Get Loan End Use Letter Format Form

When individuals apply for a loan, especially for specific non-standard purposes, financial institutions may require a declaration known as the Loan End Use Letter. This document plays a critical role in ensuring both the lender and the borrower are on the same page regarding how the loan funds will be utilized. The format of such a letter, detailed in the provided content, outlines the borrower's commitment to use the borrowed funds for purposes explicitly mentioned, ranging from education and medical treatment to business ventures and property-related expenditures. Notably, the template prohibits the use of loan funds for purchasing gold in various forms or for speculative investments, such as stock markets or land purchases, emphasizing the legal and ethical use of the funds. It also mentions the implications of misusing the funds, including the potential for it to be considered a breach of agreement, leading to default under the transaction documents. This declaration ensures transparency between the borrower and the lending institution, in this case, ICICI Bank, and sets clear boundaries for the use of the financial facility, highlighting the importance of adherence to agreed terms for both managing financial risks and maintaining trust in financial relationships.

Loan End Use Letter Format Example

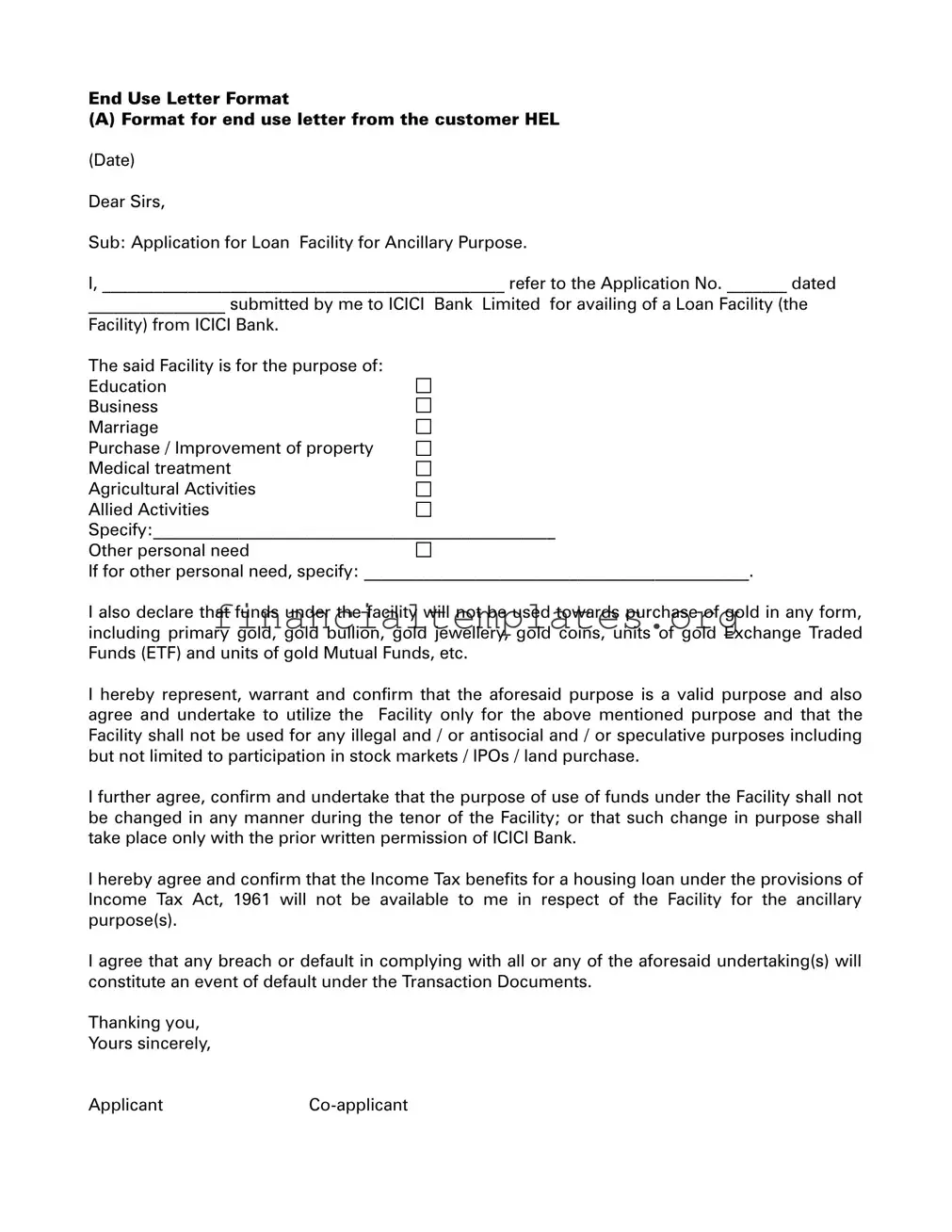

End Use Letter Format

(A) Format for end use letter from the customer HEL

(Date)

Dear Sirs,

Sub: Application for Loan Facility for Ancillary Purpose.

