Get Loan Payment Form

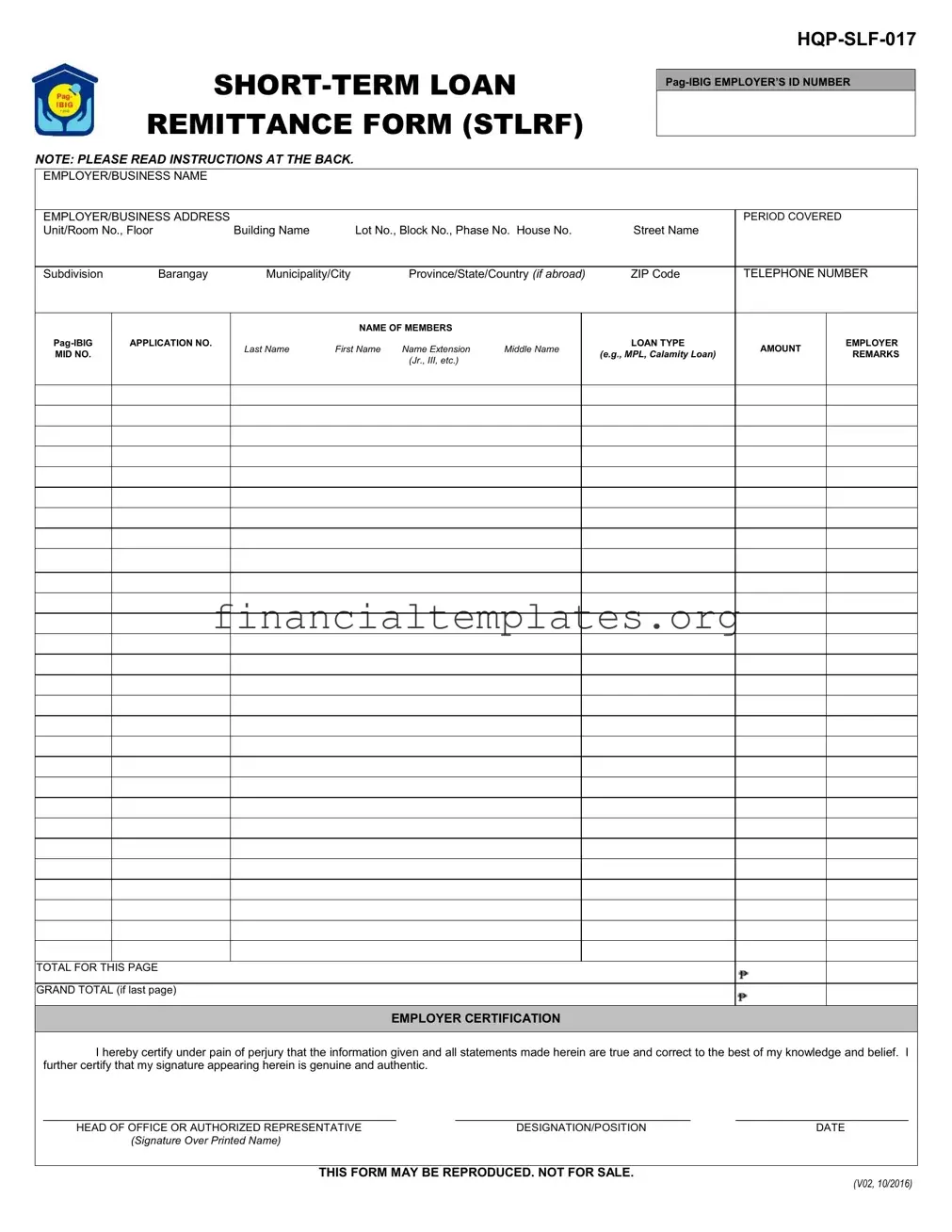

In today's fast-paced economic environment, accurately managing financial transactions is paramount for both employers and employees alike. Among these transactions, the processing of loan payments stands out as a critical operation, particularly for those involved with the Pag-IBIG Fund—a key provider of financial services in the Philippines. The Short-Term Loan Remittance Form (STLRF) HQP-SLF-017 plays a significant role in this process. This form is designed to streamline the remittance of loan payments by employers on behalf of their employees to the Pag-IBIG Fund. It requires detailed information including the employer’s Pag-IBIG ID number, the business name and address, and specific details about the employee borrower such as name, Pag-IBIG Membership Identification (MID) Number, and the loan type and amount. Employers are also tasked with certifying the accuracy of the information provided under penalty of perjury. Additionally, the form contains instructions on its proper completion and submission, emphasizing the need for timely payments and the consequences of failure to remit these contributions. Notably, the form facilitates not just the remittance of payments but also the correction of overpayments through advisories to the Fund, highlighting its role in ensuring accuracy and accountability in financial dealings between employers, employees, and the Pag-IBIG Fund.

