Get Kentucky Inheritance Tax Form

For those navigating the aftermath of a loved one's passing in Kentucky, understanding the Kentucky Inheritance Tax form is a crucial step in the estate settlement process. Authored by the Commonwealth of Kentucky's Department of Revenue, this document offers detailed guidelines for executors and beneficiaries, ensuring compliance with the state's inheritance tax laws for deaths on or after January 1, 2005. The packet includes not only the inheritance and estate tax forms but also comprehensive instructions. It's designed to serve both Kentucky residents and nonresidents, making it an essential tool for anyone dealing with an estate that has ties to Kentucky. Whether you're seeking to file a No Tax Due Return, navigating the complexities of the various Inheritance Tax Returns, or utilizing the Affidavit of Exemption when applicable, this packet provides the necessary resources. Furthermore, it embodies the Department of Revenue's commitment to fair and efficient service, underlining its mission to benefit the Commonwealth and its citizens without discrimination. Understanding these forms ensures that the estates are settled correctly, potentially avoiding unnecessary stress and financial strain during a challenging time.

Kentucky Inheritance Tax Example

Kentucky

Inheritance and Estate Tax

Forms and Instructions

COMMONWEALTH OF KENTUCKY

DEPARTMENT OF REVENUE

For Dates of Death on or After January 1, 2005

(Revised February, 2018)

Kentucky Department of Revenue

Mission Statement

As part of the Finance and Administration Cabinet, the mission of the Kentucky Department of Revenue is to administer tax laws, collect revenue, and provide services in a fair, courteous, and efficient manner for the benefit of the Commonwealth and its citizens.

* * * * * * * * * * * * *

The Kentucky Department of Revenue does not discriminate on the basis of race, color, national origin, sex, age, religion, disability, sexual orientation, gender identity, veteran status, genetic information or ancestry in employment or the provision of services.

NOTICE

If all taxable assets pass to exempt beneficiaries and a Federal Estate and Gift Tax Return is not required, it is not necessary to file an InheritanceTax Return with the Kentucky Department of Revenue. An affidavit of exemption will be accepted for the final settlement and closing of the administration of an estate. If inheritance tax is due the Commonwealth of Kentucky, Form 92A200 or 92A205 should be used.

The affidavit of exemption is to be filed only with the court. Do not send a copy of the affidavit to the Kentucky Department of Revenue.

Sample Affidavit of Exemption

AFFIDAVIT OF EXEMPTION

Affiant ____________________________ , being first duly sworn, states that he/she is fiduciary or beneficiary of the

estate of _______________________________ , who died on the _______ day of __________________ , _______ , a resident

of _________________________ County, Kentucky.

Affiant states that all assets of the estate pass to exempt beneficiaries pursuant to Kentucky Revised Statute 140.080* or exempt organizations pursuant to Kentucky Revised Statute 140.060** either by virtue of the decedent’s will, the intestate laws of this state, or by contract (survivorship, payable on death, trust, etc.).

Affiant further states that a Kentucky Inheritance Tax Return will not be filed since no death tax is due the state and a Federal Estate and Gift Tax Return (Form 706) is not required to be filed because the gross estate is less than the required amount set out in Section 2010(c) of the Internal Revenue Code. This affidavit is being submitted to satisfy the requirements of Kentucky Revised Statute 395.605.

__________________________________________________________

Signature

Witness my hand this ________ day of __________________________ , __________ .

Sworn and subscribed to before me by _____________________________________

this _______ day of ____________________________________________ , __________ .

______________________________________________________ Notary Public

My commission expires______________________________________

*Exempt beneficiaries under KRS 140.080 include spouse, children, stepchildren, grandchildren, parent, brother, and sister.

**Exempt organizations include educational, religious or other institutions, societies, or associations, whose sole purpose is to carry on charitable, educational, or religious work. Also, cities, towns or public institutions in this state qualify as exempt organizations provided that any transfer to such an organization is for public purposes.

WHAT’S INCLUDED

INHERITANCE AND ESTATE TAX FORMS

No Tax Due Return (resident and nonresident) and Instructions (Form 92A201) Inheritance Tax Return (resident and nonresident) (Form 92A200)

Inheritance Tax Return (short form) (resident and nonresident) (Form 92A205) Real Estate Valuation Information Form (Form 92A204)

Election to Qualify Terminable Interest Property and/or Power of Appointment Property (Form 92A936) Election to Defer the Payment of Inheritance Tax Through Installments (Form 92A928)

Affidavit of Exemption (Form 92A300) Inheritance Tax Table for Resident Decedent Inheritance Tax Table for Nonresident Decedent Blanket Consent

GENERAL INFORMATION |

|

Supplemental Documents |

1 |

Payment of Tax |

|

Discount |

1 |

Installment Payments |

1 |

Interest |

1 |

Penalties |

1 |

Property to be Included on the Return |

1 |

Valuation of |

2 |

Deductions |

2 |

Federal Estate Tax |

2 |

Qualified Terminable Interest Property (QTIP) and/or Powers of Appointment (POA) |