I, _______________________________________________ refer to the Application No. _______ dated

________________ submitted by me to ICICI Bank Limited for availing of a Loan Facility (the

Facility) from ICICI Bank.

The said Facility is for the purpose of:

Education

Business

Marriage

Purchase / Improvement of property

Medical treatment

Agricultural Activities

Allied Activities

Specify:_______________________________________________

Other personal need

If for other personal need, specify: _____________________________________________.

I also declare that funds under the facility will not be used towards purchase of gold in any form, including primary gold, gold bullion, gold jewellery, gold coins, units of gold Exchange Traded Funds (ETF) and units of gold Mutual Funds, etc.

I hereby represent, warrant and confirm that the aforesaid purpose is a valid purpose and also agree and undertake to utilize the Facility only for the above mentioned purpose and that the Facility shall not be used for any illegal and / or antisocial and / or speculative purposes including but not limited to participation in stock markets / IPOs / land purchase.

I further agree, confirm and undertake that the purpose of use of funds under the Facility shall not be changed in any manner during the tenor of the Facility; or that such change in purpose shall take place only with the prior written permission of ICICI Bank.

I hereby agree and confirm that the Income Tax benefits for a housing loan under the provisions of Income Tax Act, 1961 will not be available to me in respect of the Facility for the ancillary purpose(s).

I agree that any breach or default in complying with all or any of the aforesaid undertaking(s) will constitute an event of default under the Transaction Documents.

Thanking you,

Yours sincerely,

ApplicantCo-applicant

(B) Format for end use Letter from the customer for Top Up

(Date)

Dear Sirs,

Sub: Application for Loan Facility for Ancillary Purpose.

I, _______________________________________________ refer to the Application No. _______ dated

________________ submitted by me to ICICI Bank Limited , hereinafter referred to as “ ICICI Bank”

(which expression shall unless it be repugnant to the subject or context thereof, include its successors and assigns) for availing of a Loan Facility (the Facility)from ICICI Bank.

The said Facility is for the purpose of:

Education

Business

Marriage

Purchase / Improvement of property

Medical treatment

Agricultural Activities

Allied Activities

Specify: __________________________________________

Other personal need

If for other personal need, specify: _____________________________________________.

I also declare that funds under the facility will not be used towards purchase of gold in any form, including primary gold, gold bullion, gold jewellery, gold coins, units of gold Exchange Traded Funds (ETF) and units of gold Mutual Funds, etc.

I hereby represent, warrant and confirm that the aforesaid purpose is a valid purpose and also agree and undertake to utilize the loan only for the above mentioned purpose and that the loan shall not be used for any illegal and / or antisocial and / or speculative purposes including but not limited to participation in stock markets / IPOs / land purchase.

I further agree, confirm and undertake that the purpose of use of funds under the Facility shall not be changed in any manner during the tenor of the Facility; or that such change in purpose shall take place only with the prior written permission of ICICI Bank.

I hereby agree and confirm that the Income Tax benefits for a housing loan under the provisions of Income Tax Act, 1961 will not be available to me in respect of the Facility for the ancillary purpose(s).

I agree that any breach or default in complying with all or any of the aforesaid undertaking(s) will constitute an event of default under the Transaction Documents.

