Blank Loan Agreement Form

A loan agreement form is a crucial document that outlines the terms and conditions between a borrower and a lender. This contract sets the stage for a clear understanding of what is expected from both parties involved in the lending process. The form encompasses various important elements such as the amount of money being loaned, the interest rate, repayment schedule, and any collateral required. It also details the obligations of the borrower and the rights of the lender, providing legal protection to both sides. Moreover, it addresses what happens in the event of a default, specifying the consequences and possible courses of action to recover the loaned funds. By capturing all these aspects, the loan agreement form serves not only as a binding commitment but also as a tool for preventing misunderstandings and conflicts. Therefore, understanding every component of this form is essential for anyone engaging in a loan, whether they are lending money to friends or family, or entering into a more formal agreement with a financial institution.

Loan Agreement Document Subtypes

Loan Agreement Example

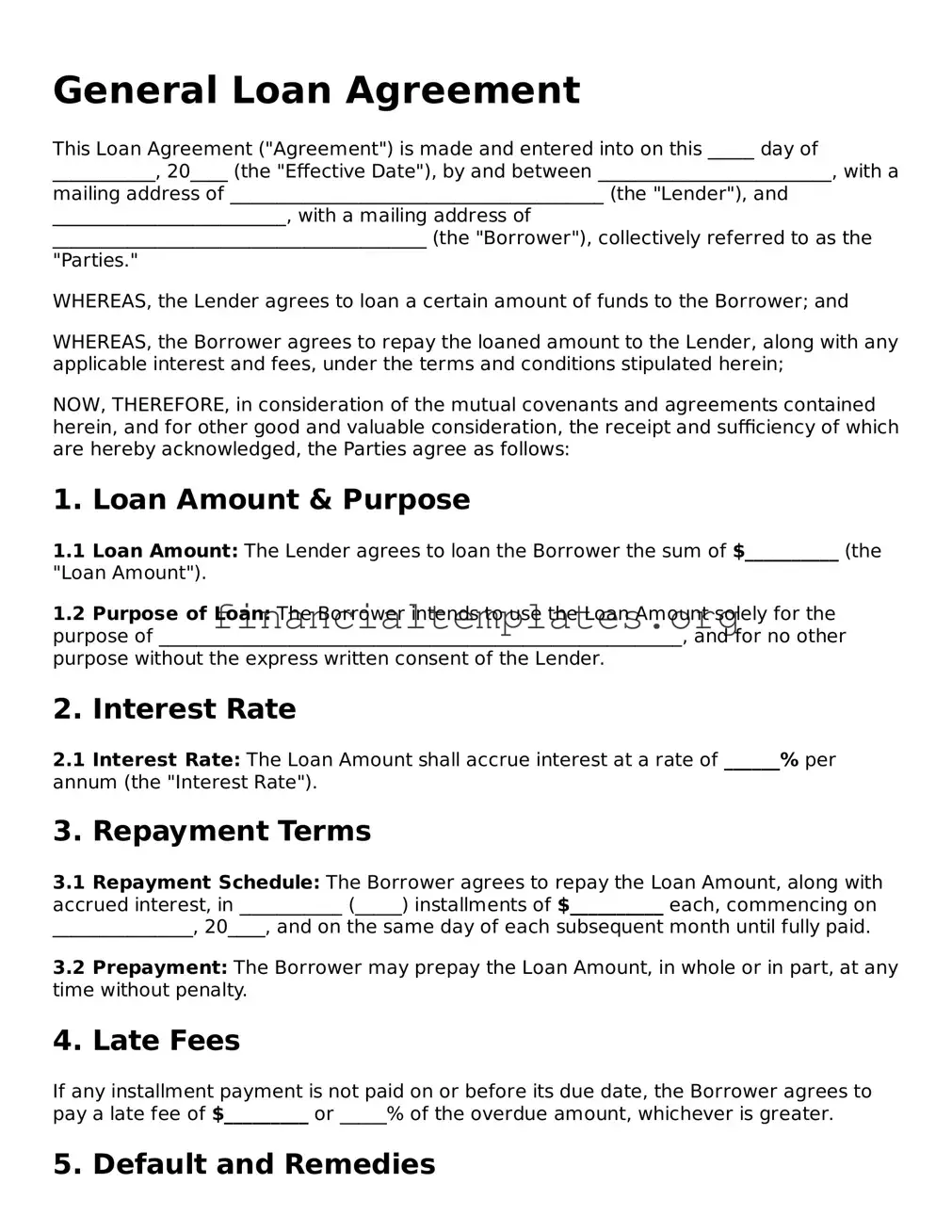

General Loan Agreement

This Loan Agreement ("Agreement") is made and entered into on this _____ day of ___________, 20____ (the "Effective Date"), by and between _________________________, with a mailing address of ________________________________________ (the "Lender"), and _________________________, with a mailing address of ________________________________________ (the "Borrower"), collectively referred to as the "Parties."

