Blank Family (Friends) Personal Loan Agreement Form

When family members or friends decide to lend or borrow money amongst each other, navigating the financial transaction can quickly become complex without a clear agreement in place. Enter the Family (Friends) Personal Loan Agreement form, a crucial tool designed to outline the specifics of the loan, including the amount borrowed, interest rates (if any), repayment schedule, and consequences for late payments or non-repayment. This form serves as a formal record that protects both parties' interests, ensuring that personal relationships are not strained by misunderstandings or miscommunications about financial matters. By clearly defining the loan's terms, the agreement minimizes potential disputes, making it easier for both lenders and borrowers to manage their expectations and responsibilities. Furthermore, this agreement can also serve as a legal document, providing a measure of legal protection should disputes arise and require resolution in a court of law.

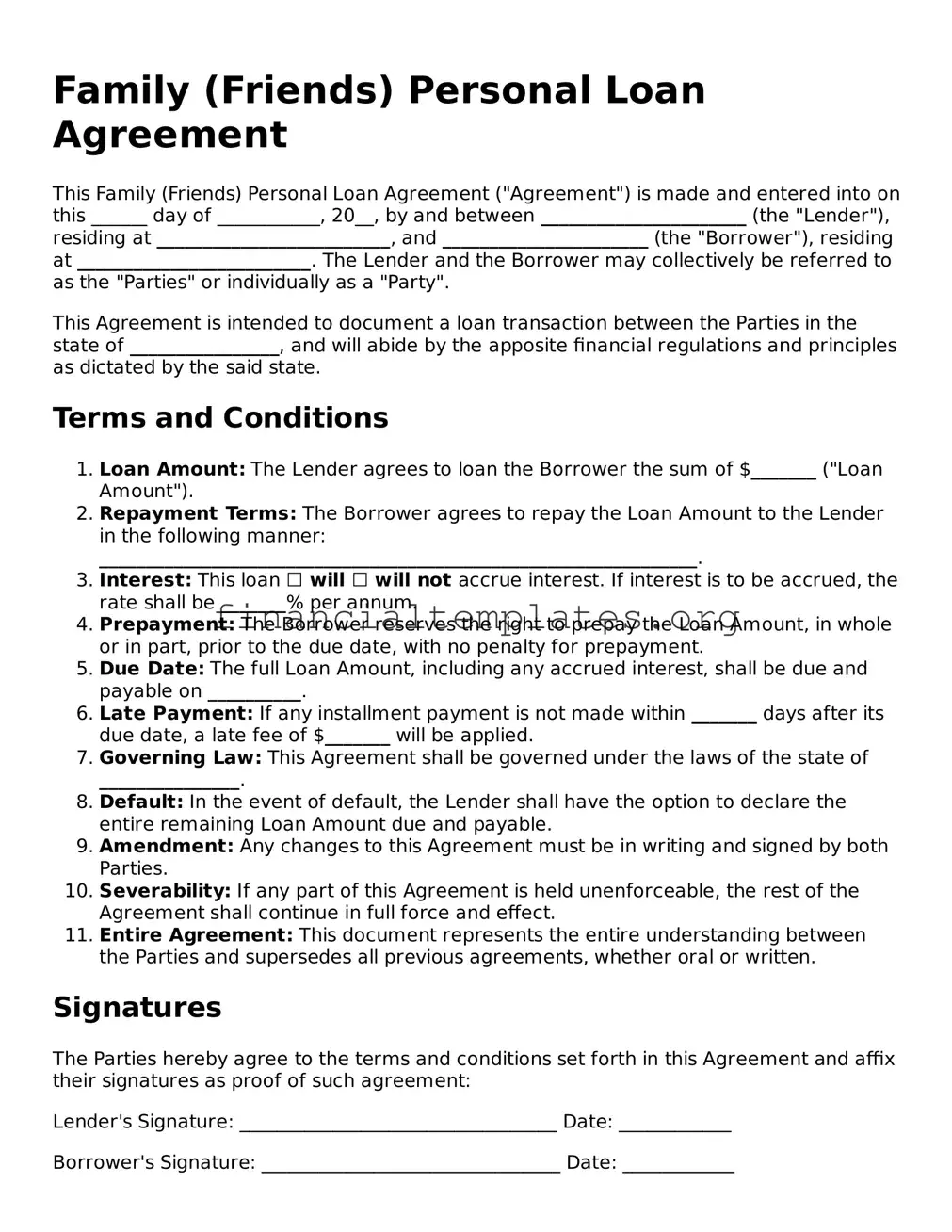

Family (Friends) Personal Loan Agreement Example

Family (Friends) Personal Loan Agreement

This Family (Friends) Personal Loan Agreement ("Agreement") is made and entered into on this ______ day of ___________, 20__, by and between ______________________ (the "Lender"), residing at _________________________, and ______________________ (the "Borrower"), residing at _________________________. The Lender and the Borrower may collectively be referred to as the "Parties" or individually as a "Party".

