Get Kenya Loan Application Form

The Kenya Tourist Development Corporation Loan Application Form is a comprehensive document designed to facilitate the lending process for development projects within the tourism sector. Eligible entities, specifically limited companies, are required to meticulously fill out the form, providing extensive details about the company, including its registered and trading names, P.I.N number, details about authorized and paid-up capital, along with the certificate of incorporation and the date of registration. The form also demands in-depth information about the nature of the business, physical and postal addresses, contact information, type of business, and specifics about the loan being requested such as the amount, repayment period, and the purpose of the loan which covers a wide range of investments from purchase and construction to refurbishing and more. Additionally, the document requires details about shareholders, guarantors, directors, and particulars of the property to be mortgaged, ensuring a thorough vetting process. Requirements stipulated extend to include the provision of a feasibility study report, legal documentation regarding the company's incorporation, directors' resolution for borrowing, and complete financial statements among others, underscoring the necessity for transparency and due diligence. The terms outlined highlight key conditions such as non-refundable fees and the requirement for property valuation and insurance, culminating in a directors’ declaration to affirm the accuracy of information provided and compliance with the ensuing obligations. This form embodies a critical gateway for businesses in the tourism sector seeking financial support to realize their development goals, emphasizing the importance of detail, accuracy, and legal compliance in the application process.

