Blank Land Purchase Agreement Form

Embarking on the journey to buy or sell a piece of land marks a significant milestone for many. It's a process filled with hope and anticipation but also one that requires meticulous attention to detail to ensure the protection of all parties involved. Central to this process is the Land Purchase Agreement, a critical document that outlines the terms and conditions of the sale. This legally binding contract serves as a blueprint, specifying the price agreed upon, the timeline for the transaction, and any contingencies that might allow either the buyer or seller to back out under predefined circumstances. Moreover, it addresses issues such as zoning restrictions, access rights, and any encumbrances that could affect the transfer of the property. Understanding the components and importance of this document can dramatically smooth the path towards a successful land transaction, providing clarity and security to what can often be a complex negotiation.

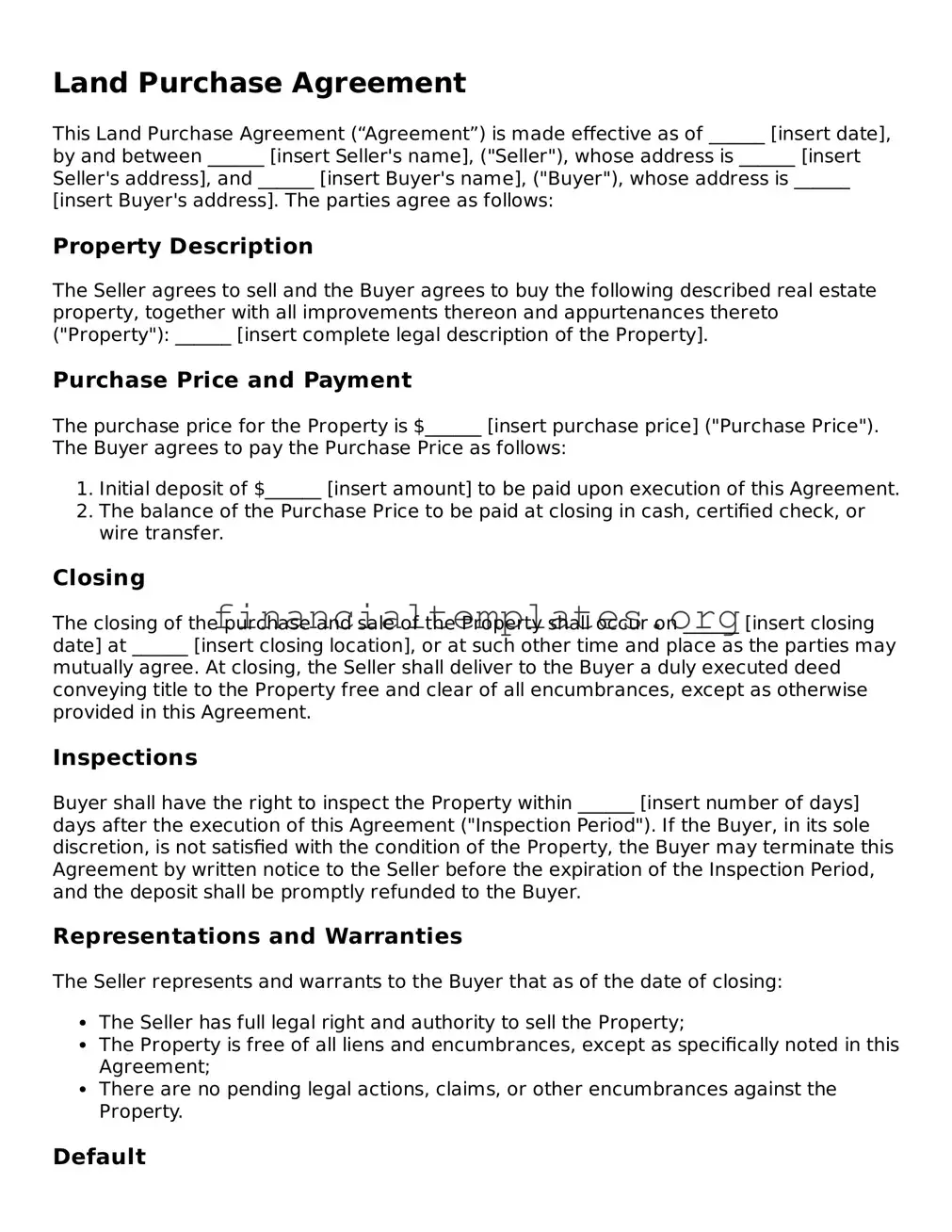

Land Purchase Agreement Example

Land Purchase Agreement

This Land Purchase Agreement (“Agreement”) is made effective as of ______ [insert date], by and between ______ [insert Seller's name], ("Seller"), whose address is ______ [insert Seller's address], and ______ [insert Buyer's name], ("Buyer"), whose address is ______ [insert Buyer's address]. The parties agree as follows:

