Get Loan Payoff Request Form

When the time comes to settle the balance on a mortgage, understanding and utilizing a Loan Payoff Request form correctly is crucial for a smooth process. This special form is your key to formally asking your mortgage servicer, such as Seneca Mortgage Servicing LLC, for the precise amount needed to pay off your loan. It clearly lays out the necessary steps for borrowers or authorized representatives to request a payoff statement, whether it’s for themselves or on behalf of someone else. The form is divided into two main sections: one for borrowers requesting their own payoff information, and another for those authorizing a third party to receive this information. Completing the form requires providing detailed contact information, deciding on the preferred method of receiving the payoff statement, and specifying the reason for the payoff. Seneca Mortgage Servicing has put in place specific guidelines to ensure the security and accuracy of this sensitive transaction, such as not providing payoff figures over the phone and only accepting bank checks, money orders, or certified checks for payment. Also, the form highlights the importance of accuracy in the provided contact details to prevent delays or issues in receiving the payoff statement. This introduction to the Loan Payoff Request form emphasizes its vital role in the final steps of mortgage management, ensuring that all parties are informed and aligned in the payoff process.

Loan Payoff Request Example

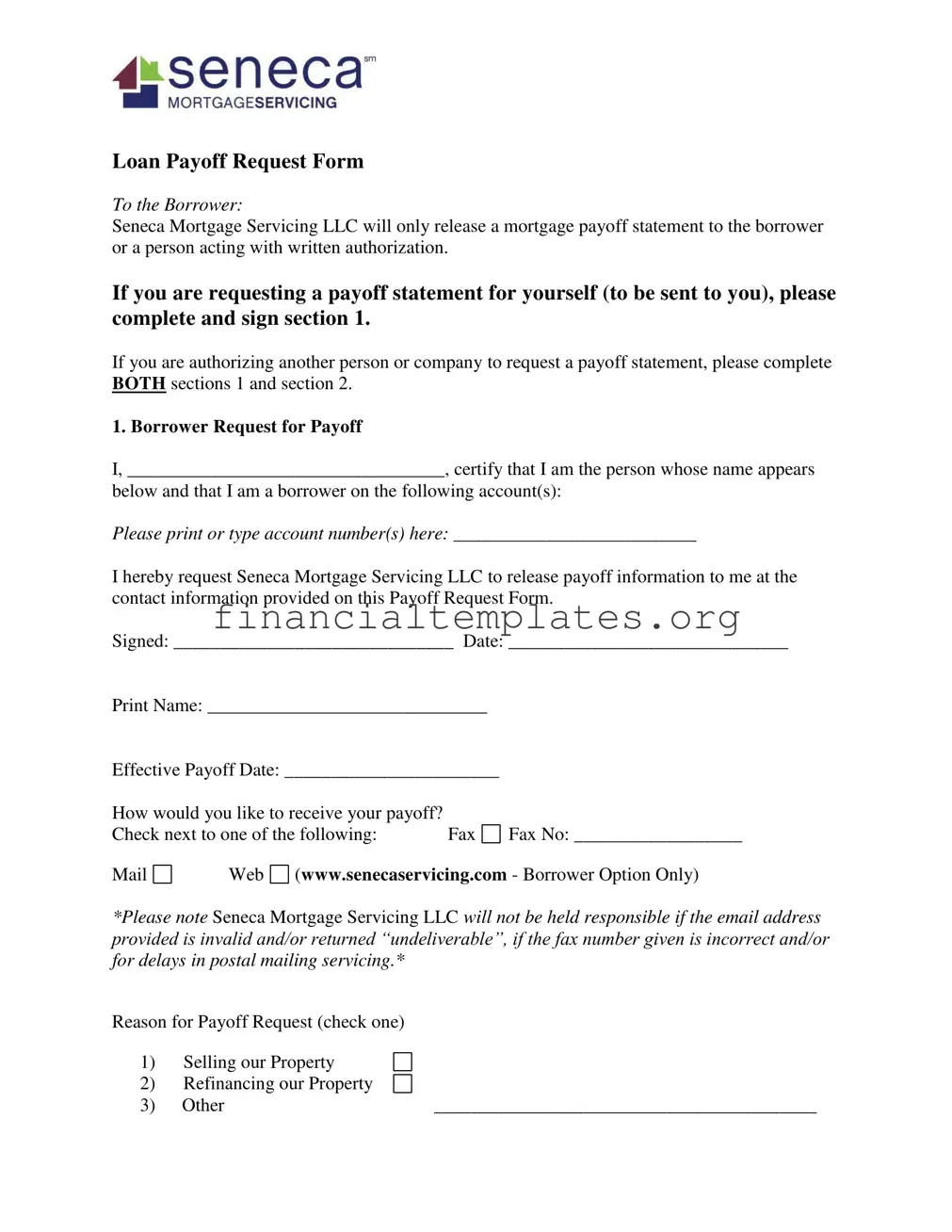

Loan Payoff Request Form

To the Borrower:

Seneca Mortgage Servicing LLC will only release a mortgage payoff statement to the borrower or a person acting with written authorization.

If you are requesting a payoff statement for yourself (to be sent to you), please complete and sign section 1.

If you are authorizing another person or company to request a payoff statement, please complete BOTH sections 1 and section 2.

1. Borrower Request for Payoff

I, __________________________________, certify that I am the person whose name appears

below and that I am a borrower on the following account(s):

Please print or type account number(s) here: __________________________

I hereby request Seneca Mortgage Servicing LLC to release payoff information to me at the contact information provided on this Payoff Request Form.

Signed: ______________________________ Date: ______________________________

Print Name: ______________________________ |

|

|

Effective Payoff Date: _______________________ |

|

|

How would you like to receive your payoff? |

|

|

Check next to one of the following: |

Fax |

Fax No: __________________ |

Web

(www.senecaservicing.com - Borrower Option Only)

*Please note Seneca Mortgage Servicing LLC will not be held responsible if the email address provided is invalid and/or returned “undeliverable”, if the fax number given is incorrect and/or

for delays in postal mailing servicing.*

Reason for Payoff Request (check one)

1) |

