Get Jt 1 Arizona Tax Form

Embarking on a business journey in Arizona entails various preliminary steps, one of which is the completion of the Arizona Joint Tax Application, also known as form JT-1. This essential documentation serves as a gateway for businesses to register for Transaction Privilege Tax, Use Tax, as well as for Employer Withholding and Unemployment Insurance. It's a collaborative initiative between the Arizona Department of Revenue and the Department of Economic Security, underscoring its significance in the unified business registration process. Given its importance, precision in filling out the form is paramount; incomplete applications are not processed, potentially delaying the start or expansion of business operations. The form requires detailed business information, including the federal Employer Identification Number or Social Security Number, if operating as a sole proprietorship without employees, and specifics about the business type, ownership model, and the nature of taxable activities or merchandise sold. Furthermore, there are stipulations for certain business types, such as construction contractors who need to meet bonding requirements before obtaining a Transaction Privilege Tax license. Applicants are encouraged to utilize online resources for filing, not only for efficiency but also for security. It's a comprehensive process designed to streamline tax and employment-related obligations of businesses, ensuring compliance and support from the outset of their Arizona operations.

Jt 1 Arizona Tax Example

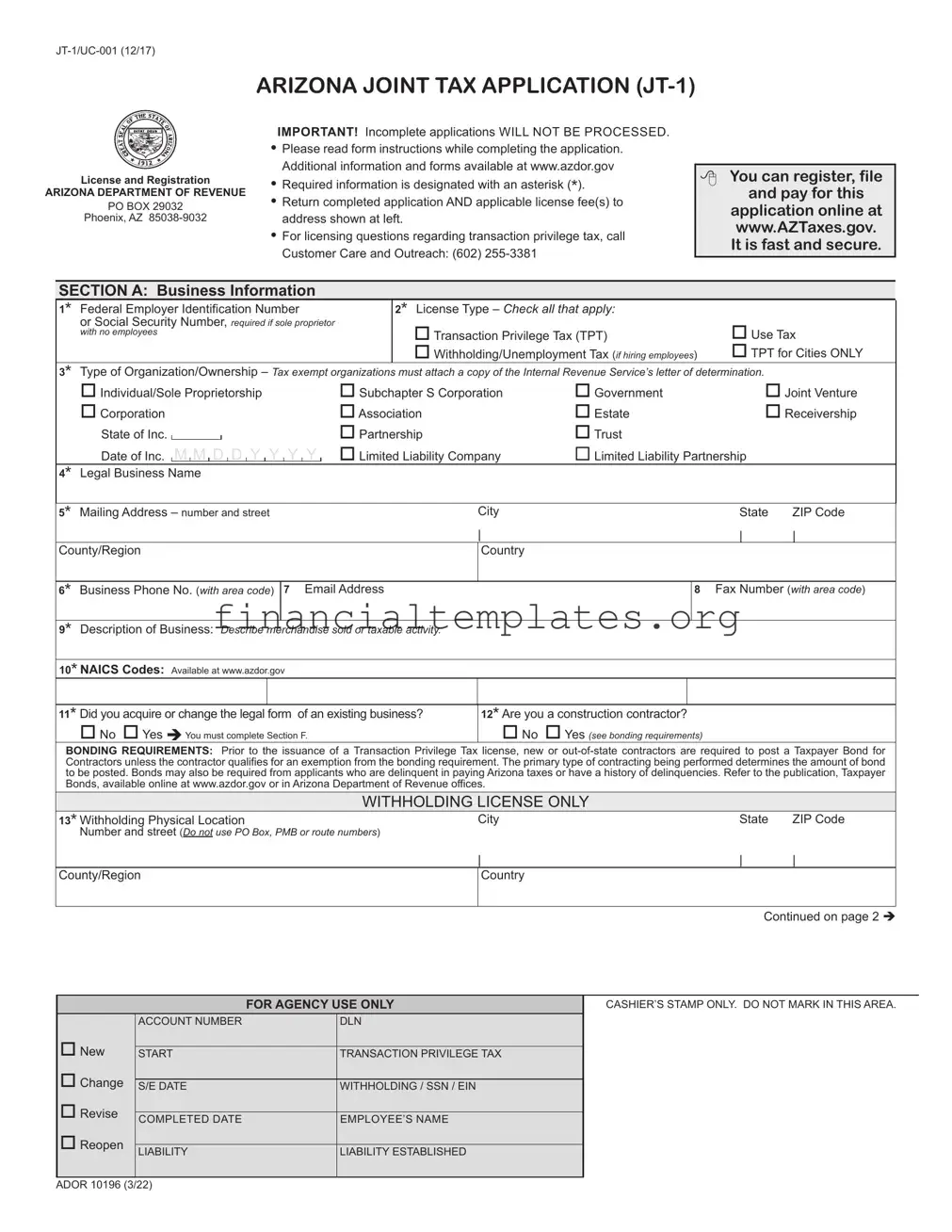

ARIZONA JOINT TAX APPLICATION

License and Registration

ARIZONA DEPARTMENT OF REVENUE

PO BOX 29032

Phoenix, AZ

IMPORTANT! Incomplete applications WILL NOT BE PROCESSED.

•Please read form instructions while completing the application. Additional information and forms available at www.azdor.gov

•Required information is designated with an asterisk (*).

•Return completed application AND applicable license fee(s) to address shown at left.

•For licensing questions regarding transaction privilege tax, call Customer Care and Outreach: (602)

You can register, file

and pay for this

application online at www.AZTaxes.gov. It is fast and secure.

SECTION A: Business Information

1* Federal Employer Identification Number

or Social Security Number, required if sole proprietor with no employees

2* License Type – Check all that apply: |

|

Transaction Privilege Tax (TPT) |

Use Tax |

Withholding/Unemployment Tax (if hiring employees) |

TPT for Cities ONLY |

3* Type of Organization/Ownership – Tax exempt organizations must attach a copy of the Internal Revenue Service’s letter of determination.

