Get Marshall County Occupational License Tax Form

Navigating the complexities of local business taxes can be a challenging endeavor, particularly for those operating within Marshall County, Kentucky. The Marshall County Occupational License Tax Form serves a crucial role in this setting, offering a structured method for businesses with employees in the area to comply with local taxation requirements. Essential for the acquisition of a withholding account identification number, this form mandates detailed information including business name, contact details, addresses for tax returns, ownership type, and specifics about the business's operation. It also includes sections for listing owner or partner details for individual and partnership ownership types, along with the federal and state ID numbers, which underline its comprehensive nature in ensuring businesses meet their tax obligations efficiently. Tailored to facilitate general outlay purposes, the document underscores the county's administrative measures to streamline tax collection processes, suggesting an organized approach towards fostering a transparent and accountable local tax environment. This insistence on precision and thoroughness, highlighted by the form's demand for verifiable information across various metrics such as business nature, location within specific Marshall County districts, and precise dates marking the start of wage payments to employees, epitomizes the structured fiscal governance regime that the county strives to maintain.

Marshall County Occupational License Tax Example

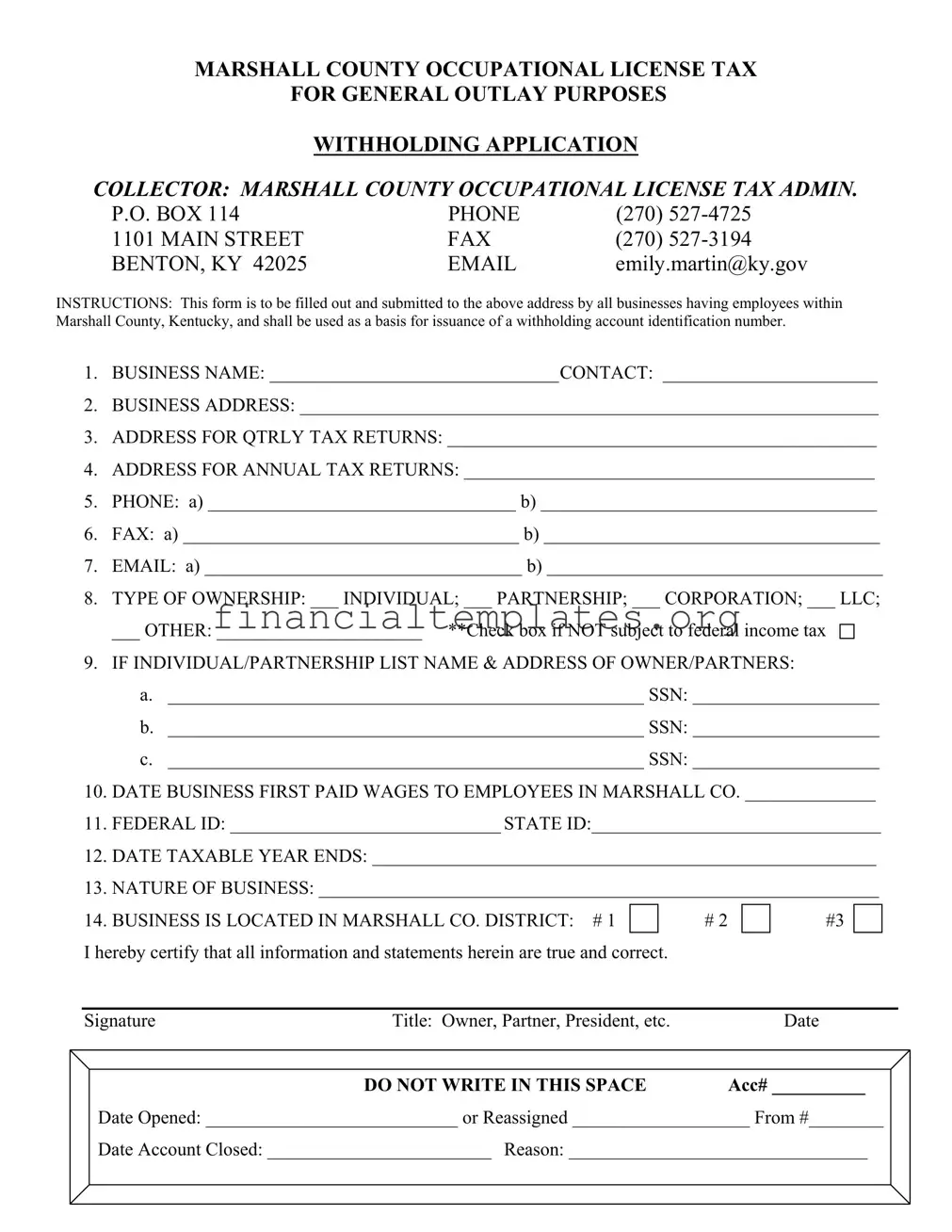

MARSHALL COUNTY OCCUPATIONAL LICENSE TAX

FOR GENERAL OUTLAY PURPOSES

WITHHOLDING APPLICATION

COLLECTOR: MARSHALL COUNTY OCCUPATIONAL LICENSE TAX ADMIN.

P.O. BOX 114 |

PHONE |

(270) |

1101 MAIN STREET |

FAX |

(270) |

BENTON, KY 42025 |

emily.martin@ky.gov |

INSTRUCTIONS: This form is to be filled out and submitted to the above address by all businesses having employees within Marshall County, Kentucky, and shall be used as a basis for issuance of a withholding account identification number.

1.BUSINESS NAME: _______________________________CONTACT: _______________________

2.BUSINESS ADDRESS: ______________________________________________________________

3.ADDRESS FOR QTRLY TAX RETURNS: ______________________________________________

4.ADDRESS FOR ANNUAL TAX RETURNS: ____________________________________________

5.PHONE: a) _________________________________ b) ____________________________________

6.FAX: a) ____________________________________ b) ____________________________________

7.EMAIL: a) __________________________________ b) ____________________________________

8.TYPE OF OWNERSHIP: ___ INDIVIDUAL; ___ PARTNERSHIP; ___ CORPORATION; ___ LLC;

___ OTHER: ______________________ **Check box if NOT subject to federal income tax

9.IF INDIVIDUAL/PARTNERSHIP LIST NAME & ADDRESS OF OWNER/PARTNERS:

