Get Loan Estimate Form

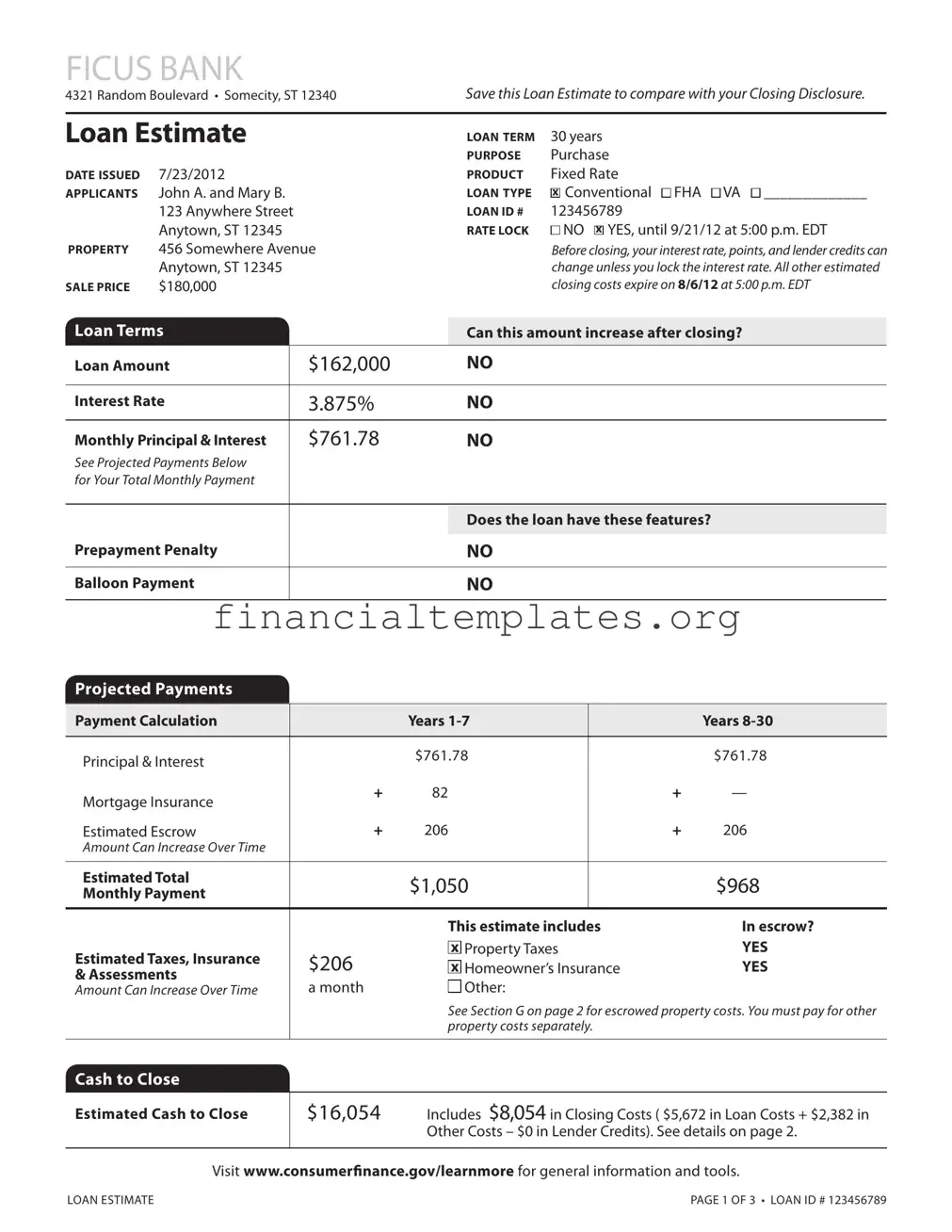

Navigating the process of securing a home loan can be daunting, with the myriad of forms and documents required. Among these, the Loan Estimate form stands out as a critical document designed to provide applicants with a clear and comprehensive overview of the terms and costs associated with their mortgage offer. Issued by the lender, this three-page document outlines the loan amount, interest rate, monthly payment, and the total closing costs for the loan. It also details whether these components can increase after closing and if the loan has particular features like prepayment penalties or balloon payments. Equally important, the Loan Estimate form specifies the estimated cash to close, summing up the upfront costs the borrower is expected to pay. With sections dedicated to the breakdown of loan costs, other costs, and how these add up to the total closing costs, this document is designed to help borrowers compare offers from different lenders and make informed decisions. Furthermore, it includes information about the lender, comparisons to help borrowers assess the loan's long-term costs, and other considerations such as appraisal requirements and late payment fees. As an integral part of the home buying process, understanding the Loan Estimate form is essential for prospective homeowners to navigate the financial aspects of purchasing a property confidently.

