Blank Employee Loan Agreement Form

When businesses decide to lend money to their employees, they enter into a mutual agreement that is formalized through an Employee Loan Agreement form. This document is critical as it outlines the loan's terms, including the amount, repayment schedule, interest rates, and any collateral involved. It serves as a legal record that protects both the employer's interest in recovering the loan and the employee's understanding of their obligations. Additionally, the form may address what happens if the employee leaves the company before the loan is fully repaid, including whether the remaining balance is deductible from final paychecks. Crafting a comprehensive Employee Loan Agreement is essential in maintaining clear expectations and fostering a trustworthy relationship between the employer and the employee, making sure that both parties are aware of their rights and responsibilities throughout the duration of the loan.

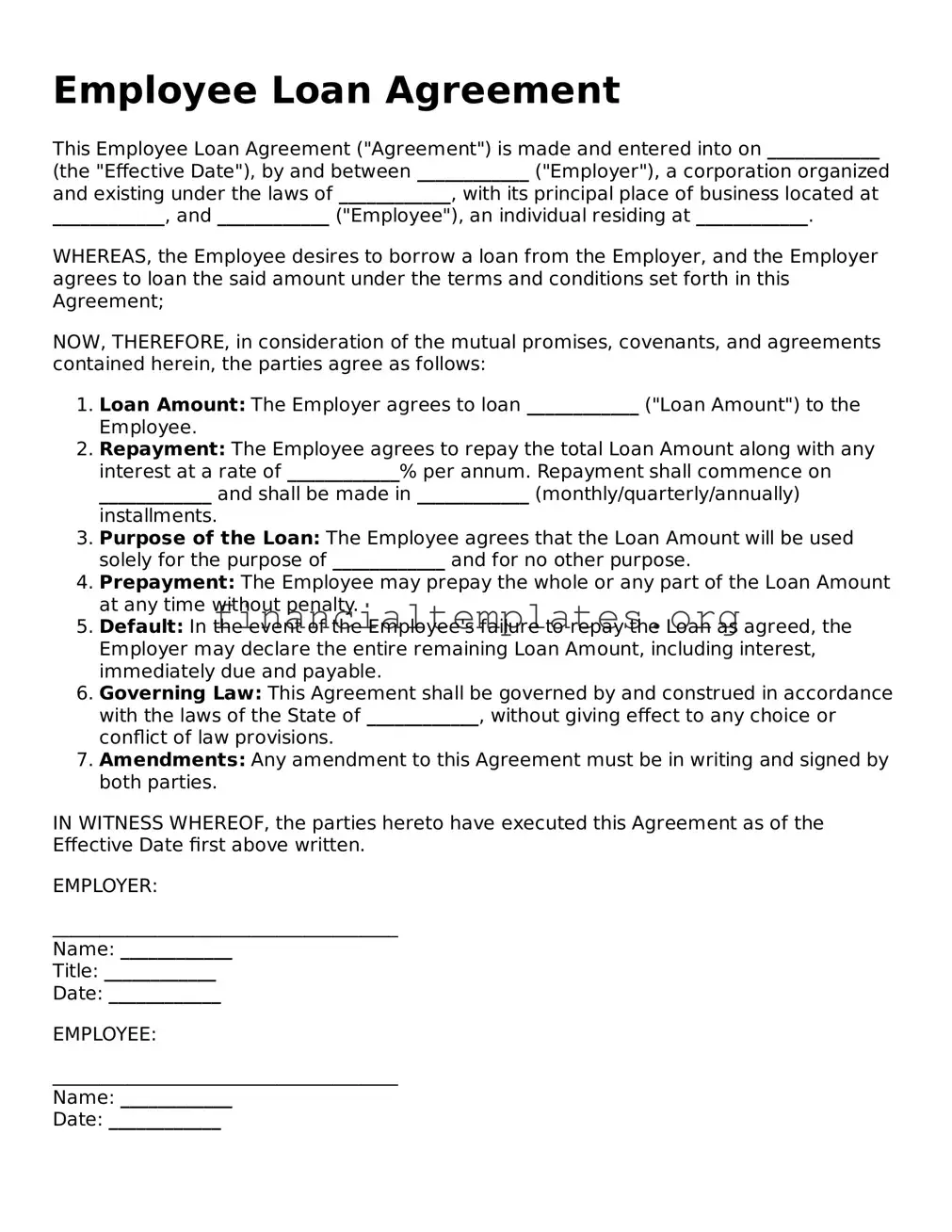

Employee Loan Agreement Example

Employee Loan Agreement

This Employee Loan Agreement ("Agreement") is made and entered into on ____________ (the "Effective Date"), by and between ____________ ("Employer"), a corporation organized and existing under the laws of ____________, with its principal place of business located at ____________, and ____________ ("Employee"), an individual residing at ____________.

