Get Maine Tax Form

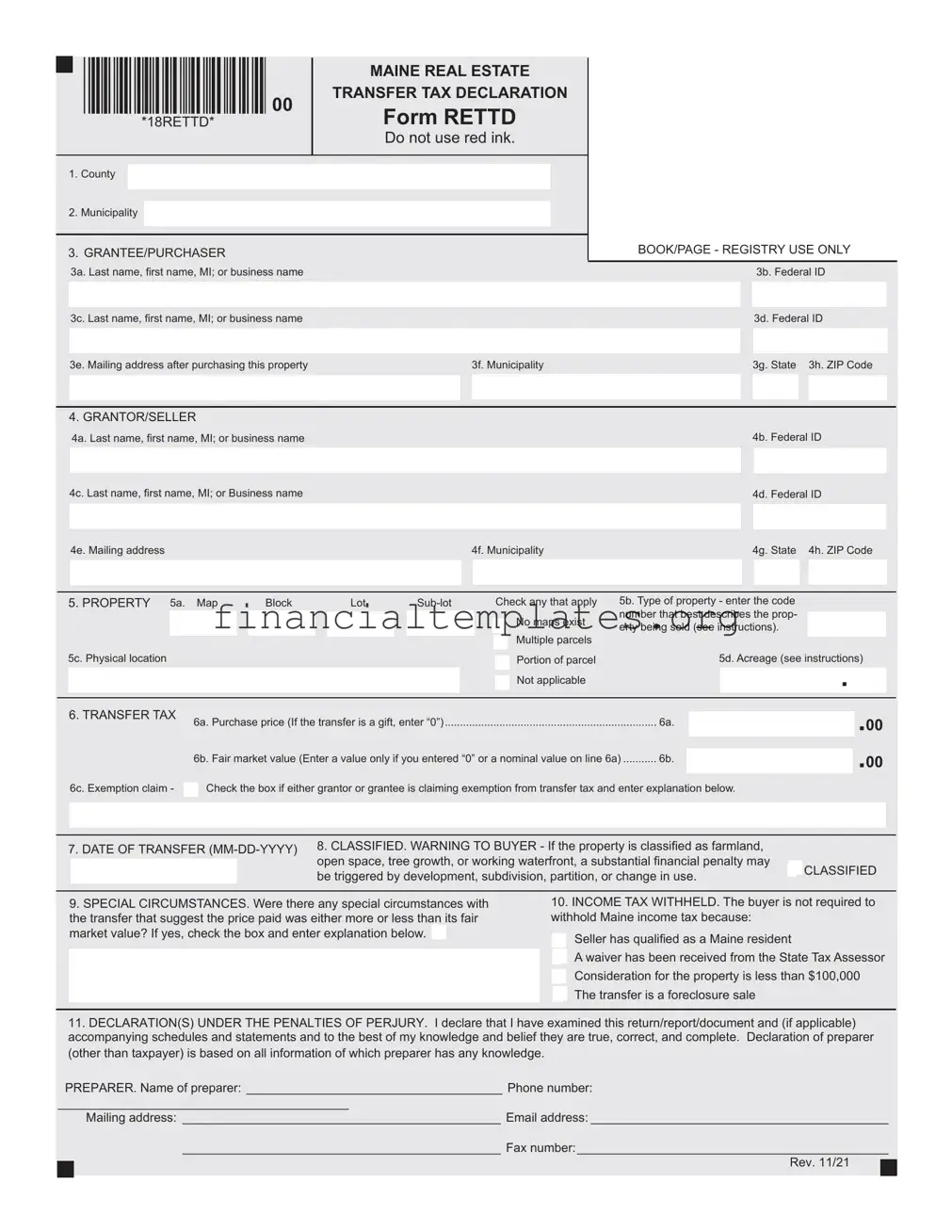

The Maine Real Estate Transfer Tax Declaration, designated as Form RETTD, plays a significant role in the real estate transaction process within Maine. When a property changes hands, this form must be filed with the county Registry of Deeds where the property is situated, to ensure the proper tax based on the value of the transferred property is collected. This tax is calculated at a rate of $2.20 for every $500 of property value, shared equally between the purchaser and the seller. Additionally, if the sale involves property that spans more than one municipality or involves multiple sellers or buyers, a Supplemental Form is required. The form encompasses details such as the county and municipality where the property is located, information about the grantee/purchaser and grantor/seller, including their names and federal ID numbers, the property details including type and acreage, the purchase price or the fair market value in the case of a gift or nominal sale, and whether any exemptions from the transfer tax are claimed. Critical dates like the date of property transfer, any classified information regarding current use programs like farmland or open space, special circumstances affecting the sale price, and income tax withholding information for nonresident sellers are also covered. Moreover, declarations under the penalties of perjury from the parties involved, along with preparer details, are essential components of this comprehensive document. This form ensures transparency and legal compliance in property transactions, reflecting the collaborative effort between state authorities and the parties involved in real estate transfers.

Maine Tax Example

|

|

|

MAINE REAL ESTATE |

|

|

|

|

|

|

00 |

TRANSFER TAX DECLARATION |

|

|

Form RETTD |

|

|

*18RETTD* |

|

|

|

|

|

|

|

|

|

Do not use red ink. |

|

|

|

|

1.County

2.Municipality

3.GRANTEE/PURCHASER

3a. Last name, fi rst name, MI; or business name

3c. Last name, fi rst name, MI; or business name

3e. Mailing address after purchasing this property |

3f. Municipality |

|

|

|

|

BOOK/PAGE - REGISTRY USE ONLY

3b. Federal ID

3d. Federal ID

3g. State 3h. ZIP Code

