Blank Purchase Letter of Intent Form

Embarking on the journey of purchasing property or goods often begins with an important step: the drafting of a Purchase Letter of Intent (LOI). This document serves as a professional gesture of one's intent to proceed with a transaction, outlining the preliminary terms between buyer and seller before any official contracts are drawn up. The Purchase Letter of Intent not only lays the groundwork for negotiations by specifying the price, description of the purchase, and any contingencies relating to the sale but also acts as a safeguard for both parties, ensuring that there is a mutual understanding of the terms before moving forward. Although not legally binding in the way a contract is, this form plays a pivotal role in the buying process, offering a clear framework for what both parties can expect. It allows for any disagreements to be solved before entering into a formal agreement, making it an invaluable tool in the early stages of any purchase transaction. Given its importance, understanding the major components and proper use of a Purchase Letter of Intent is essential for anyone looking to make a significant purchase, ensuring that the path to ownership is as smooth as possible.

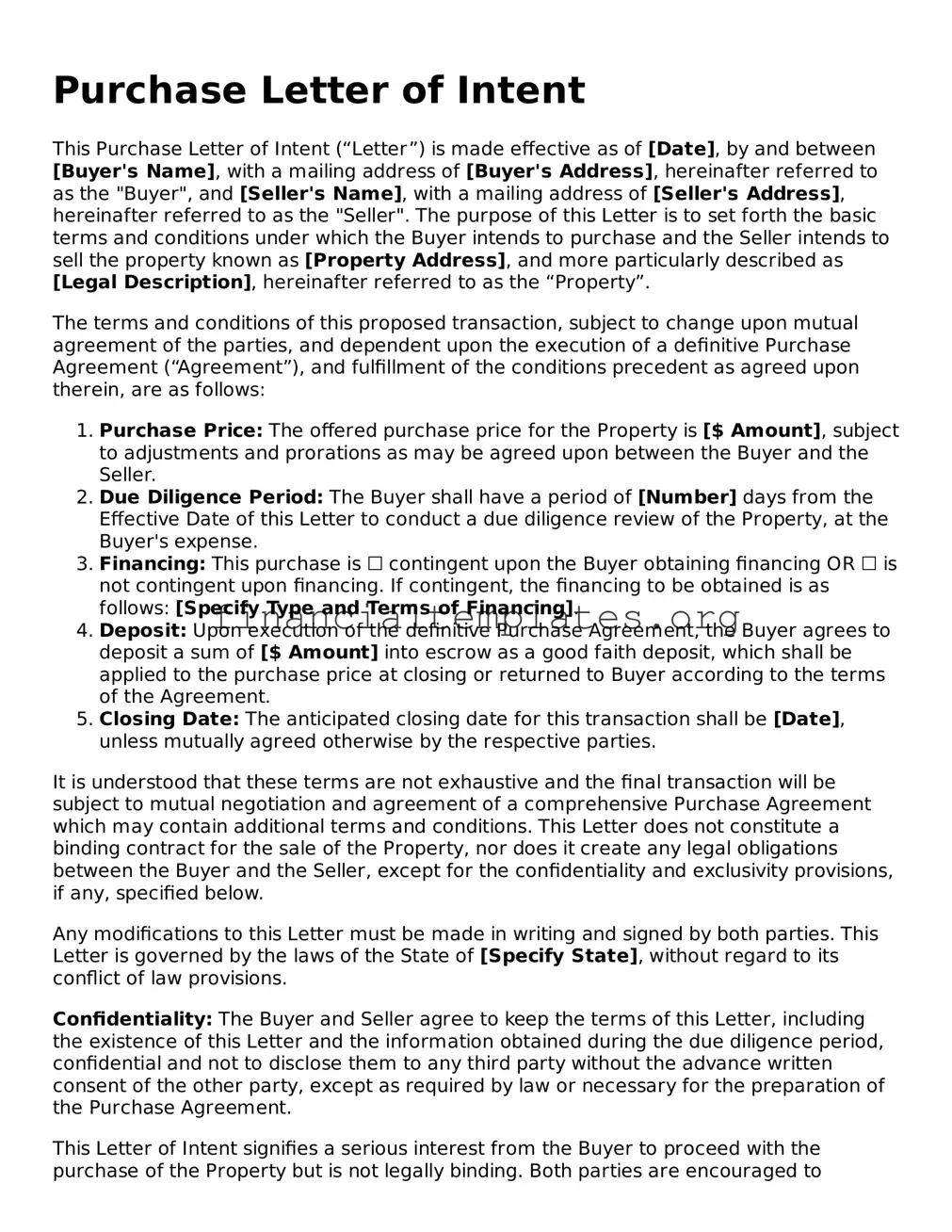

Purchase Letter of Intent Example

Purchase Letter of Intent

This Purchase Letter of Intent (“Letter”) is made effective as of [Date], by and between [Buyer's Name], with a mailing address of [Buyer's Address], hereinafter referred to as the "Buyer", and [Seller's Name], with a mailing address of [Seller's Address], hereinafter referred to as the "Seller". The purpose of this Letter is to set forth the basic terms and conditions under which the Buyer intends to purchase and the Seller intends to sell the property known as [Property Address], and more particularly described as [Legal Description], hereinafter referred to as the “Property”.

The terms and conditions of this proposed transaction, subject to change upon mutual agreement of the parties, and dependent upon the execution of a definitive Purchase Agreement (“Agreement”), and fulfillment of the conditions precedent as agreed upon therein, are as follows:

- Purchase Price: The offered purchase price for the Property is [$ Amount], subject to adjustments and prorations as may be agreed upon between the Buyer and the Seller.

- Due Diligence Period: The Buyer shall have a period of [Number] days from the Effective Date of this Letter to conduct a due diligence review of the Property, at the Buyer's expense.

- Financing: This purchase is ☐ contingent upon the Buyer obtaining financing OR ☐ is not contingent upon financing. If contingent, the financing to be obtained is as follows: [Specify Type and Terms of Financing].

- Deposit: Upon execution of the definitive Purchase Agreement, the Buyer agrees to deposit a sum of [$ Amount] into escrow as a good faith deposit, which shall be applied to the purchase price at closing or returned to Buyer according to the terms of the Agreement.