Property Description

The Seller agrees to sell and the Buyer agrees to buy the following described real estate property, together with all improvements thereon and appurtenances thereto ("Property"): ______ [insert complete legal description of the Property].

Purchase Price and Payment

The purchase price for the Property is $______ [insert purchase price] ("Purchase Price"). The Buyer agrees to pay the Purchase Price as follows:

- Initial deposit of $______ [insert amount] to be paid upon execution of this Agreement.

- The balance of the Purchase Price to be paid at closing in cash, certified check, or wire transfer.

Closing

The closing of the purchase and sale of the Property shall occur on ______ [insert closing date] at ______ [insert closing location], or at such other time and place as the parties may mutually agree. At closing, the Seller shall deliver to the Buyer a duly executed deed conveying title to the Property free and clear of all encumbrances, except as otherwise provided in this Agreement.

Inspections

Buyer shall have the right to inspect the Property within ______ [insert number of days] days after the execution of this Agreement ("Inspection Period"). If the Buyer, in its sole discretion, is not satisfied with the condition of the Property, the Buyer may terminate this Agreement by written notice to the Seller before the expiration of the Inspection Period, and the deposit shall be promptly refunded to the Buyer.

Representations and Warranties

The Seller represents and warrants to the Buyer that as of the date of closing:

- The Seller has full legal right and authority to sell the Property;

- The Property is free of all liens and encumbrances, except as specifically noted in this Agreement;

- There are no pending legal actions, claims, or other encumbrances against the Property.

Default

If the Buyer fails to comply with the terms of this Agreement, the Seller may terminate the Agreement and retain the deposit as liquidated damages, considering the administrative and legal costs associated with the sale. If the Seller fails to comply with the terms of this Agreement, the Buyer may seek specific performance or terminate the Agreement and recover the deposit, along with any agreed-upon damages.

Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of ______ [insert relevant state], without regard to its conflict of laws provisions.

Entire Agreement

This Agreement constitutes the entire agreement between the parties pertaining to the subject matter contained herein and supersedes all prior and contemporaneous agreements, representations, and understandings of the parties. No supplement, modification, or amendment of this Agreement shall be binding unless executed in writing by all parties.

Signatures

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written.

_____________________________

Seller's Signature

_____________________________

Buyer's Signature

PDF Properties

| Fact Number | Description |

|---|---|

| 1 | A Land Purchase Agreement is a legally binding document between a buyer and seller for the purchase of land. |

| 2 | This agreement outlines the terms and conditions of the sale, including the purchase price, financing conditions, and closing details. |

| 3 | It includes a legal description of the property, ensuring the exact boundaries and size of the land are clearly defined. |

| 4 | The agreement must be signed by both parties to be enforceable. |

| 5 | It often includes provisions for a due diligence period, allowing the buyer to verify the condition and legal status of the property. |

| 6 | State-specific forms must comply with local real estate laws and regulations. |

| 7 | Governing law clauses specify which state's laws will interpret and enforce the agreement. |

| 8 | Amendments to the agreement must be made in writing and signed by both parties. |

| 9 | If disputes arise, the agreement may outline a required mediation or arbitration process before litigation. |

Guide to Writing Land Purchase Agreement

Filling out a Land Purchase Agreement form is a critical step towards owning a piece of property. This document outlines the terms and conditions of the sale, ensuring both the buyer and the seller are clear on the details of the transaction. It covers everything from the purchase price to any contingencies that must be met before the sale is finalized. Following the right steps can make the process smoother and protect your interests. Here's how to fill out the form accurately.

- Start by entering the date of the agreement at the top of the form. This marks the official start of the negotiation process.