2 |

Property Previously Taxed |

2 |

Example of Credit for Previously Taxed Property |

3 |

Distribution |

4 |

Exemptions for Beneficiaries of a Resident Decedent |

4 |

Exemptions for Beneficiaries of a Nonresident Decedent |

5 |

Bequest of Tax |

5 |

Property Set Aside Under KRS 391.030(1)(c) |

5 |

Estate Tax |

5 & 6 |

Value of a Life Estate |

6 |

Amended Return |

7 |

Acceptance Letter |

7 |

Protest and Appeal |

7 |

Helpful Hints |

|

Where to Obtain Assistance |

7 |

Reporting of Intangible Property Tax |

7 |

Fiduciary Return |

7 |

Office of the Taxpayer Ombudsman |

7 |

Website for Forms |

7 |

Definitions |

8 & 9 |

Taxpayer Service Centers Locations and Phone Numbers |

10 |

Kentucky Taxpayers Bill of Rights |

inside back cover |

INHERITANCE AND ESTATE TAX FORMS IN THIS PACKET

The forms in this packet should only be used if the date of death occurred on or after January 1, 2005.The forms may be dupli- cated on a computer and the space allocated for each item may be decreased or increased depending on the amount of space required. The forms may be used for a decedent who was a resident or a nonresident of Kentucky.

If all taxable assets pass to exempt beneficiaries and a Federal Estate and Gift Tax Return is not required, it is not neces- sary to file an Inheritance Tax Return with the Kentucky Department of Revenue (DOR). An Affidavit of Exemption will be accepted for the final settlement and closing of the administration of an estate. If inheritance tax or estate tax is due the Commonwealth of Kentucky, Form 92A200 or 92A205 should be used.

If the date of death occurred prior to January 1, 2005, contact the Financial Tax Section, Department of Revenue, Station 61, 501 High Street, Frankfort, KY

Three forms are included in this booklet. Choose one unless an Affidavit of Exemption is used.

1.No Tax Due Return (Form 92A201)

This return may be used for an estate (Kentucky resident or nonresident) if: (1) there is no Kentucky inheritance tax due, (2) the date of death is on or after January 1, 2005, and (3) the entire estate passes to beneficiaries listed in the following group either by contract (survivorship, payable on death, trust, etc.), the decedents will, or the intestate laws of this state:

(1)Surviving spouse, parent

(2)Child (adult or infant)

child by blood, stepchild, child adopted during infancy, or child adopted during adulthood who was reared by the decedent during infancy

(3) Grandchild

issue of child, stepchild, child adopted during infancy, or of a child adopted during adulthood who was reared by decedent during infancy

(4) Brother, sister (whole or half)

Refer to KRS 140.080 for (1) through (4) above

(5) Exempt

Exempt organizations include educational, religious or other institutions, societies, or associations, whose sole purpose is to carry on charitable, educational, or religious work. Also, cities, towns or public institutions in this state qualify as exempt organizations provided that any transfer to such an organization is for public purposes.

2.Inheritance Tax Return (Form 92A200)

This return must be used for an estate (resident or nonresident) when: (1) the date of death is on or after January 1, 2005, and (2) any assets of the estate pass to taxable beneficiaries or taxable organizations, or when Forms 92A201 and 92A205 do not apply.

Instructions are on the back of each schedule.

3.Inheritance Tax Return (Short Form) (Form 92A205)

This return may be used for an estate (Kentucky resident or nonresident) when : (1) a federal estate tax return is not re- quired to be filed, (2) the assets of the estate consist of 10 items or less, (3) no gifts or transfers where made within three years of death without full consideration, (4) no real or personal property was transferred with a retained life interest, (5) the decedent did not possess any power to appoint any real or personal property or have the use of any qualified terminable interest property, and (6) the decedent had not received any real or personal property from another decedent within five years and paid inheritance tax on the property.

92A201

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Kentucky Inheritance

Tax Return

NO TAX DUE

FOR DEPARTMENT USE ONLY

|

4 |

6 |

|

|

__ __ __ __ __ __ / __ __ / __ __ / __ __ __ __ |

||||

Account Number |

Tax |

Mo |

Year |

|

This return may be used if: (1) there is no Kentucky inheritance tax due, (2) the date of death is on or after January 1, 2005, and

(3)the entire estate passes to beneficiaries listed in the following groups either by contract (survivorship, payable on death, trust, etc.), the decedent’s will, or the intestate laws of this state:

(1)Surviving spouse, parent

(2)Child (adult or infant)

child by blood, stepchild, child adopted during infancy,

or a child adopted during adulthood who was reared by decedent during infancy

(3)Grandchild

issue of child by blood, stepchild, child adopted during infancy,

or of a child adopted during adulthood who was reared by decedent during infancy

(4)Brother, sister (whole or half)

Refer to KRS 140.080 for (1) through (4) above

(5)Exempt

Exempt organizations include educational, religious or other institutions, societies, or associations, whose sole purpose is to carry on charitable, educational, or religious work. Also, cities, towns or public institutions in this state qualify as exempt organizations provided that any transfer to such an organization is for public purposes.

