Get Loan Modification Form

In today's ever-evolving financial landscape, understanding the nuances of various assistance programs can be the key to navigating hardships and securing one's financial future. Among these, the Home Affordable Modification Program (HAMP) stands out as a beacon for homeowners struggling to keep up with their mortgage payments. A critical component of this program is the Loan Modification Form, particularly the Non-Borrower Occupancy and Income Certification Form. This document plays a vital role, allowing occupants of a home, who may not be the borrowers, to include their income in the loan modification review process. It underscores the importance of a collaborative approach towards financial recovery, where the incomes of all residents can be considered to ensure the sustainability of the modification. The form includes declarations of occupancy, commitments to not use one's income in multiple modifications under HAMP, and consent for credit checks — all aimed at verifying the eligibility and integrity of the application. This careful balance of financial review, personal responsibility, and legal oversight embodies the program's efforts to provide meaningful assistance to those in need.

Loan Modification Example

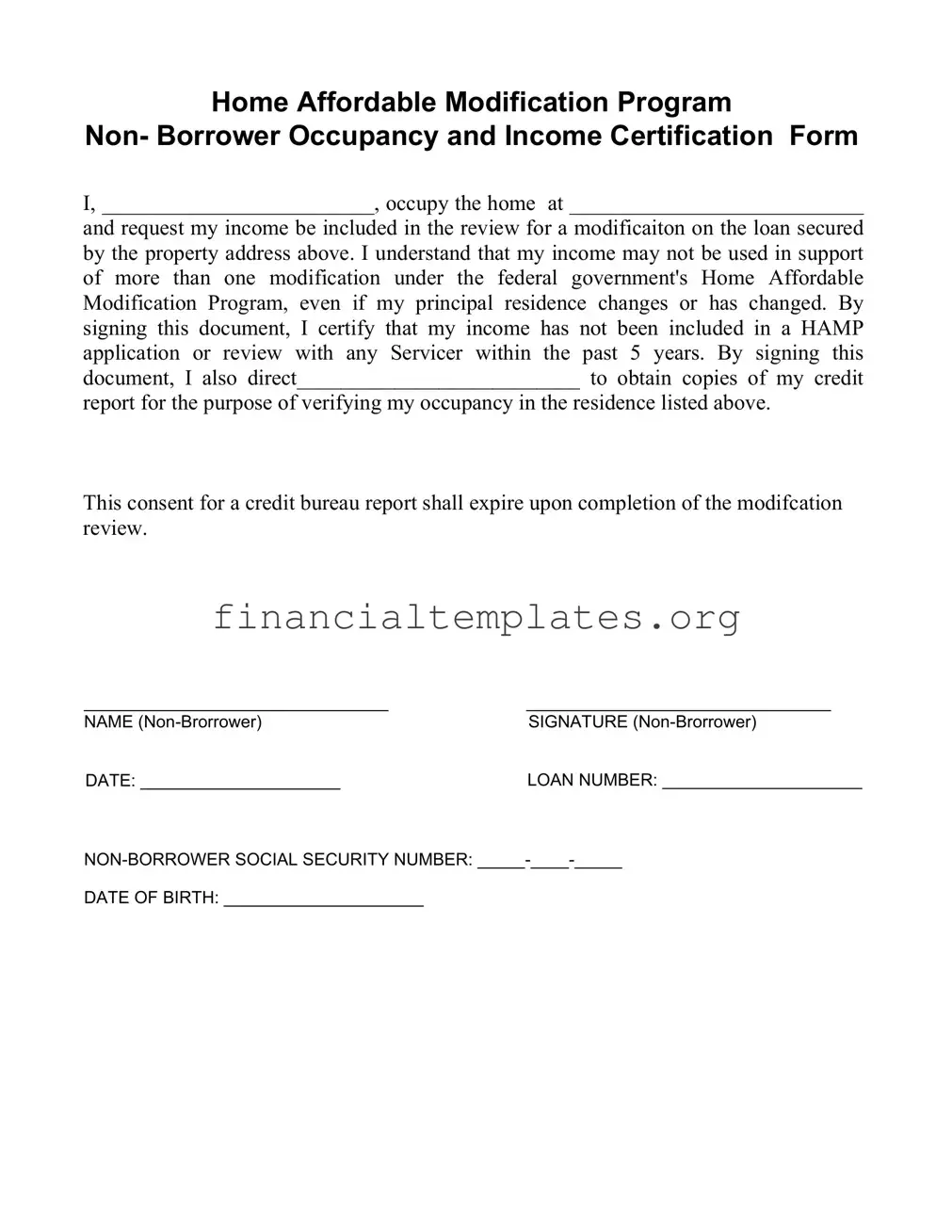

Home Affordable Modification Program

Non- Borrower Occupancy and Income Certification Form

I, _________________________, occupy the home at ___________________________

and request my income be included in the review for a modificaiton on the loan secured by the property address above. I understand that my income may not be used in support of more than one modification under the federal government's Home Affordable Modification Program, even if my principal residence changes or has changed. By signing this document, I certify that my income has not been included in a HAMP application or review with any Servicer within the past 5 years. By signing this document, I also direct__________________________ to obtain copies of my credit

report for the purpose of verifying my occupancy in the residence listed above.

This consent for a credit bureau report shall expire upon completion of the modifcation review.

________________________________ |

________________________________ |

NAME |

SIGNATURE |

DATE: _____________________ |

LOAN NUMBER: _____________________ |

DATE OF BIRTH: _____________________

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form | This form is used to include the income of a non-borrower living in the home in the review for a loan modification under the Home Affordable Modification Program (HAMP). |

| Income Certification | The non-borrower certifies that their income has not been included in a HAMP application or review with any servicer within the past 5 years. |

| Limitation on Use of Income | The non-borrower's income may only support one modification under HAMP, regardless of any changes to their principal residence. |

| Verification of Occupancy | The form authorizes the servicer to obtain copies of the non-borrower's credit report for the purpose of verifying occupancy in the residence. |

| Consent Duration | The consent for a credit bureau report expires upon completion of the modification review. |

| Governing Law | HAMP operates under federal law established to help homeowners avoid foreclosure by modifying loans to a more affordable level. |

| Requirements for Signing | The form requires the non-borrower's name, signature, date, loan number, social security number, and date of birth. |

Guide to Writing Loan Modification

