Get Loan Modification Agreement Form

Navigating through the complexities of managing a mortgage can often lead to seeking adjustments, particularly when faced with fluctuating interest rates or financial unpredictability. At the heart of these adjustments lies the Loan Modification Agreement form, a crucial document designed to formally alter the terms of a borrower's loan with their lender. This agreement, typically arising amidst scenarios requiring amendments to interest rates or monthly payment terms, serves as a supplemental bridge to the original mortgage or security deed. It ensures that the borrower's obligations are meticulously redefined under mutual agreement, encompassing changes to the unpaid principal balance, interest rates, and the schedule of repayments. Grounded in the commitment to provide financial breathing space while safeguarding the lender's interests, the agreement delineates modifications to the original terms while preserving the fundamental covenants of the loan and the security instrument. Additionally, it underscores the unchanged persistence of the borrower's liabilities and the lender's rights, indicating a balanced approach toward modifying loan conditions without negating original responsibilities. Through this agreement, both parties engage in a detailed, formalized process ensuring that every adjustment is documented and legally binding, thereby eliminating ambiguities and setting a clear path forward for the repayment of the loan.

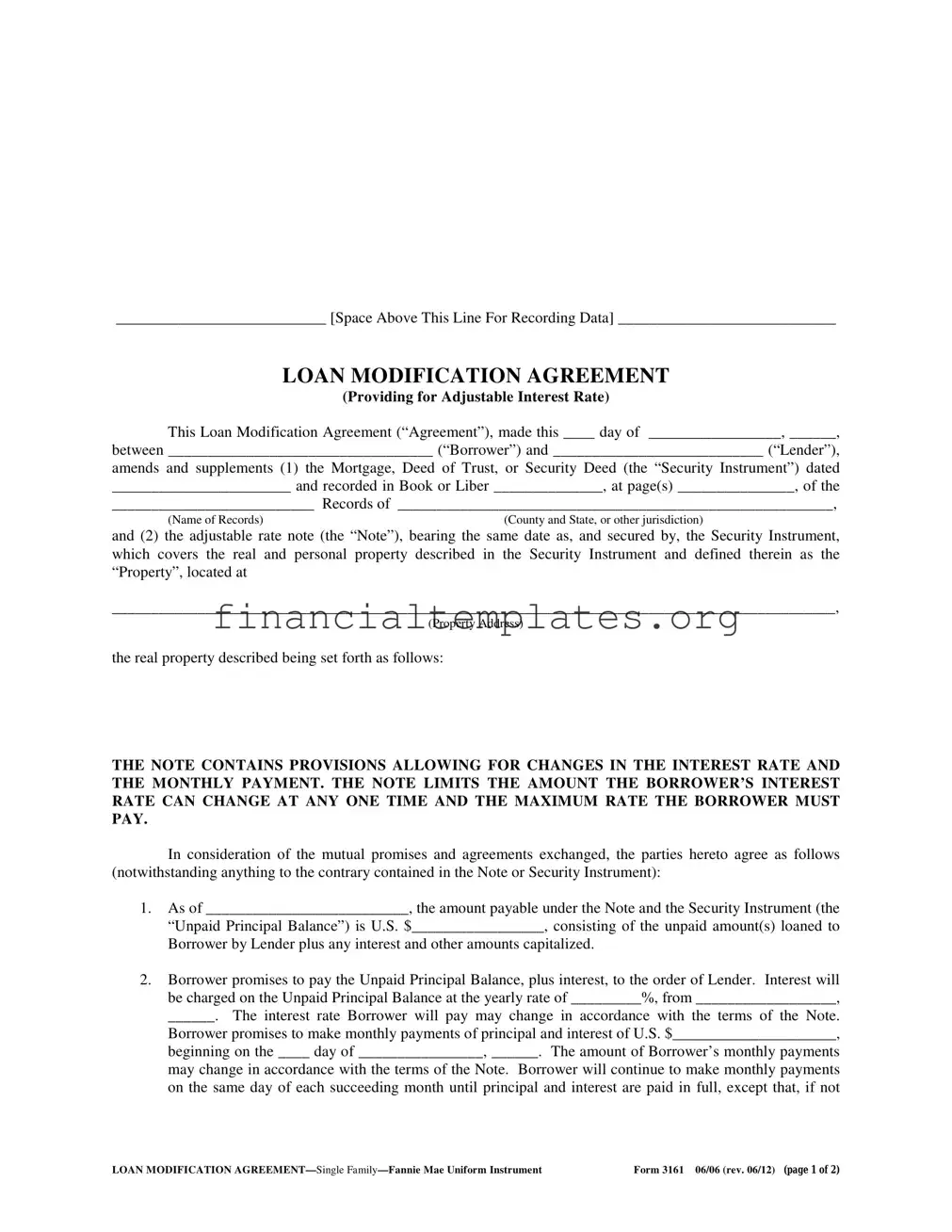

Loan Modification Agreement Example

___________________________ [Space Above This Line For Recording Data] ____________________________

LOAN MODIFICATION AGREEMENT

(Providing for Adjustable Interest Rate)

This Loan Modification Agreement (“Agreement”), made this ____ day of _________________, ______,

between __________________________________ (“Borrower”) and ___________________________ (“Lender”),

amends and supplements (1) the Mortgage, Deed of Trust, or Security Deed (the “Security Instrument”) dated

_______________________ and recorded in Book or Liber ______________, at page(s) _______________, of the

__________________________ Records of ________________________________________________________,

(Name of Records) |

(County and State, or other jurisdiction) |

and (2) the adjustable rate note (the “Note”), bearing the same date as, and secured by, the Security Instrument, which covers the real and personal property described in the Security Instrument and defined therein as the “Property”, located at

_____________________________________________________________________________________________,

(Property Address)

the real property described being set forth as follows:

THE NOTE CONTAINS PROVISIONS ALLOWING FOR CHANGES IN THE INTEREST RATE AND THE MONTHLY PAYMENT. THE NOTE LIMITS THE AMOUNT THE BORROWER’S INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MAXIMUM RATE THE BORROWER MUST PAY.

