Get Maryland Sales And Use Tax Resale Certificate Form

In the bustling world of commerce within Maryland, businesses engage in a plethora of transactions daily, involving the acquisition of tangible personal property or taxable services intended for various uses. Central to these operations is the Maryland Sales And Use Tax Resale Certificate form, a pivotal document that underscores a company's entitlement to purchase goods or services without the immediate burden of sales tax, under the condition that the acquired items are for resale or will be incorporated into other tangible products for sale. Issued by the Comptroller of the Treasury's Retail Sales Tax Division, this blanket certificate serves as a declaration by the purchaser, addressed to suppliers, such as K&K Floors Maryland, Inc., stating their intent and certifying their eligibility under the Maryland Sales and Use Tax Laws. This certification is not just a formality but a binding document that is integrated into each order by referencing the buyer's Maryland Sales and Use Tax Registration Number, ensuring the continuation of tax-exempt purchases unless expressly revoked. This form encapsulates the integrity and compliance expected in the trade relationship between buyers and sellers, safeguarding the principles of good faith and the accurate adherence to state tax regulations.

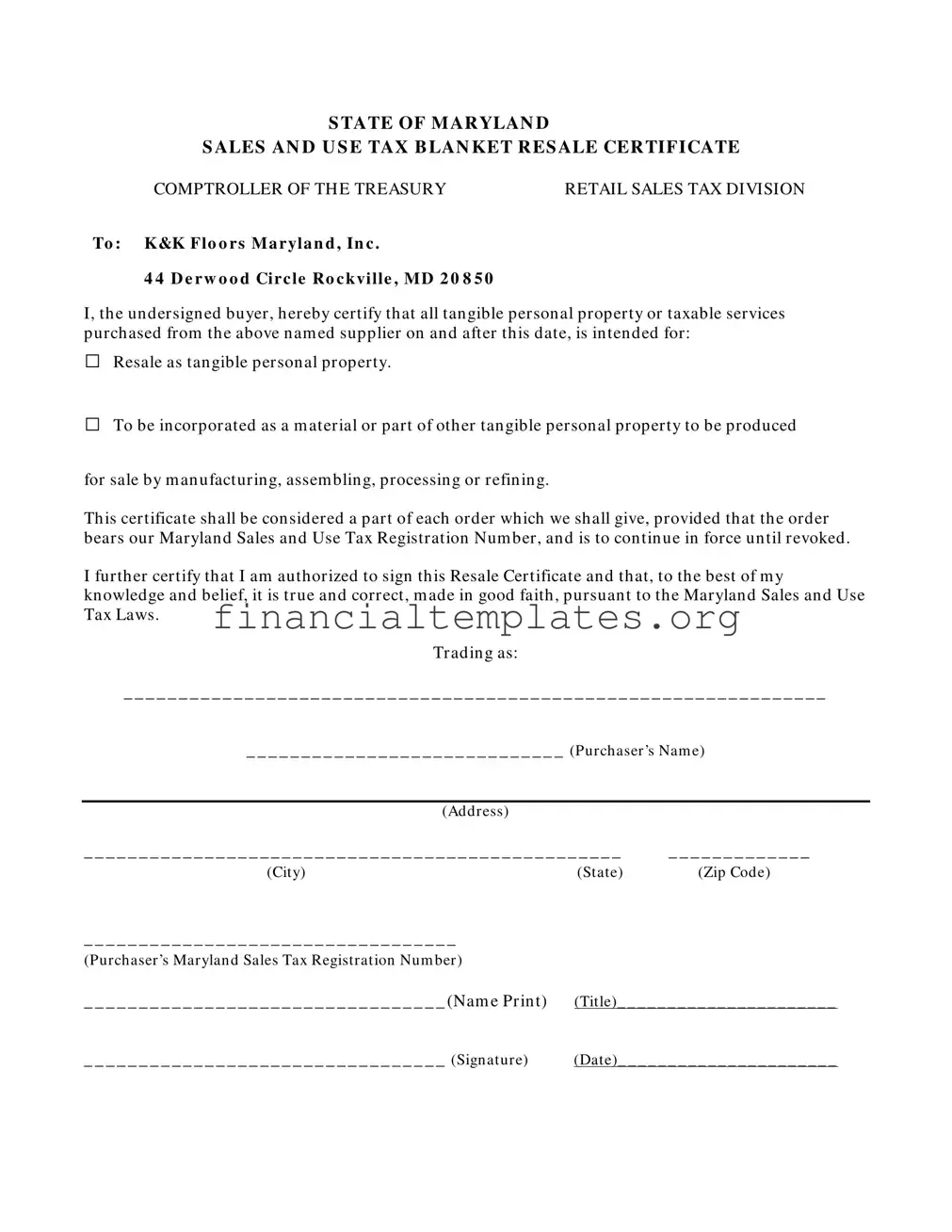

Maryland Sales And Use Tax Resale Certificate Example

S TATE OF MARYLAN D

S ALES AN D U S E TAX B LAN KET RES ALE CERTIFICATE

COMPTROLLER OF TH E TREASURY |

RETAIL SALES TAX DIVISION |

To : K&K Flo o rs Ma ryla n d , In c .

4 4 D e rw o o d Circ le Ro c kvi lle , MD 2 0 8 5 0

I, th e un dersign ed buyer , h ereby certify th at all tan gible person al property or taxable services purch ased from th e above n am ed supplier on an d after this date, is in ten ded for:

□Resale as tan gible person al property.

□To be in corporated as a m aterial or part of oth er tan gible person al property to be produced

for sale by m an ufacturing, assem blin g, processin g or refin in g.

Th is certificate sh all be con sidered a part of each order which we sh all give, provided th at th e order bears our Marylan d Sales an d Use Tax Registration Num ber, an d is to con tin ue in force un til revoked .

I furth er certify th at I am authorized to sign th is Resale Certificate an d th at, to th e best of m y

kn owledge an d belief, it is true an d correct, m ade in good faith , pursuan t to th e Marylan d Sales an d Use Tax Laws.

Tradin g as:

