sources not subject to withholding, such as interest or dividends, remember to account for this possibly by making estimated tax payments.

- Ignore potential penalties. Not having enough tax withheld could lead to penalties under the estimated tax rules. Ensure your withholdings and estimated tax payments are sufficient to avoid this.

- Leave sections incomplete. Make sure to fill out every applicable section and line item relevant to your situation. Incomplete forms may lead to incorrect withholding amounts.

- Miss checking the box if you don’t want federal income tax withheld. If you wish not to have federal income tax withheld from your pension, be sure to check the appropriate box in Part I.

- Submit the form with incorrect information. Double-check all entries for accuracy before submission to avoid issues with your tax withholdings.

Misconceptions

Understanding the Maryland Tax Form 766 can sometimes be confusing. Several misconceptions often arise regarding its purpose, how it's filled out, and what it entails for the taxpayer. Clearing up these misunderstandings can help in making informed decisions regarding state and federal tax withholdings.

Misconception 1: Form 766 is only for Maryland state tax withholding. While it might appear that the Maryland Tax 766 form is solely concerned with state tax withholding given its title, it is actually designed for both federal and Maryland state tax withholdings. It enables retirees to make elections regarding the withholding amounts for both jurisdictions.

Misconception 2: Submission of Form 766 is optional. Many might think that filing this form is a matter of choice. However, if you want to adjust your withholding preferences or revoke previous elections, submitting a new Form 766 is mandatory. Without this form, the default withholding rates determined by the agency will apply.

Misconception 3: You can specify dollar amounts for federal tax withholding. The form follows federal regulations, which allow for specifying withholding allowances but not specific dollar amounts for federal taxes, except for an additional amount you wish to withhold. This contrasts with the state tax withholding request, where you can designate a precise dollar amount.

Misconception 4: Form 766 applies to non-Maryland residents. Non-Maryland residents might think they need to file this form. However, the form allows them to indicate their non-residency and opt-out of Maryland state tax withholding, addressing specifically the needs of those who receive pension benefits from Maryland but reside in another state.

Misconception 5: Changing withholding preferences is restricted. Once you've submitted a Form 766, it's not set in stone. You can change or revoke your election at any time by submitting a new form. This flexibility is crucial for accommodating changes in your financial situation or tax status.

Misconception 6: The Maryland State Retirement Agency offers tax advice. Although the agency provides this form, it is not in a position to offer tax advice. Taxpayers are encouraged to consult the IRS, the Comptroller’s Taxpayer Service, or a tax professional for guidance.

Misconception 7: Withholding elections affect the taxability of payments. Some might think that their withholding choices influence the taxable nature of their pension or annuity payments. However, these elections only affect how much tax is withheld, not the underlying taxability of the income as determined by federal and state tax laws.

Misconception 8: Only new retirees need to complete the form. While it's particularly important for new retirees to review their withholding options, existing retirees should also reassess their withholdings annually or whenever their financial circumstances change, using Form 766 to make any adjustments.

Understanding these aspects of the Maryland Tax Form 766 can help retirees make informed decisions about their tax withholdings, ensuring they comply with federal and state requirements while managing their personal financial needs.

Key takeaways

- Filing the Maryland Tax 766 form is necessary for individuals receiving pension allowances to specify their Federal and State tax withholding preferences.

- This form enables retirees to combine their Federal and State tax withholding elections into one document, streamlining the process.

- By submitting a new Maryland Tax 766 form, retirees can modify or revoke previous Federal and State tax withholding elections.

- For Federal tax, retirees must specify their withholding allowances on the form, as opposed to selecting a specific dollar amount, with the option to add an additional dollar amount if desired.

- If no federal income tax is desired to be withheld, the retiree must check the appropriate box in Part I of the form, otherwise, the system defaults to withholding as if married with three exemptions.

- Retirees not wanting Maryland state tax withheld, or those living outside Maryland, can indicate their preference on the form, which also allows them to specify a fixed dollar amount for withholding.

- The election made by the retiree regarding tax withholding remains in effect until officially changed or revoked through the submission of a new form.

- The Maryland State Retirement Agency advises retirees to consult the IRS or a tax consultant for assistance in completing the form or understanding the tax implications.

- Retirees should regularly review and possibly adjust their withholding preferences, especially after major life changes or to avoid penalties for underpayment of estimated tax.

- It is critical for retirees to provide an accurate taxpayer identification number (TIN) on Form W-4P to avoid automatic withholding as if they are Single claiming zero allowances.

- At the end of each tax year, retirees will receive a Form 1099-R or, for foreign persons, a Form 1042-S, detailing the total payments and federal income tax withheld.

Popular PDF Documents

Affidavit of Heirship California - Filling out this form requires submitting personal details and relationships of both living and deceased relatives.

File 941 Online - Supports detailed verification of state unemployment contribution rates and periods.

IRS 4506 - Essential for financial planning and auditing, it allows for the retrieval of tax records going back several years.