Get Loan Payoff Letter Request Form

In the journey of financial management, clearing a loan stands as a significant milestone, often necessitated by the formal process of requesting a loan payoff letter. This vital document, essential for a clear transition, is sought through a particular form known as the Loan Payoff Letter Request form. Encompassing key details such as the date, recipient's contact information, loan number, borrower's name, program number, property address, and an identification number, this form serves as the borrower’s authorization for the loan servicer to prepare and issue a payoff statement. The request delineates a need for a statement that includes a per diem amount valid up to a specified effective date, clearly indicating the comprehensive financial obligations as of that date. Depending on the timing, the form might necessitate the attachment of a Loan Payoff Calculation Worksheet, especially if the request precedes the end of a fiscal or compliance period. Concomitantly, the form emphasizes prompt communication through email, recognizing the essence of timeliness in financial resolutions. By facilitating this process, the form acts as a bridge between borrowers and lenders, aiming to simplify the transition towards loan fulfillment while ensuring all parties are well-informed of the necessary steps and financial details involved.

Loan Payoff Letter Request Example

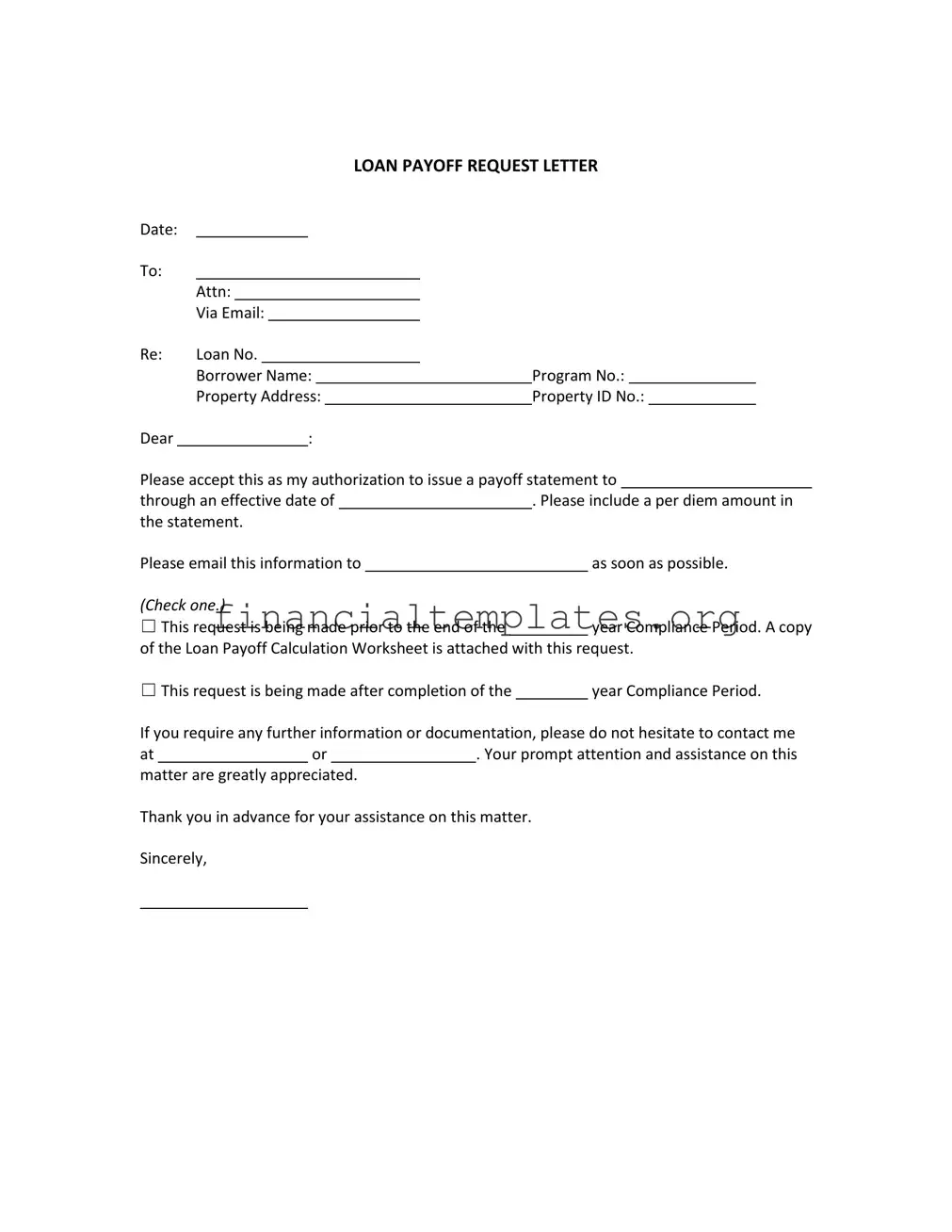

LOAN PAYOFF REQUEST LETTER

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

To: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attn: |

|

|

|

|

|

|

||||

|

|

Via Email: |

|

|

|

|

|

|

||||

Re: |

Loan No. |

|

|

|

|

|

|

|||||

|

|

Borrower Name: |

|

|

|

Program No.: |

|

|||||

|

|

Property Address: |

|

|

Property ID No.: |

|||||||

Dear |

|

|

: |

|

|

|

|

|

|

|||

Please accept this as my authorization to issue a payoff statement to

through an effective date of. Please include a per diem amount in the statement.

Please email this information to |

|

as soon as possible. |

(Check one.)

☐ This request is being made prior to the end of the year Compliance Period. A copy of the Loan Payoff Calculation Worksheet is attached with this request.

☐ This request is being made after completion of the |

|

year Compliance Period. |

If you require any further information or documentation, please do not hesitate to contact me

ator. Your prompt attention and assistance on this matter are greatly appreciated.

Thank you in advance for your assistance on this matter.

Sincerely,

Document Specifics

| Fact | Detail |

|---|---|

| Form Purpose | This form is used to request a statement of the amount required to pay off a loan. |

| Authorization | The form serves as authorization for the loan servicer to issue a payoff statement. |