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ (Purchaser’s Nam e)

(Address)

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ |

_ _ _ _ _ _ _ _ _ _ _ _ _ |

|

(City) |

(State) |

(Zip Code) |

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

(Purchaser’s Marylan d Sales Tax Registrat ion Num ber)

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ (Nam e Prin t) |

(Title)_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ |

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ (Sign ature) |

(Date)_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Maryland Sales and Use Tax Blanket Resale Certificate is used by purchasers to buy tangible personal property or taxable services for resale without paying state sales tax. |

| Applicability | It applies to items intended for resale as tangible personal property or to be incorporated as material or a part of other tangible personal property produced for sale. |

| Validity | This certificate is valid for all purchases from the named supplier and remains in force until revoked. |

| Requirement for Orders | Each order must bear the purchaser's Maryland Sales and Use Tax Registration Number to be considered under this certificate. |

| Authorization | The signer certifies they are authorized to sign the Resale Certificate and declares the information provided is true, correct, and made in good faith under Maryland Sales and Use Tax Laws. |

| Governing Law | The Resale Certificate is governed by the Maryland Sales and Use Tax Laws. |

Guide to Writing Maryland Sales And Use Tax Resale Certificate

Filling out the Maryland Sales and Use Tax Resale Certificate is a crucial step for businesses that purchase goods for resale in Maryland. Understanding how to accurately complete this form ensures that transactions are conducted in compliance with state tax laws. The process protects businesses from unnecessary tax burdens by certifying that the purchases are for resale, and not for personal use. The completion of this form requires attention to detail and an understanding of your business's obligations under Maryland tax law. Let's take a detailed look at how to properly fill out this form, step by step.

- Start by reading the entire form carefully to ensure you understand the requirements and conditions under which the resale certificate applies.

- Enter the supplier's name, “K&K Floors Maryland, Inc.”, in the designated space at the top of the form.

- Insert the supplier’s address, “44 Derwood Circle Rockville, MD 20850”, next to the supplier's name.