In consideration of the mutual promises and agreements exchanged, the parties hereto agree as follows (notwithstanding anything to the contrary contained in the Note or Security Instrument):

1.As of __________________________, the amount payable under the Note and the Security Instrument (the “Unpaid Principal Balance”) is U.S. $_________________, consisting of the unpaid amount(s) loaned to Borrower by Lender plus any interest and other amounts capitalized.

2.Borrower promises to pay the Unpaid Principal Balance, plus interest, to the order of Lender. Interest will be charged on the Unpaid Principal Balance at the yearly rate of _________%, from __________________,

______. The interest rate Borrower will pay may change in accordance with the terms of the Note. Borrower promises to make monthly payments of principal and interest of U.S. $_____________________, beginning on the ____ day of ________________, ______. The amount of Borrower’s monthly payments may change in accordance with the terms of the Note. Borrower will continue to make monthly payments on the same day of each succeeding month until principal and interest are paid in full, except that, if not

LOAN MODIFICATION |

Form 3161 06/06 (rev. 06/12) (page 1 of 2) |

sooner paid, the final payment of principal and interest shall be due and payable on the ____ day of

________________, ______, which is the present or extended Maturity Date.

3.If on the Maturity Date, Borrower still owes amounts under the Note and the Security Instrument, as amended by this Agreement, Borrower will pay these amounts in full on the Maturity Date.

4.Borrower understands and agrees that

(a)All the rights and remedies, stipulations, and conditions contained in the Security Instrument relating to default in the making of payments under the Security Instrument shall also apply to default in the making of the modified payments hereunder.

(b)All covenants, agreements, stipulations, and conditions in the Note and Security Instrument shall be and remain in full force and effect, except as herein modified, and none of the Borrower’s obligations or liabilities under the Note and Security Instrument shall be diminished or released by any provisions hereof, nor shall this Agreement in any way impair, diminish, or affect any of Lender’s rights under or remedies on the Note and Security Instrument, whether such rights or remedies arise thereunder or by operation of law. Also, all rights of recourse to which Lender is presently entitled against any property or any other persons in any way obligated for, or liable on, the Note and Security Instrument are expressly reserved by Lender.

(c)Nothing in this Agreement shall be understood or construed to be a satisfaction or release in whole or in part of the Note and Security Instrument.