Loan Estimate Example

FICUS BANK

4321 Random Boulevard • Somecity, ST 12340Save this Loan Estimate to compare with your Closing Disclosure.

Loan estimate |

LOAN TeRM |

30 years |

|

|

|

PuRPOse |

Purchase |

DATe IssueD |

7/23/2012 |

PRODuCT |

Fixed Rate |

APPLICANTs |

John A. and Mary B. |

LOAN TyPe |

x Conventional FHA VA _____________ |

|

123 Anywhere Street |

LOAN ID # |

123456789 |

|

Anytown, ST 12345 |

RATe LOCK |

NO x YES, until 9/21/12 at 5:00 p.m. EDT |

PROPeRTy |

456 Somewhere Avenue |

|

Before closing, your interest rate, points, and lender credits can |

|

Anytown, ST 12345 |

|

change unless you lock the interest rate. All other estimated |

sALe PRICe |

$180,000 |

|

closing costs expire on 8/6/12 at 5:00 p.m. EDT |

Loan Terms |

|

Can this amount increase after closing? |

Loan Amount |

$162,000 |

NO |

|

|

|

Interest Rate |

3.875% |

NO |

|

|

|

Monthly Principal & Interest |

$761.78 |

NO |

See Projected Payments Below |

|

|

for Your Total Monthly Payment |

|

|

|

|

|

|

|

Does the loan have these features? |

Prepayment Penalty |

|

|

|

NO |

|

|

|

|

Balloon Payment |

|

NO |

|

|

|

Projected Payments

Payment Calculation |

|

years |

|

|

years |

|

|

|

|

|

|

Principal & Interest |

|

$761.78 |

|

|

$761.78 |

|

|

|

|

|

|

Mortgage Insurance |

+ |

82 |

|

+ |

— |

|

|

|

|

|

|

Estimated Escrow |

+ |

206 |

|

+ |

206 |

Amount Can Increase Over Time |

|

|

|

|

|

|

|

|

|

|

|

estimated Total |

|

$1,050 |

|

|

$968 |

Monthly Payment |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This estimate includes |

|

In escrow? |

|

estimated Taxes, Insurance |

$206 |

x Property Taxes |

|

yes |

|

x Homeowner’s Insurance |

|

yes |

|||

& Assessments |

|

||||

a month |

Other: |

|

|

||

Amount Can Increase Over Time |

|

|

|||

|

|

See Section G on page 2 for escrowed property costs. You must pay for other |

|||

|

|

property costs separately. |

|

|

|

|

|

|

|

|

|

Cash to Close |

|

|

|

|

|

|

|

|

|

||

estimated Cash to Close |

$16,054 |

Includes $8,054 in Closing Costs ( $5,672 in Loan Costs + $2,382 in |

|||

|

|

Other Costs – $0 in Lender Credits). See details on page 2. |

|||

|

|

|

|

|

|

Visit www.consumerinance.gov/learnmore for general information and tools.