WHEREAS, the Lender agrees to loan a certain amount of funds to the Borrower; and

WHEREAS, the Borrower agrees to repay the loaned amount to the Lender, along with any applicable interest and fees, under the terms and conditions stipulated herein;

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

1. Loan Amount & Purpose

1.1 Loan Amount: The Lender agrees to loan the Borrower the sum of $__________ (the "Loan Amount").

1.2 Purpose of Loan: The Borrower intends to use the Loan Amount solely for the purpose of ________________________________________________________, and for no other purpose without the express written consent of the Lender.

2. Interest Rate

2.1 Interest Rate: The Loan Amount shall accrue interest at a rate of ______% per annum (the "Interest Rate").

3. Repayment Terms

3.1 Repayment Schedule: The Borrower agrees to repay the Loan Amount, along with accrued interest, in ___________ (_____) installments of $__________ each, commencing on _______________, 20____, and on the same day of each subsequent month until fully paid.

3.2 Prepayment: The Borrower may prepay the Loan Amount, in whole or in part, at any time without penalty.

4. Late Fees

If any installment payment is not paid on or before its due date, the Borrower agrees to pay a late fee of $_________ or _____% of the overdue amount, whichever is greater.

5. Default and Remedies

In the event of a default by the Borrower under the terms of this Agreement, the Lender shall have the option to declare the entire outstanding balance immediately due and payable and may pursue any remedies available under applicable law.

6. Governing Law

This Agreement shall be governed by the laws of the State of _______________, without regard to its conflict of laws principles.

7. Amendment

This Agreement may only be amended or modified by a written document duly signed by both Parties.

8. Notices

All notices under this Agreement shall be sent to the addressed Parties at their respective addresses set forth above, or to such other address as either Party may from time to time specify in writing.

9. Entire Agreement

This Agreement constitutes the entire agreement between the Parties pertaining to the subject matter hereof and supersedes all prior agreements, understandings, negotiations, and discussions, whether oral or written, of the Parties.

10. Signatures

The Parties hereby signify their agreement to the terms above by their signatures below:

______________________________________

Lender: ________________________________

Date: __________________________________

______________________________________

Borrower: ______________________________

Date: __________________________________

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose | A Loan Agreement is used to document the terms and conditions of a loan between two parties, the borrower and the lender. |

| Components | It typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral securing the loan. |

| Governing Law | Loan agreements are subject to state laws, which can vary significantly from one state to another. The agreement should specify which state's law will govern. |

| Significance of Signatures | Both the borrower's and the lender's signatures are required to enforce the agreement, making it a legally binding document. |

| Default Terms | It outlines the consequences if the borrower fails to repay the loan as agreed, which may include taking legal action or seizing collateral. |

Guide to Writing Loan Agreement

Filling out a Loan Agreement form is a crucial step in formalizing the terms and conditions of a loan between a lender and a borrower. This ensures that both parties are on the same page regarding the loan amount, interest rate, repayment schedule, and other important details. Once completed, this document serves as a binding agreement that can be referred to in case of discrepancies. Follow these steps carefully to ensure that the form is filled out correctly and comprehensively.

- Start by entering the date of the agreement at the top of the form. This marks when the agreement becomes effective.

- Fill in the names and contact details of both the lender and the borrower. Make sure to include addresses, phone numbers, and email addresses.

- Specify the loan amount in words and then in parentheses, write the amount in numerical form to avoid any confusion.

- Detail the interest rate, clearly stating if it’s a fixed or variable rate, and how it is calculated.

- Outline the repayment schedule. Include how often payments will be made (monthly, quarterly, etc.), the amount of each payment, and the duration of the loan until it’s fully repaid.

- Include any collateral that the borrower is using to secure the loan. Clearly describe the collateral and state its value.

- Specify any events of default that would enable the lender to demand immediate repayment of the loan.

- Describe the actions that will be taken if the loan is not repaid according to the agreed terms.

- Both parties should carefully review the entire document to ensure all the details are correct and complete.

- Sign and date the form. The borrower and the lender must both sign to indicate their agreement to the terms laid out in the document. Witnesses or notarization may also be required, depending on local laws.

Once the Loan Agreement form is fully completed and signed, it will serve as a legally binding document that protects the interests of both the lender and borrower. It is advised that both parties keep a copy of the agreement for their records. Moving forward, adhering to the repayment schedule and maintaining open communication can help in managing the loan effectively and preventing any potential disputes.