| Statement Recipient | The payoff statement is to be issued to a specified party, as requested by the borrower. |

| Per Diem Amount | The request asks for the inclusion of a per diem amount in the payoff statement. |

| Method of Delivery | The form specifies that the payoff statement should be delivered via email. |

| Compliance Period Consideration | The request indicates whether it is made before or after the completion of the year Compliance Period. |

| Attachment | Depending on the timing of the request, a Loan Payoff Calculation Worksheet might be attached. |

| Additional Information | The form offers the loan servicer the ability to request further information or documentation if needed. |

| Governing Laws | The form does not specify particular governing laws, as these may vary depending on the state. |

| Urgency of Request | The form emphasizes the importance of prompt attention and assistance from the loan servicer. |

Guide to Writing Loan Payoff Letter Request

When preparing to request a loan payoff letter, the form you'll be filling out is vital for obtaining clear details regarding the outstanding amount on your loan, including any per diem interest charges. This document is crucial for individuals planning to pay off their loan in full, ensuring all necessary financial adjustments are made accurately. It prompts the lender to provide a statement that breaks down the remaining balance. Here's a straightforward guide to filling out the Loan Payoff Letter Request form efficiently.

- Start by entering the Date at the top of the form. This should be the current date on which you are filling out the request.

- In the "To:" section, write the name of the lending institution from which you are requesting the payoff letter.

- Fill in the attention line ("Attn:") with the name of the individual or department within the lending institution that handles loan payoff requests, if known.

- Provide the email address ("Via Email:") where the loan payoff letter should ideally be sent, typically your email address or that of an authorized third party.

- Under "Re: Loan No.," indicate your specific loan number associated with your account for easy reference.

- Enter the "Borrower Name:" which is your full name as it appears on the loan agreement.

- Fill in the "Program No.:" if applicable, which could reference a specific lending program under which your loan was issued.

- Provide the "Property Address" associated with the loan, ensuring accuracy for identification purposes.

- Input the "Property ID No.:" if available, which is typically used for identification in certain types of loans, especially those connected to real estate.

- In the main body of the letter, replace the placeholder "Dear :" with the appropriate salutation and name of the recipient, if known.