Thanking you,

Yours sincerely,

ApplicantCo-applicant

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The Loan End Use Letter is a formal communication to ICICI Bank from a customer applying for a loan. |

| 2 | This document specifies the purpose for which the loan is sought, including options like education, business, marriage, property acquisition or improvement, medical treatment, agricultural activities, and other personal needs. |

| 3 | The borrower must clearly state the specific end use of the loan in the letter and declare that the funds will not be used for the purchase of gold in any form or for speculative purposes. |

| 4 | A declaration is made within the letter that the loan will not be utilized for illegal, antisocial, or speculative activities, including stock market investments or land purchases. |

| 5 | The borrower agrees that the loan's purpose will not change during its tenure without prior written approval from ICICI Bank. |

| 6 | Income Tax benefits associated with housing loans under the Income Tax Act, 1961, are explicitly stated as not applicable to the loan if used for purposes other than housing. |

| 7 | A breach or default of the undertakings provided in the letter by the borrower constitutes an event of default under the transaction documents. |

| 8 | The letter format demands the submission of the application number and the date the application was made to provide context and reference to the loan request. |

| 9 | The letter includes a provision for co-applicants to partake in the loan application process, indicating joint liability or shared responsibility for the loan. |

| 10 | At the end of the document, a cordial sign-off is expected from the applicant(s), reinforcing the formal nature of the request. |

Guide to Writing Loan End Use Letter Format

Preparing and submitting a Loan End Use Letter is an essential step when seeking a loan for specific purposes from financial institutions like ICICI Bank. This document serves to clarify the purpose of the loan, ensuring both the borrower and the lender are aligned on the use of the funds. The procedure involves providing detailed information about the loan request, including personal details and the specific use of the loan proceeds. It is crucial to comply with this requirement accurately to avoid any potential issues in loan processing or future disagreements.

- Begin with the header of the document which includes the format name: End Use Letter Format (A) or (B) depending on your needs.

- Enter the current date where indicated at the start of the letter.

- In the salutation ("Dear Sirs,"), ensure it's appropriately addressed to the bank or the lender.

- Complete the subject line with the purpose of your letter, for instance, "Application for Loan Facility for Ancillary Purpose."

- Fill in your full name in the space provided after "I," to assert the application is made by you.

- Enter your Application No. and the date of your original loan application submission in the respective placeholders.

- Choose the purpose of the loan from the pre-listed options such as Education, Business, Marriage, etc., and specify in the allotted space if you select "Other personal need".

- Make a declaration regarding the non-purchase of gold using the funds from the facility by marking the respective section.

- Provide your agreement and understanding of the use of funds, including commitments not to use the loan for illegal, antisocial, speculative purposes, or changing the purpose without prior permission from ICICI Bank.

- If applicable, acknowledge that Income Tax benefits for a housing loan under the Income Tax Act, 1961, will not apply to your loan if it's for an ancillary purpose.

- Confirm your understanding that any breach of these commitments may lead to default under the Transaction Documents.

- Conclude the letter with a courteous thank you note, followed by "Yours sincerely," and leave space for the applicant's and, if applicable, the co-applicant's signatures.

After completing the form, review it carefully to ensure all information is accurate and no sections have been missed. Sign and date the form where indicated. It's then ready to be submitted alongside your loan application to ICICI Bank or the lending institution you're applying to. This letter is a binding document that outlines your commitments regarding the use of the loan, so make sure you are willing and able to comply with all the declarations made within it.

Understanding Loan End Use Letter Format

- What is the purpose of the Loan End Use Letter?

- Who needs to submit this letter?

- Can the purpose of the loan be changed after receiving the funds?

- Are there restrictions on the use of the loan funds?

- What happens if the borrower fails to comply with the terms in the letter?

- Is it possible to get income tax benefits for a housing loan mentioned in this letter?

- Does this letter need to be signed by both the applicant and co-applicant?

- What if the borrower needs to use the loan for purposes not listed in the letter?

- How does the lender ensure that the loan funds are used according to the specified purpose?

The Loan End Use Letter serves as a formal declaration by the borrower to the lending institution, specifying the intended use of the loan funds. This document ensures that the borrower commits to utilizing the funds for the stated purposes, such as education, business, marriage, property purchase or improvement, medical treatment, agricultural activities, or other specified personal needs. It also includes a commitment not to use the funds for prohibited activities, such as purchasing gold in any form or engaging in illegal, antisocial, or speculative activities.

Any individual applying for a loan facility from ICICI Bank Limited that requires specifying the purpose of the loan must submit the Loan End Use Letter. This requirement applies to both primary applicants and co-applicants.

No, the purpose of the loan as specified in the Loan End Use Letter cannot be changed during the tenure of the facility without prior written permission from ICICI Bank. This condition ensures that the funds are used solely for the intended purpose.