Filling out the Loan Modification form is the first crucial step for individuals seeking to have their income considered in a loan modification review. This process involves providing personal information and certifying that your income has not been previously used in a similar application. It's important to complete this form accurately and thoroughly to ensure that your request is processed efficiently. Here are the necessary steps:

- Begin by writing your full name where it says "I, _________________________," to identify yourself as the person completing the form.

- Fill in your home address in the blank space following "occupy the home at ___________________________" to specify the property in question.

- Confirm your request for income consideration by acknowledging the text that follows your address input. This does not require any action besides your understanding and agreement.

- Understand and agree that by signing the document, you certify that your income has not been used in another application for the Home Affordable Modification Program within the last five years.

- Where it says "I also direct__________________________," fill in the name of the entity (usually your loan servicer) that you're authorizing to obtain credit report copies. This is to verify your occupancy at the mentioned address.

- Sign your name next to "SIGNATURE (NON-BRORROWER)" to formalize the certification.

- Enter the current date where it says "DATE: _____________________" to document when you completed and signed the form.

- Provide your loan number in the designated space to ensure the form is accurately associated with your loan account.

- Write your Social Security Number in the format shown (___-___-____) for identification purposes.

- Finally, input your date of birth as requested to complete all necessary personal identification information.

Once you've carefully completed all these steps, your form is ready to be submitted to your loan servicer for review. It's critical to provide all requested information accurately to avoid delays or issues in the modification process. Remember, this form is a declaration of your circumstances and a request to include your income in the modification review, making precision essential.

Understanding Loan Modification

What is the Home Affordable Modification Program (HAMP)?

The Home Affordable Modification Program (HAMP) was a federal program designed to help homeowners avoid foreclosure by modifying loans to a level that is affordable and sustainable over the long term. It targeted homeowners experiencing financial hardship by offering them a chance to adjust the terms of their loan. The program's effectiveness relies on providing lowered monthly payments through interest rate reduction, extending the loan term, and, in some cases, principal forgiveness.

Who can sign the Non-Borrower Occupancy and Income Certification Form?

This form can be signed by individuals who are not officially borrowers on the loan but occupy the home and wish to have their income considered in the loan modification review. By signing, they request their income to be included but also affirm that their income has not been used in another HAMP application or review for any servicer in the past five years.

Why is it necessary for a non-borrower to include their income in the loan modification review?

Including the income of individuals who live in the home but are not listed as borrowers on the mortgage can provide a more accurate picture of the household's financial situation. This comprehensive view can increase the chances of approval for a modification by demonstrating additional financial support that can make the modified loan payments more manageable.

How does the certification form affect the process of obtaining a credit report?

