Blank Letter of Intent to Purchase Commercial Real Estate Form

Navigating the complexities of commercial real estate purchases requires careful planning and clear communication between parties. At the heart of these transactions, often stands the Letter of Intent to Purchase Commercial Real Estate, a pivotal document that lays the groundwork for a successful negotiation and purchase. This form, while not a binding contract, serves as a formal way to express interest in a property and outlines the key terms and conditions of the purchase agreement to be negotiated. It typically covers important details such as the purchase price, deposit amounts, due diligence periods, and contingencies that must be satisfied before the deal can close. This initial document is crucial as it helps to ensure both buyer and seller are on the same page and can move forward with confidence, setting the stage for the binding agreements that will follow. As such, it is an essential tool in the commercial real estate sector, offering a structured template for negotiating and solidifying the intentions of both parties before entering into the more legally binding phases of the transaction.

Letter of Intent to Purchase Commercial Real Estate Example

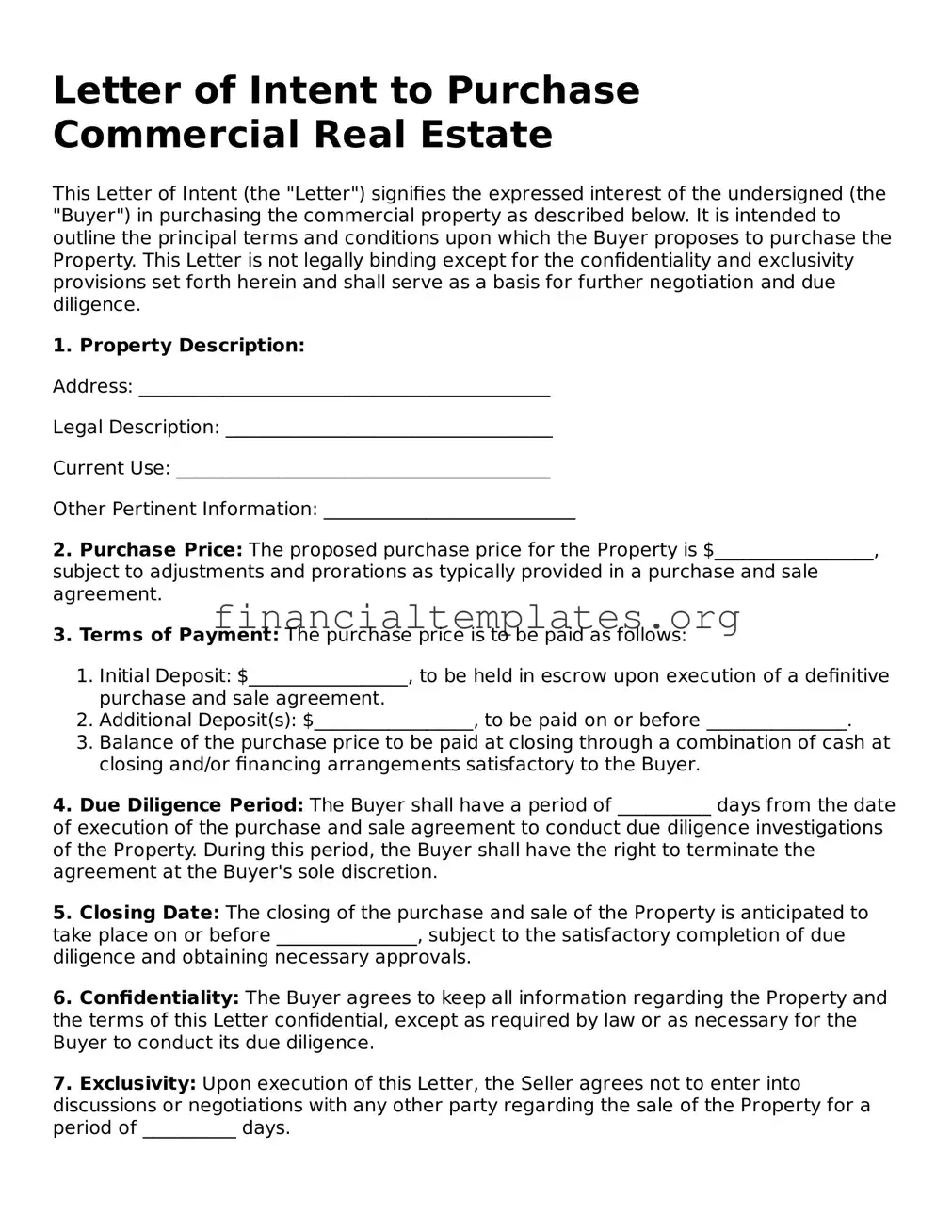

Letter of Intent to Purchase Commercial Real Estate

This Letter of Intent (the "Letter") signifies the expressed interest of the undersigned (the "Buyer") in purchasing the commercial property as described below. It is intended to outline the principal terms and conditions upon which the Buyer proposes to purchase the Property. This Letter is not legally binding except for the confidentiality and exclusivity provisions set forth herein and shall serve as a basis for further negotiation and due diligence.

1. Property Description:

Address: ____________________________________________

Legal Description: ___________________________________

Current Use: ________________________________________

Other Pertinent Information: ___________________________

2. Purchase Price: The proposed purchase price for the Property is $_________________, subject to adjustments and prorations as typically provided in a purchase and sale agreement.

3. Terms of Payment: The purchase price is to be paid as follows:

- Initial Deposit: $_________________, to be held in escrow upon execution of a definitive purchase and sale agreement.

- Additional Deposit(s): $_________________, to be paid on or before _______________.

- Balance of the purchase price to be paid at closing through a combination of cash at closing and/or financing arrangements satisfactory to the Buyer.

4. Due Diligence Period: The Buyer shall have a period of __________ days from the date of execution of the purchase and sale agreement to conduct due diligence investigations of the Property. During this period, the Buyer shall have the right to terminate the agreement at the Buyer's sole discretion.

5. Closing Date: The closing of the purchase and sale of the Property is anticipated to take place on or before _______________, subject to the satisfactory completion of due diligence and obtaining necessary approvals.

6. Confidentiality: The Buyer agrees to keep all information regarding the Property and the terms of this Letter confidential, except as required by law or as necessary for the Buyer to conduct its due diligence.