Kenya Loan Application Example

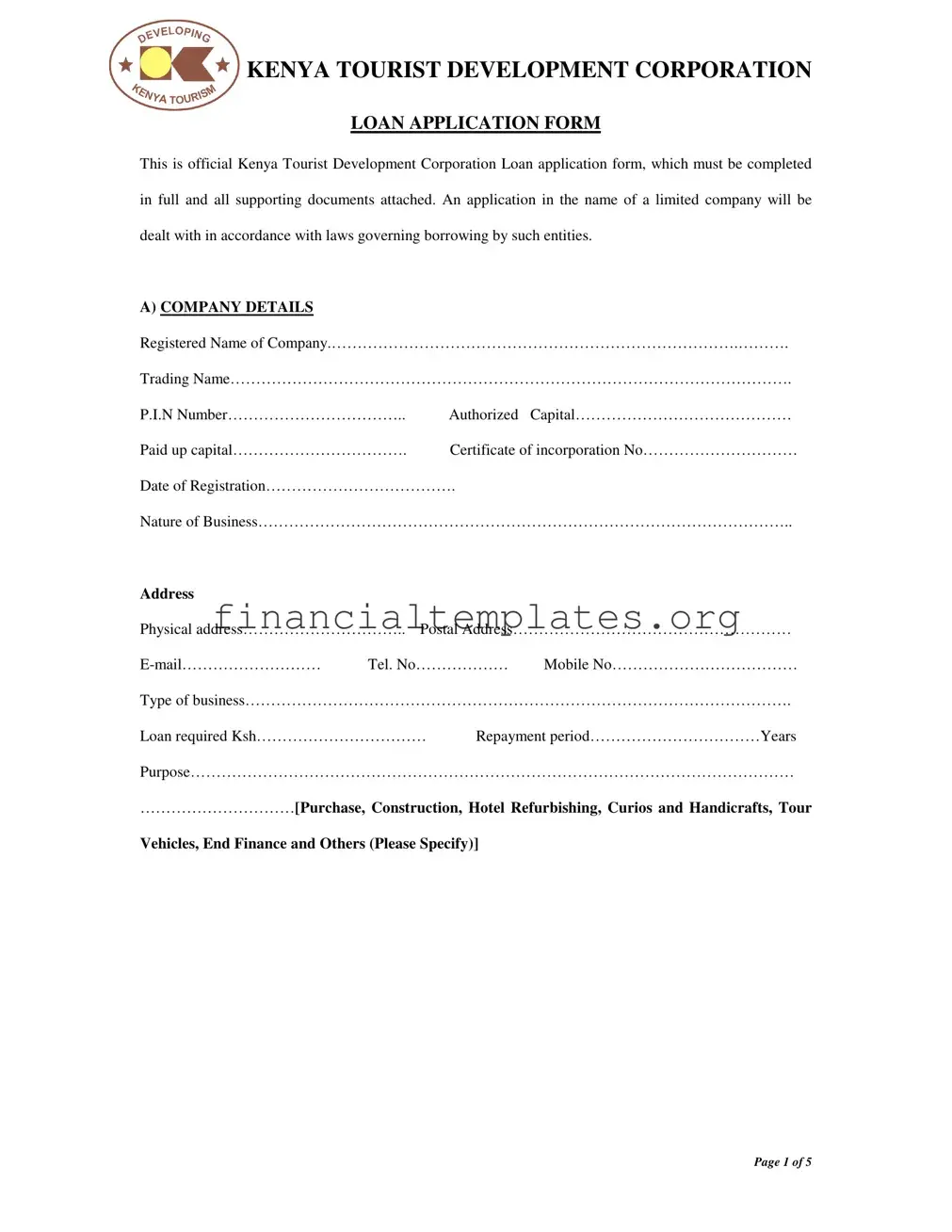

KENYA TOURIST DEVELOPMENT CORPORATION

LOAN APPLICATION FORM

This is official Kenya Tourist Development Corporation Loan application form, which must be completed in full and all supporting documents attached. An application in the name of a limited company will be dealt with in accordance with laws governing borrowing by such entities.

A)COMPANY DETAILS

Registered Name of Company.…………………………………………………………………….……….

Trading Name……………………………………………………………………………………………….

P.I.N Number…………………………….. |

Authorized Capital…………………………………… |

Paid up capital……………………………. |

Certificate of incorporation No………………………… |

Date of Registration……………………………….

Nature of Business…………………………………………………………………………………………..

Address

Physical address………………………….. Postal Address………………………………………………

Type of business…………………………………………………………………………………………….

Loan required Ksh…………………………… Repayment period……………………………Years

Purpose………………………………………………………………………………………………………

…………………………[Purchase, Construction, Hotel Refurbishing, Curios and Handicrafts, Tour

Vehicles, End Finance and Others (Please Specify)]

Page 1 of 5

KENYA TOURIST DEVELOPMENT CORPORATION

Name of Shareholders |

No. of Shares held |

% of shares held by shareholders. |

……………………………. |

…………………………. |

…………………………… |

……………………………. |

…………………………. |

…………………………… |

……………………………. |

…………………………. |

…………………………… |

……………………………. |

…………………………. |

…………………………… |

……………………………. |

…………………………. |

…………………………… |

B)Guarantors

|

Name |

ID No. |

Address |

1. |

…………………………….. |

…………… |

………………………… |

2. |

…………………………….. |

…………… |

………………………… |

3. |

…………………………….. |

…………… |

………………………… |

C) Particulars of Directors |

|

1st Director |

|

Name…………………………………………… |

Nationality………………………………… |

Date of birth……………………………………. |

Physical address………………………….. |

Telephone………………………………………. |

Mobile phone……………………………… |

Profession……………………..………….. |

|

|

……………………………………………… |

2nd Director |

|

Name…………………………………………… |

Nationality………………………………… |

Date of birth……………………………………. |

Physical address………………………….. |

Telephone………………………………………. |

Mobile phone……………………………… |

Profession……………………..………….. |

|

|

……………………………………………… |

Page 2 of 5

KENYA TOURIST DEVELOPMENT CORPORATION

3rd Director |

|

Name…………………………………………… |

Nationality………………………………… |

Date of birth……………………………………. |

Physical address………………………….. |

Telephone………………………………………. |

Mobile phone……………………………… |

Profession……………………..………….. |

|

|

……………………………………………… |

4th Director |

|

Name…………………………………………… |

Nationality………………………………… |

Date of birth……………………………………. |

Physical address………………………….. |

Telephone………………………………………. |

Mobile phone……………………………… |

Profession……………………..………….. |

|

|

……………………………………………… |

D)Particulars of the property to be mortgaged

1.Plot No. of the property……………….…….…………………………………………………….