a.___________________________________________________ SSN: ____________________

b.___________________________________________________ SSN: ____________________

c.___________________________________________________ SSN: ____________________

10.DATE BUSINESS FIRST PAID WAGES TO EMPLOYEES IN MARSHALL CO. ______________

11.FEDERAL ID: _____________________________ STATE ID:_______________________________

12.DATE TAXABLE YEAR ENDS: ______________________________________________________

13.NATURE OF BUSINESS: ____________________________________________________________

14. BUSINESS IS LOCATED IN MARSHALL CO. DISTRICT: # 1 |

# 2 |

#3 |

|

I hereby certify that all information and statements herein are true and correct. |

|

|

|

|

|

|

|

Signature |

Title: Owner, Partner, President, etc. |

|

Date |

|

DO NOT WRITE IN THIS SPACE |

|

ACC# __________ |

Date Opened: ___________________________ or Reassigned ___________________ From #________

Date Account Closed: ________________________ Reason: ________________________________

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The form serves as an application for businesses with employees in Marshall County, Kentucky, to obtain a withholding account identification number for occupational license tax purposes. |

| Collector Information | The Marshall County Occupational License Tax Admin is responsible for the collection of the occupational license tax and can be contacted at P.O. Box 114, 1101 Main Street, Benton, KY 42025. |

| Contact Details | Businesses can reach out via phone at (270) 527-4725, fax at (270) 527-3194, or email at emily.martin@ky.gov for queries or submissions regarding the form. |

| Business Information Required | The form requires detailed information including the business name, contact person, business address, and addresses for quarterly and annual tax returns. |

| Contact Information | Details such as phone numbers, fax numbers, and email addresses are required to ensure robust communication channels. |

| Type of Ownership | Businesses need to specify their type of ownership from options including individual, partnership, corporation, LLC, or other, with an option to indicate if not subject to federal income tax. |

| Individual/Partnership Information | If the business is an individual or partnership, names and social security numbers of owners/partners are required. |

| Operational Details | Businesses must provide the date they first paid wages to employees in Marshall County, along with their federal and state ID numbers. |

| Business Specifics | Information pertaining to the date the taxable year ends, the nature of the business, and the specific district within Marshall County where the business is located, must be provided. |

| Certification and Signature | An attestation that all provided information and statements are true and correct, signed by the owner, partner, president, etc., with the date of signature. |

