Blank Letter of Intent to Purchase Business Form

Embarking on the journey to purchase a business is a monumental step that blends anticipation with the complexities of legal processes. Central to this pathway is a pivotal document known as the Letter of Intent to Purchase Business. This document serves as the initial handshake between potential buyer and seller, laying the groundwork for what is often a nuanced and detailed negotiation. It outlines the basic terms and conditions of the purchase, including but not limited to the proposed purchase price, the structure of the transaction, and the timeline for due diligence. Moreover, the letter acts as a safeguard, allowing both parties to explore the feasibility of the deal without committing significant resources. Despite its non-binding nature in most clauses, it marks a critical point of progress towards the merger or acquisition, setting the tone for the negotiations that will follow and ensuring that both parties are aligned in their expectations and understanding of the process ahead. With a well-crafted letter, the complexities of purchasing a business can be navigated with greater clarity and confidence, providing a structured approach to what can otherwise be a daunting task.

Letter of Intent to Purchase Business Example

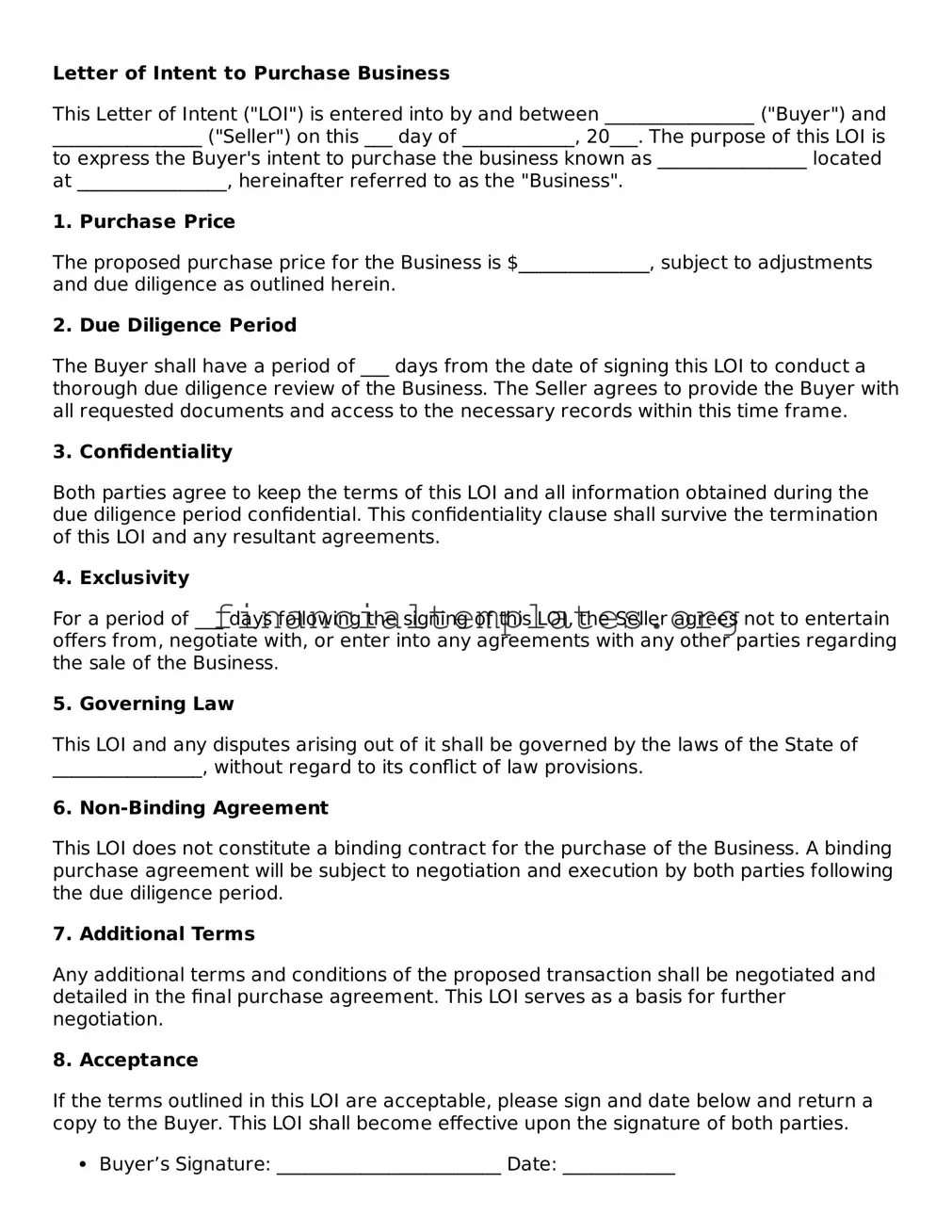

Letter of Intent to Purchase Business

This Letter of Intent ("LOI") is entered into by and between ________________ ("Buyer") and ________________ ("Seller") on this ___ day of ____________, 20___. The purpose of this LOI is to express the Buyer's intent to purchase the business known as ________________ located at ________________, hereinafter referred to as the "Business".

1. Purchase Price

The proposed purchase price for the Business is $______________, subject to adjustments and due diligence as outlined herein.

2. Due Diligence Period

The Buyer shall have a period of ___ days from the date of signing this LOI to conduct a thorough due diligence review of the Business. The Seller agrees to provide the Buyer with all requested documents and access to the necessary records within this time frame.

3. Confidentiality

Both parties agree to keep the terms of this LOI and all information obtained during the due diligence period confidential. This confidentiality clause shall survive the termination of this LOI and any resultant agreements.

4. Exclusivity

For a period of ___ days following the signing of this LOI, the Seller agrees not to entertain offers from, negotiate with, or enter into any agreements with any other parties regarding the sale of the Business.

5. Governing Law

This LOI and any disputes arising out of it shall be governed by the laws of the State of ________________, without regard to its conflict of law provisions.

6. Non-Binding Agreement

This LOI does not constitute a binding contract for the purchase of the Business. A binding purchase agreement will be subject to negotiation and execution by both parties following the due diligence period.

7. Additional Terms

Any additional terms and conditions of the proposed transaction shall be negotiated and detailed in the final purchase agreement. This LOI serves as a basis for further negotiation.