(d)All costs and expenses incurred by Lender in connection with this Agreement, including recording fees, title examination, and attorney’s fees, shall be paid by the Borrower and shall be secured by the Security Instrument, unless stipulated otherwise by Lender.

(e)Borrower agrees to make and execute such other documents or papers as may be necessary or required to effectuate the terms and conditions of this Agreement which, if approved and accepted by Lender, shall bind and inure to the heirs, executors, administrators, and assigns of the Borrower.

______________________________ (Seal) |

______________________________ (Seal) |

By: ________________________________ |

______________________________ (Seal) |

|

|

____________________________________ |

|

Date of Lender’s Signature |

|

___________________________ [Space Below This Line for Acknowledgements] __________________________

LOAN MODIFICATION |

Form 3161 06/06 (rev. 06/12) (page 2 of 2) |

Document Specifics

| Fact Name | Description |

|---|---|

| Document Type | Loan Modification Agreement |

| Purpose | Amends and supplements the original mortgage or security instrument and note, specifically for adjustable-rate loans. |

| Key Components | Adjustment of interest rate, modification of monthly payment amounts, and extension of maturity date. |

| Parties Involved | Borrower and Lender |

| Scope of Agreement | Modifies the terms of the original loan without constituting a satisfaction or release of the initial mortgage or security deed. |

| Financial Modifications | Includes changes in unpaid principal balance, interest rates, monthly payment amounts, and maturity date. |

| Legal Obligations Maintained | Preserves all rights, remedies, covenants, and conditions from the original loan agreement except as specifically modified. |

| Additional Requirements | Borrower may be required to execute further documents to effectuate the agreement's terms; all costs related to the modification are typically borne by the borrower. |

Guide to Writing Loan Modification Agreement

Completing a Loan Modification Agreement form accurately is crucial for ensuring that the terms of your mortgage loan are properly adjusted. This form serves as a formal agreement between you and your lender, outlining the changes to your loan's terms, including adjustments to the interest rate, monthly payment amount, and other essential loan details. Follow the steps below to fill out the form correctly to avoid any potential issues or delays in modifying your loan.

- Start by filling in the recording data space at the top of the form, if applicable, to ensure the document can be properly recorded in official records.

- In the introductory paragraph, enter the date on which the agreement is made using the format indicated.

- Insert the names of the Borrower and Lender where prompted.

- Fill in the original Mortgage, Deed of Trust, or Security Instrument date, and the location where it was recorded (Book or Liber number, page number(s), and the name and location of the records).

- Provide the address and legal description of the property secured by the original loan in the space provided.

- Next, you need to update the financial terms of the loan:

- Enter the current Unpaid Principal Balance of the loan.

- Specify the new interest rate and the effective date of this new rate.

- Detail the new monthly payment amount and the date the first modified payment is due.

- Indicate the updated or extended Maturity Date of the loan.

- If the borrower will still owe amounts under the loan by the Maturity Date, acknowledge that these amounts will be paid in full on the Maturity Date.

- Confirm understanding and agreement by the Borrower that all previous terms and conditions remain in effect, except as modified by this agreement, including the application of default procedures, the continued force of covenants and agreements, and the preservation of the lender's rights and remedies.

- Note that all costs and expenses related to the agreement, including recording fees, shall be borne by the Borrower, unless otherwise agreed.

- Both parties, the Borrower and Lender, must sign and seal the agreement. Make sure to include the date of the Lender’s signature.

- Leave space below the signature lines for acknowledgements if necessary.

Upon completion, carefully review the form to ensure all information is accurate and reflective of the agreed-upon terms. Both parties should retain copies of the signed agreement for their records. It's advisable to consult with a legal professional or a financial advisor if you have any questions or concerns about the implications of the modifications to your loan.

Understanding Loan Modification Agreement

-

What is a Loan Modification Agreement?

A Loan Modification Agreement is a legal document that changes the terms of an original loan agreement. Specifically, it updates conditions for an adjustable interest rate loan, covering modifications to the interest rate, monthly payment amounts, and the repayment schedule among others. This agreement acts as an amendment to the original mortgage or security instrument and the note secured by the borrower's property.

-

When should a Borrower consider a Loan Modification Agreement?