By signing the Non-Borrower Occupancy and Income Certification Form, the signatory gives explicit consent for the loan servicer to obtain copies of their credit report. This step is crucial for verifying the non-borrower’s residency at the specified address. The consent for obtaining a credit report is valid until the completion of the modification review process.

Can a non-borrower’s income be used for more than one modification under HAMP?

No, the non-borrower's income cannot be used to support more than one loan modification under the HAMP initiative. The certification form requires the individual to attest that their income has not been involved in a HAMP application or review for any loan servicer within the last five years. This restriction helps ensure the program's resources are distributed fairly among eligible applicants.

What happens if a non-borrower’s principal residence changes?

If the non-borrower’s principal residence changes after the submission of the form, it could affect their eligibility for inclusion in the loan modification process under HAMP. The form requires the non-borrower to certify that the income has not been and will not be used in support of more than one modification, regardless of any changes to their principal residence.

Is the permission to check credit reports limited in time?

Yes, the consent given by the non-borrower to obtain their credit report is explicitly limited to the duration of the modification review process. Once the review is complete, the authorization to check the credit report expires. This measure protects the non-borrower's privacy and limits the access to their credit information.

What identification details are required from the non-borrower when signing the form?

When signing the Non-Borrower Occupancy and Income Certification Form, the non-borrower is required to provide personal identification details, including their full name, date of birth, and Social Security number. These details are necessary for accurately processing the form and conducting a credit report check to verify occupancy, if applicable.

Common mistakes

When navigating the process of filling out a Loan Modification form, particularly within the Home Affordable Modification Program (HAMP), applicants often encounter various hurdles that can complicate or even jeopardize their opportunity for relief. Understanding these pitfalls can significantly increase the chances of a successful application. Here are ten common mistakes to avoid:

Failing to verify eligibility for the Home Affordable Modification Program before starting the application process. Ensure that the requirements are thoroughly reviewed and understood.

Omitting important personal information, such as the correct full name or date of birth. Accuracy is crucial for verifying your identity and processing your application.

Providing an incorrect or outdated property address. The address must match the one listed on the mortgage documents.

Overlooking the non-borrower's involvement and their requirement to sign the document if their income is considered for the loan modification.

Inaccurately reporting income details or failing to disclose all sources of income. This can lead to misrepresentation and affect the outcome of your application.

Not acknowledging the restriction on income consideration for more than one modification under HAMP. This declaration is essential to prevent violations of program rules.

Forgetting to sign and date the form or provide a loan number. Every certification form requires a signature to validate the information given.

Incorrectly entering or omitting the Social Security Number (SSN). The SSN is vital for credit checks and verifying borrower’s or non-borrower’s details.

Neglecting the consent clause for a credit report, which is necessary to verify occupancy and financial information as part of the review process.

Failing to recognize that consent for a credit bureau report expires upon completion of the modification review. It’s important to be aware of the timeline and any requirements that may need to be addressed promptly.

Avoiding these mistakes requires attention to detail, careful review of program requirements, and a clear understanding of the information being requested. By ensuring all information is complete, accurate, and truthful, applicants can improve their chances for a favorable review under HAMP or any loan modification program.

Documents used along the form

When navigating the process of loan modification, especially under programs like the Home Affordable Modification Program (HAMP), numerous forms and documents are required alongside the main application. These documents are essential for providing a comprehensive view of the borrower's financial situation, ensuring that all necessary information is accurately considered during the review process. Understanding these documents can significantly streamline the application process.

- Hardship Affidavit: This document outlines the borrower's financial difficulties that make it hard for them to meet their mortgage obligations. It explains the nature of the hardship, such as unemployment, significant medical bills, or any other relevant circumstances.

- Proof of Income: This includes recent pay stubs, profit and loss statements (for self-employed individuals), and other relevant income documentation. It helps lenders assess the borrower's ability to meet the modified loan terms.

- Tax Returns: Typically, lenders require the last two years of federal tax returns to verify income and financial status. This documentation provides a detailed view of the borrower's finances over time.

- Bank Statements: Recent bank statements, often covering the last two to three months, are necessary to verify assets and manage monthly expenses. They help establish the borrower's financial standing and stability.

- Credit Report Authorization Form: This form grants the lender permission to pull the borrower's credit report. It assesses the borrower’s creditworthiness and financial behavior, which is crucial in the modification decision.

- Statement of Debts and Liabilities: A comprehensive list of all current debts and liabilities provides the lender with a clearer picture of the borrower's financial obligations, including credit card debt, car loans, and other mortgages.