Selling our Property |

|

2) |

Refinancing our Property |

|

3) |

Other |

_________________________________________ |

1.I understand that the payoff statement will be sent within 2 business days of my completed request. Requests received after 4:00 p.m. are considered received on the following business day.

2.No payoff figures can be given via telephone.

3.Acceptable forms of payments are Bank Check, Money Order, or Certified Check. (No personal checks)

2. Borrower Authorization to release payoff to Third Party

I, __________________________________, certify that I am a borrower on the following

account(s):

Please print or type account number(s) here: ______________________________________

I hereby authorize the following person(s) and/or company to obtain a payoff statement for any of the above accounts:

Please print or type name(s) of authorized person(s) here:

________________________________________________________________________

I authorize Seneca Mortgage Servicing LLC to release said information at the contact information on this Payoff Request Form. This authorization will remain in effect for 30 days. I understand that I may revoke this authorization at any time before the payoff information is disclosed, in writing, by mail, fax or

Signed: ______________________________ Date: ______________________________

Print Name: ______________________________

Please send completed loan payoff form to one of the following:

Email: payoffs@senecaservicing.com

US Postal Service:

Seneca Mortgage Servicing LLC

ATTN: Payoffs

611 Jamison Road

Elma, NY 14059

Fax: (516)

Document Specifics

| Fact | Description |

|---|---|

| Form Purpose | Used to request a mortgage payoff statement from Seneca Mortgage Servicing LLC. |

| Authorization Requirement | Only the borrower or a person with written authorization can request a payoff statement. |

| Sections to Complete | Borrowers must complete section 1 for personal requests, and both sections 1 and 2 for third-party requests. |

| Request Processing Time | Payoff statements are sent within 2 business days of receiving a completed request, with requests after 4:00 p.m. considered on the next day. |

| Mode of Payoff Request | Options include Fax, Mail, or Web, with limitations and responsibilities stated for incorrect contact information or delivery delays. |

| Reason for Payoff | Borrowers must specify the reason, such as selling or refinancing the property, or another specified reason. |

| Payment Acceptance | Accepts Bank Check, Money Order, or Certified Check for payoff, expressly forbidding personal checks. |

| Authorization Validity Period | Third-party authorization to request payoff information is valid for 30 days. |

| Revocation of Authorization | Borrowers can revoke authorization to release information at any time before disclosure via written notice. |

| Liability Waiver | Borrowers agree to indemnify and hold harmless Seneca Mortgage Servicing LLC from liability stemming from providing payoff information. |

