Get Loan Summary Sheet Form

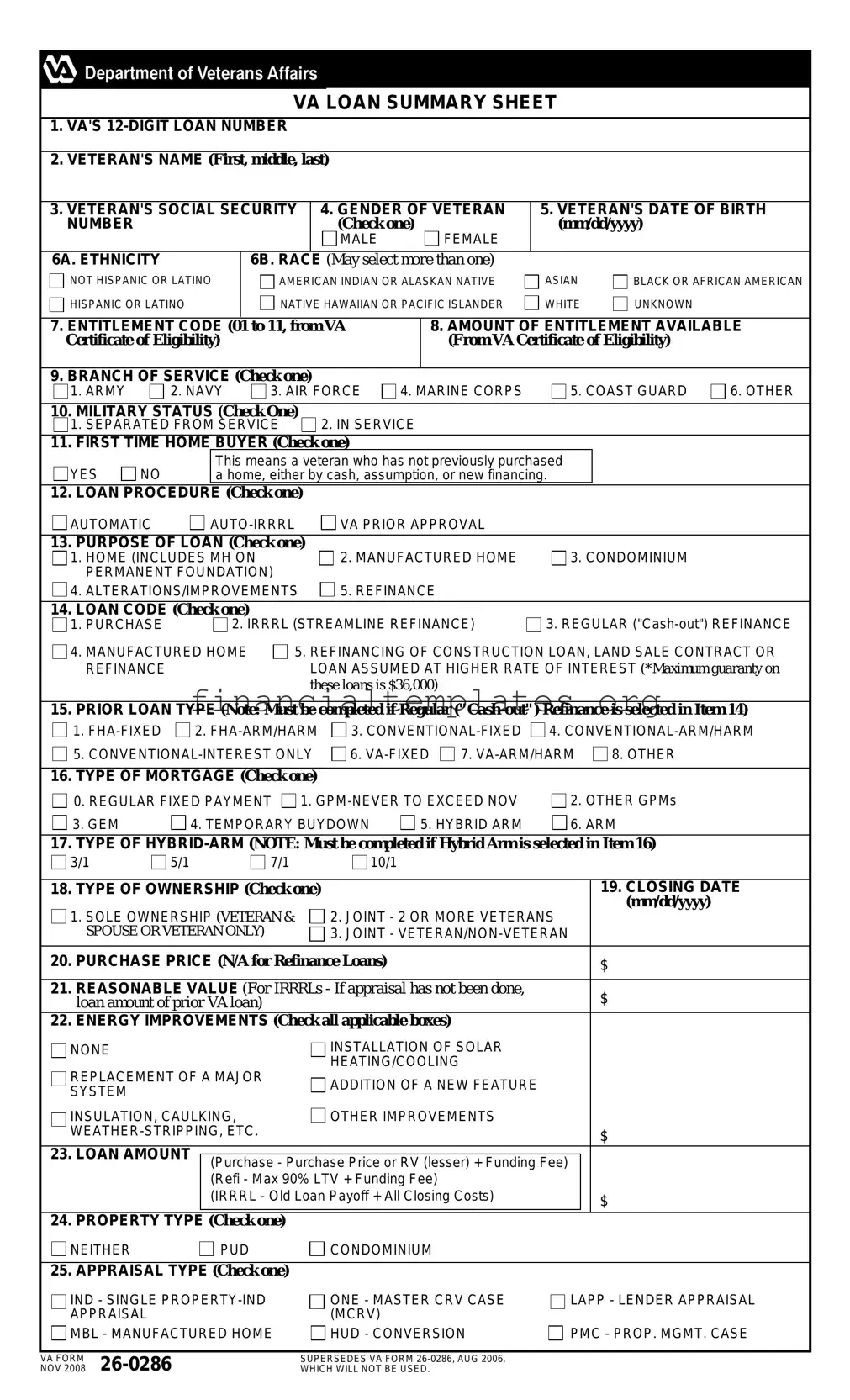

Navigating the complex world of Veterans Affairs (VA) loans can be a daunting task for veterans and their families. The VA Loan Summary Sheet serves as a critical tool in this process, providing a comprehensive overview of the loan details at a glance. This form captures essential information such as the VA's 12-digit loan number, veteran’s personal details, including their name, Social Security number, and demographic information like ethnicity and race. It delves deeper into the loan specifics, outlining the entitlement code, available amount of entitlement, and the veteran's branch of service and military status. Importantly, the form addresses whether the applicant is a first-time homebuyer, the specific loan procedure being applied for, and the purpose of the loan, offering options ranging from purchasing a home to making alterations or refinancing. The loan code section further defines the type of loan, inviting applicants to specify their previous loan type if applicable. Other vital aspects covered include the type of mortgage, property ownership details, purchase price, appraisal type, and the property's address among other crucial elements. This sheet also includes sections on the loan's financial aspects, such as income information, liquid assets, and the crucial debt-to-income ratio. For veterans seeking to navigate the VA loan process, understanding every section of the VA Loan Summary Sheet is essential in ensuring clarity, transparency, and a smoother application process.