Understanding Loan Agreement

-

What is a Loan Agreement?

A Loan Agreement is a legally binding document between a borrower and a lender that outlines the terms and conditions under which the borrower agrees to repay money borrowed from the lender. This agreement specifies the loan amount, interest rate, repayment schedule, and any other terms related to the lending and repayment process.

-

Why is having a Loan Agreement important?

Having a Loan Agreement is crucial because it legally protects both the lender and the borrower. For the lender, it ensures there is a legal recourse in case of non-payment. For the borrower, it clarifies the expectations regarding repayment and any applicable interest, thereby preventing any future misunderstandings or disputes.

-

What should be included in a Loan Agreement?

A Loan Agreement should include:

- The full names and contact information of the borrower and the lender.

- The amount of money being loaned.

- The interest rate, if applicable.

- Repayment conditions, including the schedule and duration of the loan.

- Any collateral securing the loan.

- Signatures of both parties and the date of the agreement.

-

Is a Loan Agreement legally binding without a notary or witness?

Yes, a Loan Agreement can be legally binding without the presence of a notary or witness, as long as it contains the signatures of both parties involved. However, having a notary or witness can provide an additional layer of legal protection should the agreement be disputed in court.

-

Can I modify a Loan Agreement after it's been signed?

Modifying a Loan Agreement after it has been signed is possible but requires the consent of both the borrower and the lender. Any changes should be made in writing, and both parties should sign the amended agreement, possibly in the presence of a notary or witness for additional legal validity.

-

What happens if the borrower defaults on the loan?

If the borrower defaults on the loan, the lender has the right to take legal action to seek repayment of the outstanding debt. This process may involve claiming any collateral that was used to secure the loan or pursuing other legal remedies as specified in the Loan Agreement or allowed by law.

-

Does a Loan Agreement need to be in a specific format?

While a Loan Agreement does not need to follow a specific format, it should be written in clear, understandable language and include all essential terms and conditions of the loan. Using a standard template or seeking legal advice can help ensure that the agreement complies with local laws and is enforceable.

-

Can a Loan Agreement be used for any type of loan?

Generally, a Loan Agreement can be used for various types of loans, including personal loans, business loans, and mortgages. However, the specific terms and conditions may vary depending on the nature of the loan, the amount involved, and the agreement between the parties. It's crucial to tailor the Loan Agreement to the specific type of loan and the parties' needs.

-

Where can I find a template for a Loan Agreement?

Templates for Loan Agreements can be found online through legal services websites, at local libraries, or by consulting with a legal professional. It is important to choose a template that is up-to-date and compliant with the relevant state or country laws where the agreement will be enforced.

Common mistakes

When it comes to preparing a Loan Agreement form, individuals often navigate the process with a mix of diligence and confusion. However, mistakes can occur, affecting the validity of the agreement or potentially leading to disputes in the future. Common errors include:

-

Not Clearly Identifying the Parties Involved - A crucial error is the failure to specify accurately who is borrowing and who is lending the money. This detail should include full legal names, addresses, and possibly additional identifying information to prevent any ambiguity about the parties' identities.

-

Omitting Loan Details - Sometimes, the specifics of the loan itself are glossed over or not thoroughly detailed. This mistake can lead to misunderstandings regarding the loan amount, interest rate, repayment schedule, and maturity date. Each aspect should be explicitly stated to ensure both parties have the same understanding and expectations.

-

Forgetting to Outline the Consequences of Default - Many people overlook the importance of detailing what happens if the borrower fails to repay the loan according to the agreed terms. Including clear repercussions for defaulting, such as late fees, acceleration of the debt, or legal actions, provides protection for the lender and clarity for the borrower.

-

Failing to Sign the Document - Surprisingly, some individuals forget to sign the document, rendering it unenforceable. Both the borrower and the lender must sign the agreement, and depending on state laws, witness or notary signatures may also be required to authenticate the document properly.

While these errors are common, they are also avoidable. Paying close attention to the details and ensuring complete and accurate information can save both parties from potential legal and financial complications in the future.

Documents used along the form

When entering into a financial agreement, a Loan Agreement form is a critical document outlining the terms under which money is borrowed and repaid. However, this form doesn't stand alone. To ensure a comprehensive and secure transaction, several complementary documents are often utilized alongside it. These additional forms help clarify the responsibilities of all parties involved and safeguard their interests throughout the duration of the loan. Let’s explore some of these key documents.

