Get Kentucky Tax Requisition Form

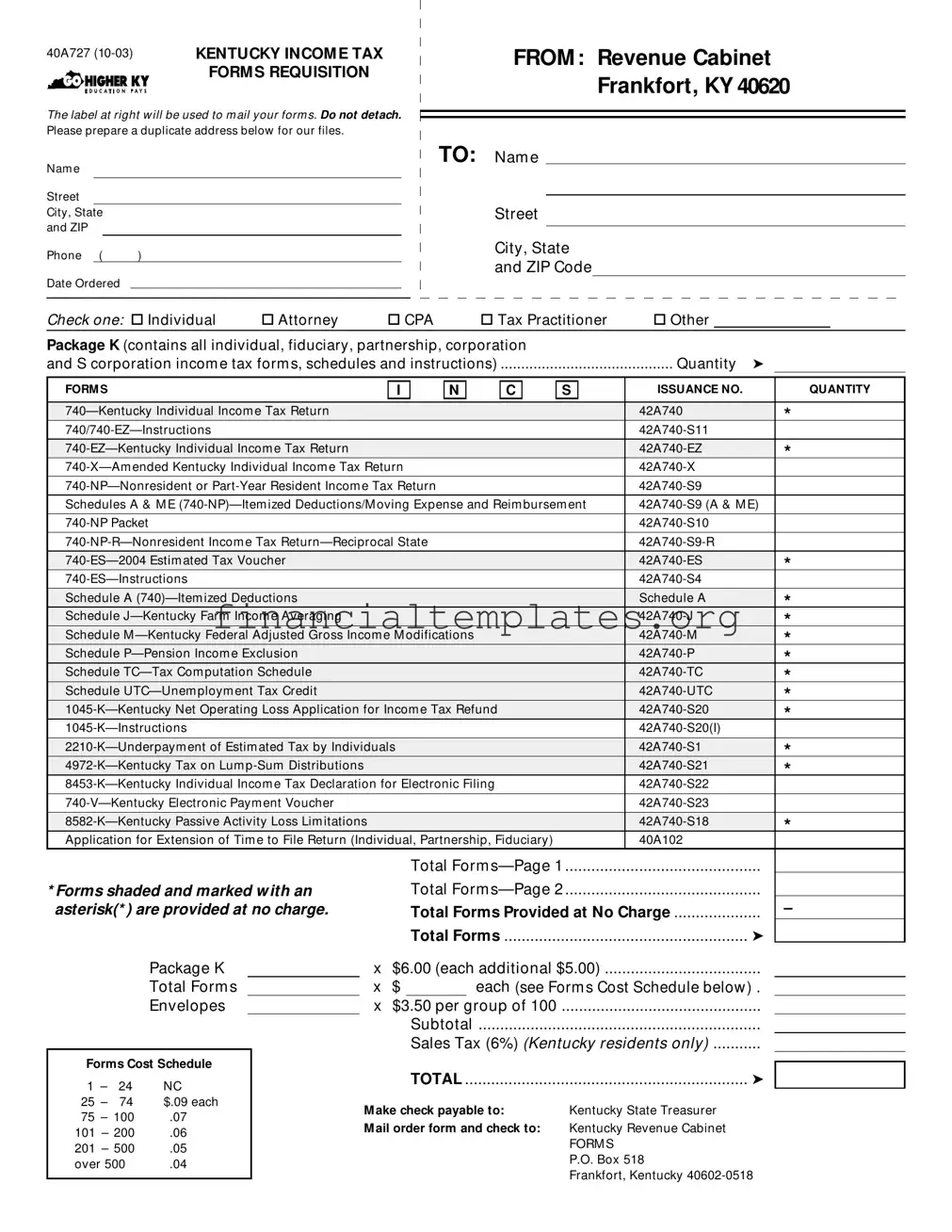

For residents and professionals in Kentucky navigating tax duties, the Kentucky Tax Requisition form, 40A727, serves as a comprehensive resource for acquiring necessary tax documents. Issued by the Revenue Cabinet in Frankfort, KY, this form facilitates the ordering of a wide range of tax-related forms and schedules, tailored to meet the needs of individuals, attorneys, CPAs, tax practitioners, and others requiring tax documentation. From the basic 740—Kentucky Individual Income Tax Return to more specialized forms like the 741—Kentucky Fiduciary Income Tax Return and the 720—Kentucky Corporation Income and License Tax Return, the requisition form covers a broad spectrum. It offers both chargeable and no-charge options, including estimated tax vouchers, instructions for electronic filing, amendments, and extensions. Additionally, the requisition process is structured to provide for bulk orders, accommodating the needs of those who require multiple copies, with a pricing schedule designed to benefit larger orders. With electronic filing options highlighted as advantageous, the Kentucky Revenue Cabinet encourages modern, efficient filing methods, alongside traditional paper-based submissions. This approach underscores Kentucky's commitment to providing accessible, user-friendly tax filing resources to its residents and the professionals who assist them.

Kentucky Tax Requisition Example

40A727 |

KENTUCKY INCOM E TAX |

|

|

|

FORM S REQUISITION |

|

|

|

|

|

|

The label at right w ill be used to m ail your form s. Do not detach.

Please prepare a duplicate address below for our files.

FROM : Revenue Cabinet Frankfort, KY 40620

Nam e

Street

City, State

and ZIP

TO: Nam e

Street

Phone ( |

) |

|

|

|

|

Date Ordered

City, State and ZIP Code

Check one: ο Individual |

ο Attorney |

|

ο CPA |

ο Tax Practitioner |

ο Other |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Package K (contains all individual, fiduciary, partnership, corporation |

|

|

|

|

|

|

|

|||||||||||

and S corporation incom e tax form s, schedules and instructions) |