Loan Summary Sheet Example

VA LOAN SUMMARY SHEET

1.VA'S

2.VETERAN'S NAME (First, middle, last)

|

|

|

|

|

|

||||

3. VETERAN'S SOCIAL SECURITY |

|

4. GENDER OF VETERAN |

5. VETERAN'S DATE OF BIRTH |

||||||

NUMBER |

|

|

|

(Check one) |

(mm/dd/yyyy) |

|

|||

|

|

|

|

MALE |

|

FEMALE |

|

|

|

6A. ETHNICITY |

|

6B. RACE (May select more than one) |

|

|

|

||||

NOT HISPANIC OR LATINO |

AMERICAN INDIAN OR ALASKAN NATIVE |

ASIAN |

BLACK OR AFRICAN AMERICAN |

||||||

HISPANIC OR LATINO |

NATIVE HAWAIIAN OR PACIFIC ISLANDER |

WHITE |

UNKNOWN |

|

|||||

|

|

|

|

|

|||||

7. ENTITLEMENT CODE (01 to 11, from VA |

|

8. AMOUNT OF ENTITLEMENT AVAILABLE |

|||||||

Certificate of Eligibility) |

|

|

|

|

(From VA Certificate of Eligibility) |

|

|||

|

|

|

|

|

|

|

|

||

9. BRANCH OF SERVICE (Check one) |

|

4. MARINE CORPS |

5. COAST GUARD |

6. OTHER |

|||||

1. ARMY |

2. NAVY |

3. AIR FORCE |

|||||||

10. MILITARY STATUS (Check One) |

2. IN SERVICE |

|

|

|

|||||

1. SEPARATED FROM SERVICE |

|

|

|

||||||

11. FIRST TIME HOME BUYER (Check one)

YES |

NO |

This means a veteran who has not previously purchased |

|

|

|

a home, either by cash, assumption, or new financing. |

|

|

|||

|

|

|

|

|

|

12. LOAN PROCEDURE |

(Check one) |

|

|

|

|

AUTOMATIC |

VA PRIOR APPROVAL |

|

|

||

13. PURPOSE OF LOAN (Check one) |

2. MANUFACTURED HOME |

3. CONDOMINIUM |

|||

1. HOME (INCLUDES MH ON |

|||||

PERMANENT FOUNDATION) |

|

|

|

||

4. ALTERATIONS/IMPROVEMENTS |

5. REFINANCE |

|

|

||

14.LOAN CODE (Check one)

1. PURCHASE |

2. IRRRL (STREAMLINE REFINANCE) |

3. REGULAR |

|

4. MANUFACTURED HOME |

5. REFINANCING OF CONSTRUCTION LOAN, LAND SALE CONTRACT OR |

||

REFINANCE |

|

LOAN ASSUMED AT HIGHER RATE OF INTEREST (*Maximum guaranty on |

|

|

|

these loans is $36,000) |

|

15.PRIOR LOAN TYPE (Note: Must be completed if Regular

1.

1.  2.

2.  3.

3.  4.

4.

5. |

6. |

8. OTHER |

|||

|

|

|

|

|

|

16. TYPE OF MORTGAGE (Check one) |

|

|

|

|

|

0. REGULAR FIXED PAYMENT 1. |

2. OTHER GPMs |

||||

3. GEM |

4. TEMPORARY BUYDOWN |

5. HYBRID ARM |

6. ARM |

||

17.TYPE OF

3/1 |

5/1 |

7/1 |

10/1 |

|

|

|

18. TYPE OF OWNERSHIP (Check one) |

|

19. CLOSING DATE |

1. SOLE OWNERSHIP (VETERAN & |

2. JOINT - 2 OR MORE VETERANS |

(mm/dd/yyyy) |

|

||

SPOUSE OR VETERAN ONLY) |

3. JOINT - |

|

|

|

|

20. PURCHASE PRICE (N/A for Refinance Loans) |

$ |

|

|

|

|

21. REASONABLE VALUE (For IRRRLs - If appraisal has not been done, |

$ |

|

loan amount of prior VA loan) |

|

|

22.ENERGY IMPROVEMENTS (Check all applicable boxes)