- Promissory Note: A promissory note is a paramount document that accompanies a Loan Agreement. It details the borrower's promise to repay the amount loaned, specifying the repayment schedule, interest rate, and consequences of default. Essentially, it serves as a formal IOU and is legally binding.

- Personal Guarantee: Often required for business loans, a personal guarantee is a document that binds an individual (typically a business owner or executive) to be personally responsible for the loan if the business fails to repay. This provides an additional layer of security for the lender, ensuring that the loan can be recovered through the guarantor's personal assets if necessary.

- Security Agreement: A Security Agreement outlines a collateral promise for the loan, detailing assets that the borrower offers to secure the loan. This could include real estate, vehicles, or other valuable property. It ensures that the lender has the right to seize the collateral if the borrower defaults on the loan, offering a way to recoup the lent funds.

- Amortization Schedule: This document is often attached to a Loan Agreement to provide a detailed payment plan over the loan's life. It breaks down payments into principal and interest, showing the borrower exactly how much of each payment goes toward reducing the loan balance versus paying interest. It helps both parties keep track of the repayment progress.

Together with a Loan Agreement, these documents create a robust framework that defines the loan's terms, protects the interests of both lender and borrower, and sets the path for a successful financial transaction. It’s essential for all parties to understand and agree upon these documents to ensure a clear, fair, and enforceable arrangement.

Similar forms

The Promissory Note shares notable similarities with the Loan Agreement as both documents outline the terms under which money has been loaned and needs to be repaid. Promissory Notes are simpler and generally more concise, focusing primarily on the repayment schedule, interest rate, and the consequences of non-payment. Unlike a Loan Agreement, a Promissory Note may not always include detailed clauses about the borrower's representations, warranties, or covenants, making it a less comprehensive document for outlining the full terms and conditions of a financial loan.

A Personal Guarantee is another document closely related to a Loan Agreement, particularly in scenarios requiring additional security for the loan. While a Loan Agreement specifies the terms between the borrower and the lender, a Personal Guarantee involves a third party who agrees to repay the loan if the original borrower fails to do so. This document is crucial in providing lenders with an added layer of financial protection, ensuring that the loan can be recovered even if the primary borrower defaults.

A Mortgage or Deed of Trust also shares similarities with a Loan Agreement, as they are used in situations where a loan is taken out to purchase real estate. These documents secure the loan by using the property as collateral, detailing the legal obligations of the borrower and the rights of the lender to foreclose on the property if the loan is not repaid according to the agreed terms. Unlike a general Loan Agreement, these documents are specifically tied to real estate transactions and involve the legal process of transferring property titles.

Lastly, a Security Agreement bears resemblance to a Loan Agreement in the context of secured loans. This document outlines the particulars of an asset or assets pledged as collateral against a loan, detailing both the borrower's and lender’s rights regarding the collateral. Should the borrower default on the loan, the Security Agreement provides the legal framework for the lender to seize the collateral. Although both documents deal with the terms of a loan, the Security Agreement specifically addresses the use and control of collateral, distinguishing it from the broader terms of a Loan Agreement.

Dos and Don'ts

Filling out a Loan Agreement form is a critical step in formalizing a loan between two parties, whether it’s between individuals or organizations. It lays down the terms and conditions of the loan to prevent misunderstandings and legal disputes down the line. To ensure that this document serves its purpose effectively, there are certain practices you should follow as well as avoid. Here’s a guide to help you navigate through the process:

- Do ensure that all parties’ details are accurate. This includes full names, addresses, and contact information. Mistakes in this section can lead to significant complications.

- Do clearly outline the loan amount and currency. Ambiguity in the loan amount or the currency can result in disagreements or legal challenges later on.

- Do specify the repayment terms in detail. This should include repayment schedule, interest rates (if applicable), and any late payment fees to avoid any misunderstandings.

- Do include a clause for early repayment. This section will outline any fees or penalties for early repayment of the loan, giving both lender and borrower clear expectations.

- Don't leave any fields blank. If a section does not apply, mark it with “N/A” instead of leaving it empty. This prevents unauthorized alterations after the agreement is signed.

- Don't rush through reading the document. Both parties should take their time to thoroughly review the agreement to ensure all terms and conditions are understood and agreed upon.

- Don't rely on verbal promises. All agreements, amendments, or special considerations should be documented in the Loan Agreement form. Verbal agreements are difficult to enforce and prove in court.

- Don't forget to include a clause about dispute resolution. This will outline the steps to be taken if a disagreement arises, potentially saving time and money on legal disputes.

Approaching the Loan Agreement form with diligence and attention to detail can prevent future conflicts and ensure the lending process is smooth and transparent for all parties involved. Remember, this document not only outlines the loan details but also serves as a legal commitment and proof of the agreement.