- Fill in the buyer's full legal name, address, and contact information. Ensure accuracy to avoid any future discrepancies.

- Enter the seller's full legal name, address, and contact information, with the same attention to detail.

- Describe the property being purchased, including its legal description, address, and any identifiers like the parcel number. This part is crucial for clearly identifying the land in question.

- List the purchase price of the land and the terms of payment. This section should include the total amount, down payment, and how the remainder will be financed.

- Specify any contingencies that apply to the sale. Common contingencies include property inspections, the buyer's ability to obtain financing, and the sale of the buyer's current home.

- Outline the closing date by when the sale should be completed. This is when the transaction is finalized, and ownership transfers from the seller to the buyer.

- Detail how closing costs and other fees will be shared between the buyer and the seller. This can include things like title search fees, attorneys' fees, and transfer taxes.

- Provide a space for any additional agreements or provisions that both parties want to include. This can cover a range of details not previously specified.

- Finish by having both the buyer and seller sign and date the form. These signatures legally bind the parties to the terms of the agreement.

After completing these steps, it's essential to have the document reviewed by legal professionals. This ensures that the agreement is legally sound and that both parties' interests are protected. Once everything is in order, the next phase can involve securing financing, conducting a title search, and preparing for the closing. Remember, this form is just one part of the process of buying land, but it's a pivotal one. Paying careful attention to each detail can help ensure a smooth transaction.

Understanding Land Purchase Agreement

-

What is a Land Purchase Agreement?

A Land Purchase Agreement is a legal document that outlines the terms and conditions under which a piece of land is sold and purchased. It includes details about the buyer, seller, description of the property, purchase price, payment plan, and any conditions or contingencies that must be met before the sale is finalized. This agreement serves as a binding contract between the parties, ensuring the rights and obligations of each are clearly defined and legally upheld.

-

Why is a Land Purchase Agreement important?

This agreement is crucial because it legally secures the transaction, ensuring both parties commit to their end of the bargain. It provides a comprehensive record of the terms agreed upon, which can help prevent misunderstandings or disputes down the line. Moreover, it outlines the steps to be taken if either party fails to meet their obligations, offering a level of protection for both the buyer and seller. In essence, it's not just about buying or selling land; it's about ensuring the transaction is fair, transparent, and legally enforceable.

-

What should be included in a Land Purchase Agreement?

- Identifying information of the buyer and seller

- A detailed description of the property being sold

- The purchase price and payment terms

- Conditions or contingencies, such as obtaining financing or satisfactory inspections

- Signatures of both parties, signaling their agreement to the terms

- Any other terms both parties wish to include, such as dispute resolution methods or closing details

It's vital to ensure that all relevant information is included and accurately described to avoid any potential issues or legal disputes in the future.

-

Can I write my own Land Purchase Agreement?

While it is possible to write your own Land Purchase Agreement, it is highly recommended to seek professional assistance. This is because real estate transactions can be complex, and the agreement needs to comply with specific legal requirements to be valid. A professional can help tailor the agreement to your specific needs, include all necessary legal terms, and ensure that the rights and obligations of all parties are properly protected. If you choose to write your own, make sure to have it reviewed by a legal professional before signing.

-

What happens after the Land Purchase Agreement is signed?

Once the Land Purchase Agreement is signed by both parties, it serves as a commitment to the sale under the terms and conditions specified. From here, both the buyer and seller must fulfill their obligations as outlined. This often includes conducting inspections, securing financing, and meeting any other contingencies before the sale can proceed to closing. At closing, ownership of the land is officially transferred from the seller to the buyer, typically through the exchange of the purchase price for the deed to the land. Both parties must comply with any final requirements stated in the agreement to successfully complete the transaction.

Common mistakes

When filling out a Land Purchase Agreement form, it's crucial to approach the task with attention to detail and thoroughness. However, mistakes can occur, and they usually fall into common patterns that are easily avoided with forethought and care. Here are 10 common mistakes people make that you should watch out for:

Not verifying the legal description of the property - This includes the exact boundaries and dimensions. If this is incorrect, it might lead to disputes about what land was actually bought or sold.

Failing to specify the purchase price clearly, or how it will be paid - Omissions here can lead to misunderstandings or legal complications later on.

Overlooking the need for a clear title - Ensuring the seller has the right to sell the property and that it is free of liens or other encumbrances is fundamental.