NONE |

|

INSTALLATION OF SOLAR |

|

REPLACEMENT OF A MAJOR |

HEATING/COOLING |

|

|

ADDITION OF A NEW FEATURE |

|

||

SYSTEM |

|

|

|

|

|

|

|

INSULATION, CAULKING, |

OTHER IMPROVEMENTS |

|

|

|

$ |

||

23. LOAN AMOUNT |

|

|

|

(Purchase - Purchase Price or RV (lesser) + Funding Fee) |

|

||

|

|

||

|

(Refi - Max 90% LTV + Funding Fee) |

|

|

|

(IRRRL - Old Loan Payoff + All Closing Costs) |

$ |

|

|

|

|

|

24. PROPERTY TYPE |

(Check one) |

|

|

NEITHER |

PUD |

CONDOMINIUM |

|

25. APPRAISAL TYPE (Check one)

IND - SINGLE

MBL - MANUFACTURED HOME

MBL - MANUFACTURED HOME

ONE - MASTER CRV CASE |

LAPP - LENDER APPRAISAL |

(MCRV) |

|

HUD - CONVERSION |

PMC - PROP. MGMT. CASE |

NOV 2008 |

WHICH WILL NOT BE USED. |

VA FORM |

SUPERSEDES VA FORM |

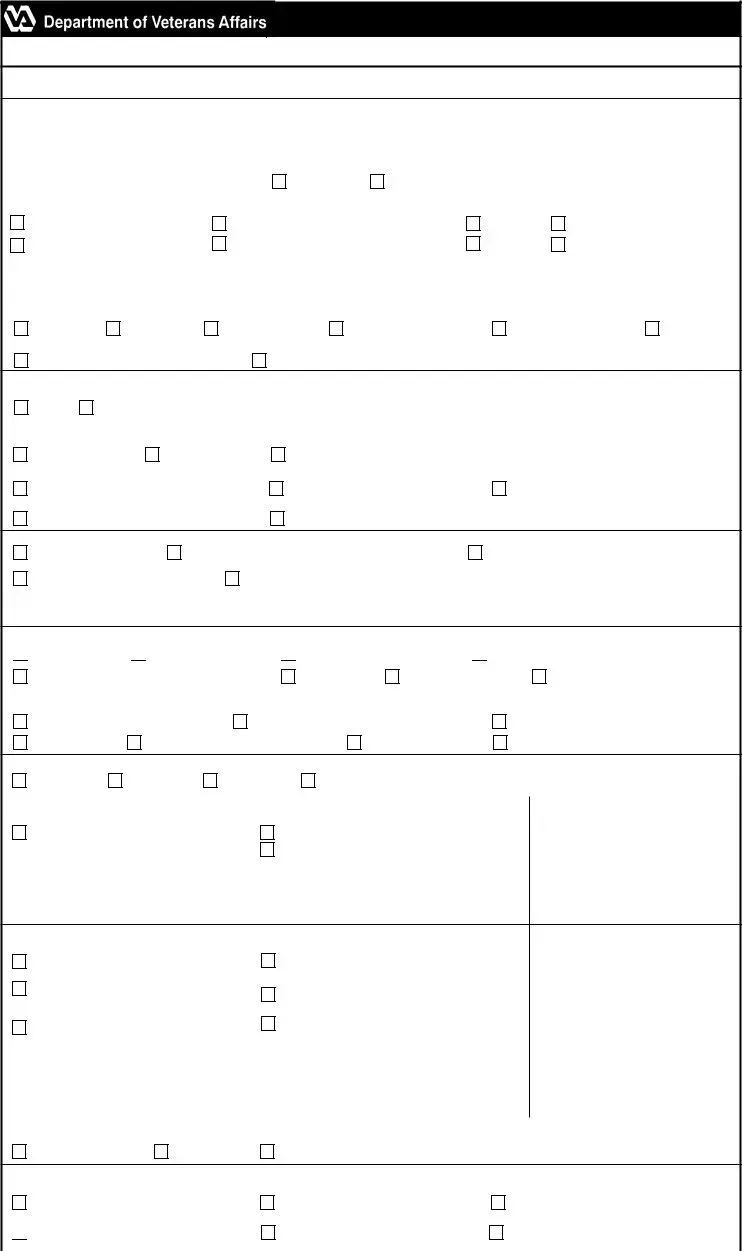

26. TYPE OF STRUCTURE (Check one)

1. CONVENTIONAL |

2. SINGLEWIDE M/H |

3. DOUBLEWIDE M/H |

CONSTRUCTION |

|

|

4. M/H LOT ONLY |

5. PREFABRICATED HOME |

6. CONDOMINIUM CONVERSION |

27. PROPERTY DESIGNATION (Check one)

1. EXISTING OR USED HOME, CONDO, M/H |

2. APPRAISED AS PROPOSED CONSTRUCTION |

|||

3. NEW EXISTING - NEVER OCCUPIED |

4. ENERGY IMPROVEMENTS |

|||

|

|

|

|

|

28. NO. OF UNITS (Check one) |

|

|

29. MCRV NO. |

|

SINGLE |

TWO UNITS |

THREE UNITS |

FOUR OR MORE |

|

|

|

|||

30. MANUFACTURED HOME CATEGORY(Check one) |

||||

0. OTHER - NOT M/H |

|

1. M/H ONLY (RENTED SPACE) |

||

2. M/H ONLY |

|

7. M/H ON PERMANENT FOUNDATION |

||

31. PROPERTY ADDRESS |

|

|

|

32. CITY |

33. STATE |

34. ZIP CODE |

35. COUNTY |

36. LENDER VA ID NUMBER |

37. AGENT VA ID NUMBER (If applicable) |