- Choose one of the checkboxes to indicate whether the request is being made before or after the end of the year Compliance Period. Tick the first box for requests made before the end of the Compliance Period and attach the required Loan Payoff Calculation Worksheet. Select the second box for requests after the Completion.

- End the letter by providing your contact information, including a phone number and/or email address, in the designated spaces for a response or further communication.

- Finally, ensure you sign the form where it says "Sincerely," followed by your name to authenticate the request.

After completing and submitting the Loan Payoff Letter Request form to your lender, your next steps will be to wait for the response. The lender will process your request and prepare a statement outlining the remaining balance on your loan, including any per diem amounts if requested. This statement is crucial for finalizing your loan payoff correctly. Ensure to review this statement carefully upon receipt, verifying all details for accuracy and completeness. Prompt action on any discrepancies will be important for a smooth completion of your loan payoff process.

Understanding Loan Payoff Letter Request

What is a Loan Payoff Letter?

A Loan Payoff Letter, also known as a payoff statement, is a document provided by a lender that gives detailed information about the amount required to fully repay the balance of a loan by a specific date. This letter includes the total amount owed, including any additional fees or interest, to completely clear the loan’s balance.

Why do I need a Loan Payoff Letter Request Form?

A Loan Payoff Letter Request Form is used to formally request the necessary document to understand the total amount you need to pay to settle your loan. This form serves as an authorization from you to the lender, allowing them to prepare and provide you with the accurate payoff information, ensuring there are no misunderstandings regarding your final payment.

What information do I need to provide in the Loan Payoff Letter Request Form?

You will need to supply several pieces of information on the form, including the loan number, your name as the borrower, program number, property address, and property identification number. Additionally, you must specify whom the payoff statement should be issued to, the effective date of the statement, and an email address where the information should be sent. Indicating whether the request is being made before or after the end of the year Compliance Period is also necessary.

What is a per diem amount and why is it included in the statement?

The term "per diem" refers to the daily interest amount on the loan. Including this amount in the payoff statement is crucial as it calculates the interest that accumulates each day until the loan is fully repaid. This ensures that the payoff amount is accurate up to the specified effective date of the payoff.

How do I submit the Loan Payoff Letter Request Form?

After filling out the form with the necessary information, you submit it to the lender’s attention via email, as stated in the form. Ensure all the details are correct and complete to avoid any delays in processing your request.

What does it mean by 'year Compliance Period'?

The "year Compliance Period" refers to a timeframe set by the lender or related to the loan agreement that dictates specific terms or conditions to be met annually. Whether your request is before or after this period can affect the details of your payout, especially concerning any potential additional fees or considerations to be made in your payoff amount.

How long does it take to receive a Loan Payoff Letter after submitting the request?

The time it takes to receive a Loan Payoff Letter can vary depending on the lender’s processing times and the specifics of your loan. It is best to submit the request well in advance of when you need the letter and to contact the lender directly if you require a specific timeframe for its delivery.

Can I request a Loan Payoff Letter if I am not the borrower but have authorization?

Yes, you can request a Loan Payoff Letter on behalf of the borrower if you have their authorization to do so. The form must clearly indicate that you are acting under the borrower’s permission, and you may need to provide additional documentation proving your authorization to make the request.

Common mistakes

When people fill out the Loan Payoff Letter Request form, they often make mistakes that can delay the process or result in inaccurate statements. Understanding these common errors can help individuals ensure their requests are processed smoothly.

Not specifying the effective date: The form requires an effective date for the payoff statement. This date informs the lender of the exact date through which interest and any other charges should be calculated. Failure to specify an effective date can lead to incorrect calculations or delays.

Incomplete borrower information: It is crucial to provide complete and accurate borrower information, including the borrower's name, loan number, and property address. Incomplete or inaccurate information can prevent the lender from properly identifying the account, resulting in processing delays.

Selecting the incorrect compliance period checkbox: The form offers options to indicate whether the request is being made before or after the end of the year Compliance Period. Checking the wrong box, or failing to check one at all, can lead to confusion and potential miscommunication, possibly affecting the calculations in the payoff statement.