WHEREAS, the Employee desires to borrow a loan from the Employer, and the Employer agrees to loan the said amount under the terms and conditions set forth in this Agreement;

NOW, THEREFORE, in consideration of the mutual promises, covenants, and agreements contained herein, the parties agree as follows:

- Loan Amount: The Employer agrees to loan ____________ ("Loan Amount") to the Employee.

- Repayment: The Employee agrees to repay the total Loan Amount along with any interest at a rate of ____________% per annum. Repayment shall commence on ____________ and shall be made in ____________ (monthly/quarterly/annually) installments.

- Purpose of the Loan: The Employee agrees that the Loan Amount will be used solely for the purpose of ____________ and for no other purpose.

- Prepayment: The Employee may prepay the whole or any part of the Loan Amount at any time without penalty.

- Default: In the event of the Employee's failure to repay the Loan as agreed, the Employer may declare the entire remaining Loan Amount, including interest, immediately due and payable.

- Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of ____________, without giving effect to any choice or conflict of law provisions.

- Amendments: Any amendment to this Agreement must be in writing and signed by both parties.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the Effective Date first above written.

EMPLOYER:

_____________________________________

Name: ____________

Title: ____________

Date: ____________

EMPLOYEE:

_____________________________________

Name: ____________

Date: ____________

PDF Properties

| Fact Number | Detail |

|---|---|

| 1 | An Employee Loan Agreement is a document used when an employer lends money to an employee. |

| 2 | This document outlines the amount of the loan, the repayment schedule, and any interest charged. |

| 3 | Interest rates in an Employee Loan Agreement must not exceed the maximum rate allowed by law. |

| 4 | The agreement can be secured or unsecured, depending on whether collateral is used to guarantee repayment. |

| 5 | State-specific laws may dictate certain provisions of the agreement, such as permissible interest rates and legal recourse for default. |

| 6 | Both parties should sign the agreement to ensure its enforceability. |

| 7 | The document should include a clause on how to handle disputes, such as arbitration or court jurisdiction. |

| 8 | Repayment terms can be flexible, including options for deductions from future paychecks. |

| 9 | A clause outlining the conditions under which the loan must be repaid immediately can provide protection for the employer. |

Guide to Writing Employee Loan Agreement

Completing an Employee Loan Agreement form is a crucial step for both the lender and the borrower in formally documenting the terms of a loan provided by the employer to the employee. This process ensures that both parties clearly understand the loan's amount, repayment terms, and any interest or fees that may apply, thereby mitigating future misunderstandings or disputes. The following steps are designed to help individuals navigate the process of filling out this form with clarity and precision.

- Begin by entering the date on which the agreement is being made at the top of the form.

- Fill in the full legal name of the employee receiving the loan in the designated section.

- Specify the amount of loan in U.S. dollars, ensuring that both numbers and words are used to eliminate any confusion.

- Detail the purpose of the loan, providing a clear description of how the funds will be used.

- Outline the repayment terms, including the start date, frequency of payments (e.g., monthly), and the amount of each payment. If applicable, include any grace periods or conditions for late payments.

- Describe the interest rate, if any, that will be applied to the loan, including how it is calculated and the conditions under which it might change.

- Include any additional fees or penalties for late payments or defaults, specifying the amounts and the circumstances under which they apply.

- Document any collateral that is being used to secure the loan, clearly identifying the item(s) and their condition.

- Both the employee and a representative of the employer must sign and date the agreement in the presence of a witness or notary, who should also sign and date the document, if required by state law.

Once the form is fully completed, both parties should keep a copy for their records. The employee should begin fulfilling the repayment terms as agreed, and the employer should monitor the repayments to ensure compliance with the agreement. This document not only facilitates a transparent lending process but also protects the interests of both the employer and the employee, serving as a binding legal agreement that underscores the seriousness and professionalism of the transaction.

Understanding Employee Loan Agreement

-

What is an Employee Loan Agreement form?

An Employee Loan Agreement form is a document that outlines the terms and conditions under which an employer lends money to an employee. It serves as a legally binding contract between the two parties, detailing the loan amount, repayment schedule, interest rate (if applicable), and any other relevant terms. This form is designed to provide clarity and protect both parties' interests in the transaction.

