Get Loan Request Repayment Form

Understanding the intricacies of a Loan Request Repayment form is crucial for anyone involved with insurance policies, especially when dealing with companies like Monumental Life Insurance Company, Transamerica Life Insurance Company, and Western Reserve Life Assurance Co. of Ohio. Located at their administrative office in Cedar Rapids, IA, these forms are a pivotal part of managing the financial aspects of your insurance policy. When you wish to either request a loan against your insurance policy or repay an existing one, this document serves as a communication tool between you and the insurance company. The form requires detailed information such as policy/certificate numbers, the insured or annuitant's name, and the owner's contact details. It categorizes the loan request into specific needs, such as obtaining a cash loan, a loan for premium payment, or adding an Automated Premium Loan (APL) option to the policy. Additionally, the repayment section allows policyholders to adjust their billing amounts to include the loan repayment. Signatures from the insured, the policy owner, any assignees, and the spouse (if applicable) are mandatory to validate the request. This process not only ensures that all parties are informed about the financial adjustments but also outlines the precise terms for loan repayment, which can prevent misunderstandings and ensure smooth financial transactions between the policyholder and the insurance company.

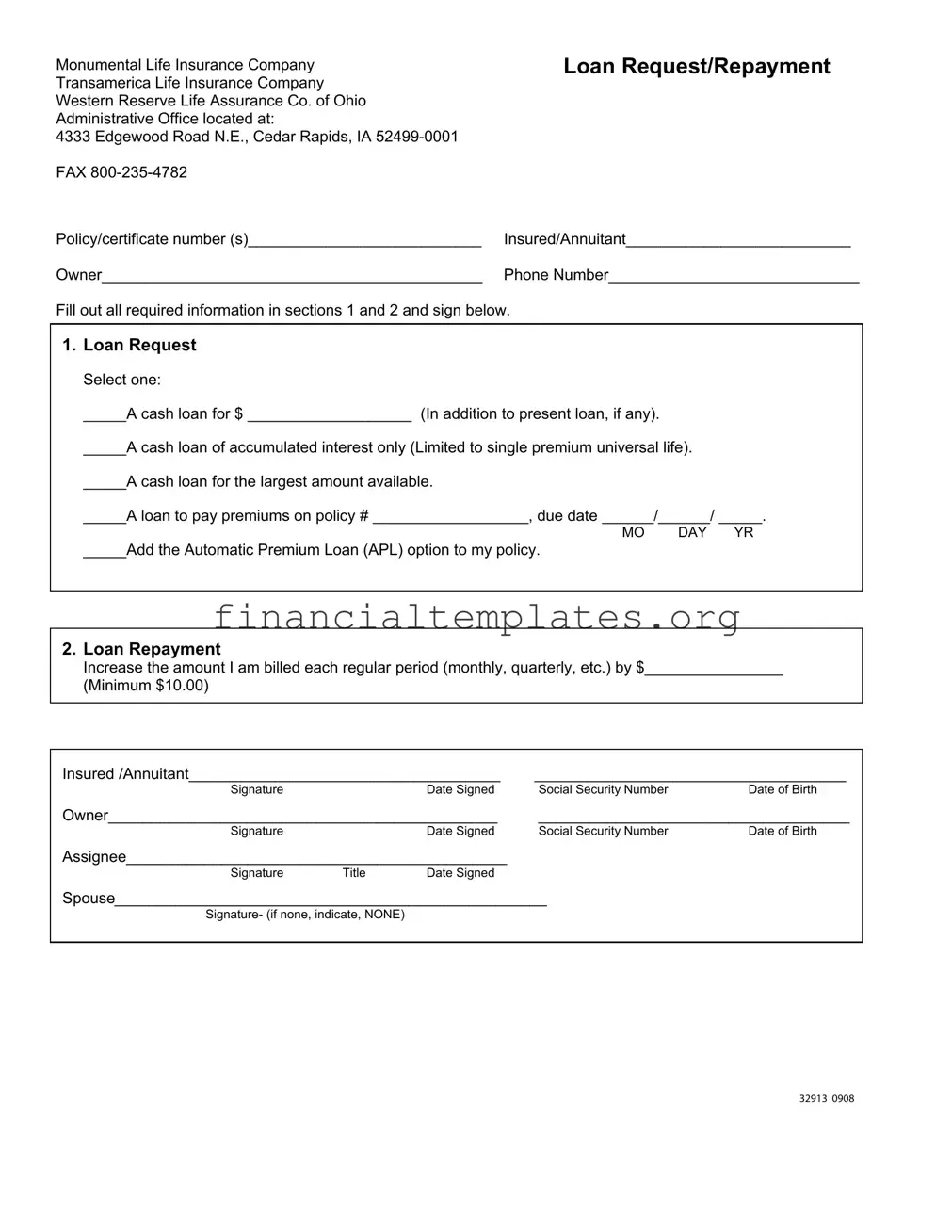

Loan Request Repayment Example

Monumental Life Insurance Company

Transamerica Life Insurance Company Western Reserve Life Assurance Co. of Ohio Administrative Office located at:

4333 Edgewood Road N.E., Cedar Rapids, IA

FAX

Loan Request/Repayment

Policy/certificate number (s)___________________________ |

Insured/Annuitant__________________________ |

Owner____________________________________________ |

Phone Number_____________________________ |

Fill out all required information in sections 1 and 2 and sign below.

1.Loan Request

Select one:

_____A cash loan for $ ___________________ (In addition to present loan, if any).

_____A cash loan of accumulated interest only (Limited to single premium universal life).

_____A cash loan for the largest amount available.

_____A loan to pay premiums on policy # __________________, due date ______/______/ _____.

MO DAY YR

_____Add the Automatic Premium Loan (APL) option to my policy.

2.Loan Repayment

Increase the amount I am billed each regular period (monthly, quarterly, etc.) by $________________

