Get Local Tax Lancaster Form

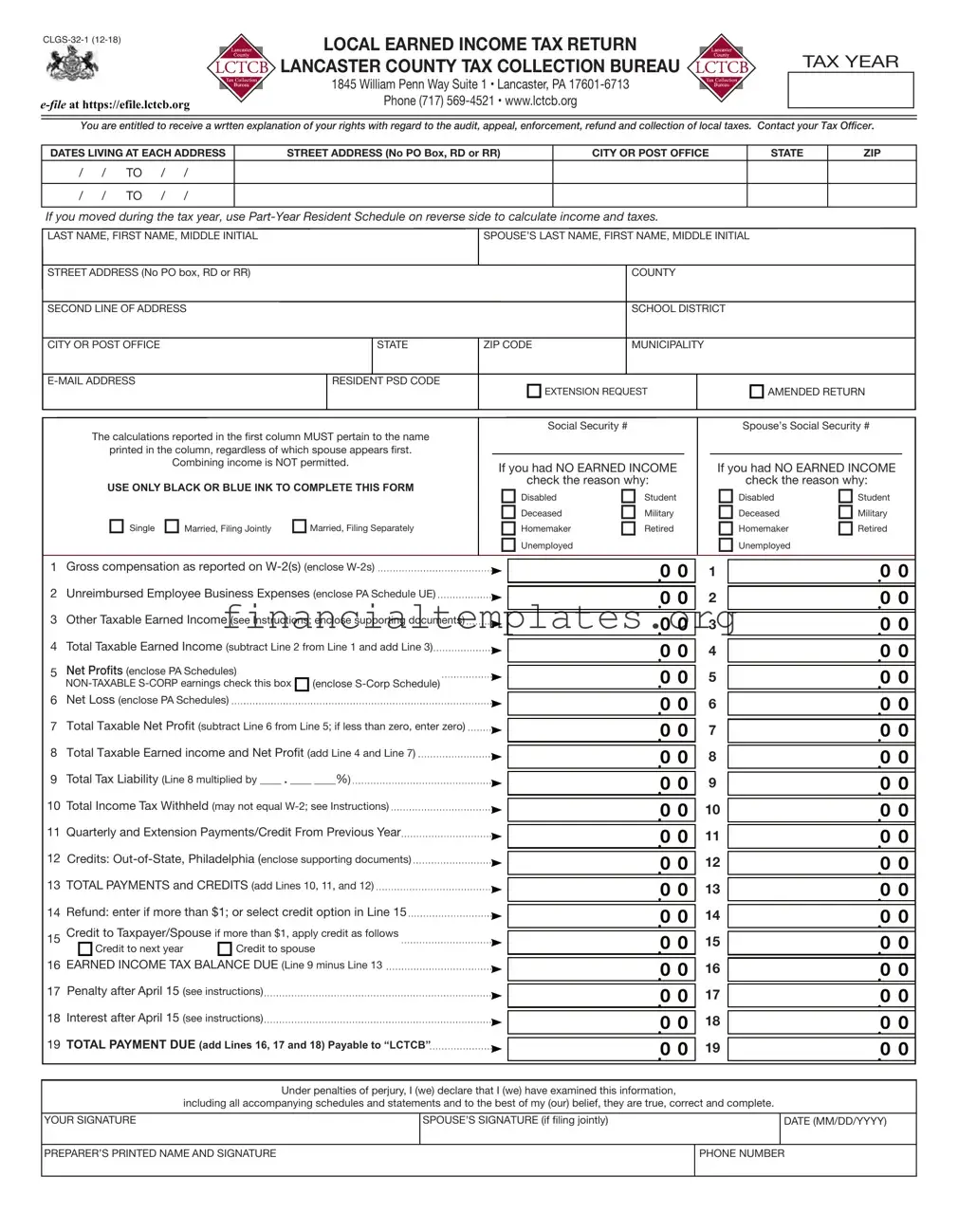

The Local Tax Lancaster form, designated as CLGS-32-1 (12-18), serves as a crucial document for residents of Lancaster County in Pennsylvania, facilitating the reporting and payment of local earned income taxes. Issued by the Lancaster County Tax Collection Bureau, located at 1845 William Penn Way Suite 1, Lancaster, PA, this form is accessible for electronic filing via the bureau's website, highlighting a commitment to streamlining the tax submission process. Taxpayers are provided with detailed instructions to accurately report various types of earned income, including wages, net profits, and other taxable earnings, ensuring compliance with local taxation laws. In particular, the form caters to both full-year and part-year residents by incorporating schedules to calculate income and taxes based on residency duration within the tax year. Furthermore, it outlines the procedure for claiming refunds or credits and calculates liabilities considering penalties and interest for late submissions. Essential contact information and resources are readily available for taxpayers requiring assistance or clarification on their rights and obligations regarding audits, appeals, enforcement, refunds, and collections of local taxes. This comprehensive approach demonstrates the bureau's dedication to taxpayer education and support, making the Local Tax Lancaster form a vital tool for maintaining tax compliance within the community.