This Agreement is intended to document a loan transaction between the Parties in the state of ________________, and will abide by the apposite financial regulations and principles as dictated by the said state.

Terms and Conditions

- Loan Amount: The Lender agrees to loan the Borrower the sum of $_______ ("Loan Amount").

- Repayment Terms: The Borrower agrees to repay the Loan Amount to the Lender in the following manner: ________________________________________________________________.

- Interest: This loan ☐ will ☐ will not accrue interest. If interest is to be accrued, the rate shall be _______% per annum.

- Prepayment: The Borrower reserves the right to prepay the Loan Amount, in whole or in part, prior to the due date, with no penalty for prepayment.

- Due Date: The full Loan Amount, including any accrued interest, shall be due and payable on __________.

- Late Payment: If any installment payment is not made within _______ days after its due date, a late fee of $_______ will be applied.

- Governing Law: This Agreement shall be governed under the laws of the state of _______________.

- Default: In the event of default, the Lender shall have the option to declare the entire remaining Loan Amount due and payable.

- Amendment: Any changes to this Agreement must be in writing and signed by both Parties.

- Severability: If any part of this Agreement is held unenforceable, the rest of the Agreement shall continue in full force and effect.

- Entire Agreement: This document represents the entire understanding between the Parties and supersedes all previous agreements, whether oral or written.

Signatures

The Parties hereby agree to the terms and conditions set forth in this Agreement and affix their signatures as proof of such agreement:

Lender's Signature: __________________________________ Date: ____________

Borrower's Signature: ________________________________ Date: ____________

PDF Properties

| Fact Name | Description |

|---|---|

| Form Purpose | Establishes a formal loan arrangement between friends or family members. |

| Interest Rates | Can include an interest rate to comply with IRS minimum interest rate requirements, if applicable. |

| Repayment Schedule | Details the repayment terms, such as the amount, frequency, and duration of payments. |

| Loan Security | May be secured or unsecured, depending on the agreement between the parties. |

| Governing Law(s) | Specifies the state law(s) that will govern the agreement. This can vary based on the parties' location. |

| Signatory Requirements | Must be signed by both the lender and borrower to be legally binding. |

| Witness or Notarization | Depending on the state, it may require witnessing or notarization to enhance its enforceability. |

| Default Terms | Includes conditions and remedies in case the borrower fails to make payments as agreed. |

| Amendment Process | Procedure for making changes to the agreement must be mutually agreed upon and documented. |

Guide to Writing Family (Friends) Personal Loan Agreement

When lending money to family or friends, it's important to have a personal loan agreement to make the terms clear and protect the relationship. This document outlines the loan amount, repayment schedule, and any interest charges. Filling out the Family (Friends) Personal Loan Agreement form correctly ensures both parties understand their obligations. Here's a step-by-step guide to help you through the process.

- Start by entering the date the loan agreement is being made at the top of the form.

- Write the full names and addresses of the lender and the borrower in the designated spaces.

- Specify the total amount of money being lent. Write this amount in both words and numbers to avoid confusion.

- Choose the interest rate option, if applicable. If charging interest, write down the annual percentage rate. If not charging interest, clearly state this.

- Outline the repayment plan. Include the start date of the repayments, the frequency of repayments (e.g., monthly), and the amount of each payment. Also, specify the final payment date.

- Include a clause on what happens if a payment is missed or late. This might involve late fees or other penalties.

- Decide on the method of payment (e.g., cash, check, bank transfer) and document it. This helps track payments effectively.

- If collateral is being used to secure the loan, describe the collateral in detail.

- Both the lender and borrower should read the entire agreement carefully.

- Have the lender and borrower sign and date the form in front of a witness, if required. Some agreements might also suggest having the signatures notarized for additional legal validation.

- Make copies of the signed agreement. Give one to the borrower, keep one for the lender, and consider having a third party hold a copy for safekeeping.

After completing the Family (Friends) Personal Loan Agreement form, both parties should feel more at ease about the loan arrangement. This document serves as a clear record of the loan terms, helping to prevent misunderstandings and preserve personal relationships. Remember to adhere to the repayment schedule and communicate openly should any issues arise during the term of the loan.