Loan Payment Example

REMITTANCE FORM (STLRF)

NOTE: PLEASE READ INSTRUCTIONS AT THE BACK.

EMPLOYER/BUSINESS NAME

EMPLOYER/BUSINESS ADDRESS |

|

|

|

|

|

|

PERIOD COVERED |

|

|

Unit/Room No., Floor |

Building Name |

|

Lot No., Block No., Phase No. House No. |

Street Name |

|

|

|||

|

|

|

|

|

|

|

|||

Subdivision |

Barangay |

Municipality/City |

Province/State/Country (if abroad) |

ZIP Code |

TELEPHONE NUMBER |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF MEMBERS |

|

|

|

|

|

APPLICATION NO. |

Last Name |

First Name Name Extension |

Middle Name |

|

LOAN TYPE |

AMOUNT |

EMPLOYER |

||

MID NO. |

|

|

(e.g., MPL, Calamity Loan) |

REMARKS |

|||||

|

|

|

(Jr., III, etc.) |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL FOR THIS PAGE

GRAND TOTAL (if last page)

EMPLOYER CERTIFICATION

I hereby certify under pain of perjury that the information given and all statements made herein are true and correct to the best of my knowledge and belief. I further certify that my signature appearing herein is genuine and authentic.

___________________________________________________ |

__________________________________ |

_________________________ |

HEAD OF OFFICE OR AUTHORIZED REPRESENTATIVE |

DESIGNATION/POSITION |

DATE |

(Signature Over Printed Name)

THIS FORM MAY BE REPRODUCED. NOT FOR SALE.

(V02, 10/2016)

GUIDELINES AND INSTRUCTIONS

a.Type or print all entries in BLOCK or CAPITAL LETTERS.

b.Accomplish this form in softcopy when making remittances to

c.A separate

d.In case there is a correction in the remittance which resulted to overpayment, the employer shall advise the Fund. Once validated, a Notice of Overpayment and Credit Memo shall be issued to the employer. From the date of issuance of the said Notice, the employer may request, not later than six (6) months for refund of the excess amount or have it applied to the future remittance with the Fund.

e.The total amount to be remitted should be equal to the total amount reflected on the STLRF. Check payments should be made payable to

|

|

|

|

1 |

|

|

|

2 |

|

|

|

|

|

3 |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

5 |

6 |

7 |

8 |

9 |

10 |

11 |

|

|

|

|

12

13

f.Failure or refusal of the Employer to pay or to remit the contributions herein prescribed shall not prejudice the right of the covered employee to the benefits under the Fund. Such Employer shall be charged a penalty equivalent to 1/10 of 1% per day of delay of the amount due starting on the first day immediately following the due date until the date of full settlement.

1

2Employer/Business Name – per DTI/SEC Registration.

Employer/Business Address - indicate Unit/Room No., Floor,

3Building Name or Lot No., Block No., Phase No. or House No. and Street Name, Subdivision, Barangay, Municipality/City, Province, and ZIP Code.

4Period Covered – indicate the applicable month and year of MS remittance in the following format: yyyy/mm.

5Telephone Number – indicate current telephone number.

6

7Application No. – indicate the borrower’s loan application number per type of loan.

8Name of Borrower – indicate borrower’s complete name in the following format: Last Name, First Name, Name Extension (Jr., III, etc.), Middle Name

Loan Type – indicate if payment is intended for

9 Loan (MPL) or Calamity Loan (CL) in the following format: MPL or

CL

10Amount – indicate the amount due as indicated in the latest billing statement

Employer Remarks – accomplish this portion only to report

11changes in the borrower’s employment status and to update any information regarding the borrower. Indicate the appropriate code and effectivity date in the following formate (mm/dd/yy) on the space provided. Please refer to the following codes and examples.

N |

- Newly Hired |

Examples |

||

L |

- Leave Without Pay/AWOL |

1. |

N: |

1/4/2013 |

RS |

- Resigned/Separated |

2. |

L: |

1/21/2013 |

RT |

- Retired |

3. |

RS: 1/3/2013 |

|

D |

- Deceased |

4. |

D: |

1/14/2013 |

O- Others, please specify reason

12Indicate the total amount due per page.