Omitting contact information: Providing a return email address and a contact number is vital for any necessary follow-up. Omitting this information can slow down the process significantly, as the lender may have no way to return the requested information or to clarify any uncertainties regarding the request.

Addressing these common mistakes before submitting the Loan Payoff Letter Request can lead to a more efficient and error-free process. This attention to detail ensures that the requestor receives accurate and timely information related to their loan payoff.

Documents used along the form

Completing a loan payoff process involves several key documents besides the Loan Payoff Letter Request form. These documents are crucial in ensuring the loan payoff process is conducted smoothly and efficiently, providing all necessary information for both the lender and borrower. Below is a list and brief description of each document typically required during this process.

- Authorization to Release Information Form: This form grants the lender permission to share the borrower's loan information with third parties, ensuring that privacy regulations are followed.

- Loan Payoff Calculation Worksheet: Often attached to the Loan Payoff Letter Request, this worksheet breaks down the remaining amount due, including any interest, fees, or penalties, to clearly outline what the borrower needs to pay to settle their debt.

- Good Faith Estimate: Although typically provided early in the loan process, a revised version might be used near payoff to give an accurate estimate of closing costs associated with loan payoff transactions.

- Final Truth in Lending Disclosure: This document provides a detailed summary of the loan's terms, including the annual percentage rate (APR), total interest paid, and the total cost of the loan over its lifetime. It is crucial for ensuring the borrower fully understands the financial implications of their loan.

- Mortgage or Deed of Trust: This is the original document that secures the loan with the property. It is necessary to prepare for the release or satisfaction of mortgage upon loan payoff.

- Satisfaction of Mortgage (or Deed of Trust) Document: Filed with the county recorder's office, this document legally removes the lien from the property once the loan is fully paid off.

- HUD-1 Settlement Statement: Required for real estate transactions, including refinances, this form itemizes all transactions made and fees paid during the loan payoff process.

- Escrow Account Statements: If the borrower had an escrow account for taxes and insurance, the latest statements might be required to adjust or refund the remaining balance in the account.

- Loan Statement: The current loan statement shows the outstanding balance, interest rate, and payment history, serving as a reference point for the payoff amount.

- Amortization Schedule: Although not always required, an amortization schedule can help both the lender and borrower understand how the loan payments were applied over time, including how much went toward principal versus interest.

In conclusion, gathering and completing these documents is an essential step in the loan payoff process. Each plays a unique role in providing the necessary information and legal requirements to finalize the payoff, ensuring that the property's title is clear and the borrower is released from their debt obligation. It's important for all parties involved to review and understand these documents to ensure a successful and smooth transition.

Similar forms

A Mortgage Statement Request is notably similar to a Loan Payoff Letter Request in that both forms serve as formal requests for specific financial information concerning real estate transactions. While a Loan Payoff Letter Request focuses on obtaining the exact payoff amount necessary to clear the loan balance, a Mortgage Statement Request seeks a statement detailing the remaining mortgage balance, including interest and any other charges. This similarity underscores their shared goal of providing clarity and transparency regarding the financial status of property-related loans.

A Loan Modification Request Letter shares a foundational objective with the Loan Payoff Letter Request, as both involve formal communication with a lending institution regarding adjustments to the terms of a loan. The Loan Modification Request Letter specifically requests changes to the loan's payment structure, interest rate, or other terms to avoid foreclosure or to make payments more manageable. Like the Loan Payoff Letter, it requires detailed borrower information and a clear statement of the request, reflecting the significant overlap in their procedural approach.

A Debt Settlement Proposal Letter and a Loan Payoff Letter Request are aligned in their purpose of addressing and resolving outstanding financial obligations. The Debt Settlement Proposal Letter outlines a consumer’s offer to a creditor to settle a debt for less than the amount owed, often when the borrower is facing financial hardship. It closely mirrors the payoff request by engaging with financial institutions to negotiate terms that diverge from the original loan agreement, aiming to reach a financially sustainable resolution for the borrower.