Yes, there are specific restrictions on the use of the loan funds. The borrower agrees not to use the funds for the purchase of gold in any form, illegal activities, antisocial behavior, speculative purposes, stock market participation, IPOs, or land purchases. Violating these terms can result in a default under the transaction documents.

If the borrower breaches or defaults on any of the commitments made in the Loan End Use Letter, it constitutes an event of default under the transaction documents. This breach can lead to penal actions or sanctions from the bank, including calling in the loan or taking legal action to recover the funds.

No, income tax benefits under the provisions of the Income Tax Act, 1961, for a housing loan will not be available if the facility is used for ancillary purposes as mentioned in the Loan End Use Letter.

Yes, the Loan End Use Letter should be signed by both the applicant and any co-applicants, indicating their agreement and undertaking to the terms outlined within the document.

If the borrower needs to use the loan for a purpose not listed in the letter, they must specify this other personal need in the provided space within the document. Any changes to the stated purpose after receiving the loan require prior written approval from ICICI Bank.

Lenders, such as ICICI Bank, may require borrowers to furnish proof of the use of funds according to the specified purpose detailed in the Loan End Use Letter. This can include invoices, receipts, or other documentation. Additionally, the lender may perform follow-up checks or audits to ensure compliance with the terms of the loan.

Common mistakes

Not specifying the purpose of the loan in detail: Many individuals filling out the Loan End Use Letter simply check off a category such as "Education" or "Medical treatment" without providing specific details about how the loan funds will be used. Lenders are looking for clarity to ensure the loan is used for its intended purpose and not for something that violates the terms, like speculative investments.

Failure to declare the non-use for prohibited purposes: It's crucial that applicants explicitly declare that the funds will not be used for buying gold in any form or for speculative purposes including stock market investments or land purchases. Skipping this declaration or not understanding its importance can lead to complications or even default.

Forgetting to include the Application No. and Date: Applicants often overlook the importance of referencing their Application No. and the Date of application submission. This information is vital for the lender to track and associate the Loan End Use Letter with the correct loan application, ensuring swift processing.

Omitting signatures from all parties involved: A common mistake is for only one party (either the applicant or co-applicant) to sign the letter, when in fact, signatures from all parties involved are required. This is essential for legal and verification purposes, confirming that all parties are aware of and agree to the loan's terms and intended use.

In summary, meticulous attention to detail and a clear understanding of the requirements can significantly streamline the loan application process. Ensuring that the Loan End Use Letter is correctly filled out not only aids in faster processing but also establishes a solid foundation of trust and compliance between the borrower and the lender.

Documents used along the form

When applying for a loan, a Loan End Use Letter is a crucial document that outlines the specific purposes for which the borrowed funds will be used. However, this is just one piece of the puzzle in the documentation required by financial institutions. Other forms and documents often accompany the Loan End Use Letter to ensure a comprehensive and legally compliant loan application process. Here's a list of six such documents that are frequently part of the loan documentation suite.

- Loan Application Form: This is the starting point for any loan request. It captures personal and financial information about the applicant, including their name, address, employment history, and income details.

- Credit Authorization Form: This document authorizes the lender to conduct a credit check on the applicant. It's essential for assessing the borrower's creditworthiness and determining the loan terms.

- Proof of Income Documents: These can include recent pay stubs, tax returns, or bank statements. They serve as evidence of the applicant's ability to repay the loan.

- Property Appraisal Report: For loans related to purchasing or improving property, a report evaluating the property's value is usually required. This helps in determining the loan amount.

- Collateral Documents: If the loan is secured, documents proving ownership and value of the collateral will be necessary. Examples include vehicle titles or property deeds.

- Guarantor Forms: In some cases, especially if the borrower has a limited credit history, lenders may require a guarantor. These forms formalize the guarantor's agreement to repay the loan if the borrower defaults.

Collectively, these documents, along with the Loan End Use Letter, form a robust framework to assess, approve, and administer a loan. Each piece plays a vital role in ensuring that the loan serves its intended purpose and that both lender and borrower are protected under the law. Navigating through these documents with a clear understanding will make the loan application process smoother and more efficient.

Similar forms

A Personal Loan Agreement is quite similar to the Loan End Use Letter Format, as both documents outline the terms and conditions under which a loan is provided. The Personal Loan Agreement, however, goes into more detail regarding repayment terms, interest rates, and the consequences of non-repayment. Both documents ensure there's a clear understanding between the lender and borrower about how the loan will be used and the obligations involved.