Not detailing the conditions that must be met before the sale is finalized - These might include inspections, approvals, or financing arrangements.

Ignoring the closing date or being vague about it - A specific date should be mentioned for when the sale is expected to be completed.

Omitting who pays for which expenses, such as closing costs, surveys, and inspections - This can lead to conflicts over unexpected financial responsibilities.

Forgetting to include clauses regarding contingencies, like the sale being subject to obtaining a mortgage - Without these, buyers might find themselves legally bound to purchase without the necessary funds.

Leaving out details on how disputes will be resolved should they arise - Including arbitration or mediation clauses can save time and money by avoiding court.

Not ensuring all the parties sign the agreement or have their signatures witnessed - This can question the enforceability of the document.

Skipping the step of having the agreement reviewed by a legal professional before signing - Professionals can spot potential issues that laypersons might overlook.

Being cautious and thorough when filling out a Land Purchase Agreement can prevent many of these mistakes. Ensuring all elements are correctly addressed and understood not only solidifies the understanding between buyer and seller but also provides a smoother path to transferring property ownership.

Documents used along the form

When engaging in the purchase of land, several documents besides the Land Purchase Agreement itself are often necessary to ensure a smooth and legally sound transaction. These documents serve various purposes, from confirming the legal status of the land to outlining the specific terms of the sale. Here is a list of forms and documents commonly used alongside the Land Purchase Agreement to facilitate the purchase process.

- Title Search Report: This report provides detailed information about the ownership history of the property, including any liens or encumbrances that may affect the sale. It is vital for verifying the seller's right to sell the land.

- Property Survey: A survey outlines the property's boundaries and identifies any potential encroachments or discrepancies that might need resolving before the sale is finalized.

- Disclosure Forms: Sellers often need to provide disclosure forms that reveal any known issues or defects with the land. This can include environmental hazards or zoning restrictions.

- Environmental Assessment Report: This report evaluates the environmental condition of the property, highlighting any contamination or ecological concerns that may influence the buyer's decision or the property's value.

- Zoning Verification Letter: Obtaining this document from the local municipal authority confirms the current zoning classification of the land and any restrictions on its use.

- Financing Documents: If the purchase involves a loan, various financing documents will be required to detail the terms of the loan, including the mortgage agreement and promissory note.

- Appraisal Report: An appraisal provides an expert opinion on the value of the property, which is crucial for both the buyer and the financial institution providing the loan.

- Insurance Documents: Buyers must typically show proof of insurance, such as title insurance and hazard insurance, to protect against potential future disputes or damage.

- Closing Statement: This document itemizes all financial transactions and fees associated with the sale, providing a clear record of the costs involved for both the buyer and seller.

Together with the Land Purchase Agreement, these documents create a comprehensive framework that addresses the major legal, financial, and practical considerations involved in the purchase of land. Ensuring that each of these documents is properly handled and reviewed can significantly reduce the risk of complications during and after the transaction. It's recommended that both buyers and sellers seek professional advice to navigate this complex process effectively.

Similar forms

The Real Estate Sales Agreement bears a close resemblance to the Land Purchase Agreement, as both serve the foundational purpose of outlining the terms and conditions for the transfer of property ownership. Both documents specify the identities of the buyer and seller, describe the property in detail, and enumerate the financial particulars, including the purchase price and payment schedule. Where they primarily converge is in their role as legally binding contracts that ensure the agreed-upon conditions are met before the transition of ownership is finalized.

The Bill of Sale shares similarities with the Land Purchase Agreement, especially in its function of documenting the transfer of ownership of an asset from one party to another. While a Bill of Sale is typically used for personal property like vehicles or equipment, and the Land Purchase Agreement is used for real estate transactions, both include critical information such as the description of the item being sold, the sale price, and the parties involved. Each serves as a receipt and proof of the agreement between the buyer and seller for the specific asset being transferred.

A Lease Agreement is related to a Land Purchase Agreement in that it pertains to the use of real property, but it differs in that it does not transfer ownership. Instead, a Lease Agreement outlines the terms under which one party agrees to rent property owned by another party. It specifies the duration of the lease, payment terms, and responsibilities of each party. Similar to a Land Purchase Agreement, it legally binds both parties to the terms set forth, including the use and maintenance of the property.