Refinance Application Forms bear a resemblance to Loan Payoff Letter Requests in terms of their role in the process of renegotiating loan terms. Where a Loan Payoff Letter seeks the total outstanding amount for the purpose of clearing a loan, a Refinance Application is the first step towards securing a new loan with different terms, often to take advantage of lower interest rates or to consolidate debt. Both documents necessitate detailed financial information and signal a borrower's initiative to modify their loan commitments.

An Early Mortgage Payoff Calculator Input Form mirrors the Loan Payoff Letter Request by providing individuals with crucial information on finalizing their mortgage. While the Loan Payoff Letter formally requests the payoff amount from a lender, the Early Mortgage Payoff Calculator aids borrowers in understanding how additional payments may affect the timeline and total interest paid on their mortgage. This document shares the intent to expedite the path to loan satisfaction, although it serves more as a planning tool rather than an official request to a financial institution.

A Release of Mortgage Form is fundamentally connected to the Loan Payoff Letter Request as it serves as the culminating document in the loan payoff process. After the loan balance is settled as per the payoff letter's details, the Release of Mortgage Form is issued by the lender to officially denote that the borrower is relieved from their mortgage obligations, thus signifying the full repayment of the loan. Both documents play pivotal roles in the transition towards complete ownership of property without the encumbrance of a loan.

Automatic Payment Cancellation Letters are akin to Loan Payoff Letter Requests because they both involve initiating a change regarding how a borrower meets their loan obligations. Specifically, an Automatic Payment Cancellation Letter is used to stop pre-arranged monthly deductions from a borrower’s bank account for loan repayments. It shares a commonality with the Loan Payoff Request in that it alters the ongoing payment process, often as a precursor to the loan being fully paid or refinanced elsewhere.

Dos and Don'ts

When it comes to filling out the Loan Payoff Letter Request form, ensuring accuracy and clarity is key. Here are several do's and don'ts that can help streamline the process, ensuring that your request is processed smoothly and efficiently.

Do's:- Double-check the details: Before submitting the form, verify all provided information, such as the loan number, borrower name, property address, and property ID, to ensure accuracy.

- Specify the effective date: Clearly mention the effective date for which the payoff amount is requested. A specific date aids in obtaining an accurate calculation.

- Include contact information: Provide your current contact information, including an email address and phone number, facilitating prompt communication.

- Check the appropriate box: Mark the correct box indicating whether the request is being made before or after the end of the year Compliance Period, as this affects the processing.

- Attach necessary documents: If your request is made prior to the end of the year Compliance Period, attach the Loan Payoff Calculation Worksheet as required.

- Request a per diem amount: Asking for a per diem amount in your letter will help you understand daily interest charges up to the actual payoff date.

- Follow-up: After submission, if you haven't heard back within a reasonable time frame, follow up to ensure your request was received and is being processed.

- Leave fields blank: Avoid submitting the form with incomplete information. Every detail requested is crucial for the processing of your payoff statement.

- Estimate numbers: Do not guess loan numbers or other critical information. Incorrect details can delay the process or result in inaccurate statements.

- Forget to check the compliance period box: Skipping this step can lead to processing errors. Ensure you mark the correct status relating to the compliance period.

- Ignore the attachment requirement: If you are in the period requiring the Loan Payoff Calculation Worksheet, forgetting this attachment can halt the entire request.

- Use unclear language: Be concise and clear in your communication. Ambiguities in your request can lead to misunderstandings and delays.

- Submit without reviewing: A quick scan for typos, inaccuracies, or omitted details is crucial before sending off the form.

- Delay your request: Time is of the essence, especially when it comes to financial transactions. Avoid procrastination to ensure a timely processing of your request.

Misconceptions

When it comes to understanding the Loan Payoff Letter Request form, there are several misconceptions that can confuse borrowers. Here's a list of ten common ones, demystified:

- It's only necessary if you're selling your property. This isn't true. While a common reason for requesting a payoff letter is when you're preparing to sell, it's also useful if you're refinancing or simply want to pay off your loan early.

- The process is complicated. Actually, the process is quite straightforward. You need to provide key information like your loan number, borrower name, and property details, making sure your request is authorized and clearly stated.

- It takes a long time to get a response. Lenders are typically prompt with their responses, especially if you provide all required information correctly. The time it takes can vary, but it's often quicker than expected.

