Blank IOU Form

When it comes to formalizing a personal loan, whether between friends, family members, or even acquaintances, the simplicity and ease of an IOU form often make it a preferred choice. This humble document, despite its informal nature, serves a crucial function in acknowledging that a debt exists between two parties. At its core, an IOU details the borrower's promise to repay a specified amount to the lender within an agreed timeframe. While it may lack the comprehensive legal protections found in more complex agreements, the IOU still lays a clear foundation for the financial transaction, helping to avoid misunderstandings and disputes down the line. Notably, this form usually includes critical information such as the amount borrowed, the names of the parties involved, repayment dates, and any interest or conditions agreed upon. In a world where verbal agreements can easily be forgotten or disputed, having a written record, even one as straightforward as an IOU, provides a level of security and peace of mind for both lender and borrower.

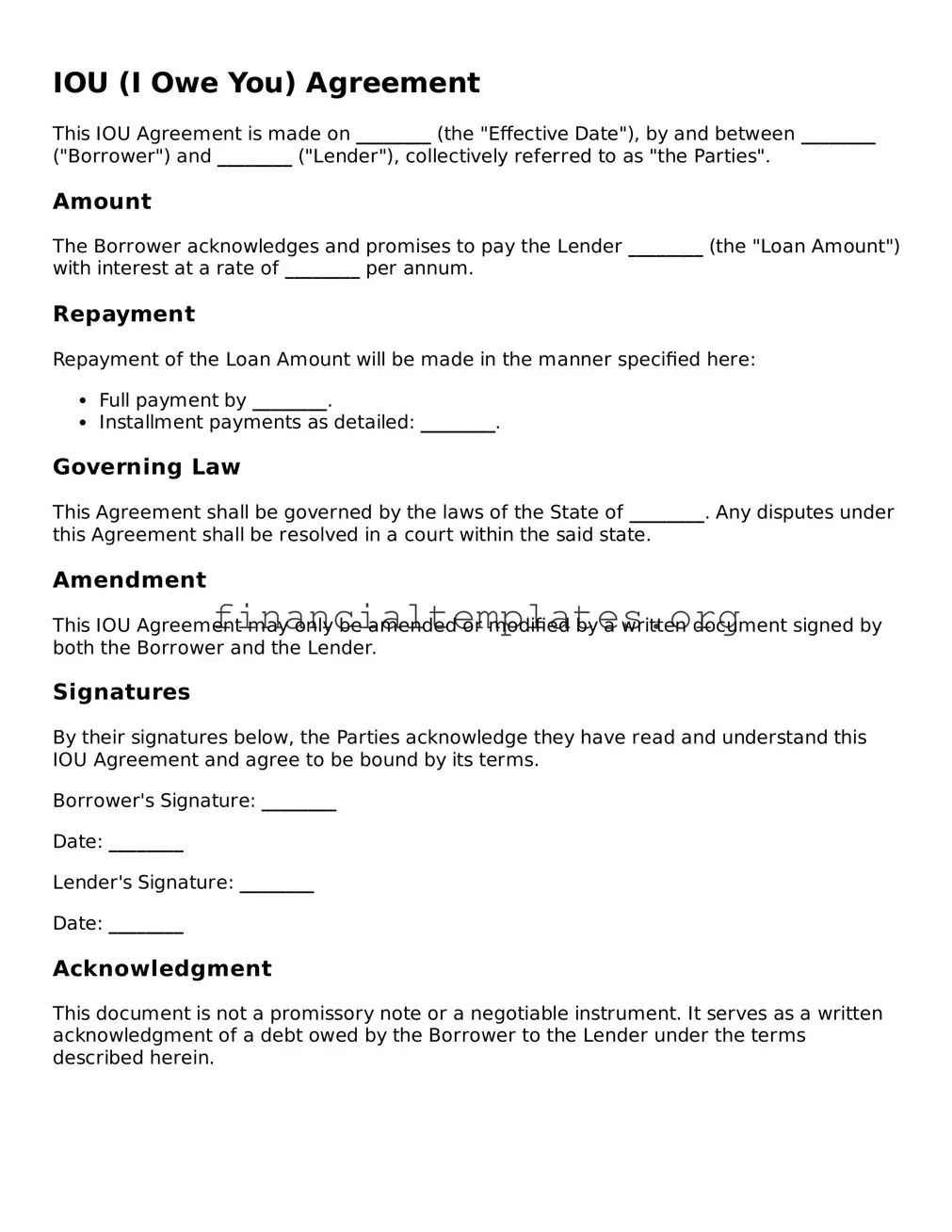

IOU Example

IOU (I Owe You) Agreement

This IOU Agreement is made on ________ (the "Effective Date"), by and between ________ ("Borrower") and ________ ("Lender"), collectively referred to as "the Parties".

