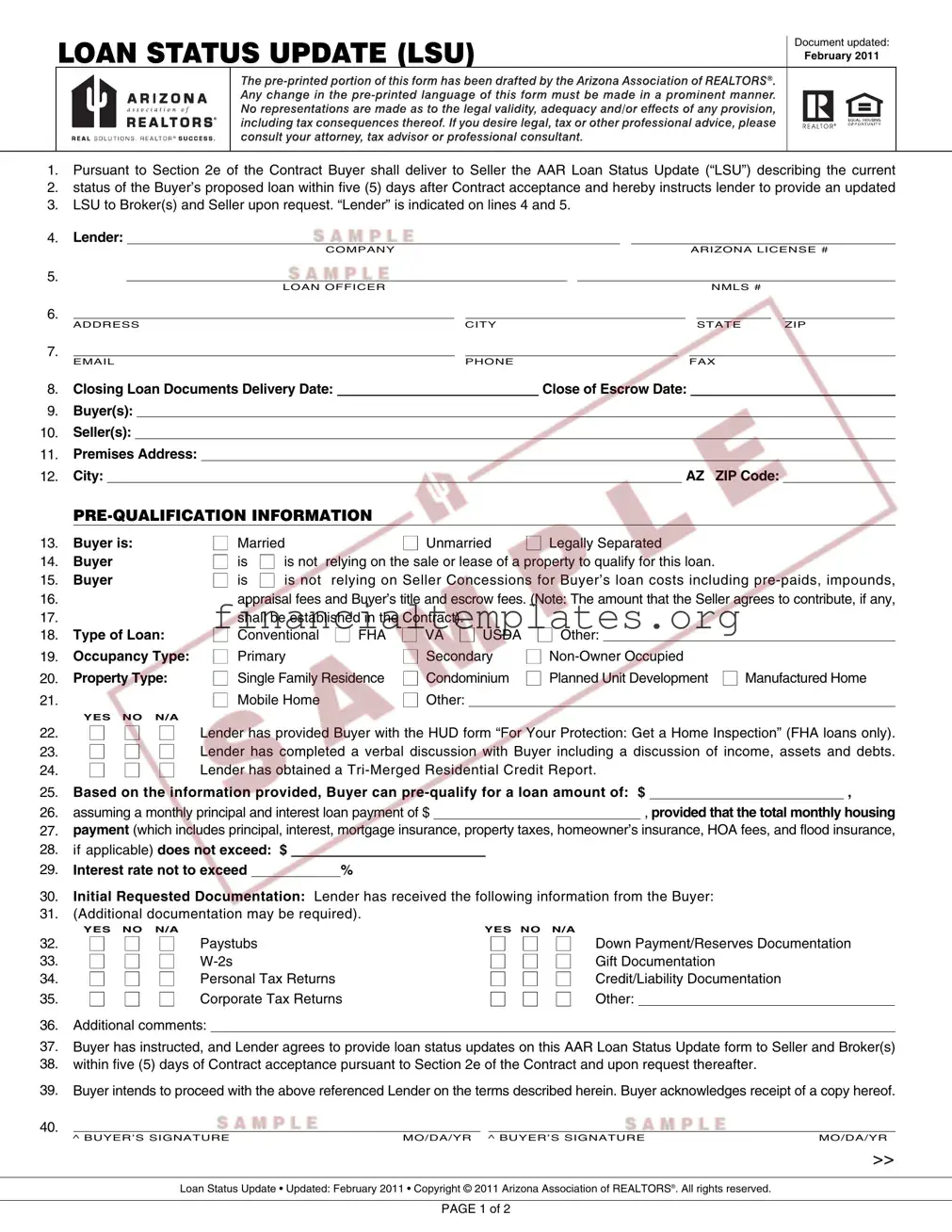

Get Loan Status Update Form

Navigating the journey to secure a loan for a real estate purchase is a process filled with detailed steps and documentation. Among the key components in this process is the Loan Status Update (LSU) form, a document that plays a vital role in keeping all parties informed about the progress of a loan application. Updated in February 2011, the LSU is designed to streamline communication between buyers, sellers, and lenders. As mandated by Section 2e of the Contract, buyers are obliged to deliver the AAR LSU to the seller within five days of contract acceptance, further ensuring that the lender keeps the broker(s) and seller updated upon request. This document includes comprehensive details such as the lender’s information, buyer and seller details, and specifics about the loan itself, such as type, occupancy, and property type. It also covers pre-qualification information, initial requested documentation for the loan process, and various compliance checks throughout the loan application process. The LSU ensures transparency by outlining the current status of the buyer’s proposed loan, which is vital for maintaining the timelines crucial for closing real estate transactions. Its exhaustive nature ensures that all parties are on the same page regarding loan progression, making it an indispensable tool in the real estate industry.

Loan Status Update Example

LOAN STATUS UPDATE (LSU)

Document updated:

February 2011

1.Pursuant to Section 2e of the Contract Buyer shall deliver to Seller the AAR Loan Status Update (“LSU”) describing the current

2.status of the Buyer’s proposed loan within five (5) days after Contract acceptance and hereby instructs lender to provide an updated

3.LSU to Broker(s) and Seller upon request. “Lender” is indicated on lines 4 and 5.

4. |

Lender: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

COMPANY |

|

|

|

|

|

|

|

|

|

ARIZONA LICENSE # |

|||||

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOAN OFFICER |

|

|

|

|

|

|

|

|

|

|

|

NMLS # |

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

CITY |

|

|

|

|

|

|

|

|

|

STATE |

|

ZIP |

||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHONE |

|

|

|

|

|

|

|