|

Quantity |

➤ |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM S |

|

|

|

I |

|

|

N |

|

|

C |

|

S |

|

ISSUANCE NO. |

|

QUANTITY |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42A740 |

|

* |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Schedules A & M E |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule A |

|

|

|

|

|

|

|

|

|

|

|

Schedule A |

|

* |

|

|||

Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

* |

|

|||||

Schedule M |

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

* |

|

|||||||||||

Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

* |

|

|||||

Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

* |

|

|||||

Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

* |

|

|||||

|

|

|

|

|||||||||||||||

|

|

|

* |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

* |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

* |

|

|||||

|

|

|

|

|||||||||||||||

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* |

|

|||||

Application for Extension of Tim e to File Return (Individual, Partnership, Fiduciary) |

|

|

40A102 |

|

|

|||||||||||||

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

Total Form |

|

|

|

|

|

|||||||

* Forms shaded and marked w ith an |

|

|

|

.............................................Total Form |

|

|

|

|

|

|||||||||

asterisk(* ) are provided at no charge. |

|

|

|

Total Forms Provided at No Charge |

– |

|||||||||||||

|

|

|

|

|

|

........................................................Total Forms |

|

|

|

➤ |

|

|

||||||

Package K |

|

|

x |

....................................$6.00 (each additional $5.00) |

|

|

|

|

|

|||||||||

Total Form s |

|

|

x |

$ |

|

|

|

|

each (see Form s Cost Schedule below ) . |

|

||||||||

Envelopes |

|

|

x $3.50 per group of 100 |

.............................................. |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

Subtotal |

................................................................. |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