Misconceptions

Loan agreements are essential documents that define the terms and conditions under which money is lent. However, numerous misconceptions surround their structure and necessity. Whether you're lending money to a friend or borrowing for your small business, understanding these common myths can help you navigate the process more effectively.

- Myth #1: Verbal agreements are just as binding as written ones. While verbal agreements can be legally binding, proving the terms without a written record is challenging. A loan agreement form clearly outlines each party's obligations, reducing disputes.

- Myth #2: Loan agreements are only for large sums of money. No matter how small the loan, a written agreement can prevent misunderstandings and provide a clear repayment plan, making it a wise choice for any amount.

- Myth #3: A standard template fits all loan situations. Generic templates may not address specific needs or comply with local laws. Tailoring the document to the particulars of the loan ensures all aspects are covered.

- Myth #4: Only the borrower needs to sign the agreement. For the agreement to be enforceable, both the lender and the borrower must sign it, acknowledging their acceptance of the terms.

- Myth #5: Loan agreements are too complex for non-professionals to understand. While legal documents can be daunting, loan agreements are relatively straightforward. Both parties should read and understand the terms before signing.

- Myth #6: You don't need a witness or notary. While not always legally required, having a neutral third party witness or notarize the signing adds an extra layer of validation and can be crucial in the event of a dispute.

- Myth #7: The lender has the upper hand in setting terms. The loan agreement should be negotiated to ensure fairness and transparency. Both the lender and the borrower have a say in the terms, reflecting their interests and concerns.

- Myth #8: Loan agreements are only for financial institutions and businesses. Whether lending or borrowing money among friends, family, or acquaintances, a formal agreement protects both parties’ interests and helps preserve personal relationships.

- Myth #9: If something isn't in the agreement, it's not enforceable. Although the written terms are the basis for enforcement, oral agreements or subsequent amendments can also be legally binding if they can be proven. However, including all terms in the original document is safest and most clear.

Understanding these misconceptions about loan agreements can help individuals and businesses make informed decisions, reducing risks and preventing conflicts. When in doubt, consulting with a legal professional to ensure that your agreement is comprehensive and compliant with local laws is always a good practice.

Key takeaways

When it comes to managing financial transactions between two parties, a Loan Agreement form plays a crucial role. This document not only outlines the terms of the loan, but it also serves as a legally binding record of the agreement. Here are key takeaways to ensure clarity and compliance during the process of filling out and using this form.

- Understand Every Section Before You Start: Before filling out the Loan Agreement, it's important to read through each section thoroughly. Understanding the purpose and requirement of each part ensures the information you provide is accurate and appropriate for your situation.

- Identify the Parties Correctly: Clearly identify the lender and the borrower. Include full names and contact information. It's crucial for legal identification and might also include additional identifying details when necessary.

- Specify Loan Amount and Terms Clearly: The heart of the Loan Agreement is the amount being loaned and the terms for repayment. This includes the loan amount, interest rate, repayment schedule, and any other conditions related to repayment. These terms should be detailed and clear to avoid any future disputes.

- Include Interest Rate Details: If the loan involves interest, state this explicitly, including how the interest rate is calculated and applied. This prevents any misunderstandings about how much the borrower will owe over the life of the loan.

- Outline the Consequences of Late Payments: Specify what constitutes a late payment and the consequences. This could range from additional fees to acceleration of the loan repayment.

- Describe the Collateral, if Applicable: For secured loans, describe the collateral that will secure the loan. This section should detail what the collateral is, its value, and what will happen in the event of a default.

- Include a Co-signer Section if Necessary: If there's a co-signer, their responsibilities and liabilities should be explicitly defined. This includes stating that the co-signer is equally responsible for repayment of the loan.

- Don’t Forget to Sign and Date: A Loan Agreement isn't complete or enforceable without the signatures of both the borrower and the lender. Include a space for each party to sign and date the document.

Tailoring the Loan Agreement to the specific needs of the parties involved and following these guidelines can help protect both the borrower and the lender. It's not just about filling out a form; it's about ensuring all parties are on the same page, reducing the potential for conflicts, and creating a clear path for repayment.

Popular Documents

Do Golf Carts Come With Titles - The form can also stipulate payment terms, including down payment, full payment, or installment plans, clarifying the financial agreement between buyer and seller.

IRS 8960 - Adapting to changes in tax law including those affecting form 8960 is crucial for taxpayers with substantial investment income.

Pay Sales Tax Colorado - Denver hosts a variety of businesses. Specify yours to understand specific tax licenses or occupational tax registrations you may need.