Local Tax Lancaster Example

|

LOCAL EARNED INCOME TAX RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

LANCASTER COUNTY TAX COLLECTION BUREAU |

|

|

TAX YEAR |

|

|

1845 William Penn Way Suite 1 • Lancaster, PA |

|

|

|

|

Phone (717) |

|

|

|

|

|

|

|

|

You are entitled to receive a wrtten explanation of your rights with regard to the audit, appeal, enforcement, refund and collection of local taxes. Contact your Tax Officer.

DATES LIVING AT EACH ADDRESS |

|

STREET ADDRESS (No PO Box, RD or RR) |

CITY OR POST OFFICE |

|

STATE |

ZIP |

|||||

/ |

/ |

TO |

/ |

/ |

|

|

|

|

|

|

|

/ |

/ |

TO |

/ |

/ |

|

|

|

|

|

|

|

If you moved during the tax year, use |

|

|

|||||||||

LAST NAME, FIRST NAME, MIDDLE INITIAL |

|

SPOUSE’S LAST NAME, FIRST NAME, MIDDLE INITIAL |

|

|

|||||||

|

|

|

|||||||||

|

|

|

|

|

|

|

|

||||

STREET ADDRESS (No PO box, RD or RR) |

|

|

COUNTY |

|

|

||||||

SECOND LINE OF ADDRESS |

|

|

SCHOOL DISTRICT |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||

CITY OR POST OFFICE |

|

|

|

STATE |

ZIP CODE |

MUNICIPALITY |

|

|

|||

|

RESIDENT PSD CODE |

|

EXTENSION REQUEST |

|

|

AMENDED RETURN |

|

|

||||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

Social Security # |

|

|

Spouse’s Social Security # |

|

|

||

The calculations reported in the first column MUST pertain to the name |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||

printed in the column, regardless of which spouse appears first. |

|

|

|

|

|

|

|

|

|

|

||

|

Combining income is NOT permitted. |

|

|

If you had NO EARNED INCOME |

|

|

If you had NO EARNED INCOME |

|

|

|||

USE ONLY BLACK OR BLUE INK TO COMPLETE THIS FORM |

|

|

check the reason why: |

|

|

check the reason why: |

|

|

||||

|

|

Disabled |

Student |

|

|

Disabled |

Student |

|

|

|||

|

|

|

|

|

|

|

|

|

||||

Single |

Married, Filing Jointly Married, Filing Separately |

|

|

Deceased |

Military |

|

|

Deceased |

Military |

|

|

|

|

|

Homemaker |

Retired |

|

|

Homemaker |

Retired |

|

|

|||

|

|

|

|

|

Unemployed |

|

|

|

Unemployed |

|

|

|

1Gross compensation as reported on

2Unreimbursed Employee Business Expenses (enclose PA Schedule UE)

3Other Taxable Earned Income (see Instructions; enclose supporting documents)

4Total Taxable Earned Income (subtract Line 2 from Line 1 and add Line 3)

5Net Profits (enclose PA Schedules)

6Net Loss (enclose PA Schedules)

7Total Taxable Net Profit (subtract Line 6 from Line 5; if less than zero, enter zero)

8Total Taxable Earned income and Net Profit (add Line 4 and Line 7)

9Total Tax Liability (Line 8 multiplied by ____ . ____ ____%)

10Total Income Tax Withheld (may not equal

11Quarterly and Extension Payments/Credit From Previous Year

12Credits:

13TOTAL PAYMENTS and CREDITS (add Lines 10, 11, and 12)