Decedent’s Name Last |

First |

Middle Initial |

Date of Death |

|

|

|

|

|

|

Social Security Number |

Occupation (If decedent was retired |

Age at Death |

Cause of Death |

HR Code Number (if known) |

|

at death, state occupation prior to |

|

|

|

|

retirement.) |

|

|

|

|

|

|

|

|

Residence (Domicile) at Time of Death

|

Number and Street |

City |

State |

ZIP Code |

County |

|

|

|

|

|

|

|

|

Name and Address of Executor/Administrator/Beneficiary |

|

Name and Address of Preparer |

|

|||

|

|

|

|

|

|

|

Exec |

|

|

Atty |

|

|

|

Admr |

|

|

CPA |

|

|

|

________ |

|

|

________ |

|

|

|

|

|

|

|

|

|

|

Did the decedent have a will? No Yes If Yes, attach a copy of the will.

Did the decedent have a trust agreement? No |

Yes If Yes, attach a copy of the trust agreement. |

|

Filing status of Federal Estate and Gift Tax Return for this estate (check one): |

||

Not Required |

Required (enclose copy) |

Not Required, but filed for Portability (enclose copy) |

Schedules for listing property (real and personal) and beneficiaries are on the reverse side of this form. Listing of property is optional. Listing of beneficiaries and their relationship is required.

Total Value of Property from Reverse Side |

(optional) $ |

|

|

|

|

|

|

Under criminal penalties, I declare that this return, including accompanying documents, has been examined by me, and is, to the best of my knowledge and belief, true, correct and complete.

|

|

|

|

( |

) |

|

|

Signature of Executor/Administrator/Beneficiary |

|

Date |

|

Telephone Number |

|

||

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

Signature of Preparer |

|

Date |

|

Telephone Number |

|

||

Mail to: Kentucky Department of Revenue, Frankfort, Kentucky 40620

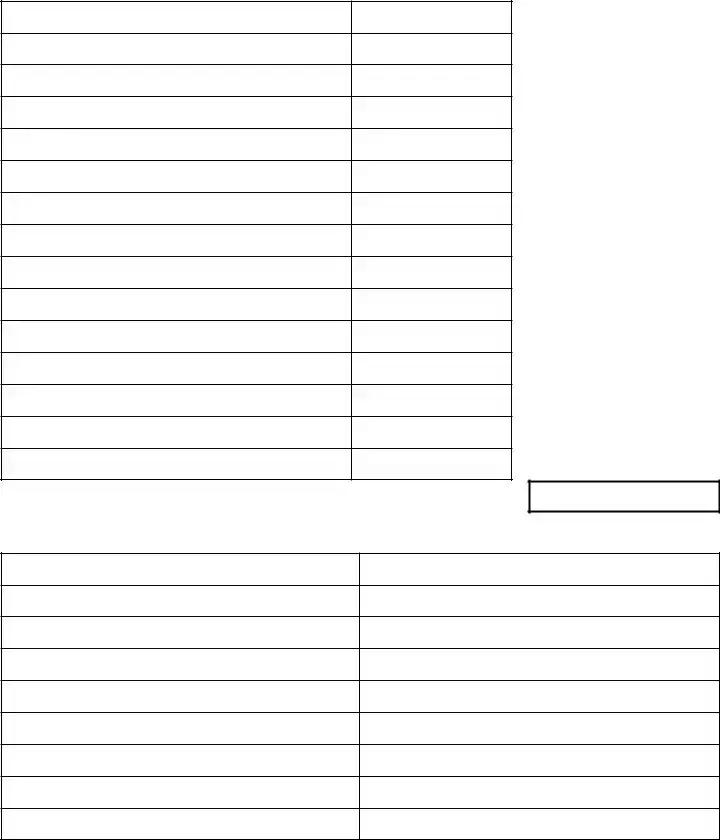

92A201

PART

Description and Location

of Real or Personal Property

Fair Cash Value at Date of Death

Total Value of Property |

|

PART

$

Name of Beneficiary

Relation to Decedent (Required)

If all taxable assets pass to exempt beneficiaries and a Federal Estate and Gift Tax Return is not filed, it is not necessary to file an InheritanceTax Return with the Kentucky Department of Revenue. An affidavit of exemption will be accepted by the courts for the final settlement and closing of the administration of an estate. If inheritance tax is due the Commonwealth of Kentucky, Form 92A200 or 92A205 should be used.

92A200 |

KENTUCKY |

Commonwealth of Kentucky |

INHERITANCE TAX RETURN |

|

|

DEPARTMENT OF REVENUE |

|

FOR DEPARTMENT USE ONLY

|

4 |

6 |

|

|

__ __ __ __ __ __ / __ __ / __ __ / __ __ __ __ |

||||

Account Number |

Tax |

Mo |

Year |

|

Requirements for use of this

Return Status (check one):