- Closing Date: The anticipated closing date for this transaction shall be [Date], unless mutually agreed otherwise by the respective parties.

It is understood that these terms are not exhaustive and the final transaction will be subject to mutual negotiation and agreement of a comprehensive Purchase Agreement which may contain additional terms and conditions. This Letter does not constitute a binding contract for the sale of the Property, nor does it create any legal obligations between the Buyer and the Seller, except for the confidentiality and exclusivity provisions, if any, specified below.

Any modifications to this Letter must be made in writing and signed by both parties. This Letter is governed by the laws of the State of [Specify State], without regard to its conflict of law provisions.

Confidentiality: The Buyer and Seller agree to keep the terms of this Letter, including the existence of this Letter and the information obtained during the due diligence period, confidential and not to disclose them to any third party without the advance written consent of the other party, except as required by law or necessary for the preparation of the Purchase Agreement.

This Letter of Intent signifies a serious interest from the Buyer to proceed with the purchase of the Property but is not legally binding. Both parties are encouraged to proceed with due diligence and good faith negotiations towards executing a definitive Purchase Agreement by [Negotiation Deadline].

Kindly indicate your agreement to these terms by signing and returning a copy of this Letter. This Letter will expire, and shall be null and void if not signed and returned by the Seller by [Expiration Date].

Thank you for considering this intent to purchase. We look forward to the possibility of working together to complete the transaction.

Sincerely,

__________________________________

[Buyer's Name]

Agreed and Accepted:

__________________________________

[Seller's Name]

PDF Properties

| Fact Name | Detail |

|---|---|

| Purpose | Indicates a buyer's intention to purchase goods or services from a seller, outlining the terms of the proposed deal. |

| Legally Binding | Not typically a legally binding document, but it can contain provisions that are, such as confidentiality agreements. |

| Key Contents | Includes buyer and seller details, description of goods or services, price, and terms of payment. |

| Benefits | Serves as a framework for future negotiations, reducing misunderstandings by clarifying terms early in the transaction. |

| Due Diligence Period | May specify a period for the buyer to conduct due diligence before finalizing the purchase. |

| Governing Law | Subject to the laws of the specific state where the transaction occurs or as agreed by the parties in the document. |

| State-Specific Forms | Different states may have varying requirements or standard forms, emphasizing the importance of using the correct version for the transaction. |