Guide to Writing Marshall County Occupational License Tax

Filling out the Marshall County Occupational License Tax form is a necessary step for businesses operating within Marshall County, Kentucky, with employees. This form establishes your business's withholding account for occupational taxes and ensures compliance with local tax obligations. Below are steps to accurately complete and submit the form.

- Write the full Business Name in the designated space provided.

- Enter the Business Address, ensuring it matches the address registered with any other state or federal documents.

- Provide an Address for Quarterly Tax Returns, if different from the business address.

- Supply an Address for Annual Tax Returns, specifying where you prefer to receive annual tax correspondence.

- For the Phone section, list your primary business contact number (a) and an alternate number (b) if available.

- In the Fax field, input your primary fax number (a) and an alternate fax number (b) if one exists.

- Under Email, provide your primary business email address (a) and an alternate email address (b).

- Indicate the Type of Ownership by checking the appropriate box: Individual, Partnership, Corporation, LLC, or Other. If "Other," specify the type. If your business is not subject to federal income tax, make sure to check the corresponding box.

- If an Individual or Partnership, list the Name & Address of Owner/Partners (a, b, c) along with their Social Security Numbers (SSNs).

- Enter the Date Business First Paid Wages to Employees in Marshall Co., which is essential for tax reporting purposes.

- Provide your Federal ID and State ID numbers to affirm your business's legal registration for tax purposes.

- Indicate the Date Taxable Year Ends, aligning with your business’s fiscal year-end.

- Describe the Nature of Business in the space provided, giving a brief overview of what your business does.

- Check the box(es) to indicate which Marshall Co. District (#1, #2, or #3) your business is located in.

- Finally, the form must be signed by the Owner, Partner, President, etc., and include the title and date of signing to verify the accuracy and truthfulness of the information provided.

Following the completion of the Marshall County Occupational License Tax form, it should be submitted to the address listed at the top of the form: Marshall County Occupational License Tax Admin., P.O. Box 114, Benton, KY 42025. It's important to keep a copy of the completed form for your records. The issuance of a withholding account identification number is contingent upon the form's approval.

Understanding Marshall County Occupational License Tax

Who needs to fill out the Marshall County Occupational License Tax form?

Any business that has employees within Marshall County, Kentucky, is required to fill out this form. This process is necessary for the business to receive a withholding account identification number, which is used for tax purposes.

How can I submit the completed form?

The completed form can be submitted by mailing it to Marshall County Occupational License Tax Admin, P.O. Box 114, 1101 Main Street, Benton, KY 42025. Alternatively, you can send it via fax to (270) 527-3194 or via email to emily.martin@ky.gov.

What information do I need to provide about the business ownership type on the form?

You are required to indicate the type of ownership of your business by checking the appropriate box: Individual, Partnership, Corporation, LLC, or Other (specifying the type if "Other" is selected). Additionally, if your business is an individual or partnership, you must list the name and address of the owner or partners, along with their Social Security Numbers (SSNs).

What should I do if my business is not subject to federal income tax?

If your business is not subject to federal income tax, you should check the provided box on the form indicating this status. This information helps the Marshall County Occupational License Tax Admin understand your business's tax obligations better.

Where do I indicate the address for quarterly and annual tax returns?

On the form, you will find specific fields to enter the address for your quarterly tax returns and another field for the address of your annual tax returns. It is crucial to provide these addresses accurately to ensure all correspondences and tax documents are received promptly.

Is it mandatory to provide both a telephone and a fax number?