7. Exclusivity: Upon execution of this Letter, the Seller agrees not to enter into discussions or negotiations with any other party regarding the sale of the Property for a period of __________ days.

8. Governing Law: This Letter shall be governed by and construed in accordance with the laws of the State in which the Property is located, without giving effect to any principles of conflicts of law.

This Letter is intended as a preliminary indication of interest and does not constitute a binding contract except for the confidentiality and exclusivity provisions contained herein. Either party may terminate negotiations at any time, for any reason, upon written notice to the other party.

Yours sincerely,

______________________________________

Buyer's Name: ___________________________

Buyer's Contact Information: ___________________________

Date: __________________________________

Seller's Acknowledgment:

This Letter of Intent to Purchase is hereby acknowledged and accepted by the undersigned on this _____ day of __________, 20__.

______________________________________

Seller's Name: ___________________________

Seller's Contact Information: ___________________________

PDF Properties

| Fact | Description |

|---|---|

| Definition | A Letter of Intent to Purchase Commercial Real Estate is a document that outlines the preliminary agreements between a buyer and seller before a formal purchase agreement is signed. |

| Purpose | It serves to formalize the buyer's intent to purchase the property, outline the terms and conditions preliminarily agreed upon, and set the stage for formal negotiations and the drafting of the official purchase agreement. |

| Non-Binding | Typically, this document is non-binding, meaning it does not legally compel either party to proceed with the transaction. However, some parts, such as confidentiality clauses, can be binding. |

| Key Components | It generally includes details such as the proposed purchase price, due diligence period, earnest money deposit, financing terms, and any contingencies that must be met before the deal is finalized. |

| Due Diligence Period | This period allows the buyer to investigate the property's condition, legal standing, and any other considerations critical to the purchase decision. |

| Governing Law | The governing law clause specifies which state's laws will apply to the interpretation of the letter and the subsequent purchase agreement. This is critical for state-specific forms. |

| Final Steps | After the terms are agreed upon in the Letter of Intent, the next steps typically include conducting due diligence, securing financing, and drafting and signing the Purchase and Sale Agreement. |

Guide to Writing Letter of Intent to Purchase Commercial Real Estate

Filling out a Letter of Intent to Purchase Commercial Real Estate is a crucial step in the process of purchasing property for business purposes. This document serves as a preliminary agreement between the buyer and the seller, outlining the terms and conditions of the potential sale. It's important to complete this form carefully and accurately, as it sets the stage for the official purchase agreement. Here are the steps to follow to ensure the letter is properly prepared.