Individual/Sole Proprietorship |

Subchapter S Corporation |

Government |

Joint Venture |

||

Corporation |

Association |

Estate |

Receivership |

||

State of Inc. |

|

|

Partnership |

Trust |

|

Date of Inc. M M D D Y Y Y Y |

Limited Liability Company |

Limited Liability Partnership |

|

||

|

|

|

|

|

|

4* Legal Business Name

5* Mailing Address – number and street |

City |

State |

ZIP Code |

||||

|

|

|

| |

|

|

| |

| |

County/Region |

Country |

|

|

||||

|

|

|

|

|

|

|

|

6* Business Phone No. (with area code) |

7 Email Address |

|

|

8 |

Fax Number (with area code) |

||

|

|

|

|

|

|

|

|

9* Description of Business: Describe merchandise sold or taxable activity. |

|

|

|

|

|

||

|

|

|

|

|

|

||

10* NAICS Codes: Available at www.azdor.gov |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

11* Did you acquire or change the legal form of an existing business? |

12* Are you a construction contractor? |

|

|

||||

No Yes You must complete Section F. |

No Yes (see bonding requirements) |

|

|

||||

BONDING REQUIREMENTS: Prior to the issuance of a Transaction Privilege Tax license, new or

WITHHOLDING LICENSE ONLY

13* Withholding Physical Location |

City |

State |

ZIP Code |

Number and street (Do not use PO Box, PMB or route numbers) |

|

|

|

|

| |

| |

| |

County/Region |

Country |

|

|

|

|

|

|

Continued on page 2

FOR AGENCY USE ONLY

CASHIER’S STAMP ONLY. DO NOT MARK IN THIS AREA.

New

Change

Revise

Reopen

ACCOUNT NUMBER |

DLN |

|

|

START |

TRANSACTION PRIVILEGE TAX |

|

|

S/E DATE |

WITHHOLDING / SSN / EIN |

|

|

COMPLETED DATE |

EMPLOYEE’S NAME |

|

|

LIABILITY |

LIABILITY ESTABLISHED |

|

|

ADOR 10196 (3/22)

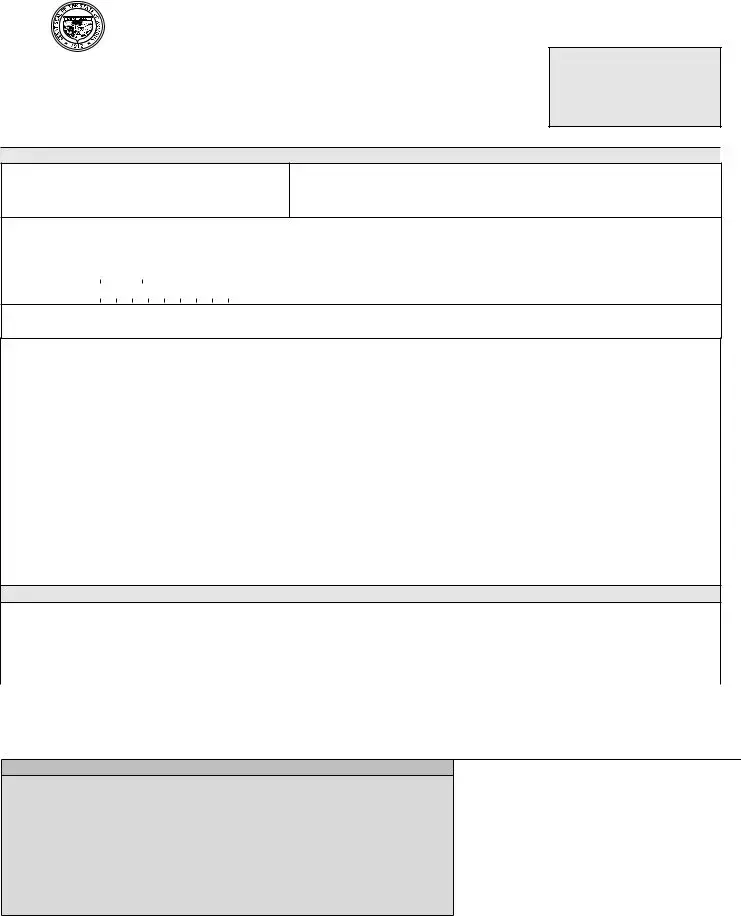

Name (as shown on page 1)

FEIN or SSN (as shown on page 1)

SECTION B: Identification of Owners, Partners, Corporate Officers Members/Managing Members or Officials of this Employing Unit

If you need more space, attach Additional Owner, Partner, Corporate Officer(s) form available at www.azdor.gov. If the owner, partners, corporate officers or combination of partners or corporate officers, members and/or managing members own more than 50% of or control another business in Arizona, attach a list of the businesses, percentages owned and unemployment insurance account numbers or provide a Power of Attorney (Form 285) which must be filled out and signed by an authorized corporate officer.

|

*Social Security No. |

|

*Title |

1 |

|

|

|

Owner |

*Street Address |

|

|

*ZIP Code |

|

*County |

|

|

|||

|

|

||

|

*Social Security No. |

|

*Title |

|

|

||

|

|

||

2 |

|

|

|

Owner |

*Street Address |

|

|

*ZIP Code |

|

*County |

|

|

|||

|

|

||

|

*Social Security No. |

|

*Title |

|

|

||

|

|

||

3 |

|

|

|

Owner |

*Street Address |

|

|

*ZIP Code |

|

*County |

|

|

|||

|

|

||

|

|

|

|

*Last Name |

First Name |

Middle Intl. |

||

| |

|

|

|

| |

*City |

|

|

*State |

* % Owned |

|

|

|

|

|

*Phone Number (with area code) |

|

*Country |

|

|

|

|

|

|

|

*Last Name |

First Name |

Middle Intl. |

||

| |

|

|

|

| |

*City |

|

|

*State |

* % Owned |

|

|

|

|

|

*Phone Number (with area code) |

|

*Country |

|

|

|

|

|

|

|

*Last Name |

First Name |

Middle Intl. |

||

| |

|

|

|

| |

*City |

|

|

*State |

* % Owned |

|

|

|

|

|

*Phone Number (with area code) |

|

*Country |

|

|

|

|

|

|

|

SECTION C: Transaction Privilege Tax (TPT)