38. LENDER LOAN NUMBER |

|

FOR LAPP CASES ONLY

|

|

|

39. LENDER SAR ID NUMBER |

|

|

|

|

|

40. GROSS LIVING AREA |

41. AGE OF PROPERTY (Yrs.) |

42. DATE SAR ISSUED NOTIFICATION |

(Square Feet) |

|

OF VALUE (mm/dd/yyyy) |

|

|

|

43. TOTAL ROOM COUNT |

44. BATHS (No.) |

45. BEDROOMS (No.) |

46.IF PROCESSED UNDER LAPP, WAS THE FEE APPRAISER'S ORIGINAL VALUE ESTIMATE CHANGED OR REPAIR RECOMMENDATIONS REVISED, OR DID THE SAR OTHERWISE MAKE SIGNIFICANT ADJUSTMENTS?

YES (If "Yes," there must be written justification by fee appraiser and/or SAR) |

NO |

|

||||

|

INCOME INFORMATION (Not Applicable for IRRRLs) |

|

||||

47A. LOAN PROCESSED UNDER VA RECOGNIZED AUTOMATED UNDERWRITING SYSTEM |

||||||

YES |

NO (If "Yes," Complete Item 47B and 47C) |

|

|

|||

47B. WHICH SYSTEM WAS USED? |

01. LP |

|

47C. RISK CLASSIFICATION |

|||

02. DU |

03. PMI AURA |

04. CLUES |

05. ZIPPY |

|

1. APPROVE |

2. REFER |

|

|

|

|

|

|

|

48.CREDIT SCORE (Enter the median credit score for the veteran only)

49. LIQUID ASSETS |

|

$ |

|

|

|

|

|

|

50. TOTAL MONTHLY GROSS INCOME |

(Item 31+Item 38 from |

$ |

VA Form |

|

|

51. RESIDUAL INCOME |

|

$ |

|

|

|

|

|

|

52. RESIDUAL INCOME GUIDELINE |

|

$ |

|

|

53.DEBT- INCOME RATIO (If Income Ratio is over 41% and Residual Income is not 120% of guideline, statement of justification signed by underwriter's supervisor must be included on or with VA Form

|

|

|

|

|

|

|

|

|

% |

54. SPOUSE INCOME CONSIDERED |

|

55. SPOUSE'S INCOME AMOUNT (If considered) |

|||||||

YES |

NO |

(If "Yes," Complete Item 55) |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