FAX |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

8. |

Closing Loan Documents Delivery Date: |

|

|

|

Close of Escrow Date: |

|

|

|

|||||||||

9.Buyer(s):

10.Seller(s):

11.Premises Address:

12. City: |

|

AZ ZIP Code: |

13.Buyer is:

14.Buyer

15.Buyer

18.Type of Loan:

19.Occupancy Type:

20.Property Type:

21.

N Married |

N Unmarried |

N Legally Separated |

N is N is not |

relying on the sale or lease of a property to qualify for this loan. |

|

Nis N is not relying on Seller Concessions for Buyer’s loan costs including

NConventional N FHA N VA N USDA N Other:

N Primary |

N Secondary |

N |

|

N Single Family Residence |

N Condominium |

N Planned Unit Development N Manufactured Home |

|

N Mobile Home |

N Other: |

|

|

|

YES |

NO |

N/A |

|

|

|

|

|

22. |

N |

N |

N |

Lender has provided Buyer with the HUD form “For Your Protection: Get a Home Inspection” (FHA loans only). |

||||

23. |

N |

N |

N |

Lender has completed a verbal discussion with Buyer including a discussion of income, assets and debts. |

||||

24. |

N |

N |

N |

Lender has obtained a |

|

|

|

|

25. |

Based on the information provided, Buyer can |

|

, |

|||||

26. |

assuming a monthly principal and interest loan payment of $ |

|

, provided that the total monthly housing |

|||||

27.payment (which includes principal, interest, mortgage insurance, property taxes, homeowner’s insurance, HOA fees, and flood insurance,

28.if applicable) does not exceed: $

29. Interest rate not to exceed |

|

% |

30.Initial Requested Documentation: Lender has received the following information from the Buyer:

31.(Additional documentation may be required).

|

YES |

NO |

N/A |

|

YES NO N/A |

|

|

||

32. |

N |

N |

N |

Paystubs |

N |

N |

N |

Down Payment/Reserves Documentation |

|

33. |

N |

N |

N |

N |

N |

N |

Gift Documentation |

||

34. |

N |

N |

N |

Personal Tax Returns |

N |

N |

N |

Credit/Liability Documentation |

|

35. |

N |

N |

N |

Corporate Tax Returns |

N |

N |

N |

Other: |

|

36.Additional comments:

37.Buyer has instructed, and Lender agrees to provide loan status updates on this AAR Loan Status Update form to Seller and Broker(s)

38.within five (5) days of Contract acceptance pursuant to Section 2e of the Contract and upon request thereafter.