1* Date Business Started in Arizona 2* Date Sales Began |

3 What is your Estimated Tax Liability for your first twelve months of business? |

|

M |

|

M |

|

D |

|

D |

|

Y |

|

Y |

|

Y |

|

Y |

M |

|

M |

|

D |

|

D |

|

Y |

|

Y |

|

Y |

|

Y |

|

|

|

||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

4 |

Filing Frequency Monthly |

Quarterly |

|

Seasonal Annual |

If seasonal filer, check the months for which you intend to do business: |

||||||||||||||||||||||||||||||

|

JAN FEB MAR |

APR MAY |

JUN JUL |

AUG |

SEP OCT NOV DEC |

||||||||||||||||||||||||||||||

5 |

Does your business sell tobacco products? |

|

6 |

TPT Filing Method |

|

7 |

Does your business sell new motor vehicle tires or vehicles? |

||||||||||||||||||||||||||||

|

Yes Retailer OR Distributor |

|

|

|

|

|

|

|

Cash Receipts |

|

|

Yes You will have to file Motor Vehicle Tire Fee form |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accrual |

|

|

available at www.azdor.gov |

||||||

8* Tax Records Physical Location – number and street |

|

|

|

|

|

|

City |

State ZIP Code |

|||||||||||||||||||||||||||

|

(Do not use PO Box, PMB or route numbers) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

County

9* Name of Contact

| |

| |

Country |

|

* Phone Number (with area code) |

Extension |

|

| |

SECTION D: Transaction Privilege Tax (TPT) Physical Location

1* Business Name, “Doing Business As” or Trade Name at this Physical Location

2* Phone Number (with area code)

3* Physical Location of Business or Commercial/Residential Rental |

City |

State |

ZIP Code |

Number and street (Do not use PO Box, PMB or route numbers) |

|

|

|

|

|

| |

| |

County/Region |

Country |

|

|

Residential Rental Only – Number of Units

Reporting City (if different than the physical location city)

4* Additional County/Region Indian Reservation/City: County/Region Indian Reservation and City Codes available at www.azdor.gov

County/ |

|

|

|

|

|

|

|

|

|

|

Region |

|

|

|

|

|

City |

|

|

|

|

Business Codes (Include all codes that apply): |

See instructions. Complete list available at www.azdor.gov |

|||||||||

State/ |

|

|

|

|

|

|

|

|

|

|

County |

|

|

|

|

|

City |

|

|

|

|

If you have more locations, attach Additional Business Locations form available at www.azdor.gov

ADOR 10196 (3/22) |

ARIZONA JOINT TAX APPLICATION |

Page 2 of 4 |

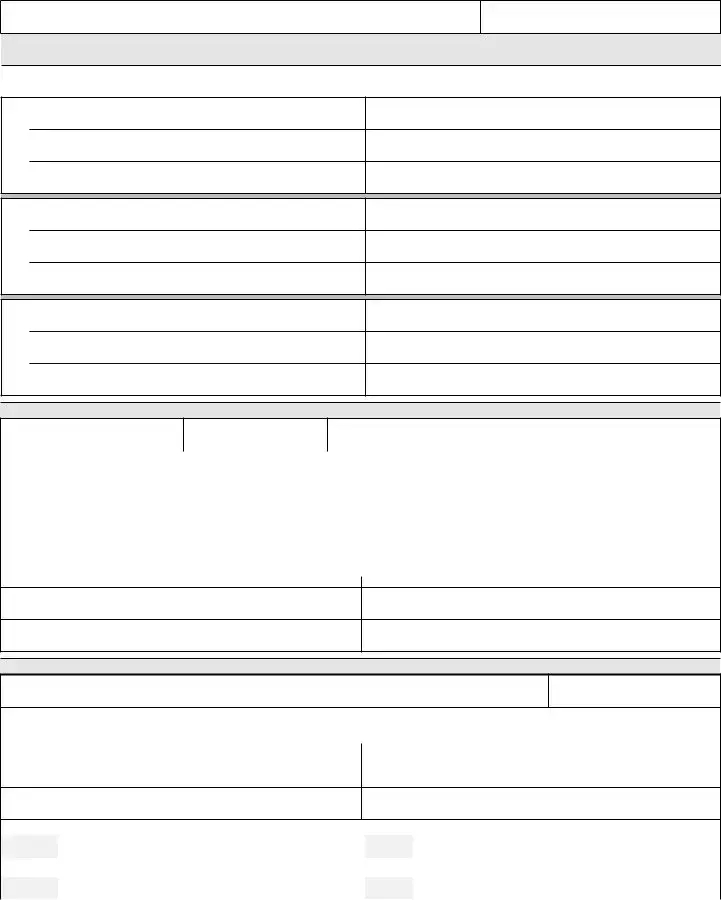

Name (as shown on page 1)

FEIN or SSN (as shown on page 1)

SECTION E: Withholding & Unemployment Tax Applicants

1* Regarding THIS application, Date Employees First Hired in Arizona |

2 |

Are you liable for Federal Unemployment Tax? |

||||||||||||

|

M M |

|

D D |

|

Y Y Y Y |

|

Yes First year of liability: Y |

|

Y |

|

Y |

|

Y |

|

|

|

|

||||||||||||

3 Are individuals performing services that are excluded from withholding |

4 |

Do you have an IRS ruling that grants an exclusion from |

||||||||||||

or unemployment tax? |

|

Federal Unemployment Tax? |

||||||||||||

Yes Describe services: |

|

Yes Attach a copy of the Ruling Letter. |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5Do you have, or have you previously had, an Arizona unemployment tax number?

|

No |

|

|

|

Unemployment Tax Number: |

||||

|

Yes Business Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

First calendar quarter Arizona employees were/will be hired and paid |

Hired Year |

Hired Quarter |

|

|

Paid Year |

Paid Quarter |

||

|

(indicate quarter as 1, 2, 3, 4): |

Y Y Y Y |

Q |

|

Y Y Y Y |

Q |

|||

|

|

|

|

||||||

7 |

When did/will you first pay a total of $1,500 or more gross wages in a calendar quarter? |

|

|

|

Year |

Quarter |

|||

|

(indicate quarter as 1, 2, 3, 4) |

|

|

|

|

|

|

|

|

|

|

|

|

Y Y Y Y |

Q |

||||

|

Exceptions: $20,000 gross cash wages Agricultural; $1,000 gross cash wages Domestic/Household; not applicable to 501(c)(3) |

|

|||||||

8 |

When did/will you first reach the 20th week of employing 1 or more individuals for some portion of a day in |

|

|

Year |

Quarter |

||||

|

each of 20 different weeks in the same calendar year? (indicate quarter as 1, 2, 3, 4) |

|

|

Y Y Y Y |

Q |

||||

|

Exceptions: 10 or more individuals Agricultural; 4 or more individuals 501(c)(3) |

|

|||||||

|

|

|

|

|

|

|

|

|

|

SECTION F: Acquired Business Information

If you answered “Yes” to Section A, question 11, you must complete Section F.