...........Sales Tax (6%) (Kentucky residents only) |

|

|

||||||||||

Forms Cost Schedule

1 – |

24 |

NC |

|

25 |

– |

74 |

$.09 each |

75 |

– 100 |

.07 |

|

101 |

– 200 |

.06 |

|

201 |

– 500 |

.05 |

|

over 500 |

.04 |

||

TOTAL |

➤ |

M ake check payable to: |

Kentucky State Treasurer |

M ail order form and check to: |

Kentucky Revenue Cabinet |

|

FORM S |

|

P.O. Box 518 |

|

Frankfort, Kentucky |

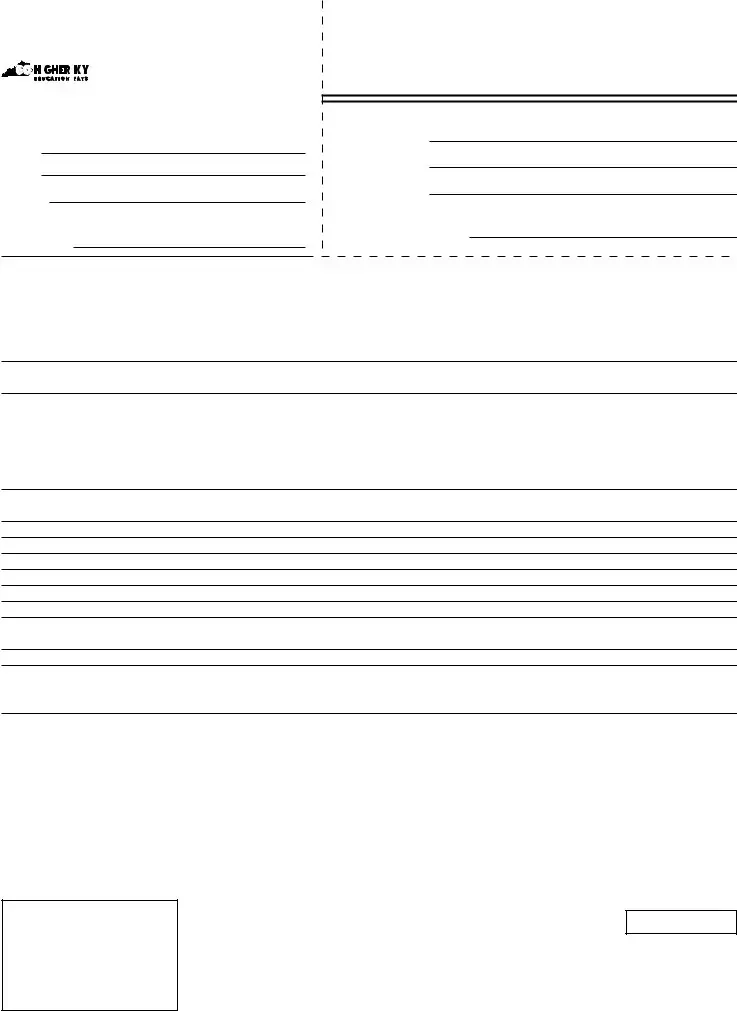

FORM S |

ISSUANCE NO. |

|

|

QUANTITY |

Kentucky Individual Incom e Tax Installm ent Agreem ent Request |

12A200 |

|

|

|

42A741 |

|

|

|

|

42A741(I) |

|

|

|

|

|

|

|

||

Schedule |

42A741 |

|

|

|

42A765 |

|

|

|

|

42A765(I) |

|

|

|

|

Schedule |

42A765 |

|

|

|

41A720 |

|

* |

||

41A720(I) |

|

|||

|

|

|

||

41A720S |

|

* |

||

41A720S(I) |

|

|||

|

|

|

||

Schedule |

41A720S |

|

* |

|

41A720X |

|

|||

|

|

|

||

41A720ES |

|

|

* |

|

|

|

|||

|

|

|

||

Schedule A |

41A720A |

|

* |

|

Application for Extension of Tim e to File KY Corporation Incom e and License Tax Return |

41A720SL |

|

||

|

* |

|||

Schedule |

41A720EZC |

|

||

|

* |

|||

Schedule |

41A720HH |

|

||

|

* |

|||

Schedule |

41A720RC |

|

||

|

* |

|||

Schedule |

41A720RC(C) |

|

||

|

* |

|||

Schedule RC |

41A720RC |

|

||

|

* |

|||

41A722 |

|

|||

|

* |

|||

|

||||

|

* |

|||

Total |

|

➤ |

||

|

|

|||

|

|

|

|

|

ENVELOPES (Available in groups of 100 only) |

|

|

|

|

Refund 6" x 9" Blue |

|

➤ |

|

|

Paym ent 6" x 9" Yellow |

|

➤ |

|

|

* Forms shaded and marked w ith an asterisk(* ) are provided at no charge.

