Get Kra Application Removal Tax Obligation Form

Dealing with tax obligations can sometimes feel overwhelming, especially for registered taxpayers seeking relief or adjustments to their current tax responsibilities. Recognizing this need, the introduction of the Kra Application Removal Tax Obligation form stands as a significant tool designed to aid these taxpayers. This form, which adheres to the strict standards of ISO 9001:2008 certification, primarily serves to process requests from individuals or businesses aiming to remove one or more specific tax obligations. It is intricately divided into two parts, with Part A requiring detailed input from the taxpayer. This includes personal identification, contact information, the nature of the business, and the specific tax obligations they wish to have removed, along with a rationale and supporting documentary evidence for their request. Notably, the form emphasizes the necessity of completeness for processing, underscoring the importance of providing full and accurate information. On the flip side, Part B is reserved for official use, where officers from the Tax Regulation Realm (TRR) meticulously review the application, making observations, and ultimately deciding on the taxpayer's request based on provided evidence and compliance to tax laws. This dual-part process ensures a thorough evaluation, maintaining integrity and fairness in the removal or adjustment of tax obligations. Through this form, taxpayers are afforded a formal avenue to adjust their tax profiles, making it an essential element in the landscape of tax administration.

Kra Application Removal Tax Obligation Example

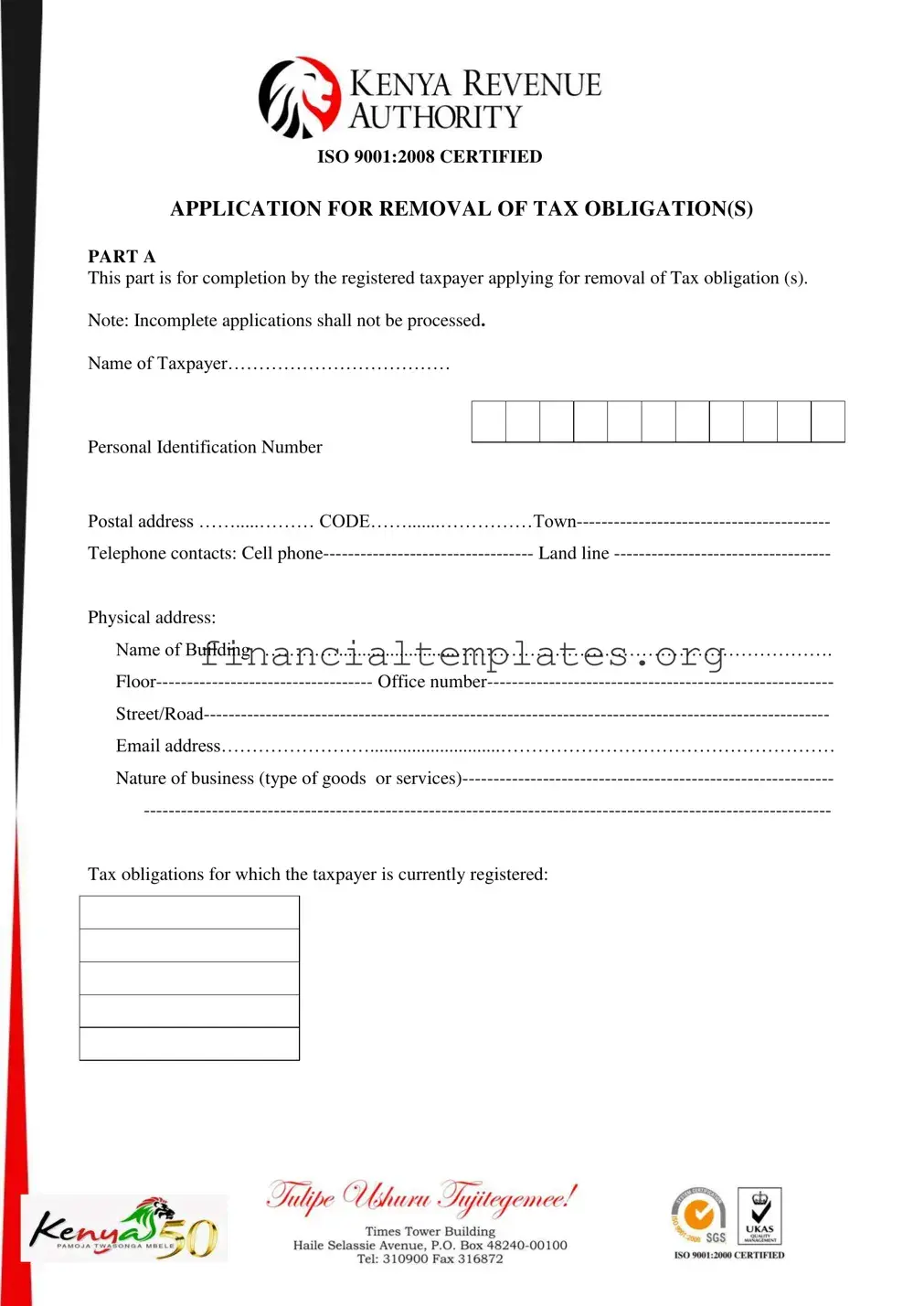

ISO 9001:2008 CERTIFIED

APPLICATION FOR REMOVAL OF TAX OBLIGATION(S)

PART A

This part is for completion by the registered taxpayer applying for removal of Tax obligation (s).

Note: Incomplete applications shall not be processed.

Name of Taxpayer………………………………

Personal Identification Number

Postal address …….....………

Telephone contacts: Cell

Physical address: |

|

Name of Building |

………….........................……………………………………………………. |

Office |

Email address……………………............................………………………………………………

Nature of business (type of goods or

Tax obligations for which the taxpayer is currently registered:

ISO 9001:2008 CERTIFIED

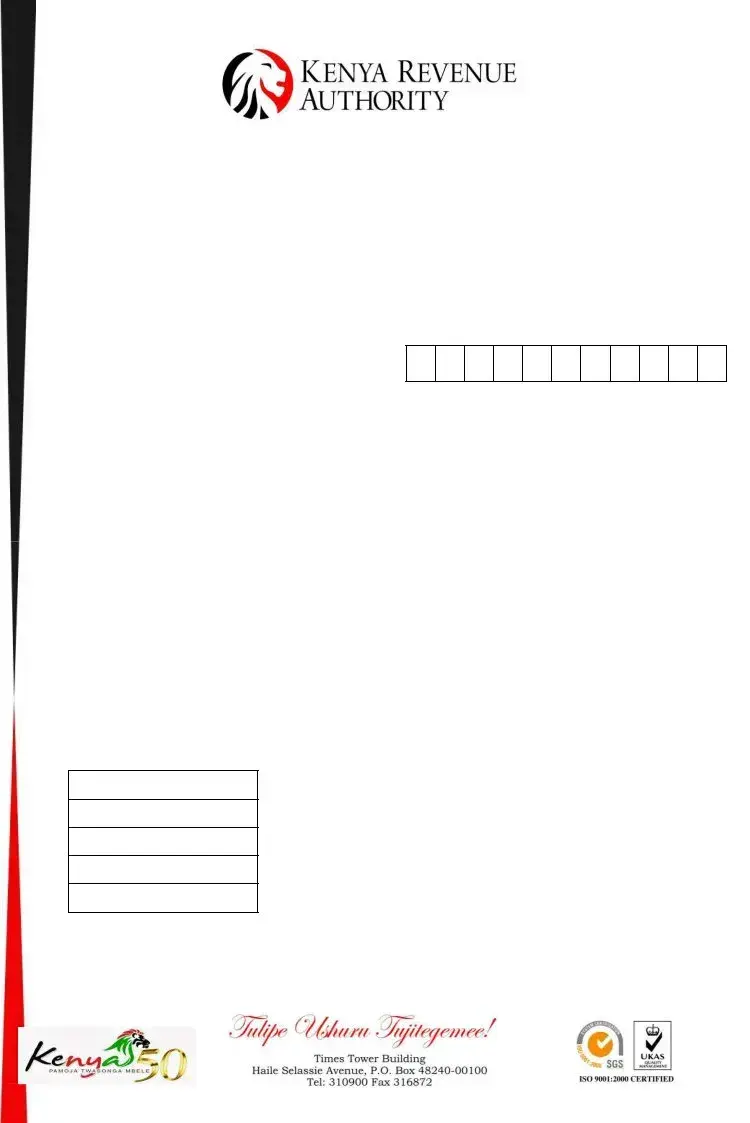

Tax obligation(s) to be removed

Reasons for request for removal of Tax obligation(s)

Documentary evidence attached in support of the reasons above (where

Attach copies of PIN, Certificate of Incorporation, Business Registration and the documentary evidence where applicable.