The Deed of Trust presents another document type that aligns closely with the Land Purchase Agreement in real estate transactions. This document comes into play when a loan is involved in purchasing property. It grants a trustee the authority to hold the property's title until the borrower has repaid the loan in full. Like the Land Purchase Agreement, it is a key document in the process of transferring property ownership, albeit it focuses more on securing the loan rather than detailing the sale's terms.

An Option Agreement in real estate transactions, which gives the buyer the right, but not the obligation, to purchase or sell a property at an agreed-upon price within a certain period, shares a strategic resemblance to the Land Purchase Agreement. Both documents are instrumental in setting the conditions under which a property may change hands and help manage the risks associated with buying or selling real estate. However, the Land Purchase Agreement commits parties to the transfer, while the Option Agreement offers the potential buyer a choice.

Mortgage Agreements are closely associated with Land Purchase Agreements, particularly because they both play significant roles in the process of buying property. A Mortgage Agreement outlines the terms under which a lender provides funds to the buyer for purchasing a property, which then serves as collateral for the loan. The Land Purchase Agreement specifies the sale's terms, while the Mortgage Agreement details the loan's repayment. Both are crucial for the conveyance and financing of real estate transactions.

Escrow Agreements are integral to real estate transactions and share a connection with Land Purchase Agreements by ensuring that the transaction's conditions are met before the transfer of ownership occurs. An Escrow Agreement involves a third party that holds funds or assets until the buyer and seller fulfill certain conditions or obligations. This parallels the Land Purchase Agreement's role of specifying the conditions for the transfer but adds a layer of protection and neutrality to the transaction.

Finally, Title Insurance Policies complement Land Purchase Agreements by safeguarding against future disputes over the property’s title. While a Land Purchase Agreement facilitates the transfer of property between buyer and seller, a Title Insurance Policy protects against losses arising from title defects not identified during the purchase process. It ensures that the buyer receives a clear title, highlighting its importance alongside the Land Purchase Agreement in securing a safe and transparent real estate transaction.

Dos and Don'ts

When completing a Land Purchase Agreement form, taking the right steps is crucial to ensure the process is smooth and legally sound. Here are seven things you should do and not do:

Do's:

- Verify the Property Details: Ensure that the property details are accurate, including the address, legal description, and parcel number.

- Review the Terms Carefully: Understand all the terms of the agreement, such as payment schedules, contingencies, and closing dates.

- Consult with a Professional: Seek advice from a real estate lawyer or a trusted advisor to review the agreement before signing.

- Clarify Closing Costs: Know who is responsible for covering closing costs and specify this in the agreement.

- Check for Contingencies: Include necessary contingencies, such as financing approval, inspections, and appraisal, to protect your interests.

- Ensure Clear Title: Confirm that the title is clear of liens or disputes to avoid legal issues later.

- Keep Records: Retain a copy of the signed agreement and any related documents for your records.

Don'ts:

- Rush the Process: Take your time to review every detail of the agreement and understand its implications.

- Overlook Zoning Regulations: Failing to check local zoning laws can lead to issues with property use after purchase.

- Ignore Environmental Issues: Neglecting to consider possible environmental constraints or liabilities can result in costly remediation down the line.

- Skip Professional Inspections: Deciding against property inspections can overlook potential problems with the land.

- Omit Crucial Information: Leaving out important details or agreements from the contract can lead to disputes and legal challenges.

- Assume Financing is Guaranteed: Presuming loan approval without confirmation can derail the purchase if financing falls through.

- Sign Under Pressure: Avoid making decisions under pressure or coercion; always make informed and well-considered choices.

Misconceptions

When navigating the process of buying land, many people encounter misconceptions about the Land Purchase Agreement form. This document is crucial in the sale and purchase of real estate, acting as the contract that stipulates the terms and conditions of the deal. Here, we will address some common misunderstandings to provide clearer insight into the role and importance of a Land Purchase Agreement.

All Land Purchase Agreements are the same. Contrary to this belief, Land Purchase Agreements can vary significantly depending on the state where the transaction is occurring, as well as the specific terms negotiated by the buyer and seller. Each agreement should be tailored to fit the unique aspects of the land being sold and the stipulations agreed upon by the parties involved.