14Refund: enter if more than $1; or select credit option in Line 15

15Credit to Taxpayer/Spouse if more than $1, apply credit as follows

Credit to next year Credit to spouse

EARNED INCOME TAX BALANCE DUE (Line 9 minus Line 1316

17 Penalty after April 15 (see instructions)

18 Interest after April 15 (see instructions)

19 TOTAL PAYMENT DUE (add Lines 16, 17 and 18) Payable to “LCTCB”

0 0 |

|

|

1 |

||

0 0 |

|

|

2 |

||

0 0 |

|

|

3 |

||

0 0 |

|

|

4 |

||

0 0 |

|

|

5 |

||

0 0 |

|

|

6 |

||

0 0 |

|

|

7 |

||

0 0 |

|

|

8 |

||

0 0 |

|

|

9 |

||

0 |

0 |

|

10 |

||

0 0 |

|

|

11 |

||

0 0 |

|

|

12 |

||

0 0 |

|

|

13 |

||

0 0 |

|

|

14 |

||

0 0 |

|

|

15 |

||

0 0 |

|

|

16 |

||

0 0 |

|

|

17 |

||

0 0 |

|

|

18 |

||

0 0 |

|

|

19 |

||

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

Under penalties of perjury, I (we) declare that I (we) have examined this information,

including all accompanying schedules and statements and to the best of my (our) belief, they are true, correct and complete.

YOUR SIGNATURE

SPOUSE’S SIGNATURE (if filing jointly)

DATE (MM/DD/YYYY)

PREPARER’S PRINTED NAME AND SIGNATURE

PHONE NUMBER

Report passive or unearned

TAXPAYER

.0 0

TAXPAYER SPOUSE

.0 0

Current Residence |

|

|

|

|

|

|

|

(street address) |

|

|

|

# months at this address |

|||||

Employer (1) |

|

|

|

|

|

|

|

|

|

(municipality, State, ZIP) |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income |

$ |

|

|

divided by 12 months X |

|

|

(months at this address) = $ |

|

|

|

|

|

|||||

Withholding |

$ |

|

|

divided by 12 months X |

|

|

(months at this address) = $ |

|

|

|

|

||||||

Employer (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income |

$ |

|

|

divided by 12 months X |

|

|

(months at this address) = $ |

|

|

|

|

|

|||||

Withholding |

$ |

|

|

divided by 12 months X |

|

|

(months at this address) = $ |

|

|

|

|

|

|||||

Current Residence Total Income $ |

|

|

Total Local Tax Withheld $ |

|

|

|

|

|

|||||||||

Put the Total Income on Line 1 and the Tax Withheld on Line 10 of the Local Earned Income Tax Return for your current residence taxing jurisdiction.

Previous Residence |

|

|

|

|

|

|

|

|

(street address) |

|

|

|

# months at this address |

|||||

Employer (1) |

|

|

|

|

|

|

|

|

|

|

(municipality, State, ZIP) |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income |

$ |

|

|

divided by 12 months X |

|

|

|

|

(months at this address) = $ |

|

|

|

|

|||||

Withholding |

$ |

|

|

divided by 12 months X |

|

|

|

|

(months at this address) = $ |

|

|

|

||||||

Employer (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income |

$ |

|

|

divided by 12 months X |

|

|

|

|

(months at this address) = $ |

|

|

|

|

|||||

Withholding |

$ |

|

|

divided by 12 months X |

|

|

|

|

(months at this address) = $ |

|

|

|

|

|||||

Previous Residence Total Income $ |

|

|

Total Local Tax Withheld $ |

|

|

|

|

|

||||||||||

PuttheTotal Income on Line1and theTaxWithheld on Line10 ofthe Local Earned IncomeTaxReturn foryour previousresidencetaxing jurisdiction.

If you moved within LCTCB’s jurisdiction please see special instructions for calculating a blended tax rate.