Name of Applicant

ISO 9001:2008 CERTIFIED

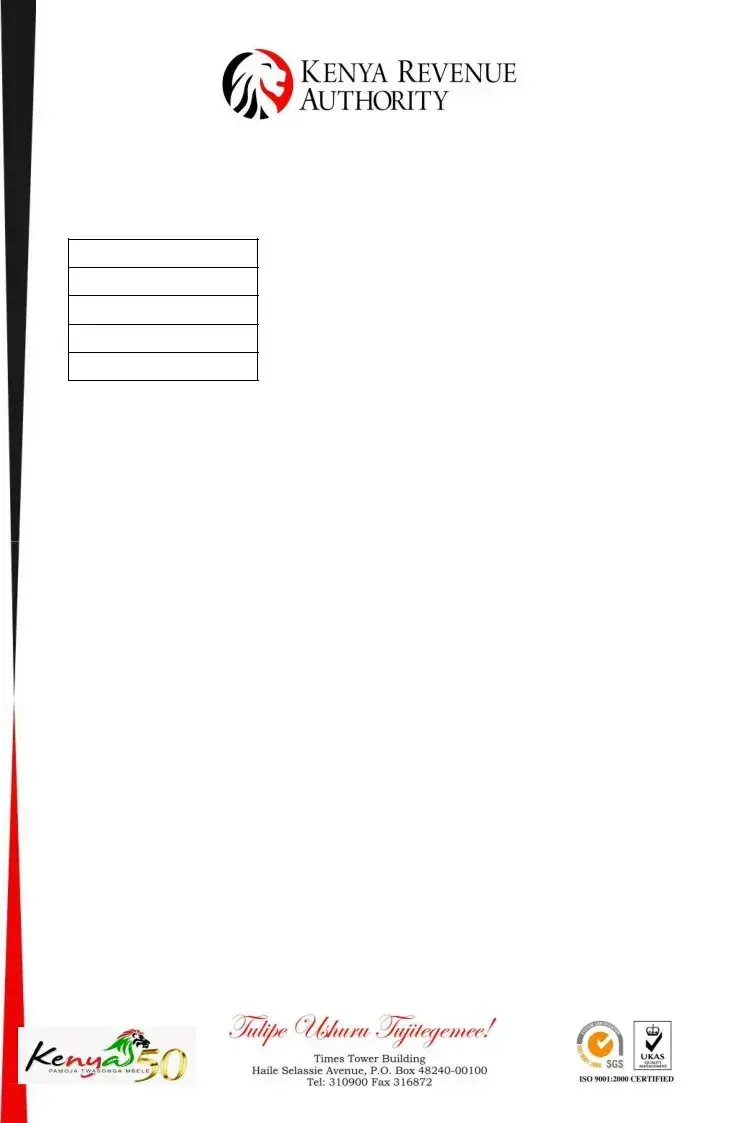

PART B (FOR OFFICIAL USE ONLY)

Observations by TRR Officer

Recommendations:

Obligation(s) to be

Obligation(s) to be

System TRE update reference Number

Name of TRR

Signature

Date

Comments by TRR manager

Obligation(s)

Date obligation(s)