(Minimum $10.00)

Insured /Annuitant____________________________________ |

____________________________________ |

||

Signature |

Date Signed |

Social Security Number |

Date of Birth |

Owner_____________________________________________ |

____________________________________ |

||

Signature |

Date Signed |

Social Security Number |

Date of Birth |

Assignee____________________________________________

Signature Title Date Signed

Spouse__________________________________________________

Signature- (if none, indicate, NONE)

32913 0908

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | Used by policyholders to request a loan or make a loan repayment against their life insurance policy. |

| Form Companies | Involves Monumental Life Insurance Company, Transamerica Life Insurance Company, and Western Reserve Life Assurance Co. of Ohio. |

| Administrative Office Location | 4333 Edgewood Road N.E., Cedar Rapids, IA 52499-0001. |

| Contact Information | Fax number provided for submission or inquiries: 800-235-4782. |

| Loan Request Options | Offers multiple loan options including cash loans, loans for accumulated interest only, and loans to pay premiums. |

| Governing Law | While the form itself does not specify, the laws governing the use of this form would typically be based on the state in which the insurance policy was issued or the state laws where the insurance companies are headquartered. |

Guide to Writing Loan Request Repayment

Filling out the Loan Request Repayment form is a significant step toward managing your policy's financial aspects with your insurance company. This process involves indicating whether you are requesting a new loan or making repayments on an existing one. By carefully completing this form, you provide the necessary information to process your request efficiently. Here’s a step-by-step guide to help you fill out the form correctly.

- Locate the policy/certificate number(s) of your insurance policy and fill it in the designated space.

- Write the name of the insured or annuitant, followed by the name of the owner of the policy. If the insured/annuitant and the owner are the same, you will enter the same name twice.

- Provide a contact phone number where you can easily be reached for any queries or confirmation.

- Under section 1 for the Loan Request:

- Choose the option that best describes the type of loan you are requesting. Mark one box only.

- If you’re requesting a specific cash loan amount, enter that dollar amount.