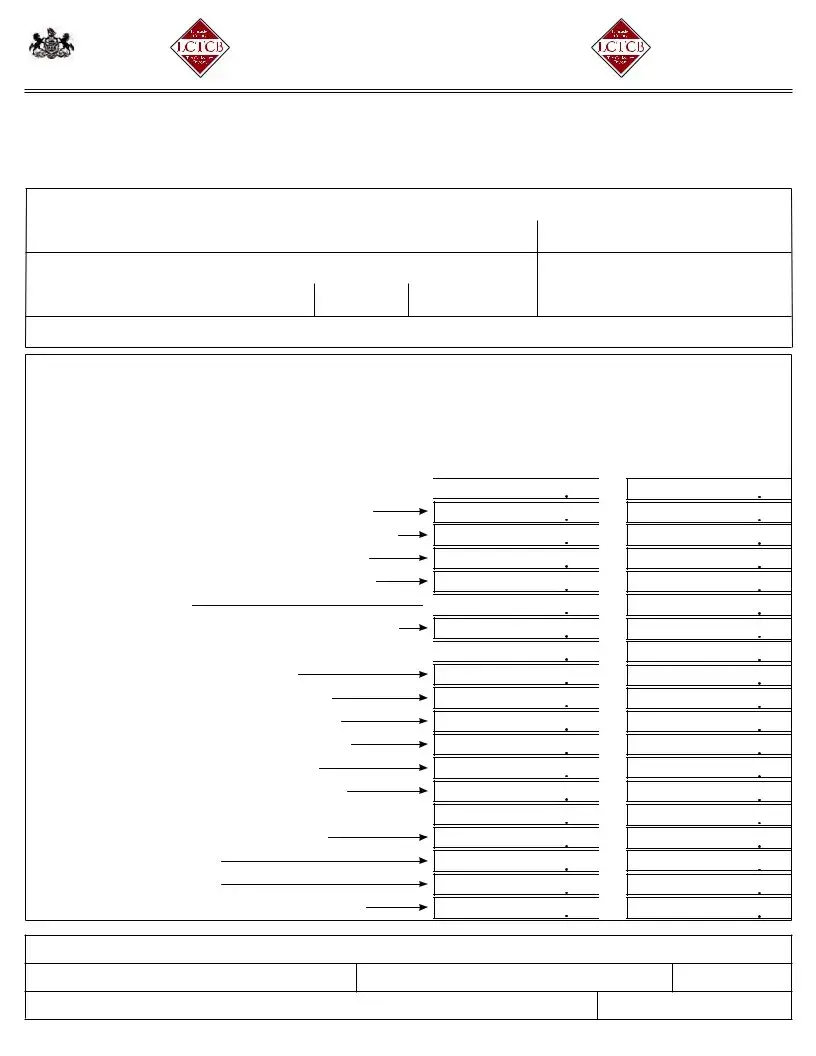

LINE 10: DISTRESSED/COMMUTER LOCAL TAX WITHHELD WORKSHEET

(Complete worksheet if you work in an area where the

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

|

Local Wages |

Tax Withheld |

Resident EIT Rate |

Workplace Location |

Column (4) minus |

Disallowed |

Credit Allowed for |

|

Column (3) |

Withholding Credit |

Tax Withheld |

||||

|

Tax Form Line 9 |

(See Instructions) |

If less than 0 enter 0 |

Col (1) times Col (5) |

Col (2) minus Col (6) |

||

Example |

$10,000.00 |

$130.00 |

1.25% |

1.30% |

0.05% |

$5.00 |

$125.00 |

1. |

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

TOTAL Enter this amount on Line 10 |

|

|

||

EARNED INCOME: Taxed in other state as shown on the state tax return. |

|

|

Enclose a copy of state return or credit will be disallowed |

(1) |

|

Local tax rate as specified on the front of this form |

x |

|

Tax Liability Paid to other state(s) |

(3) |

(2) |

|

||

PA Income Tax (line 1 x PA Income Tax rate for year being reported) |

(4) |

|

CREDIT to be used against Local Tax |

|

|

(Line 3 minus line 4) On line 12 enter this amount |

|

|

or the amount on line 2 worksheet, whichever is less. (If less than zero, enter zero) |

(5) |

|

A NOTE FOR RETIRED AND/OR SENIOR CITIZENS

If you are retired and are no longer receiving a salary, wages or income from a business, you may not owe an earned income tax. Social Security payments from qualified pension plans, interest and/or dividends accrued from bank accounts and/or investments are not subject to local earned income tax. If you received an Annual Local Earned Income Tax Return, please check the “retired” box on the front of the form and return it to your tax collector. If you still receive wages from a

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identifier | CLGS-32-1 (12-18) |

| Form Name | Local Earned Income Tax Return |

| Applicable Area | Lancaster County Tax Collection Bureau |

| Address for Submission | 1845 William Penn Way Suite 1, Lancaster, PA 17601-6713 |

| E-filing Option | Available at https://efile.lctcb.org |

| Contact Information | Phone (717) 569-4521, Website: www.lctcb.org |

| Types of Filing Statuses | Single, Married Filing Jointly, Married Filing Separately, Deceased, and others |

| Governing Laws | Pennsylvania State and Local Tax Laws |

Guide to Writing Local Tax Lancaster

Filling out the Local Tax Lancaster form requires careful attention to detail and an understanding of your individual or joint financial income for the tax year. This process involves reporting earned income, calculating taxes due, and potentially identifying any credits or payments already made. The following instructions aim to simplify the process, ensuring accurate completion and submission of your Local Earned Income Tax Return.