- Identify the nature of the goods or services being purchased by checking the appropriate box: either “Resale as tangible personal property” or “To be incorporated as a material or part of other tangible personal property to be produced for sale by manufacturing, assembling, processing or refining.”

- Under the statement beginning with "I, the undersigned buyer," write your business's legal name where it says “(Purchaser’s Name)”.

- Fill out your business address, city, state, and zip code in the respective fields following your business name.

- Write your “Maryland Sales and Use Tax Registration Number” in the designated spot. This number is essential, as it verifies your business is registered to collect sales tax in Maryland.

- In the section provided at the bottom, print the name of the individual authorized to sign this certificate on the “(Name Print)” line.

- Next to the printed name, provide the title of the authorized signer (e.g., Owner, Director) on the line labeled “(Title)”.

- The authorized individual must sign the form on the line that is designated for the signature, next to the title line.

- Lastly, enter the date on which the form is being signed in the space provided.

Once the form is fully completed, review it to make sure all information provided is correct and accurate. Signing the Maryland Sales and Use Tax Resale Certificate validates that your purchases are for resale purposes and are, therefore, exempt from sales tax. It is a declaration made under penalty of perjury, so accuracy and honesty in completing this document are paramount. Keep a copy of this certificate for your records, and be prepared to furnish it upon request by the supplier or the Maryland Comptroller's Office. Properly executed, this form facilitates smooth transactions between your business and its suppliers, ensuring compliance with Maryland’s tax regulations.

Understanding Maryland Sales And Use Tax Resale Certificate

Understanding the Maryland Sales and Use Tax Resale Certificate can be complex. Here are some frequently asked questions to help clarify the process and requirements:

- What is the purpose of the Maryland Sales and Use Tax Resale Certificate?

The Maryland Sales and Use Tax Resale Certificate allows businesses to purchase tangible personal property or taxable services without paying sales tax, on the condition that these items will be resold or will be used as materials in manufacturing, assembling, processing, or refining goods that will be sold. It exempts the buyer from paying sales tax at the time of purchase, with the understanding that sales tax will be collected from the end consumer at the point of sale.

- Who needs to fill out this form?

Any business intending to purchase goods for resale, or that will incorporate the goods as a material part of other tangible personal property intended for sale, must fill out this form. This form is crucial for businesses that wish to avoid the upfront payment of sales tax on items that will not remain as part of their final inventory for use but will be sold to customers.

- How does a business qualify to use the Resale Certificate?

To qualify for using the Maryland Sales and Use Tax Resale Certificate, a business must be registered with the Maryland Comptroller's office and have a valid Maryland Sales and Use Tax Registration Number. This number must be included on each resale certificate issued to suppliers to validate the certificate's authenticity and the business's eligibility.

- What are an entity's obligations after issuing a Resale Certificate?

After issuing a Resale Certificate, the business assumes responsibility for collecting sales tax from the end consumer at the point of sale for any items purchased tax-exempt. It must also ensure that all conditions of the certificate are met, including the resale or incorporation of purchased items into other goods intended for sale. Failure to comply with these conditions may result in the owed sales tax becoming due, along with possible penalties and interest. The certificate remains in effect until revoked by the issuing business or otherwise invalidated.

Common mistakes

When filling out the Maryland Sales and Use Tax Resale Certificate form, attention to detail is crucial. However, errors can occur. Here are six common mistakes people make:

- Not including the Maryland Sales and Use Tax Registration Number: This is a key piece of information that validates the form. Without it, the certificate may not be recognized.

- Failing to check the appropriate box indicating the intended use of purchased items: This clarifies whether items are for resale or for incorporation in manufacturing. Mistakes here can lead to discrepancies in tax liabilities.

- Incomplete buyer information: Leaving out details like the purchaser’s name, address, city, state, or ZIP code hampers the form’s validity. These elements are essential for tracking and verification purposes.

- Incorrect or missing signature and title: The form requires a signature from an authorized individual, along with their title. Missing or inaccurate information here questions the form's authenticity.