- To use the loan for premium payments, provide the policy number and the due date in the format MM/DD/YYYY.

- If opting for the Automatic Premium Loan option, tick the corresponding box.

- In section 2 for Loan Repayment:

- Specify the additional amount you wish to be billed for each payment period to contribute toward loan repayment. Remember, this amount must be at least $10.00.

- Have the insured or annuitant sign and date the form. They must also provide their Social Security Number and Date of Birth.

- The owner of the policy (if different from the insured/annuitant) should also sign and date the form, providing their Social Security Number and Date of Birth.

- If applicable, have the assignee sign and date the form, indicating their title.

- A section is provided for the spouse’s signature. If the insured’s spouse is not applicable, indicate "NONE."

After completing the form, review all the information for accuracy. This ensures your request is processed without unnecessary delays. The completed form can then be sent to the administrative office via the fax number provided. As you navigate this process, remember that clear and accurate information is crucial for a smooth and efficient handling of your loan request or repayment.

Understanding Loan Request Repayment

-

What is the purpose of the Loan Request/Repayment Form?

This form is designed for policyholders associated with Monumental Life Insurance Company, Transamerica Life Insurance Company, and Western Reserve Life Assurance Co. of Ohio who wish to request a loan against their policy's cash value or make a repayment on an existing loan. It facilitates either the borrowing of funds from the policy's accumulated value or the adjustment of repayment terms to manage the loan effectively.

-

Where do I send the completed Loan Request/Repayment Form?

Completed forms should be sent to the Administrative Office located at 4333 Edgewood Road N.E., Cedar Rapids, IA 52499-0001. For faster processing, you can also fax the form to 800-235-4782. Ensure all sections are filled out accurately to avoid delays.

-

How do I determine the loan amount I can request?

When requesting a cash loan, you have several options: request a specific dollar amount, a loan covering only the accumulated interest on your policy, the largest amount available, or a loan to pay premiums on your policy. Your policy's current cash value and any existing loans will determine the maximum amount you can borrow. Consult your policy documentation or contact customer service for precise figures.

-

What is the Automatic Premium Loan (APL) option, and how does it work?

The APL option is a feature that, once activated on your policy, automatically applies for a loan against your policy's cash value to cover premium payments if they are not paid by their due date. This helps keep the policy active without the policyholder needing to make manual payments, ensuring continuous coverage as long as there is sufficient cash value to cover the premiums.

-

What is the minimum amount I can elect to increase my loan repayment by?

Policyholders have the option to increase their loan repayment amount at any time. The form specifies that the minimum increase amount is $10.00. This amount will be added to your regular billing period (monthly, quarterly, etc.), allowing you to adjust your repayment plan according to your financial capacity.

-

Can I request a loan for just the accumulated interest on my policy?

Yes, it's possible to request a cash loan specifically for the accumulated interest on your policy. However, this option is limited to policies classified under single premium universal life. This allows for greater flexibility in managing policy gains without affecting the principle.

-

Who needs to sign the Loan Request/Repayment Form?

The form must be signed by several parties: the Insured/Annuitant, the policy Owner (if different from the Insured), and any Assignee if the policy has been assigned to another party. If applicable, the spouse of the Insured/Annuitant also needs to sign. In the absence of a spouse, indicate "NONE" in the designated area. Each signature must be accompanied by the signatory's Social Security Number and Date of Birth for verification purposes.

-

How will I know if my Loan Request/Repayment Form has been processed?

Upon receiving and processing your form, the insurance company will send a confirmation to the contact information provided on the form. For updates or to confirm receipt of your form, you may contact the Administrative Office directly. Ensure your phone number is correctly filled out on the form to facilitate smooth communication.

Common mistakes

Not providing the policy/certificate numbers: A common mistake is when individuals fail to include their policy or certificate numbers at the beginning of the form. These numbers are crucial for identifying the policy in question and processing the loan request or repayment efficiently. Without them, the request can be delayed or even rejected.