LOAN ESTIMATE |

page 1 of 3 • Loan ID # 123456789 |

Closing Cost Details

Loan Costs

A. Origination Charges |

$1,802 |

.25 % of Loan Amount (Points) |

$405 |

Application Fee |

$300 |

Underwriting Fee |

$1,097 |

Other Costs

e. Taxes and Other Government Fees |

$85 |

||||||

Recording Fees and Other Taxes |

|

|

$85 |

||||

Transfer Taxes |

|

|

$0 |

||||

|

|

|

|

|

|

|

|

F. Prepaids |

|

|

$867 |

||||

Homeowner’s Insurance Premium ( |

6 months) |

$605 |

|||||

|

|

|

|

|

|

|

|

Mortgage Insurance Premium ( 0 |

months) |

$0 |

|||||

|

|

|

|

|

|

||

Prepaid Interest ( $17.44 per day for 15 days @ 3.875%) |

$262 |

||||||

Property Taxes ( 0 months) |

|

|

$0 |

||||

|

|

|

|

|

|

|

|

B. services you Cannot shop For |

$672 |

Appraisal Fee |

$405 |

Credit Report Fee |

$30 |

Flood Determination Fee |

$20 |

Flood Monitoring Fee |

$32 |

Tax Monitoring Fee |

$75 |

Tax Status Research Fee |

$110 |

G. Initial escrow Payment at Closing |

|

|

$413 |

|

Homeowner’s Insurance |

$100.83 per month for |

23mo. $202 |

||

Mortgage Insurance |

per month for |

0 |

mo. |

|

Property Taxes |

$105.30 per month for |

2 |

mo. |

$211 |

H. Other |

$1,017 |

Title – Owner’s Title Policy (optional) |

$1,017 |

C. services you Can shop For |

$3,198 |

Pest Inspection Fee |

$135 |

Survey Fee |

$65 |

Title – Insurance Binder |

$700 |

Title – Lender’s Title Policy |

$535 |

Title – Title Search |

$1,261 |

Title – Settlement Agent Fee |

$502 |

D. TOTAL LOAN COsTs (A + B + C) |

$5,672 |

I. TOTAL OTHeR COsTs (e + F + G + H) |

$2,382 |

|

|

J. TOTAL CLOsING COsTs |

$8,054 |

|

|

D + I |

$8,054 |

Lender Credits |

$0 |

Calculating Cash to Close |

|

|

|

Total Closing Costs (J) |

$8,054 |

Closing Costs Financed (Included in Loan Amount) |

$0 |

Down Payment/Funds from Borrower |

$18,000 |

Deposit |

– $10,000 |

Funds for Borrower |

$0 |

Seller Credits |

$0 |

Adjustments and Other Credits |

$0 |

estimated Cash to Close |

$16,054 |

|

|

LOAN ESTIMATE |

page 2 of 3 • Loan ID # 123456789 |

Additional Information About This Loan

LeNDeR NMLs/LICeNse ID

LOAN OFFICeR

NMLs ID

PHONe

Ficus Bank

Joe Smith 12345 joesmith@icusbank.com

MORTGAGe BROKeR NMLs/LICeNse ID LOAN OFFICeR NMLs ID

eMAIL PHONe

Comparisons |

use these measures to compare this loan with other loans. |

||

|

|

|

|

In 5 years |

$56,582 |

Total you will have paid in principal, interest, mortgage insurance, and loan costs. |

|

$15,773 |

Principal you will have paid of. |

||

|

|||

|

|

|

|

Annual Percentage Rate (APR) |

4.494% |

Your costs over the loan term expressed as a rate. This is not your interest rate. |

|

|

|

|

|

Total Interest Percentage (TIP) |

69.447% |

The total amount of interest that you will pay over the loan term as a |

|

|

|

percentage of your loan amount. |

|

|

|

|

|

Other Considerations

Appraisal |

We may order an appraisal to determine the property’s value and charge you for this |

|

appraisal. We will promptly give you a copy of any appraisal, even if your loan does not close. |

|

You can pay for an additional appraisal for your own use at your own cost. |

Assumption |

If you sell or transfer this property to another person, we |

|

will allow, under certain conditions, this person to assume this loan on the original terms. |

|

x will not allow this person to assume this loan on the original terms. |

Homeowner’s |

This loan requires homeowner’s insurance on the property, which you may obtain from a |

Insurance |

company of your choice that we ind acceptable. |

Late Payment |

If your payment is more than 15 days late, we will charge a late fee of 5% of the monthly |

|

principal and interest payment. |

Reinance |

Reinancing this loan will depend on your future inancial situation, the property value, and |

|

market conditions. You may not be able to reinance this loan. |

servicing |

We intend |

|

to service your loan. If so, you will make your payments to us. |

|

x to transfer servicing of your loan. |

Conirm Receipt

By signing, you are only conirming that you have received this form. You do not have to accept this loan because you have signed or received this form.