2.Purchase Price……………………………………………………………………………………..

3.Is the property Freehold or Leasehold…………………………...………………………………..

4.If Leasehold, state the term of years

…………………………………………………………………………………………………………

5.Is the property mortgaged anywhere else?…………………………………………………….…

6.Where are the Title deeds?……………………………………………………………………….

7.The Title Deed is in whose Name? ………………………………………………………………

8.Indicate the nearest Township, Municipality or Trading Centre.………………………………..

Page 3 of 5

KENYA TOURIST DEVELOPMENT CORPORATION

E) Requirements

1.Feasibility study report.

2.Certified copy of Certificates of Incorporation.

3.Certified copy of Memorandum and Article of Association.

4.Director’s Resolution authorizing the borrowing prior to the draw down.

5.Director’s personal guarantees prior to the draw down.

6.Certified copies of the company’s audited accounts and Bank statements for the last 3 years.

For Construction Cases

1.Approved building plans.

2.Approved structural drawings.

3.NEMA Approval

4.Priced bills of Quantity.

F)Your application will be considered on the following terms.

1.That the acceptance of a fee does not place an obligation to on the company to lend you money.

2.The corporation will, at your expense, insure your life and the mortgage property during the life of the mortgage.

3.The corporation will inform the advocates to prepare mortgage deed at your cost. I addition, you will be required to meet the legal costs and other disbursements in connection with the charge and transfer of property. Such fees are paid directly to the corporation’s Advocate.

4.The corporation expects you to carry out a valuation of the pledged security at your cost using any of the Valuers on the corporation’s panel.

5.The fees payable to the corporation are application fees, approval fees and commitment fees are not refundable.

Page 4 of 5

KENYA TOURIST DEVELOPMENT CORPORATION

G)Directors’ declaration

I/we undertake to notify the company immediately of any situation, which materially changes the representation of this application.

I/we confirm that I/we have read and agreed to the foregoing and declare that our answers are true statement and that they shall form the basis of a loan the corporation may decide to advance to us.

Signed on behalf of company:

Name………………………………………………….Signature……………………………………

(Director)

Name………………………………………………….Signature……………………………………

(Director)

Date: ………………………………………

Note:

The application should be forwarded to:

The Managing Director,

Kenya Tourist Development Corporation,

P. O Box 42013 – 00100,

Tel:

Fax

NAIROBI.

Page 5 of 5

Document Specifics

| Fact | Description |

|---|---|

| Form Purpose | The form is for applying for a loan from the Kenya Tourist Development Corporation. |

| Completion Requirement | The form must be completed in full with all supporting documents attached. |

| Entity Type | Applications in the name of a limited company are governed by the laws related to borrowing by such entities. |

| Company Information | Applicants must provide detailed company information, including the registered name, trading name, P.I.N number, authorized and paid-up capital, certificate of incorporation number, date of registration, nature and addresses of business. |

| Loan Details | Information regarding the loan amount, repayment period, and purpose needs to be furnished. |

| Shareholder Information | Details about the shareholders, including the number of shares held and the percentage of shares held, are required. |

| Guarantors and Directors | Particulars of guarantors and directors including names, ID numbers, addresses, contact information, and profession must be provided. |

| Property Details | For properties to be mortgaged, details including plot number, purchase price, lease terms, and other relevant information are necessary. |

| Requirements | Submission of various documents like feasibility study report, certified copies of certificates of incorporation, director’s resolution, and more are specified under this section. |

| Terms for Consideration | Terms include that the payment of a fee does not guarantee the loan, the obligation for insurance, and the expectation of a valuation of the security, among others. |

| Directors’ Declaration | Directors must sign a declaration confirming the truthfulness of the application's information and agreeing to the terms. |

Guide to Writing Kenya Loan Application

Completing the Kenya Tourist Development Corporation Loan Application form is a straightforward process, designed to collect detailed information about your company, its directors, and the specific requirements for the loan. Gathering all necessary documents before starting the application will help streamline the process. Here's how to fill out the form step by step:

- Start with the COMPANY DETAILS section by inputting the Registered Name of the Company, Trading Name, P.I.N Number, Authorized Capital, Paid-up Capital, Certificate of Incorporation No., Date of Registration, Nature of Business, Physical Address, Postal Address, Email, Telephone Number, Mobile Number, and Type of Business.