Electronic

‰Federal/State Electronic Filing Federal/State Online Filing

Have you seen our Web page?

Form s

‰Instructions

and a Whole Lot M ore!

w w w.revenue.ky.gov

Document Specifics

| Fact | Detail |

|---|---|

| Form Number | 40A727 (10-03) |

| Title | KENTUCKY INCOME TAX FORMS REQUISITION |

| Issued by | Revenue Cabinet Frankfort, KY 40620 |

| Audience | Individual, Attorney, CPA, Tax Practitioner, Other |

| Package K Contents | Contains all individual, fiduciary, partnership, corporation, and S corporation income tax forms, schedules, and instructions |

| Forms Provided at No Charge | Forms marked with an asterisk (*) |

| Order Submission | Mail order form and check to Kentucky Revenue Cabinet FORMS P.O. Box 518 Frankfort, Kentucky 40602-0518 |

| Payment to | Make check payable to: Kentucky State Treasurer |

| Governing Law | Kentucky State Income Tax Laws |

Guide to Writing Kentucky Tax Requisition

Filling out the Kentucky Tax Requisition form is an important step for individuals, attorneys, CPAs, tax practitioners, or anyone needing various Kentucky income tax forms and guidance documents. This form helps you order the necessary paperwork from the Kentucky Revenue Cabinet, ensuring you have all the tools required to manage tax responsibilities efficiently. It’s crucial to follow each step carefully to ensure your order is correct and complete.

- At the top section of the form labeled "FROM: Revenue Cabinet Frankfort, KY 40620", leave as is since this is pre-filled information for the issuing office.

- Under the "TO:" section, enter your Name, Street Address, Phone Number, and Date Ordered. This will ensure the forms are sent to the right recipient and location.

- Check the appropriate box to indicate if you are an Individual, Attorney, CPA, Tax Practitioner, or select Other and specify your role. This information helps the Revenue Cabinet understand who is requesting the tax forms.

- For the "Package K (contains all individual, fiduciary, partnership, corporation, and S corporation income tax forms, schedules, and instructions)" section, enter the Quantity of packages needed if applicable.

- In the section for individual forms, input the desired Quantity next to each form you require. Forms with an asterisk (*) are provided at no charge, so pay close attention to select only what you need.

- Calculate the total cost for payable forms based on the Forms Cost Schedule provided at the bottom of the form. Additionally, add the cost for any Envelopes needed, at $3.50 per group of 100.

- Add the subtotal, then calculate and add the Sales Tax (6%) for Kentucky residents only.

- Fill in the “Total” line with the combined total of the forms and sales tax.

- Make your check payable to: Kentucky State Treasurer.

- Mail the completed form and your check to: Kentucky Revenue Cabinet, FORMS P.O. Box 518, Frankfort, Kentucky 40602-0518.

Once your form and payment are received, the Kentucky Revenue Cabinet will process your order and mail the requested tax forms and instructions to the provided address. Remember to double-check your entries for accuracy to avoid any delays in receiving your materials. Preparing in advance and having all necessary tax forms on hand can significantly simplify the process of managing and filing your Kentucky taxes.

Understanding Kentucky Tax Requisition

Who is eligible to order Kentucky Income Tax Forms using the 40A727 Requisition Form?

Individuals, attorneys, certified public accountants (CPAs), tax practitioners, and other professionals can order Kentucky Income Tax Forms using the 40A727 Requisition Form. This form allows for the request of a comprehensive range of tax documents, including but not limited to individual, fiduciary, partnership, corporation, and S corporation income tax forms, schedules, and instructions, designated as Package K. Whether you are filing for yourself, managing a client's taxes, or have another professional requirement, this requisition form meets a wide array of needs.