Guide to Writing Purchase Letter of Intent

Filling out a Purchase Letter of Intent form is a crucial early step in the process of purchasing a piece of property or business. This form serves as a formal declaration of your intention to purchase, outlining the terms under which you agree to proceed. It's essential to pay close attention to detail when completing this form to ensure all the information is accurate and reflects your intentions. The form typically asks for details about the buyer and seller, the property or business in question, and the terms of the agreement, including price and closing conditions. After this form is filled out and submitted, the next steps usually involve negotiations on the final terms, followed by the drafting of the official purchase agreement.

- Start by accurately filling in the buyer's details, including full name or corporate entity, address, and contact information.

- Enter the seller's details, mirroring the format you used for the buyer's information. Make sure to include the full legal name and contact details.

- Describe the property or business to be purchased, detailing its location and significant characteristics that identify it uniquely.

- Specify the proposed purchase price. Make sure this figure is agreed upon preliminarily by both parties or is your starting offer.

- Outline the terms of payment. This includes whether the amount will be paid in installments, in cash, through financing, or other arrangements.

- Include any contingencies that must be met before the transaction can proceed. These could involve financing approval, property inspections, or other conditions significant to the buyer or seller.

- Detail the timeline for the intended purchase, including the date by which you expect to sign the official purchase agreement and the proposed closing date.

- Sign and date the form. If you're representing a corporation or other entity, ensure the correct individual signs the form.

After the form is completed and all parties review it, it should be submitted appropriately, following the instructions provided by the seller or their agent. Often, this step includes sending the form via email or delivering a physical copy. Once received, the seller will review your Letter of Intent and may initiate negotiations to finalize the terms. Remember, this document is not legally binding in terms of completing the sale but signals serious interest and outlines the terms under which you’re willing to proceed. The next phase involves refining these terms into a binding purchase agreement, contingent on negotiations and any required inspections or approvals.

Understanding Purchase Letter of Intent

-

What is a Purchase Letter of Intent?

A Purchase Letter of Intent (LOI) is a document that outlines the preliminary agreements between a buyer and a seller before a formal purchase agreement is finalized. It signifies the intention to enter into a transaction and typically includes the proposed purchase price, description of the item or property to be purchased, and any terms or conditions the parties want to highlight. While not always legally binding in all aspects, it sets the stage for negotiations and drafting of the final purchase agreement.

-

Why use a Purchase Letter of Intent?

A Purchase Letter of Intent is beneficial as it helps both parties clarify and document their intent to engage in a transaction. It ensures that both the buyer and seller are on the same page regarding the key aspects of the deal, such as price and conditions, before proceeding with the more detailed and legally binding purchase agreement. It can also serve as a foundation for negotiating final terms and demonstrates a serious commitment by the buyer.

-

Is a Purchase Letter of Intent legally binding?

The legal binding nature of a Purchase Letter of Intent can vary. Generally, the LOI itself is not a legally binding contract to complete the purchase. However, it can contain provisions that are binding, such as confidentiality agreements, exclusivity clauses, or penalties for withdrawal under certain conditions. Parties should clearly state which elements, if any, are intended to be binding.

-

What are the key components of a Purchase Letter of Intent?

A well-crafted Purchase Letter of Intent typically includes:

- Identification of the buyer and seller.

- Description of the property or item to be purchased.

- The proposed purchase price and terms of payment.

- Conditions for the sale, such as due diligence periods, financing contingencies, and any specific terms both parties agree upon.

- Any binding provisions like confidentiality requirements.

- Timeline for moving forward to a purchase agreement.

-

How does one create a Purchase Letter of Intent?

Creating a Purchase Letter of Intent involves clearly stating the intentions of both the buyer and the seller regarding the key terms of the proposed transaction. It’s important to include detailed information about the transaction to avoid any misunderstandings. Consulting with legal advisors can help ensure that the language used doesn’t inadvertently create a binding agreement where none was intended and that any intentionally binding clauses are clearly identified.

