Get Maryland Sales Use Tax 202 Form

Transitioning or concluding your business operations in Maryland requires attention to specific tax responsibilities, among which the Maryland Sales and Use Tax Form 202 (202FR) plays a crucial role. This form is an essential document for businesses that are either discontinuing their operations or transferring ownership. It ensures that the final sales and use tax liabilities are properly reported and settled with the state. When completing this form, it is mandatory to provide detailed information such as the Federal Employer Identification Number, Central Registration Number, and the date the business was either permanently discontinued or sold. Additionally, it includes fields for the business name and address, as well as the purchaser's details if the business was sold. The person completing the form must also include their contact information and signature, thereby certifying the accuracy of the information provided. Filing instructions emphasize submitting this form together with the final sales and use tax return, with an option to mail it separately if electronic filing was utilized. Keeping a copy for records and ensuring all documents include necessary identification details are advised to facilitate proper processing and avoid errors. This form, directed to the Comptroller of Maryland's Revenue Administration Division, signifies a significant step in complying with Maryland's tax obligations during pivotal business transitions.

Maryland Sales Use Tax 202 Example

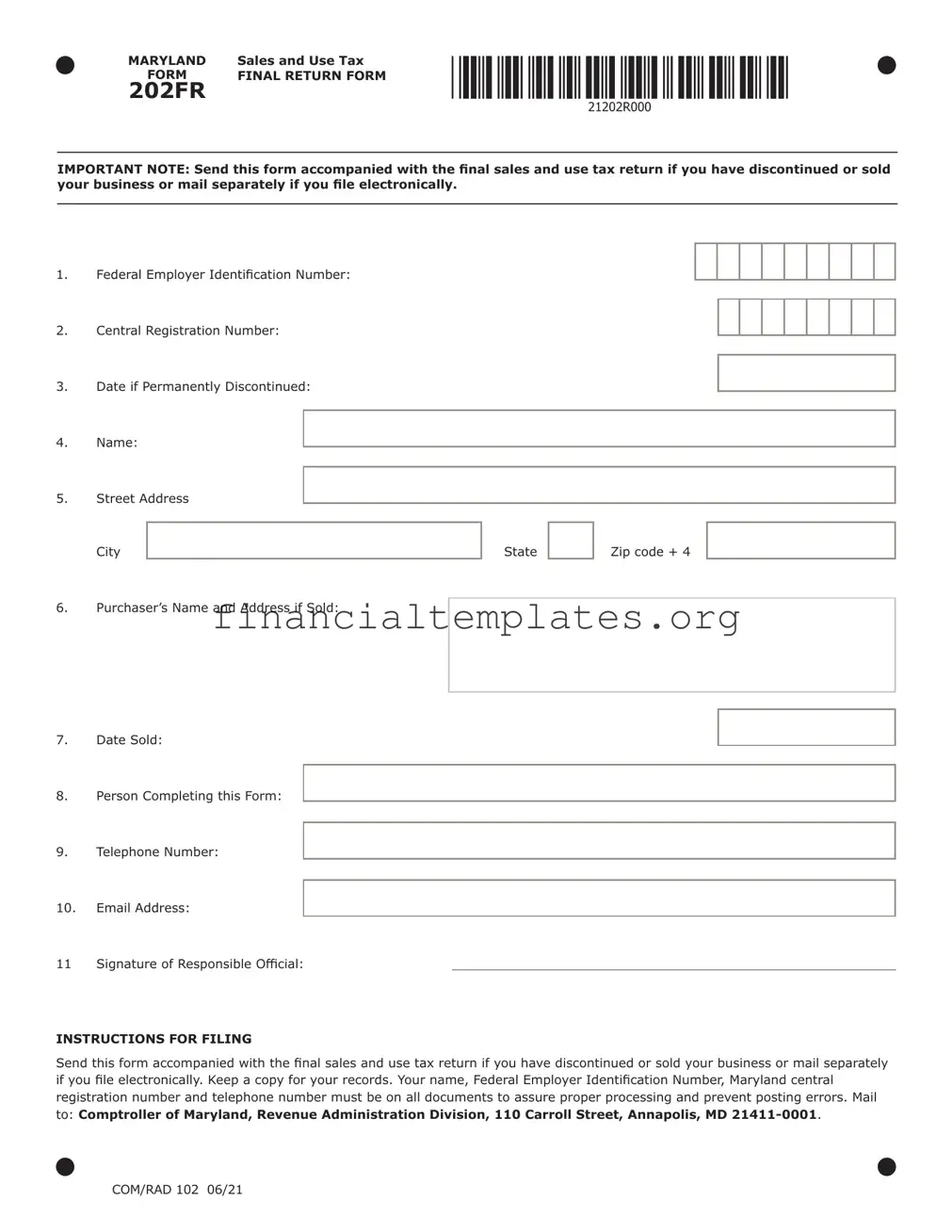

MARYLAND |

Sales and Use Tax |

FORM |

FINAL RETURN FORM |

202FR |

|

IMPORTANT NOTE: Send this form accompanied with the final sales and use tax return if you have discontinued or sold your business or mail separately if you file electronically.

1.Federal Employer Identification Number:

2.Central Registration Number:

3.Date if Permanently Discontinued:

4.Name:

5.Street Address

City

6.Purchaser’s Name and Address if Sold:

7.Date Sold:

8.Person Completing this Form:

9.Telephone Number:

10.Email Address:

11 Signature of Responsible Official:

INSTRUCTIONS FOR FILING

State

Zip code + 4

Send this form accompanied with the final sales and use tax return if you have discontinued or sold your business or mail separately if you file electronically. Keep a copy for your records. Your name, Federal Employer Identification Number, Maryland central registration number and telephone number must be on all documents to assure proper processing and prevent posting errors. Mail to: Comptroller of Maryland, Revenue Administration Division, 110 Carroll Street, Annapolis, MD