4. GRANTOR/SELLER

|

4a. Last name, fi rst name, MI; or business name |

|

|

4b. |

Federal ID |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4c. Last name, fi rst name, MI; or Business name |

|

|

|

|

|

|

|

|

|

|

|

4d. |

Federal ID |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4e. Mailing address |

4f. Municipality |

4g. |

State 4h. ZIP Code |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. PROPERTY 5a. Map |

|

Block |

|

Lot |

|

Check any that apply |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No maps exist |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Multiple parcels |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

5c. Physical location |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Portion of parcel |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Not applicable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5b. Type of property - enter the code number that best describes the prop- erty being sold (see instructions).

5d. Acreage (see instructions)

.

6. TRANSFER TAX |

6a. |

Purchase price (If the transfer is a gift, enter “0”) |

6a. |

|

|

.00 |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

||

|

6b. |

Fair market value (Enter a value only if you entered “0” or a nominal value on line 6a) |

6b. |

|

|

||

|

|

|

|

|

|

|

|

6c. Exemption claim -  Check the box if either grantor or grantee is claiming exemption from transfer tax and enter explanation below.

Check the box if either grantor or grantee is claiming exemption from transfer tax and enter explanation below.

7. DATE OF TRANSFER |

8. CLASSIFIED. WARNING TO BUYER - If the property is classifi ed as farmland, |

|

|

||

open space, tree growth, or working waterfront, a substantial fi nancial penalty may |

|

|

|||

|

|

|

|

CLASSIFIED |

|

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

be triggered by development, subdivision, partition, or change in use. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.SPECIAL CIRCUMSTANCES. Were there any special circumstances with

the transfer that suggest the price paid was either more or less than its fair market value? If yes, check the box and enter explanation below.