- Start with the date at the top of the document. This shows when the letter of intent (LOI) is being submitted.

- Enter the full legal name of the seller and the buyer. Include any co-buyers or entities involved in the purchase.

- Provide the full address and legal description of the commercial property. This may include the lot number, block number, and any other identifiers.

- State the offered purchase price for the property clearly. Also, include terms of payment if applicable, such as a down payment or if the sum will be paid in installments.

- Detail any contingencies that must be met before the final sale. These can include property inspections, financing approval, and any necessary approvals from local government or homeowners' associations.

- List the expected closing date or the timeline in which you anticipate finalizing the purchase.

- Specify who will be responsible for paying closing costs, which might include taxes, attorney fees, and title insurance.

- Include any other terms and conditions that are part of the offer. This might involve items or equipment to be included with the sale, or renovations the seller agrees to complete before closing.

- Insert a confidentiality clause if necessary. This can protect both parties from information leaks related to the property sale.

- Allocate space at the bottom of the document for both the buyer and seller to print and sign their names, showing their intent to proceed under the outlined terms.

After completing this form, it's important to review the document thoroughly, ensuring that all information is accurate and reflects the agreement between the buyer and the seller. Once both parties sign the Letter of Intent, the document serves as a formal indication of their intention to enter into a purchasing agreement, leading to more detailed negotiations and, eventually, the final sale of the commercial property. Keep in mind that this is not a binding contract but rather a significant step in the pathway to purchase.

Understanding Letter of Intent to Purchase Commercial Real Estate

What is a Letter of Intent to Purchase Commercial Real Estate?

A Letter of Intent to Purchase Commercial Real Estate is a document used by a potential buyer to express interest in buying a commercial property. It outlines the preliminary terms and conditions under which the buyer proposes to purchase the property. Although not a legally binding agreement, it serves as a foundation for negotiations and can lead to a binding contract if both parties agree.

What should be included in a Letter of Intent to Purchase Commercial Real Estate?

This letter typically includes details such as the proposed purchase price, deposit amount, due diligence period, financing terms, and closing date. It might also outline conditions for the sale, like property inspections and any other contingencies that need to be satisfied before finalizing the purchase.

Is a Letter of Intent to Purchase Commercial Real Estate legally binding?

No, a Letter of Intent is generally not legally binding in terms of the agreement to purchase the property. However, certain aspects, like confidentiality clauses or an agreement to negotiate exclusively with one party for a certain period, can be binding if explicitly stated. It’s important to clearly specify which parts, if any, are intended to be legally binding.

How can I withdraw from a Letter of Intent to Purchase Commercial Real Estate?

Since a Letter of Intent is usually not legally binding regarding the purchase agreement, a party can typically withdraw by notifying the other party in writing. Be sure to review the document for any terms that might be legally binding or for any stated procedures on withdrawing to ensure compliance.

Can I negotiate the terms in a Letter of Intent to Purchase Commercial Real Estate?

Yes, the terms outlined in a Letter of Intent are not final and are open to negotiation. This document serves as a starting point for discussions. It is advisable to engage in negotiations to reach mutually agreeable terms before moving forward with a more detailed and binding purchase agreement.

What happens after both parties agree on a Letter of Intent to Purchase Commercial Real Estate?

Once both parties agree on the terms outlined in the Letter of Intent, the next step is typically for one or both parties to draft a formal purchase agreement. This agreement will include a more detailed outline of the terms, conditions, and contingencies for the sale. It is highly recommended that both parties have this document reviewed by legal professionals before signing to ensure that all terms are accurately represented and legally enforceable.