Guide to Writing Loan Payoff Request

When you're ready to find out the balance required to completely pay off your loan, filling out a Loan Payoff Request Form is the necessary first step. This form communicates your request to your lender, prompting them to provide a detailed statement of your payoff amount. The information you provide ensures that the statement is sent to you or a designated third party, according to your instruction. The steps below guide you through filling out this form correctly, ensuring a smooth process.

- Start by carefully reading the instructions at the top of the form to understand whether you're requesting the payoff statement for yourself or if you're authorizing another party to receive this information.

- If you're filling the form out for yourself, proceed to section 1 titled "Borrower Request for Payoff."

- In the space provided, print your full name as it appears on your account(s).

- Enter your account number(s) in the designated space. Ensure this information is accurate to avoid any delays in processing your request.

- Provide your contact information clearly, including any fax number or email address, if you choose to receive your payoff statement through fax or web.

- Sign and date the form in the allocated spaces at the bottom of section 1.

- If you would like someone else to obtain your payoff information, you must also complete section 2 titled "Borrower Authorization to release payoff to Third Party."

- Repeat the process of entering your name and account number(s).

- Under the authorization section, print the name(s) of the person(s) or company you're authorizing to request your payoff statement.

- Sign and date the form at the bottom of section 2 to confirm your authorization.

- Choose how you'd like the recipient to receive the payoff statement: via fax, mail, or web. Check the appropriate option and provide the necessary contact information.

- Indicate the reason for your payoff request by selecting one of the provided choices or specifying another reason in the space provided.

- Review your form for any errors or omissions to ensure accurate processing of your request.

- Send the completed form to Seneca Mortgage Servicing LLC through one of the provided contact methods: email, US Postal Service, or fax.

After you've submitted the form, expect to receive your loan payoff statement within two business days, provided your request was received before 4:00 p.m. Remember, the faster you submit your form accurately, the quicker you'll receive your payoff information. This step is crucial for planning your next move, whether it's selling your property, refinancing, or simply closing your account.

Understanding Loan Payoff Request

Frequently Asked Questions about the Loan Payoff Request Form

Who can request a mortgage payoff statement?

Only the borrower or a person with written authorization from the borrower can request a mortgage payoff statement from Seneca Mortgage Servicing LLC. If the borrower wishes to obtain the statement themselves, they should complete and sign section 1 of the form. If they're authorizing someone else, both sections 1 and 2 must be completed and signed.How can I submit the Loan Payoff Request form?

The completed loan payoff request form can be submitted via email, US Postal Service, or fax. Send it to payoffs@senecaservicing.com, Seneca Mortgage Servicing LLC, ATTN: Payoffs, 611 Jamison Road, Elma, NY 14059, or fax it to (516) 506-4335, respectively.What methods are available to receive the payoff statement?

You can receive your payoff statement via fax, mail, or web. However, it's important to note that Seneca Mortgage Servicing LLC is not responsible for any issues such as invalid or undeliverable email addresses, incorrect fax numbers, or delays caused by postal services.When will I receive my payoff statement?

The payoff statement will be sent within 2 business days after your completed request has been received. Keep in mind that requests submitted after 4:00 p.m. will be considered received on the next business day.Can I get payoff figures over the phone?

No, payoff figures cannot be provided over the telephone. All requests for payoff statements must be submitted through the Loan Payoff Request Form and received via the previously mentioned methods.What are the accepted forms of payment?

Acceptable forms of payment for the payoff include Bank Check, Money Order, or Certified Check. Personal checks are not accepted.