Choosing multiple options in Section 1: Some people mark more than one selection in the loan request section. However, applicants are required to choose only one option that best suits their needs, whether it's a cash loan, a loan of accumulated interest, a loan for the largest amount available, a loan to pay premiums, or adding the Automatic Premium Loan (APL) option to their policy. Multiple selections can lead to confusion and processing delays.

Omitting the amount for the loan request or repayment: Another frequent oversight is not specifying the loan amount requested or the increment by which to increase the regular billing period for repayment. Accurate figures are essential for both processing the loan and establishing the repayment schedule. This can be particularly problematic if seeking the maximum available amount without specifying it.

Incomplete or incorrect personal information: It’s critical to provide complete and correct information regarding the insured/annuitant and the owner, including phone numbers. Incomplete or inaccurate information can hinder communication and delay the processing of the request.

Forgetting to sign and date the form: The form requires signatures from the insured/annuitant, the owner, the assignee (if applicable), and the spouse (if applicable). Leaving any of these signatures, along with their corresponding dates, off the form can invalidate the request. Indicating 'NONE' where appropriate, such as for the spouse section if not applicable, is also necessary for clarity.

Neglecting to provide Social Security Numbers and Dates of Birth: The form requires the social security numbers and dates of birth for both the insured/annuitant and the owner. These pieces of information are vital for verifying the identities involved and ensuring that the request is processed for the correct individuals. Omission of these details can lead to significant delays.

Documents used along the form

When managing finances, particularly when dealing with loans, a comprehensive understanding of the required documents is crucial. The Loan Request Repayment form is a critical document, especially for policyholders of Monumental Life Insurance Company, Transamerica Life Insurance Company, and Western Reserve Life Assurance Co. of Ohio. However, navigating through the loan process usually involves more than just this form. Various other documents play a vital role in ensuring the process is smooth, compliant, and adequately recorded.

- Loan Agreement: This document outlines the terms and conditions of the loan, including interest rates, repayment schedule, and the consequences of defaulting on the loan. It serves as a legal record of the loan arrangement between the borrower and the lender.

- Promissory Note: A promissory note is a written promise to pay a specified amount of money to another party under agreed-upon terms. It serves as a binding legal document that evidences the loan and the obligation of the borrower to repay it.

- Credit Report Authorization Form: This form allows the lender to request and review the borrower's credit history. The credit report is essential for assessing the borrower's creditworthiness and determining the potential risk for the lender.

- Collateral Documents: If the loan is secured, collateral documents detail the asset(s) pledged as security for the loan. These documents prove ownership and the value of the collateral, ensuring the lender has a claim to it in case of default.

- Amortization Schedule: An amortization schedule is a table detailing each periodic payment on a loan over time. It breaks down each payment into principal and interest components, showing how the loan balance decreases over the life of the loan.

- Disclosure Statement: This document provides detailed information about the loan, including fees, charges, interest rates, and the annual percentage rate (APR). It ensures transparency between the borrower and the lender regarding the loan's costs.

- Guarantor Agreement: When a third party agrees to guarantee the loan, a guarantor agreement is required. This document outlines the guarantor's obligation to repay the loan if the original borrower fails to make payments.

Understanding each of these documents and their roles in the loan process can significantly impact the ease and success of acquiring or repaying a loan. It ensures all parties are informed, obligations are clear, and legal protections are in place. For policyholders and borrowers alike, staying informed and prepared with the necessary documentation is key to managing financial responsibilities effectively.

Similar forms

The Personal Loan Agreement Form is quite similar to the Loan Request Repayment form described. Both documents are used to outline the terms of a loan between two parties. In a Personal Loan Agreement Form, details include the loan amount, interest rate, repayment schedule, and any collateral. This mirrors the Loan Request Repayment form's focus on the loan amount, repayment method, and specifics regarding the use of the loan, such as for premium payments or as a cash loan.