- In the Loan required subsection, specify the amount in Kenyan Shillings (Ksh), the Repayment period in years, and the Purpose of the loan, detailing if it's for Purchase, Construction, Hotel Refurbishing, among other specified purposes.

- Fill in the Name of Shareholders section, including the number of Shares held and the percentage of shares held by each shareholder.

- Under the Guarantors part, provide the Name, ID Number, and Address for each guarantor listed.

- Complete the Particulars of Directors section for each director required, indicating their Name, Nationality, Date of Birth, Physical Address, Telephone, Mobile phone, Email, and Profession.

- In the Particulars of the property to be mortgaged section, include information about the Plot Number, Purchase Price, whether the property is Freehold or Leasehold, term of years un-expired and annual rent if Leasehold, existing mortgages, location of Title Deeds, the Name on the Title Deed, and nearest Township, Municipality, or Trading Centre.

- For the Requirements section, ensure all necessary documents such as the Feasibility study report, Certified copies of Certificates of Incorporation, Memorandum and Article of Association, Director’s Resolution, personal guarantees, audited accounts, Bank statements, building plans, structural drawings, NEMA Approval, and priced bills of Quantity are attached and in order.

- Review the terms under which your application will be considered, as stated in the form, ensuring understanding and compliance with the requirements for insurance, valuation, legal costs, and fees.

- In the Directors’ declaration section, confirm the accuracy and agreement to the declarations by having the company directors sign and date the form.

- Finally, ensure all required documents are attached before sending the completed application form and supporting documents to the Managing Director at the provided address via mail or as instructed.

Completing the form accurately and attaching all required documents will facilitate a smooth review process by the Kenya Tourist Development Corporation, bringing your company one step closer to securing the desired loan.

Understanding Kenya Loan Application

- What is the purpose of the Kenya Tourist Development Corporation Loan Application Form?

This form is an official document required for applying for a loan from the Kenya Tourist Development Corporation. Applicants must fill it out completely and attach all supporting documents. The purpose of the loan can range from purchase, construction, hotel refurbishing, to acquiring tour vehicles, among others.

- Who can apply for this loan?

Applications can be submitted in the name of a limited company. These applications will be processed in accordance with laws that govern borrowing by such entities.

- What details must be provided about the company?

Applicants need to provide comprehensive details such as the registered name of the company, trading name, P.I.N Number, authorized and paid-up capital, certificate of incorporation number, date of registration, nature of business, postal and physical addresses, email, telephone and mobile numbers, and the type of business.

- How is the amount and purpose of the loan detailed?

Applicants must specify the loan amount in Kenyan Shillings (Ksh), the repayment period in years, and the precise purpose of the loan, including specific needs like hotel refurbishing, purchase of tour vehicles, etc.

- What information is required about shareholders and guarantors?

Information about the shareholders must include the number of shares held and the percentage of shares each shareholder owns. For guarantors, their names, ID numbers, and addresses must be provided.

- What particulars are required for the directors of the company?

Details required for each director include name, nationality, date of birth, physical address, telephone and mobile phone numbers, email, and profession.

- What information is needed about the property to be mortgaged?

Applicants must detail the plot number, purchase price, whether the property is freehold or leasehold (including term of years un-expired and annual rent if leasehold), current mortgage status, location of title deeds, the name on the title deed, and proximity to the nearest township, municipality, or trading center.

- What requirements must be fulfilled for the application?

Required documents include a feasibility study report, certified copies of the certificate of incorporation, memorandum and article of association, director’s resolution authorizing borrowing, director’s personal guarantees, and certified copies of the company’s audited accounts and bank statements for the last 3 years. For construction loans, additional documents are required.