COM/RAD 102 06/21

Document Specifics

| Fact Name | Description |

|---|---|

| Form Designation | MARYLAND Sales and Use Tax Form 202FR - FINAL RETURN |

| Purpose | Used for businesses to report the discontinuation or sale of their business in Maryland. |

| Required Documentation | This form must accompany the final sales and use tax return if a business is discontinued or sold, or it can be mailed separately if filing electronically. |

| Identification Numbers | Businesses must provide a Federal Employer Identification Number and a Maryland Central Registration Number. |

| Business Closure Date | Includes a field for the date if the business is permanently discontinued. |

| Business Sale Information | Requests details of the purchaser’s name and address if the business is sold, including the date sold. |

| Contact Information | Form requires the name, telephone number, and email address of the person completing the form. |

| Official Signatory | A signature from a responsible official is required to validate the form. |

| Submission Instructions | Details provided on where to mail the completed form, emphasizing the importance of including all necessary contact information to ensure proper processing. |

| Governing Law | The use and regulations surrounding this form are governed under Maryland state law, specifically by the Comptroller of Maryland, Revenue Administration Division. |

Guide to Writing Maryland Sales Use Tax 202

Filing the Maryland Sales and Use Tax Final Return Form 202 is a necessary step for businesses that have either discontinued operations or been sold. This ensures that your business complies with state tax obligations and provides a clear end to your tax responsibilities related to sales and use tax in Maryland. Completing this form accurately is essential for a smooth transition, whether you’re closing your business or transferring ownership. Follow these steps to complete the form correctly.

- Federal Employer Identification Number: Start by entering your business’s Federal Employer Identification Number (FEIN) in the space provided.

- Central Registration Number: Fill in your Maryland Central Registration Number.

- Date if Permanently Discontinued: If your business is closing, enter the date of permanent discontinuation.

- Name: Write the full legal name of the business as it appears in state and federal tax records.

- Street Address City State Zip Code + 4: Enter your business’s complete street address, including the city, state, and zip+4 code.

- Purchaser’s Name and Address if Sold: If the business was sold, provide the new owner’s full name and address.