Applicant Signature |

Date |

Date |

LOAN ESTIMATE |

page 3 of 3 • Loan ID #123456789 |

Document Specifics

| Fact Name | Detail |

|---|---|

| Purpose of the Form | Provides an estimate of loan terms and closing costs before closing |

| Issuance Date | Issued on 7/23/2012 |

| Loan Type | Conventional loan selected with fixed interest rate |

| Rate Lock | Interest rate locked until 9/21/12 at 5:00 p.m. EDT |

| Key Loan Terms | Loan amount, interest rate, and monthly principal & interest |

| Projected Payments | Details payments calculation for years 1-7 and years 8-30 |

| Cash to Close | Estimates total cash needed at closing |

| Governing Laws | Governed by the Truth in Lending Act (TILA) and Real Estate Settlement Procedures Act (RESPA) |

Guide to Writing Loan Estimate

Filling out a Loan Estimate form is a crucial step in understanding the costs associated with a potential loan before finalizing the decision to proceed. This form provides a detailed summary of the terms, payments, and fees you can expect. Here's a straightforward guide to help you accurately complete the Loan Estimate form.

- Start by reviewing the top section that includes the lender's information, ensuring all details such as the lender's name, "FICUS BANK", and the address are correct.

- Confirm the loan term mentioned is "30 years" and the purpose is for a "Purchase".

- Verify the "Date Issued" is accurate. For example, it should read "7/23/2012".

- Check the "Product" to ensure it states "Fixed Rate".

- Ensure the "Applicants" section accurately lists your name(s), in this case, "John A. and Mary B."

- Under "Loan Type", confirm the selected option is "x Conventional" and other options are left blank.

- For the property address under “LOAN ID #”, confirm it correctly states "123 Anywhere Street, Anytown, ST 12345".

- Check the "Rate Lock" section. If your interest rate is locked, it should be marked "x YES", including the expiration date and time.

- Move to the "Loan Terms" section to validate key figures such as the loan amount, interest rate, monthly principal, and whether certain conditions such as a prepayment penalty or balloon payment apply.

- In the "Projected Payments" section, review the breakdown of payments over time, checking for accuracy in principal, interest, mortgage insurance, and estimated escrow.

- Confirm the "Estimated Cash to Close" is the correct sum, including the breakdown of closing costs and how much cash you'll need upfront.

- Proceed to the "Closing Cost Details" section on page 2. Break down the costs into "Loan Costs" and "Other Costs" categories, filling out each part with precise figures for services like the origination charges, services you cannot shop for, prepaids, and initial escrow payment at closing.

- Under “Calculating Cash to Close”, verify the total closing costs, down payment, and estimated cash to close align with your expectations.

- Review the "Additional Information" section for lender details, and ensure the loan officer's information is complete and accurate.

- Lastly, check the comparisons section to understand how your payments, APR, and TIP add up over the first 5 years and over the life of the loan.

- Remember, prior to signing the form, read through the "Other Considerations" and "Confirm Receipt" sections carefully to understand your rights and obligations.

After completing the Loan Estimate form, the next steps involve reviewing all the information for accuracy, asking your lender any questions you might have about the estimate, and deciding whether to proceed with this loan offer. This document is a valuable tool for comparing loan offers, so consider keeping it handy for comparison with the Closing Disclosure that you'll receive if you decide to move forward with the loan.

Understanding Loan Estimate

What is a Loan Estimate?

A Loan Estimate is a three-page document that you receive after applying for a mortgage. It provides important information about the loan you've applied for, such as the estimated interest rate, monthly payment, and total closing costs for the loan. The Loan Estimate also outlines the loan terms and depicts how the payments may change over time.

Why is the Loan Estimate important?

This document is crucial because it provides a detailed look at the terms and costs associated with your mortgage allowing you to compare different lenders' offers. Receiving a Loan Estimate doesn't mean you're approved or denied a loan, but it does give you a clear picture of what to expect if you proceed.

When should I receive a Loan Estimate?

You should receive a Loan Estimate within three business days of submitting your loan application. The information on the Loan Estimate is based on the details you provided in your application.

Is the interest rate on my Loan Estimate guaranteed?

The Loan Estimate shows the interest rate for your mortgage if it has been locked. An interest rate lock guarantees your interest rate for a specified period, typically until closing. If your rate is not locked, it can change based on market conditions.

Can the Loan Amount increase after closing?

No, the loan amount cannot increase after closing. The Loan Estimate provides the amount you asked to borrow, and this figure should remain consistent, barring any changes you request or agree to before closing.

What are prepayment penalties and balloon payments?