Name of TRR

Document Specifics

| Fact Name | Description |

|---|---|

| Certification Standard | The form is under the ISO 9001:2008 certification standard. |

| Purpose | This form is used for applying for the removal of tax obligations by registered taxpayers. |

| Application Requirement | Incomplete applications will not be processed, indicating the necessity for thoroughness in completion. |

| Documentation Required | Taxpayers must attach copies of their Personal Identification Number, Certificate of Incorporation, Business Registration, and any supporting documentary evidence for the removal request. |

| Processing Parts | The form is divided into two main parts: Part A for the taxpayer's completion and Part B for official use only by the TRR officer. |

| Official Use | Part B includes sections for observations, recommendations, and the final decision on tax obligation removal by TRR officers and managers, including system updates and signatures. |

Guide to Writing Kra Application Removal Tax Obligation

Getting your tax obligations in order can feel overwhelming, especially when you need to make changes to your current situation. The Kra Application Removal Tax Obligation form is a crucial step for registered taxpayers who find themselves needing to remove certain tax obligations. It's important to fill out this form with precision to ensure a smooth process. Below is a step-by-step guide designed to help you complete the form accurately, ensuring all your information is up-to-date and correctly submitted.

- Start with PART A, designated for the registered taxpayer. Ensure you're accurately filling out this section as it specifically pertains to your request.

- Enter the Name of Taxpayer as officially recognized in tax documents.

- Write down your Personal Identification Number (PIN) without errors.

- Provide your Postal Address, including the CODE and Town.

- Fill in your Telephone Contacts, both your Cell phone number and Land line, ensuring they are current.

- Under Physical Address, specify the Name of Building, Floor, and Office number where your business is located, followed by the Street/Road.

- Indicate your current Email Address; double-check for correctness.

- Describe the Nature of Business (type of goods or services) you provide, in detail.

- List all Tax obligations for which the taxpayer is currently registered.

- In the next section, specify the Tax obligation(s) to be removed and provide clear Reasons for the request, ensuring to offer detailed explanations and any necessary context.

- Include an itemized list of Documentary Evidence attached that supports your reasons. Attach copies of relevant documents, such as your PIN, Certificate of Incorporation, Business Registration, and any other supportive documentation requested.

- Fill in the Name of Applicant, your formal Position/Designation in the company or organization, and your signature. Ensure to date the application appropriately.

Once you've accurately completed PART A of the form, your role in the initial submission process is complete. The form will then be processed by the Tax Regulatory Authority, detailed in PART B, which is strictly for official use. This part evaluates your application, considering the officer's observations, recommendations, updates on tax obligations to be added or removed, and final comments and signatures from both the processing officer and TRR manager. Understanding the sequential steps and ensuring complete and detailed information in your section will facilitate a smoother review and a quicker response to your application.

Understanding Kra Application Removal Tax Obligation

What is the purpose of the Application for Removal of Tax Obligation form?

The Application for Removal of Tax Obligation form is designed for taxpayers who wish to remove certain tax obligations registered under their name. It serves as an official request to the tax regulatory authority, detailing the specific obligations the taxpayer seeks to eliminate and providing justifications for the request. This form is an essential step for individuals or businesses seeking to adjust their tax responsibilities due to changes in their business operations or status.

Who needs to fill out the Application for Removal of Tax Obligation form?

This form must be completed by registered taxpayers who wish to have one or more of their tax obligations removed. It applies to both individuals and businesses that are currently registered for specific tax obligations but, for valid reasons, need these obligations adjusted. Applicants are required to provide detailed information, including their Personal Identification Number, contact information, the nature of their business, and the tax obligations they are requesting to remove.

What documents are required to support the Application for Removal of Tax Obligation?

When submitting the Application for Removal of Tax Obligation, taxpayers must attach documentary evidence supporting their reasons for requesting the removal of specific tax obligations. Required documents typically include copies of the taxpayer's Personal Identification Number (PIN), Certificate of Incorporation, Business Registration, and any other relevant evidence that supports the request for removal. These documents are crucial for verifying the validity of the application and assisting the reviewing officer in making an informed decision.