Common mistakes

Filling out a Loan Payoff Request form is an essential step in paying off your mortgage, but it’s a task where small errors can lead to delays or difficulties in processing. Here are four common mistakes people make when completing the Loan Payoff Request form:

Not completing both required sections for third-party authorization: The form requires borrowers who want a third party to receive the payoff statement to fill out both sections 1 and 2. An oversight here can prevent the third party from obtaining the necessary information, which might be crucial if you’re working with a real estate agent or a financial advisor to sell or refinance your property.

Incorrect contact information: It’s crucial to provide accurate contact information. The service provider has clearly stated they are not responsible for undeliverable emails or incorrect fax numbers. Any mistake in this information could lead to delays in receiving your loan payoff information, or worse, it might not reach you at all.

Forgetting to specify the preferred method for receiving the payoff: Different people have different preferences when it comes to receiving important documents. The form provides options for receiving the payoff information via fax, mail, or web. Forgetting to indicate your preference might result in receiving the information in a format that’s less convenient for you, or it might slow down the process entirely.

Leaving the reason for the payoff request blank: Although it might seem like a minor detail, the reason for your request can provide essential context for the processing of the form. Whether you’re selling the property, refinancing, or have another reason, this information helps the servicing company understand your needs better, which can streamline the process.

In conclusion, when filling out a Loan Payoff Request form, attention to detail is paramount. Making sure that all sections are correctly filled out, providing accurate and clear contact information, indicating how you wish to receive your payoff information, and stating the reason for your request are critical steps for a smooth process. Avoiding these common mistakes can save you time and ensure that you receive your payoff information promptly and in the manner you prefer.

Documents used along the form

When managing a mortgage or loan, a Loan Payoff Request Form is a crucial document that sets the stage for finalizing your loan responsibilities. However, settling a loan typically involves more than just this single form. Understanding the other documents often needed can streamline the process and prevent possible delays. Let's explore some of the commonly required forms and documents that accompany a Loan Payoff Request Form.

- Authorization for Release of Information: This document allows the lender to share your loan information with third parties, such as your legal or financial advisor. It's particularly useful if someone else is handling the payoff process on your behalf.

- Final Truth in Lending Disclosure: This form summarizes the final details of your loan, including the actual amount paid over the life of the loan versus the amount initially disclosed. It's essential for ensuring that all loan terms were honored.

- Mortgage Release or Satisfaction of Mortgage Document: Once your loan is paid off, this document from your lender officially releases the lien on your property. It's a critical document for clearing the title to your home.

- HUD-1 Settlement Statement: If you're settling your loan as part of a real estate transaction, this document itemizes all charges and credits to both buyer and seller. It's essential for confirming that the payoff amount has been correctly applied.

- Good Faith Estimate: Although typically provided at the beginning of a loan application, reviewing your Good Faith Estimate can help you verify that all expected charges and fees were correctly applied at payoff.

In conclusion, navigating the end of a loan agreement requires attention to detail and an understanding of various forms and documents. Alongside the Loan Payoff Request Form, items such as an Authorization for Release of Information, Final Truth in Lending Disclosure, Mortgage Release or Satisfaction of Mortgage Document, HUD-1 Settlement Statement, and Good Faith Estimate play vital roles. These documents ensure that all aspects of the loan payoff are transparent and accounted for, leading to a smoother transition out of debt. Remember, proper preparation and organization of these documents can significantly aid in finalizing your loan payoff process efficiently.

Similar forms

The Loan Application Form shares a strong resemblance with the Loan Payoff Request Form, particularly in how they both initiate a process regarding the status of a loan. The Loan Application Form collects comprehensive information from a prospective borrower to determine if they are eligible for a loan. Similarly, the Loan Payoff Request Form is used by an existing borrower who wishes to find out the amount needed to fully repay their loan. Both require personal and financial information from the requester and often necessitate consent for information sharing and verification purposes.

The Mortgage Statement is another document akin to the Loan Payoff Request Form, as both provide crucial financial information regarding a loan. A Mortgage Statement outlines the current status of a mortgage loan, showing the remaining balance, interest rate, and payment history. Conversely, the Loan Payoff Request Form is used when a borrower wants to know the exact amount needed to completely settle their mortgage, often in preparation for selling the property, refinancing, or simply paying off the loan early.