Borrowers might consider a Loan Modification Agreement when facing financial challenges that make it difficult to meet the current terms of their mortgage payments. It's a viable option if borrowers are seeking changes to their loan's interest rate, payment schedule, or other key terms to avoid foreclosure. It's also sought after for adjusting the loan's terms to more favorable conditions that reflect changes in financial markets or the borrower's personal financial situation.

-

What are the key components of this Loan Modification Agreement?

- Unpaid Principal Balance: The current amount owed by the Borrower, which includes unpaid loan amounts, interest, and capitalized amounts.

- Interest Rate and Payment Changes: Details on how the interest rate is adjusted and its effect on monthly payments.

- Payment Schedule: The modified schedule for monthly payments and the new maturity date if extended.

- Legal and Financial Obligations: The agreement outlines the continuation of obligations under the original note and security instrument, including any default penalties.

- Costs and Expenses: It specifies that costs incurred in connection with the agreement are to be borne by the Borrower.

-

Are there any costs associated with a Loan Modification Agreement?

Yes, borrowers are responsible for covering all costs and expenses related to the Loan Modification Agreement. This includes, but is not limited to, recording fees, title examination fees, and attorney's fees. These costs are also secured by the security instrument, meaning the lender has a lien on the property for these amounts unless otherwise agreed.

-

How does a Loan Modification Agreement impact a borrower's legal and financial obligations?

The agreement modifies the borrower’s payment schedule and possibly the interest rate but maintains all other legal and financial obligations under the original loan agreement. This means that all covenants, agreements, and conditions from the original note and security instrument remain intact except as explicitly modified. Additionally, all rights of recourse available to the lender, against the property or any guarantors of the loan, remain in full effect.

Common mistakes

Not accurately filling in the date and personal details at the beginning of the Loan Modification Agreement, which can lead to processing delays or the agreement being deemed invalid.

Failing to correctly state the Unpaid Principal Balance, including any capitalized interest and other amounts, which could affect the modified terms of the loan.

Omitting or incorrectly entering the new interest rate and monthly payment amount, leading to misunderstandings or incorrect implementation of the modified loan terms.

Skipping sections that require initialing, particularly those acknowledging changes in payment amounts and interest rates, thus not clearly demonstrating agreement with the modifications.

Not providing the required signatures at the end of the document, including those of the borrower(s) and the lender, which are necessary to make the agreement legally binding.

Overlooking the inclusion of necessary additional documents or information required to effectuate the terms and conditions of the Agreement, potentially invalidating the modifications.

Ignoring the requirement to cover all costs and expenses incurred in connection with the Agreement, including recording fees and attorney’s fees, leading to potential disputes or additional liens against the property.

Always double-check the completed form for accuracy and completeness to ensure that all terms are correctly understood and agreed upon.

Review all financial information, including Unpaid Principal Balance and monthly payment amounts, for accuracy.

Ensure all necessary signatures and initials are provided where required.

Documents used along the form

When engaging in the amendment of a loan through a Loan Modification Agreement, several other forms and documents often become necessary to solidify the changes and ensure all legal bases are covered. These documents not only support the modification process but also help in documenting the adjustments made to the original loan agreement. Understanding the purpose and interconnection of these documents can provide a clear framework for both parties involved in the loan modification.

- Hardship Letter: This document is a detailed explanation from the borrower to the lender, outlining the unexpected financial difficulties that have led to the need for a loan modification. It serves as a personal plea for adjusting the loan's terms.

- Financial Statement: Often required by the lender, this detailed form provides a complete overview of the borrower's financial situation. It lists all sources of income, expenses, assets, and liabilities to assess the borrower's ability to meet the modified loan payment terms.

- Proof of Income: These documents, which can include recent pay stubs, tax returns, or profit and loss statements for self-employed individuals, are used to verify the borrower's income as stated in the Financial Statement.

- Authorization Letter for Release of Information: This letter authorizes the lender to verify the borrower's employment and income as part of the loan modification review process.

- Insurance Documents: Borrowers are often required to furnish proof of current property insurance coverage to reassure the lender that the collateral (the property) remains protected against damage or loss.

- Property Appraisal Report: Lenders might request an updated appraisal of the property to ensure that the loan amount does not exceed the current value of the property, which is particularly important if property values have significantly changed.