8. Acceptance

If the terms outlined in this LOI are acceptable, please sign and date below and return a copy to the Buyer. This LOI shall become effective upon the signature of both parties.

- Buyer’s Signature: ________________________ Date: ____________

- Seller’s Signature: ________________________ Date: ____________

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose | A Letter of Intent to Purchase Business serves as a formal document that outlines the preliminary agreement between a buyer and seller before the final purchase agreement. This letter sets forth the terms and conditions, purchase price, and structure of the deal, providing both parties with a clear understanding of the intentions and frameworks of the transaction. |

| Non-binding Nature | Generally, the Letter of Intent is non-binding regarding the purchase agreement except for certain provisions such as confidentiality or exclusivity, which are intended to be legally binding. This allows the parties to negotiate in good faith without committing to complete the transaction. |

| Due Diligence Clause | This clause allows the buyer to conduct a thorough investigation of the business. Through due diligence, the buyer assesses the financial performance, legal compliance, and operational mechanics of the business to ensure that the investment is sound and to identify any potential risks or liabilities. |

| Governing Law | Though the Letter of Intent itself may not be a binding contract, it often specifies which state's laws will govern the terms and enforceability of the binding provisions, such as confidentiality and exclusivity. This is crucial for understanding how any disputes will be resolved and what legal standards will apply to the agreement. |

Guide to Writing Letter of Intent to Purchase Business

Filling out a Letter of Intent to Purchase Business is a critical step in the negotiation process for buying a business. This document outlines the preliminary agreement between the buyer and the seller, setting the stage for more detailed negotiations and due diligence. It's important to approach this task with care to ensure all terms are clear, fair, and accurately reflect the preliminary agreement. Following these steps will help create a solid foundation for the subsequent purchase process.

- Gather all necessary information about the business, including its legal name, type of business, location, and any relevant identification numbers.

- Identify both the buyer and the seller by their full legal names and contact information to ensure clear communication.

- Outline the proposed purchase price and the terms of payment. Specify if the payment will be in cash, through financing, or a combination of both.

- Detail any contingencies that must be met before the transaction can be finalized, such as approval from financing sources or satisfactory results from a due diligence investigation.

- Agree on a timeline for the due diligence process, negotiations, and the final closing date. It’s important to set realistic dates that work for both parties.