Amount

The Borrower acknowledges and promises to pay the Lender ________ (the "Loan Amount") with interest at a rate of ________ per annum.

Repayment

Repayment of the Loan Amount will be made in the manner specified here:

- Full payment by ________.

- Installment payments as detailed: ________.

Governing Law

This Agreement shall be governed by the laws of the State of ________. Any disputes under this Agreement shall be resolved in a court within the said state.

Amendment

This IOU Agreement may only be amended or modified by a written document signed by both the Borrower and the Lender.

Signatures

By their signatures below, the Parties acknowledge they have read and understand this IOU Agreement and agree to be bound by its terms.

Borrower's Signature: ________

Date: ________

Lender's Signature: ________

Date: ________

Acknowledgment

This document is not a promissory note or a negotiable instrument. It serves as a written acknowledgment of a debt owed by the Borrower to the Lender under the terms described herein.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition of IOU | An IOU is a document acknowledging a debt to another party. |

| Legally Binding | While simple, an IOU is recognized as legally binding, signifying a promise to pay a specified amount. |

| Components | Typical components include the amount owed, the date, names of the parties involved, and sometimes the repayment terms. |

| Governing Law | State-specific laws may dictate the enforceability and the requirements of an IOU, making it important to consult local laws. |

Guide to Writing IOU

An IOU form is a straightforward document that acknowledges a debt owed from one party to another. This succinct form is a powerful tool for ensuring that both lender and borrower are on the same page about the amount borrowed and the repayment expectations. Filling out this form correctly is crucial to its validity and effectiveness in any financial agreement between parties. It's an essential step for both protecting your rights and clearly outlining the responsibilities of each party involved in the transaction. Below are the steps needed to properly fill out an IOU form.

- Start by writing the date at the top of the form. This helps to establish when the agreement was made.

- Write the full legal name of the borrower and the lender on the lines provided. Make sure to print clearly to avoid any confusion about who is involved.

- Specify the amount of money being borrowed. Write this amount in both words and numbers to ensure clarity about the exact sum of the debt.

- Describe the repayment terms. This includes when the loan needs to be repaid by and if there will be any interest attached. If so, detail the interest rate and how it will be applied.

- Include both parties' contact information. This should cover physical addresses, phone numbers, and email addresses, ensuring both the borrower and the lender can be reached if needed.

- Both the borrower and the lender must sign the form. By signing, both parties agree to the terms outlined in the document.

- Lastly, although not always required, it is a good practice to have a witness sign the IOU. This adds an extra layer of validity and can help protect both parties if disputes arise.

Once the IOU form is fully completed and signed by all relevant parties, it serves as a legally binding agreement. It's crucial to keep the document in a safe place and make copies for both the lender and the borrower. This ensures that both have a record of the agreement and can refer back to it if any questions or issues arise during the repayment process. Remember, an IOU form is not just a casual promise but a committed acknowledgment of a debt that carries legal weight.

Understanding IOU

-

What is an IOU form?

An IOU (I Owe You) form is a straightforward document that acknowledges an individual's debt to another. It serves as a written promise from the borrower to the lender, specifying the amount owed and sometimes, the terms under which the debt will be repaid. Unlike formal loan agreements, IOU forms typically do not include interest rates or collateral terms.

-

When should one use an IOU form?

An IOU form is most useful for informal loans or financial agreements between individuals who know and trust each other, such as friends or family members. It's an appropriate choice for small to moderate sums of money, where a simple acknowledgment of the debt is sufficient and a more complex contract isn't necessary.

-

Is an IOU legally binding?

Yes, an IOU is a legally binding document. As long as it clearly mentions the amount owed and the parties involved, it can serve as a legal instrument to acknowledge a debt. In the event of a dispute, an IOU can be used in court to demonstrate the existence of a loan.