- Account Statements: Recent account statements for bank accounts, investment accounts, and other financial assets provide the lender with a snapshot of the borrower's financial health and liquidity.

- Government Issued Identification: A copy of a government-issued identification, such as a driver's license or passport, is often required for verification of the borrower's identity as part of the loan modification process.

Each document plays a role in painting a thorough picture of the borrower's situation and the feasibility of the modification request. By requiring a compilation of these forms and documents, lenders can ensure that the modification is in the best interest of both the lender and the borrower, potentially leading to a more sustainable financial arrangement. Understanding these additional requirements can ease the process for borrowers seeking modifications and align expectations for the thoroughness and types of documentation needed to support their requests.

Similar forms

A Refinancing Agreement is closely related to a Loan Modification Agreement in that both are used to alter the terms of an existing loan. While a Loan Modification Agreement typically adjusts the interest rate, payment schedule, or other terms without disbursing additional funds, a Refinancing Agreement involves taking out a new loan to pay off the old one. Both aim to make the loan more manageable for the borrower, but refinancing usually involves a more extensive change, including possibly changing lenders.

A Forbearance Agreement shares similarities with a Loan Modification Agreement in terms of providing temporary relief to borrowers facing financial hardship. However, unlike a Loan Modification Agreement, which permanently changes the loan terms, a Forbearance Agreement provides temporary suspension or reduction of payments. The essence of both documents lies in assisting the borrower during times of financial difficulty, but the measures in a forbearance are typically short-term with the expectation that the borrower will return to the original payment schedule afterward.

Mortgage Assumption Agreements and Loan Modification Agreements also align closely as they both involve changes to the original loan agreement. In a Mortgage Assumption Agreement, a new borrower assumes the obligations of the original loan from the current borrower, including the remaining balance, interest rate, and payment schedule. The key difference is that while a Loan Modification Agreement adjusts the terms for the original borrower, a Mortgage Assumption Agreement transfers the responsibility of the loan to another party, under the consent of the lender.

A Deed in Lieu of Foreclosure Agreement lessens a borrower's financial burden, much like a Loan Modification Agreement. Through this agreement, the borrower voluntarily transfers the title of the property back to the lender to avoid foreclosure. Although the goal of reducing the borrower's financial stress is common between the two, a Deed in Lieu essentially results in the borrower losing the property, as opposed to a Loan Modification Agreement which aims to modify the loan terms to enable the borrower to retain ownership and manage payments more effectively.

Dos and Don'ts

Filling out a Loan Modification Agreement form requires careful attention to detail and understanding of the terms. It is vital to ensure that both parties, the borrower and the lender, have clear expectations and agree on the modifications to prevent future disputes. Below are several dos and don'ts to consider during this process.

Dos:

Ensure all information is accurate and complete before submission, including personal details, loan amounts, interest rates, and payment schedules.

Review the implications of the interest rate adjustment provisions carefully to understand how they might affect future payments.

Check the agreement for any additional costs, such as recording fees, title examination fees, or attorney’s fees, and understand who is responsible for these costs.

Sign and seal the agreement as indicated to legally bind all parties to the terms.

Keep a copy of the fully executed agreement for personal records.

Consider seeking advice from a financial advisor or legal professional to understand the full implications of the loan modification.

Don'ts:

Do not rush through filling out the form without understanding each section, particularly those that outline the adjusted payment schedule and interest rates.

Avoid omitting any information that could affect the terms of the agreement, thinking it might be inconsequential.

Do not sign the agreement without ensuring all agreed modifications are accurately reflected.

Avoid assuming additional fees and costs will be handled by the lender without confirmation within the agreement.

Do not disregard the need for legal or financial advice, especially if the terms of the modification are complex.

Avoid failing to execute and submit any additional documents necessary to effectuate the terms and conditions of the agreement as required.

Misconceptions

When navigating the realm of loan modifications, several misconceptions may confuse or mislead borrowers. Understanding the truth behind these can make the process smoother and more understandable.

Signing a Loan Modification Agreement means restarting your mortgage term from scratch: This is not always the case. While a loan modification can alter the terms of your original loan, it doesn't necessarily mean starting over from the beginning. The agreement may adjust the interest rate, monthly payments, or the loan's duration, but it is tailored to the borrower's current situation.