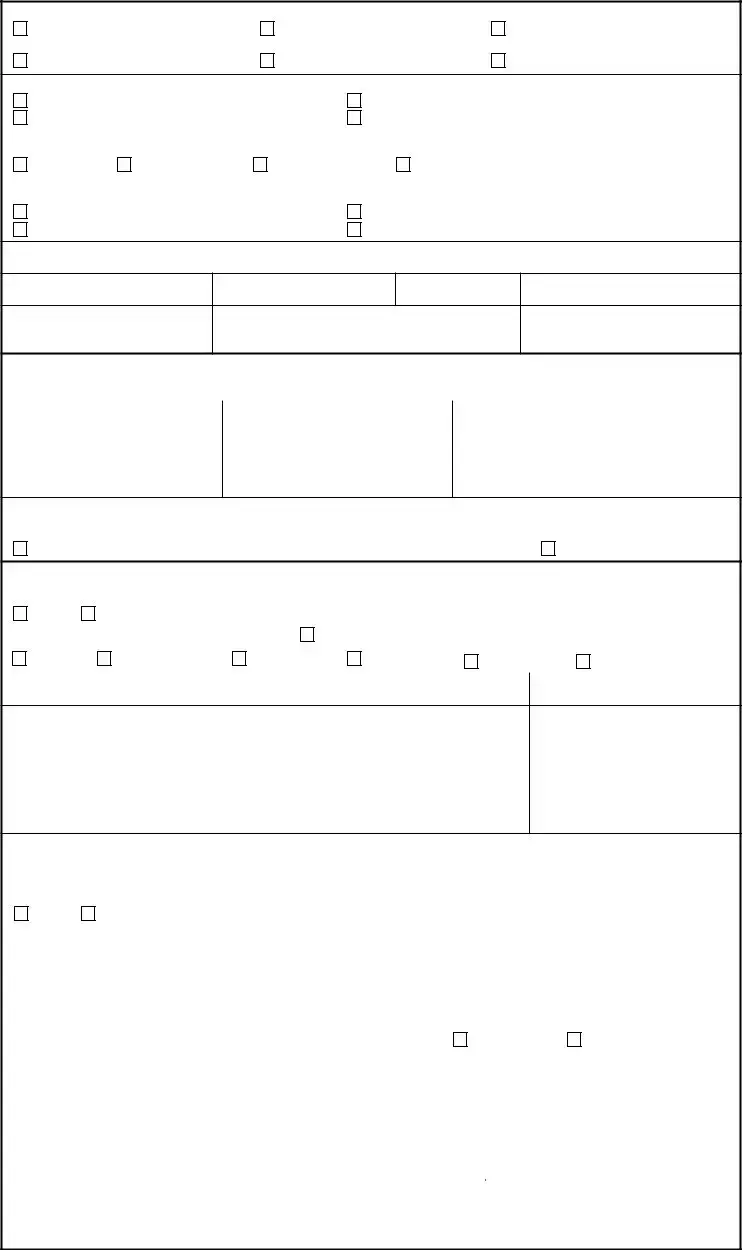

DISCOUNT INFORMATION (Applicable for All Loans) |

|

||||||

56. DISCOUNT POINTS CHARGED |

|

|

|

% OR |

$ |

|

|||

|

|

|

|

|

|

|

|

||

57. DISCOUNT POINTS PAID BY VETERAN |

|

|

|

% OR |

$ |

|

|||

|

|

|

|

|

|

|

|

||

58. TERM (Months) |

|

59. INTEREST RATE |

|

|

60. FUNDING FEE EXEMPT |

||||

|

|

|

|

|

% |

|

Y - EXEMPT |

N - NOT EXEMPT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR IRRRLS ONLY |

|

|

|

|||

61. PAID IN FULL VA LOAN NUMBER |

|

|

|

|

|

||||

|

|

|

|

|

|

||||

62. ORIGINAL LOAN AMOUNT |

|

63. ORIGINAL INTEREST RATE |

|||||||

$ |

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

64. REMARKS |

|

|

|

|

|

|

|

|

|

VA FORM

Document Specifics

| Fact Name | Details |

|---|---|

| Form Title | VA Loan Summary Sheet |

| Form Number and Revision Date | VA Form 26-0286, November 2008 |

| Purpose | Used to summarize key loan details for VA Loans. |

| Key Sections Covered | Veteran information, loan details, property information, and lender details. |

| Governing Law | Federal law, specific to VA loans and benefits. |

Guide to Writing Loan Summary Sheet

Filling out the VA Loan Summary Sheet requires attention to detail and understanding of the specific terms used within. This form is crucial for veterans seeking to secure a loan, as it summarizes key information about the loan and the applicant's eligibility. The following steps are designed to guide individuals through the process, ensuring accuracy and completeness.

- Enter the VA's 12-digit loan number in the space provided.

- Provide the veteran's full name: first, middle, and last.

- Input the veteran's Social Security Number.

- Select the gender of the veteran: MALE or FEMALE.

- Fill in the veteran's date of birth using the format mm/dd/yyyy.

- For ethnicity (6A) and race (6B), check the appropriate boxes. Note that more than one race may be selected.

- Input the Entitlement Code and Amount of Entitlement available, both of which are found on the VA Certificate of Eligibility.

- Select the branch of service and military status from the given options.

- Indicate if you are a first-time homebuyer by checking YES or NO.

- Choose the loan procedure and purpose of the loan that applies to your situation.

- Select the appropriate loan code, especially noting if a Regular ("Cash-out") Refinance is selected, as this requires completion of the next section on prior loan type.