- Locate a blue or black ink pen to ensure all written information is clear and legible.

- Start by entering the date ranges you lived at each address during the tax year at the top of the form under "DATES LIVING AT EACH ADDRESS." If you moved during the year, you'll need the Part-Year Resident Schedule on the reverse side of the form.

- Fill in your and, if applicable, your spouse's full name(s) along with your last known address, including the street address, county, school district, city or post office, state, and ZIP code.

- Provide a valid email address where you can receive communications about your tax return.

- Enter your Resident PSD Code. This is crucial for ensuring your taxes are allocated to the correct jurisdictions.

- Specify the tax year for which you are filing by checking the appropriate box at the beginning of the form.

- Indicate your filing status: Single, Married Filing Jointly, Married Filing Separately, Deceased, Military, Homemaker, Retired, or Unemployed. Each status affects how your taxes are processed.

- Enter your and your spouse's Social Security Numbers in the designated spaces.

- List all sources of gross compensation and any unreimbursed employee business expenses. Attach W-2 forms and, if applicable, PA Schedule UE.

- Calculate your total taxable earned income, net profits (or losses), and report any NON-TAXABLE S-CORP earnings, following the detailed instructions for each line.

- Compute your total tax liability based on the earnings reported, applying the appropriate percentage as indicated on the form.

- Document all income tax withheld and any quarterly and extension payments or credits from the previous year.

- If you worked in areas where the non-resident tax rate exceeds your home resident rate, complete the Distressed/Commuter Local Tax Withheld Worksheet.

- For those who earned income in a non-reciprocal state, complete the Non-Reciprocal State Worksheet to calculate your credit.

- Review and sum up total payments and credits, then determine your balance due or refund.

- Fill in your payment information, and if you owe, make your check payable to "LCTCB."

- Sign and date the form. If filing jointly, ensure your spouse also signs.

- Double-check all entered information for accuracy and completeness before submission.

- Mail your completed form to the address provided on the form, including all required attachments.

By closely following these steps, you can confidently complete and submit the Local Tax Lancaster form. Accuracy in filling out each section is essential for the correct assessment of your local earned income tax liability or refund. Once submitted, your form will be processed by the Lancaster County Tax Collection Bureau, and you will be notified of any further actions required or the status of your tax return.

Understanding Local Tax Lancaster

What is the purpose of the Local Earned Income Tax Return form CLGS-32-1 (12-18) for Lancaster County?

The Local Earned Income Tax Return form CLGS-32-1 (12-18) is designed for residents of Lancaster County to report their earned income and calculate the local earned income tax due for the tax year. This form facilitates the accurate collection of taxes that support local services and infrastructure within Lancaster County. Residents who have earned income, including wages, salaries, and net profits from business operations, are required to complete this form, ensuring their contributions are correctly allocated to support the county's budget.

How can I file the Local Earned Income Tax Return?

Residents have the option to e-file their Local Earned Income Tax Return by visiting https://efile.lctcb.org, or they can complete the form using black or blue ink and mail it to the Lancaster County Tax Collection Bureau at the address provided on the form. When filing, ensure that all necessary documentation, such as W-2s, PA Schedules, and supporting documents for other taxable earned income and deductions, are included to support the income and tax calculations reported on the form.

Am I required to file this form if I had no earned income during the tax year?

Yes, if you had no earned income during the tax year, you are still required to file the form. You should check the appropriate reason for having no earned income, such as being a student, disabled, retired, etc., on the form. This helps the Tax Collection Bureau understand your situation and ensures that their records are accurate. It’s important to return the form to avoid unnecessary follow-up and to keep your tax records up to date.

What should I do if I moved during the tax year?

If you moved during the tax year, you must use the Part-Year Resident Schedule included on the reverse side of the form to calculate your income and taxes correctly. This schedule allows you to allocate your earned income and tax liabilities proportionately based on your residence in different taxing jurisdictions within the tax year. It's crucial to fill out this section to ensure taxes are accurately distributed according to where you lived during the year.

How are penalties and interest calculated if I file late?

Penalties and interest are charged for returns filed after April 15. The form instructions provide detailed information on how these charges are calculated. Generally, a penalty is assessed as a percentage of the unpaid tax, and interest accumulates on the unpaid tax at a rate specified by the tax bureau. To avoid these charges, it’s advisable to file your return and make any payments due by the April 15 deadline, or file for an extension if necessary.