Original Return

Amended

Amended

|

Decedent’s Name |

Last |

First |

Middle Initial |

|

Occupation (If decedent was |

Age at Death |

Date of Death |

|||||||||

|

|

|

|

|

|

|

|

|

retired at death, state occu- |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

pation prior to retirement.) |

|

|

|

|

||||

|

Social Security Number |

|

|

|

|

|

|

|

|

|

Cause of Death |

HR Code Number |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Residence (Domicile) at Time of Death |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Number and Street |

|

|

|

City |

|

|

State |

ZIP Code |

County |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Name and Address of Executor/Administrator/Beneficiary |

|

|

|

Name and Address of Preparer |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Exec |

|

|

|

|

|

|

|

Atty |

|

|

|

|

|

|||

|

Admr |

|

|

|

|

|

|

|

CPA |

|

|

|

|

|

|||

|

________ |

|

|

|

|

|

|

|

________ |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Did the decedent have a will? No |

Yes |

If Yes, attach a copy of the will. |

|

|

|

|

||||||||||

|

Did the decedent have a trust agreement? No |

Yes |

If Yes, attach a copy of the trust agreement. |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Filing status of Federal Estate and Gift Tax Return for this estate (check one): |

|

|

|

|

||||||||||||

|

Not Required |

Required (enclose copy) |

Not Required, but filed for Portability (enclose copy) |

||||||||||||||

|

Gross Estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

1. |

Individually owned assets |

|

|

|

|

|

$ |

|

|

|

|

|

||||

|

2. |

Jointly owned assets |

|

|

|

|

|

$ |

|

|

|

|

|

||||

|

3. |

Qualified terminable interest property |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

and/or powers of appointment |

|

|

|

|

|

$ |

|

|

|

|

|

||||

|

4. |

Previously taxed property |

|

|

|

|

|

$ |

|

|

|

|

|

||||

|

5. |

Gifts and transfers |

|

|

|

|

|

|

$ |

|

|

|

|

|

|||

|

|

|

|

Total Gross Estate |

|

|

|

|

|

|

|

$ |

|

||||

|

Deductions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

6. |

Funeral expenses |

|

|

|

|

|

|

$ |

|

|

|

|

|

|||

|

7. |

Administration expenses |

...................................................................... |

|

|

|

|

|

$ |

|

|

|

|

|

|||

|

8. |

Debts of decedent |

|

|

|

|

|

|

$ |

|

|

|

|

|

|||

|

9. |

...................................Federal estate |

|

|

|

|

$ |

|

|

|

|

|

|||||

|

|

|

|

Total Deductions |

|

|

|

|

|

|

|

|

$ |

|

|||

|

|

|

|

Net Estate (Total Gross Estate less Total Deductions) |

|

$ |

|

||||||||||

|

|

|

|

Total Tax Due from Tax Computation Form 92A200 |

$ |

|

|||||||||||

|

Interest and Penalty |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

10. |

Interest for late payment (see general information) |

.................................................................... |

|

|

|

|

|

|

$ |

|

||||||

|

11. |

Late filing penalty (see general information) |

|

|

|

|

|

|

|

$ |

|

||||||

|

12. |

Late payment penalty (see general information) |

|

|

|

|

|

|

$ |

|

|||||||

|

13. |

Total Due (tax plus interest and penalties, if applicable) |

|

|

|

$ |

|

||||||||||

|

14. |

Total previously paid |

|

|

|

|

|

|

|

|

|

$ |

|

||||

|

15. |

Balance due/Refund |

|

|

|

|

|

|

|

|

|

$ |

|

||||

Attach check payable to “Kentucky State Treasurer” to this return and mail to Kentucky Department of Revenue, Frankfort, KY 40620

Under criminal penalties, I declare that this return, including accompanying documents, has been examined by me, and is, to the best of my knowledge and belief, true, correct and complete.

( )

Signature of Executor/Administrator/Beneficiary |

Social Security Number |

Date |

Telephone Number |

( )

Signature of Preparer |

Date |

Telephone Number |

Estate of: |

92A200 |

|

|

|

|

Individually Owned Assets |

Page ____ of ____ |

|

|

List in this schedule all items individually owned by the decedent including life insurance payable to the estate.

(Please review instructions on reverse side for details.)

Item |

Description of Property/Name of Corporation |

Accrued Rents/ |

Number |

Fair Cash Value |

Number |

or Obligor/ Name of Bank or Debtor |

Interest/Dividends |

of Shares |

on Date of Death |

1.

Total (including continuation page(s)) (enter on page 1, line 1) |

|

|

|

If additional space is needed, duplicate this page and attach as a continuation page(s). |

|

INSTRUCTIONS

INDIVIDUALLY OWNED ASSETS

All real proper t y individually owned must b e lis ted in this schedule . For re por ting agricultural or horticultural land, see General

Stocks and bonds individually owned are includable in this schedule. Stock values are determined by using an average of the high and low quoted selling price on the decedent’s date of death. In case of inactive stock such as closely held corporations, explain the method used in computing the value at the date of death. A balance sheet, at a date nearest the decedent’s death, together with a statement of net earnings and dividends paid for the

Dividends declared and of record in the decedent’s name but not paid prior to death must be included in this schedule. Provide statements, lists, etc. supporting valuation of these assets.

United States bonds individually owned as well as those payable upon death to another should be included in this schedule. Indicate series, maturity value and date of purchase of all United States bonds.

In some instances, the estate will include stocks and bonds listed on a stock exchange that did not make sales on the date of the decedent’s death. When this occurs, their value must be determined by averaging the high and low for the last working day preceding the date of death and the first working day subsequent to the date of death. For reporting stock of a corporation owning qualified real estate passing to a qualified person(s), see General

Mortgages, notes and cash individually owned must be listed in this schedule. List accrued interest to date of death. The description of mortgages and notes must include interest rate, the date the last payment of interest was made preceding the date of the decedent’s death, and the due date

of the mortgages or notes. If an account is held out of state, show name and address of financial institution on the tax return.