A Loan Modification Agreement will reduce the principal balance owed: Not necessarily. While some modifications may adjust the principal, the primary goal is to modify the loan terms to make payments more manageable, often by extending the loan term or reducing the interest rate rather than cutting the principal balance.

Only borrowers who are late on payments qualify for a loan modification: This is a common misconception. Borrowers facing financial hardship that might lead to missed payments can also be eligible for a loan modification, even before any payments are missed. Proactive communication with the lender is key.

Loan modifications are a quick fix for financial problems: The process of obtaining a loan modification can be lengthy and requires detailed documentation of financial hardship. It's a solution designed to make long-term payments more sustainable, not an instant fix to financial distress.

Loan Modification Agreements are standardized: Each agreement is unique and tailored to the borrower's financial situation and the lender's policies. Although certain forms, like the Fannie Mae Uniform Instrument, provide a framework, the terms are negotiable and customized.

You need to pay upfront fees to get a loan modification: Legitimate lenders and loan modification programs do not require upfront fees. Borrowers should beware of scams that demand payments for loan modification services.

Getting a loan modification will hurt your credit score: While the modification itself may be noted on your credit report, it's the missed payments leading up to a modification that can impact your score negatively. Successfully modifying your loan and making timely payments can stabilize and potentially improve your credit over time.

A Loan Modification Agreement means you can’t refinance your mortgage in the future: Not true. Successfully completing a loan modification can actually put you in a better position to refinance in the future, especially as you demonstrate a consistent payment history under the new terms.

If you’re denied once, you can’t apply again: Financial situations and lender policies change. If you've been denied a loan modification in the past but your financial situation has worsened, or if the lender has updated their assistance programs, it's worth applying again or discussing other available options with your lender.

It's essential to communicate openly with your lender and understand your rights and options. Remember, each borrower's situation is unique, and what might be true for one person may not apply to another. Seeking the advice of a financial advisor or legal consultant can also provide guidance customized to your specific circumstances.

Key takeaways

Before executing a Loan Modification Agreement, both parties, the borrower and the lender, must clearly understand that this agreement amends and supplements existing documents related to the borrower's mortgage. These include primarily the Security Instrument (e.g., Mortgage, Deed of Trust, or Security Deed) and the adjustable rate note secured by the Security Instrument.

The Agreement outlines the updated amount payable under the Note and the Security Instrument, referred to as the "Unpaid Principal Balance," which includes all unpaid amounts loaned to the borrower by the lender, along with any capitalized interest and other relevant amounts.

Under this Agreement, the borrower commits to paying the revised Unpaid Principal Balance with interest. The interest rate, as specified in the Loan Modification Agreement, may be subject to change in accordance with the terms indicated in the original note.

Monthly payment amounts, including principal and interest, are adjusted in the Agreement. These payments are set to continue until the entire balance, including interest, is fully paid off by the borrower, highlighting a clear schedule of payments leading to the maturity date or an extended maturity date if applicable.

Any remaining balance owed by the borrower at the maturity date must be fully paid off. This ensures that the borrower and the lender have a mutual understanding of the loan's timeline and the borrower's obligations up until the final payment.

Important to note is that the rights, remedies, stipulations, and conditions regarding defaults outlined in the original Security Instrument are maintained and applied to any modified payment arrangements agreed upon in the Loan Modification Agreement.

The Agreement does not diminish or release the borrower from any obligations or liabilities previously established in the Note and Security Instrument. It also does not impair the lender’s rights or remedies under those documents or by law, fully preserving the lender's rights of recourse.

All costs associated with the agreement, including fees for recording, title examination, and attorney's interventions, fall to the borrower unless otherwise specified by the lender. This ensures that the lender is not financially disadvantaged by agreeing to modify the loan.

Both the borrower and the lender may be required to create and sign additional documents to enforce the terms of the Loan Modification Agreement, signifying that modifications to the loan terms are comprehensive and may necessitate further documentation and agreements.

Popular PDF Documents

Faa 8050-2 - By completing this form, sellers confirm that they have provided the buyers with all necessary documentation related to the aircraft.

IRS 8453 - Its role is especially crucial for those dealing with investments, small businesses, or other complex tax issues.