What should I do if I need an extension or need to file an amended return?

If you require more time to gather information needed for your return, you may check the “extension request” box on the form to indicate that you are filing for an extension. Additionally, if you discover an error on a previously filed return and need to correct it, you can check the “amended return” box. In both cases, provide all relevant information and documentation to support your request or the changes made on your amended return. Keep in mind that an extension to file your return does not extend the due date for any tax payment.

Common mistakes

Filling out tax forms can be daunting and the Local Tax Lancaster form is no exception. While aiming for accuracy, individuals often stumble over common pitfalls. Here are five mistakes to avoid:

Not updating personal information: One of the most common oversights is failing to update personal details such as a change in address. If you moved during the tax year, ensuring your address is current is crucial for accurate tax calculations and avoiding delays in receiving any potential refunds.

Incorrect Social Security Numbers (SSNs): It might seem basic, but entering an incorrect Social Security Number for yourself or your spouse can lead to a processing nightmare. This mistake can delay refunds or result in the need to refile.

Failing to report all income types: Often individuals forget to include all sources of taxable income. This could vary from W-2s, freelancing earnings, or even net profits from a small business. Ensuring every dollar earned is reported is key to staying on the right side of tax obligations.

Miscalculating part-year resident income: For those who have moved into or out of Lancaster during the tax year, correctly calculating part-year resident income is vital. Missing the accurate division of income based on residence duration can affect the tax owed or refunded.

Misunderstanding non-taxable income: Not all income is taxable. Understanding which income types are considered non-taxable, such as Social Security payments, and correctly indicating them on the form, can prevent overstating your taxable income.

Avoiding these mistakes will help ensure that your Local Tax Lancaster form is completed accurately, resulting in a smoother processing of your taxes. Remember, when in doubt, seeking guidance from a tax professional can provide clarity and peace of mind.

Documents used along the form

When preparing and filing the Local Tax Lancaster form, individuals may need to use various other forms and documents to provide accurate and complete information. Below are several of these forms and documents that are often used in conjunction with the Local Tax Lancaster form.

- W-2 Forms: These are Wage and Tax Statements that employers provide to employees, summarizing the employee's earnings and the taxes withheld from those earnings during the tax year.

- PA Schedule UE (Unreimbursed Employee Business Expenses): This schedule is used to report allowable employee business expenses that were not reimbursed by the employer.

- PA Schedules: Various Pennsylvania schedules, such as Schedule C for profit or loss from business or Schedule E for rental income, are used depending on the taxpayer's sources of income.

- S-Corporation Schedule: Used by individuals who receive income (or losses) from S-Corporations, to report their share of the income or loss.

- Documentation for Credits: Supporting documents for any credits being claimed, such as out-of-state tax payments or credits for taxes paid to other jurisdictions.

- DISTRESSED/COMMUTER LOCAL TAX WITHHELD WORKSHEET: A worksheet for those who work in areas with a non-resident tax rate higher than their home resident rate, to calculate the allowable credit.

- NON-RECIPROCAL STATE WORKSHEET: For taxpayers who have earned income taxed in a state that does not have a reciprocal tax agreement with their resident state, this worksheet helps calculate the credit against local tax.

- Copy of state tax return: Individuals claiming a credit against local tax for taxes paid to another state must provide a copy of their state tax return to substantiate the claim.

These forms and documents play a crucial role in ensuring that taxpayers accurately report their income and calculate their taxes due. They also provide evidence for any claims or adjustments made on the Local Tax Lancaster form. By gathering and preparing these documents in advance, taxpayers can streamline the filing process and ensure compliance with local and state tax laws.

Similar forms

The Internal Revenue Service (IRS) Form 1040, U.S. Individual Income Tax Return, shares similarities with the Local Earned Income Tax Return Lancaster County form, primarily in its purpose of reporting annual income and calculating taxes owed or refunds due. Both forms require detailed income information, including wages, salaries, and potentially business income, and allow for deductions and credits. Each form is structured to guide taxpayers through the tax reporting process, offering sections for personal identification, income details, and tax computation. However, the IRS Form 1040 caters to federal tax obligations, whereas the Local Earned Income Tax Return focuses on local (municipal) tax responsibilities.