-

What happens after a Purchase Letter of Intent is signed?

Once a Purchase Letter of Intent is signed, it typically triggers a series of events that lead to the drafting of a formal purchase agreement. This may include due diligence activities by the buyer, negotiations on final terms based on findings during the due diligence, and adjustments to the final purchase price or terms. The LOI serves as a guiding document for these negotiations, but the definitive agreement will be a separate, detailed contract that legally binds the parties to the terms of the sale.

-

Can a Purchase Letter of Intent be withdrawn?

Yes, a Purchase Letter of Intent can often be withdrawn, especially if it’s specifically stated to be non-binding regarding the purchase itself. However, withdrawing from an LOI must be done carefully to avoid breaching any binding provisions that may exist within the document, such as confidentiality agreements. Communication between the parties should remain open and clear to manage expectations and obligations until a final decision is reached.

Common mistakes

Filling out a Purchase Letter of Intent is a crucial step in the process of acquiring or selling a property or goods. It outlines the preliminary agreement between the buyer and seller before the final purchase agreement. However, mistakes can occur, which might complicate or delay the process. Here are four common errors that should be avoided:

Not specifying the terms clearly: One common oversight is failing to clearly define the terms of the purchase. This includes being vague about the payment amount, payment method, and timelines. Precision in these areas reduces the likelihood of misunderstandings later on.

Overlooking due diligence periods: Buyers should always stipulate a due diligence period in the letter. This allows the buyer time to verify the condition of the property or goods. Neglecting to include this can lead to a commitment to purchase without a thorough inspection.

Forgetting to mention contingencies: It's essential to include any conditions that must be met before the completion of the purchase. Common contingencies might involve financing, sale of existing property, or acceptable inspections. Leaving these out can lock parties into agreements they can't fulfill.

Failing to detail the binding and non-binding provisions: The letter should clearly distinguish between what aspects are legally binding (such as confidentiality and exclusivity) and what are not (like the purchase price or closing date). This oversight can lead to legal disputes if either party misunderstands their obligations.

Being meticulous while completing the Purchase Letter of Intent not only demonstrates professionalism but also safeguards the interests of all involved parties. Paying attention to these common pitfalls will help ensure a smoother transaction for both buyers and sellers.

Documents used along the form

When navigating the complexities of a purchase, especially in the realm of business or real estate, a Purchase Letter of Intent (LOI) is often just the starting point. This document signifies the buyer's intention to enter into a formal agreement to purchase a product, business, or property. However, to ensure a smooth and legally sound transaction, several other forms and documents are frequently used alongside the Purchase LOI. These additional documents help to clarify the terms, protect all parties involved, and outline the detailed agreements that the LOI suggests. Understanding each document’s role can empower buyers and sellers to navigate transactions more effectively.

- Due Diligence Checklist: This comprehensive list outlines all the documents and information needed to thoroughly evaluate the business or asset prior to purchase. It includes financial records, legal contracts, and other crucial information. This checklist helps ensure that the buyer is making an informed decision.

- Confidentiality Agreement: Often, in the process of negotiation, sensitive information needs to be exchanged. A confidentiality agreement protects this information, ensuring that it cannot be disclosed to third parties without explicit permission.

- Non-Disclosure Agreement (NDA): Similar to a confidentiality agreement, an NDA is a legal contract that binds one or more parties to secrecy regarding classified information they share. It is crucial in negotiations that involve the sharing of proprietary information or trade secrets.

- Purchase Agreement: Following the LOI, the purchase agreement is the binding contract that outlines the specific terms and conditions of the sale, including price, timelines, and any contingencies that must be met before the deal is finalized. This agreement is the cornerstone of the transaction, providing a clear roadmap for both buyer and seller.

In conclusion, while a Purchase Letter of Intent marks the beginning of a purchase negotiation, its effectiveness is significantly enhanced by accompanying documents like the Due Diligence Checklist, Confidentiality Agreement, Non-Disclosure Agreement, and the Purchase Agreement. Each plays a vital role in safeguarding the interests of all parties, ensuring transparency, and facilitating a thorough understanding of the deal. By leveraging these documents together, buyers and sellers can proceed with confidence towards a successful transaction.