-

What should be included in an IOU form?

An effective IOU form should include the following details:

- The lender's and borrower's names and contact information.

- The amount of money borrowed.

- The date the loan was made.

- Repayment terms, such as the due date or installment plan, if applicable.

- Signatures of both parties involved.

-

Does an IOU need to be notarized or witnessed?

No, an IOU does not generally need to be notarized or witnessed to be legally binding. However, having the document notarized or witnessed can add an extra level of authenticity and may be helpful in situations where the IOU's validity might be questioned.

-

Can an IOU form specify repayment in installments?

Yes, an IOU can specify that the repayment will be made in installments. If the parties agree on installment payments, the form should detail the amount of each installment, the frequency of payments, and when the first and last payments are due.

-

What happens if the borrower fails to repay the debt as agreed?

If the borrower fails to repay the debt according to the terms specified in the IOU, the lender has the right to pursue legal action to recover the owed amount. The specific remedies available may depend on the laws of the state where the agreement was made.

-

Can an IOU be modified after it’s signed?

Yes, an IOU can be modified, but any changes should be agreed upon in writing by both the lender and the borrower. For clarity and legal protection, it's best to create a new IOU that reflects the updated terms and have both parties sign it again.

-

Where can one get an IOU form?

IOU forms can be drafted from scratch, tailored to the specific agreement between the parties involved. Alternatively, templates can be found online or obtained from legal document services. Regardless of the source, it's essential for the form to include all necessary details and be clear and concise to ensure its effectiveness and legality.

Common mistakes

When it comes to drafting an IOU form, which is essentially a document that acknowledges a debt, many common mistakes can compromise its effectiveness and enforceability. Understanding these pitfalls can help ensure that the IOU serves its intended purpose as a clear, legal acknowledgment of a debt owed. Below are six frequent mistakes people make when filling out an IOU form:

Not Specifying the Amount Clearly: The exact amount of money being borrowed should be written in both words and figures to prevent any ambiguity. Leaving the amount vague or unclear can lead to disputes and confusion regarding the debt amount.

Forgetting to Include the Date: The date when the IOU is created is crucial. It helps to establish when the agreement was made and can also determine the timeline for repayment. Omitting the date can complicate enforcement and collection efforts.

Omitting Terms of Repayment: An effective IOU should outline the repayment terms clearly, including due dates, installment arrangements (if any), and interest rates. When these details are not provided, it becomes harder to enforce the agreement based on verbal promises or assumptions.

Lacking Clear Identification of Parties Involved: Both the borrower and the lender should be clearly identified by their full names and possibly addresses. When this information is incomplete or incorrect, it raises questions about the document's validity and whom it legally binds.

Failure to Sign the Document: For an IOU to be considered valid, it must be signed by the borrower, and in some cases, by the lender as well. Unsigned IOUs lack the necessary legal acknowledgment of the debt and are harder to enforce in a court of law.

Not Witnessing or Notarizing the Document: While not always required, having an IOU witnessed or notarized can lend additional credibility and legal weight. Skipping this step makes it easier for a party to dispute the document's authenticity or the terms agreed upon.

By avoiding these common mistakes, individuals can create an IOU that is clear, detailed, and more enforceable. This ensures both parties understand their obligations and rights, thereby reducing the potential for disputes and complications down the line.

Documents used along the form

When drafting an IOU (I Owe You) form, which is a simple document acknowledging a debt, it's not uncommon to encounter a need for additional documents to comprehensively cover the details of the financial arrangement. These documents can provide clearer terms, legal protection, and detailed agreements between the parties involved. Below is a list of other forms and documents often used alongside an IOU form to ensure a thorough and legally binding agreement.

- Promissory Note: This is a written promise to pay a specific sum of money to a certain individual or entity by a specified date. Unlike the IOU, it includes payment details such as interest rates and repayment schedule.

- Loan Agreement: A more formal and detailed contract than an IOU, outlining the terms and conditions of a loan between two parties. It includes information on collateral, late fees, and the legal recourse for default.

- Bill of Sale: Used primarily in the sale of goods, documenting that something was sold by one party to another. It acts as a receipt and can include details on the condition and value of the item sold.