A prepayment penalty is a fee that could be charged if you pay off your mortgage early. A balloon payment is a large, lump-sum payment due at the end of a loan term. The Loan Estimate indicates whether your loan includes a prepayment penalty or a balloon payment.

What does 'Cash to Close' include?

'Cash to Close' is the total amount of money you need to bring to the closing, including your down payment and all closing costs. This number might also include any lender credits towards closing costs or adjustments for items already paid for, like the earnest money deposit.

What are closing costs?

Closing costs are fees associated with finalizing your mortgage and transfer of property ownership. These costs can include charges for originating the loan, appraisals, title insurance, and taxes. The Loan Estimate provides a detailed list of anticipated closing costs.

Is the Loan Estimate the final word on my mortgage costs?

No, the Loan Estimate provides an estimate of the terms and costs based on the best information available at the time. You'll receive a Closing Disclosure three business days before closing, which will list the final terms and costs of your mortgage.

Common mistakes

When filling out the Loan Estimate form, applicants often overlook or inaccurately complete several sections. These mistakes can lead to misunderstandings about loan terms, unexpected costs, and delays in the loan process. The following are common errors made during the completion of the Loan Estimate form:

- Not checking the loan type box correctly, causing confusion about the nature of the loan being applied for.

- Inaccurately recording the Loan ID number, which is crucial for tracking and reference throughout the loan process.

- Failing to accurately reflect the sale price of the property in the designated area, leading to discrepancies in loan calculations.

- Incorrectly indicating whether the interest rate is locked and misunderstanding the expiration date of locked rates and estimated closing costs.

- Omitting or incorrectly detailing the estimated taxes, insurance, and assessments included in escrow, affecting the accuracy of the total monthly payment.

- Underestimating or not correctly detailing cash to close, including not accounting for all closing costs, down payment, and other credits or debits at the closing of the loan.

- Misinterpreting the section on loan costs, particularly origination charges, and fees for services you cannot shop for, leading to underestimation of total loan costs.

- Overlooking the Other Costs section, including taxes and government fees, prepaids, and initial escrow payment, which all contribute to the final closing costs.

- Not carefully reviewing or misunderstanding the Comparisons and Other Considerations sections, which can help in evaluating the loan's long-term financial implications.

- Forgetting to confirm receipt of the Loan Estimate form, which is necessary for the loan process to proceed.

It is imperative for applicants to thoroughly review each section of the Loan Estimate form to ensure accuracy and completeness. Avoiding the mentioned mistakes can help facilitate a smoother loan process, leading to a better understanding of the loan terms and obligations.

Documents used along the form

When navigating the home buying process, the Loan Estimate form provides a crucial overview of the terms of a potential mortgage. However, it's just one piece of the puzzle. Understanding other essential documents can help buyers better manage their overall experience. These documents vary in purpose, from providing detailed cost breakdowns to ensuring clear property titles. Let's explore some of these important forms and documents often used alongside the Loan Estimate.

- Closing Disclosure: This document offers a final review of the loan terms, closing costs, and other transaction details. It's crucial for comparing with the Loan Estimate to ensure consistency.

- Promissory Note: This legal document signifies the borrower's promise to repay the mortgage under agreed terms, including the interest rate and payment schedule.

- Mortgage or Deed of Trust: Acting as security for the loan, this document places a lien on the property as collateral, detailing the legal implications of not repaying the loan.

- Initial Escrow Statement: This outlines how much will be paid into escrow each month for things like property taxes and insurance, providing an estimate for the first year.

- Appraisal Report: Required by lenders, this assesses the property's value to ensure it meets or exceeds the purchase price and determines if it provides sufficient collateral for the loan.

- Title Insurance Policy: Offers protection against legal issues that could challenge one's ownership of the property, ensuring the title is free and clear.

- Home Inspection Report: Though not always required by lenders, this provides an in-depth review of the property's condition, revealing any potential issues.

- Proof of Homeowners Insurance: This confirms that the property will be insured against damages, a requisite for loan approval.

Together with the Loan Estimate, these documents ensure transparency, legal security, and a thorough understanding of the home buying process. Each plays a pivotal role in moving from the excitement of an offer to the reality of homeownership, providing buyers with the detailed information necessary to make informed decisions. As the journey to home ownership unfolds, staying informed and understanding each document's role and what it signifies about one’s financial commitment and rights can be both empowering and reassuring.