An Installment Agreement is another document that shares similarities with the Loan Request Repayment form. This type of agreement lays out a plan for repaying a debt in regular installments over a specified period. The similarity comes into play with the Loan Repayment section of the form, which specifies how repayment will be increased per billing period. Both documents effectively manage and schedule debt repayment to ensure clarity for all parties involved.

The Debt Settlement Agreement can also be compared to the Loan Request Repayment form. This agreement is a negotiation between the debtor and creditor that allows for the repayment of a debt under new terms. This might include a reduction in the overall amount owed or an extension of the repayment period. The Loan Request Repayment form, especially its Loan Repayment section, reflects a negotiated approach to managing an existing loan, focusing on adjusting repayment terms.

Mortgage Refinance Documents share a purpose with the Loan Request Repayment form specifically in the context of adjusting the terms of an existing loan. Refinancing a mortgage involves taking out a new loan to pay off an existing mortgage, often to benefit from a lower interest rate or different loan term. This is akin to the Loan Request Repayment form’s option to apply for a new loan to pay premiums or modify repayment schedules, highlighting a re-negotiation of terms.

A Credit Card Payment Agreement Form is relevantly similar as well. This form usually specifies how a borrower will pay off the outstanding balance on a credit card, potentially including interest rates and payment deadlines. Similar to the Loan Repayment section of the Loan Request Repayment form, it formalizes the commitment to pay under specified terms, with clear implications for interest management and repayment period.

The Line of Credit Agreement is another document related to the Loan Request Repayment form. It establishes terms under which a borrower can withdraw funds up to a certain limit at their discretion. This agreement controls how and when the borrowed funds need to be repaid, akin to the flexibility seen in the Loan Request section of the Loan Request Repayment form, where different loan options are presented.

A Payment Plan Agreement, used to break down a large payment into smaller, manageable installments, aligns closely with the repayment aspect of the Loan Request Repayment form. It outlines how debt will be repaid over time, including any interest or fees, very much like how the repayment section of the form structures the increase in billed amount over regular periods, making large sums more manageable.

Lastly, Auto Loan Documents, which include details such as the loan amount, interest rate, repayment schedule, and information about the vehicle serving as collateral, have parallels with the Loan Request Repayment form. Both set out terms for repaying borrowed money, though the context and specifics may vary, the foundational concept of structuring the repayment of a loan connects them closely.

Dos and Don'ts

When completing the Loan Request Repayment form for any of the listed insurance companies, such as Monumental Life Insurance Company, Transamerica Life Insurance Company, or Western Reserve Life Assurance Co. of Ohio, it is essential to adhere to specific do’s and don’ts. Below are key points to ensure the process is completed correctly and efficiently.

Do:- Verify all personal information including the policy/certificate number(s), insured/annuitant, owner name, and contact details. Accuracy is critical for the processing of your request.

- Complete all required sections thoroughly. Sections 1 and 2 must be filled out with precise information regarding the loan request and repayment details.

- Clearly indicate the type of loan requested by selecting the appropriate option in Section 1. This will ensure your loan is processed according to your specific needs.

- Sign and date the form where indicated. Both the insured/annuitant and the owner must provide signatures to validate the request.

- Include the Social Security Number and Date of Birth for both the insured/annuitant and the owner. This information is necessary for identification purposes.

- Review the form for completeness before submitting. Ensuring all information is present and correct will expedite the processing of your loan request.

- Leave any sections blank. Incomplete forms may lead to delays or rejection of your loan request.

- Omit the signature of the spouse if applicable. If none, clearly indicate "NONE" to acknowledge this section has not been overlooked.

- Avoid guessing on loan amounts or repayment figures. Ensure the numbers provided in sections regarding loan requests and repayments are accurate and feasible for your financial situation.

- Use incorrect policy numbers or misidentify the insurance company. Each company has a distinct processing system, and accurate information is key to routing your request properly.

- Submit the form without verifying the current contact information for the administrative office. Addresses or fax numbers may change, and using outdated information could result in processing delays.