List life insurance payable to the insured or to the estate. Life insurance payable to a designated beneficiary, including a testamentary or inter vivos trustee, is

List in this schedule other individually owned items of the gross estate, such as debts due decedent; business or partnership (attach balance sheet showing capital accounts); claims, exclusive of those claimed under KRS 411.130 (wrongful death); rights; royalties; leaseholds; judgments; shares in trust funds; contracts; household goods and personal effects, including antiques, jewelry and collections of any type; farm products and growing crops; livestock; farm machinery; automobiles; etc.

The value of an annuity or other payment made to a beneficiary of a deceased employee (other than the executor or equivalent) under (1) an exempt trust or qualified nontrusted annuity plan as described by the Internal Revenue Code or (2) a contract purchased by an educational or charitable organization as referred to in Section 170(b)(1)(A)(ii) or (vi) of the Internal Revenue Code or a religious organization exempt from tax under Internal Revenue Code Section 501(a), is taxable in the proportion that the total contributions made by the decedent bears to the total contributions made. The proceeds from a Retired Serviceman’s Family Protection Plan or Survivor Benefit Plan are exempt under KRS 140.015(2). Refer to KRS 140.063(3) and (4) regarding the taxation of individual retirement accounts and annuities as described in Section 408(a) and (b) of the Internal Revenue Code.

All other annuities, including deferred compensation plans, or payments other than those described in the preceding paragraph made to a beneficiary, executor or equivalent, are fully taxable if the decedent retained ownership at death such as the right to name or change the beneficiary and must be listed in this schedule.

Document Specifics

| Fact | Detail |

|---|---|

| Relevant Law | Kentucky Revised Statute 140.080 and 140.060 mention exempt beneficiaries and organizations. |

| Affidavit of Exemption | If all taxable assets pass to exempt beneficiaries and a Federal Estate and Gift Tax Return is not required, an affidavit of exemption can be used. |

| Forms for Tax Due | If inheritance tax is owed, Form 92A200 or 92A205 should be submitted. |

| Eligible Deaths | The packet forms are relevant for deaths occurring on or after January 1, 2005. |

| Forms Included | The packet includes various forms, including No Tax Due Return (Form 92A201) and Inheritance Tax Return (Form 92A200). |

| Exempt Beneficiaries | Exempt beneficiaries include spouse, children, and certain relatives as specified under KRS 140.080. |

| Exempt Organizations | Organizations exempt under KRS 140.060 include educational, religious institutions, and public institutions for public purposes. |

| Mission Statement | The Kentucky Department of Revenue aims to administer tax laws and collect revenue efficiently and fairly. |

Guide to Writing Kentucky Inheritance Tax

Filing the Kentucky Inheritance Tax form is a necessary process for estates that need to report and possibly pay inheritance tax to the Commonwealth of Kentucky. The process can seem daunting, but taking it step-by-step can make it manageable. Whether you're an executor or administrator handling an estate, or a professional preparing the form on behalf of someone else, accuracy and thoroughness are key. The instructions provided aim to navigate through the complexities of the form without overwhelming you with technical jargon. Here are the steps needed to properly complete the form:

- Begin by selecting the appropriate form for the estate you are managing. Based on the information provided, if all assets pass to exempt beneficiaries and no Federal Estate and Gift Tax Return is required, an Affidavit of Exemption rather than an Inheritance Tax Return may be filed.

- For estates where an Inheritance Tax Return is deemed necessary, determine which form suits the estate's circumstances:

- Form 92A200 for estates passing assets to taxable beneficiaries or organizations.

- Form 92A205 (short form) for simpler estates meeting specific criteria such as not requiring a federal estate tax return, consisting of 10 items or less, and having no questionable transfers within three years of the decedent's death.

- Collect all necessary documentation and information about the deceased, including their name, social security number, date of death, and last address. Documents like wills or trust agreements, if existent, will be attached to the form.

- Complete the “Decedent’s Information” section by filling in the deceased's personal details, including occupation, age at death, cause of death, and their residence at the time of death.

- Fill in the “Executor/Administrator/Beneficiary” section, identifying the individual responsible for handling the estate. Include contact information for easy communication.

- If applicable, provide information regarding whether the decedent had a will or a trust agreement. Attach copies of these documents to the return.

- Indicate the filing status of the Federal Estate and Gift Tax Return for the estate. Check the appropriate box and attach a copy of the return if it was required or filed.

- In the “Schedules” section on the reverse side of the form, list all real and personal property of the estate. Though listing property is optional, detailing beneficiaries and their relationship to the decedent is mandatory.

- Calculate and enter the total value of the property, if you choose to list it. This step precisely quantifies the estate's worth for tax purposes.

- Review the completed form for accuracy and completeness. Make sure that all necessary documents are attached and that the form is signed by the Executor/Administrator/Beneficiary. Providing a contact email and phone number ensures the department can reach you if further information is needed.

- Mail the completed form and any attachments to the Kentucky Department of Revenue at the address provided. Ensure to keep copies for your records.

By carefully following these steps, you can accurately complete the Kentucky Inheritance Tax form. This task, while detailed, contributes to a pivotal part of estate management and helps in fulfilling the final wishes of the deceased in accordance with Kentucky law.