1* Did you acquire or change all or part of an existing business? |

2* |

|

Date of Acquisition |

3* EIN of Business Under Previous Owner |

||||||||||||||||||||||||||||

All |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part |

|

|

M |

|

M |

|

D |

|

D |

|

|

Y |

|

|

Y |

|

|

Y |

|

|

Y |

|

||||||||||

|

|

|

|

|

|

|||||||||||||||||||||||||||

4* Previous Owner’s Telephone Number |

5* Name of Business Under Previous Owner |

6* Name of Previous Owner |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7* Did you change the legal form of all or part of the Arizona operations of |

|

8* |

|

|

|

Date of Change |

9* EIN of Previous Legal Form |

|||||||||||||||||||||||||

your existing business? (e.g., change from sole proprietor to corporation or etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part |

|

|

M |

|

M |

|

D |

|

D |

|

Y |

|

Y |

|

Y |

|

Y |

|

||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION G: AZTaxes.gov Security Administrator

Visit www.AZTaxes.gov (the Arizona Department of Revenue’s online customer service center) to register for online services. The authorized individual will have full online access to transaction privilege, use, withholding and corporate tax account information and services. The authorized individual will be able to add or delete users and grant user privileges. Online services include viewing tax account information, filing tax returns, signing returns electronically with a

SECTION H: Required Signatures

This application must be signed by either a sole owner, at least two partners, managing member or corporate officer legally responsible for the business, trustee or receiver or representative of an estate that has been listed in Section B.

1 Print or Type Name

2 Print or Type Name

Title

Title

Date

Date

Signature

Signature

This application must be completed, signed, and returned as provided by A.R.S. §

Equal Opportunity Employer/Program

This application is available in alternative formats at Unemployment Insurance Tax Office.

PLEASE COMPLETE SECTION I: STATE/COUNTY & CITY LICENSE FEE WORKSHEET

TO CALCULATE AND REMIT TOTAL AMOUNT DUE WITH THIS APPLICATION.

ADOR 10196 (3/22) |

ARIZONA JOINT TAX APPLICATION |

Page 3 of 4 |

Name (as shown on page 1)

FEIN or SSN (as shown on page 1)

SECTION I: State/County & City License Fee Worksheet

ALL FEES ARE SUBJECT TO CHANGE. Check for updates at www.azdor.gov.

To calculate CITY FEE: Multiply No. of Locations by the License Fee and enter sum in License Subtotal.