39.Buyer intends to proceed with the above referenced Lender on the terms described herein. Buyer acknowledges receipt of a copy hereof.

40.

^ BUYER’S SIGNATURE |

MO/DA/YR ^ BUYER’S SIGNATURE |

MO/DA/YR |

>>

Loan Status Update • Updated: February 2011 • Copyright © 2011 Arizona Association of REALTORS®. All rights reserved.

PAGE 1 of 2

|

|

|

|

|

|

|

|

|

|

|

Page 2 of 2 |

|

Loan Status Update (LSU) >> |

|

|

|

|

|

|

|

|

||

|

|

|

DOCUMENTATION |

|

|

|

|

|

|

|

|

|

YES NO |

|

DATE |

LENDER |

|||||||

|

|

|

|

COMPLETED |

INITIALS |

||||||

41. |

N N Lender has received the Contract and all Addenda |

|

|

/ |

|

/ |

|

|

|

||

42. |

N N Lender has sent initial Good Faith Estimate and Truth in Lending (TIL) Disclosures |

|

|

/ |

|

/ |

|

|

|

||

43. |

N N Lender has received a signed Application/1003 and disclosures |

|

|

/ |

|

/ |

|

|

|

||

44. |

N N Lender has identified down payment source |

|

|

/ |

|

/ |

|

|

|

||

45. |

N N Lender has received and reviewed the Title Commitment |

|

|

/ |

|

/ |

|

|

|

||

46. |

N N Payment for the appraisal has been received |

|

|

/ |

|

/ |

|

|

|

||

47. |

N N Lender has ordered the appraisal |

|

|

/ |

|

/ |

|

|

|

||

48. |

N N Buyer has locked the interest rate and points with Lender |

|

|

/ |

|

/ |

|

|

|

||

49. |

Lock expiration date |

|

|

|

|

|

|

|

|

|

|

50. |

N N Lender has received the Initial Requested Documentation listed on lines |

|

|

/ |

|

/ |

|

|

|

||

51. |

N N Appraisal received and the Premises appraised for at least the purchase price |

|

|

/ |

|

/ |

|

|

|

||

|

|

UNDERWRITING AND APPROVAL |

|

|

|

|

|

|

|

|

|

52. |

N N Lender has submitted the loan package to the Underwriter |

|

|

/ |

|

/ |

|

|

|

||

53. |

N N Lender has obtained loan approval with Prior to Document (“PTD”) Conditions |

|

|

/ |

|

/ |

|

|

|

||

54. |

N N Appraisal conditions have been met |

|

|

/ |

|

/ |

|

|

|

||

55. |

N N Buyer has loan approval without PTD Conditions |

|

|

/ |

|

/ |

|

|

|

||

|

|

|

CLOSING |

|

|

|

|

|

|

|

|

56. |

N N Lender has ordered the Closing Loan Documents (“DOCs”) and Instructions |

|

|

/ |

|

/ |

|

|

|

||

57. |

N N Lender has sent the DOCs to the Escrow Company |

|

|

/ |

|

/ |

|

|

|

||

58. |

N N Lender has received the |

|

|

/ |

|

/ |

|

|

|

||

59. |

N N Lender has approved the |

|

|

/ |

|

/ |

|

|

|

||

60. |

N N Lender has received signed DOCs from all parties |

|

|

/ |

|

/ |

|

|

|

||

61. |

N N All lender Quality Control Reviews have been completed |

|

|

/ |

|

/ |

|

|

|

||

62. |

N N All Prior to Funding (“PTF”) Conditions have been met and buyer has obtained |

|

|

/ |

|

/ |

|

|

|

||

63. |

loan approval without conditions |

|

|

|

|

|

|

|

|

||

64. |

N N Funds have been ordered |

|

|

/ |

|

/ |

|

|

|

||

65. |

N N All funds have been received by Escrow Company |

|

|

/ |

|

/ |

|

|

|

||

66.Close of escrow occurs when the deed has been recorded at the appropriate county recorder’s office.

67.

^ LOAN OFFICER’S SIGNATURE |

MO/DA/YR |

Loan Status Update • Updated: February 2011 • Copyright © 2011 Arizona Association of REALTORS®. All rights reserved.