- Describe any non-compete clauses or confidentiality agreements that will be in place either before or after the purchase is completed.

- Provide information on any deposits or earnest money that will be paid upfront by the buyer, including the conditions under which it is refundable or will be forfeited.

- If applicable, list any assets or inventory included in the purchase, making sure to be as specific as possible to avoid future disputes.

- State the governing law, which specifies the state laws that will apply to the interpretation and enforcement of the agreement.

- Both the buyer and the seller should sign and date the document, making sure copies are made for both parties.

After the Letter of Intent to Purchase Business form is filled out and signed, both parties should prepare for the due diligence phase. This includes a deep dive into the financials, operations, and legal aspects of the business to ensure the buyer knows exactly what they are purchasing. During this time, negotiations will continue, possibly leading to amendments to the Letter of Intent based on findings. Both parties should remain in clear communication and work with their respective legal and financial advisors to navigate the next steps toward finalizing the business sale.

Understanding Letter of Intent to Purchase Business

-

What is a Letter of Intent to Purchase Business?

A Letter of Intent to Purchase Business (LOI) is a document where a potential buyer expresses their interest to buy a specific business. The LOI lays the groundwork for negotiation by outlining the terms and conditions of the sale, including the purchase price, assets to be bought, and other critical details. Though not always legally binding in all its parts, it signifies a serious commitment from the buyer to pursue the transaction.

-

Why use a Letter of Intent instead of going straight to a Purchase Agreement?

Using a LOI in the business purchasing process has strategic advantages. It allows both parties to agree on key terms before spending time and money on due diligence and legal fees associated with drafting a Purchase Agreement. A LOI can help in identifying deal breakers early, saving both buyer and seller from potential future conflicts. Moreover, it establishes a framework for negotiations, making the final drafting of the Purchase Agreement smoother and more efficient.

-

Are the terms in the Letter of Intent legally binding?

The LOI typically includes both legally binding and non-binding provisions. Legally binding clauses might involve confidentiality, exclusivity, and governing law. Non-binding clauses often cover the proposed purchase price, payment terms, and due diligence rights. The specific binding nature of each provision should be clearly defined within the LOI to avoid misunderstandings.

-

What key elements should be included in a LOI?

- Purchase price and payment terms

- Description of the assets or stock to be purchased

- Timeline for due diligence and expected closing date

- Confidentiality agreements

- Exclusivity or no-shop clauses

- Arrangements for employees, especially if their existing contracts are to be honored

- Any conditions precedent to closing the deal

- Signature of both parties

While not exhaustive, these elements form the backbone of an effective LOI.

-

How does the due diligence process fit with the Letter of Intent?

The due diligence process typically follows the signing of the LOI and is a critical phase where the buyer assesses the business's financial performance, legal standings, and overall operations. The LOI often stipulates a specific timeline for due diligence, allowing the buyer exclusive rights to examine the business in detail within this period. It ensures that the buyer can make an informed decision on proceeding with the purchase.

-

Can either party back out after signing a LOI?

Yes, either party can usually back out after signing a LOI, especially from the non-binding sections. However, if either party breaches legally binding clauses, such as confidentiality or no-shop provisions, they may be subject to legal ramifications. Therefore, it is crucial that both parties understand which parts of the LOI are binding before proceeding.

-

How long is a LOI valid?

The validity of a LOI depends on the terms agreed upon by both parties. It often includes an expiration date, after which the LOI is no longer valid if no agreement is reached. The time frame provides a deadline for negotiations, due diligence, and finalization of the Purchase Agreement. This period is negotiable but ensures that the deal maintains momentum and concludes within a reasonable timeframe.

-

Should both parties have legal representation when drafting a LOI?

Yes, it is highly recommended that both parties engage legal representation when drafting a LOI. Lawyers can help clarify the binding and non-binding terms, ensure compliance with relevant laws, and protect each party’s interests. Legal counsel can also foresee potential pitfalls and advise on the best practices to avoid future disputes. Investing in skilled legal guidance during the early stages of a business purchase can save time, resources, and prevent misunderstandings.