Indicate the grand total of the total amount due if this is the last

13page.

14Employer Certification - to be accomplished and duly signed by the Head of Office/Authorized Representative.

14

Document Specifics

| Fact # | Name | Description |

|---|---|---|

| 1 | Pag-IBIG Employer's ID Number | Unique number assigned to an employer for identification. |

| 2 | Employer/Business Information | Information includes Employer/ Business Name per DTI/SEC Registration and address details. |

| 3 | Period Covered | Specifies the month and year of mandatory savings (MS) remittance. |

| 4 | Telephone Number | Current contact number of the employer/business. |

| 5 | Pag-IBIG MID Number and Application No. | Identification numbers for the borrower including membership and loan application specifics. |

| 6 | Loan Type and Amount | Details about the loan being paid for, including its type (e.g., MPL, Calamity Loan) and the due amount. |

| 7 | Employer Certification | A declaration by the employer confirming the accuracy of the information provided, under penalty of perjury. |

Guide to Writing Loan Payment

Filling out the Short-Term Loan Remittance Form (STLRF) accurately is essential to ensuring that loan payments are processed smoothly and efficiently. This form is a critical document for employers to submit their employee's loan payments to Pag-IBIG Fund. It requires detailed information about the employer, the loan, and the employee making the loan repayment. Once completed, the form should be submitted to Pag-IBIG Fund or any accredited collecting partner, adhering to the set deadlines. Following the steps below will guide you through completing the STLRF form correctly.

- Pag-IBIG Employer’s ID No. - Enter the Pag-IBIG Employer’s ID Number assigned to your company.

- Employer/Business Name – Fill in the official name of your business as registered with DTI/SEC.

- Employer/Business Address - Provide detailed address information including Unit/Room No., Floor, Building Name, Lot No., Block No., Phase No., House No., Street Name, Subdivision, Barangay, Municipality/City, Province, and ZIP Code.

- Period Covered – Specify the month and year of the loan remittance using the format yyyy/mm.

- Telephone Number – Enter the current telephone number of the business or HR department handling the loan remittance.

- Pag-IBIG MID No. – Input the Pag-IBIG Membership Identification (MID) Number of the employee making a loan repayment.

- Application No. – Specify the loan application number for the type of loan being repaid (e.g., MPL, Calamity Loan).

- Name of Borrower – Write the complete name of the employee repaying the loan, including Last Name, First Name, Name Extension (Jr., III, etc.), and Middle Name.

- Loan Type – Indicate the type of loan being repaid, such as MPL or Calamity Loan.

- Amount – Enter the exact amount due as shown in the latest billing statement.

- Employer Remarks – Only complete this section if there are changes to the borrower’s employment status or any updates to their information. Use the provided codes (N for Newly Hired, L for Leave Without Pay/AWOL, RS for Resigned/Separated, RT for Retired, D for Deceased, O for Others) and specify the date in mm/dd/yy format.

- Total for This Page – Indicate the total amount due as calculated on this page.

- Grand Total (if last page) – If this is the last page of your submission, state the grand total of all amounts due.

- Employer Certification – This section must be completed and duly signed by the Head of Office or Authorized Representative, certifying the accuracy and authenticity of the information provided.

After filling out the STLRF, it’s crucial to review all information for accuracy before submission. This ensures that loan payments are credited correctly and helps avoid potential issues or delays. Remember, timely and accurate completion and submission of this form are key components of compliance with Pag-IBIG requirements.

Understanding Loan Payment

-

What is the purpose of the Short-Term Loan Remittance Form (STLRF) HQP-SLF-017?

The Short-Term Loan Remittance Form is specifically designed to facilitate the remittance process of loan repayments to the Pag-IBIG Fund by employers on behalf of their employees who have availed themselves of short-term loans. These loans could be Multi-Purpose Loans (MPL) or Calamity Loans (CL). Employers are required to accurately report and remit the loan payments of their employees to ensure proper credit to each borrower's account.

-

How should the STLRF be filled out?

All entries on the form must be typed or printed in BLOCK or CAPITAL LETTERS for clarity. It's crucial to carefully provide all the requested information, including the Pag-IBIG Employer’s ID Number, the Employer/Business Name as per DTI/SEC Registration, and detailed address information. Additionally, the form requires specific borrower details like the Pag-IBIG MID Number, Application Number, Loan Type, and the Amount due for remittance.