- What terms are applicants considered under?

Terms include the clarification that an acceptance fee does not obligate the corporation to lend money, requirements for insurance of life and the mortgage property, legal costs related to the mortgage deed, and the understanding that application, approval, and commitment fees are non-refundable.

- What is the Directors’ declaration?

The Directors’ declaration is a commitment by the company’s directors to notify the corporation of any material changes to the application’s representation and to confirm that the information provided is true and will form the basis of the loan if approved.

Common mistakes

Filling out the Kenya Loan Application form correctly is crucial for successfully securing a loan. However, several common mistakes can hinder the application process. It's important to be meticulous and pay close attention to detail when completing the form and submitting the necessary documents.

Not filling out the form completely: Missing information can delay the process as it leads the lender to request further details.

Incorrect company details: Providing inaccurate information such as the wrong registered name, trading name, or incorrect P.I.N number can lead to issues in the validation of your application.

Omitting shareholder information: Failure to detail the shareholders’ names, number of shares held, and the percentage of shares each holds can impede the application's transparency.

Forgetting to include guarantor details: Neglecting to provide information about guarantors, such as their names, ID numbers, and addresses, can weaken your application.

Incorrect particulars of directors: It's essential to accurately list each director's details, including their nationality, date of birth, physical address, and profession, to meet the requirements.

Overlooking property details: Missing or incorrectly detailing the property to be mortgaged, including plot number, purchase price, and whether it’s freehold or leasehold, can cause issues in the property valuation process.

Not attaching required documents: Failing to attach necessary documents like the feasibility study report, certified copies of Certificates of Incorporation, and financial statements for the last three years can delay processing.

Ignoring directors' declaration: Not signing the directors’ declaration or incorrectly filling out the date and names can render the application void or lead to delays in processing.

Avoiding these mistakes can improve the chances of loan approval. It’s advised to carefully review the form before submission to ensure all required information and documents are correctly provided and attached.

Documents used along the form

When applying for a loan with the Kenya Tourist Development Corporation, several important forms and documents accompany the application form to ensure a comprehensive and well-supported loan request. These additional items play crucial roles in strengthening the application, providing detailed information about the applicant's financial status, business operations, and the specifics of the proposed investment. Understanding each of these documents helps applicants prepare better for the loan application process.

- Feasibility Study Report: This document outlines the viability of the proposed project for which the loan is being sought. It includes market analysis, financial projections, and the project’s potential social and environmental impacts, offering a comprehensive overview of the project's success chances.

- Company Financial Statements and Bank Statements: Audited financial statements from the last three years alongside recent bank statements provide a snapshot of the company's financial health. These documents demonstrate the company's ability to manage its finances and repay the loan.

- Certified Copies of Legal Documents: These include the Certificate of Incorporation, Memorandum and Articles of Association, and the Director’s Resolution authorizing borrowing. They serve to verify the legal standing and operational framework of the company, assuring the lender of the company’s legitimacy and legal authority to engage in the loan process.

- Property Documents: For loans requiring collateral, documents such as the title deed, lease agreements, and valuation reports are critical. They provide proof of ownership, detail the property's worth, and outline any existing encumbrances that might affect its value as security.

These documents, alongside the loan application form, form a suite of required materials for a loan application with the Kenya Tourist Development Corporation. By submitting a well-prepared and complete set of documents, applicants significantly increase their chances of obtaining the necessary financing for their projects. It's always recommended to consult with a financial advisor or loan specialist when preparing these documents to ensure all requirements are met and presented in the best possible manner.

Similar forms

The Kenya Loan Application form shares similarities with a Mortgage Application Form found in many countries, including the United States. Both require detailed information about the borrower, like the company details, directors' particulars, and the financial health of the company applying for the loan. They gather data on the property to be mortgaged, including its value, status (freehold or leasehold), and any existing mortgages. This foundational data serves to assess the borrower's capability to repay the loan and the property's suitability as security.