- Property Appraisal Report: Sometimes, a current appraisal of the property is required to determine its value. This helps the lender assess whether the property's value supports the loan modification request.

- Letter of Authorization: If a borrower is working with a third party, like a housing counselor or legal representative, they'll need this document. It authorizes the representative to communicate with the lender on the borrower’s behalf.

Together, these documents paint a full picture of the borrower's financial situation, providing the lender with the necessary information to make an informed decision regarding the loan modification request. Properly preparing and organizing these documents can make the modification process smoother and more efficient for both the borrower and the lender.

Similar forms

The Forbearance Agreement is one document that shares similarities with the Loan Modification Form. Both documents are created with the intent of assisting borrowers facing financial difficulties, albeit through different means. While a Loan Modification Form aims to alter the terms of the current mortgage to reduce the borrower's monthly payments, a Forbearance Agreement temporarily suspends or reduces payments for a short period. Each document requires the borrower to provide specific financial information to evaluate their current situation, though the Loan Modification Form specifically involves altering loan terms, whereas a Forbearance Agreement focuses on a temporary relief solution.

Affidavit of Financial Hardship is another document bearing resemblance to the Loan Modification Form. Individuals complete this affidavit to demonstrate their financial difficulties to a lender or court to seek relief or assistance, similar to how one would request a change in loan terms due to financial constraints through the Loan Modification Form. Both documents necessitate detailed personal financial information to assess the requester’s financial situation, aiming to provide proof of hardship that justifies the need for assistance, either through loan modification or other legal relief efforts.

The Refinance Application is similar to the Loan Modification Form as both involve adjusting the terms of an existing mortgage. However, the Refinance Application is used to obtain a new loan with different terms to replace the original mortgage, which can result in a lower interest rate or different loan duration. Despite this difference, both documents share the objective of making mortgage payments more manageable for the borrower, and they each require the borrower to provide comprehensive financial information to determine eligibility.

Deed in Lieu of Foreclosure Agreement shares a common goal with the Loan Modification Form: to avoid foreclosure. When a borrower can no longer make mortgage payments, a Deed in Lieu of Foreclosure can be an alternative to foreclosure, where the borrower voluntarily transfers the property title to the lender. Like the Loan Modification Form, this agreement is a potential solution for borrowers in distress, though the outcomes differ significantly—one modifies the loan terms to retain the home, while the other involves surrendering the property to the lender.

The Home Affordable Refinance Program (HARP) Application is akin to the Loan Modification Form as both seek to provide relief to homeowners struggling with their mortgage payments. The HARP program was specifically designed to enable homeowners, who are underwater on their mortgages, to refinance their homes at lower interest rates, similar to how a Loan Modification Form could adjust the terms of a loan to reduce monthly payments. Each document serves the purpose of assisting borrowers in financial distress, though through slightly different means: refinancing versus modifying the existing loan terms.

Credit Report Authorization Form is closely related to the Loan Modification Form, particularly in the section where the latter authorizes credit report checks to verify occupancy or income as part of the modification review process. Both documents involve consenting to a credit inquiry, which is crucial for lenders to assess the borrower's financial health and risk before making a decision. While the primary purpose of a Credit Report Authorization Form is to obtain a borrower's credit information for various reasons, it plays a critical role in the loan modification process as well.

Income Verification Form is similar to segments of the Loan Modification Form, especially where income documentation is required to substantiate the borrower's request for loan modification due to financial hardship. Both forms require detailed proof of the borrower's income to assess their ability to meet modified loan terms. The key goal is to ensure that the borrower's income is sufficient to support the new, adjusted payment arrangements, thus preventing future defaults.

Dos and Don'ts

Filling out the Loan Modification Form, particularly within the context of the Home Affordable Modification Program (HAMP), demands accuracy, honesty, and a careful approach to ensure all information provided reflects the current situation. It's a process that can significantly alter the terms of your mortgage, making it more manageable based on your financial situation. Below are some critical dos and don’ts when completing this form:

Do:- Verify all personal information for accuracy. Before submitting, double-check that the home address, Social Security number, date of birth, and other personal details are correct. Mistakes here can result in delays or even the rejection of your modification request.

- Disclose your income honestly. The purpose of this form is to assess your ability to meet the modified loan terms. Underreporting or overreporting your income can lead to issues down the line, including potential legal ramifications.

- Understand the implications of the certification. By signing the form, you're certifying that your income hasn't been used in another HAMP application within the past five years. Ensure this statement is true to avoid committing fraud.