-

What is the deadline for submitting the STLRF?

The form should be submitted to Pag-IBIG Fund or any accredited collecting partner on or before the fifteenth (15th) day of the month. This timely submission ensures that the loan repayments are processed within the necessary timeframe, avoiding any potential penalties for late payments.

-

Is a separate STLRF needed for each loan type or payment method?

Yes, a separate STLRF is required for each type of loan payment (whether cash or check payment) and also if a Credit Memo is to be applied as payment to the Fund. This separation ensures that payments are accurately applied to the correct loan account and type, streamlining the accounting process for both Pag-IBIG and the employer.

-

What happens if there is an overpayment or correction needed for the remittance?

If an overpayment occurs or a correction is needed, the employer must immediately advise the Fund. Once validated, the Fund will issue a Notice of Overpayment and Credit Memo to the employer. The employer then has the option, within six (6) months from the notice, to request a refund of the excess amount or apply it towards future remittances.

-

Are there penalties for failing to remit loan repayments on time?

Employers who fail or refuse to remit the required loan repayments on behalf of their employees by the prescribed due date will face penalties. These penalties are calculated as 1/10 of 1% per day of delay on the amount due, starting from the first day immediately following the due date until the date the full payment is settled.

-

Can the STLRF be reproduced?

Yes, the STLRF may be reproduced as necessary. The form is not for sale and is available for free download or reproduction to ensure that employers have the means to comply with their remittance obligations efficiently. This flexibility assists in maintaining accurate and timely loan repayment processes for the benefit of the employees availing of Pag-IBIG's loan facilities.

Common mistakes

Filling out the form in handwriting rather than typing can lead to legibility issues. The guidelines clearly state that entries should be typed or printed in BLOCK or CAPITAL LETTERS to ensure clarity and prevent processing errors.

Another frequent oversight involves not accurately updating the employer’s details. It's crucial to provide the current Employer/Business Name and Address as registered with DTI/SEC, including the specific details like Unit/Room No., Floor, Building Name, etc., to ensure that the communication between Pag-IBIG and the employer is seamless.

Misreporting or omitting the Period Covered can also lead to complications. This form requires the specific month and year of the remittance in yyyy/mm format, which is paramount for keeping accurate records of payments.

Entering incorrect member identification numbers, such as the Pag-IBIG MID No. or the Application No., is a common issue. These numbers are critical for correctly allocating payments to the corresponding borrower accounts.

A lack of specificity when indicating the Loan Type is another common mistake. It's essential to explicitly state whether the payment is for a Multi-Purpose Loan (MPL) or Calamity Loan (CL) to direct the funds appropriately.

Not properly totaling the amounts due on the form can lead to under or overpayments. Employers must carefully indicate the total amount due per page and the grand total if it's the last page to align with the latest billing statements and ensure accurate remittances.

Failing to update the borrower's employment status accurately under the Employer Remarks section is another oversight. Any changes such as new hires, leave without pay, resignation, or retirement must be properly documented with the respective codes and effective dates to maintain current records.

When filling out the Short-Term Loan Remittance Form (STLRF), individuals often encounter various pitfalls that could complicate their submission process. Being aware of these missteps can significantly streamline the process and ensure accuracy and compliance. Here are seven common mistakes to avoid:

By attentively avoiding these mistakes, individuals can ensure their STLRF submissions are accurate and compliant, facilitating a smoother transaction with the Pag-IBIG Fund and ensuring that all parties have the correct information moving forward.

Documents used along the form

When managing loans, particularly in contexts such as employment and investment, it's quite common to deal with a variety of forms and documents, each serving its own unique purpose alongside the Loan Payment form. These documents collectively ensure a smooth transaction and compliance with legal and operational requirements. Understanding each one can significantly streamline the process for all parties involved.

- Loan Agreement: This foundational document lays out the terms and conditions of the loan. It includes the loan amount, interest rate, repayment schedule, and the rights and responsibilities of both the lender and the borrower. It's essential for clarifying the obligations of each party and serves as a legal point of reference in case of disputes.

- Amortization Schedule: This is a table detailing each payment over the life of the loan. It breaks down how much of each payment goes towards the principal amount and how much goes towards interest. This document is useful for both the borrower and the lender to keep track of payments and outstanding balances.