What happens after the Application for Removal of Tax Obligation form is submitted?

After the form is submitted, it undergoes a review process. This process is detailed in Part B of the form, designated for official use only. A Tax Regulatory (TRR) Officer will first observe and make recommendations regarding the application. They might suggest additional obligations to be added or confirm the obligations to be removed. Following this, the TRR manager will provide further comments, finalize which obligations are to be removed, and document the date these changes are made. The system will then be updated with this new information, noted by a TRE update reference number. The TRR Officer and manager will both add their names, signatures, and the date to certify the completion of the review process. This thorough examination ensures that every application is meticulously evaluated to determine its compliance with regulatory standards before any tax obligation is removed.

Common mistakes

When completing the Kra Application for Removal of Tax Obligation form, there are common mistakes that can hinder the process. Recognizing and avoiding these errors can streamline the application, ensuring a smoother path towards resolution.

Not including complete personal or business information. Filling out all required fields such as the Name of Taxpayer, Personal Identification Number, and contact details is crucial. Leaving any of this information incomplete may result in processing delays.

Failing to specify the tax obligation(s) to be removed clearly. Applicants must identify specifically which obligations they are seeking to remove, ensuring no misunderstanding exists regarding their intent.

Omitting reasons for the removal request. Detailed explanations on why the obligation(s) should be removed are essential. This includes providing context and any relevant circumstances to support the request.

Not attaching the required documentary evidence. When claims are made for the removal of obligations, supporting documentation must be attached. This could include copies of the PIN, Certificate of Incorporation, and business registration among others.

Incorrect or missing signatures and dates. The application must be signed and dated by the applicant to be considered valid. Overlooking this step can make the document ineligible for processing.

Neglecting to specify the nature of business accurately. A thorough description of the goods or services provided by the business should be included. Vague or inaccurate descriptions may confuse the evaluation process.

Overlooking the conditions stated for the application. The form clearly states that incomplete applications will not be processed. It is the responsibility of the applicant to ensure every section is completed appropriately.

Avoiding these mistakes not only helps in the efficient processing of the application but also significantly reduces the likelihood of unexpected delays or rejections.

Documents used along the form

When individuals or businesses seek to manage their tax obligations more effectively, they may opt to use the Kra Application Removal Tax Obligation form. This form is a pivotal document for registered taxpayers wishing to remove specific tax obligations. Its proper use ensures compliance with the set requirements and facilitates smoother operations within the regulatory framework. Alongside this form, there are several other essential documents and forms that typically accompany or complement the application process, ensuring a comprehensive approach to tax management and compliance.

- Certificate of Incorporation: This document is crucial for businesses as it serves as legal proof of the company's formation and is often required to validate the business's existence and eligibility for certain tax obligations.

- Business Registration Certificate: Similar to the Certificate of Incorporation, this certificate proves the registration of the business with relevant local or national authorities, providing essential details about the business, such as its name and type of business activities.

- Personal Identification Number (PIN) Certificate: The PIN certificate is vital for tax matters, uniquely identifying the taxpayer for transactions with the tax authorities. It supports the verification of the taxpayer's registration for specific tax obligations.

- Proof of Address Documents: Documents such as utility bills or lease agreements serve as proof of the business or individual's physical address, ensuring that correspondence and legal documents are accurately directed.

- Financial Statements: Although not always compulsory, financial statements can be required to support the application, providing insight into the financial status of the business. They help in justifying the removal of certain tax obligations based on financial evidence.

Together with the Kra Application Removal Tax Obligation form, these documents form a robust framework for legal and regulatory compliance. They ensure that individuals and businesses provide a comprehensive set of information, facilitating clear communication and efficient processing by tax authorities. Efficient management of these documents can significantly smooth the path towards achieving favorable outcomes in the removal of tax obligations.