- Date Sold: Enter the date when the business was officially sold.

- Person Completing this Form: Write the name of the individual filling out the form. This could be the business owner, an authorized representative, or an accountant.

- Telephone Number: Provide a contact number where the person completing the form can be reached.

- Email Address: Include an email address for further communications regarding this form.

- Signature of Responsible Official: The form must be signed by the business owner or authorized official, confirming the accuracy and completeness of the information provided. This signature verifies responsibility for the information.

After completing the Maryland Sales and Use Tax Final Return Form 202, ensure that you attach it with the final sales and use tax return if your business has been discontinued or sold. If you file electronically, you may mail it separately. Always keep a copy of this form for your records. To prevent processing delays or posting errors, make sure your name, Federal Employer Identification Number, Maryland central registration number, and telephone number are clearly indicated on all documents. Mail the completed form to the Comptroller of Maryland, Revenue Administration Division, at the address provided. Proper completion and submission of this form are crucial steps in finalizing your business’s tax responsibilities in Maryland.

Understanding Maryland Sales Use Tax 202

Understanding the nuances of tax forms can often seem overwhelming, particularly when it involves specific situations such as discontinuing or selling a business. For businesses in Maryland, the Sales and Use Tax Form 202 (FINAL RETURN FORM 202FR) plays a crucial role in ensuring compliance with state tax obligations in such scenarios. Below are answers to frequently asked questions about this form to facilitate a clearer understanding and smoother filing process.

What is the purpose of the Maryland Sales and Use Tax Form 202FR?

The Maryland Sales and Use Tax Form 202FR is designed for businesses that are either discontinuing operations or undergoing ownership changes. This form should be completed and submitted in conjunction with the final sales and use tax return. Its primary purpose is to notify the Comptroller of Maryland of the business’s cessation or change in ownership, ensuring the proper closure of the business’s tax obligations within the state.

When should Form 202FR be filed?

This form should be filed as soon as possible after the business has been either permanently discontinued or sold. The prompt submission is key to preventing potential misunderstandings or tax liabilities associated with the business after its operational status has changed. It is important to note that filing this form separately is an option if the business’s final sales and use tax return is submitted electronically.

What information is needed to complete Form 202FR?

To adequately fill out the Form 202FR, you will need to provide various details about the business and the transaction that led to discontinuation or change in ownership. Required information includes:

- Federal Employer Identification Number (FEIN)

- Central Registration Number

- Date the business was permanently discontinued or sold

- Name and address of the business

- If sold, the name and address of the purchaser

- Date of sale

- Contact details of the person completing the form

- Signature of the responsible official or individual

This comprehensive approach ensures all pertinent information is conveyed to the Maryland Comptroller, facilitating a smooth transition for both the business and the state’s revenue department.

Where should Form 202FR be sent?

Completed forms, along with the final sales and use tax return if applicable, should be mailed to the Comptroller of Maryland, Revenue Administration Division, at 110 Carroll Street, Annapolis, MD 21411-0001. It is imperative to keep a copy of the form for your records, as this will help verify the fulfillment of your tax obligations should any questions arise in the future. Ensuring that your business’s name, Federal Employer Identification Number, Maryland central registration number, and contact information are clearly indicated on all documents helps prevent processing delays and posting errors.

Comprehending the specifics of Form 202FR is vital for businesses concluding their operations or undergoing ownership changes in Maryland. The key to a smooth filing process lies in understanding the form’s purpose, knowing when and how to file it, and providing accurate information to the Maryland Comptroller’s office. Being meticulous with these details can greatly facilitate the transition for businesses while also ensuring compliance with state tax legislation.

Common mistakes

Filling out the Maryland Sales and Use Tax Form 202 (often referred to simply as Form 202) is a pivotal step for many businesses, particularly when they're winding down operations or changing hands. However, the process isn't always straightforward, and small mistakes can lead to big headaches. Let's explore seven common errors that people frequently make when completing this form.