- Promissory Note: A promissory note is a written promise to pay a specified sum of money to a certain person or entity at a specified time or on demand. It includes the interest rate, repayment schedule, and consequences of default, making it a critical document for enforcing the loan terms.

- Collateral Documents: If the loan is secured, there will be documents describing the collateral (property or assets) used to secure the loan. These could include titles, deeds, appraisals, and other documents proving the lender's legal claim to the collateral in case of default.

- Loan Modification Agreement: If the terms of the original loan agreement change, a loan modification agreement is needed. This document outlines any changes to the loan's terms, such as adjustments to the interest rate, payment schedule, or loan amount. It is crucial for documenting agreed-upon modifications and ensuring both parties are clear on the new terms.

Having these documents in order not only simplifies the loan management process but also protects the interests of all involved parties. By understanding the purpose and importance of each component, individuals and organizations can navigate the complexities of loan transactions with greater ease and security.

Similar forms

The Loan Payment form, at its essence, is similar to a Mortgage Payment Slip. Like the Loan Payment form, a Mortgage Payment Slip serves as a communication tool between the borrower and the lender. It outlines the specifics of the payment due, such as the amount and the period covered. While the Loan Payment form may be used for various types of loans given by an entity like Pag-IBIG Fund, a Mortgage Payment Slip specifically relates to payments for a property loan. Both documents ensure that payments are correctly applied to the appropriate account, providing a clear record of the transaction for both parties.

Another document similar to the Loan Payment form is the Utility Bill Payment Slip. This type of slip, much like the Loan Payment form, includes essential details about the payer, the payment amount, and the specific billing period. While the Loan Payment form is designed for loan repayments, the Utility Bill Payment Slip is used for monthly services like electricity, water, or internet. However, both serve the purpose of facilitating a transaction between two parties, ensuring that the payment is attributed correctly to the payer’s account.

The Tuition Fee Payment Slip shares a resemblance with the Loan Payment form in terms of structure and purpose. It is provided by educational institutions to students or their guardians, detailing the amount due for a specific term or semester. Like the Loan Payment form, it includes necessary identifiers such as the student's name and other pertinent information to ensure that the payment is credited to the right individual. Both forms serve as a proof of payment intention and completion, facilitating a clear record of financial transactions for future reference.

Another analogous document is the Credit Card Payment Slip, which individuals use to make payments towards their credit card bills. Similar to the Loan Payment form, it contains specific payment details, including the account number, the payment amount, and the period the payment covers. While the Loan Payment form is utilized for loan remittances to entities like Pag-IBIG Fund, the Credit Card Payment Slip is directed towards settling credit card debts. Both documents are pivotal for maintaining a good credit standing and ensuring accurate application of payments.

Lastly, the Insurance Premium Payment Slip bears similarities to the Loan Payment form. This document facilitates the payment of insurance premiums, detailing the policy number, the amount due, and the coverage period. Like the Loan Payment form, it is a crucial link between the payer and the receiving institution, ensuring that payments are accurately matched to the proper accounts. Both forms play significant roles in financial management, enabling individuals and businesses to keep track of their obligations and maintain their commitments.

Dos and Don'ts

When filling out the Loan Payment Form, attention to detail and accuracy are paramount. Below are lists of things you should and shouldn't do to ensure the process is completed smoothly and correctly.

Do:

- Use BLOCK or CAPITAL LETTERS for all entries to enhance readability.

- Complete the form in softcopy when making remittances to Pag-IBIG Fund or any accredited collecting partner before the monthly deadline.

- Prepare a separate Short-Term Loan Remittance Form (STLRF) for each type of payment (whether cash or check) and for Credit Memo applications.

- Contact the Fund for corrections resulting in overpayment to obtain a Notice of Overpayment and Credit Memo. This allows for a refund or future remittance application.

- Ensure that the total amount remitted matches the total amount indicated on the STLRF and that check payments are made payable to Pag-IBIG Fund.

Don't:

- Ignore the importance of double-checking the information provided for accuracy and truthfulness.

- Delay remittance beyond the due date, as penalties apply for late submissions (1/10 of 1% per day of the amount due).

- Mistake the Precision required for filling in the borrower's details, including the complete and correct format of names and identification numbers.

- Overlook the necessity to get the Employer Certification section duly signed by the Head of Office or Authorized Representative, verifying the authenticity of information provided.

- Disregard the guidelines for specifying employment status changes or information updates in the Employer Remarks section, using the correct codes and format.