Common mistakes

-

Not Specifying Payment Details: One frequent oversight is not being explicit about the payment terms. This includes the purchase price, initial deposit, and the balance payment method. Clearly outlining these terms ensures transparency and minimizes misunderstandings between buyer and seller.

-

Omitting Due Diligence Conditions: Buyers often neglect to include conditions for due diligence in their letter. This crucial step allows the buyer to assess the property's condition, legal standing, and more. Without this, buyers risk committing to a purchase without a complete understanding of the property.

-

Forgetting Contingency Clauses: Similarly, failing to mention contingency clauses can be a major oversight. These clauses protect the buyer’s interests by allowing them to back out of the deal under specific circumstances without financial penalty. For example, contingencies can be related to financing approval or the sale of another property.

-

Ignoring Closing and Possession Dates: Another common mistake is not specifying the expected dates for closing the deal and taking possession of the property. Clearly stated timelines help both parties plan and avoid potential conflicts over scheduling.

-

Lack of Specificity in Property Description: A vague or incomplete description of the property is a significant error. This should include the exact address, legal description, and any pertinent details that define the property being purchased. It's vital for avoiding confusion over which property is under negotiation.

-

Not Verifying Zoning and Use Permissions: Finally, buyers occasionally fail to confirm that the property’s zoning aligns with their intended use. Assuming a property can be used for a specific business without verification can lead to legal and financial hurdles down the line.

Beyond these common mistakes, it's also important to approach the Letter of Intent with a clear understanding of its non-binding nature, except where explicitly stated otherwise. The key is to provide a solid foundation for negotiations, helping both buyer and seller to reach an agreement with all the necessary terms and protections in place.

Documents used along the form

In the complex process of purchasing commercial real estate, the Letter of Intent (LOI) is merely the beginning. This initial agreement between the buyer and seller outlines the terms and conditions of the sale, serving as a precursor to formal legal agreements. Ensuring a seamless transaction requires the use of several other critical documents and forms beyond the LOI. Each plays a unique role in safeguarding the interests of all parties involved and ensuring the transaction complies with legal standards.

- Purchase Agreement: This detailed contract follows the LOI and officially sets the terms of the sale, including price, closing conditions, and any contingencies such as financing or property inspections. It is legally binding upon both parties.

- Due Diligence Checklist: Buyers use this document to conduct a thorough investigation of the property and the business. It covers areas such as property inspections, financial audits, and zoning compliances.

- Title Report: This report outlines the history of the property’s ownership and any encumbrances, liens, or easements that could affect the buyer’s use of the property. It is crucial for ensuring clear title.

- Environmental Assessment: This ensures that the property does not have environmental issues that could impose liabilities on the new owner. Depending on the findings, further detailed reports may be required.

- Property Appraisal: A professional appraisal provides an estimate of the property's market value, which is critical for financing and for the buyer to ensure they are making a prudent investment.

- Financing Documents: If the purchase involves securing a mortgage or other financing, the buyer will need to provide these documents from their lender, outlining the terms and conditions of the loan.

- Closing Statement: Also known as a HUD-1 statement, it itemizes all the final closing costs and financial transactions, including down payments, fees, and any others associated with the transaction.

- Deed: This legal document transfers the property's title from the seller to the buyer, officially recording the new ownership with the local government office.

Each of these documents plays a vital role in ensuring the legal, financial, and physical aspects of a commercial real estate transaction are thoroughly evaluated and agreed upon. By understanding and meticulously preparing these forms and documents, both buyers and sellers can navigate the complexities of real estate transactions with greater confidence, ensuring a transparent and secure transfer of property.

Similar forms

A Purchase Agreement for Commercial Real Estate is closely similar to the Letter of Intent to Purchase Commercial Real Estate but is more detailed and legally binding. While the letter of intent serves as an initial agreement between the parties about their intent to enter a transaction, the purchase agreement outlines the specific terms and conditions of the sale, including price, closing conditions, and warranties.