Understanding Family (Friends) Personal Loan Agreement

-

What is a Family (Friends) Personal Loan Agreement?

A Family (Friends) Personal Loan Agreement is a formal document that outlines the terms and conditions of a loan between two parties, typically a borrower and a lender, who are friends or family members. This agreement encapsulates details such as the loan amount, interest rate, repayment schedule, and any other terms deemed necessary by both parties. It serves not only as a binding commitment but also as a measure to preserve the relationship by clarifying expectations and responsibilities.

-

Why should I use a Family (Friends) Personal Loan Agreement?

Using a Family (Friends) Personal Loan Agreement is crucial for several reasons. It helps in preventing misunderstandings by clearly setting out the loan terms, ensuring both parties are on the same page. This can safeguard personal relationships from potential financial disputes. Additionally, it provides a legal framework that could be used for recourse in case of disagreements, making the agreement a protective tool for both the lender and the borrower.

-

What information do I need to include in the agreement?

The agreement should contain vital information including the full names and contact details of both the lender and the borrower, the loan amount, interest rate (if any), repayment schedule (specific dates or duration), and any collateral if secured against the loan. Specifying what happens in case of late payments or default is also recommended to prevent future disputes and to protect the lender’s interests.

-

Should I charge interest on the loan?

Deciding whether to charge interest is a personal decision and may be influenced by the relationship between the lender and the borrower, or the purpose of the loan. While it is not mandatory, charging a modest interest rate can serve as an incentive for timely repayment and can also help the lender to keep pace with inflation. Before finalizing an interest rate, ensuring it is fair and compliant with state usury laws is important.

-

How can I ensure repayment of the loan?

Ensuring repayment involves clearly communicating the expectations around the loan and drafting a comprehensive agreement. Including specific terms related to the repayment schedule, grace periods for late payments, and consequences of defaulting can help manage expectations. Additionally, securing the loan with collateral or involving a co-signer could provide an extra layer of security for the lender.

-

Is the Family (Friends) Personal Loan Agreement legally binding?

Yes, when properly executed, a Family (Friends) Personal Loan Agreement is a legally binding document. Both parties’ acknowledgment and signatures, ideally witnessed by a neutral third party or notarized, give the agreement legal strength. This means that in the event of a dispute, the agreement can be used in a court of law to enforce terms or seek damages.

-

Can the terms of the loan agreement be modified after signing?

Yes, the terms of the loan agreement can be modified after signing, but any modifications must be agreed upon by both parties. It’s best to document these changes in writing and have both parties sign off on the amendments to maintain clarity and ensure that the agreement remains enforceable.

-

What should I do if the borrower is unable to repay the loan?

If the borrower is unable to repay the loan, it's suggested to communicate openly to understand their situation and attempt to reach a mutually agreeable solution. Options might include restructuring the loan terms, granting an extension, or partially forgiving the loan. It is wise to document any agreed-upon changes. As a last resort, legal action could be considered, but it is important to weigh its potential impact on personal relationships.

Common mistakes

When entering into a financial agreement with family or friends, it's crucial to handle the process with care to avoid misunderstandings or legal complications. The Family (Friends) Personal Loan Agreement form is a valuable tool to establish clear terms and protect both parties' interests. However, people often make mistakes when filling out this form. Identifying these common errors can help in avoiding potential issues:

Not specifying the loan amount in clear terms can lead to disputes. It's essential to write the exact figure both in numbers and words.

Failure to clearly state the loan’s purpose. Describing how the loan will be used can prevent miscommunication and ensure both parties are on the same page.

Omitting the repayment schedule details. Both parties should agree on a clear timeline for repayments, including the dates and amounts.

Lack of clarity on the interest rate, if applicable. Even among family and friends, discussing whether interest is expected and documenting the rate helps keep the agreement formal.

Ignoring potential late fees or penalties. While it might be uncomfortable, outlining consequences for late payments can prevent future conflicts.

Forgetting to include terms for early repayment. Sometimes the borrower can pay back the loan earlier than expected, so it’s wise to clarify any conditions or benefits for doing so.

Not defining the course of action if the borrower can't repay. Understanding what will happen in the worst-case scenario protects the relationship and the lender’s assets.

Failure to document the security or collateral, if any is agreed upon. This is essential to make the agreement enforceable.

Not having witnesses or a notary public sign the document. Although not always legally required, this step adds credibility and can be vital in case of disputes.

Leaving out the date when the agreement was made. The document should be dated to establish when the terms were agreed upon.