Misconceptions

Misunderstandings can often cloud the interpretation and execution of processes like submitting a Loan Payment Form, particularly when it comes to the Short-Term Loan Remittance Form (STLRF) used by the Pag-IBIG Fund. Let's clarify some common misconceptions to ensure accuracy and compliance.

- Any form will do for loan payment submission. It's essential to use the specific STLRF for loan payments. This form is designed to streamline the submission process and ensure that all necessary details are accounted for accurately.

- Information can be written in any format. The instructions clearly state that all entries should be typed or printed in block or capital letters. This requirement helps prevent misinterpretation of the data due to unclear handwriting or formatting.

- The form allows for late remittances without penalty. Contrary to this belief, there's a stipulated penalty for late payments. The form mentions a penalty equivalent to 1/10 of 1% per day of delay of the amount due starting the day after the due date until full settlement.

- Multiple loan types can be included in one form. A separate STLRF must be accomplished per type of payment (cash or check) and per type of loan. This organizational detail ensures that payments are applied correctly to the intended loan accounts.

- Employers aren't obligated to report overpayments. Actually, if there's a correction resulting in overpayment, employers must advise the Fund. This triggers a process to issue a Notice of Overpayment and Credit Memo, with options for the employer regarding the excess amount.

- Check payments are processed immediately. The form specifies that check payments to Pag-IBIG Fund shall be posted upon clearing, with an exception for National Government Agencies. Understanding the clearing policy is crucial for managing expectations regarding payment processing times.

- An employer's failure to remit doesn't affect an employee's entitlements. While the employee's rights to benefits are protected, the employer faces penalties for non-compliance. This system underscores the importance of timely and accurate remittance by employers.

- Personal information adjustments are unnecessary. It's crucial to update the Borrower's information to reflect changes in employment status accurately. These updates keep records current and prevent potential issues with loan repayment tracking.

- The form can be submitted at any time within the month. Submissions should be made to Pag-IBIG Fund or any accredited collecting partner on or before the 15th day of the month. This deadline is in place to ensure timely processing and allocation of payments.

Clearing up these misconceptions aids both employers and borrowers in navigating the loan remittance process with greater clarity and compliance. Proper adherence to guidelines detailed in the STLRF ensures that all parties fulfill their obligations efficiently, maintaining the integrity of the system for the benefit of the Pag-IBIG Fund members.

Key takeaways

Filling out and using the Short-Term Loan Remittance Form (STLRF) accurately can streamline the process of making loan payments efficiently. Here are key takeaways to ensure the form is correctly completed and submitted:

- Entries must be typed or printed in block or capital letters to ensure clarity and readability.

- The form should be accomplished and submitted, in softcopy if possible, to the Pag-IBIG Fund or any accredited collecting partner by or before the 15th day of every month.

- A separate STLRF must be used for each type of payment (cash or check) and when applying a Credit Memo as payment to the fund.

- If corrections on the remittance lead to overpayment, the employer must inform the fund. Once verified, a Notice of Overpayment and Credit Memo will be issued, which the employer could request for a refund or apply to future remittances within six months from issuance.

- The total amount remitted should match the total amount indicated on the STLRF. For check payments, they should be payable to the Pag-IBIG Fund and are subject to clearing.

- Failure or delay in remitting the loan payments by the employer could result in penalties, calculated as a fraction of the amount due, assessed daily from the day following the due date until full settlement.

- The employer must provide their Pag-IBIG Employer's ID number, business name per DTI/SEC registration, detailed business address, and the applicable month and year of remittance.

- It's important to clearly indicate the borrower's Pag-IBIG Membership Identification (MID) Number, loan application number, complete name, type of loan (MPL or Calamity Loan), and the amount due based on the latest billing statement.

Besides these basic details, the form also requires information on the borrower's employment status and any changes therein, with codes provided for common situations such as newly hired, leave without pay, resignation, retirement, and death among others. All amounts due should be calculated per page and a grand total provided if it's the last page of documentation. Lastly, the Employer Certification section must be filled out and signed by an authorized representative, certifying the truth and accuracy of the information provided.

Popular PDF Documents

K-1 Self Employment Earnings Box 14 C - Partners use this form to adjust the basis of their investment in the partnership, which is crucial for determining gain or loss on disposition.

For Payment - Facilitates a streamlined approach to payment transactions by centrally gathering vendor’s bank details and preferred remittance advice method.

What Is a Transfer Tax - The formal declaration section underscores the signatory’s responsibility towards the accuracy of information provided.