- Omitting the date: The date is crucial as it indicates the certificate’s effective timeline. Neglecting to include it can lead to disputes over the period covered by the certificate.

- Assuming the certificate automatically renews: While the certificate continues in force until revoked, parties must remain vigilant about its validity and any changes in tax law. Regular reviews are recommended to avoid using an outdated certificate.

By avoiding these common mistakes, individuals and businesses can ensure smoother transactions and compliance with Maryland tax laws. Accuracy, attentiveness, and regular updates are key to utilizing the Maryland Sales and Use Tax Resale Certificate effectively.

Documents used along the form

When businesses engage in transactions that involve the Maryland Sales and Use Tax Resale Certificate, there are often several other forms and documents they might need to utilize to ensure compliance with Maryland tax laws and regulations. Each of these forms serves a distinct purpose, from declaring the nature of the business to ensuring the correct tax reporting and payment. Understanding these documents can help businesses efficiently navigate the complexities of tax compliance.

- Combined Registration Application (CRA): This is essential for businesses to legally operate in Maryland. It is used to register for a Maryland Sales and Use Tax License, among other tax-related responsibilities. This comprehensive form covers registration for various taxes and permits.

- Sales and Use Tax Return: Filed periodically (monthly, quarterly, or annually), this return details the amount of sales and use tax collected and is due to the state. It's critical for businesses to report accurately and pay any taxes owed.

- Use Tax Payment Form: For purchases made out-of-state where Maryland sales tax was not collected, this form is used to report and pay the use tax directly to Maryland.

- Exemption Certificate for Utility and Fuel Use: Businesses that purchase utilities or fuel for certain exempt purposes may qualify to use this form to buy these items tax-free.

- Vendor's License: While not a form, holding a valid vendor's license is essential for businesses selling tangible personal property or taxable services in Maryland. This license is evidence of the business's authority to collect sales tax.

- Maryland Employer Withholding Tax Forms: Businesses with employees must collect and remit withholding taxes to the state, requiring a variety of forms for reporting and payment purposes.

- Business Personal Property Return: Though it is more related to property tax than sales tax, businesses must annually report their taxable personal property to the Maryland Department of Assessments and Taxation.

- New Hire Reporting Form: This is required for all businesses to complete for each new employee, ensuring proper child support enforcement and security of public assistance programs.

Each document and form plays a pivotal role in a business’s financial and legal duties within the state of Maryland. Having a clear understanding of these documents, alongside the Maryland Sales and Use Tax Resale Certificate, positions businesses to better manage their tax obligations and maintain compliance. Keeping accurate records and staying informed on state tax laws will help streamline the tax reporting process, allowing businesses to focus more on their operations and less on tax-related complexities.

Similar forms

The Certificate of Exemption is a document that closely resembles the Maryland Sales And Use Tax Resale Certificate in its purpose and function. Both forms serve as declarations by purchasers that the acquired goods will not be used in a manner that subjects them to sales tax. While the Sales and Use Tax Resale Certificate focuses on items bought for resale or manufacturing purposes, the Certificate of Exemption may apply to a broader range of tax-exempt purposes, such as purchases made by nonprofit organizations or government entities. Each certificate is a pledge that the buyer fulfills specific criteria, exempting them from paying sales tax.

A Seller's Permit, also known as a Sales Tax Permit, shares commonalities with the Maryland Sales and Use Tax Resale Certificate regarding tax regulation compliance. Both documents are essential for businesses engaged in selling physical goods or taxable services. While the Resale Certificate is used to purchase items tax-free for resale, the Seller's Permit authorizes a business to sell those goods in the first place. It acts as a license confirming that the business is registered to collect sales tax on taxable sales.

The Uniform Sales & Use Tax Certificate - Multijurisdiction is another document with a similar purpose to the Maryland Sales and Use Tax Resale Certificate. It facilitates tax-exempt purchases for resale across multiple states, streamlining the process for businesses that operate in more than one jurisdiction. Like the Maryland-specific certificate, it requires businesses to attest that the purchases are for resale or for manufacturing products for sale. This uniform certificate simplifies tax exemption procedures for companies, allowing them to use a single document in participating states.