-

Why do employers and employees need an Employee Loan Agreement?

There are a few reasons why this agreement is essential. First, it ensures that both parties have a clear understanding of the loan's terms, reducing the potential for misunderstandings or disputes. Second, it provides legal protection for the employer should difficulties arise in recovering the loaned funds. Lastly, it helps maintain a professional relationship between employer and employee, as all terms of the loan are agreed upon and documented in writing.

-

What key elements should be included in the form?

Several critical elements should be captured within the Employee Loan Agreement form to make it effective:

- The names and contact details of the employer and the employee entering into the agreement.

- The loan amount being provided to the employee.

- Any interest rate applied to the loan amount, if applicable.

- The repayment schedule, detailing when repayments will commence, the frequency of repayments, and any deadlines for full repayment.

- Conditions under which the terms of the agreement might be modified or the loan may be forgiven.

- Signatures from both parties, indicating their agreement to the terms detailed in the document.

-

Can an Employee Loan Agreement include provisions for loan forgiveness?

Yes, an Employee Loan Agreement can include provisions for loan forgiveness, where the employer agrees to forgive (cancel) all or part of the loan under specific conditions. These conditions must be clearly outlined in the agreement and might include scenarios such as the employee meeting certain performance goals, remaining with the company for a specified period, or other agreed-upon criteria. Including such provisions can serve as an additional incentive for the employee and must be carefully considered and detailed by both parties in the agreement.

Common mistakes

One of the most critical mistakes is not specifying the loan amount clearly. Ensuring that both parties are on the same page regarding the total amount loaned helps avoid confusion or disputes down the line.

Frequently, people fail to outline the repayment schedule in detail. Including precise dates and amounts for repayments is essential for setting expectations and avoiding misunderstandings about the loan’s terms and timeframe.

Another error often encountered is neglecting to define the consequence of late payments or default. Without this, enforcing the agreement and managing defaults become significantly harder.

Many overlook the importance of including a clause that addresses what happens if the employee leaves the company. Whether due to resignation or termination, the agreement should specify how the outstanding loan balance will be handled.

Lastly, a common mistake is failing to have the agreement reviewed by a legal professional. Given the potential legal implications of such agreements, professional review can prevent issues that may arise from unclear or legally insufficient terms.

To ensure the validity and enforceability of an Employee Loan Agreement, attention to detail is paramount. Avoiding these mistakes not only protects both parties involved but also fosters a positive employer-employee relationship. Employers should encourage transparency and fairness throughout the process, and employees should thoroughly review and understand the terms before consenting to them. Ultimately, the goal is to create a document that respects the interests of both the lender and the borrower, minimizing risks and promoting mutual agreement.

Documents used along the form

When an organization decides to provide a loan to an employee, the Employee Loan Agreement form is a critical document. It outlines the terms under which the loan is provided, including the repayment schedule, interest rates, and any collateral involved. To ensure a comprehensive and enforceable agreement, several other forms and documents are typically used in conjunction with the Employee Loan Agreement form. These documents help to clarify the responsibilities of all parties involved and protect both the employee and the employer throughout the duration of the loan.

- Promissory Note: Details the amount borrowed and the commitment of the employee to repay it. This document serves as a formal promise and is legally binding.

- Loan Amortization Schedule: Provides a breakdown of payments over the loan period, including how much of each payment is applied to the principal versus interest.

- Direct Deposit Authorization Form: Allows for the automatic deduction of loan repayments from the employee's paycheck, ensuring consistent payment.

- Collateral Agreement: Specifies any assets or property pledged by the employee as security for the loan. This becomes relevant if the loan is not repaid as agreed.

- Loan Modification Agreement: Documents any agreed-upon changes to the original loan terms, such as adjustments to the repayment schedule or interest rates.

- Employee Acknowledgment Form: A signed statement by the employee confirming their understanding and agreement to the loan's terms.

- Financial Statements: Used to assess the employee's ability to repay the loan, these include recent pay stubs, bank statements, and possibly a credit report.

- Interest Statement: Breaks down the amount of interest that will be paid over the life of the loan, providing transparency about the cost of borrowing.

- Release of Liability Form: Signed upon the full repayment of the loan, this document releases the employee from any further financial obligation related to the loan.

Together, these documents form a comprehensive framework that supports the Employee Loan Agreement form. They provide clarity and legal protection, ensuring that the loan process is conducted fairly and transparently for both the employer and the employee. By carefully completing and maintaining these documents, organizations can foster a positive lending relationship with their employees, aiding in financial emergencies while safeguarding the company's assets and interests.