Similar forms

The Kra Application Removal Tax Obligation form shares similarities with the IRS Form 941 (Employer's Quarterly Federal Tax Return) in the United States. Both forms are utilized by entities to communicate regarding tax responsibilities, albeit for different purposes. The Kra form is aimed at removing tax obligations for registered taxpayers, while the IRS Form 941 is used to report payroll taxes. However, both require detailed taxpayer information, including identification numbers and evidence to support their respective claims or reports, underscoring their role in managing and updating tax obligations.

Another document akin to the Kra Application Removal Tax Obligation form is the Change of Address or Responsible Party — Business (Form 8822-B) by the IRS. This form is used when a business needs to update its address or the contact information for the responsible party. Similar to the Kra form, Form 8822-B ensures that the tax authorities have updated and accurate information about the entity or individual, facilitating proper communication and administration of tax duties. Both forms play a crucial role in maintaining the accuracy of tax records.

The Application for Employer Identification Number (EIN), also known as Form SS-4, bears resemblance to the Kra form in its foundational purpose of updating the tax agency's records with essential taxpayer information. Form SS-4 is necessary for obtaining an EIN for newly established businesses, which is pivotal for tax identification purposes. Like the Kra form, it collects detailed information about the business and its nature, demonstrating both forms' roles in keeping tax records current and comprehensive.

The Sales Tax Exemption Certificate is another document sharing commonalities with the Kra Application Removal Tax Obligation form. Businesses use the Sales Tax Exemption Certificate to denote their eligibility for exemption from sales tax on certain purchases. The necessity to provide specific business information and the nature of the transaction or exemption being claimed mirror the Kra form's requirement to detail the tax obligation to be removed and the justification for its removal. Both forms facilitate specific adjustments to tax liabilities.

The Offer in Compromise (Form 656) from the IRS is designed for taxpayers seeking to settle tax debts for less than the full amount owed. This process involves submitting detailed financial information and reasons for the offer, akin to the Kra form's requirement for explaining the basis for tax obligation removal. Though serving different ends—one for reducing tax debt and the other for removing tax obligations—both documents necessitate a thorough justification supported by documentary evidence.

The Certificate of Incorporation is a fundamental document that shares a procedural similarity with the Kra form, especially in the context of including copies with applications. While the Certificate of Incorporation establishes a corporation’s legal existence, the Kra form might require a copy for verifying the legitimacy of a business applying for tax obligation removal. This inclusion aids in the administrative processing and validation of the entity’s tax-related requests.

Lastly, the Business License Renewal forms that many local governments require businesses to file periodically parallel the Kra Application Removal Tax Obligation form in their administrative purpose. Both sets of documents ensure businesses' compliance with essential legal and tax responsibilities. By updating or modifying tax obligations or business details, they help maintain updated records with regulatory bodies, ensuring that businesses operate in accordance with local, state, or federal requirements.

Dos and Don'ts

When preparing to submit the Kra Application for Removal of Tax Obligation form, there are important steps to follow and common pitfalls to avoid to ensure your application is processed without delay. Here's a guide to help you through the process:

Things You Should Do

Double-check that all sections of Part A are fully completed, providing detailed information for each field. The form requires your name, Personal Identification Number, contact information, and specifics about your tax obligation(s).

Clearly explain your reasons for requesting the removal of each tax obligation in the designated section. Your explanations should be concise and backed by valid reasons to help the reviewing officer understand your situation.

Attach all required documentary evidence supporting your reasons for requesting the removal. This includes copies of your PIN, Certificate of Incorporation, Business Registration, and any other relevant documents that can strengthen your case.

Ensure that the signature and date sections at the bottom of the application are duly filled out. These elements are crucial for validating the form.

Things You Shouldn't Do

Do not leave any sections incomplete. Incomplete applications will not be processed, as noted at the beginning of the form. Pay special attention to each section to ensure nothing is overlooked.

Avoid providing vague reasons for the removal of tax obligations. The TRR Officer will need clear and straightforward explanations to make an informed decision.

Do not forget to attach the necessary documentary evidence. Failing to include supporting documents may result in the denial of your application.

Refrain from submitting the application without checking for errors. Review your form thoroughly for any inaccuracies or missing information before submission.