A Reseller Permit or Resale License bears resemblance to the Maryland Sales and Use Tax Resale Certificate in that both are used by businesses to purchase goods tax-free that will later be resold. The primary distinction lies in their regional usage and specific requirements set by individual states. These permits confirm that the holder is authorized to purchase items without paying sales tax at the time of purchase, predicated on the condition that sales tax will be collected from the end consumer.

The Streamlined Sales and Use Tax Agreement Certificate of Exemption is designed to simplify and modernize sales and use tax collection and administration, much like the Maryland Certificate aims to streamline tax-exempt purchases for qualifying businesses. Though the Streamlined Certificate is part of a multi-state agreement, its primary function mirrors that of the state-specific certificate: to attest to a buyer's eligibility for tax-exempt purchases. The goal of both documents is to ensure tax compliance while reducing administrative burdens.

The Business License, while not a tax exemption certificate, is essential for establishing and operating a business legally. It ties into the Maryland Sales and Use Tax Resale Certificate by illustrating a company's legal status and capability to engage in activities, including those that involve resale of goods. The necessity for maintaining compliance with local and state regulations is underscored by obtaining both a business license and the appropriate tax exemption certificates, highlighting the intertwined nature of legal and tax compliance.

The Wholesale License, similar to the Maryland Sales and Use Tax Resale Certificate, enables a business to operate within the wholesale trade industry. It permits tax-exempt purchases of items intended for resale. Both licenses ensure that taxes are not paid at the point of purchase but are instead collected from the end customer, maintaining the flow of goods from manufacturer to consumer in a tax-compliant manner.

An Exemption Certificate for Government Purchase is narrowly targeted compared to the broader application of the Maryland Sales and Use Tax Resale Certificate, yet they serve similar tax-exemption purposes. When a government entity makes purchases, it often uses such certificates to buy goods or services tax-free, provided those purchases are used for official government business. This parallels the resale certificate's function of allowing tax-free purchases under specific conditions.

The Purchase Order, while not a tax document, intertwines with the use of the Maryland Sales and Use Tax Resale Certificate by specifying the goods or services to be purchased under the tax-exempt agreement. It details the transaction between the buyer and seller, referencing the resale certificate when indicating that the purchase qualifies for tax exemption. In essence, it acts as the transactional document that utilizes the tax exemption status granted by the resale certificate.

Dos and Don'ts

When completing the Maryland Sales And Use Tax Resale Certificate form, it is crucial to adhere to certain guidelines to ensure the process is done correctly and efficiently. Below is a list of things you should and shouldn't do:

- Do thoroughly check that all tangible personal property or taxable services purchased are intended for resale, or as part of manufacturing or production procedures. This ensures your eligibility to use the certificate.

- Do include your Maryland Sales and Use Tax Registration Number on each order. This is a requirement for the certificate to be applicable.

- Do ensure that the person signing the certificate is authorized to do so. This legitimizes the certificate’s validity in terms of representation.

- Do verify that all the information provided is accurate and truthful to the best of your knowledge and belief. Accuracy and honesty are paramount in legal documentation.

- Do keep in mind that this certificate is part of an ongoing agreement and will remain in force until revoked. Be aware of the certificate's active period.

- Don't leave any relevant fields blank, such as the purchaser’s name, address, and Maryland Sales Tax Registration Number. Incomplete forms may result in non-acceptance.

- Don't sign the certificate if you are uncertain about any of the statements it declares. Misrepresentation can have serious legal implications.

- Don't overlook the importance of being as specific as possible when describing the purpose of purchases made with this certificate. Vagueness can lead to misunderstandings or misuse.

- Don't disregard the necessity of regularly reviewing and updating the certificate as needed. Changes in business operations or tax law could affect its use.

Adhering to these dos and don'ts will help streamline the process, guarantee compliance with Maryland tax laws, and prevent potential legal issues from arising. It’s about ensuring that every step taken is in line with legal requirements and serves the intended purpose of the resale certificate.