PAGE 2 of 2

Document Specifics

| Name | Fact |

|---|---|

| Document Update | The Loan Status Update (LSU) was updated in February 2011. |

| Submission Timeline | The AAR LSU must be delivered to the Seller within five (5) days after Contract acceptance. |

| Lender Instruction | Buyer instructs the lender to provide updated LSU to Broker(s) and Seller upon request. |

| Governing Law | Regulated under the Arizona Association of REALTORS®. |

| Disclosure Items | Includes lender's preliminary verification of buyer's income, assets, debts, and credit report. |

| Closing and Underwriting Requirements | Details actions required from the lender, from receiving contract documents to closing loan documents and funding. |

Guide to Writing Loan Status Update

Filling out a Loan Status Update (LSU) form is a critical step in the home buying process, ensuring all parties are informed about the progress of the buyer's loan application. This document tracks from initial loan application to closing, detailing loan approval stages, underwriting, and eventual funding. Proper completion of this form facilitates clear communication between buyers, sellers, and lenders. Here’s a detailed guide on how to complete the LSU form.

- Start by filling in the "Lender" section with the company name and Arizona license number.

- Enter the loan officer’s name along with their NMLS number.

- Provide the full address of the lender, including the city, state, and ZIP code.

- Input the loan officer's contact details: email, phone number, and fax number.

- List the expected dates for closing loan documents delivery and the close of the escrow.

- Fill in the buyer(s) and seller(s) names.

- Provide the address of the premises, including city and ZIP code in Arizona.

- Under "Pre-Qualification Information," indicate the buyer's marital status, if the buyer is relying on the sale or lease of another property, and whether the buyer needs seller concessions.

- Select the type of loan, occupancy type, and property type.

- If applicable, mark whether the lender has provided the HUD form for FHA loans, completed a verbal discussion with the buyer about their financial situation, and obtained a Tri-Merged Residential Credit Report.

- Indicate the loan amount the buyer can pre-qualify for, assuming certain monthly payment details and an interest rate not to exceed a specified percentage.

- For initial requested documentation, check the appropriate boxes to show what the lender has received from the buyer and if any additional documentation may be required.

- Add any additional comments about the loan application process in the space provided.

- Ensure the buyer signs and dates the document, acknowledging receipt and agreement to proceed with the specified lender.

- On the second page, check off each step as completed by the lender, including receipt of the contract, sending and receiving of various documents and disclosures, appraisal order and receipt, underwriting steps, and closing specifics. Each item should be marked as "Yes," "No," or "Date Completed" as appropriate, with lender initials next to each completed action.

- The loan officer must sign and date the bottom of the second page, confirming the accuracy and completion of the form.

Once the Loan Status Update form is fully completed and signed, it will be used to keep all relevant parties updated on the loan process. This ensures a smooth transition to closing and helps prevent any misunderstandings or delays. It is important for the buyer and lender to provide accurate, up-to-date information throughout this process.

Understanding Loan Status Update

Welcome to the FAQ section for the Loan Status Update (LSU) form. This guide aims to address common questions and clarify the process, making the loan application journey easier to navigate.

What is a Loan Status Update (LSU) form?

The LSU form is a document that outlines the current status of a buyer's proposed loan. It's designed to keep all parties informed - including sellers, brokers, and lenders - regarding the progress of the buyer’s mortgage application. Updated as the loan process advances, it ensures transparency and timely communication.

When should the LSU form be delivered?

According to the details in the form, the buyer is required to deliver an updated LSU to the seller and brokers within five days after the acceptance of the contract. Updates should continue to be provided upon request, ensuring all parties remain informed throughout the process.

Who provides the updates to the Seller and Broker(s)?

The lender, as indicated in the form, is responsible for providing the updated LSUs to the seller and broker(s) as instructed by the buyer. This collaboration facilitates clear communication and helps manage expectations during the buying process.

What kind of information does the LSU contain?