|

|

|

No. of |

License |

License |

|

|

|

|

|

|

No. of |

License |

|

License |

|

|

No. of |

License |

License |

City/Town |

Code |

Loc’s |

Fee |

Subtotal |

City/Town |

|

Code |

Loc’s |

Fee |

|

Subtotal |

City/Town |

Code |

Loc’s |

Fee |

Subtotal |

||||

Apache Junction |

AJ |

|

$2.00 |

|

Goodyear |

|

|

|

GY |

|

$5.00 |

|

|

Sahuarita |

SA |

|

$5.00 |

|

||

Avondale |

AV |

|

$0.00 |

|

Guadalupe |

|

|

|

GU |

|

$2.00 |

|

|

San Luis |

SU |

|

$2.00 |

|

||

Benson |

BS |

|

$5.00 |

|

Hayden |

|

|

|

HY |

|

$5.00 |

|

|

Scottsdale |

SC |

|

$50.00 |

|

||

Bisbee |

BB |

|

$1.00 |

|

Holbrook |

|

|

|

HB |

|

$1.00 |

|

|

Sedona |

SE |

|

$2.00 |

|

||

Buckeye |

BE |

|

$2.00 |

|

Huachuca City |

|

HC |

|

$2.00 |

|

|

Show Low |

SL |

|

$2.00 |

|

||||

Bullhead City |

BH |

|

$2.00 |

|

Jerome |

|

|

|

JO |

|

$2.00 |

|

|

Sierra Vista |

SR |

|

$1.00 |

|

||

Camp Verde |

CE |

|

$2.00 |

|

Kearny |

|

|

|

KN |

|

$2.00 |

|

|

Snowflake |

SN |

|

$2.00 |

|

||

Carefree |

CA |

|

$10.00 |

|

Kingman |

|

|

|

KM |

|

$2.00 |

|

|

Somerton |

SO |

|

$2.00 |

|

||

Casa Grande |

CG |

|

$2.00 |

|

Lake Havasu |

|

|

LH |

|

$5.00 |

|

|

South Tucson |

ST |

|

$2.00 |

|

|||

Cave Creek |

CK |

|

$20.00 |

|

Litchfield Park |

|

LP |

|

$2.00 |

|

|

Springerville |

SV |

|

$5.00 |

|

||||

Chandler |

CH |

|

$2.00 |

|

Mammoth |

|

|

|

MH |

|

$2.00 |

|

|

St. Johns |

SJ |

|

$2.00 |

|

||

Chino Valley |

CV |

|

$2.00 |

|

Marana |

|

|

|

MA |

|

$5.00 |

|

|

Star Valley |

SY |

|

$2.00 |

|

||

Clarkdale |

CD |

|

$2.00 |

|

Maricopa |

|

|

|

MP |

|

$2.00 |

|

|

Superior |

SI |

|

$2.00 |

|

||

Clifton |

CF |

|

$2.00 |

|

Mesa |

|

|

|

ME |

|

$20.00 |

|

|

Surprise |

SP |

|

$10.00 |

|

||

Colorado City |

CC |

|

$2.00 |

|

Miami |

|

|

|

MM |

|

$2.00 |

|

|

Taylor |

TL |

|

$2.00 |

|

||

Coolidge |

CL |

|

$2.00 |

|

Nogales |

|

|

|

NO |

|

$0.00 |

|

|

Tempe |

TE |

|

$50.00 |

|

||

Cottonwood |

CW |

|

$2.00 |

|

Oro Valley |

|

|

|

OR |

|

$12.00 |

|

|

Thatcher |

TC |

|

$2.00 |

|

||

Dewey/Humboldt |

DH |

|

$2.00 |

|

Page |

|

|

|

PG |

|

$2.00 |

|

|

Tolleson |

TN |

|

$2.00 |

|

||

Douglas |

DL |

|

$5.00 |

|

Paradise Valley |

PV |

|

$2.00 |

|

|

Tombstone |

TS |

|

$1.00 |

|

|||||

Duncan |

DC |

|

$2.00 |

|

Parker |

|

|

|

PK |

|

$2.00 |

|

|

Tucson |

TU |

|

$20.00 |

|

||

Eagar |

EG |

|

$10.00 |

|

Patagonia |

|

|

|

PA |

|

$0.00 |

|

|

Tusayan |

TY |

|

$2.00 |

|

||

El Mirage |

EM |

|

$15.00 |

|

Payson |

|

|

|

PS |

|

$2.00 |

|

|

Wellton |

WT |

|

$2.00 |

|

||

Eloy |

EL |

|

$10.00 |

|

Peoria |

|

|

|

PE |

|

$50.00 |

|

|

Wickenburg |

WB |

|

$2.00 |

|

||

Flagstaff |

FS |

|

$20.00 |

|

Phoenix** |

|

|

|

PX |

|

$50.00 |

|

|

Willcox |

WC |

|

$1.00 |

|

||

Florence |

FL |

|

$2.00 |

|

Pima |

|

|

|

PM |

|

$2.00 |

|

|

Williams |

WL |

|

$2.00 |

|

||

Fountain Hills |

FH |

|

$2.00 |

|

Pinetop/Lakeside |

PP |

|

$2.00 |

|

|

Winkelman |

WM |

|

$2.00 |

|

|||||

Fredonia |

FD |

|

$10.00 |

|

Prescott |

|

|

|

PR |

|

$5.00 |

|

|

Winslow |

WS |

|

$10.00 |

|

||

Gila Bend |

GI |

|

$2.00 |

|

Prescott Valley |

PL |

|

$2.00 |

|

|

Youngtown |

YT |

|

$10.00 |

|

|||||

Gilbert |

GB |

|

$2.00 |

|

Quartzsite |

|

|

|

QZ |

|

$2.00 |

|

|

Yuma |

YM |

|

$2.00 |

|

||

Glendale |

GE |

|

$35.00 |

|

Queen Creek |

|

|

QC |

|

$2.00 |

|

|

|

|

|

|

|

|||

Globe |

GL |

|

$2.00 |

|

Safford |

|

|

|

SF |

|

$2.00 |

|

|

|

|

|

|

|

||

Subtotal City License Fees |

|

|

Subtotal City License Fees |

|

|

|

Subtotal City License Fees |

|

|

|||||||||||

|

|

(column 1) |

$ |

|

|

|

|

|

|

(column 2) |

$ |

|

|

|

(column 3) |

$ |

|

|||

AA TOTAL City License Fee(s) (column 1 + 2 + 3) |

|

|

|

|

|

|

|

|

|

|

$ |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fee per |

TOTAL |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No. of Loc’s |

Location |

|||

BB TOTAL State License Fee(s): Calculate by multiplying number of business locations by $12.00 |

|

$12.00 |

$ |

|

||||||||||||||||

|

Residential Rental License Fees - Only Chandler, Phoenix, and Scottsdale |

|

|

|

|

|

||||||||||||||

|

Multiply the number of units per locations by $2.00 ($50.00 Annual Cap per license). |

|

No. of Units |

No. of Loc’s |

City Fee |

|||||||||||||||

|

|

|

|

|

|

|

|

|

Residential Rental |

|

|

|

$ |

|

||||||

|

ONLY CHANDLER, PHOENIX, and SCOTTSDALE |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

should use this section. |

|

|

|

|

Residential Rental |

|

|

|

$ |

|

||||||||

|

DO NOT use the fee chart above to calculate license fees. |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

The amount for each city CANNOT EXCEED $50.00 |

|

Residential Rental |

|

|

|

$ |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

CC TOTAL City Residential Rental License Fees (Add Chandler, Phoenix, & Scottsdale) |

............................................................. |

|

|

|

$ |

|

||||||||||||||

DD TOTAL DUE (Add lines AA + BB + CC) |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|||||

•Make check payable to Arizona Department of Revenue.

•Include FEIN or SSN on payment.

•Do not send cash.

•License will not be issued without full payment of fee(s).

**If your only business is under Class 213, Commercial Lease, there is no license fee due.

ADOR 10196 (3/22) |

ARIZONA JOINT TAX APPLICATION |

Page 4 of 4 |

ARIZONA DEPARTMENT OF REVENUE

GENERAL INSTRUCTIONS FOR ARIZONA JOINT TAX APPLICATION

Online Application

Go to www.AZTaxes.gov

Notice for Construction Contractors: Due to bonding requirements, construction contractors are not permitted to license for transaction privilege tax online. For more information, please contact us.

Mailing Address

Arizona Department of Revenue

PO Box 29032

Phoenix, AZ

Customer Service

Center Locations

8:00 a.m. - 5:00 p.m.

Monday through Friday

(except Arizona holidays)

Phoenix Office

1600 W Monroe

Phoenix, AZ 85007

Tucson Office

400 W Congress

Tucson, AZ 85701

7:00 a.m. - 6:00 p.m.

Monday through Thursday

8:00 a.m. - 12:00 p.m.

Friday

(except Arizona holidays)

Mesa Office

55 N Center

Mesa, AZ 85201

(This office does not handle billing or account disputes.)

Customer Service

Telephone Numbers

Licensing for TPT, Withholding or Use Tax

(Arizona Department of Revenue)

(602)

Unemployment Tax

(Arizona Department of

Economic Security)

(602)

The Arizona Joint Tax Application

USE THIS APPLICATION TO:

License New Business: If you are selling a product or engaging in a service subject to transaction privilege tax, you will most likely need to obtain the state transaction privilege tax license (TPT) license.

Change Ownership: If acquiring or succeeding to all or part of an existing business or changing the legal form of your business (sole proprietorship to corporation, etc.).

IMPORTANT: To avoid delays in processing of your application, we recommend you read these instructions and refer to them as needed to ensure you have accurately entered all the required information. This application must be completed, signed, and returned as provided by A.R.S. §

Please read form instructions while completing the application. Additional information and forms are available at www.azdor.gov.

Required information is designated with an asterisk (*).

Please complete Section I: State/County & City License Fee Worksheet to calculate and remit Total Amount Due with this application.