A Mortgage Agreement shares common elements with the Loan End Use Letter Format, mainly in specifying the purpose of the loan. While the Loan End Use Letter Format can cover various purposes like education or business needs, a Mortgage Agreement is specifically for the purchase or improvement of property. Both documents include clauses to ensure the borrower does not use the funds for illegal or unspecified purposes.

The Business Loan Agreement, similar to the Loan End Use Letter Format, outlines the specifics of a loan taken for business purposes. Both documents include details about the loan amount, purpose, and restrictions on fund usage. However, Business Loan Agreements typically also detail collateral requirements, financial covenants, and conditions precedent to the funding of the loan.

An Education Loan Agreement and the Loan End Use Letter Format are similar in that they are both used for specifying the purpose of the loan related to education. However, the Education Loan Agreement will often have more detailed sections on repayment schedules, grace periods, and the specifics of how the funds can be applied towards education expenses.

A Debt Settlement Agreement differs from the Loan End Use Letter Format in purpose but is similar in its formal arrangement between two parties. While the Loan End Use Letter outlines how a borrower plans to use the loan funds, a Debt Settlement Agreement comes into play when negotiating the repayment of existing debt under new terms. Both documents formalize the intentions and agreements of the parties involved to prevent misunderstandings.

The Promissory Note, while typically shorter and less detailed, serves a purpose similar to that of the Loan End Use Letter Format by documenting a promise to pay. However, it focuses more on the repayment of the loan rather than the specifics of its use. The clarity and binding commitment in both documents serve to protect the interests of the lender and borrower.

A Credit Agreement shares similarities with the Loan End Use Letter Format in that it is a formal document between a lender and borrower outlining the terms of a loan. Credit Agreements tend to be more comprehensive, covering a broad range of terms such as interest rates, repayment terms, and covenants, beyond just the usage of the loan funds.

An Investment Agreement, although generally used for equity transactions, shares the formal structure and purpose specification with the Loan End Use Letter Format. Both document the intent of the funds – the Investment Agreement for an equity stake in a business, and the Loan End Use Letter for specific personal or business needs.

The Lease Agreement, while primarily used for the rental of property, resembles the Loan End Use Letter Format in its structure of stating terms and conditions agreed upon by two parties. Both define the use of property or funds, conditions, and restrictions, ensuring both parties adhere to agreed-upon terms.

Last, a Cosigner Agreement is analogous to the Loan End Use Letter Format in situations where a cosigner is involved in a loan. It outlines the responsibilities of the cosigner should the primary borrower fail to repay the loan. Although focusing more on repayment, it shares the element of formalizing an agreement to safeguard the involved parties' interests.

Dos and Don'ts

When you're filling out the Loan End Use Letter Format form, it's important to approach it with care. There are specific dos and don'ts that can help guide you through the process. Here are some essential tips to keep in mind:

Dos:- Be honest about the purpose of the loan. Misstating the purpose can lead to legal issues.

- Specify the purpose if it falls under "Other personal need" to ensure transparency.

- Double-check the Application No. and date for accuracy to match your loan application records.

- Confirm that you will not use the funds for purchasing gold in any form as explicitly stated in the form.

- Acknowledge the limitations on the use of the loan, such as not using it for illegal activities or stock market speculation.

- Understand that changing the purpose of the loan without prior written permission from ICICI Bank is not allowed.

- Recognize that you will not be eligible for Income Tax benefits under certain conditions mentioned in the form.

- Sign the letter sincerely, as both the applicant and co-applicant, if applicable.

- Keep a copy for your records once the form is filled out and submitted.

- Seek clarification from ICICI Bank if any part of the form is unclear.

- Do not rush through filling out the form. Take your time to read and understand each section.

- Avoid leaving blank spaces for fields that are applicable to your loan application.

- Do not use vague language when specifying the purpose of the loan. Be as detailed as possible.

- Refrain from changing the purpose of your loan on a whim. Remember, a change requires prior approval from ICICI Bank.

- Do not overlook the declaration section that prohibits the use of funds for buying gold.

- Avoid assuming your eligibility for Income Tax benefits without understanding the criteria.

- Do not ignore the terms that outline the consequences of breaching the agreement.

- Keep away from speculation in financial markets with the funds, as it's against the agreement.