Similar forms

A Purchase Letter of Intent (LOI) is similar to a Term Sheet in that both documents outline the key terms and conditions of a transaction before finalizing a deal. While an LOI is often used in the context of purchasing goods or services, a Term Sheet is more commonly associated with investment agreements. Both serve as preliminary agreements that precede a more detailed and legally binding contract. They both aim to ensure that the parties involved have a mutual understanding of the main aspects of the deal.

Comparable to an LOI, a Memorandum of Understanding (MOU) is another type of preliminary agreement. An MOU outlines the parties' intention to engage in a contract and the principles of the agreement. It's less formal than an LOI and usually not legally binding. However, it signifies a serious commitment from all the parties involved to move forward with negotiations. MOUs are often used in international transactions, partnerships, and collaborations.

Much like a Purchase Letter of Intent, a Non-Disclosure Agreement (NDA) protects sensitive information. While an LOI may include clauses that touch on confidentiality, an NDA is entirely dedicated to ensuring that confidential information shared during negotiations remains secure. This document is crucial in transactions where disclosing proprietary information is necessary to proceed with the deal. NDAs can be one-sided or mutual, depending on whether one or both parties are sharing confidential information.

An Agreement in Principle shares similarities with a Purchase LOI as it represents an initial agreement highlighting the key aspects of a transaction. Often used in the finance and banking sectors, this document signifies that the parties have agreed on certain terms, though the details may still need to be worked out. Like an LOI, it sets the stage for more detailed negotiations and agreements to follow, yet it's not always binding.

Another document comparable to a Purchase LOI is a Heads of Agreement (HOA). This document outlines the main terms of a deal and the intention of all parties to continue negotiating in good faith. Like an LOI, it may not be fully binding but acts as a signpost for the negotiations, setting out the key points that will form the basis of the contract. HOAs are often used in complex transactions, such as mergers and acquisitions.

A Purchase Agreement is a step beyond a Purchase LOI in the transaction process. While an LOI indicates a buyer's intention to purchase under certain conditions, a Purchase Agreement is the binding contract that finalizes the terms and conditions of the sale, including price, delivery, and warranties. The Purchase Agreement is the culmination of negotiations signified by an LOI, serving as the definitive agreement between the parties.

Lastly, an Expression of Interest (EOI) is somewhat similar to a Purchase LOI in its purpose. An EOI is used by a buyer to express interest in purchasing goods, services, or property, but it is more preliminary and less detailed than an LOI. It indicates a party's interest in a transaction without engaging in specifics. An EOI is often the first step before a formal LOI is issued, signaling a buyer's serious intent to pursue negotiations.

Dos and Don'ts

When you're ready to take the first formal step towards purchasing property, a Purchase Letter of Intent is a crucial document. It outlines your initial offer and sets the tone for negotiations. Let's make sure you start off on the right foot with some do's and don'ts.

Do's:

- Be clear and concise: Make sure your intentions and terms are clearly stated. Avoid any ambiguity that could lead to misunderstandings or disputes.

- Include all relevant information: Your full name, contact information, the property address, and the offered price should be accurately filled in.

- Review local regulations: Different areas may have specific requirements for Purchase Letters of Intent. Ensuring you're compliant will smooth the process.

- Consult with a professional: Whether it’s a lawyer or a real estate expert, getting advice can help you avoid mistakes and make a stronger offer.

- Confirm financing: If your purchase depends on securing a mortgage or other financing, mention this condition and ensure you have preliminary approval.

Don'ts:

- Ignore the fine print: Any terms and conditions, deadlines, or contingencies included by the seller need to be thoroughly understood and considered.

- Make unrealistic offers: An offer far below market value can insult the seller and close the door on negotiations before they even begin.

- Overcommit: Avoid agreeing to terms that are not favorable or beyond what you can afford. It’s important to negotiate terms that are comfortable for you.

- Forget about deadlines: Failing to respect deadlines could lead to losing the property or harming your credibility with the seller.

- Submit without reviewing: Double-check for typos, incorrect information, or unclear terms. Your offer should reflect your seriousness about the purchase.

Misconceptions

Many individuals have misconceptions about the Purchase Letter of Intent (LOI) form, which can lead to confusion and complications in the buying process. Understanding what these misunderstandings are can help clarify the purpose and implications of the LOI.