Another similar document is the Business Credit Application form. This type of form is used by businesses to apply for credit through banks or suppliers. Like the Kenya Loan Application, it collects comprehensive information about the business, such as company details, trade references, bank accounts, and financial statements. Both forms serve the purpose of evaluating the financial stability and creditworthiness of the business applying for financial support.

Investment Loan Applications for business ventures or real estate investment projects also mirror the Kenya Loan Application form. These applications require in-depth information about the investment, including the purpose of the loan, expected returns, and details about the business or project needing financing. Information about guarantors, similar to the Kenya form, is also often needed to secure the loan.

The Commercial Loan Application form is akin to the Kenya Loan Application in its requirement for detailed business and financial information. Commercial loans, designed for business enterprises, require specifics such as business plans, financial projections, and company financial histories. These forms assess a company’s viability and its capacity to repay the loan, ensuring lenders can make informed decisions.

A Personal Guarantee Form, often supplementary to main loan application forms, bears resemblance in the context of providing additional security to the lender. Guarantors, as in the Kenya Loan Application form, pledge to fulfill the debt obligations should the primary borrower fail to do so. This document contains information about the guarantor's financial status, mimicking the thoroughness of business loan applications in assessing risk.

Construction Loan Application Forms display parallels with the section of the Kenya Loan Application form that addresses construction cases. They detail the purpose of the loan, such as purchasing land or refurbishing existing structures, and require supporting documents including building plans, approvals, and feasibility studies. Both types of applications necessitate comprehensive information to evaluate the feasibility and financial implications of construction projects.

Lastly, the Small Business Administration (SBA) Loan Application in the U.S. shares similarities, particularly in its thoroughness of required information about the business, its owners, and its financial health. Like the Kenya form, it requires details on company registration, ownership structure, and financial statements. These forms are critical in assessing whether a business is a viable candidate for a loan, focusing on both its current financial health and future revenue-generating potential.

Dos and Don'ts

Applying for a loan can be a pivotal step in achieving your business goals, especially in sectors like tourism where the capital outlay can be significant. If you're considering applying for a loan with the Kenya Tourist Development Corporation, remember that the process involves more than just filling out forms. It's about making a strong case for your business and meticulously presenting your information. To guide you through this process, here's a list of dos and don'ts that can help you navigate your loan application more effectively:

Dos:

Complete the form diligently: Fill out every section of the Kenya Tourist Development Corporation Loan Application Form thoroughly. An incomplete form can lead to unnecessary delays or even the rejection of your application.

Attach all necessary documents: Ensure you attach all the supporting documents required, such as the feasibility study report, certified copies of certificates of incorporation, and any other documentation listed under the requirements section of the application form.

Provide accurate information: Accuracy is key when filling out your loan application. Double-check details like your company's registered and trading names, P.I.N number, and the particulars of directors and shareholders to avoid any discrepancies.

Read the terms carefully: Understand the terms under which your application will be considered. This includes acceptance fees, the requirement for a life and property insurance at your expense, and specific fees that are non-refundable.

Don'ts:

Overlook the details: Don’t gloss over the small details. The directors' declaration section and the requirement to notify the company of any material changes are critical components of your application. Ensuring these are accurately addressed shows professionalism and attention to detail.

Underestimate the importance of your business case: The purpose of your loan and your business plan are vital to your application. Simply listing 'purchase' or 'construction' without a strong business case will not suffice. Be detailed and persuasive in how the loan will contribute to your business's success.

Forget about the property details: If your loan involves mortgaging a property, do not overlook the importance of providing comprehensive details about the property, whether it's leasehold or freehold, and if it's mortgaged elsewhere. Clarity in these areas is essential for the assessment of your application.

Ignore follow-up: Once your application is submitted, don’t just wait for a response. Follow up with the Kenya Tourist Development Corporation to show your keen interest and to address any possible queries they might have regarding your application.

Remember, a well-prepared loan application not only demonstrates your seriousness and preparedness but also significantly increases your chances of securing the loan you need for your business venture.