Yes, the form requests that you provide both a telephone number (with two fields available, likely for primary and secondary numbers) and a fax number. Providing these contact details ensures that the Marshall County Occupational License Tax Admin can reach you through multiple channels if necessary.

Common mistakes

Filling out the Marshall County Occupational License Tax Form accurately is essential for businesses operating within Marshall County, Kentucky. However, several common mistakes can be made during this process. Awareness of these errors can aid in ensuring the form is completed correctly, facilitating smooth interactions with the Marshall County Occupational License Tax Admin.

- Not providing complete business information: Failing to fill out every required section, such as the business name, contact person, and all addresses (business, quarterly tax returns, and annual tax returns) can lead to processing delays.

- Incorrect or missing contact details: Inputting inaccurate phone, fax, or email details or leaving these fields empty can hinder effective communication. It’s crucial for the tax administrator to have correct and up-to-date contact information.

- Ownership Type not specified: Not checking the appropriate box for the type of ownership or neglecting to specify the 'Other' category if none of the listed options apply, can result in an incomplete application.

- Omitting the ownership details for individual/partnership: For individuals and partnerships, it’s mandatory to list the name and address of the owner(s)/partner(s) along with their Social Security Numbers. Overlooking this requirement can lead to unnecessary complications.

- Incorrect dates: Providing incorrect dates for when the business first paid wages to employees in Marshall County, the taxable year end, or failing to provide these dates at all, can cause discrepancies in tax records.

- Missing Tax IDs: Not providing a Federal or State ID number can affect the legal compliance of the business. These numbers are essential for tax identification purposes.

- Failure to signify if not subject to federal income tax: For businesses not subject to federal income tax, it’s important to check the relevant box. This mistake could lead to incorrect tax obligations being assessed.

Each of these common mistakes has the potential to affect a business’s compliance with local tax laws. Paying close attention to detail and thoroughly reviewing the form before submission can prevent such errors, ensuring that businesses remain in good standing within Marshall County.

Documents used along the form

When handling the Marshall County Occupational License Tax form, various additional documents and forms are often necessary to ensure compliance and accurate reporting. These materials support various aspects of the tax filing and payment process, from establishing the identity and legal status of the business to reporting specific financial activities. Below is a list of other forms and documents commonly used alongside the Marshall County Occupational License Tax form.

- Business Registration Certificate: Confirms that a business is legally registered to operate in a specific area. It is fundamental in proving the legitimacy of the business when applying for an occupational license tax account.

- IRS Form W-9: Request for Taxpayer Identification Number and Certification. This form is used to provide the correct taxpayer identification number to entities that are required to file information returns with the IRS.

- Quarterly Wage and Tax Report: Filed by employers to report the wages paid to employees and taxes withheld from them for each quarter. It's crucial for reconciling employee withholdings with annual tax liabilities.

- Annual Reconciliation of Occupational License Tax Withheld: This document summarizes the total tax withheld from employees' earnings throughout the fiscal year and reconciles these withholdings with quarterly reports.

- Proof of Federal and State Tax ID Numbers: Documentation that verifies the business's Federal Employer Identification Number (EIN) and any applicable state tax ID numbers. These identifiers are necessary for tax reporting and business identification.

- Application for Employer Identification Number (EIN): IRS Form SS-4 is used by businesses to apply for an EIN. The EIN is required for businesses to report employment taxes to the federal government.

- Copy of Business Lease or Property Ownership Documents: May be needed to verify the physical location and operating address of the business within Marshall County. This information can affect tax jurisdiction and rates.

Together, these documents form a comprehensive file that supports the occupational license tax process for businesses operating in Marshall County, Kentucky. They ensure that businesses can efficiently manage their tax responsibilities and remain in good standing within the county. Handling these documents with attention to detail and timeliness is crucial for accurate and compliant tax filing and reporting.

Similar forms

The Federal Employer Identification Number (EIN) application is remarkably similar to the Marshall County Occupational License Tax form. Both are initiated by entities aiming to properly identify themselves for tax purposes. The EIN application is crucial for businesses to legally operate within the United States, facilitating the process of reporting taxes to the federal government. It requires details about the type of business, ownership, and primary business activities, akin to the information needed for the Marshall County form which serves a similar purpose at a more localized level.