The LOI is legally binding like a contract. One common misconception is that the LOI is as legally binding as a contract. In reality, the LOI typically outlines the terms of a deal and expresses the intent to enter into a contract but does not bind the parties to the terms, except for certain provisions like confidentiality.

Everything in the LOI is negotiable after signing. People often believe that signing an LOI doesn't commit them to anything and that everything can be renegotiated. While it's true that the LOI is generally not fully binding, it sets expectations for the deal. Renegotiating terms listed in the LOI can lead to lost trust or a collapsed deal.

An LOI is unnecessary if both parties agree on terms. Some think that an LOI is superfluous if there's already an agreement. However, an LOI serves as a written record of terms agreed upon and can be crucial in resolving misunderstandings or disputes before a formal contract is signed.

All LOIs are the same. There's a notion that there's a one-size-fits-all LOI. However, LOIs are tailored to reflect the specifics of each transaction, including terms, conditions, and specific clauses necessary for the deal's context.

The LOI guarantees the final sale will happen. Another misunderstanding is believing that once an LOI is signed, the sale is guaranteed. The truth is, an LOI shows intent but does not guarantee the completion of the sale, as unforeseen issues can arise during due diligence or financing efforts.

Signing an LOI is a quick process. Many people assume signing an LOI is straightforward and quick. The process can be lengthy and complex, as it involves negotiation and the careful drafting of terms to ensure clarity and mutual understanding.

An LOI must include all details of the transaction. While it's important for an LOI to include critical terms, it doesn't need to be as detailed as the final contract. The LOI provides a framework for the deal, which will be fleshed out in the binding agreement.

There are no risks in signing an LOI. Lastly, there's a misconception that there's no risk in signing an LOI. However, signing an LOI can create legal obligations, such as confidentiality requirements, or it can signal to the market that the company is no longer available for offers, potentially affecting its bargaining position.

Key takeaways

When dealing with the Purchase Letter of Intent (LOI) form, there are several important takeaways to keep in mind. This document plays a crucial role in the initial stages of a transaction, setting the tone for negotiations and outlining the intentions of both parties. Understanding its key aspects can greatly benefit anyone involved in a purchasing process.

- Clearly State Intentions: The primary purpose of the LOI is to outline the intentions of the buyer towards purchasing goods, services, or property. It serves as a preliminary agreement before the final contract, so it's crucial to be clear and specific about what is being proposed.

- Non-Binding Nature: Typically, an LOI is a non-binding document, meaning that it doesn't legally obligate either party to complete the transaction. However, it should be taken seriously as it sets the stage for negotiations and can include provisions that might be binding, such as confidentiality clauses.

- Include Key Details: Essential information such as the names of the parties involved, description of the goods, services, or property in question, purchase price or method of determining the price, and any contingencies that the purchase is subject to, should be included.

- Outline Terms and Conditions: Clarifying the terms of the transaction, including payment terms, delivery dates, and conditions precedent to the sale (such as passing inspections or obtaining financing), can help prevent misunderstandings later on.

- Confidentiality: If the transactions or negotiations require discretion, including a confidentiality clause to protect sensitive information is advisable. This ensures that details of the deal are not disclosed inappropriately.

- Consult Legal Guidance: Given its importance in the purchasing process, consulting with a legal professional to review or draft the LOI can help ensure that your interests are protected and that the document aligns with legal standards and practices.

- Timeline: It's beneficial to include a timeline or an expiration date within the LOI, specifying how long the offer stands. This can help maintain momentum in negotiations and encourage a timely response from the other party.

Effective use of a Purchase Letter of Intent can pave the way for smoother negotiations and a clearer understanding between parties during the preliminary stages of a purchase agreement. By paying attention to these key takeaways, individuals and businesses can navigate the initial phases of their transactions more confidently and with greater success.

Other Types of Purchase Letter of Intent Templates:

Business Purchase Letter of Intent - It helps in fostering a sense of trust and cooperation between the buyer and seller, facilitating a smoother negotiation process.

Commercial Real Estate Loi - A professional approach by a potential buyer to express interest in purchasing commercial real estate, initiating the negotiation process.