The LSU includes comprehensive details such as the type of loan, occupancy and property type, pre-qualification information, including the buyer's ability to qualify based on income, assets, and debts. It also records the receipt of necessary documentation, underwriting status, appraisal results, and other critical stages up to the closing of the loan.

What is the importance of the "Initial Requested Documentation" section?

This section outlines the documents initially required from the buyer, such as pay stubs, W-2s, tax returns, and more. Completion and submission of these documents are crucial for the lender to proceed with the loan application, underwrite the loan, and ultimately ensure a smooth path to approval.

How does the LSU form affect the closing process?

The LSU keeps all parties apprised of the loan's progress, including any conditions that must be met before funding. By highlighting key milestones and whether they've been achieved, the form aids in anticipating and planning for the closing date, contributing to a smoother transaction.

Can changes in loan terms or requirements be updated in the LSU?

Yes, any changes in the loan terms, requirements, or status should be updated in the LSU. This includes adjustments to the interest rate, loan amount, or documentation requirements. Keeping the LSU current ensures that all involved have the most accurate information, reducing the chances of misunderstandings or delays.

What happens if the LSU shows the loan cannot be approved?

If the LSU reflects that the loan cannot be approved, it allows the buyer and seller to discuss alternatives or potentially cancel the contract. This information provides a crucial decision-making basis for all parties involved, emphasizing the importance of timely and honest updates through the LSU.

Understanding and properly utilizing the Loan Status Update form simplifies the home buying process, fosters transparency, and helps ensure successful real estate transactions for all parties involved.

Common mistakes

-

Not submitting the AAR Loan Status Update (LSU) within the specified five-day period after Contract acceptance can significantly delay the process. This requirement provides both the Seller and Broker(s) timely updates, ensuring all parties are well-informed about the loan's progress.

-

Failing to accurately indicate the lender's details, including the company name, Arizona license number, loan officer's name, and NMLS number, creates confusion and may lead to unnecessary back-and-forth communication that could delay processing times.

-

Overlooking the section on initial requested documentation is a common mistake. If the form indicates that certain documents were received by the lender (e.g., paystubs, W-2s, personal and corporate tax returns, etc.), but these documents were actually not submitted, this error can pause or derail the verification process. It’s pivotal to properly check off these items to reflect the true state of document submission.

-

Incomplete pre-qualification information, such as not specifying the type of loan, occupancy type, property type, or misunderstanding the sections regarding reliance on sale or lease of property and seller concessions for loan costs, can lead to misinterpretation of financial capabilities and intentions. This information helps paint a clearer picture of the buyer's situation and loan requirements.

-

Not thoroughly reviewing and confirming the correctness of all sections before signing. The buyer's signature is a testament to the accuracy and completeness of the information provided. Missing signatures, dates, or inaccurately filled sections can invalidate the document, necessitating a redo. Ensuring every detail is correct before adding a signature is crucial.

Avoiding these mistakes not only smoothes out the loan process but also ensures a more positive experience for all parties involved. Proper attention to detail and diligent adherence to instructions can lead to a more expedient and less stressful loan acquisition process.

Documents used along the form

The Loan Status Update form plays a crucial role in the financing aspect of buying a home, acting as a communication bridge between the buyers, sellers, and lenders. It ensures all parties are informed about the progress of the loan application and its approval status. Alongside this document, several other forms and documents further facilitate a smooth transaction process. These documents, each serving a unique purpose, are vital to fulfilling regulatory requirements, providing clarity and transparency, and ensuring the financial readiness of the buyer.

- Good Faith Estimate (GFE): This document provides an estimate of the costs involved in the mortgage transaction. It helps buyers understand their potential closing costs and compare offers from different lenders.

- Truth in Lending Act (TILA) Disclosures: TILA disclosures offer detailed information about the terms of the loan, including the annual percentage rate (APR), the total cost of the loan over its lifetime, and any prepayment penalties.

- Uniform Residential Loan Application (Form 1003): This standardized form collects detailed financial information from the buyer, which lenders use to assess creditworthiness and determine loan approval.

- Income Verification Documents: Paystubs, W-2s, and personal tax returns verify the buyer’s income, ensuring they have the means to repay the mortgage.