Pennsylvania State Tax Return Form PA-40 plays a similar role at the state level to what the Lancaster form does at the local level. Both documents are designed to collect income data and calculate taxes owed to their respective authorities. They request taxpayer information, income breakdowns, and allow for various deductions and credits specific to each jurisdiction. The PA-40 form, however, is tailored to meet the state's tax laws and requirements, including state tax rates, which differ from local tax considerations outlined in the Lancaster form.

The Quarterly Estimated Tax Payment form, commonly used by self-employed individuals or those with additional sources of income not subject to withholding, resembles the Lancaster form in its forward-looking approach to tax payments. It requires an estimation of income and subsequent tax owed for the current year, much like parts of the Lancaster form that might be used by taxpayers to report and pay anticipated taxes on non-withheld earnings. The key difference lies in the frequency and purpose of filing; the estimated tax form is filed quarterly to cover ongoing income, whereas the Lancaster form is an annual settlement of local earned income tax.

The W-2 Form, or Wage and Tax Statement, although not a tax return form, provides critical information that feeds into the Lancaster form. It details an employee's annual wages and the amount of taxes withheld from their paycheck, information which is essential for accurately completing the Lancaster form's sections on gross compensation and income tax withheld. While the W-2 is an informative document provided by employers, the Lancaster form uses this information to determine the tax liability or refund at the local level.

The Local Services Tax (LST) form, required in some jurisdictions, also shares objectives with the Lancaster tax form, focusing on taxing individuals working within certain areas. Like the Lancaster form, it is geared towards local taxation but aims specifically at funding emergency services, road construction, and other community projects through a flat tax rate. Both forms require personal and employment information but serve different aspects of local tax collection, with the LST focusing more on the provision of public services.

The Unreimbursed Employee Business Expenses form (PA Schedule UE), required when taxpayers have work-related expenses not reimbursed by their employer, complements the Lancaster form. Taxpayers use it to itemize allowable expenses to reduce their taxable income, directly impacting the calculation of taxes on the Lancaster form. While the PA Schedule UE specifically addresses the deduction of work expenses, the Lancaster form incorporates these figures to adjust gross taxable income at the local level.

The Declaration of Estimated Tax for Individuals form is akin to the section of the Lancaster form that deals with quarterly and extension payments. It is for taxpayers who expect to owe tax beyond what is covered by withholding or other credits, providing a method to pay estimated taxes in advance. This parallels the Lancaster form’s provision for entering payments made throughout the tax year against estimated tax liability, ensuring compliance and helping manage cash flow related to tax obligations.

The Schedule for Passive or Unearned Income, somewhat mirrored by the S-Corporation section in the Lancaster form, is relevant for individuals who receive income from sources other than regular employment, such as dividends or rental properties. While specifically the S-Corporation report part of the Lancaster form focuses on earnings from S-Corps, it recognizes the need to account for varied income sources within the framework of local tax responsibilities, integrating these into the broader income reporting and tax calculation process.

Finally, the Amended Tax Return form, which taxpayers use to correct mistakes or omissions in previously filed returns, shares its corrective purpose with the option to file an amended return indicated on the Lancaster form. This option ensures accuracy in tax reporting and compliance, allowing individuals to rectify filing status, income, and deductions or credits, whether on a federal, state, or local level, thereby ensuring that taxpayers meet their obligations accurately.

Dos and Don'ts

When approaching the Local Tax Lancaster form, accurate and diligent completion is highly important. Below are essential dos and don'ts that one must adhere to in order to ensure the process goes smoothly and correctly.

- Do ensure you have all necessary documents ready, such as W-2s, PA schedules, and any supporting documents for other taxable earned income or deductions.

- Do use only black or blue ink when filling out the form manually, as specified in the form's instructions.

- Do carefully read and understand the instructions for each section, particularly for part-year residents or those with specific circumstances such as retirement or disability.

- Do double-check your calculations and the information entered for accuracy before submitting the form.

- Do sign and date the form. If filing jointly, ensure both parties have signed.

- Don't skip sections or leave blanks; if a section does not apply to you, follow the form's instructions on how to indicate this properly.

- Don't combine income figures if filing jointly; report each spouse's income separately as required.

- Don't forget to attach all required documents, such as W-2s, PA Schedule UE, and schedules for net profits or losses.

- Don't overlook the requirement to report and attach documentation for any credits you're claiming, such as out-of-state taxes paid.

By following these guidelines, you can ensure your Local Earned Income Tax Return is complete and accurate, minimizing the risk of errors or processing delays. It's also beneficial to be mindful of the deadlines to avoid penalties and interest for late submissions.