By being mindful of these aspects, both lender and borrower can establish a solid agreement that respects their relationship while ensuring clear terms are set. A well-drafted Personal Loan Agreement form upholds the seriousness of the transaction and can prevent potential misunderstandings or conflicts.

Documents used along the form

When parties enter into a Family (Friends) Personal Loan Agreement, additional documents often support, clarify, or secure the transaction. These documents can serve to ensure a clear understanding between the parties and provide safeguards for the lender and borrower. Below is a list of critical forms and documents that are commonly used in conjunction with a Family (Friends) Personal Loan Agreement, which help in documenting the transaction more comprehensively and securely.

- Promissory Note: This legal document outlines the borrower's promise to repay the loan under specified conditions. It typically includes details like the loan amount, interest rate, repayment schedule, and consequences of non-payment.

- Amortization Schedule: An amortization schedule is a table detailing each periodic payment on a loan over time. It breaks down the amount that goes towards the principal and the amount that goes towards interest.

- Loan Repayment Agreement: This document specifies the terms of repayment for the loan, including payment dates, amounts, and penalties for late payments, differing slightly in detail from the initial loan agreement.

- Security Agreement: If the loan is secured, this document outlines the collateral that the borrower offers to the lender as a security interest, in case of default on the loan.

- Guaranty: This legal document is an agreement where a guarantor agrees to pay back the loan if the borrower cannot. It provides an additional layer of security for the lender.

- Lien Waivers: Often used in loans involving property, lien waivers are documents from contractors or businesses stating they have received payment and waive any future lien rights to the property.

- Cosigner Agreement: If a loan involves a cosigner, this document outlines the cosigner’s responsibility to repay the loan if the primary borrower fails to do so.

- Gift Letter: In cases where part or all of the loan might be considered a gift, a gift letter states that the money given is not a loan and does not need to be repaid, clarifying the nature of the funds for tax purposes.

- Debt Acknowledgment Letter: This document serves as a written acknowledgment from the borrower that they owe a specified amount of money to the lender.

- Release of Debt Agreement: Once the loan is fully repaid, this document officially releases the borrower from their obligation to repay, closing the transaction.

Including these documents in the loan process between family and friends can make the terms clear, prevent misunderstandings, and offer legal protections. However, both parties should carefully consider and agree upon the need for each document, possibly with legal counsel, to ensure that the loan does not strain the relationship but rather serves its intended purpose of financial support within trust-based parameters.

Similar forms

A Promissory Note is one of the documents that closely resembles a Family (Friends) Personal Loan Agreement form. Like the personal loan agreement, a Promissory Note outlines the amount of money borrowed, the interest rate if applicable, and the repayment terms. However, while the personal loan agreement may include more detailed clauses about the borrower-lender relationship, a Promissory Note typically focuses on the promise made by the borrower to pay back the loan under the agreed-upon conditions. Thus, both documents serve to formalize the loan process, ensuring that there is a written record of the loan and its terms.

An IOU (I Owe You) document is similar to a Family (Friends) Personal Loan Agreement in its foundational purpose of acknowledging debt. An IOU is a simple acknowledgement that the borrower owes money to the lender without specifying repayment details. Unlike a more detailed personal loan agreement that includes specific terms regarding repayment schedule, interest rates, and legal recourse in event of default, an IOU is typically less formal and used for informal loans. The simplicity of an IOU contrasts with the more comprehensive nature of a personal loan agreement, which aims to protect both parties through more detailed documentation.

A Loan Contract shares similarities with a Family (Friends) Personal Loan Agreement in that both are legally binding documents designed to outline the terms and conditions of a loan. A Loan Contract, often used in more formal or commercial lending environments, includes detailed information about the loan such as the loan amount, interest rate, repayment schedule, and any collateral attached to the loan. Like a personal loan agreement, it also specifies the obligations of the borrower and the rights of the lender, ensuring clarity and legal enforceability. While both documents serve similar purposes, a Loan Contract may involve more complex terms and legal requirements due to its typical use in professional lending situations.

A Mortgage Agreement is akin to a Family (Friends) Personal Loan Agreement when it comes to documenting a loan, but with a focus on real estate transactions. This agreement secures a loan with real property as collateral and includes specific terms such as the loan amount, interest rate, repayment schedule, and the consequences of default. Although principally used for real estate, its structure and purpose to provide a legal framework for borrowing mirrors that of a personal loan agreement, which ensures that both borrower and lender's interests are protected. The primary difference lies in the collateral involved, which in the case of a Mortgage Agreement, is the property being financed.