- Down Payment Verification: Proof of the source of the down payment and reserves assure lenders that the buyer has sufficient funds for the initial home purchase costs.

- Credit and Liability Documentation: A comprehensive look at the buyer's credit history and current debts to evaluate their financial stability and risk as a borrower.

- Appraisal Report: An assessment of the property’s value ensures the mortgage amount does not exceed the home's worth, safeguarding both the lender and buyer.

- Title Commitment: This document outlines any liens, encumbrances, or other title issues with the property, ensuring the buyer receives clear ownership.

- Closing Disclosure: A final breakdown of loan and closing costs, provided before the closing, gives buyers a chance to review and confirm the terms of their loan.

Each document complements the Loan Status Update form, creating a comprehensive picture of the financial and legal aspects of the home buying process. Understanding the role and importance of these documents can significantly enhance the efficiency and transparency of real estate transactions, providing peace of mind for buyers, sellers, and lenders alike.

Similar forms

The Loan Status Update (LSU) form bears a resemblance to the Loan Application (also known as Form 1003). Just as the LSU form serves to update involved parties on the current status of a buyer's loan, including pre-qualification details and loan terms, the Loan Application gathers comprehensive information about the borrower's financial status, employment history, and the property being financed. Both documents are foundational to the lending process, facilitating communication between the lender, buyer, and, in the case of the LSU, the seller and brokers, by providing detailed insights into the financial aspects of the transaction.

Similarly, the Good Faith Estimate (GFE) document shares commonalities with the LSU form. The GFE outlines the estimated costs involved in obtaining a loan for the buyer, providing an early snapshot of expected charges and loan terms. Like the LSU, it plays a pivotal role in keeping the buyer informed about the financial dimensions of their loan. While the GFE focuses predominantly on cost estimates at the early stages of the loan application process, the LSU encompasses a broader spectrum of loan progress updates, including appraisal results, interest rates, and closing document deliveries.

The Truth in Lending Disclosure (TIL) also parallels the LSU form in certain respects. This document is designed to inform borrowers about the costs of their loan, including the annual percentage rate (APR), finance charges, and the total amount financed. While the TIL provides a detailed account of the loan's financial implications for the borrower, the LSU offers a broader overview of the loan's status, including verification of documents received, approval status, and adherence to contractual timelines. Both documents serve to enhance transparency and ensure borrowers are well-informed about their financial commitments.

The Closing Disclosure (CD), mandated by the TILA-RESPA Integrated Disclosure (TRID) rules for most types of mortgage transactions, also exhibits similarities to the LSU form. The Closing Disclosure offers a final review of the loan terms, monthly payments, and closing costs, and must be provided to the borrower at least three business days before the loan closing date. The LSU, while broader in scope, similarly updates parties on the completion of necessary steps toward loan finalization, such as appraisal completion and approval conditions. Both the CD and LSU contribute to the borrower's understanding and readiness for loan acceptance and property purchase completion.

Dos and Don'ts

When filling out the Loan Status Update (LSU) form, there are several important guidelines to follow to ensure accurate and timely processing of your loan application. Below are three things you should do and three things you should avoid.

Do:

- Ensure that the lender’s information, including the company’s Arizona license number and the loan officer’s NMLS number, is accurately filled out. Correct and complete identification helps in avoiding any confusion or delay.

- Provide a comprehensive update on the loan's status within five days after contract acceptance, as required by Section 2e of the Contract. This timely update is crucial for keeping all parties informed.

- Complete the section on initial requested documentation thoroughly, indicating whether items such as paystubs, down payment reserves, W-2s, gift documentation, and personal tax returns have been received. Accurate documentation is key to the loan approval process.

Don't:

- Avoid leaving sections incomplete. For instance, do not skip the sections that ask about the buyer's marital status, reliance on seller concessions, or type of loan and property. Incomplete information can delay the process.

- Do not provide inaccurate financial details, such as overstating income or underreporting debts, in the verbal discussion section or the pre-qualification information. Honesty is essential for a smooth loan process.

- Refrain from delaying the provision of any additional documents required by the lender. Delays in submitting necessary paperwork can result in missed deadlines and potential issues with closing the loan on time.