10.INCOME TAX WITHHELD. The buyer is not required to withhold Maine income tax because:

Seller has qualified as a Maine resident

Seller has qualified as a Maine resident

A waiver has been received from the State Tax Assessor

A waiver has been received from the State Tax Assessor

Consideration for the property is less than $100,000

Consideration for the property is less than $100,000  The transfer is a foreclosure sale

The transfer is a foreclosure sale

11.DECLARATION(S) UNDER THE PENALTIES OF PERJURY. I declare that I have examined this return/report/document and (if applicable) accompanying schedules and statements and to the best of my knowledge and belief they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

PREPARER. Name of preparer: _____________________________________ Phone number:

__________________________________________

Mailing address: ______________________________________________ Email address: ___________________________________________

______________________________________________ Fax number:_____________________________________________

Rev. 11/21

Real Estate Transfer Tax Declaration

Instructions

The Real Estate Transfer Tax Declaration (Form RETTD) must be fi led with the county Registry of Deeds when the accompanying deed is recorded. The Registry of Deeds will collect a tax based on the value of the transferred property. The tax is equals $2.20 for each $500 of value and is imposed half on the purchaser and half on the seller. If the transferred property is in more than one municipality or if there are more than two sellers or buyers, a Supplemental Form must be completed. For more information, visit www.maine.gov/ revenue/propertytax/transfertax/transfertax.htm or contact the Property Tax Division at

Line 1. County. Enter the name of the county where the property is lo- cated. If the property is in more than one county, complete separate Forms

RETTD.

Line 2. Municipality. Enter the name of the municipality where the prop- erty is located. If the transferred property is located in more than one mu- nicipality, complete a Supplemental Form.

Line 3. Grantee/Purchaser. a) & c): Enter one name on each available line, beginning with last name fi rst. If more than two purchasers, complete a Supplemental Form. b) & d): If a business entity is entered on a) or c), enter the entity’s federal ID number. Do not enter a social security number. If you do not have a federal ID number, or if the transfer is of unimproved land for less than $25,000 or land with improvements for less than $50,000, you may enter all 0s in this fi eld. e) through h): Enter the mailing address for the buyer after the purchase of this property.

Line 4. Grantor/Seller. a) & c): Enter one name on each available line, beginning with last name fi rst. If more than two sellers, complete a Supplemental Form. b) & d): If a business entity is entered on a) or c), enter the entity’s federal ID number. Do not enter a social security number If you do not have a federal ID number, or if the transfer is of unimproved land for less than $25,000 or land with improvements for less than $50,000, you may enter all 0s in this fi eld. e) through h): Enter the mailing address for the seller after the purchase of this property.

Line 5. Property. a): Enter the appropriate

don’t know the exact acreage, enter an estimate based on the available information. The acreage recital is for MRS purposes only and it does not constitute a guarantee to the buyer of the acreage being conveyed. EXCEPTION: If the transferred property is a gift, you do not need to complete lines b) and d).

Line 6. Transfer tax. a): Enter the actual sale price or “0” if the transfer

is a gift. b): If you entered 0 or a sale price that is considered nominal on line a), enter the fair market value of the property on this line. The fair market value is based on the estimated price a property will bring in the open market and under prevailing market conditions in a sale between a willing buyer and a willing seller and must reflect the value at the time of the transfer. c): If either party is claiming an exemption from the transfer tax, check this box and enter an explanation of the reason for the claim. See 36 M.R.S. §

Line 7. Date of transfer. Enter the date of the property transfer, which refl ects when the ownership or title to the real property is delivered to the purchaser. This date may not be the same as the recording date.

Line 8. Classified. Check the box if the property is enrolled in one of the current use programs. Current use programs are tree growth, farm and open space, and working waterfront.

Line 9. Special circumstances. If the sale of the property was either substantially more or less than the fair market value, check this box and enter an explanation of the circumstances.

Line 10. Income tax withheld. Nonresident sellers are subject to real estate withholding under 36 M.R.S. §

Line 11. Declaration(s) under penalty of perjury. Please provide the name, mailing address, phone number, and email address of the person or company preparing this form if diff erent from the parties of the transaction.