- Keep a copy of the completed form. After you've filled out the form and submitted it, make sure to keep a copy for your records. This will be useful for future reference and in case any disputes arise.

- Sign without reading. Understand each section of the form and what you're attesting to by signing it. This document has legal implications, and signing without comprehending its contents can lead to unintended consequences.

- Use incomplete or vague information. When providing details about your occupancy, income, or any other necessary information, be as precise and comprehensive as possible. Incomplete or ambiguous entries can cause processing delays.

- Forget to direct the servicer to obtain a credit report. The form includes a directive for the servicer to verify your residency through a credit report. Failing to properly complete this section might impede the verification process.

- Attempt to use income for multiple modifications under HAMP. The form specifically states that your income cannot support more than one modification under HAMP. Attempting to do so is against the program's rules and can lead to your application being denied.

Misconceptions

When dealing with the Home Affordable Modification Program (HAMP) Loan Modification Form, several misconceptions can lead to confusion and misunderstandings. Here are six common misconceptions:

- Only borrowers can apply for a loan modification: Many people mistakenly believe that only the borrower's income and circumstances are considered in the HAMP application process. However, non-borrowers living in the home can also submit their income for consideration by completing the Non-Borrower Occupancy and Income Certification Form.

- Income from multiple non-borrowers can be used for one application: A common misconception is that the income of several non-borrowers residing in the household can be combined to support a single modification application. In truth, each non-borrower's income can only support one modification at a time within the HAMP framework.

- A non-borrower's income can be used repeatedly: It's incorrectly assumed that a non-borrower can use their income to support multiple HAMP applications over time. The reality is, a non-borrower can only have their income considered for one HAMP application within a five-year period.

- Occupancy verification is not required: Some believe that simply stating occupancy is sufficient for HAMP applications. Contrary to this belief, non-borrowers must give permission for a credit check to verify their occupancy in the residence related to the loan modification review.

- Credit checks for non-borrowers are ongoing: There's a misconception that permission for a credit report to verify occupancy grants ongoing access to a non-borrower's credit information. In fact, this permission expires once the modification review is complete, limiting the time frame in which the credit report can be accessed.

- There's no consequence for misrepresentation: Some might think there’s little risk in inaccurately stating their situation on the HAMP form. However, inaccuracies or misrepresentations, especially concerning prior use of income in a HAMP application or the occupancy status of the non-borrower, can lead to denial of the application or more severe legal consequences.

Understanding these misconceptions can help non-borrowers and borrowers alike navigate the HAMP loan modification process more effectively, ensuring accurate submissions and improving the chances of approval.

Key takeaways

Filling out and using the Loan Modification form, specifically under the Home Affordable Modification Program (HAMP), involves careful attention to detail and understanding of the process. Here are seven key takeaways to guide individuals through this important financial adjustment:

- Understanding Non-Borrower Contribution: The form allows individuals who are not the borrowers but occupy the home to include their income for the modification review. This can be a vital step for households with multiple contributors to the mortgage payment.

- One Modification Rule: It's important to recognize that an individual's income can only support one modification under HAMP at a time. If your living situation or principal residence changes, this rule still applies, ensuring the program's fairness and preventing abuse.

- Certification of Income: By signing the form, the non-borrower certifies that their income has not been used in another HAMP modification application or review with any service provider in the past five years. This certification is crucial to maintain the integrity of the modification process.

- Permission for Credit Report: Completing the form gives consent for the loan servicer to obtain the non-borrower's credit report. This step verifies the applicant's occupancy in the home, an essential part of the loan modification review.

- Expiration of Consent: The consent to access a credit report is not indefinite. It expires once the modification review is completed, protecting the non-borrower's privacy and credit information.

- Required Personal Information: The form requires detailed personal information, including the non-borrower's social security number and date of birth. This data must be provided accurately to avoid delays or issues in the review process.

- Form Signature and Date: The non-borrower's signature and the date are essential parts of the form. They affirm the accuracy of the information provided and agree to the terms outlined. Without this, the request for income consideration in the loan modification cannot proceed.

Navigating the loan modification process requires a clear understanding of these and other related aspects. Providing accurate information and understanding the implications of the non-borrower's contribution are fundamental to achieving a successful modification under HAMP.

Popular PDF Documents

Ohio Sales Tax Due Dates - The form's design allows for straightforward calculation of tax liabilities and any discounts or additional charges applicable.

It-201 Resident Income Tax Return - Sections included for specific New York state credits like Empire State child credit, property tax credit, and educational credits.