What is Package K, and what does it include?

Package K is a comprehensive collection of tax documents designed to accommodate various filing needs. It includes all necessary forms, schedules, and instructions for individual, fiduciary, partnership, corporation, and S corporation income tax filings. This package is specifically tailored for those who need access to multiple forms across different tax categories, making it a versatile choice for professionals handling diverse cases or individuals with complex filing requirements.

How can one order forms, and what are the associated costs?

Forms can be ordered by mailing the completed requisition form along with a check payable to the Kentucky State Treasurer to the specified address. Costs vary depending on the number of forms and packages ordered. For instance, Package K costs $6.00, with each additional package priced at $5.00. Prices for individual forms vary from free of charge to a nominal fee based on the quantity ordered, as detailed in the form's cost schedule. Additionally, envelopes are available at $3.50 per group of 100. Kentucky residents must also include sales tax at a rate of 6% on their orders.

Are there any forms provided at no charge, and how does one opt for electronic filing?

Yes, several forms are provided at no charge, as indicated by an asterisk (*) next to the form's name in the requisition form. These include key filings and instructions that are essential for many taxpayers. For those interested in electronic filing, the Kentucky Revenue Cabinet encourages taxpayers to take advantage of this option for its convenience and efficiency. Information about federal/state electronic filing and online filing options can be found on the Kentucky Revenue Cabinet’s website. This site also serves as a resource for additional forms, instructions, and tax filing information.

Common mistakes

When filling out the Kentucky Tax Requisition form, individuals may inadvertently make mistakes that could delay processing or cause other complications. Below are five common errors to avoid to ensure the form is completed accurately and efficiently.

- Incorrect or Incomplete Address Information: One of the most basic yet crucial details is the mailing address. Individuals sometimes forget to fill in their complete address or make errors in the house number, street name, city, state, or ZIP code. This mistake can lead to the tax forms being sent to the wrong address, thereby causing significant delays.

- Selection of the Wrong Tax Package or Forms: The Kentucky Tax Requisition form offers various options for tax packages, including those for individuals, attorneys, CPAs, tax practitioners, and others. Selecting the wrong category may result in receiving the incorrect forms, which are not applicable to the filer’s tax situation.

- Incorrect Quantity of Forms Requested: Filers sometimes underestimate or overestimate the number of forms they need. This can lead to either a shortage of necessary forms, halting the process of tax filing, or an excess, which wastes resources.

- Forgetting to Include Payment for Forms Not Provided at No Charge: While some forms are provided at no charge, others incur a cost. Individuals often overlook the need to calculate the total cost of their order and include the appropriate payment. This omission can delay the receipt of the forms needed.

- Omission of Sales Tax for Kentucky Residents: Kentucky residents are required to include sales tax with their payment at the rate of 6%. Neglecting to add sales tax to the total payment can result in an incomplete submission, requiring further communication to resolve the oversight.

By paying careful attention to these details, filers can avoid common pitfalls and ensure their Kentucky Tax Requisition form is processed smoothly and efficiently.

Documents used along the form

When dealing with Kentucky taxes, the Kentucky Tax Requisition form is a critical document. However, to ensure a comprehensive approach to tax filing and planning, several other forms and documents might also be required. Each serves a specific purpose in the broader context of managing taxes effectively within the state of Kentucky. Here’s a brief overview of some of these key documents:

- Kentucky Individual Income Tax Return (740): This is the primary form used by residents to file their annual state income tax return. It collects information about income, deductions, and credits to calculate the tax owed or refund due.

- Instructions for 740/740-EZ (42A740-S11): Provides detailed guidance on how to correctly fill out the Kentucky Individual Income Tax Return forms.

- Amended Kentucky Individual Income Tax Return (740-X): Used to make changes to a previously filed Kentucky income tax return. It helps taxpayers correct errors or update information.