Common mistakes

Filling out a Letter of Intent to Purchase Business is a critical step in the process of buying a business. This document outlines the preliminary agreement terms between the buyer and seller, setting the stage for negotiations and, ultimately, the purchase agreement. However, individuals often make mistakes during this crucial phase, which can lead to misunderstandings, delays, or the deal falling through entirely. Here are ten common mistakes:

Not seeking legal advice: Many individuals try to navigate the complexities of a business purchase without consulting a legal professional, leading to oversights and potential legal issues.

Being too vague or too detailed: Striking the right balance in a Letter of Intent is crucial. Being too vague can lead to ambiguity, while being too detailed may prematurely lock you into terms before proper due diligence.

Failing to include confidentiality clauses: Without such clauses, sensitive information shared during negotiations may not be protected if the deal doesn't go through.

Omitting contingency clauses: These are essential for protecting the buyer, allowing them to back out of the deal under certain conditions, such as failing to secure financing or discovering significant issues during due diligence.

Not specifying the transaction structure clearly: Whether it's an asset purchase or a stock purchase can have significant tax and liability implications for both parties.

Ignoring the importance of the non-compete clause: This prevents the seller from starting a new, competing business, which could undermine the value of the purchased business.

Forgetting to outline the due diligence process: The Letter of Intent should specify what will be examined, by whom, and the timeline for this process.

Not setting a clear timeframe for the agreement: Without specifying when the offer expires, and the expected timeline for closing, the process can drag on indefinitely.

Failing to include a provision for adjustments based on due diligence findings: The purchase price or terms may need to be adjusted based on what is uncovered during due diligence.

Assuming the letter is non-binding without stating it: While certain sections like confidentiality may be binding, the intent to purchase is generally not. However, this needs to be clearly stated to avoid any legal confusion.

When filling out the Letter of Intent to Purchase Business, individuals should approach the task with care and attention to detail. A well-crafted Letter of Intent can pave the way for a smooth transaction, while mistakes can lead to delays, extra costs, or the deal falling apart.

Documents used along the form

When considering the acquisition of a business, a Letter of Intent (LOI) to Purchase Business is a critical document that initiates the transaction. However, the LOI is just the beginning. Several other documents play vital roles throughout the process, ensuring clarity, compliance, and the proper transfer of ownership. Understanding these additional forms can help streamline the acquisition process, making it more efficient and legally sound.

- Confidentiality Agreement: Also known as a Non-Disclosure Agreement (NDA), this document ensures that all sensitive information shared during the negotiations and due diligence process remains confidential. It binds all parties to secrecy concerning the business's operational, financial, and strategic details.

- Due Diligence Checklist: This is not a singular document but a comprehensive list that outlines all the documents, records, and information needed to evaluate the business's worthiness. It includes financial statements, employee records, legal contracts, and more, serving as a roadmap for the thorough investigation of the business being acquired.

- Purchase Agreement: Following the LOI and due diligence, the Purchase Agreement is the binding contract that finalizes the sale. It details the terms of the sale, including the price, payment schedule, warranties, and contingencies. This document ensures both parties are clear on their obligations and the terms of the transfer.

- Bill of Sale: This document officially transfers ownership of the business assets from the seller to the buyer. It lists all the assets included in the sale, ensuring nothing is overlooked and providing legal proof of the transaction.

- Non-Compete Agreement: Often, the seller will be required to sign a Non-Compete Agreement, which restricts their ability to start a new, competing business within a certain geographical area and time frame. This protects the buyer’s investment in the acquired business.

- Employment Agreement(s): If the transaction includes keeping the existing staff or hiring key employees from the business being acquired, new or revised Employment Agreements may be necessary. These documents outline the terms of employment, including roles, salaries, and obligations, under the new ownership.

In conclusion, a successful business acquisition hinges on more than just the initial letter of intent. Each supporting document—from the confidentiality agreement to employment agreements—plays a crucial part in ensuring the process is conducted with due diligence, legal compliance, and mutual understanding between buyer and seller. It's advisable to consult with legal professionals versed in business acquisitions to navigate this complex journey effectively.

Similar forms

A Term Sheet is quite similar to the Letter of Intent (LOI) to Purchase Business as both serve as preliminary documents outlining the key terms and conditions of a business deal before final agreements are made. While a Term Sheet is often used in the context of venture capital or early-stage investing, delineating the terms of an investment, the LOI performs a similar function by specifying the framework of a business sale, including the purchase price, assets, and liabilities to be acquired. Both documents set the stage for negotiations, leading to more detailed, legally binding agreements.