Understanding Kentucky Inheritance Tax

Below are answers to some frequently asked questions regarding the Kentucky Inheritance Tax form:

Who needs to file a Kentucky Inheritance Tax Return?

A Kentucky Inheritance Tax Return (Form 92A200 or Form 92A205) is required for estates where the decedent was a resident or nonresident of Kentucky and the date of death occurred on or after January 1, 2005, if any assets pass to taxable beneficiaries or organizations. If the entire estate passes to exempt beneficiaries or no federal estate tax return is required, an Affidavit of Exemption may be filed instead.

What are considered exempt beneficiaries under Kentucky law?

Exempt beneficiaries include the surviving spouse, parents, children (including stepchildren and adoptees), grandchildren, brothers, and sisters of the decedent. Educational, religious, or other charitable organizations, as well as cities, towns, or public institutions in Kentucky provided the transfer is for public purposes, are also considered exempt.

Is it necessary to file an Inheritance Tax Return if all assets pass to exempt beneficiaries?

No, it's not necessary to file an Inheritance Tax Return with the Kentucky Department of Revenue if all assets pass to exempt beneficiaries and a federal estate and gift tax return is not required. An Affidavit of Exemption is accepted for the final settlement and closing of the administration of an estate in such cases.

Where can I find the forms and instructions for the Kentucky Inheritance Tax Return?

Forms and instructions can be obtained from the Kentucky Department of Revenue's website, local Kentucky Department of Revenue offices, or by contacting the Department of Revenue directly. The packet includes forms for both no tax due returns and taxable returns, plus related schedules and instructions.

What information is needed to complete the Kentucky Inheritance Tax Return?

To complete the Kentucky Inheritance Tax Return, you'll need detailed information about the decedent's assets, beneficiaries, the value of the estate, and any deductions. Information on real estate valuation, terminable interest property, and previously taxed property might also be necessary, depending on the specifics of the estate.

Common mistakes

When it comes to estate planning and navigating the process of inheritance, filling out Kentucky's Inheritance Tax forms is a crucial step for many. However, this process can be complicated, and people often make crucial errors. Identifying and understanding these mistakes can save a lot of time, money, and frustration. Here are seven common mistakes people make when dealing with the Kentucky Inheritance Tax forms:

Not filing when required: Some individuals mistakenly believe they don't need to file an Inheritance Tax Return, especially if they think no tax is due. This error often stems from misunderstanding the requirements or the estate's tax liability, potentially leading to penalties.

Incorrectly determining beneficiary exemptions: The tax liability can significantly differ based on the beneficiary's relationship to the decedent. Misclassifying a beneficiary or misunderstanding exemption statuses can result in incorrect tax calculations.

Failing to include all taxable assets: An oversight in listing all assets, including those held in trust or joint ownership, can result in under-reported estate value and, subsequently, tax due. Remember, transparency is key in financial declarations.

Using the wrong form version: Laws and form requirements may change. Using outdated forms or instructions can lead to filing errors or even the rejection of the submission.

Miscalculating deductions: Properly accounting for debts, administration expenses, and other deductions is crucial for accurate tax calculation. Overlooking or double-dipping into deductions can attract scrutiny and penalties.

Ignoring fiduciary responsibilities: Executors or administrators handling the estate must understand their responsibilities, including the proper filing of tax forms. Neglecting these duties can complicate the estate’s tax matters further.

Delay in filing or payment: Timeliness is essential; late filings or payments can result in interest and penalties, increasing the estate’s financial burden.

To navigate the complexities of Kentucky's Inheritance Tax forms, it's wise to seek professional guidance. This ensures compliance, maximizes exemptions or deductions, and minimizes any potential legal or financial complications. Remember, understanding these common pitfalls is the first step toward a smoother inheritance process.

Documents used along the form

When dealing with the administration of an estate in Kentucky, especially concerning the Kentucky Inheritance Tax, several forms and documents often come into play. These are not just about taxes but encompass a range that helps in valuating assets, claiming exemptions, and more. Navigating through these documents can seem daunting, but each plays a vital role in ensuring compliance and facilitating the smooth execution of the estate's financial responsibilities.

- Real Estate Valuation Information Form (Form 92A204): This form is crucial for estates that include real estate assets. It helps in determining the fair market value of real property owned by the decedent at the time of death, which is essential for accurate tax calculation.

- Election to Qualify Terminable Interest Property and/or Power of Appointment Property (Form 92A936): This form is used when making an election under the Kentucky inheritance law for qualified terminable interest property and for property over which the decedent held a power of appointment. It’s a tactical decision that can influence the inheritance tax implications.

- Election to Defer the Payment of Inheritance Tax Through Installments (Form 92A928): In situations where paying the entire inheritance tax at once would be burdensome, this form allows the estate to request payment through installments. This can ease the financial strain on the estate or the beneficiaries.

- Affidavit of Exemption (Form 92A300): This is used when no inheritance tax is due, either because all assets are passing to exempt beneficiaries or because the total value of the estate does not meet the threshold that requires tax filing. This affidavit is a declaration of such exemptions.