PROPERTY TYPE CODES

VACANT LAND |

|

COMMERCIAL |

|

INDUSTRIAL |

|

RESIDENTIAL |

|

MISC CODES |

|

Rural |

101 |

Mixed use |

301 |

Gas and oil |

401 |

Rural |

201 |

Government |

501 |

Urban |

102 |

5+ unit apt. |

303 |

Utility |

402 |

Urban |

202 |

Condominium |

502 |

Oceanfront |

103 |

Bank |

304 |

Gravel pit |

403 |

Oceanfront |

203 |

Timeshare unit |

503 |

Lake/pond front |

104 |

Restaurant |

305 |

Lumber/saw mill |

404 |

Lake/pond front |

204 |

Nonprofi t |

504 |

Stream/riverfront |

105 |

Medical |

306 |

Pulp/paper mill |

405 |

Stream/riverfront |

205 |

Mobile home park |

505 |

Agricultural |

106 |

Office |

307 |

Light manufacture |

406 |

Mobile home |

206 |

Airport |

506 |

Commercial zone 107 |

Retail |

308 |

Heavy manufacture |

407 |

207 |

Conservation |

507 |

||

Other |

120 |

Automotive |

309 |

Other |

420 |

Other |

220 |

Current use |

|

|

|

Marina |

310 |

|

|

|

|

classifi cation |

508 |

|

|

Warehouse |

311 |

|

|

|

|

Other |

520 |

|

|

Hotel/motel/inn |

312 |

|

|

|

|

|

|

|

|

Nursing home |

313 |

|

|

|

|

|

|

|

|

Shopping mall |

314 |

|

|

|

|

|

|

|

|

Other |

320 |

|

|

|

|

|

|

Document Specifics

| Fact | Detail |

|---|---|

| Form Name | Maine Real Estate Transfer Tax Declaration |

| Form Number | RETTD |

| Revision Date | November 2021 |

| Ink Requirement | Do not use red ink |

| Tax Rate | $2.20 for each $500 of property value |

| Governing Law | 36 M.R.S. § 4641-C |

| Exemption Check | Box for claiming exemption from transfer tax |

| Special Instructions for Property Types | Includes codes for various property types such as vacant land, commercial, industrial, and residential |

Guide to Writing Maine Tax

Filling out the Maine Real Estate Transfer Tax Declaration (Form RETTD) is a necessary step when recording a deed with the county Registry of Deeds in Maine. This process involves accurate reporting of the details concerning the property transfer, including information about the grantee/purchaser and grantor/seller, the property being transferred, and the financial specifics of the transaction. The tax collected is based on the property's value at a rate of $2.20 per $500 of value, shared equally between the buyer and seller. To ensure compliance and accuracy, the following steps should be diligently followed:

- County: Enter the name of the county where the property is located. For properties spanning multiple counties, separate forms are required.

- Municipality: Specify the municipality where the property is situated. If applicable to more than one municipality, a Supplemental Form must be filled out.

- Grantee/Purchaser Information:

- a) & c) Write the last name, first name, and middle initial or business name for each purchaser. Use additional forms if there are more than two purchasers.

- b) & d) For business entities, provide the federal ID number. Enter all zeros if no ID is available or the transaction involves specific conditions.

- e) to h) Detail the mailing address of the purchaser post-transaction, including municipality, state, and ZIP code.

- Grantor/Seller Information:

- a) & c) Enter the last name, first name, and middle initial, or business name of each seller. Use additional forms for more than two sellers.

- b) & d) For a business entity, provide the federal ID number. Use all zeros if no ID is available or specific transaction conditions apply.

- e) to h) Provide the post-transaction mailing address of the seller, including municipality, state, and ZIP code.

- Property Information:

- a) Input the map-block-lot-sub lot number or check the appropriate box if maps or multiple parcels are involved.

- b) Enter the code number that best describes the property type.

- c) If no property tax maps are available, specify the property's physical location.

- d) Write the acreage, estimated if exact size is unknown.

- Transfer Tax:

- a) Indicate the purchase price, or enter “0” if the transfer is a gift.

- b) For gifts or nominal sales, fill in the fair market value.