Another related document is the Purchase Agreement, which, unlike the LOI that indicates a mutual interest to proceed with a transaction, serves as the definitive agreement that legally binds both parties to the sale of the business. The Purchase Agreement details every aspect of the sale, from payment terms and closing conditions to representations, warranties, and covenants. While the LOI marks the beginning of the negotiation process with broad terms, the Purchase Agreement finalizes it with precise legal terms, conditions, and agreements.

The Confidentiality Agreement or Non-Disclosure Agreement (NDA) shares common goals with the LOI to Purchase Business by protecting sensitive information. When parties express interest in a business transaction through an LOI, they will likely share confidential data to evaluate the deal thoroughly. An NDA ensures that this information remains protected during these initial discussions just as it does throughout the business relationship, prohibiting the misuse or disclosure of proprietary information shared between the potential buyer and seller.

The Due Diligence Checklist serves a complementary role to the LOI to Purchase Business by providing a comprehensive list of documents and information needed to evaluate the business's worth and risks. This checklist guides the buyer in what information to request and review before proceeding with the purchase. While the LOI signals the parties' intentions to enter into a transaction, the due diligence process facilitated by this checklist helps confirm or revise the terms initially outlined in the LOI based on the findings.

A Memorandum of Understanding (MOU) shares similarities with the LOI to Purchase Business as both are preliminary agreements indicating the intention to proceed toward a final deal. An MOU is broader and can be used in various types of partnerships beyond the business purchase context. It outlines the parties' intentions and key terms before entering into a binding contract. Like an LOI, an MOU seeks to build trust and mutual understanding before formalizing the agreement through contractual documents.

The Partnership Agreement is somewhat akin to the LOI to Purchase Business in the way it sets forth the terms of a business relationship, but it specifically applies to the formation of partnerships. While an LOI lays down the initial terms for acquiring a business, a Partnership Agreement outlines the structure, contributions, and obligations of partners entering a business venture together. Both documents are crucial early steps in the formation and acquisition processes, aiming to clarify terms and prevent future disputes.

Dos and Don'ts

Filling out a Letter of Intent to Purchase a Business is a pivotal step in the process of acquiring a company. This document outlines the preliminary agreement between the buyer and the seller, setting the stage for negotiations and, eventually, the final transaction. Given its significance, it's crucial to approach this task with care and precision. Here are six essential dos and don'ts to keep in mind:

Do:- Conduct thorough due diligence. Before you even begin to fill out your Letter of Intent (LOI), make sure you understand the business you're intending to purchase. This entails a comprehensive review of its financials, operations, legal standing, and market position.

- Be clear and concise. Clarity is key in a LOI. Outline your intentions, the structure of the deal, and any other crucial details in straightforward language, avoiding ambiguity.

- Specify the terms and conditions. Clearly state the purchase price, terms of payment, contingencies, and any other conditions you require for the purchase. This will serve as a foundation for the final agreement.

- Include a confidentiality clause. Protecting sensitive information is critical during negotiations. Ensure your LOI stipulates that all negotiations are confidential and that any information exchanged must not be disclosed to third parties.

- State that the LOI is non-binding. Except for certain provisions like confidentiality, it’s vital to indicate that the LOI does not constitute a legally binding agreement to purchase. This protects both parties as they move forward with negotiations.

- Seek legal advice. Given the legal implications of a LOI, it's wise to consult with a legal professional before finalizing the document. This can help prevent misunderstandings and ensure that your interests are adequately protected.

- Overlook the importance of a thorough investigation. Skipping due diligence can lead to significant problems down the line. Never assume that all provided information is accurate without verifying it first.

- Use vague or overly complicated language. Ambiguities or complex legalese can lead to misinterpretations and may complicate the negotiation process. Stick to clear, simple language.

- Forget to specify the expiration date. Your LOI should indicate when the offer expires. This adds a sense of urgency and helps ensure a timely response from the seller.

- Neglect to consider contingencies. Failing to account for potential obstacles or changes in circumstances can leave you vulnerable. Always include clauses that protect you if certain conditions aren't met.