- You need a lawyer to request it. While having legal assistance can be beneficial for some aspects of property and loan management, you can request a payoff letter on your own without needing a lawyer.

- There's a cost involved. In most cases, requesting a loan payoff letter doesn't involve any extra fees. However, it's always wise to check with your lender as policies can vary.

- Any form of communication will suffice. While some lenders may accept requests in various formats, a specific form or structured letter—like the Loan Payoff Request Letter—is usually required to ensure all necessary information is provided.

- Checking one of the checkboxes is optional. Those checkboxes indicate whether the request is being made before or after the year's Compliance Period end, which is crucial information for your lender. Leaving them unchecked can delay processing.

- Personal information isn't necessary. Actually, details like your contact information are vital. They enable the lender to reach out to you if further information is needed, or to deliver the requested letter.

- It's a one-size-fits-all request. Each request is unique, taking into account factors like the specific property, loan details, and whether the compliance period has ended. Customizing the letter to your situation is necessary.

- It guarantees immediate loan closure. Receiving a payoff letter is a significant step towards closing your loan, but it's part of a process. You'll still need to follow through with the payment and ensure all necessary procedures are completed.

Clearing up these misconceptions can make the process of requesting a loan payoff letter feel less daunting and more manageable. With the right information and preparation, it can be a smooth and straightforward step towards achieving your financial goals.

Key takeaways

Understanding how to correctly fill out and utilize the Loan Payoff Letter Request form is essential for a smooth transaction when paying off your loan. This guidance can assist both individual borrowers and professionals in ensuring they provide the necessary information effectively and accurately.

Start with completing the basic information: The form begins by requesting the date and the lender's details, including the official name, attention line, and email address. This basic information should be accurately filled out to ensure the document reaches the right department or individual.

Loan and borrower details are crucial: Clearly mentioning your loan number, borrower name, program number, property address, and property ID number is critical. These identifiers help the lender to accurately locate your loan account and issue the correct payoff information.

Explicit authorization is necessary: The form serves as a written authorization for the lender to issue a payoff statement to a specified recipient. This formal request is a necessary step in the process to ensure privacy laws and regulations are adhered to.

State the intended payoff date: It's important to specify an effective date for your requested payoff amount. This helps in determining the actual amount needed to completely satisfy the loan by that particular date.

Request for per diem amount: Including a request for a per diem amount in your payoff statement can be very helpful. This daily interest amount allows for adjustment in case the payment date shifts, ensuring you know the exact payoff sum at any given time.

Communication preferences: The form allows you to specify how you prefer to receive the payoff information, with an option to provide an email address. This electronic delivery can speed up the process, saving valuable time.

- Compliance period acknowledgment: The form distinguishes between requests made before or after the end of the year compliance period. Understanding the significance of this compliance period in relation to your loan terms can impact the final payoff calculations.

- Attachment of calculation worksheet: For requests made prior to the end of the compliance period, attaching a Loan Payoff Calculation Worksheet is necessary. This document helps in verifying the accuracy of the payoff amount calculated.

- Open line for additional information: The form provides space for you to include contact information, facilitating further communication if more details or documentation are needed. This ensures any issues can be promptly addressed to prevent delays.

- A courteous close matters: Ending the request with a note of thanks and expressing appreciation for prompt attention and assistance underscores the importance of good communication and may encourage a quicker response.

The Loan Payoff Letter Request form is a key document in the loan payoff process. By understanding how to fill it out properly and what each section means, borrowers can ensure a smoother transaction. It's not just about getting the details right; it's about facilitating clear, efficient communication between all parties involved. Whether you're a first-time borrower or a seasoned professional handling multiple properties, these tips can help guide you through the process with ease.

Popular PDF Documents

Filing Taxes for Deceased Parent - The Privacy Act and Paperwork Reduction Act Notice explain the form's confidentiality and information use.

IRS 8396 - Lower your tax liability by effectively using the mortgage interest credit available through IRS Form 8396.

Cab Bill Format in Word - Structured specifically for passenger convenience, capturing essential travel information when using taxi services.