Not including the Federal Employer Identification Number (FEIN): The FEIN is crucial for identifying your business to the state and federal government. Omitting this number can result in processing delays or even the return of your form.

Skipping the Central Registration Number: Similar to the FEIN, the Central Registration Number is how the state of Maryland keeps track of your business. Failing to include this number can disrupt the processing of your form.

Forgetting to specify the Date of Permanent Discontinuation: If you're closing your business, it's essential to indicate the date operations officially ended. This information helps the state update its records accurately.

Incomplete contact details: Whether it's your name, the street address, or both, incomplete contact information can significantly slow down processing. The state needs this information to get in touch with you if there are any issues with your filing.

Omitting the purchaser’s information when the business is sold: If you're selling your business, including the new owner's information is a must. This detail is necessary for the state to update its records and direct future tax documents to the right party.

Not specifying the sale date: Similar to the date of permanent discontinuation, the date the business was sold is critical. It marks the transition of tax responsibilities from one party to another.

Failing to sign the form: The signature of a responsible official is not just a formality; it's a legal attestation to the accuracy of the information provided. Without it, the form is considered incomplete and won't be processed.

In addition to these common mistakes, here are a few extra tips to ensure a smooth filing process:

Always keep a copy of the form for your records. This can be invaluable if there are any questions or disputes in the future.

Double-check that your name, FEIN, Maryland central registration number, and telephone number appear on all documents you submit. This helps avoid posting errors and processing delays.

Finally, make sure to mail your completed form to the correct address: Comptroller of Maryland, Revenue Administration Division, 110 Carroll Street, Annapolis, MD 21411-0001. Using an outdated or incorrect address can result in unwanted delays.

Correctly completing the Maryland Sales and Use Tax Form 202 not only ensures compliance with state regulations but also helps avoid potential fines and complications. Taking the time to review your form for these common errors can save a lot of time and stress down the line.

Documents used along the form

When handling business taxes in Maryland, particularly with the Maryland Sales and Use Tax Form 202, understanding associated forms and documents is crucial for comprehensive compliance. These documents often play a vital role in ensuring that your tax obligations are accurately met and can aid in various situations, such as discontinuing a business or updating business information.

- Combined Registration Application (CRA): Before a business can file the Maryland Sales and Use Tax Form 202, it must first register with the state. The CRA is used for this purpose. It collects information about the business, such as its name, address, and type of business activity. This registration is essential for obtaining a sales tax license.

- Business Personal Property Return: This document is necessary for businesses that have personal property (equipment, furniture, etc.) used in the business. It's submitted annually to the Maryland Department of Assessments and Taxation and helps determine the value of your business personal property for tax purposes.

- Sales and Use Tax Exemption Certificate: If your business purchases goods for resale or produces products, this certificate allows you to buy goods without paying sales tax. It's crucial for businesses to properly manage and use these certificates to avoid unnecessary taxation.

- Change of Address Form: It’s inevitable that businesses might change locations. When this happens, this form updates the business's contact information with the Maryland Comptroller’s office. Timely updating of this information is essential for receiving important tax documents and correspondence.

Together, these forms and documents support the proper filing and processing of the Maryland Sales and Use Tax Form 202, ensuring that businesses remain compliant with state tax laws. Whether you are starting a new business, managing the ongoing tax obligations of an existing business, or discontinuing operations, each document plays a unique role in the broader context of state tax administration. Being familiar with and understanding how to correctly utilize these forms is beneficial for efficient and accurate tax filing processes.

Similar forms

The Uniform Sales & Use Tax Exemption/Resale Certificate – Multijurisdiction Form is one document similar to the Maryland Sales and Use Tax 202 form. Both serve crucial roles in the sales and use tax process, facilitating businesses in the transaction of goods and services. While the Maryland form is specific to declaring the final sales and use tax for businesses ending operations, the Multijurisdiction Form allows businesses to purchase goods for resale without paying sales tax upfront across different states. Each requires detailed business identification information, like the Federal Employer Identification Number and specific instructions for their use to ensure compliance with tax laws.