- Amortization Schedule: Relevant in scenarios involving installment payments, this document outlines the breakdown of payments over time, showing how much goes towards interest and how much reduces the principal amount.

- Security Agreement: A document that grants the lender a security interest in a specific asset or property, which serves as collateral for a loan. It details the rights of the secured party in case of the debtor's default.

- Guaranty: This is an agreement whereby a third party agrees to fulfill the payment obligations of the debtor should they default. It provides additional security for the lender.

- Lien Waiver: Often used in construction, this document relinquishes the right of the filer to place a lien on the property, usually after receiving payment.

- Debt Settlement Agreement: An agreement between a debtor and creditor to settle a debt for less than the amount owed. This document outlines the terms of the settlement, including the final amount to be paid.

- Release of Final Payment: This document is used once a debt is fully paid off, acknowledging the completion of payments and releasing the debtor from further obligations.

Combining an IOU form with any of these documents, depending on the situation, can ensure all parties are on the same page and legally protected. These documents can address specific details and conditions of a financial agreement more comprehensively than an IOU form alone. When in doubt, consulting with a legal professional can help in selecting the right documents for your needs.

Similar forms

An IOU form, known as an "I Owe You," documents a transaction where one party owes a debt to another. This simple agreement acknowledges that money, goods, or services will be exchanged from the debtor to the creditor. A similar document is a promissory note. Unlike an IOU, a promissory note is more formal and includes detailed information such as the repayment schedule, interest rate, and consequences of non-payment. The promissory note provides a clearer agreement on the terms of repayment, making it legally stronger than an IOU.

Another document resembling an IOU is a loan agreement. This is a comprehensive contract between a borrower and lender that outlines the details of a loan. It covers terms including, but not limited to, the loan amount, interest rate, repayment schedule, and collateral. The loan agreement serves a more formal and legally binding arrangement compared to an IOU, which is often informal and based on trust between the parties involved.

A bill of sale is also akin to an IOU, particularly when it comes to transactions involving goods. This document is used when ownership of goods, such as vehicles or personal property, is transferred from the seller to the buyer. It typically specifies the item being sold, the sale amount, and the parties involved. Like an IOU, it acknowledges a transaction, but the bill of sale finalizes the transfer of ownership, which an IOU does not do.

The deed of trust represents another document related to an IOU, especially in the context of securing a debt with property. It involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee, who holds the property title until the loan is paid off. While an IOU signifies a debt owed, a deed of trust provides legal protection to the lender by securing the loan with real property.

A mortgage agreement is similar to an IOU in that it indicates a debt owed by one party to another. However, a mortgage specifically involves a loan for purchasing property, with the property itself serving as collateral. The terms include the loan amount, interest rate, repayment schedule, and the rights of the lender in case of the borrower's default. A mortgage is more complex and bound by more regulations than an IOU.

An acknowledgment of debt is closely related to an IOU, as it is a written statement from the debtor confirming the amount owed to the creditor. However, this acknowledgment may include additional details such as the basis for the debt and the agreement for repayment. While an IOU might simply state an amount owed, an acknowledgment of debt often serves as a more formalized confirmation of the debtor's obligation.

A credit agreement shares similarities with an IOU, in that it is a contract between a borrower and a lender outlining the terms of extending credit. This could include loans, lines of credit, or credit card agreements. It details the amount borrowed, interest rate, repayment schedule, and other terms. Credit agreements, unlike IOUs, are extensive contracts specifying credit terms in detail and are enforceable under financial regulations.

Lastly, a lease agreement can also mirror the nature of an IOU but in the context of renting property or equipment. It specifies the terms under which one party agrees to rent property owned by another party. It includes details such as the duration of the lease, monthly payments, and responsibilities of each party. Though a lease agreement and an IOU both signify an agreement between two parties, lease agreements are specifically tailored to rental arrangements and include comprehensive legal obligations and rights.

Dos and Don'ts

When filling out an IOU (I Owe You) form, it's crucial to approach the document with seriousness and precision, given its potential legal implications. Below are essential dos and don'ts that should guide you through this process:

- Do ensure that all parties involved have a clear understanding of the amount being loaned and the repayment terms.

- Do include full names and contact information of both the borrower and lender to avoid any ambiguity regarding the parties involved.