A Business License Application, frequently encountered by entities seeking permission to legally conduct business within a specific jurisdiction, closely resembles the Marshall County Occupational License Tax form. This document collects comprehensive business information, including the nature of the business, ownership details, and contact information, to ensure compliance with local regulations and tax obligations. Both documents are foundational steps for a business to be recognized as a legitimate entity within its respective operational scope.

The State Withholding Tax Registration form shares similarities with the Marshall County Occupational License Tax form, with both serving to establish accounts for withholding taxes from employees' wages. Required by entities employing personnel, these forms gather details on the business, including federal and, if applicable, state tax identification numbers, along with the commencement date of wage payments. This registration is imperative for managing and remitting the taxes withheld to the pertinent tax authorities.

The Unemployment Insurance Tax Registration is akin to the Marshall County Occupational License Tax form in that it requires businesses to register for purposes related to employee wages. This form is specifically focused on unemployment insurance, a mandatory state-level insurance program aiding workers who have lost their jobs. Similar to the Marshall County form, it collects detailed business information and employment specifics to ensure accurate tax collection and compliance with state labor laws.

The Sales and Use Tax Permit application parallels the Marshall County Occupational License Tax form by necessitating businesses to register for the collection and remittance of sales and use taxes on goods and services sold. While the sales tax is typically state-mandated, the aim of promoting fair trade and ensuring tax compliance is a common thread, with both requiring detailed business information and operational specifics to facilitate proper monitoring and tax processing.

The Workers' Compensation Insurance form, required for businesses to provide injury and disability coverage for their employees, shares commonalities with the Marshall County Occupational License Tax form. Both involve regulatory compliance affecting employer-employee relations, gathering comprehensive information on the business and its operations. This ensures both the protection of employees under workers' compensation laws and the proper collection of related taxes or premiums.

The Zoning Permit application, though more focused on land use and development, shares similarities with the Marshall County Occupational License Tax form in its role in ensuring business compliance with local regulations. It requires detailed information on the business location and nature of operations, essential for aligning business activities with zoning laws. Both forms facilitate a check on appropriate land use and adherence to local business operation standards.

The Home Occupation Permit, necessary for businesses operating out of a residential location, and the Marshall County Occupational License Tax form both serve to legitimize business operations within a specific jurisdiction. By collecting information on the nature of the business, ownership, and the business address, these documents ensure that home-based businesses meet local guidelines and tax requirements, thus fostering legal operation and community compliance.

The Alcohol Beverage License application, required for businesses intending to sell alcoholic beverages, and the Marshall County Occupational License Tax form both demand detailed business information to regulate and tax specific types of commercial activities. The Alcohol Beverage License ensures compliance with local and state laws governing the sale of alcohol, paralleling the Marshall County form's intent to ensure legal operation and correct tax remittance for businesses within its purview.

The Environmental Permits and Licenses required by businesses that could impact the environment closely align with the Marshall County Occupational License Tax form in ensuring businesses operate within legal and regulatory frameworks. These documents demand detailed operational information to assess environmental impact, similar to how the Marshall County form collects business specifics to ensure tax compliance and legal operation within the local jurisdiction.

Dos and Don'ts

When filling out the Marshall County Occupational License Tax Form, there are specific actions you should take to ensure accuracy and compliance, as well as some practices you should avoid. Here is a list of dos and don'ts:

Do:- Double-check the business name and contact information to make sure they're correct.

- Provide both the physical and mailing addresses accurately, especially if they differ, to ensure proper communication.

- Include all relevant phone numbers and email addresses to facilitate easy contact by the Marshall County Occupational License Tax Admin.

- Accurately identify the type of ownership (Individual, Partnership, Corporation, LLC, etc.) and check the corresponding box.

- List the names and social security numbers of all owners or partners if the business structure requires it.

- Clearly indicate the date the business first paid wages to employees in Marshall County.