- c) Check the box if an exemption from the transfer tax is claimed, providing an explanation.

- Date of Transfer: Provide the transfer date, reflecting when the title was officially handed to the purchaser.

- Classified: Check if the property falls under any current use programs such as farmland, open space, tree growth, or working waterfront and be aware of potential penalties for changing the use.

- Special Circumstances: Indicate if the transaction price significantly deviates from the fair market value, providing details.

- Income Tax Withheld: Confirm the exemption from withholding Maine income tax, specifying the applicable condition.

- Declaration(s) Under Penalty of Perjury: Complete this section with the preparer’s contact details if they're different from the transaction parties.

By following these instructions, individuals can ensure their tax declaration is compliant with Maine's real estate transfer requirements. Attention to detail and accurate reporting will facilitate a smooth transaction and recording process.

Understanding Maine Tax

-

What is the Maine Real Estate Transfer Tax Declaration Form RETTD?

The Maine Real Estate Transfer Tax Declaration (Form RETTD) is a document that must be filed with the county Registry of Deeds when a real estate deed is recorded. This form helps in calculating the transfer tax based on the property's value, which is imposed on both the buyer and seller.

-

How is the transfer tax calculated?

The transfer tax is calculated at a rate of $2.20 for every $500 of the property's value. This cost is equally divided between the buyer and the seller.

-

What should I do if the property is in more than one municipality?

If the transferred property is located in more than one municipality, a Supplemental Form must be completed in addition to the main RETTD form.

-

Is it mandatory to include a federal ID?

Yes, if a business entity is part of the transaction, its federal ID must be entered. For individuals or if certain conditions apply (e.g., the transfer is of unimproved land for less than $25,000), you may enter all zeros in this field.

-

What if the property sale is a gift?

If the transfer is a gift, you should enter "0" as the purchase price on the form. Additionally, the fair market value must be noted if the entered sale price is considered nominal or marked as zero.

-

How do I claim an exemption from the transfer tax?

If either the grantor or grantee is claiming exemption from the transfer tax, check the appropriate box on the form and provide an explanation for the exemption claim. Refer to 36 M.R.S. § 4641-C for a list of possible exemptions.

-

What should I do if there are special circumstances affecting the sale price?

If the sale of the property was for a value substantially more or less than its fair market value due to special circumstances, mark the appropriate box on the form and provide details about these circumstances.

-

Are there any penalties for providing false information?

Yes, the form must be signed under the penalties of perjury. Providing false information can result in legal consequences for the individuals involved.

-

Who should I contact if I have questions about the form or the transfer tax?

For questions regarding the Real Estate Transfer Tax Declaration Form or the transfer tax, you should contact the Maine Property Tax Division at 207-624-5606 or visit their website for more information.

-

What is the date of transfer and why is it important?

The date of transfer is when the ownership or title to the real property is officially transferred to the buyer. It is crucial as it dictates the effective date of the property's change in ownership and may differ from the recording date.

Common mistakes

Filling out tax forms can sometimes feel like navigating through a maze. The Maine Real Estate Transfer Tax Declaration, also known as Form RETTD, is no exception. Here are nine common mistakes people make when completing this form:

Using Red Ink: The instructions specify not to use red ink, yet many overlook this directive, leading to processing delays.

Incorrect Municipality or County Information: These fields require accurate data, including spelling. Misinformation can lead to the form being returned or misplaced.

Not providing the complete and correct names for the grantee/purchaser and grantor/seller. Oftentimes, individuals mistakenly omit middle initials or inaccurately enter business names.

Failing to provide or incorrectly entering the Federal ID numbers for businesses involved in the transaction can cause significant delays.

Incorrectly marking or leaving blank the area related to property type and acreage. Many don’t realize the importance of selecting the correct property type code or inaccurately estimate the acreage of the property.

Not accurately reporting the transfer tax information. This includes incorrectly entering the sale price or fair market value, or not properly claiming exemptions if applicable.