Misconceptions

Understanding tax forms can sometimes be complicated, leading to misconceptions that can cause confusion and potentially result in errors when filing taxes. Regarding the Local Tax Lancaster form, also known as the CLGS-32-1 (12-18) Local Earned Income Tax Return for Lancaster County, it is essential to clarify common misunderstandings to ensure accurate and stress-free tax filing.

- Misconception 1: All income is taxable on the Local Earned Income Tax Return.

Not all types of income are subject to local earned income tax. Only earned income, such as wages from employment and net profits from a business, are taxable. Other sources of income, such as Social Security benefits, interest, and dividends, are not taxable at the local level.

- Misconception 2: You must always use a street address for filing.

While the form specifies that a street address is needed and not a PO Box, RD, or RR, this requirement is primarily for ensuring accurate tax jurisdiction determination. Taxpayers without a traditional street address should contact the Lancaster County Tax Collection Bureau for guidance on how to proceed.

- Misconception 3: Combining income of spouses is allowable.

The form explicitly states that the calculations in the first column pertain to the individual whose name appears in that column. Spouses filing jointly must report their earned incomes separately to comply with filing requirements.

- Misconception 4: Only residents of Lancaster County need to file this form.

Part-Year Residents or individuals who moved in or out of Lancaster County during the tax year are also required to file, using the Part-Year Resident Schedule to properly calculate their tax due based on their residence period within the county.

- Misconception 5: The form is only for reporting income taxes.

This form not only reports income but also allows for adjustments such as unreimbursed employee business expenses, net profits or losses from businesses, and credits for taxes paid to other states. It’s a comprehensive tool for reporting and calculating local earned income tax liability.

- Misconception 6: You cannot file an amended return on this form.

An amended return can indeed be filed using this form. Taxpayers need to check the "AMENDED RETURN" box at the top of the form and complete the document with the corrected information.

- Misconception 7: Taxpayers without earned income need not file this form.

Even if you had no earned income during the tax year, checking the applicable reason why on the form and submitting it helps the Tax Collection Bureau update their records properly, ensuring that taxpayers are not mistakenly pursued for unfiled returns.

- Misconception 8: Only traditional employment income must be reported.

The form requires reporting all forms of earned income, including W-2 wage compensation and business income reflected on PA Schedules. Special income types, like non-taxable S-Corp earnings, also have their reporting box to ensure all income types are covered.

It’s vital to carefully review the Local Tax Lancaster form instructions and information to ensure compliance and avoid errors. For situations where ambiguity remains, seeking guidance from the Lancaster County Tax Collection Bureau or a professional tax preparer is advisable.

Key takeaways

Filling out the Local Tax Lancaster form requires attention to detail and an understanding of your income sources throughout the tax year. Here are several key takeaways to assist individuals in navigating this process:

- It's crucial to report your earnings accurately on the form, separating any non-taxable earnings, such as Social Security payments or dividends from investments, which are not subject to local earned income tax.

- For individuals who have moved within Lancaster County during the tax year, the Part-Year Resident Schedule provides a formula to calculate income and taxes owed for each residence based on the months lived at each address.

- Using only black or blue ink when completing the form is mandatory, ensuring the legibility and proper processing of your tax return.

- Documentation such as W-2 forms, PA Schedule UE for unreimbursed employee business expenses, and other relevant schedules must be enclosed with the tax return to support the figures reported.

- If you worked in an area where the non-resident tax rate is higher than your home resident rate, the Distressed/Commuter Local Tax Withheld Worksheet will help calculate the credit allowed.

- Any penalties and interest due for filing after April 15 must be calculated as per the instructions and added to the total payment due.

Furthermore, those who fall under specific categories such as disabled, student, military, retirees, homemakers, or unemployed, have designated checkboxes to indicate their status, potentially affecting their tax liabilities. It's essential for all taxpayers to provide their signature and the date of signing, affirming the accuracy and completeness of the information to the best of their knowledge under penalties of perjury. These mentioned aspects are critical in ensuring the Local Earned Income Tax Return for Lancaster County is filled out comprehensively and in compliance with local tax laws.

Popular PDF Documents

Moneygram Refund Form - MoneyGram ExpressPayment Service is your solution for immediate bill settlements and card reloads—just fill in your information.

Nevada Consumer Use Tax - Structured to facilitate the reporting of use tax on a quarterly basis, aligning with standard accounting periods for businesses.

Sample Letter to Land Owner to Buy Land - A procedural letter indicating readiness to buy property, setting the stage for a detailed purchase and sale agreement.