- Assume it’s legally binding. Remember, the LOI is typically a stepping stone to a formal agreement and, apart from a few exceptions, should not be treated as a final contract.

- Bypass professional guidance. Attempting to navigate the complexities of a business purchase without expert advice can be risky. Legal counsel can provide invaluable assistance throughout the process.

Approaching the Letter of Intent to Purchase Business form with these dos and don'ts in mind will help streamline the process, setting a solid foundation for your transaction and future business endeavors.

Misconceptions

When considering the acquisition of a business, the Letter of Intent (LOI) to Purchase Business form is a critical initial step. However, there are common misconceptions about this document that need clarification. Understanding these points can help ensure smoother negotiations and a better foundation for the transaction.

- It’s Legally Binding: Many believe the entire LOI to be legally binding. While it's true that some sections, like confidentiality agreements, are binding, the LOI as a whole is generally a non-binding document outlining the preliminary agreement between the parties.

- It’s Just a Formality: Another misconception is that the LOI is merely a formality without real substance. In reality, it serves a critical function by laying the groundwork for the business acquisition, including price, terms, and the structure of the deal, which guides the subsequent, more detailed negotiations and agreements.

- It’s the Same as a Purchase Agreement: Confusing an LOI with a purchase agreement is common. However, the LOI identifies the basic terms of the deal and the intent to purchase, while the purchase agreement is a comprehensive, binding contract that finalizes the sale details after due diligence and negotiations.

- It Has a Standard Format: People often think there’s a one-size-fits-all template for an LOI. While there are common elements, the specifics can and should be tailored to fit the unique aspects of each business transaction.

- It’s Only About Price: While price is a critical component, an LOI covers much more, such as the proposed timeline, financing arrangements, due diligence periods, and any conditions precedent to closing the deal. These elements are all crucial to the negotiation process.

- Amendments Are Unusual: Sometimes, there’s a misconception that once an LOI is signed, its terms are set in stone. In practice, amendments can be made if both parties agree. This flexibility is important as due diligence may reveal new information that impacts the deal’s terms.

- It Guarantees the Sale Will Happen: Finally, there’s a belief that once the LOI is signed, the sale is guaranteed to proceed. However, due to its generally non-binding nature, either party can typically walk away from the deal at any point before signing a binding purchase agreement, subject to any binding provisions.

Clearing up these misconceptions is essential for both buyers and sellers to approach the Letter of Intent to Purchase Business form with a comprehensive understanding of its purpose, scope, and limitations.

Key takeaways

When considering the acquisition of a business, the use of a Letter of Intent to Purchase Business form (LOI) is often the first formal step in the negotiation process. Here are key takeaways that individuals should keep in mind while filling out and utilizing this form:

- Clarify Terms Early: The LOI should clearly outline the proposed terms and conditions of the purchase, including price, payment terms, and any contingencies that the purchase is subject to. This early clarification helps prevent misunderstandings during later stages of negotiation.

- Non-Binding Agreement: Typically, an LOI is a non-binding document, meaning it does not legally obligate either party to proceed with the transaction. However, certain parts, such as confidentiality clauses, may be binding.

- Due Diligence: The LOI often includes provisions for a due diligence period. This allows the buyer to thoroughly examine the business's finances, operations, and legal matters to ensure there are no surprises after the purchase.

- Confidentiality: Protecting sensitive information is crucial when purchasing a business. An LOI usually includes a confidentiality clause to ensure that all proprietary information shared during the negotiation process is not disclosed to third parties.

- Exclusivity Period: Many LOIs request an exclusivity or no-shop clause, preventing the seller from soliciting or considering offers from other buyers for a specified period. This gives the potential buyer a clear path to complete their due diligence and finalize negotiations without competition.

- Preparation for Formal Agreements: While the LOI itself is generally non-binding, it lays the groundwork for the binding purchase agreement. Completing an LOI with care can streamline the process of drafting the final purchase documents.

It's important for both buyers and sellers to approach the LOI with a clear understanding of its potential impact on the deal. While it is an initial step, the information and terms outlined in the LOI are critical for setting the stage for a successful business purchase.

Other Types of Letter of Intent to Purchase Business Templates:

Commercial Real Estate Loi - An expression of intent from a buyer to a seller, detailing the potential purchase of commercial real estate and the initial terms.