Similar forms

The Employee Loan Agreement form bears resemblance to the Personal Loan Agreement, as both serve the purpose of detailing the terms under which money has been lent and must be repaid. In a Personal Loan Agreement, the focus is on the transaction between individuals, often without the involvement of institutional lenders, which is similar to the employee loan scenario where the employer acts as the lender to the employee. The essence of both documents lies in specifying loan amounts, repayment schedules, interest rates if applicable, and the consequences of default, ensuring both parties have a clear understanding of their obligations and rights.

It is also akin to the Promissory Note, which is a financial instrument that outlines a written promise by one party to pay a certain sum of money to another. The Employee Loan Agreement form acts as a specific type of promissory note that not only includes the promise to repay but also ties the agreement to the context of an employment relationship, adding layers such as potential payroll deductions as a repayment method. Although a Promissory Note might be more broad in application, both documents are similar in their function of formalizing a loan's terms.

Similar to an Employee Loan Agreement, the Employment Contract establishes an agreement between an employee and employer, detailing the rights, responsibilities, and terms of employment. While the focus of an Employment Contract is broader, covering aspects such as job duties, salary, and termination conditions, it may also include provisions related to loans or advancements made by the employer to the employee. In this sense, an Employee Loan Agreement can be seen as a specific component or extension of the broader employment relationship established by an Employment Contract.

The Employee Loan Agreement shares characteristics with a Mortgage Agreement, in that both are secured by collateral. In a Mortgage Agreement, the collateral is real property (real estate), whereas in an Employee Loan Agreement, the "collateral" could be considered the ongoing employment relationship and potential for wage garnishment. Both agreements set forth the conditions under which the loan will be repaid and detail the recourse the lender has if the borrower defaults, emphasizing the legal obligation of the borrower to fulfill the repayment terms.

Lastly, the Employee Loan Agreement is similar to a Student Loan Agreement, as both are designed to support the borrower in achieving something that benefits their future, with clear terms for repayment. A Student Loan Agreement facilitates the borrower's education, while an Employee Loan Agreement might enable the employee to cover immediate personal financial needs or invest in career development opportunities. Despite the difference in goals, both agreements thus share a foundational premise of an investment in the borrower's future, governed by structured repayment terms.

Dos and Don'ts

If you're in the process of filling out an Employee Loan Agreement form, taking the right steps can protect both the lender and the borrower, ensuring clarity and mutual understanding. While the content available does not detail the form's specific sections, general guidelines can be applied universally to such agreements. Here are seven do's and don'ts to consider:

Do:- Read through the entire document before filling it out. Ensuring you understand each section fully can prevent misunderstandings down the line.

- Use clear, precise language that leaves no room for interpretation. Specificity is key in legal documents to avoid potential disputes.

- Include all relevant details such as loan amount, repayment schedule, interest rates (if any), and both parties' full names and addresses.

- Clarify the consequences of late payments or default. Such stipulations should be explained in understandable terms.

- Sign and date the agreement in the presence of a witness or notary public to add an extra layer of legal protection and verification.

- Make copies of the signed agreement for both parties. This ensures that everyone has a record of what was agreed upon.

- Consult with a legal professional if any part of the agreement is unclear. A small investment in legal advice could prevent costly disputes.

- Leave any fields empty. If a section does not apply, mark it as "N/A" (not applicable) instead of leaving it blank to prevent unauthorized additions.

- Use vague terms or jargon that might be misunderstood. The document should be accessible to anyone, regardless of their legal knowledge.

- Rely solely on verbal agreements or assurances. The contract should encompass all terms of the loan comprehensively.

- Forget to specify a repayment deadline or terms of repayment. Absence of this crucial detail can lead to uncertainty and conflict.

- Sign without reading or if you have reservations. It's important that all parties fully agree with the document's contents.

- Assume goodwill will resolve disputes. While trusting relationships are valuable, clear legal documentation is essential when money is involved.

- Ignore state laws and regulations that might influence the agreement. Some states have specific laws regarding loans that might affect your agreement.

Misconceptions

Discussing Employee Loan Agreements can often lead to misunderstandings, as the topic combines elements of employment law with contractual obligations. It is crucial to clarify these misconceptions to ensure both employers and employees are adequately informed about such agreements. Below are some common misconceptions:

All Employee Loan Agreements are the same: There is a common belief that employee loan agreements are standardized documents. However, the truth is that the specifics of these agreements can vary significantly depending on the employer's policies and the purpose of the loan. It is essential for both parties to carefully review the terms specific to their agreement.