- Do specify the loan amount in numbers and words to prevent discrepancies and ensure clarity.

- Do clearly outline the repayment schedule, including due dates, to set explicit expectations for both parties.

- Don't leave any sections of the form blank. Incomplete forms can lead to misunderstandings or exploitation.

- Don't forget to sign and date the document; a written agreement without the signatures of both parties may not be considered legally binding.

- Don't rely solely on verbal agreements. While trust is important, having a written document is crucial for legal protection and clarity.

Misconceptions

An IOU form, standing for "I Owe You," is a basic acknowledgment of debt, yet it is often misunderstood in both casual and formal contexts. The misconceptions about this simple document are numerous, but understanding its proper use and limitations can ensure it serves its intended purpose effectively.

An IOU is legally binding in all situations. While an IOU does serve as a documented acknowledgment of debt, its enforceability can vary by jurisdiction. Some legal systems may require additional elements, like consideration and witness signatures, to elevate its strength in court.

IOU forms are only informal agreements. Although IOUs are considered less formal than promissory notes or loan agreements, they can be legally binding if they include the necessary elements such as the amount owed, the parties involved, and the repayment terms. Their informality doesn't inherently diminish their legal weight.

Writing an IOU is a complicated process. On the contrary, creating an IOU can be quite straightforward. The fundamental requirements are the creditor and debtor's names, the amount owed, and the repayment terms. For added legal strength, signatures from both parties are advisable.

IOUs must include interest rates. While including interest rates can clarify the terms of repayment, especially in long-term loans, it is not a mandatory component of an IOU. An IOU can simply document the principal amount owed without specifying interest.

Only monetary debts can be documented with IOUs. Although commonly used for money lent and borrowed, IOUs can also document the intention to return or compensate for borrowed property. The versatility of an IOU makes it useful for a variety of debts beyond just financial ones.

An IOU is always a formal contract. The formality of an IOU depends on its context and content. While it can be drafted with legal advice and detailed terms, it can also be a simple note acknowledging a small personal loan among friends or family, without the need for legal language.

IOUs are the same as promissory notes. This is a common misunderstanding. Unlike IOUs, promissory notes are more formalized documents that typically include detailed repayment terms, interest rates, and may be legally binding in broader circumstances. IOUs are simpler and generally indicate a debt without extensive details.

All parties need to sign the IOU for it to be valid. While having both the lender's and borrower's signatures can strengthen the document's validity, the essential signatory is the person who owes the debt. Their signature acknowledges the debt and the terms of repayment.

Understanding these common misconceptions about IOU forms can lead to their more effective and confident use. Although they may seem simple, their power in acknowledging and detailing debts should not be underestimated. As with any legal document, consideration of the specific laws and requirements of one's jurisdiction is key to maximizing an IOU's utility.

Key takeaways

An IOU form is a straightforward financial document confirming one party's debt to another. It’s important to get it right to ensure clarity and legal enforceability. Here are key takeaways to remember when filling out and using an IOU form:

- Include complete information: Make sure to fill in all necessary details clearly. This includes the full names of both the lender and borrower, the loan amount, and the date the loan was given. Accurate and comprehensive details help avoid any misunderstandings or disputes.

- Be clear about repayment terms: Clearly state the repayment schedule, including dates or conditions under which the loan should be repaid. If interest is to be applied to the loan, specify the rate and how it will be calculated.

- Signatures are crucial: For an IOU to be considered valid, both the lender and the borrower must sign the document. Consider having witnesses or a notary public witness the signing to add another layer of authenticity and protection.

- Keep it professional: Even if the IOU is between friends or family members, treat the transaction professionally. This ensures that both parties understand the seriousness of the agreement and are more likely to adhere to its terms.

- Maintain records: After the IOU is signed, both parties should keep a copy of the document. It’s wise to also keep a record of any payments made towards the debt. This documentation can be critical in case of a dispute or for tax purposes.

Other Types of IOU Templates:

Family (Friends) Personal Loan Agreement - Even when lending money to friends, it's crucial to have a clear agreement in place. This form ensures everyone's expectations are aligned.

Sample Employee Loan Agreement - Incorporates a section for signatures from both the employer and employee, alongside a date, to authenticate the agreement.