- Forget to specify the repayment increase amount in Section 2 with at least the minimum required amount. This detail is crucial for setting up your repayment plan accurately.

Following these guidelines when filling out the Loan Request Repayment form will help ensure your submission is processed smoothly and efficiently. It is always best to double-check each part of the form for accuracy and completeness before submission.

Misconceptions

There are several misconceptions about the Loan Request Repayment form that need to be addressed to ensure clarity and avoid potential errors during the process. Understanding these aspects is crucial for a smooth transaction.

- Only the loan amount needs to be specified. This is incorrect. The form requires detailed information, including policy/certificate numbers, insured/annuitant and owner’s details, and phone numbers, in addition to the loan amount.

- Any type of loan can be requested. In reality, the form outlines specific types of loans, such as a cash loan, a loan for accumulated interest (limited to specific policies), a loan for the largest amount available, and a loan to pay premiums.

- Loan repayment details are optional. Contrary to this belief, section 2 of the form asks for specific repayment instructions, including the increase in billing amount per period, which has a minimum requirement.

- Signature requirements are flexible. The form mandates signatures from the insured/annuitant, owner, assignee (if any), and the spouse (if any) to validate the request. This is essential to confirm agreement from all parties.

- Submitting the form is only through mail. This misconception overlooks the possibility of faxing the completed form to a specified fax number, offering a faster means of submission.

- Automatic Premium Loan (APL) is a standard feature. It is not automatically included; one must specifically elect to add the APL option to their policy using this form. It is an important feature that prevents a policy from lapsing by automatically applying for a loan to cover premiums when necessary.

It is crucial to read and understand all sections of the Loan Request Repayment form thoroughly to ensure accurate and complete submissions. This not only speeds up the process but also ensures compliance with the insurance company’s requirements.

Key takeaways

Filling out and using the Loan Request Repayment form is a crucial step for policyholders who need to either request a loan against their life insurance policy or repay an existing one. Understanding the details and implications can help ensure that you're making informed decisions about your financial future. Here are some key takeaways:

- Complete all necessary information accurately: It's essential to fill out every section of the form with accurate and up-to-date information. This includes policy/certificate numbers, the insured/annuitant and owner's names, contact details, and your preference for loan request or repayment details. A mistake here could delay processing.

- Understand your loan options: The form provides various options for loans, such as a cash loan, a loan for accumulated interest only (specific to single premium universal life policies), a loan for the largest amount available, or a loan to pay premiums. Understanding each option's implications on your policy's cash value and death benefit is crucial.

- Automatic Premium Loan (APL) option: Adding the APL option can prevent your policy from lapsing if you forget to pay premiums. However, it increases the loan amount against your policy, potentially eroding the policy's value over time if not carefully managed.

- Specify loan repayment amounts: When setting up repayment, you're required to increase your regular billing amount by a minimum of $10.00. This approach helps in systematically reducing the loan balance, but it's important to consider how the increased payment fits into your budget.

- Signatures are crucial: The form requires signatures from the insured/annuitant, the owner (if different), any assignees, and potentially the spouse. Each signature verifies consent and understanding of the loan request or repayment's terms and conditions. Without these signatures, the form may not be processed.

It's also helpful to note the importance of consulting with a financial advisor or the insurance company's representative before taking out a loan against your life insurance policy. They can provide guidance tailored to your specific situation, helping you navigate the potential benefits and risks. Remember that while life insurance loans offer flexible, tax-advantaged access to cash, they also carry implications for your policy's benefits and your beneficiaries.

Popular PDF Documents

IRS 4506T-EZ - This form is particularly helpful for individuals who have misplaced their tax return documents and need a quick way to access their tax information.

How to Print 2022 Tax Forms - Form 433-D can be a significant step towards financial stability and peace of mind for taxpayers facing significant tax dues.

How Does Financing a Boat Work - Liabilities section delves into details like notes payable and loans against real estate, ensuring full financial disclosure.