Forgetting to check boxes related to classifications or special circumstances that might affect the transfer tax.

Omitting the date of transfer, an essential detail that dates the transaction.

Incorrectly handling the income tax withholding section, particularly for non-resident sellers, which could result in tax compliance issues.

To avoid these pitfalls, it’s critical to:

Read the instructions thoroughly before filling out the form.

Double-check the details against official documents to ensure accuracy in names, numbers, and codes.

Consult with a professional if any part of the form is unclear, especially concerning tax obligations.

Making a mistake on a tax form is not uncommon, but it can lead to delays and potential penalties. Paying close attention to the details and adhering strictly to the instructions can help ensure the process goes smoothly.

Documents used along the form

When dealing with property transactions in Maine, several additional forms and documents often accompany the Maine Real Estate Transfer Tax Declaration (Form RETTD). These materials are crucial for ensuring the accurate processing of property transfers and the fulfillment of legal and tax obligations. The following provides a snapshot of other commonly used forms and documents in this context.

- Warranty Deed or Quitclaim Deed: Depending on the nature of the property transfer, either a warranty deed or a quitclaim deed is used to legally convey the property from the seller (grantor) to the buyer (grantee). A warranty deed provides a guarantee about the clear title of the property, while a quitclaim deed transfers any ownership interest the grantor might have without any guarantee.

- Municipal Lien Certificate: This document is obtained from the municipality where the property is located and shows any liens for unpaid property taxes or other municipal charges against the property. It is essential for closing to ensure that all debts are cleared.

- Property Disclosure Statement: Sellers typically provide this form to disclose the condition of the property, including any known defects or issues. This document is crucial for the buyer's due diligence process.

- Supplemental Form: As mentioned in the Maine Real Estate Transfer Tax Declaration instructions, a Supplemental Form must be completed if the transferred property is in more than one municipality or if there are more than two sellers or buyers involved in the transaction.

- Title Insurance Policy: This is an insurance policy to protect the buyer and the mortgage lender from losses arising from disputes over the title of the property. It is based on a title search, which should match the description of the property on the transfer tax declaration form.

- Federal and State Tax Forms: Depending on the specifics of the property transfer, various tax forms may need to be filed with federal and state tax authorities. For example, if the sale involves a non-resident seller, specific withholding forms may be required under state law.

Each of these documents plays a specific role in the property transfer process, serving to validate, disclose, or protect the rights and obligations of the parties involved. It's essential for anyone involved in real estate transactions in Maine to understand these documents and ensure they are accurately completed and filed. This not only helps in adhering to legal requirements but also in securing the interests of both buyers and sellers.

Similar forms

The Maine Real Estate Transfer Tax Declaration is closely related to the Uniform Residential Loan Application used in the mortgage industry. Both documents require detailed information about the property involved, including its location, type, and in some instances, its value. Similar to the Real Estate Transfer Tax Declaration, the loan application also demands personal and financial details about the applicants (or grantee/buyer in the tax form's case) to assess eligibility and compliance with applicable laws.

Another analogous document is the Property Deed, which, like the Maine Real Estate Transfer Tax Declaration, identifies the grantor (seller) and grantee (buyer), alongside the precise location and description of the property being transferred. Both documents are integral to the conveyance process, ensuring legal title is correctly passed and appropriately recorded with local authorities.

The Federal Tax Return for individuals or businesses shares similarities with the Maine Tax Form because both require taxpayer identification information and involve reporting values that may affect tax liabilities. While the Federal Tax Return focuses on income and deductible expenses, the Maine form addresses transaction-specific details to calculate real estate transfer taxes, yet both inform tax obligations to governmental authorities.

A Grant Application is similarly structured to the Maine Real Estate Transfer Tax Declaration in that it necessitates the presentation of detailed information to support a request – for funding in the case of the grant application and for tax calculation in the real estate document. Both require a clear declaration of participants' identities, purposes, and justifications for the request, supporting documentation, and an attestation of the truthfulness and accuracy of the information provided.