Misconceptions

When delving into the complexities of tax forms and compliance, the Kra Application for Removal of Tax Obligation form is often shrouded in myths and misunderstandings. These misconceptions can lead to unnecessary stress and errors in the application process. Let's debunk some of these myths to ease the burden on taxpayers.

It's only for businesses in trouble: A common mistaken belief is that this form is exclusively for businesses facing legal or financial difficulties. In reality, it's a tool for any registered taxpayer seeking to adjust their tax obligations, perhaps due to changes in business structure or cessation of certain taxable activities.

Completion guarantees approval: Filling out and submitting the form doesn't ensure the removal of the tax obligation. Approval depends on the review and discretion of the tax authorities, who consider the reasons and documentary evidence provided.

It's a complex process: Many assume the process to be overly complicated. While it requires attention to detail, understanding the instructions and gathering the necessary documentation can make it straightforward.

Personal Identification Number (PIN) changes: There's a misconception that applying for removal of tax obligation will change or invalidate your PIN. Your PIN remains intact; only the specific tax obligations associated with it are affected.

No evidence required: Some think that stating a reason for removal is sufficient. However, the application must be supported by relevant documentary evidence to substantiate the reasons for the request.

Immediate processing: Another myth is that applications are processed immediately. Processing times can vary, and applications are subject to review, which may take time.

Can only be done once: The idea that you can only apply for removal once is incorrect. Taxpayers can submit this application as their business needs evolve and different tax obligations become irrelevant.

It eliminates all tax liabilities: Some believe that removing a tax obligation clears all their tax liabilities. This form only removes the specific obligation(s) listed; it doesn't affect other existing tax liabilities.

Offline only: While traditionally such applications might have been paper-based, increasingly, tax authorities are moving towards digital platforms for such submissions, debunking the myth that it has to be a strictly offline process.

Understanding the Kra Application for Removal of Tax Obligation form is crucial for registered taxpayers aiming to manage their tax responsibilities efficiently. Dispelling these myths is a step towards empowering taxpayers with knowledge, simplifying the process, and promoting compliance.

Key takeaways

Filling out the Kra Application for Removal of Tax Obligation form requires attention to detail and complete information for successful processing. Here are seven key takeaways to ensure accuracy and compliance:

- It is mandatory for the registered taxpayer requesting the removal of tax obligations to complete Part A of the form. This section gathers basic information about the taxpayer as well as the specifics of the request.

- The application will not be processed if it is incomplete. It is crucial to fill out every required field and provide comprehensive answers to all sections.

- Taxpayers must provide their Personal Identification Number (PIN), postal address, telephone contacts, physical address, and email address. This information is essential for communication and verification purposes.

- The nature of the taxpayer's business, including the type of goods or services, must be clearly described. This insight helps in assessing the legitimacy of the request for removing certain tax obligations.

- Applicants are required to list the tax obligations they are currently registered for and explicitly identify which obligations they seek to have removed. Clear reasons must be stated for each request to remove specific tax obligations.

- Supporting documentary evidence must be attached to substantiate the reasons for requesting the removal of tax obligations. This may include copies of the Personal Identification Number (PIN), Certificate of Incorporation, Business Registration, and any other relevant documents.

- The form demands the name, position/designation of the applicant, and their signature along with the date. This acknowledges the responsibility of the information provided and supports the authenticity of the application.

Part B of the form is for official use only, where the tax revenue officer records observations, recommendations, and the final decision regarding the request. This includes any additions or removals of obligations, updates to the tax system, and final approvals, highlighted with the necessary details of the TRR officer and manager.

Popular PDF Documents

Pa Sales Tax Exemption Number Lookup - Discover the importance of providing comprehensive institution and officer information for your PA Tax Exemption request.

IRS Schedule O 990 or 990-EZ - The form allows non-profits to exhibit their dedication to good governance practices, including establishing and adhering to conflict of interest policies.

1040 X - The IRS 1040-X can be filed if you need to correct your filing status, income, deductions, or credits on a previously submitted tax form.