Interest is always charged on employee loans: Many people assume that loans from an employer to an employee automatically include interest. While it's true that some companies may charge interest to protect against inflation or as a form of investment return, other employers may offer interest-free loans as a benefit or to meet specific, short-term financial needs of their employees.

An Employee Loan Agreement is legally binding without a witness: While an employee loan agreement forms a contract between the employee and employer, having a witness or notarization can add a layer of validation and protection for both parties involved, though not necessarily required by law. The necessity for a witness or notarization varies by jurisdiction and the amount being loaned.

Employee loans are taxable income: A common misconception is that any money received by an employee from their employer as a loan is taxable income. In reality, loans are not considered income as long as there is a clear expectation from both sides that the money will be repaid. It differs from other financial benefits or bonuses that are indeed considered taxable income.

Employee Loan Agreements cannot include clauses for forgiveness: It is often mistakenly believed that these agreements cannot have provisions that allow for part or all of the loan to be forgiven. However, loans can include forgiveness clauses, which might be activated under certain conditions, such as continuing to work for the company for a set number of years.

Only written agreements are valid: While it's highly advisable to have all loan agreements documented in writing to provide a clear record of the terms and expectations, verbal agreements can also be legally binding. Nonetheless, proving the terms of a verbal agreement can be significantly more challenging than with a written contract.

Defaulting on an employee loan cannot lead to legal action: There is a false sense of security that if an employee fails to repay a loan according to the agreed terms, the matter cannot escalate to legal action due to the employer-employee relationship. In fact, employers have the right to seek repayment through legal means if an employee fails to meet the repayment terms outlined in the agreement.

Loans can be deducted from an employee’s final paycheck without authorization: Some believe that if an employee leaves or is terminated, the employer can automatically deduct the remaining loan balance from the final paycheck. Laws regarding these actions vary by state, and in many cases, explicit authorization is needed from the employee before such deductions can be made.

Employee Loan Agreements are optional for informal loans: Certain individuals might think that for small, informal loans, there is no need for any formal agreement. No matter the size of the loan, it's beneficial to have a written agreement to outline the terms and ensure both parties understand their obligations, thereby preventing future disputes.

Key takeaways

The Employee Loan Agreement form is a critical document designed to outline the specifics of a loan provided by an employer to an employee. This agreement serves as a binding contract that protects both parties' interests, ensuring that the employer can lend money with confidence and the employee can borrow under clear terms. Below are ten key takeaways to consider when filling out and using this form:

- Complete Information: Ensure that all fields in the form are filled out with accurate and complete information. This includes the names of the parties involved, the loan amount, repayment schedule, interest rate (if applicable), and any other relevant details.

- Clarify Terms: Both parties should have a clear understanding of the loan terms, including the repayment period, interest rates, and the consequence of failing to meet these terms. These should be explicitly stated in the agreement.

- Interest Regulations: If interest is being charged, verify that the rate is compliant with state laws to avoid any legal issues relating to usury.

- Repayment Schedule: The agreement should clearly lay out the repayment schedule. Include the number of installments, the amount of each installment, and due dates to avoid any confusion.

- Signatures Matter: The form must be signed by both the employer and the employee. Signatures serve as proof that both parties agree to the terms and understand their obligations.

- Witnesses or Notarization: Depending on your state's requirements, it might be beneficial or necessary to have the form witnessed or notarized to add an extra layer of legal validity.

- Keep Copies: Ensure that both the employer and the employee retain a copy of the agreement. This is crucial for documentation purposes and helps protect both parties' interests.

- Legal Advice: It may be wise for both parties to seek legal advice prior to finalizing the agreement. This can help prevent any misunderstanding regarding legal obligations and rights.

- Confidentiality: Respect the confidentiality of the agreement. The terms and condition of the loan, as well as any personal information disclosed, should be kept private between the employer and the employee.

- Amendments: If any terms of the agreement need to be changed, make sure these amendments are documented and signed by both parties. This ensures that the agreement remains up-to-date and reflects the current understanding between the employer and the employee.

Adhering to these guidelines can ensure that the Employee Loan Agreement serves its purpose effectively, fostering a positive and transparent loan process within the workplace. Both employers and employees should handle this document with the seriousness and attention it requires to ensure a smooth and equitable lending arrangement.

Other Types of Employee Loan Agreement Templates:

What Does Iou Stand for - Considering the simplicity of creating an IOU, it is a convenient way to document a loan without involving lawyers or complex paperwork.