The Residential Real Estate Purchase Agreement shares a common purpose with the commercial focus of the letter of intent but applies to residential properties. This document outlines the terms under which a residential property will be sold, indicating the responsibilities of both the buyer and seller, and it covers aspects such as financing conditions, inspections, and closing dates, tailored for the residential market.

A Real Estate Option Agreement gives one party the right, but not the obligation, to purchase or sell a piece of real estate at a predetermined price within a set period. Similar to a letter of intent, this document expresses a preliminary agreement, but it specifically allows a buyer to "lock in" a property at today's price for future purchase, reflecting a commitment to the potential transaction.

A Lease Agreement, for either commercial or residential property, is akin to a letter of intent to purchase real estate in that it outlines the terms under which property will be rented. However, instead of leading to ownership, it sets the conditions for the use of a property for a specified time, including rent, duration of lease, and responsibilities of each party.

A Joint Venture Agreement, when used in real estate, shares similarities with a letter of intent as it often outlines the preliminary understanding between parties to undertake a real estate development project together. It goes further by specifying the contributions, roles, and profit distribution among the partners, moving beyond intent to a structured plan for collaboration.

The Letter of Intent for Lease of Commercial Property is similar to its counterpart for purchase, as it signifies the beginning stages of negotiation. However, it focuses on leasing arrangements rather than purchasing, detailing the potential lessee's and lessor's expectations regarding lease terms before a formal lease agreement is signed.

The Memorandum of Understanding (MOU) in real estate transactions functions similarly to a letter of intent. It records the preliminary agreements between all parties involved in a transaction or project. While not as legally binding as a purchase agreement, it formalizes the mutual intent to proceed in a specific direction, laying a foundation for formal contracts.

An Assignment of Lease Agreement shares resemblance with a letter of intent when one party wishes to transfer its interest in a lease to another party. This document can precede a more detailed transfer agreement, outlining the conditions under which the lease will be assigned and any obligations the new party will assume.

The Land Contract, akin to the letter of intent, is used in the sale of real estate where the seller provides financing to the buyer to purchase the property over time. While the letter of intent marks the initial agreement to negotiate the terms of a sale, the land contract goes further, establishing the financing terms, interest rates, and payment schedules, eventually leading to full ownership.

Finally, a Financing Contingency Addendum is often attached to real estate purchase agreements, including those preceded by a letter of intent. This document outlines conditions under which a buyer must secure financing for the purchase. It protectively outlines what happens if the buyer cannot obtain financing, allowing them to withdraw from the deal without penalty, underscoring its preparatory role in ensuring the transaction can proceed.

Dos and Don'ts

When filling out the Letter of Intent to Purchase Commercial Real Estate, it's imperative to approach the document with attention to detail and a clear understanding of its implications. Here's a concise guide on what to do and what not to do during this process:

- Do: Clearly specify the terms of the purchase, including the purchase price, deposit amount, and any contingencies that may affect the deal. This clarity helps prevent misunderstandings down the line.

- Do: Conduct thorough due diligence on the property. This includes understanding its physical condition, legal standing, and any zoning issues that could affect its use.

- Do: Consult with professionals, such as a real estate attorney or a commercial broker, to review the letter before sending it. Their expertise can be invaluable in identifying potential issues or areas for negotiation.

- Do: Keep the language clear and concise. Avoid legal jargon if it's not necessary, to ensure that all parties have a mutual understanding of the agreement.

- Don't: Neglect to include a timeframe for the seller to respond. Without a specified deadline, the process may drag on indefinitely, potentially costing you other opportunities.

- Don't: Forget to outline the steps that will follow once the letter is accepted. This usually involves drafting a formal purchase agreement and undergoing a more detailed due diligence process.

- Don't: Underestimate the importance of confidentiality, especially if you're negotiating in a competitive market. It may be prudent to include a confidentiality clause to protect sensitive information.

- Don't: Assume the letter is binding without explicitly stating so. In most cases, Letters of Intent are non-binding, but specifying the nature of the document can help manage expectations on both sides.

Treating the Letter of Intent as an essential step in the purchase process, and following these guidelines, can smooth the path toward a successful real estate transaction.