Similar forms

The Good Faith Estimate (GFE) is similar to the Loan Estimate in many ways. Both documents outline the costs associated with obtaining a mortgage before the final contract is signed. They provide details on the interest rate, loan terms, and estimated closing costs, allowing borrowers to compare different loan offers. The key purpose of both forms is to give consumers clear, upfront information on what to expect in terms of financing costs.

The Closing Disclosure is another document closely related to the Loan Estimate. While the Loan Estimate provides an initial overview of terms and costs, the Closing Disclosure offers the final terms and costs of the mortgage. It is typically provided to the borrower at least three days before closing, ensuring that they have the opportunity to review the final details. This document confirms or updates the information initially presented on the Loan Estimate.

The Truth in Lending Act (TILA) statement, which was traditionally given to borrowers, shares a common goal with the Loan Estimate. The TILA statement delineates the costs of the loan, the annual percentage rate (APR), and the finance charge. The Loan Estimate consolidates this information by including APR and finance charges upfront to assist borrowers in understanding their loan's costs and terms more comprehensively.

The HUD-1 Settlement Statement, used primarily before the implementation of the TILA-RESPA Integrated Disclosures (TRID), is akin to the Loan Estimate in function. The HUD-1 itemized all costs to the buyer and seller in a real estate transaction. Although the Loan Estimate is provided earlier in the mortgage process, both documents serve to detail the fees and charges associated with taking out a mortgage.

Annual Percentage Rate (APR) disclosures can be seen as a complement to the information found in the Loan Estimate. While the Loan Estimate offers a detailed breakdown of loan costs, including the APR as a means to understand the cost of borrowing over the life of the loan, APR disclosures go further in-depth about how the APR is calculated, providing borrowers with a deeper understanding of how their loan costs are determined.

The Mortgage Servicing Disclosure Statement, while not identical, shares some similarities with the Loan Estimate because it provides important information about the servicing of the mortgage. This statement tells the borrower whether the lender intends to service the loan or transfer it to another company. The Loan Estimate touches on aspects of loan servicing by indicating whether the lender intends to service the loan or transfer servicing.

The Initial Escrow Statement, which outlines the payments that will be put into escrow for items such as property taxes and homeowners insurance, is also related to the Loan Estimate. The Loan Estimate includes an estimated escrow payment as part of the projected monthly payment, helping borrowers understand how much they need to budget for these costs.

The Right to Receive Appraisal Report informs borrowers that they are entitled to receive a copy of any appraisal conducted on the property they are financing. The Loan Estimate mentions the possibility of an appraisal and its associated cost, highlighting the borrower's rights and responsibilities concerning property appraisals.

Finally, the Affiliated Business Arrangement Disclosure is somewhat similar to information provided in the Loan Estimate because it discloses when a lender has an ownership interest in a company providing services required for the loan (e.g., title insurance). The Loan Estimate includes costs for such services, and this disclosure ensures that borrowers are aware of business relationships that might affect their costs.

Dos and Don'ts

When it comes to filling out the Loan Estimate form, it's important to pay close attention to detail to ensure accuracy and make well-informed decisions. Here are some dos and don'ts to consider:

- Do double-check the property address and loan information. It's crucial to verify that the property address and loan ID number match your application and intended property to avoid any confusion.

- Don't forget to lock in your interest rate if it's an option. If your loan estimate states the interest rate is locked, note the expiration date and time to prevent any surprises in rate changes.

- Do review the projected payments section carefully. Understanding how your monthly payments can change over time is essential, especially if there's mortgage insurance or estimated escrow included.

- Don't overlook the loan terms. Confirm that the loan amount, interest rate, and monthly principal and interest payment match your expectations and that the terms indicate no prepayment penalty or balloon payment if that's important to you.

- Do ask questions about anything unclear. If there are terms or fees you don't understand, reach out to your loan officer for clarification.

- Don't just glance over the closing cost details. The breakdown of loan costs, other costs, and total closing costs are critical. Know what you're being charged for and why.

- Do compare this loan estimate with others. Using the comparisons and other considerations sections can help you evaluate if this loan is competitive and the right fit for your needs.

- Don't ignore the lender's contact information. Make a note of the loan officer's contact details. Having a direct line of communication can be incredibly helpful for any queries or concerns you might have.