- Nonresident or Part-Year Resident Income Tax Return (740-NP): For individuals who lived in Kentucky for only a portion of the year or not at all, this form helps calculate the tax on income earned within the state.

- Estimated Tax Voucher (740-ES): Allows taxpayers to make quarterly estimated tax payments throughout the year if they do not have taxes withheld from their income.

- Application for Extension of Time to File Return (Individual, Partnership, Fiduciary) (40A102): Provides taxpayers with additional time to file their tax return without facing penalties for late filing.

- Kentucky Fiduciary Income Tax Return (741): Required for estates and trusts earning income within the state, detailing income, deductions, and the distribution of income to beneficiaries.

- Kentucky Partnership Income Return (765): Used by partnerships to report their income, gains, losses, deductions, and credits to the state.

- Kentucky Corporation Income and License Tax Return (720): Corporations file this form to report their income and calculate their income and license tax obligations to the state.

Utilizing the correct forms and completing them accurately is essential for compliance with Kentucky tax laws. Whether you're an individual, part of a partnership, or running a corporation, understanding which documents apply to your situation can help streamline your tax preparation process and avoid potential issues. Remember, when in doubt, consulting with a tax professional can provide clarity and ensure that you're meeting all your tax obligations.

Similar forms

The Kentucky Individual Income Tax Return Form 740 is closely related to the federal IRS Form 1040, which serves the same fundamental purpose but at the national level. Both forms are used by residents to report their income and calculate taxes owed to the government for the year. The process involves detailing earned income, tax credits, deductions, and determining the final tax liability or refund due. Similar to the Kentucky form 740, the 1040 form also comes with a variety of schedules and instructions designed to guide individuals through the tax filing process, ensuring they comply with applicable tax laws and claim all allowable deductions and credits.

The Kentucky Tax Requisition form for ordering tax documents mirrors the purpose of the IRS Form 4506-T, Request for Transcript of Tax Return. While the Kentucky form is designed for ordering specific state tax forms and documents, the IRS Form 4506-T is utilized to request past tax returns, tax account information, and other IRS documents for federal purposes. Both forms serve as tools for taxpayers to obtain necessary documents, whether for personal records, loan applications, or legal reasons, and highlight the administrative process involved in managing and reviewing tax-related paperwork.

Similarly, the Kentucky 740-ES, the Estimated Tax Voucher, shares its function with the federal IRS Form 1040-ES, Estimated Tax for Individuals. These forms are used by individuals to pay estimated taxes on income that is not subject to withholding taxes, such as earnings from self-employment, interest, dividends, and rent. The necessity for these forms stems from the need to settle tax liabilities as income is earned throughout the year, promoting timely tax payments and helping taxpayers avoid underpayment penalties. Both the state and federal systems require quarterly payments, reflecting the governments' parallel approaches to tax collection.

The Application for Extension of Time to File Return parallels the IRS Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. This similarity lies in their shared goal of providing taxpayers with additional time to file their tax returns without incurring penalties for late submission. While the Kentucky form applies to extending the deadline for state tax returns, Form 4868 serves the same purpose at a federal level. Each form acknowledges that circumstances may prevent timely filing and offers a systematic method to legally delay submission while maintaining compliance with tax filing requirements.

Dos and Don'ts

When filling out the Kentucky Tax Requisition form, there are certain practices that you should follow to ensure the process is completed smoothly and accurately. Equally, there are practices you should avoid to prevent mistakes or delays. Here are three suggestions for what you should do and three warnings about what you shouldn't do:

- Do ensure that all the information you provide on the form is accurate, including your name, address, and the specific tax forms you require. Mistakes can lead to delays in receiving your forms.

- Do double-check the quantity of each form you are requesting. This helps in ensuring that you receive the correct number of forms needed without the necessity for additional requests.

- Do choose the correct type of tax form package based on your needs, whether it's for an individual, attorney, CPA, tax practitioner, or another category as specified on the form.