Whencompletingthisform,pleaseprintortypeinblackink. Legible applications are required for accurate processing. The following numbered instructions correspond to the numbers on the Form

If you need to update a license, add a business location, get a copy of your license, or make other changes: Complete a Business Account Update form and include a State fee of $12 per location and any applicable fees related to locations within the City/Town jurisdictions. Additional information and forms are available at www.azdor.gov.

ADOR 10196 (3/22) |

Instructions Page 1 |

ARIZONA JOINT TAX APPLICATION |

INSTRUCTIONS |

Section A: BUSINESS INFORMATION

1.Provide your Federal Employer Identification No. (FEIN) or Social Security No. (SSN) if you are a sole proprietor without employees. Taxpayers are required to provide their taxpayer identification number (TIN) on all returns and documents. A TIN is defined as the federal employer identification number (EIN) or SSN, depending upon how income tax is reported. The EIN is required for all employers. A penalty of $5 will be assessed by the Department of Revenue for each document filed without a TIN.

2.License Type (Check all that apply):

Transaction Privilege Tax (TPT): Anyone engaged in a business taxable under the TPT statutes must apply for a TPT License before engaging in business. For TPT, you are required to obtain and display a separate license certificate for each business or rental location. This may be accomplished in one of the following ways:

Each location may be licensed as a separate business with a separate license number for purposes of reporting transaction privilege and use taxes individually. Therefore, a separate application is needed for each location.

Multiple locations may be licensed under a consolidated license number, provided the ownership is the same, to allow filing of a single tax return. If applying for a new license, list the various business locations as instructed below. If already licensed and you are adding locations, do not use this application to consolidate an existing license. Please submit a Business Account Update form, available at www.azdor.gov.

Withholding & Unemployment Taxes: Employers paying wages or salaries to employees for services performed in the State must apply for a Withholding number & Unemployment number.

Use Tax:

TPT for cities only: This type of license is needed if your business activity is subject to city TPT which is collected by the state, but the activity is not taxed at the state level.

3.Type of Organization/Ownership: Check as applicable. A corporation must provide the state and date of incorporation.

4.Provide the Legal Business Name or owner or corporation as listed in its articles of incorporation, or individual and spouse, or partners, or organization owning or controlling the business.

5.Provide the MailingAddress (number and street) where all correspondence is to be sent. You may use your

home address, corporate headquarters, or accounting firm’s address, etc. If mailing address differs for licenses (for instance withholding and unemployment insurance), please send a cover letter with completed application to explain.

6.Provide the Business Phone Number including the area code.

7.Provide the Email Address for the business or contact person.

8.Provide the Business Fax Number including the area code.

9.Provide the Description of Business by describing the major taxable business activity, principle product you manufacture, commodity sold, or services performed. Your description of business is very important and MUST link to the appropriate NAICS Code and Business Code.

10.Provide all North American Industries Classification System (NAICS) Code(s) that apply. The NAICS is identified for your business, based on your major business activity, principle product you manufacture, commodity sold, or services performed. You must indicate at least one NAICS code. A current listing is available at www.azdor.gov.

11.If you acquired or changed the legal name of an existing business, you must complete Section F of this application. If you check NO, proceed to number 12.

12.If you are a construction contractor, read bonding requirements and submit the appropriate bonding paperwork with this application. If you check NO, proceed to number 13.

13.Provide the Withholding Physical Location of the business. This address cannot be a PO Box or Route Number.

Section B: IDENTIFICATION OF OWNERS, PARTNERS, CORPORATE OFFICERS,

MEMBERS/ MANAGING MEMBERS OR

OFFICIALS OF THIS EMPLOYING UNIT

Provide the full name, social security number and title of all Owners, Partners, Corporate Officers, Members/ Managing Members or Officials of the Employing Unit. If you need additional space, attach Additional Owners, Partners, Corporate Officer(s) Addendum available at www.azdor.gov. If the owner, partners, corporate officers or combination of partners or corporate officers, members and/ or managing members own more than 50% of, or control another business in Arizona, attach a list of the businesses, percentages owned and unemployment insurance account numbers or provide a General Disclosure/ Power of Attorney (Form 285) which must be filled out and signed by an authorized corporate officer.

ADOR 10196 (3/22) |

Instructions Page 2 |

ARIZONA JOINT TAX APPLICATION |

INSTRUCTIONS |

Section C: TRANSACTION PRIVILEGE TAX (TPT)

1.Provide the Date Business Started in Arizona.

2.Provide the Date Sales Began in Arizona or estimate when you plan to begin selling in Arizona.

3.Tax Liability: Provide the amount of gross income you can reasonably expect to generate in your first twelve months of business. You will be set up for monthly filing unless your Estimated Tax Liability will result in a tax liability of less than $8,000, which will require you to file quarterly.

4.Based on your tax liability, provide your filing frequency. If your total estimated annual combined Arizona, county and municipal TPT liability is:

•Less than $2,000, you may file and pay annually.

•Between $2,000 and $8,000, you may file and pay quarterly.

•Otherwise, your transaction privilege taxes are due

monthly.

If your business is Seasonal or you are a transient vendor, indicate the months in which you intend to do business in Arizona.

5.Indicate whether your business sells tobacco products. If you checked yes, check the box to indicate if you are a retailer or distributor of tobacco products.

6.TPT Filing Method: Check which filing method your business uses for determining tax liability. Cash basis requires the payment of tax based on sales receipts actually received during the period covered on the tax return. When filing under the accrual basis the tax is calculated on the sales billed rather than actual receipts.

7.If you sell new Motor Vehicle Tires or Vehicles, you must file the Motor Vehicle Waste Tire Fee form

8.through 9. Tax Records Physical Location indicate the physical address where your tax records are located. Include the contact person’s name and phone number.

Section D: TRANSACTION PRIVILEGE TAX (TPT)

PHYSICAL LOCATION

1.Provide the Business Name, “Doing Business As” (DBA). DBA is the name of a business other than the owner’s name or, in the case of a corporation, a name that is different from the legal or true corporate name. If it is the same as the Legal Business Name enter “same”.

2.Provide the Business Phone Number including the area code.

3.Provide the Physical Location of the business. This address cannot be a PO Box or Route Number. Provide:

County/Region

Residential Rentals ONLY - Number of Units

Reporting City, if different from the Physical Location city. For example, if the location for the listed address

is listed in an adjacent city, such as Scottsdale, but the location of the business is actually within the city of Phoenix. See “TPT Rate Look Up” on www.AZTaxes.gov .