- Do confirm receipt of the document, but recognize it's not an agreement to accept the loan. Signing or acknowledging receipt indicates you've received the estimate but doesn't bind you to accept the loan offer.

Misconceptions

When embarking on the journey of securing a mortgage, borrowers are often presented with a Loan Estimate form. This crucial document lays out the terms, projected payments, and costs associated with the loan. However, misconceptions abound, leading to confusion and, at times, misguided decisions. Here are ten common misunderstandings about the Loan Estimate form, demystified:

- The Loan Estimate is a commitment to lend. This assumption is incorrect. The Loan Estimate is essentially an initial offer, not a guarantee of financing. It outlines the terms under which the lender is willing to provide the loan, pending further verification of information and underwriting.

- All fees listed are set in stone. While the Loan Estimate does give a detailed account of expected costs, many of these can change before closing. It's important to note which costs are fixed and which are estimates that might adjust, such as services you can shop for.

- The interest rate on the Loan Estimate is final. Unless the interest rate is locked, as explicitly stated on the form, it can fluctuate with market conditions until it is indeed locked in by the lender.

- A rate lock is permanent. Rate locks have an expiration date. If the loan does not close by this date, the rate can change. It is essential to understand the terms of the rate lock and manage the closing timeline accordingly.

- Closing costs are the borrower's sole responsibility. The Loan Estimate includes an estimation of closing costs, but these can be negotiated. For example, the seller might agree to cover some costs as part of the sale negotiations.

- The lowest interest rate is always the best option. The APR (Annual Percentage Rate) and other loan features, such as the ability to make prepayments without penalties, should also be considered. The Loan Estimate helps compare these aspects.

- The Loan Estimate is only useful for comparing costs within the same lender. This form can and should be used to compare offers between different lenders. It provides a standardized format, making it easier to compare apples to apples.

- All lenders must provide a Loan Estimate within the same timeframe. Lenders are required to provide a Loan Estimate within three business days of receiving an application. However, the speed at which they can compile and send this information can vary.

- Homeowners insurance and property taxes are always included in the monthly payment. While these items are estimated on the Loan Estimate, whether they are actually included in your mortgage payment depends on if you have an escrow account. This is where the lender pays these costs on your behalf from funds collected with your payment.

- Once you get a Loan Estimate, you must proceed with that lender. Receiving this form does not obligate the borrower to proceed with the loan from that lender. It's a tool for understanding the terms offered and for shopping around.

Clearing up these misconceptions helps borrowers make more informed decisions when navigating the loan process. Understanding the Loan Estimate form is a crucial step in securing a mortgage that fits one's financial situation and goals.

Key takeaways

Understanding the Loan Estimate form is crucial for borrowers considering a mortgage. Here are six key takeaways:

- The Loan Estimate form provides critical information, including loan terms, projected payments, and closing costs, enabling borrowers to compare different loan offers effectively.

- Interest rates, points, and lender credits are subject to change until the rate lock is in place. The form indicates whether the rate is locked and the expiration of this lock, guiding borrowers on possible changes before closing.

- Closing costs are detailed in sections such as Loan Costs and Other Costs, which include origination charges, services you cannot shop for, and services you can shop for, along with a concise breakdown of each.

- The Cash to Close section offers a summarised estimate of the money borrowers need upfront, incorporating closing costs and any down payment, helping borrowers prepare for the financial commitment required at closing.

- Comparative features such as the Annual Percentage Rate (APR) and Total Interest Percentage (TIP) allow borrowers to assess the cost of the loan over time, making it easier to compare the long-term impact of different loan offers.

- Additional Information about the loan covers critical aspects like appraisal, assumption, homeowner’s insurance, late payment fees, refinancing possibilities, and loan servicing, providing a comprehensive overview of what borrowers can expect.

By closely reviewing the Loan Estimate form, borrowers can make more informed decisions, understanding the full implications of their mortgage options.

Popular PDF Documents

IRS 6251 - By accurately completing the form, taxpayers ensure compliance with AMT regulations, potentially avoiding audits and penalties.

IRS 990-EZ - This form is publicly accessible, allowing donors, members, and stakeholders to review the financial health and practices of a nonprofit.

What Is Form 8879 - Ultimately, the 8879 form facilitates a smoother, quicker tax filing experience, reinforcing the benefits of electronic tax submissions.