- For those selecting a Regular Refinance, specify the prior loan type.

- Choose the type of mortgage, and if selecting a Hybrid ARM, specify the type of Hybrid-ARM.

- Select the type of ownership, input the closing date, and the purchase price or reasonable value as applicable.

- Check any applicable boxes for energy improvements.

- Fill in the loan amount, property type, and appraisal type.

- Select the type of structure and property designation.

- Indicate the number of units, manufactured home category, and complete the property address section.

- Provide the required lender and agent information, as well as the gross living area, age of property, and if processed under LAPP, whether significant adjustments were made.

- If applicable, fill in the sections on income information, including automated underwriting system details, credit score, and income figures.

- Specify discount information, loan term, interest rate, and if the funding fee is exempt.

- For IRRRLs only, input the prior VA loan number, original loan amount and interest rate.

- In the remarks section, add any additional information or explanations necessary for understanding your loan application.

Once completed, review the form carefully to ensure all information is accurate and complete. Submission of the Loan Summary Sheet follows specific guidelines provided by the VA or your lender, which typically include mailing or electronically submitting the form. This document plays a crucial role in processing your loan application, making careful completion and prompt submission essential.

Understanding Loan Summary Sheet

-

What is a VA Loan Summary Sheet?

The VA Loan Summary Sheet is a document used by veterans applying for a loan through the Veterans Affairs (VA) loan program. It captures essential information about the borrower, the loan, and the property being financed. This includes details such as the veteran's personal information, loan type, property type, and financial specifics. It's designed to provide a comprehensive overview of the loan application for both the borrower and the VA.

-

Who needs to complete the VA Loan Summary Sheet?

Any veteran or service member applying for a VA loan must complete the Loan Summary Sheet. This includes those buying a home, refinancing an existing loan, or seeking changes to their current VA loan terms. The form plays a critical role in the application process, helping the VA and lenders assess eligibility and entitlement.

-

How does one find their VA's 12-digit loan number or entitlement code?

For existing loans, the VA's 12-digit loan number can be found on loan documents or by contacting the lender. The entitlement code, indicating eligibility for the VA loan program, is found on the VA Certificate of Eligibility (COE). Veterans can obtain their COE through the eBenefits portal or by submitting a request through their lender or the VA.

-

Can a borrower select more than one race on the form?

- Yes, the VA Loan Summary Sheet allows borrowers to select more than one race to accurately reflect their heritage. This helps ensure that all veterans have the opportunity to fully represent their background while applying for a loan.

Common mistakes

Not entering the VA's 12-digit loan number accurately, which is critical for identifying the loan application within the VA system.

Incorrectly filling out the veteran's name section by either misspelling the name or not including the full legal name (first, middle, and last).

Omitting or incorrectly entering the veteran's Social Security number. This can lead to delays in processing since the Social Security number is a key piece of identifying information.

Failure to correctly indicate the gender of the veteran, which is a required demographic detail.

Entering the wrong date of birth for the veteran, which is used for verification purposes and to ensure eligibility based on age-related criteria.

Skipping the ethnicity and race questions or not selecting all applicable options. Veterans may select more than one race to accurately reflect their heritage.

Not specifying the correct entitlement code from the VA Certificate of Eligibility, which could affect the loan's terms and conditions.

Incorrectly filling out the amount of entitlement available. This information, taken from the VA Certificate of Eligibility, directly impacts the veteran's borrowing capacity.

When filling out the Loan Summary Sheet form, it's important for individuals to take their time and ensure all information is accurate and complete. Attention to detail is critical in avoiding processing delays and ensuring the smooth progress of the loan application.

Documents used along the form

When applying for a loan, particularly a VA loan, the process involves several forms and documents beyond just the VA Loan Summary Sheet. Each document serves a specific purpose, ensuring that all aspects of the veteran's eligibility, financial background, and the specifics of the property being financed are clearly documented and reviewed as part of the loan approval process. Here is a list of forms and documents often required in addition to the Loan Summary Sheet.

- Certificate of Eligibility (COE): This document is essential as it verifies the veteran's eligibility for a VA loan based on their service. It indicates the amount of entitlement available, which is crucial for the loan process.

- DD Form 214: For veterans who are no longer in the service, the DD Form 214 proves military discharge status and conditions, key factors in determining loan eligibility.

- Statement of Service: For active military members, a Statement of Service signed by their commander or personnel officer is necessary. It confirms the active duty status and terms of service.

- VA Form 26-6393, Loan Analysis: This form outlines the borrower's income, expenses, and overall financial condition, aiding the lender in determining the veteran’s ability to pay the mortgage.