4.Provide if your business is located on an Indian Reservation; provide the Additional County/Region Indian Reservation Code(s). A current listing is available at www.azdor.gov.

Provide the Business Code(s) including all State and City Business Code(s) that apply; based on your major business activity, principle product you manufacture, commodity sold, or services performed. You must indicate at least one business code. A current listing is available at www.azdor.gov.

If you have more locations, attach Additional Business Locations form available at www.azdor.gov.

Section E: WITHHOLDING & UNEMPLOYMENT TAX

APPLICANTS

1.Provide the Date Employees First Hired in Arizona.

2.If you are liable for Federal Unemployment Tax, check YES and enter the first year of liability.

3.If individuals in your business are performing services that are excluded from withholding or unemployment tax, check YES and describe the services these individuals are performing.

4.If your business has an IRS ruling that grants an exclusion from Federal Unemployment Tax, check YES and you must attach a copy of the Ruling Letter to this application.

5.If you have, or previously had an Arizona unemployment tax number, check YES and provider the business name you used and the unemployment number.

6.Provide the first calendar quarter Arizona employees were or will be hired and paid.

7.When do you anticipate or did you first pay a total of $1,500 or more in gross wages in a calendar quarter? Indicate the year and quarter in which this occurred or will occur.

8.When do you anticipate or did you first reach the 20th week of employing 1 or more individuals for a full or partial day within the same calendar year? Indicate the year and quarter in which this occurred or will occur.

Section F: ACQUIRED BUSINESS INFORMATION

1.Did you acquire or change all or part of an existing business? If part, to obtain an unemployment tax rate based on the business’s previous account, you must request it no later than 180 days after the date of acquisition or legal form of business change; contact the Unemployment Tax Office Experience Rating Unit for an Application & Agreement for Severable Portion Experience Rating Transfer (form

ADOR 10196 (3/22) |

Instructions Page 3 |

ARIZONA JOINT TAX APPLICATION |

INSTRUCTIONS |

2.Provide the date you acquired the previous owner’s business or changed the legal form of your existing business (sole proprietor to corporate, etc.).

3.through 6. Complete as indicated if you know the previous owner’s information.

7.through 9. If you merely changed the legal form of your existing business, indicate whether or not you changed all or part of the business, the date of change and EIN of previous Legal Form of Business.

SectionG:AZTAXES.GOVSECURITYADMINISTRATOR

Visit www.AZTaxes.gov (the Arizona Department of Revenue’s online customer service center) to register for online services. The authorized individual will have full online access to transaction privilege, use, withholding and corporate tax account information and services. The authorized individual will be able to add or delete users and grant user privileges. Online services include viewing tax account information, filing tax returns, signing returns electronically with a

Section H: REQUIRED SIGNATURES

This application must be signed only by either a sole owner, at least two partners, managing member or corporate officer legally responsible for the business. This application CANNOT be signed by agents or representatives.

Section I: STATE/COUNTY & CITY LICENSE FEE

WORKSHEET

There are no fees for Withholding/Unemployment Insurance, or Use Tax registrations. State license fees are calculated per business location. To calculate the city license fees, use the listing of cities on page 4, Section I of this application. City fees are subject to change. Check for updates at www.azdor.gov.

AA: TOTAL City License Fees – To calculate the city fees, multiply No. of Locations in the city by the license fee and enter sum in Subtotal City License Fees. Then calculate and enter the sum of columns 1 + 2 + 3. If you have a location in Phoenix and the business is only under Class 213, Commercial Lease, there is no license fee due.

BB: TOTAL State License Fees – To calculate the state fees, multiply the No. of locations in the state by $12.

CC: TOTAL City Residential Rental License Fee –

USE THIS SECTION FOR CHANDLER, PHOENIX AND SCOTTSDALE ONLY. These cities WILL NOT use the larger fee chart. To calculate Residential Rental license fee, multiple the No. of units by the No. of locations by $2.00 ($50.00 Annual Cap per license). The amount for each city CANNOT EXCEED $50.00.

DD: TOTAL DUE – Add lines AA + BB + CC.

Please send your payment for this amount. Failure to include your payment with this application will result in a delay in processing your license. Licenses are not issued until all fees have been paid.

Make checks payable to the Arizona Department of Revenue. Be sure to return all pages of the application with your payment. Retain a copy of the application for your records.