The HUD-1 Settlement Statement, used in real estate closing transactions, parallels the Maine form in documenting transaction details, including the sale price and real estate taxes. The HUD-1 outlines charges paid by the buyer and seller, closely mirroring the tax declaration's purpose of summarizing financial aspects of the property transfer, albeit with a broader scope on the financial settlement.

Commercial Lease Agreements bear resemblance to the Maine form in the detail required about the property and the parties involved in a transaction. Both documents outline terms and conditions specific to the property use and transfer – the lease from a lessor to lessee, and the tax document from seller to buyer, involving declarations about the property meant to ensure legal and tax compliance.

Statement of Information forms, typically used in real estate transactions, share similarities with the Maine Tax Form because they collect detailed personal information from the parties involved to prevent fraud and clear titles. This includes names, addresses, and identifying numbers—information crucial for both legal documentation and tax purposes.

Homeowner Association (HOA) Transfer fees documentation, requiring the declaration of ownership changes within an HOA jurisdiction, has parallels with the Maine Real Estate Transfer Tax Declaration. Both involve processing fees based on property or membership transfers and necessitate detailed property and ownership information to ensure accurate record-keeping and compliance with applicable rules or laws.

The IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, while focusing on the transfer of gifts, resembles the Maine tax form in the necessity of reporting transfers involving real property. Both forms require information on the property's value and the parties' identities to calculate and enforce tax liabilities arising from the transfer of valued assets.

Lastly, the Seller's Disclosure Statement, which sellers provide to buyers disclosing known issues with a property, shares objectives with the Maine Real Estate Transfer Tax Declaration in ensuring transparency in a real estate transaction. Although focusing on different aspects, both documents serve to inform buyers, contribute to fair dealings, and are integral to the process of transferring property rights.

Dos and Don'ts

When filling out the Maine Real Estate Transfer Tax Declaration Form RETTD, it's important to follow a set of guidelines to ensure that your form is accurate and compliant with the state's requirements. Below are things you should and shouldn't do:

Do:- Use blue or black ink to ensure that the information is legible and can be scanned correctly.

- Clearly enter the county and municipality where the property is located to avoid any confusion or processing delays.

- Provide accurate names and federal ID numbers for both the grantee/purchaser and the grantor/seller to ensure legal correctness.

- Enter the correct property type code that best describes the property being sold, referring to the provided codes for guidance.

- Fill out the actual sale price or enter “0” if the transfer is a gift, along with the fair market value if applicable.

- Indicate any exemptions claimed from the transfer tax with a thorough explanation for the claim.

- Check the appropriate boxes for classified properties or special circumstances that affect the fair market value.

- Complete the declaration under penalty of perjury, ensuring that all information provided is true, correct, and complete.

- Don't use red ink, as it may not be recognized by scanning and processing equipment.

- Don't leave any required fields blank, especially those concerning property details and transaction information.

- Don't guess property details; instead, verify all information, such as acreage and property type codes, to avoid errors.

- Don't ignore supplemental form requirements if the property is in more than one municipality or if there are more than two parties on either side of the transaction.

- Don't enter a social security number in place of a federal ID number for a business entity to maintain confidentiality and accuracy.

- Don't underestimate the importance of the date of transfer, as it reflects the official change of ownership.

- Don't forget to check for special programs enrollment such as current use programs that may affect the property.

- Don't submit the form without a thorough review to ensure all information is complete and accurately reported.

Misconceptions

When filing the Maine Real Estate Transfer Tax Declaration, Form RETTD, several misconceptions can lead to misunderstandings or errors in the process. Here are nine misconceptions about this form and the facts to clarify each one:

- Use of Red Ink: It's a common misconception that any ink color can be used to fill out this form. However, the form specifically states that red ink should not be used. This is likely to ensure that all text is clearly legible when the form is scanned or photocopied.