- Credit Report: A thorough review of the applicant's credit history is conducted to assess creditworthiness and financial responsibility.

- Appraisal Report: An appraisal determines the fair market value of the property being purchased or refinanced, ensuring the loan amount does not exceed the property’s worth.

- Proof of Homeowners Insurance: This document shows that the property will be insured against losses or damage, protecting both the borrower and the lender's interests.

Together with the VA Loan Summary Sheet, these forms and documents compose a comprehensive package that lenders review during the loan approval process. They ensure that all requirements are met and that the loan meets VA standards, ultimately facilitating a smoother transaction for the veteran. Accurate and complete documentation is critical to securing a VA loan and achieving homeownership or refinancing goals.

Similar forms

The Uniform Residential Loan Application (URLA) shares similarities with the VA Loan Summary Sheet, as both forms collect comprehensive information regarding the borrower's personal and financial details to assess their eligibility for a loan. The URLA is broader in scope, catering to various types of mortgage loans beyond VA loans, yet it similarly requests data on the applicant’s employment history, income, assets, and liabilities, along with property information and loan type being sought, paralleling the structured approach to gathering applicant and loan details found in the VA Loan Summary Sheet.

Similarly, the Loan Estimate form, mandated by the Truth in Lending Act (TILA), presents an itemized list of fees and costs associated with a mortgage transaction. Like the VA Loan Summary Sheet, it is designed to provide clarity and transparency to the borrower, detailing the terms of the loan, projected payments, and closing costs. Both documents serve to inform borrowers of the financial specifics of their loan, aiding in their understanding of obligations and entitlements, albeit the Loan Estimate provides a broader financial overview, while the VA Loan Summary focuses on VA-specific loan characteristics.

The Closing Disclosure form, also required by TILA-RESPA Integrated Disclosure rules, shares a common purpose with the VA Loan Summary Sheet in the mortgage process by itemizing final loan terms and closing costs to the borrower. Although the Closing Disclosure is specific to the closing phase of a loan transaction, supplying finalized details as opposed to preliminary information, both documents contribute to an informed borrowing and lending decision-making process, emphasizing transparency and accuracy in loan terms and expenses.

The Mortgage Servicing Disclosure Statement, mandated by the Real Estate Settlement Procedures Act (RESPA), resembles the VA Loan Summary Sheet in its function of informing the borrower. This document discloses the lender’s intentions regarding the transferring of loan servicing rights. While the Mortgage Servicing Disclosure focuses on post-closing loan administration and the VA Loan Summary Sheet concentrates on loan terms and borrower qualifications, both play crucial roles in managing borrower expectations and clarifying lender practices.

Lastly, the Homeownership Counseling Notice, another RESPA document, is akin to the VA Loan Summary Sheet by supporting informed decision-making. It advises applicants of their rights to receive homeownership counseling for understanding loan obligations thoroughly. Despite the difference in focus—homeownership counseling versus detailed loan terms—the intention to equip borrowers with the necessary information and resources for a successful loan experience aligns these documents within the framework of borrower support and education.

Dos and Don'ts

When completing the VA Loan Summary Sheet form, attention to detail and accuracy are paramount. The following list provides guidance on what to do and what to avoid for a seamless process.

- Do double-check the VA's 12-digit loan number for accuracy to avoid any processing delays.

- Do ensure the veteran's name matches the name on their official documents.

- Do accurately input the veteran's Social Security number to prevent identity mistakes.

- Do select the correct gender of the veteran as it is a required detail for the form.

- Do carefully enter the veteran's date of birth in the mm/dd/yyyy format for consistency.

- Do correctly identify and mark the veteran's ethnicity and race, recognizing that more than one race can be selected when applicable.

- Do verify the entitlement code and amount of entitlement available from the VA Certificate of Eligibility to ensure loan processing accuracy.

- Do check the appropriate box that accurately reflects the veteran's branch of service and military status.

- Do indicate clearly whether the veteran is a first-time home buyer as this can affect loan terms.

- Do ensure all other sections of the form are filled out based on the current loan's specifics and the property in question.

- Don't rush through filling out the form, as errors can cause delays or issues with loan approval.

- Don't guess on any information. If unsure, it's better to verify the correct details before submission.

- Don't leave any required fields blank. Incomplete forms may be returned or not processed.

- Don't use nicknames or shortened versions of the veteran's name; use the legal name as it appears on formal documents.

- Don't misstate the veteran's military status or branch as this information is crucial for loan eligibility.

- Don't ignore the importance of the entitlement code and available entitlement, as these impact the loan's terms.