Misconceptions

Misunderstandings about the Maryland Sales and Use Tax Resale Certificate are common among business owners and consumers alike. Addressing these misconceptions is crucial for maintaining compliance with the state's tax laws.

It's the same as a business license: A Maryland Sales and Use Tax Resale Certificate is not equivalent to a business license. The certificate allows businesses to purchase goods without paying sales tax, provided those goods are intended for resale. In contrast, a business license grants the right to operate a business within a particular jurisdiction.

Any business can use it: Only businesses that are registered with the Maryland Comptroller and hold a valid Sales and Use Tax Registration Number can utilize the certificate. Unauthorized use can lead to penalties and fines.

It covers all purchases: The certificate specifically applies to purchases intended for resale or incorporated as materials in products for sale. It does not cover items for personal use or that do not become part of another taxable item for sale.

No expiration date means unlimited use: Despite not having a definitive expiration date, the validity of the certificate relies on the holder's compliance with Maryland tax laws. Misuse or changes in business status can invalidate the certificate.

It's automatically applied to all transactions: For the certificate to apply, each transaction must reference the purchaser’s Maryland Sales and Use Tax Registration Number. The seller must also maintain records of these transactions to document compliance.

It exempts a business from all sales tax: The certificate only exempts taxes on purchases intended for resale. Businesses are still liable for collecting and remitting sales taxes on their retail sales to end consumers.

Only tangible personal property qualifies for exemption: While the certificate prominently mentions tangible personal property, it also applies to taxable services that are purchased for resale or as part of a production process for another taxable service or product.

It serves as a blanket exemption for all company purchases: A resale certificate cannot be used indiscriminately for all company purchases. Each purchase using the certificate must meet the qualifying criteria of being for resale or incorporated into another product for sale.

Immediate fines for incorrect use: While incorrect use of the certificate can result in fines and penalties, businesses typically have opportunities to rectify mistakes. The state aims for compliance and may offer guidance on proper certificate use before resorting to punitive measures.

Understanding and adhering to the rules governing the Maryland Sales and Use Tax Resale Certificate are essential for businesses to operate legally and efficiently in the state. Misconceptions can lead to legal issues and financial penalties, emphasizing the importance of staying informed and compliant.

Key takeaways

When conducting business in Maryland, it's crucial to understand how to properly use the Maryland Sales and Use Tax Resale Certificate. Here are key takeaways for businesses looking to streamline compliance and avoid common pitfalls:

- The certificate enables businesses to purchase tangible personal property or taxable services for resale without paying sales tax at the point of purchase. This allows for the flow of goods through the supply chain until the final sale to the consumer.

- This form must be fully completed and presented to the supplier at the time of purchase to validate the tax-exempt status of the transaction. The form should include the buyer’s Maryland Sales and Use Tax Registration Number, which is crucial for verification.

- It’s important to accurately declare the intent of the purchased goods: whether they are for resale as is, or to be incorporated into another product as a material or part. Misuse or misrepresentation can lead to penalties or revocation of tax-exempt privileges.

- The certificate is considered a blanket certificate; it remains in effect for ongoing transactions with the supplier until it is revoked. This means that businesses do not need to present a new form for each individual purchase, simplifying the purchasing process.

- It is essential that the person signing the certificate is authorized to do so and that they certify the information to be true and correct to the best of their knowledge. Fraudulent or inaccurate certificates can lead to serious legal consequences, including penalties and fines.

Proper use of the Maryland Sales and Use Tax Resale Certificate is not just a matter of regulatory compliance; it also represents a significant financial strategy for businesses involved in resale activities. Ensuring that the process is handled correctly empowers businesses to manage costs effectively and maintain good standing with Maryland's tax authorities.

Popular PDF Documents

Estimate Taxes Due - Form 2210 is for taxpayers to assess penalties for not paying enough estimated tax payments.

I-9 Verification - Employer sanctions for failing to complete, retain, or present I-9 forms upon request can include fines and, in severe cases, criminal penalties.

IRS 1120 - Guidance for filling out the 1120 form is available from the IRS, ensuring corporations can accurately report their financial information.