- Property Location: Some people assume that if the property spans more than one county or municipality, they can simply list all locations on the same form. The reality is that separate Forms RETTD should be completed for each county involved, and a Supplemental Form should be used for properties spanning more than one municipality.

- Federal ID for Individuals: There's a belief that individuals must provide their Social Security Number (SSN) on the form. Instead, individuals should not enter their SSN. Businesses involved in the transaction will enter their federal ID number, but if no federal ID is available under certain conditions, all zeros can be entered.

- Reporting the Sale Price: A common misunderstanding is that the purchase price should always reflect the market value. In fact, if the transfer is a gift, "0" should be entered as the purchase price, with the fair market value entered only if the purchase price is "0" or considered nominal.

- Exemptions from Transfer Tax: There's often confusion about exemptions to the transfer tax. Exemptions are available under certain conditions, and if either party believes they're exempt, this should be indicated on the form with a proper explanation based on 36 M.R.S. § 4641-C.

- Property Type Codes: Users frequently think that a detailed description of the property's appearance or condition is required. However, the form asks for a property type code that broadly categorizes the property (e.g., Vacant Land, Commercial). The specific code must be chosen from a provided list.

- Date of Transfer: There is a misconception that the date of transfer is the same as the recording date. The date of transfer actually reflects when the ownership or title is physically delivered to the buyer, which may not coincide with the recording date.

- Income Tax Withheld: Some sellers believe that Maine income tax must always be withheld by the buyer. In reality, withholding is not required if certain conditions are met, such as the seller qualifying as a Maine resident or the transfer being a foreclosure sale.

- Preparer Information: A common mistake is neglecting to provide the preparer's information if different from the transaction parties. Even when a third party prepares the form, their name, contact information, and email address must be included.

Understanding these aspects can help individuals and businesses accurately complete the Maine Real Estate Transfer Tax Declaration Form RETTD, ensuring compliance with Maine's property transfer regulations.

Key takeaways

Filling out the Maine Real Estate Transfer Tax Declaration form, known as Form RETTD, is a critical step during the process of transferring property ownership within Maine. Here are some key takeaways to guide you through this process:

- The form must be filed with the county Registry of Deeds at the time the accompanying deed is recorded. This ensures that the transfer of property is officially documented and the appropriate taxes are collected.

- A transfer tax is imposed based on the value of the transferred property. The tax rate is $2.20 for every $500 of value. This cost is typically divided evenly between the buyer and seller, making it financially important for both parties to understand the valuation and tax implications of their transaction.

- Information required includes details on the county and municipality where the property is located, names and Federal ID numbers of both the grantee (purchaser) and grantor (seller), and the mailing addresses post-transaction. Accuracy here is crucial for legal and tax purposes.

- For properties spanning more than one municipality or involving multiple sellers or buyers, a Supplemental Form must be completed. This ensures all parts of the transaction are recorded and taxed appropriately.

- The form requires details on the type and physical location of the property, as well as its sale price or fair market value if the property is a gift or sells for a nominal value. There are specific codes to describe property types, which should be selected carefully to accurately represent the property being transferred.

- If either the buyer or seller is claiming an exemption from the transfer tax, this must be indicated on the form with an explanation. Maine State Law provides a list of exemptions for certain scenarios, which could potentially save either party a significant amount in taxes if applicable.

Understanding and correctly completing the Maine Real Estate Transfer Tax Declaration form is essential for ensuring compliance with state laws and for the smooth continuation of property transactions. Sellers, purchasers, and their agents should pay careful attention to these guidelines to avoid complications and to ensure the correct tax amount is applied to their transaction.

Popular PDF Documents

940 Taxes - The distinct reporting mechanism for the U.S. Virgin Islands on Schedule A highlights tailored tax compliance needs.

What Is Foreign Tax Credit - Insight into how specific income and filing status thresholds can directly impact the available credit amount.

Allocation of Refund (Including Savings Bond Purchases) - It serves as a convenient mechanism for individuals to manage their tax refund proactively.