Misconceptions

Commercial real estate transactions often begin with a document known as a Letter of Intent (LOI). This document outlines the preliminary agreements between a buyer and a seller. However, numerous misconceptions surround the nature and use of the LOI in the process of purchasing commercial property. Some of these misunderstandings can potentially lead to legal and financial complications if not properly addressed.

- Misconception 1: An LOI is Legally Binding

Many people mistakenly believe that a Letter of Intent is a legally binding agreement that obligates either the buyer or the seller to proceed with the transaction. In reality, the LOI is primarily a tool for negotiation, laying out the terms under which the parties might agree to a deal. It generally serves as a foundation for drafting the purchase agreement, which is the binding document. However, certain sections within the LOI, such as confidentiality and exclusivity clauses, can be binding if explicitly stated.

- Misconception 2: The LOI is Unnecessary if a Purchase Agreement will be Signed

The misconception that an LOI is redundant if the parties intend to sign a purchase agreement overlooks the LOI's critical role in streamlining negotiations. An LOI outlines the main terms of the transaction, making it easier for both parties to agree on a detailed purchase agreement. It can save time and reduce costs associated with legal fees by ensuring that there is mutual understanding and agreement on key points before drafting the more complex purchase agreement.

- Misconception 3: The Terms in the LOI are Final

Some individuals assume that once terms are outlined in an LOI, they are set in stone. However, the nature of an LOI is fundamentally preliminary and subject to change. The LOI serves as a starting point for negotiations, and its terms can be renegotiated or refined as the parties work towards a final purchase agreement. This flexibility allows both buyers and sellers to adapt to new information or circumstances that may arise.

- Misconception 4: A Standard LOI Template is Adequate for All Transactions

While there are many templates available for drafting a Letter of Intent, relying solely on a standard template can be risky. Every commercial real estate transaction is unique, and a template might not cover specific terms necessary for a particular deal or protect the interests of the parties involved. Tailoring the LOI to the specifics of the transaction and having it reviewed by legal counsel can prevent misunderstandings and provide better protection for both parties.

- Misconception 5: An LOI Guarantees the Completion of the Sale

Finally, there is a belief that once an LOI is signed, the sale is guaranteed to be completed. However, the LOI does not guarantee that the transaction will close. Various factors, such as financing approval, property inspections, and due diligence findings, can affect the progress of a transaction. Even with a signed LOI, these factors can lead to renegotiations or termination of the potential deal.

Key takeaways

When considering the purchase of commercial real estate, the Letter of Intent (LOI) plays a pivotal role in facilitating negotiations between the buyer and the seller. Below are key takeaways that anyone dealing with the LOI should keep in mind:

- It’s not legally binding. Although it outlines the terms of the purchase, the LOI itself doesn’t legally oblige the buyer or seller to complete the transaction. However, it's advised to treat it with the seriousness of a binding agreement.

- Clarity is key. The LOI should clearly state the purchase price, terms, and conditions of the sale. This prevents misunderstandings that could derail the deal later on.

- Diligence is a must. The LOI often includes provisions for due diligence, allowing the buyer to investigate the property's condition and verify financials. Meeting these conditions is crucial for progress.

- Expiration date. Including an expiration date for the offer shows seriousness and can prompt a timely response. Without this, negotiations could drag on indefinitely.

- Confidentiality provisions. Protect sensitive information from the start by incorporating confidentiality terms. This becomes particularly important when dealings involve proprietary or competitive business insights.

- Contingencies matter. Clearly outlined contingencies enable either party to back out if certain conditions aren’t met, like financing approvals or satisfactory inspections.

- Professional advice is invaluable. Given the complexities and potential impact of the LOI, consulting with a real estate attorney before drafting or signing can safeguard interests and investments.

Using a Letter of Intent to Purchase Commercial Real Estate is a strategic step in the negotiation process. It signals serious interest and serves as a foundation for the binding purchase agreement. Remembering these key takeaways will ensure that the LOI acts as an effective tool in the negotiation process, balancing protection with progress towards a successful transaction.

Other Types of Letter of Intent to Purchase Commercial Real Estate Templates:

Letter of Intent to Purchase - It serves as a tool to communicate the buyer's intention to purchase goods, services, or real estate from the seller.