Dos and Don'ts

When completing a Family (Friends) Personal Loan Agreement form, certain practices should be embraced, while others are best avoided to ensure clarity, legality, and the preservation of relationships. Here is a list of do's and don'ts to consider:

Do:

Include the full names and contact information of both the lender and borrower to clearly identify the parties involved.

Specify the loan amount in words and figures to avoid any ambiguity regarding the loan size.

Clearly outline the repayment schedule, including due dates, to set clear expectations for the loan repayment.

State the interest rate, if applicable, to avoid potential disputes about financial obligations beyond the principal amount.

Describe what will happen if the borrower fails to make payments on time, detailing any late fees or consequences to protect both parties.

Have all parties sign and date the agreement in front of a witness or notary to add a level of formality and legal validation to the document.

Don't:

Omit details such as the loan's purpose, as this can lead to misunderstandings about how the borrowed funds can be used.

Forget to include a clause about modifications, which would clarify that any changes to the agreement must be in writing and agreed upon by all parties.

Leave out information on dispute resolution, to ensure there's an agreed-upon method for handling any disagreements that may arise.

Ignore the need for a witness or notary, as their presence adds credibility to the document and may be required for enforcement.

Allow informal verbal agreements to replace or supersede the written agreement, as this could lead to enforceability issues.

Fail to provide a copy of the signed agreement to each party for their records, which can help prevent future disputes.

Misconceptions

When it comes to lending money between family members or friends, many people choose to formalize the agreement using a Family (Friends) Personal Loan Agreement form. However, there are several misconceptions about these forms that can lead to misunderstandings or legal issues down the line. Here are five common misconceptions:

- All personal loan agreements are the same: Many people believe that a standard template will suffice for all personal loans, regardless of the amount or terms. Each loan agreement should be tailored to the specific transaction, including the loan amount, repayment schedule, interest rate (if any), and what happens if the loan is not repaid on time.

- A verbal agreement is enough: While verbal agreements can be legally binding, proving the terms of the agreement and the intentions of each party can be challenging without written documentation. A written personal loan agreement provides a clear record that can help prevent misunderstandings and disputes.

- Interest cannot be charged on personal loans: It is a common misconception that charging interest on loans to family members or friends is illegal or unethical. However, lenders have the right to charge interest, and specifying an interest rate in the loan agreement is perfectly legal. Furthermore, if the loan is substantial, charging interest can have tax implications, making it important to document this in the agreement.

- You don't need to include a repayment schedule: Failing to outline a detailed repayment schedule can lead to confusion and conflict. A clear repayment schedule, including the amount due at each installment and due dates, ensures both parties understand their obligations, reducing the potential for disputes.

- Personal loan agreements are only for large loans: Some believe that these forms are unnecessary for small amounts. However, even small loans can lead to disagreements or misunderstandings. Using a personal loan agreement for any amount helps ensure clarity and accountability, safeguarding relationships and providing legal protection.

Key takeaways

When it comes to handling money matters between family and friends, clarity and documentation are key. A Family (Friends) Personal Loan Agreement is a valuable tool in this regard. Here are the most essential takeaways for filling out and using this type of agreement effectively:

- Ensure that all parties involved fully understand the terms before signing. Clear comprehension prevents misunderstandings and potential disputes.

- Include detailed personal information of all parties (name, address, phone number) to prevent any confusion about who is involved in the agreement.

- Be explicit about the loan amount and ensure it's written both in numbers and words to avoid discrepancies.

- Specify the repayment plan, including dates, amounts, and intervals. Clarity on repayment terms helps manage expectations and provides a clear roadmap for the borrower.

- Agree on and document the interest rate, if applicable. Even if it’s a minimal amount, documenting this helps in maintaining transparency.

- Discuss and decide on collateral or securities, if any, that the borrower pledges against the loan. This should be detailed in the agreement to safeguard the lender's interests.

- Outline the consequences of late payments or default. Knowing the repercussions can motivate timely repayments and clarify the steps in a worst-case scenario.

- Include a governing law clause to determine which state laws will interpret the agreement. This is crucial in case of a legal dispute.

- Ensure the agreement is witnessed and signed by an independent third-party. This adds a layer of formalization and can help in enforcement.

It's also wise for both lender and borrower to keep a signed copy of the agreement. This way, both parties have proof of the agreement's terms, ensuring a smoother relationship and transaction process. Filling out the Family (Friends) Personal Loan Agreement form carefully and considering these key points can help prevent future conflicts and maintain healthy relationships, even in financial dealings.

Other Types of Family (Friends) Personal Loan Agreement Templates:

What Does Iou Stand for - The flexibility of an IOU allows it to be easily modified or updated if both parties agree to changes in the loan terms.