- Do not forget to sign the letter. An unsigned letter is invalid.

- Avoid submitting the letter without verifying all the details against your loan application.

Misconceptions

Many people have misunderstandings about the Loan End Use Letter format, especially when it comes to loans for specific purposes. Here's a look at seven common misconceptions:

It's only for bank loans: The format can be required by various financial institutions, not just banks. Borrowers may need to submit this letter when seeking loans from non-banking financial companies (NBFCs) or other lending institutions as well.

Only for large loan amounts: This letter is not exclusive to large loans. Regardless of the loan size, lenders may request this letter to ensure the borrowed funds will be used for the stated purposes.

Limited to certain uses: While the letter lists common purposes like education, business, and property purchase, it also allows for “other personal need” to be specified, providing flexibility in the loan's end use.

Purchase of gold is allowed if not specified: The letter explicitly states that funds cannot be used for the purchase of gold in any form. This is a strict prohibition, not an oversight or option left to the borrower's discretion.

Changing the end use is easily negotiable: The letter makes it clear that the purpose for which the funds are used cannot be changed without prior written permission from the lender. This is a binding condition, not a formality that can be easily bypassed or renegotiated.

Violation of terms has no real consequences: Breach of any conditions outlined in the letter, including unauthorized change in the end use of funds, constitutes an event of default. This can have serious legal and financial repercussions.

Income tax benefits are automatic: The document explicitly states that income tax benefits for a housing loan under the Income Tax Act, 1961, are not available for loans taken for ancillary purposes. Borrowers should not assume tax benefits without verifying their eligibility based on the loan's purpose.

It's crucial to understand the conditions and stipulations outlined in the Loan End Use Letter to ensure compliance and avoid any unintended violations of the loan agreement.

Key takeaways

Understanding the Loan End Use Letter is crucial when applying for a loan, particularly for those seeking funds from ICICI Bank. This document plays a pivotal role in ensuring that borrowers and the bank are on the same page regarding the intended use of the borrowed funds. Here are key takeaways to keep in mind when filling out and using the Loan End Use Letter Format:

- The Loan End Use Letter must clearly specify the purpose of the loan. Options include education, business, marriage, property purchase or improvement, medical treatment, agricultural activities, and other personal needs. Specifying the exact purpose helps in ensuring the funds are utilized for the intended objectives.

- Applicants must expressly declare that the loan will not be used for purchasing gold in any form. This includes primary gold, gold bullion, jewelry, coins, units of gold Exchange Traded Funds (ETF), and gold Mutual Funds.

- The letter includes a commitment from the borrower that the loan funds will not be used for illegal, antisocial, or speculative purposes. This includes activities like stock market participation, Initial Public Offerings (IPOs), or land purchase without clear constructive intent.

- The borrower agrees not to change the declared purpose of the loan without obtaining prior written permission from ICICI Bank. This ensures that the funds are used as initially intended and agreed upon.

- Income Tax benefits associated with housing loans will not apply to loans taken for purposes specified in the letter that are considered ancillary.

- A breach of any stipulated undertakings in the letter, such as using the funds for unauthorized purposes, constitutes an event of default. This could have serious repercussions, including legal actions and impact on the borrower's credit score and ability to secure future loans.

- Both primary borrowers and co-applicants must sign the letter, making it a mutual agreement on the usage of the loan facility.

- It's crucial for applicants to fill out the form with accurate and truthful information to avoid any potential issues with the loan application or usage.

- Before submitting the letter, borrowers should review all declarations and undertakings to ensure understanding and compliance with the terms set by ICICI Bank.

- This document not only serves as a protective measure for the bank but also as a clear guideline for borrowers on how the loan should be utilized, emphasizing the importance of financial responsibility.

When applying for a loan, it's important to understand all documentation thoroughly. The Loan End Use Letter is more than just a formality; it's a binding agreement that outlines the expected conduct and usage of funds by the borrower. Ensuring all conditions are met with integrity not only facilitates a smoother loan application process but also fosters a trusting relationship between the borrower and the bank.

Popular PDF Documents

Irs Payment Plans - The form is a formal request for installment payments, providing taxpayers a way to repay their debt over time.

Fire Tcc - Accurate completion of Form 4419 ensures that your entity's electronic filing capabilities remain uninterrupted.

IRS 8962 - Through this form, the IRS assesses whether you need to repay any health insurance premium subsidies.