- Don't provide inaccurate financial information, such as misunderstanding the type of prior loan or the type of mortgage sought.

- Don't overlook the significance of checking the right options under the property type and loan procedure sections.

- Don't forget to include the property's address and the loan amount, as these are key components of the loan summary.

- Don't submit the form without reviewing all the details for completeness and accuracy to ensure a smooth processing experience.

Misconceptions

When it comes to the Loan Summary Sheet form, especially regarding VA loans, several misconceptions can lead to confusion. Understanding each element of the form is crucial for veterans and their families to maximize their benefits accurately. Here are nine common misconceptions debunked:

- Only the loan amount matters: Many believe that the only vital detail is the loan amount, but details such as the veteran’s personal information, military service, first-time homebuyer status, and type of loan are equally crucial in determining eligibility and loan conditions.

- Loan Summary Sheets are the same for every loan: Each VA loan summary is unique and tailored to the individual, taking into account various factors including service history, purpose of the loan, and whether the veteran is a first-time buyer.

- Automatic approval for veterans: While being a veteran qualifies you for consideration, the form requires detailed information, such as credit score and income details, to determine loan approval and conditions.

- Filling out the form guarantees a loan: Completing the form is a step in the process. Approval depends on several factors, including the type of mortgage and property, lender criteria, and the veteran’s creditworthiness.

- Entitlement code is irrelevant: The entitlement code, found on the VA Certificate of Eligibility, is critical. It gives information about a veteran's eligibility, including any previous use of entitlement and remaining entitlement for loan guarantees.

- The purpose of the loan is unimportant: Indicating the loan's purpose (e.g., buying a home, refinancing) is essential as it directly impacts loan terms and approval. Each purpose has specific requirements and eligibility criteria.

- Any property type is eligible: The loan summary sheet requires specifying the property type, which must meet VA loan guidelines for eligibility. Some types of properties, like certain condominiums or manufactured homes, have specific considerations.

- All veterans receive the same interest rate: Interest rates are not standardized and can vary based on credit score, the economy, lender policies, and whether discount points are chosen to lower the rate.

- VA loans cover 100% of the property cost in every case: While VA loans do offer up to 100% financing, the loan amount, purchase price, and property appraisal value are carefully considered. In some cases, especially refinancing, maximum loan-to-value ratios apply.

Understanding these nuances can make a significant difference in the loan process for veterans. The Loan Summary Sheet is an integral part of this, providing a detailed snapshot of the loan conditions and requirements, thereby debunking common misunderstandings and assisting veterans in making informed decisions.

Key takeaways

Filling out a VA Loan Summary Sheet is a critical step for veterans who are applying for a VA loan, whether they're buying a home, refinancing, or seeking improvements. Understanding the form's elements can greatly ease the application process. Here are six key takeaways to guide individuals through this process:

- The VA Loan Summary Sheet requires detailed personal information, including the veteran's name, social security number, and details about their military service. It's imperative to have all relevant personal and service-related information readily available before starting the form.

- Choosing the correct type of loan from the options provided (such as purchase, IRRRL (Interest Rate Reduction Refinancing Loan), or cash-out refinance) is crucial. The choice influences the loan's terms and conditions, and selecting the wrong option could delay approval.

- Information on the type of property being purchased or refinanced, including property type and details on the number of units, must be accurately filled. This is vital for the VA and lenders to assess the loan's purpose and ensure it meets all VA loan program requirements.

- The form also requires detailed financial information, such as income and assets. These details help the lender assess the applicant's financial situation and determine their eligibility for the loan amount they're applying for.

- If energy improvements are being made, such as the installation of solar panels or major heating and cooling system upgrades, these must be checked off accordingly. Such improvements can impact loan amounts and might qualify for additional VA loan benefits.

- Attention to detail is paramount when filling out the form, especially with regards to dates (such as the closing date and the veteran's date of birth), and numeric information like the loan amount and property value. Accurate data ensures that the application is processed smoothly and without unnecessary delays.

Whether veterans are buying their first home, refinancing, or making improvements, the VA Loan Summary Sheet is a foundational component of the application process. Accurate and complete answers expedite the lending process, bringing veterans one step closer to achieving their homeownership or refinancing goals.

Popular PDF Documents

IRS 1065 - The form includes schedules for partners to report items of income, deductions, and credits that affect their individual tax returns.

IRS 8829 - Completing IRS 8829 requires attention to detail and precise documentation, emphasizing the need for diligent tax preparation practices.

Total Ordinary Dividends Vs Qualified Dividends - Explanation on calculating taxable income adjustments on the Qualified Dividends Tax Worksheet.