Conversely, there are actions you should avoid:

- Don't detach the label at the right of the form intended for mailing your forms. This label contains important tracking information necessary for processing.

- Don't forget to include a duplicate address below for file purposes. This address is crucial for accurate record-keeping and future communications.

- Don't leave the payment section blank if payment is required for your order. Ensure that your check is made payable to the Kentucky State Treasurer and that it includes the correct amount based on the forms cost schedule and quantity ordered.

Misconceptions

When it comes to managing taxes, especially in Kentucky, misconceptions can easily arise, particularly with the Kentucky Tax Requisition form. Clarifying these misunderstandings is crucial in ensuring both accuracy and compliance.

Misconception 1: The Form Is Only for Individuals Filing Taxes. Many believe the Kentucky Tax Requisition form is exclusively for individual taxpayers. However, this form is versatile and also caters to attorneys, CPAs, tax practitioners, and others who require tax forms for different entities, including individuals, fiduciaries, partnerships, corporations, and S corporations. This broad range acknowledges various filing needs.

Misconception 2: All Forms Must Be Purchased. It's a common misunderstanding that all forms listed on the requisition need to be bought. In reality, the form details that certain documents, indicated with an asterisk, are provided at no charge. This includes crucial forms for individuals, corporations, and other entities, ensuring essential tax documentation is accessible without cost.

Misconception 3: Electronic Filing Options Are Limited. Some taxpayers are under the impression that their electronic filing options are restricted. The Kentucky Tax Requisition form highlights multiple electronic methods, including Federal/State Electronic Filing and Federal/State Online Filing. This variety accommodates different preferences and situations, making the filing process more convenient.

Misconception 4: The Form Doesn’t Support Nonresidents or Part-Year Residents. A frequent misconception is that nonresidents or part-year residents cannot use the form to requisition their necessary tax documents. Contrary to this belief, the form specifically lists items like the 740-NP for nonresidents or part-year residents and related schedules for itemized deductions and moving expenses. This ensures that everyone, regardless of their residency status, has access to the required forms for their tax obligations.

Understanding these aspects of the Kentucky Tax Requisition form is crucial for accurately handling tax responsibilities. By debunking these misconceptions, taxpayers can navigate their tax preparation process with more clarity and confidence.

Key takeaways

Filling out and using the Kentucky Tax Requisition form is crucial for residents and professionals in Kentucky needing state tax-related forms. Here are five key takeaways to ensure the process is conducted smoothly and effectively:

- There are specific forms available for different tax needs, including individual income tax forms, fiduciary, partnership, corporation, and S corporation income tax forms, among others. Identifying the exact form needed before filling out the requisition form can save time and effort.

- Forms are designated with an issuance number and description to facilitate easy identification. For example, the Kentucky Individual Income Tax Return form is numbered 42A740. Being familiar with these numbers can expedite the process of requisition.

- Certain forms on the Kentucky Tax Requisition form are provided at no charge, denoted with an asterisk (*). This is particularly helpful for individuals or organizations needing multiple copies, as it can reduce overall costs.

- The requisition form offers options for different roles, including individuals, attorneys, CPAs, tax practitioners, and others, ensuring that the right forms are provided for the specific requirements of the requester.

- Electronic filing is highly encouraged, with mention of it being to the filer's advantage, highlighting the efficiency and speed of processing electronically submitted forms. This could be especially beneficial during the peak tax season when processing paper forms could take longer.

Thorough completion of the Kentucky Tax Requisition form, along with an understanding of the available forms and the benefits of electronic filing, can help streamline the state tax filing process. This contributes to a more efficient tax season for both individuals and professionals across Kentucky.

Popular PDF Documents

What Kind of Power of Attorneys Are There - An agreement empowering a third party to act in tax matters, including filing and negotiations.

Pa Department of Revenue Tax Clearance - An inquiry into the business's termination activities within the state checks for proper dissolution and tax settlement procedures.

Sba 1201 Loan Forgiveness - Facilitates a seamless process for employers to contribute towards their employees' loan obligations.