Another comparable document is the California Sales and Use Tax Return Form. Similar to Maryland's version, this form serves as a means for businesses to report and pay taxes on sales and use within the state. Both forms require the business's sales information, including gross sales, and deductions to calculate the tax owed. They are vital in ensuring businesses meet their tax obligations timely, thereby avoiding penalties and interest. Additionally, both forms demand accurate business identification numbers to ensure the correct processing of tax payments and returns.

The New York State ST-100 Sales and Use Tax Return shares similarities with Maryland's form by requiring businesses to file periodically based on their taxable sales and purchases within the state. Each form plays a pivotal role in the collection of taxes that fund state operations and services. They both necessitate detailed transaction records, including taxable and nontaxable sales, and apply adjustments for accurate tax reporting. By providing a structured means for tax reporting, these forms ensure state compliance and support the equitable collection of taxes from businesses operating within their jurisdictions.

The Texas Sales and Use Tax Return, similarly, mandates businesses to report their taxable sales and calculate the tax owing. Both the Texas and Maryland forms are integral to the state's ability to gather needed revenue for public services. They require businesses to detail their sales activities, applying appropriate tax rates and deductions. The forms serve as a formal record of sales and use tax liability, which is critical for both state budget planning and business financial management.

Finally, the Virginia Retail Sales and Use Tax Return is akin to the Maryland 202 form by requiring businesses to account for their sales and the corresponding tax. Both documents are essential for state tax administration, providing a pathway for businesses to report taxes on goods sold or used within the state. Each form includes sections for the reporting of gross sales, taxable sales, and the calculation of the tax due, underpinned by the necessity of accurate business identification information to ensure proper account reconciliation with the state’s revenue department.

Dos and Don'ts

When it comes time to sail through the process of filling out the Maryland Sales and Use Tax Form 202, it's like navigating through choppy regulatory waters. Let's ensure your journey is smooth sailing with a handy list of dos and don'ts:

Do:- Double-check your information: Accuracy is key. Ensure that your Federal Employer Identification Number, Central Registration Number, business name, and contact information are correctly entered.

- Remember the date: Whether your business is discontinuing or has changed hands, the correct dates of these events are critical for your final tax return.

- Electronic filers, take note: Even if filing electronically, this form needs to accompany your final sales and use tax return separately if your business has been discontinued or sold.

- Keep records: Make a copy of the form for your records. It’s always smart to have a backup for your records.

- Contact Information: Ensure the contact information is current and correct. A simple mistake here could lead to unnecessary delays.

- Signature: The form requires the signature of a responsible official. Make sure it is signed before sending it off.

- Rush through the form: Taking your time to fill out the form carefully can prevent errors and potential headaches down the road.

- Forget postage: If you’re mailing the form, ensure it’s addressed correctly to the Comptroller of Maryland, Revenue Administration Division, and pay attention to postage requirements.

- Overlook the instructions: Each field in the form has specific requirements. Paying attention to these can save time and ensure your form is processed smoothly.

- Use unsupported formats: If attaching additional documents, ensure they are in a format that the Comptroller's office can process.

- Skip sections: Even if a section seems not to apply, verify its relevance. Sometimes, providing a N/A is better than leaving it blank.

- Wait till the last minute: Procrastinating on this task can lead to rushed errors or missed deadlines. Give yourself plenty of time.

By following these guidelines, you'll help ensure the process is as efficient and error-free as possible, allowing you to focus on what's next for you and your business.

Misconceptions

Navigating the complexities of tax forms can often lead to misunderstandings, especially with forms as specific as the Maryland Sales and Use Tax Form 202 (FORM 202FR). Let's clarify six common misconceptions to ensure individuals and businesses alike can approach this form with confidence and accuracy.

- Misconception 1: The form is only for businesses ceasing operations.

While it's true that FORM 202FR is critical for businesses that are discontinuing operations or have been sold, it's a misconception that its use is limited to these scenarios. In reality, this form plays a crucial role in the final reporting process, ensuring that Maryland's Comptroller has accurate records for the concluding sales and use tax return.