Misconceptions

When approaching the Kenya Tourist Development Corporation Loan Application form, various misconceptions can arise, mainly due to the complexity and formal nature of financial documents. Here’s a breakdown of five common misunderstandings and their clarifications:

- Completeness Is Optional: A prevalent misconception is that not all sections of the form need to be completed fully. However, every part of the application is crucial. The form explicitly states that it must be "completed in full," which includes attaching all supporting documents. Any missing information can delay or negatively impact the application process.

- Applicable Only for Large Enterprises: Another common misunderstanding is that the loan application is designed solely for large companies with substantial turnover. While it does cater to registered companies, there’s no indication that small and medium-sized enterprises (SMEs) cannot apply. The form assesses the viability of a business based on factors like capital, business nature, and shareholder structure, not just company size.

- Guarantors Are Optional: The section on guarantors is often overlooked or misunderstood as optional. However, listing guarantors is a crucial part of the application, providing the corporation with additional security and demonstrating the applicants' commitment and confidence in their business's viability.

- Only for Tourist Businesses: Given the corporation's name, it's a common mistake to think the loan solely supports tourism-related businesses, like hotels or travel agencies. While the tourism sector is a significant focus, the application form is broad enough to encompass various business types related to the tourism industry, including construction for tourism infrastructure, curios and handicrafts, and tour vehicles.

- Financial Information Is Required Only for the Current Year: Financial transparency over multiple years is essential. The application requires certified copies of the company's audited accounts and bank statements for the last three years, not just the current year. This historical financial data provides a clearer picture of the company's performance and stability over time.

Understanding these nuances not only simplifies the loan application process but also enhances the chances of approval by acknowledging and adhering to the stipulated requirements. Each section of the application plays a vital role in painting a complete picture of the business seeking financial assistance.

Key takeaways

Filling out the Kenya Loan Application form for a tourist development project is an essential step in securing financial support. However, the process involves more than just completing fields. Here are five key takeaways to ensure that your application is not only complete but stands a good chance of being approved:

- Thorough completion is non-negotiable. Every section of the Kenya Tourist Development Corporation Loan application form requires your attention. Missing out on details or providing incomplete information could hinder your application's progress. Ensure all supporting documents are attached, as they play a crucial role in the assessment process.

- Understanding legal requirements is crucial. If you're applying in the name of a limited company, it's governed by specific laws relating to borrowing. Familiarize yourself with these legalities to ensure your submission adheres to all necessary statutes and regulations, which could otherwise lead to unnecessary delays or rejections.

- Clarity on the purpose and terms of the loan. Clearly state the purpose of the loan, whether it's for purchasing, construction, hotel refurbishing, or other tourism-related expansions. Your chosen repayment period also needs careful consideration; it should be realistic relative to your projected cash flows and the loan's purpose.

- Property and guarantor details must be precise. If the loan requires security in the form of mortgaged property, provide exact and verifiable details about the property. This includes whether it’s leasehold or freehold, its purchase price, and the current status of any mortgages. Equally, guarantors play a significant role in securing your loan. Their information must be accurate and trustworthy, as they will be part of the financial agreement.

- Financial documents and feasibility studies are key. The requirement for audited accounts, bank statements of the last three years, and a feasibility study report cannot be overlooked. These documents provide a snapshot of the financial health of your business and the viability of your project. Ensure these are prepared professionally and reflect your business accurately. Construction-specific documents like NEMA approval and building plans are also pivotal for relevant projects.

Lastly, always keep in mind that application, approval, and commitment fees are non-refundable, emphasizing the importance of preparing a detailed, well-thought-out application. By following these guidelines, your application to the Kenya Tourist Development Corporation stands a stronger chance of moving forward successfully.

Popular PDF Documents

Irs Power of Attorney - Structured to provide clear and concise directions to the IRS regarding who is authorized to represent the taxpayer’s interest.

433a Instructions - The 433-A (OIC) form is an essential tool in negotiating tax debts, potentially easing the burden on individuals facing financial difficulties.