The Authorization to Release Information Form is closely related to the section of the Loan Payoff Request Form that allows a borrower to authorize a third party to request payoff information. This shared aspect underlines the control borrowers have over their personal and financial information, ensuring that such data can only be released with explicit, written consent. Both documents facilitate the sharing of sensitive information in a controlled and secure manner, adhering to privacy regulations and individual rights.

Comparable to the Loan Payoff Request Form, the Refinance Application Form is central to the process of adjusting the terms of an existing loan. It's used when a borrower wishes to change their loan's interest rate, term, or borrow additional funds against their equity. The Loan Payoff Request Form often precedes this, providing a clear picture of the loan's current standing, which is essential for making informed decisions about refinancing. Both are pivotal in managing and planning one's financial commitments and goals.

A Debt Settlement Agreement Form parallels the Loan Payoff Request Form in its focus on resolving or altering the terms of an existing financial obligation. While the Debt Settlement Agreement Form is generally used to negotiate lower payoff amounts for debts, the Loan Payoff Request Form gives borrowers the necessary details to fully pay off a loan, potentially ceasing the interest accrual and improving financial status. Each serves as a step towards financial resolution, whether through adjustment or fulfillment of existing commitments.

Finally, the Change of Address Form, while primarily administrative, shares a similarity with the specific instruction on the Loan Payoff Request Form regarding how the payoff information can be received. Both forms manage the logistics of information delivery, ensuring that sensitive documents reach the correct party securely. Whether changing where all account communication is sent or specifying delivery methods for payoff information, each document is essential for maintaining the flow of accurate and timely information.

Dos and Don'ts

When completing the Loan Payoff Request Form, it is crucial to follow specific dos and don'ts to ensure that the process is completed accurately and efficiently. Understanding these key points can help prevent any unnecessary complications or delays.

Things You Should Do:

- Verify your information: Ensure that the name and account number(s) provided match precisely with what is on record with Seneca Mortgage Servicing LLC.

- Complete all required sections: If you're requesting the statement for yourself, fill out section 1. For authorization to a third party, both sections 1 and 2 must be completed.

- Choose a method of receipt: Clearly indicate whether you prefer to receive the payoff information via fax, mail, or web, and provide the correct contact information or address.

- Specify the reason for the request: Check the appropriate box indicating whether the property is being sold, refinanced, or other and provide details if necessary.

- Sign and date the form: Your signature confirms your request and authorization for the release of information.

- Review for accuracy: Before submitting the form, double-check all the information for accuracy to ensure there are no delays.

- Choose a secure submission method: Decide whether to email, fax, or mail the form based on convenience and security considerations.

Things You Shouldn't Do:

- Leave sections incomplete: Omitting information can lead to significant delays or refusal of the request.

- Submit without reviewing: Errors or discrepancies in the form can complicate the request process.

- Provide incorrect contact information: This could result in the payoff statement being undeliverable or sent to the wrong address.

- Use personal checks for payment: Acceptable forms of payment include Bank Check, Money Order, or Certified Check only.

- Expect immediate results: Understand that it takes up to 2 business days for the request to be processed.

- Attempt to obtain payoff figures via telephone: This form is required for such requests, as no information will be given by phone.

- Forget to specify the effective payoff date: This information is crucial for processing the request accurately.

Adhering to these guidelines can smooth the process of requesting a loan payoff statement from Seneca Mortgage Servicing LLC, ensuring that you receive the needed information promptly and correctly.

Misconceptions

Understanding the Loan Payoff Request form can seem straightforward at first glance, but there are common misconceptions that borrowers might have. Clarifying these can help you navigate the process more smoothly.

Misconception 1: Any communication method will suffice for a request. One might think that a simple phone call or an informal email is enough to request a mortgage payoff statement. However, the Loan Payoff Request Form specifically requires a formal submission through either email, fax, or postal service, following the completion of the designated form, to ensure proper handling and confidentiality.