Misconceptions

When discussing the Loan Status Update (LSU) form, it's essential to clear up several common misconceptions. These misunderstandings can create confusion among buyers, sellers, and even professionals in the real estate transaction process.

Misconception #1: The LSU is only necessary for FHA or VA loans. This form is valuable for all types of loans, providing detailed information regarding the loan's status, enhancing transparency for all parties involved in the transaction.

Misconception #2: Filling out the LSU is the exclusive responsibility of the buyer. While the buyer plays a significant role in providing accurate information, it is a collaborative effort that involves the lender directly, ensuring all data reflected is up-to-date and correct.

Misconception #3: The lender's role is limited to initial completion. In reality, lenders are involved throughout the process, with responsibilities including providing updates and finalizing the loan details as specified in the form. They are integral in communicating any changes or needed documentations as the process progresses.

Misconception #4: All sections of the LSU are mandatory for every transaction. Specific segments of the form may be marked as "Not Applicable," reflecting the unique aspects of each loan situation, such as the reliance on the sale or lease of another property to qualify for the loan.

Misconception #5: The HUD form mentioned is required for all loans. This document, "For Your Protection: Get a Home Inspection," is specific to FHA loans, aiming to ensure borrowers fully understand the importance of home inspections.

Misconception #6: The interest rate must be locked in before completing the LSU. Interest rates are often not locked in at the time of initial submission. The LSU allows for the indication of expected rates but recognizes that these may change until the rate lock occurs.

Misconception #7: Buyer acknowledgments on the form are cursory. In contrast, these acknowledgments are critical, ensuring that the buyer comprehends the terms, the information provided, and the implications of their decisions throughout the loan process.

Misconception #8: The LSU is a one-time submission document. This form can be, and often is, updated throughout the loan process. It serves as a living document that should be revised to reflect the most current status of the buyer’s loan application.

Misconception #9: The LSU is purely informational and has no bearing on the actual loan approval. This document plays a key role in the transaction, helping to keep all parties informed and can influence decisions on both sides based on the loan's progression and terms outlined.

Understanding the LSU form is vital for a smoother real estate transaction process. By addressing these misconceptions, buyers, sellers, and professionals can more effectively navigate the complexities of home financing.

Key takeaways

Filling out and using the Loan Status Update (LSU) form is a crucial step in the home buying process. It streamlines communication between the buyer, seller, and lender, ensuring that everyone is on the same page. Here are six key takeaways to understand:

- The buyer is required to deliver the AAR Loan Status Update form to the seller within five days of contract acceptance. This ensures the seller is promptly informed about the status of the buyer's proposed loan.

- The lender, as identified on the form, is obliged to provide updated LSUs to the broker(s) and seller upon request. This obligation ensures continuous and up-to-date communication throughout the loan approval process.

- Pre-qualification information, including whether the buyer is relying on the sale or lease of another property or requires seller concessions to cover loan costs, must be clearly stated. This information helps all parties understand the financial foundation of the transaction.

- The form requires detailed loan information such as the type of loan, occupancy type, and property type. By providing a comprehensive overview, it helps in assessing the buyer’s eligibility and suitability for the loan in question.

- Initial requested documentation listed on the LSU form, such as pay stubs, W-2s, tax returns, and proof of down payment, must be provided by the buyer. This documentation is fundamental in evaluating the buyer’s loan application.

- The LSU form also outlines the procedural steps leading up to the closing of the loan, including receiving and reviewing the contract and addenda, the appraisal process, underwriting and approval, and finally, preparing for closing. Each step includes a checklist for both the buyer and lender to ensure no detail is overlooked.

Overall, the Loan Status Update form is a pivotal document designed to keep all parties informed throughout the home buying process, ultimately aiding in a smoother transaction from start to finish.

Popular PDF Documents

Profit and Loss Form - With its focus on business income and expenses, Schedule C is a cornerstone document for tax reporting among entrepreneurs and freelancers.

Itr - Form 1701 reinforces the taxpayers' role in contributing to the nation’s fiscal health through accurate tax reporting.