The form is just a simple document that can be easily filled out without legal advice. While templates are available, a Land Purchase Agreement is a complex legal document. It's advisable to seek guidance from a real estate attorney to ensure that your rights are protected, and all legal requirements are met. This ensures that the document accurately reflects the terms agreed upon and adheres to all relevant laws and regulations.

A Land Purchase Agreement is only about the price. While the purchase price is a critical component, the agreement covers a broad range of other important issues, including zoning restrictions, easements, contingencies (like financing or the sale of another property), and the specific timeline for the transaction. These details are essential for a clear, enforceable agreement.

If something isn’t explicitly stated in the agreement, it’s not legally binding. The Land Purchase Agreement should detail all conditions, representations, and warranties related to the sale. If an issue isn’t included in the document, it can lead to disputes and legal complications down the road. Everything of importance should be explicitly stated to ensure all parties have a clear understanding of their rights and obligations.

Verbal agreements will hold up in court as long as there are witnesses. Real estate transactions must be documented in writing to be legally enforceable. While verbal agreements can be compelling, they are incredibly challenging to prove and, in most cases, will not stand up in court. This emphasizes the importance of having a comprehensive written agreement.

Once signed, the agreement cannot be changed. Amendments can be made to a Land Purchase Agreement if both the buyer and seller agree. Any changes should be made in writing and attached to the original agreement to ensure they are legally binding and enforceable.

The seller is the only party that needs to worry about the accuracy of the agreement. Both the buyer and the seller must ensure the accuracy and completeness of the agreement. Mistakes or omissions can delay or derail the transaction and lead to potential legal conflicts. It’s in the best interest of both parties to carefully review and confirm the details of the agreement.

Environmental and zoning issues are the responsibility of the seller. While the seller should disclose known issues, it is wise for the buyer to conduct their own due diligence. This includes researching zoning laws and conducting environmental assessments. A thorough understanding of these factors is crucial for making informed decisions and protecting one’s investment.

Signing the agreement binds you to purchase the land, no matter what. In reality, most Land Purchase Agreements contain contingencies that allow either party to withdraw under specific conditions, such as the failure to secure financing, unsatisfactory inspection reports, or title issues. These contingencies are vital protection for both buyers and sellers.

Understanding these misconceptions about the Land Purchase Agreement can make the process of buying land less daunting. With proper attention to the details of this legal document and the guidance of a professional, potential landowners can navigate the purchase process more confidently and securely.

Key takeaways

When it comes to filling out and using a Land Purchase Agreement form, it's essential to approach the process with attention to detail and a clear understanding of what is involved. Here are key takeaways to guide you:

- Correctly identify the parties involved: It's crucial to correctly list the names and contact information of the buyer and seller to ensure there are no misunderstandings about who is involved in the transaction.

- Describe the property accurately: The legal description of the land being purchased should be precise, including boundaries and any pertinent details that identify the specific parcel of land.

- Agree on the purchase price and terms: The agreement must clearly state the purchase price of the land and the terms of the payment, including any deposit to be paid and the schedule of payments.

- Include contingencies: Common contingencies might include the buyer obtaining financing, the results of a land survey, or environmental assessments. These should be clearly outlined with deadlines for each.

- Detail the closing process: The agreement should specify when and where the closing will take place, what documents will be exchanged, and who is responsible for closing costs and fees.

- Address title and property condition: Ensure the agreement stipulates that the title to the property will be clear and that the current condition of the land is acceptable, including any disclosures about known issues or defects.

- Include a breach of contract clause: This section outlines the recourse available if either the buyer or seller fails to meet the terms of the agreement.

- Signatures: The agreement must be signed by both the buyer and seller to be legally binding. Depending on the jurisdiction, witness signatures or a notary may also be required.

Filling out a Land Purchase Agreement with accuracy and thoroughness is fundamental to a successful real estate transaction. Both buyers and sellers are advised to review the document carefully and consider consulting a legal professional to ensure their interests are fully protected.

Popular Documents

How to Sell Your Cat - With sections for important details like breed, color, and health information, this form is comprehensive, leaving no stone unturned.

IRS 8889 - The IRS 8889 form is used for Health Savings Account (HSA) contributions and deductions.

5329 Form - It provides a way for taxpayers to report and potentially reduce additional taxes on retirement plans through exceptions.