- Misconception 2: Electronic filing eliminates the need to send FORM 202FR.

Even in the digital age, where electronic filing is prevalent, it's a mistake to think you don't need to concern yourself with FORM 202FR if you submit your sales and use tax returns online. The instructions explicitly state that if you file electronically, you should mail FORM 202FR separately, ensuring compliance with Maryland's tax laws.

- Misconception 3: Any employee can complete and sign the form.

Accuracy and accountability are paramount when it comes to tax documents. FORM 202FR requires the signature of a responsible official from the business. This ensures that the information is verified and authoritative, preventing potential legal or financial implications due to inaccuracies.

- Misconception 4: The form is self-explanatory and requires no additional documentation.

Though the form itself provides a structured way to report crucial information, businesses must remember to accompany it with the final sales and use tax return. Failure to include all required documents could result in processing delays or inaccuracies in the business's tax records.

- Misconception 5: Personal contact information is optional.

In an era where privacy concerns are ever-present, some may hesitate to provide personal contact details. However, including your name, telephone number, and email address on FORM 202FR is mandatory for proper processing and to prevent posting errors. This information is crucial for any follow-up required by the Maryland Comptroller's office.

- Misconception 6: The form's mailing address is irrelevant with electronic filing.

A common oversight is neglecting to mail FORM 202FR to the specified address when filing taxes electronically, considering it an outdated step. The Comptroller of Maryland, Revenue Administration Division, remains a pivotal point for document submission, ensuring that all pieces of your tax puzzle are correctly put together, even in the digital age.

Understanding the nuances of Maryland's FORM 202FR can demystify the process, making it less daunting for businesses at the crossroads of change. By correcting these misconceptions, businesses can ensure smoother transitions, whether scaling down, changing hands, or simply keeping up with their tax obligations.

Key takeaways

When it comes to managing your business's responsibilities in Maryland, understanding how to correctly fill out and use the Maryland Sales and Use Tax Form 202FR is crucial. Here are 10 key takeaways to ensure you complete this task accurately and efficiently:

- Specific Purpose: Use the Form 202FR specifically when you have discontinued or sold your business to notify the state and settle your final sales and use tax obligations.

- Combination or Separate Submission: You can send this form alongside your final sales and use tax return if closing your business. Alternatively, if you file electronically, you may send it separately.

- Retention of Records: It's essential to keep a copy of this form for your records. This helps in tracking your compliance and can be valuable for any future queries or clarifications.

- Identification Numbers are Crucial: Your Federal Employer Identification Number and Maryland Central Registration Number are key details that must be accurately provided on the form to ensure your submission is processed without delays.

- Contact Information: Providing correct and comprehensive contact information, including your telephone number and email address, facilitates communication regarding your form.

- Accuracy in Filling: The form requires details like the date when the business was permanently discontinued or sold, along with the purchaser’s name and address if applicable. Ensuring these are accurate is important for a smooth process.

- Signature Requirement: A responsible official must sign the form to verify the information and authorize the submission. This attests to the accuracy of the information provided.

- Mailing Details: The completed form should be mailed to the Comptroller of Maryland at the Revenue Administration Division, with the specific address provided in the instructions.

- Electronic Filing Option: For those who file their taxes electronically, this form can also be sent separately if not combined with the final tax return, offering flexibility in how you complete your obligations.

- Keep Updated Information: Ensure that all the information provided, especially contact and business status details, are current and reflect your final operations status to avoid any confusion.

Understanding and following these key points will help streamline the process of submitting your Maryland Sales and Use Tax Form 202FR, making the transition smoother whether you are discontinuing or selling your business.

Popular PDF Documents

D-400 Tax Form - Its layout enables a clear comparison between what was previously reported and the corrected amounts for tax withheld.

Cdp Hearing - A pathway for taxpayers to possibly avoid or delay tax levies and liens.

Form 990 Ez - The form allows tax-exempt entities to provide a snapshot of their financial health and operations.