- Federal Estate and Gift Tax Return (Form 706): Although this is a federal form, it is often required when dealing with larger estates. Submission of this form can affect the Kentucky Inheritance Tax, especially in determining the taxable estate after federal taxes have been accounted for.

- The Consent to Transfer Personal Property or Form 71A101: This form is needed when transferring personal property, such as vehicles or stocks that were owned by the decedent. It's a part of settling the estate and may involve tax considerations.

- Trust Agreement or Will Copies: While not forms, copies of the decedent’s trust agreement or will are often submitted along with the Kentucky Inheritance Tax forms to substantiate the transfer of assets as per the decedent’s wishes. These documents guide the distribution and taxation of the estate.

This compilation offers a roadmap for navigating through the documentation required in the process of settling an estate in Kentucky. While the task may seem complex, understanding the purpose and requirement of each form or document helps demystify the process, making it more manageable. Remember, each document is a piece to the puzzle that contributes to the complete and compliant execution of the estate's financial obligations.

Similar forms

The Federal Estate Tax Return (Form 706) shares similarities with the Kentucky Inheritance Tax form in terms of its purpose to declare the value of an estate for tax purposes. Both forms are used after an individual's death to assess the tax liabilities based on the value of the deceased person's estate. The Federal Estate Tax Return is used to determine the estate's obligation to the federal government, while the Kentucky form pertains specifically to the state's tax requirements.

Affidavit of Exemption for the Kentucky Inheritance Tax is akin to various other affidavit forms that are used in legal and financial contexts to assert a particular fact, such as the Small Estates Affidavit. This type of document is a sworn statement used when the assets of a deceased person do not exceed a certain value, rendering the estate exempt from formal probate or, in the case of the Kentucky Inheritance Tax, exempt from the tax itself due to the value or nature of the beneficiaries.

The Real Estate Valuation Form (Form 92A204) included with the Kentucky Inheritance Tax forms parallels the Real Property Appraisal Form often used in estate planning and property tax disputes. Both forms serve the purpose of establishing the value of real estate, which is critical for tax assessment and ensuring the correct tax amount is levied based on the property's current market value.

Installment Payment Agreements, akin to the Election to Defer Payment of Inheritance Tax Through Installments (Form 92A928), allow the taxpayer to make payments over time, rather than a lump sum. Such agreements are common in various tax contexts, including income and property tax, catering to individuals or entities that require a more manageable payment schedule due to financial constraints, ensuring compliance while alleviating immediate financial burden.

The QTIP (Qualified Terminable Interest Property) Election Form (Form 92A936) found in the Kentucky packet is similar to other QTIP election forms in estate planning that deal with federal taxes. Both are designed to take advantage of marital deductions while ensuring the surviving spouse benefits from the property during their lifetime, with the remainder going to specified heirs, thus providing flexibility in how estates are managed and taxed.

Blanket Consent Forms are commonly used in various legal and tax situations, mirroring the intent behind the Blanket Consent included with Kentucky's inheritance documents. These forms authorize a broad scope of actions or agreements without needing individual consents for each decision, streamlining processes such as the administration of estates or other complex arrangements requiring multiple levels of approval.

The No Tax Due Return (Form 92A201) shares its purpose with other tax declaration forms that confirm no tax liability, such as Nil Returns in sales tax or income tax contexts. These forms are necessary when certain criteria are met that exempt the filer from tax or when no taxable transactions have occurred within the reporting period, essentially serving as a formal declaration of a zero tax liability.

Amended Return Forms, mentioned as part of the Kentucky packet, are common in both state and federal tax practices. These forms allow taxpayers to correct or update previously submitted returns. Whether due to an oversight or the availability of new information, such forms ensure the accuracy of tax records and the proper assessment of taxes owed or refunds due.

Finally, forms related to the Reporting of Intangible Property, while not explicitly named in the Kentucky Inheritance Tax packet, are closely related to the process of valuing an estate's assets, including non-physical assets. These are parallel to securities valuation forms used in other contexts, where the worth of stocks, bonds, and other intangible assets needs to be accurately reported for tax assessment or financial disclosure purposes.

Dos and Don'ts

When filling out the Kentucky Inheritance Tax form, it's important to pay close attention to detail and ensure proper completion of the form to avoid complications. Below are some key do's and don'ts to keep in mind:

Do:- Double-check beneficiary classifications: Ensure beneficiaries are correctly classified as either exempt or taxable according to Kentucky law. Exempt beneficiaries typically include direct relatives like spouses, children, and parents, while others may fall under the taxable category. This classification affects whether the estate owes inheritance tax.

- Accurately list all assets: Include all assets within the estate, ensuring that valuations are fair and accurate. Real Estate Valuation Information Form (Form 92A204) may be required for real estate assets.

- Attach necessary documents: If the decedent had a will or trust, attach a copy to the tax form. Additionally, include a copy of the Federal Estate and Gift Tax Return if it was required or filed.

- Utilize the Correct Form: Choose the appropriate form based on the estate's specific circumstances—either the No Tax Due Return (Form 92A201) for estates passing to exempt beneficiaries without inheritance tax due, or the Inheritance Tax Return (Forms 92A200 or 92A205) for estates with taxable assets.

- Seek assistance if needed: Don't hesitate to contact the Kentucky Department of Revenue or a tax professional for guidance if you have questions or uncertainties about the process.