Misconception 2: Payoff information can be obtained immediately over the phone. It may seem efficient to just call and receive your payoff figures instantly. However, the form explicitly states that no payoff figures can be given via telephone to maintain privacy and accuracy. Instead, the information will be sent within two business days of the completed request.

Misconception 3: Personal checks are an acceptable form of payment. While it might be convenient to use a personal check to make the payoff, Seneca Mortgage Servicing LLC only accepts Bank Checks, Money Orders, or Certified Checks. This policy helps prevent fraud and ensures the reliability of the funds.

Misconception 4: Payoff statements can be authorized verbally. Given the significance of the information and the potential for fraud, the form requires written authorization to release a mortgage payoff statement to a third party. This process involves completing the form's second section and not merely giving verbal consent.

Misconception 5: The authorization for a third party to receive the payoff statement is indefinite. The form specifies that the authorization to release information to a third party remains in effect for only 30 days. This limitation safeguards the borrower's information and ensures the authorization is genuinely representative of the borrower's current wishes.

Misconception 6: The borrower is not responsible if the information is sent to the wrong place. It is the borrower's responsibility to ensure that the contact information provided for receiving the payoff statement is correct. The form notes that Seneca Mortgage Servicing LLC will not be held responsible if the provided email address is invalid, the fax number is incorrect, or there are postal delays.

Addressing these misconceptions can help borrowers better understand the process of requesting a loan payoff, ensuring smoother transactions with mortgage servicing entities.

Key takeaways

When handling a Loan Payoff Request Form, individuals should be aware of several crucial points to ensure a smooth and efficient process. Understanding these key aspects will help borrowers and authorized third parties effectively manage their interactions with Seneca Mortgage Servicing LLC regarding the release of mortgage payoff statements.

Firstly, it is important to know who can request a payoff statement. Seneca Mortgage Servicing LLC stipulates that only the borrower or a person with written authorization from the borrower can request a mortgage payoff statement. This policy guarantees that sensitive financial information is safeguarded and shared only with authorized individuals.

Next, the form requires completion and signing of specific sections based on who is requesting the payoff statement. If the borrower is requesting the statement for themselves, completing and signing section 1 is necessary. However, if the borrower wishes for a third party to receive this information, both sections 1 and 2 must be completed and signed, ensuring proper authorization is granted.

- Accuracy in providing contact information is crucial. Borrowers have the option of receiving the payoff statement via fax, mail, or web. Nevertheless, it is emphasized that Seneca Mortgage Servicing LLC is not liable for any issues arising from incorrect or undeliverable contact details provided by the requester.

- Requests are processed timely, with the understanding that payoff statements will be sent within two business days from the receipt of a completed request. This prompt service facilitates planning and decision-making for the borrower.

- It is made clear that no payoff figures will be communicated over the phone, ensuring that all financial information is exchanged through secure and verifiable means.

- Regarding payment, only specific forms such as Bank Check, Money Order, or Certified Check are acceptable; personal checks are not permitted. This policy ensures that transactions are conducted securely and without risk of payment issues.

The process for authorizing a third party to receive payoff information is detailed, requiring the borrower's consent and identification of the authorized individual(s) or company. This step is significant for borrowers who prefer or need someone else to handle their mortgage matters on their behalf.

Lastly, it's critical to understand that this authorization to release information is valid for 30 days, offering a sufficient window for the third party to act. The borrower also retains the right to revoke this authorization at any time before the information is disclosed by communicating in writing. This provision protects the borrower's control over their financial information.

In summary, when submitting a Loan Payoff Request Form to Seneca Mortgage Servicing LLC, attention to detail, understanding of the authorization process, and compliance with the prescribed methods of communication are essential. By adhering to these guidelines, borrowers and authorized third parties can navigate the payoff process effectively.

Popular PDF Documents

IRS 5498 - IRA custodians also report the year's contributions to Coverdell education savings accounts (ESAs) on this form.

8879-f - Form 8879-EO keeps the e-filing process secure by requiring officer verification and PIN selection for the signature.

Investment Income Tax Rate - Estates and trusts with investment income over certain thresholds will also need to navigate Form 8960 for tax purposes.