- Sign and date the form to validate the information provided is true and correct.

- Leave any fields blank. If a particular section does not apply, write “N/A” to indicate this.

- Mistype social security numbers or tax identification numbers, as these errors can lead to significant processing delays.

- Forget to check the box if your business is not subject to federal income tax, assuming this applies to your situation.

- Ignore the instructions regarding the addresses for quarterly and annual tax returns; these are essential for timely filings.

- Omit the Federal ID and State ID numbers. These identifiers are crucial for your business's tax processes.

- Skip the section that asks for the nature of business. This information is important for classification and tax assessment purposes.

- Alter any pre-filled sections or write in the spaces marked for office use only.

Misconceptions

Understanding the nuanced aspects of the Marshall County Occupational License Tax form can sometimes lead to confusion. Here are eight common misconceptions and clarifications to help navigate this process more accurately:

- The form is only for large businesses: This form must be completed by all businesses with employees in Marshall County, regardless of size. This includes small, medium, and large enterprises.

- It's optional for sole proprietors: Even if you're an individual owner, if you have employees, you need to fill out this form. It's a common misunderstanding that sole proprietors are exempt from this requirement.

- Only businesses in Benton need to comply: While the mailing address is in Benton, KY, the requirement covers all businesses operating within Marshall County. The location of the administrative office doesn't limit the form's scope.

- Email communication is not formal: The form's provision for an email address indicates that email is a recognized and official channel for communication regarding the occupational license tax.

- The form is complicated: While it may appear daunting at first, the form essentially requires basic information about your business and its operations. Understanding each section can greatly simplify the process.

- You need a lawyer to fill it out: While legal advice can be valuable in many situations, most businesses can complete this form without legal assistance. Accuracy and honesty in providing the required information are key.

- Submitting this form means you are fully compliant: While important, submitting this form is just one step in compliance. Businesses must also adhere to tax withholding, remittance, and reporting responsibilities throughout the year.

- Checking the "not subject to federal income tax" box applies to many businesses: This option is specific and does not apply to most businesses. Misunderstanding its applicability could lead to incorrect filing.

Understanding these points can ease the filing process and ensure that your business complies with all requirements set by the Marshall County Occupational Tax Administrator.

Key takeaways

Filing the Marshall County Occupational License Tax form is an essential but straightforward process for business owners in Marshall County, Kentucky. Here are key takeaways to understand when navigating this requirement:

- Every business with employees in Marshall County is required to fill out and submit this form to obtain a withholding account identification number.

- The form needs to be sent to the Marshall County Occupational License Tax Administrator at the addresses provided, either through mail, fax, or email.

- Accurate business information is crucial, including the business name, address, and contact details.

- Businesses must specify different addresses for quarterly and annual tax returns if applicable.

- Contact information such as phone numbers, fax numbers, and email addresses must be provided. Multiple entries are allowed for each field.

- The type of ownership must be clearly indicated, choosing from options like individual, partnership, corporation, LLC, or other.

- For individual or partnership businesses, the name and address of the owner or partners, along with their Social Security Numbers, are required.

- It's vital to mention the date when the business first paid wages to employees in Marshall County.

- Both the Federal ID and State ID of the business must be included in the form.

- The date when the business’s taxable year ends should be accurately noted.

- An explanation of the nature of the business, along with the district within Marshall County where the business is located, is needed.

- Finally, the form must be signed by a person with authority, such as the owner, partner, or president of the company, certifying that all provided information is true and correct.

Following these guidelines will help ensure that the process of complying with Marshall County's occupational license tax requirements is as smooth and accurate as possible. It's a civic responsibility that supports the local economy and contributes to the community's overall well-being.

Popular PDF Documents

IRS 1310 - It provides a legal pathway for transferring the taxpayer's assets according to federal tax laws.

File Business Tax Extension - Form 7004 is a key resource for businesses facing unexpected challenges that may delay their tax filing process.

Notice to Pay Rent or Quit California - Informs tenants of the judicial process initiated by their landlord for rent default, pointing out the date and place for their mandatory appearance.