- Omit any assets or information: Failing to include all assets or necessary information can result in inaccuracies and potential penalties. Ensure every section is completed thoroughly.

- Send the Affidavit of Exemption to the Kentucky Department of Revenue: If filing an Affidavit of Exemption, submit it only with the court. This document is used when all assets pass to exempt beneficiaries, and no inheritance tax is due.

- Misclassify exemptions: Incorrectly claiming exemptions for beneficiaries not recognized as exempt under Kentucky law could lead to an inaccurate tax obligation.

- Ignore instructions on the forms: Each form and schedule has specific instructions that should be read carefully to ensure correct completion. Skipping these instructions can lead to errors.

- Delay filing beyond deadlines: Ensure the inheritance tax form is filed within the appropriate timeframe to avoid penalties and interest for late submissions.

Misconceptions

When dealing with the Kentucky Inheritance Tax form, it's easy to stumble upon misconceptions. These misunderstandings can make navigating inheritance and estate planning more confusing than it needs to be. Let's clear up some of the most common myths.

- Only heirs have to worry about it.

This statement misses the mark. While it's true that the inheritance tax affects heirs, the responsibility of filing the necessary forms often falls on the executor or administrator of the estate. This role involves ensuring that all tax obligations are met, which can include completing and submitting the correct forms to the Department of Revenue.

- Every estate must file a Kentucky Inheritance Tax Return.

This isn't always the case. As noted in the documents, if an estate's assets pass to exempt beneficiaries (such as a spouse, child, or charitable organization) and no Federal Estate and Gift Tax Return is required, an affidavit of exemption may be all that's needed. This simplifies the process significantly for many estates.

- Filing a Kentucky Inheritance Tax Return is always complicated.

This misconception can scare some people away from tackling this task. While tax matters can be complex, the Commonwealth of Kentucky provides forms with instructions, and in cases where the estate is passing to exempt beneficiaries, or when no tax is due, simplified procedures can be followed. This includes the option to file an Affidavit of Exemption instead of a full tax return.

- The same rules apply regardless of the decedent's residency.

Actually, the rules can vary significantly based on whether the decedent was a resident or nonresident of Kentucky at the time of death. The Kentucky Department of Revenue requires different forms depending on this status, and exemptions and tax rates may also vary. It’s crucial to understand the specific requirements for each situation.

- All assets are subject to the Inheritance Tax.

This is not necessarily true. The Kentucky Inheritance Tax acknowledges a range of exemptions, such as property passing to certain close relatives or to exempt organizations. Moreover, the valuation of assets, including deductions and allowable exemptions, can considerably reduce the taxable portion of an estate.

Understanding these nuances is essential for anyone handling an estate in Kentucky. By dispelling these myths, individuals can approach the process with clarity and confidence, ensuring that they meet their obligations without undue stress.

Key takeaways

Understanding the complexities involved in handling a decedent's estate in Kentucky, especially in regard to inheritance tax, is crucial for proper compliance and strategic planning. Below are key takeaways from the Kentucky Inheritance Tax form and guidelines that should help individuals navigate this delicate process.

- An Affidavit of Exemption may be filed instead of an Inheritance Tax Return if all assets pass to exempt beneficiaries under Kentucky law or if a Federal Estate and Gift Tax Return is not required due to the gross estate being below the IRS threshold.

- Exempt beneficiaries include the spouse, children, stepchildren, grandchildren, parents, brothers, and sisters of the decedent, as well as certain exempt organizations defined under the Kentucky Revised Statutes.

- The Inheritance Tax Return must be used if any assets of the estate pass to non-exempt beneficiaries. This requirement highlights the importance of understanding the relationship of each beneficiary to the decedent.

- There are three forms included for different scenarios: the No Tax Due Return (Form 92A201), the Inheritance Tax Return (Form 92A200), and the Inheritance Tax Return (Short Form) (Form 92A205), each designed to streamline the process based on the estate's specifics.

- The Affidavit of Exemption and No Tax Due Return are applicable only when the estate passes entirely to exempt beneficiaries or when no federal estate tax is due, simplifying the settlement for many estates.

- For estates that require the submission of an Inheritance Tax Return, detailed documentation and proper valuation of both real and personal property are essential. This includes understanding fair cash and agricultural value assessments for real estate.

- The Kentucky Department of Revenue's mission includes providing services in a fair, courteous, and efficient manner, and it does not discriminate based on race, color, religion, sexual orientation, or other such characteristics. This ethos should ideally extend to all interactions with them.

Ultimately, correctly handling the Kentucky Inheritance Tax forms and understanding beneficiary exemptions are vital steps in the estate administration process. These actions ensure compliance with Kentucky law and can potentially minimize the tax burden on the estate and its beneficiaries.

Popular PDF Documents

How to Calculate Trust Accounting Income - A crucial form for anyone inheriting assets, outlining their share of income and deductions to report on their tax return.

IRS Schedule 3 1040 or 1040-SR - This form helps taxpayers claim a variety of less common credits, reducing their tax liability more effectively.

W-9s - The clear instructions provided with the W-9S form ensure individuals can accurately provide their taxpayer information without needing specialized tax knowledge.