DO NOT SEND CASH

Include your EIN or SSN on payment

ADOR 10196 (3/22) |

Instructions Page 4 |

ARIZONA JOINT TAX APPLICATION

State/County Business Codes

Codes |

Taxable Activities |

Codes |

Taxable Activities |

Codes |

Taxable Activities |

002 |

Mining - Nonmetal |

014 |

Personal Property Rental |

051 |

Jet Fuel Use Tax |

004 |

Utilities |

015 |

Contracting - Prime |

053/055 |

Rental Car Surcharge |

005 |

Communications |

017 |

Retail |

129 |

Use Tax Direct Payments |

006 |

Transporting |

019 |

Severance |

153 |

Rental Car Surcharge - Stadium |

007 |

Private (Rail) Car |

023 |

Recreational Vehicle Surcharge |

315 |

MRRA Amount |

008 |

Pipeline |

025 |

Transient Lodging |

911 |

911 Telecommunications |

009 |

Publication |

029 |

Use Tax Purchases |

912 |

E911 Prepaid Wireless |

010 |

Job Printing |

030 |

Use Tax from Inventory |

|

|

011 |

Restaurants and Bars |

033 |

Telecommunications Devices |

|

|

012 |

Amusement |

041 |

Municipal Water |

|

|

013 |

Commercial Lease |

049 |

Jet Fuel Tax |

|

|

City Business Codes

Codes |

Taxable Activities |

Codes |

Taxable Activities |

Codes |

Taxable Activities |

004 |

Utilities |

020 |

Timbering & Other Extraction |

116 |

Feed Wholesale |

005 |

Communications |

027 |

Manufactured Buildings |

144 |

Hotel/Motel (additional tax) |

|

|

|

|

|

Commercial Rental, Licensing |

006 |

Transporting |

029 |

Use Tax |

213 |

for Use |

|

|

|

|

|

Rental, Leasing and Licensing for |

009 |

Publication |

030 |

Use Tax from Inventory |

214 |

Use of Tangible Personal Property |

010 |

Job Printing |

037 |

Contracting - Owner Builder |

244 |

|

|

|

|

|

|

Commercial Lease (additional |

011 |

Restaurants and Bars |

040 |

Rental Occupancy |

313 |

tax) |

012 |

Amusement |

044 |

Hotels |

315 |

MRRA Amount |

015 |

Contracting - Prime |

045 |

Rental Residential |

|

|

016 |

Contracting Spec Builder |

049 |

Jet Fuel Tax |

|

|

017 |

Retail |

051 |

Jet Fuel Use |

|

|

|

|

|

Retail Sales Food for Home |

|

|

018 |

Advertising |

062 |

Consumption |

|

|

|

Severance - Metalliferous |

|

|

|

|

019 |

Mining |

111 |

Additional Restaurants & Bars |

|

|

ADOR 10196 (3/22)

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Identification | The form is known as JT-1/UC-001 and is used for applying for Transaction Privilege Tax, Use Tax, and Employer Withholding and Unemployment Insurance in Arizona. |

| Issuing Authority | This form is issued by the Arizona Department of Revenue and the Department of Economic Security. |

| Application Purpose | It serves to license new business activities, change ownership, or alter the legal form of existing businesses concerning state transaction privilege tax and related taxes. |

| Important Contact Information | For licensing questions regarding transaction privilege tax, Customer Care and Outreach can be contacted at (602) 255-3381. For Unemployment Tax queries, contact the Arizona Department of Economic Security at (602) 771-6602 or email uitstatus@azdes.gov. |

| Online Submission | Businesses can register, file, and pay for this application online at www.AZTaxes.gov, providing a fast and secure option for handling the application process. |

| Application Requirements | The form requires essential business information, including Federal Employer Identification Number or Social Security Number, business description, NAICS Codes, and information on business ownership and locations. |

Guide to Writing Jt 1 Arizona Tax

Filling out the JT-1 Arizona Tax Form is an essential step for conducting business within the state, particularly when it comes to taxation and employer responsibilities. This comprehensive document is designed to account for Transaction Privilege Tax, Use Tax, and Employer Withholding and Unemployment Insurance. The process may seem daunting at first, but breaking it down into manageable steps can simplify things. Below, you’ll find a streamlined guide to complete your JT-1 form efficiently and accurately.

Steps to Fill Out JT-1 Arizona Tax Form- Start with Section A: Business Information. Provide your Federal Employer Identification Number or Social Security Number if you’re a sole proprietor without employees.

- Check the appropriate box(es) under License Type that apply to your business operations. This could include Transaction Privilege Tax (TPT), Use Tax, Withholding/Unemployment Tax, or others as listed.

- Select the Type of Organization/Ownership that best describes your entity’s structure, such as Individual/Sole Proprietorship, Corporation, Partnership, etc.

- Enter your Legal Business Name and Mailing Address, including the city, state, ZIP code, and country if applicable. Ensure you complete the section about the county/region as well.

- Provide your Business Phone Number, Email Address, and Fax Number, ensuring clear communication channels are established.

- In the Description of Business section, briefly describe the merchandise sold or services provided that are taxable.

- Look up and enter the proper North American Industry Classification System (NAICS) Code that applies to your primary business activity.

- If applicable, indicate whether you have acquired or changed the legal form of an existing business, and if you’re a construction contractor, as there are specific sections related to these situations.

- Move on to Section B: Identification of Owners, Partners, Corporate Officers, providing details as instructed. If more space is needed, attach an additional form as instructed on the JT-1.

- Sections C through E focus on specifics about the Transaction Privilege Tax, the physical location of the business, withholding, and unemployment tax applicants. Fill these out in detail as they apply to your business operations.

- Complete Sections F if you answered "Yes" to acquiring or changing the form of an existing business, providing all necessary previous ownership information.

- In Section G, register for or provide information about your AZTaxes.gov Security Administrator.

- Ensure the appropriate party signs the document in Section H, with titles and dates provided next to signatures.

- Finally, fill out Section I, the State/County & City License Fee Worksheet, to account for all applicable fees required with this application. Double-check the totals, ensuring accurate payment.

- Review the entire application for accuracy and completeness. Send the completed application, along with the applicable license fee(s), to the address provided on the form.

By following these steps closely, you can navigate the JT-1 Arizona Tax Form more efficiently. Remember, this form is crucial for legal tax operations within Arizona, and its timely and accurate completion helps ensure compliance with state regulations.

Understanding Jt 1 Arizona Tax

-

What is the JT-1 Arizona Tax form used for?

The JT-1 Arizona Tax Form, also known as the Arizona Joint Tax Application, is primarily used for applying for Transaction Privilege Tax (TPT), Use Tax, and Employer Withholding and Unemployment Insurance. This form serves as a unified application for both the Arizona Department of Revenue and the Department of Economic Security.

-

Who needs to fill out the JT-1 form?

Businesses engaging in activities subject to the Transaction Privilege Tax (TPT) or services that require withholding and unemployment taxes need to complete the JT-1 form. This includes new businesses, those acquiring or taking over parts of existing businesses, or businesses changing their legal forms of operation.

-

How can one apply for the licenses mentioned in the JT-1 form?

You can apply for the required licenses by filling out the JT-1 form and submitting it to the Arizona Department of Revenue either by mail or online through the AZTaxes.gov website. However, construction contractors have specific bonding requirements and must contact the department directly for TPT licensing.

-

Can I submit the JT-1 form online?

Yes, you can register, file, and pay for the JT-1 application online at www.AZTaxes.gov. This platform is fast, secure, and recommended for a smoother application process. Note, construction contractors may face restrictions and should inquire directly for online capabilities.

-

What documents are necessary to complete the JT-1 form?

When filling out the JT-1 form, you will need your Federal Employer Identification Number (FEIN) or Social Security Number (if you are a sole proprietor without employees), business information including legal name and address, business description and NAICS codes, and information about any owners or partners. Tax-exempt organizations must attach the IRS's determination letter.

-

What sections are included in the JT-1 form?

The JT-1 form consists of several sections including Business Information, Identification of Owners/Partners/Officers, details specific to Transaction Privilege Tax (TPT) and Withholding & Unemployment Tax, information on acquired businesses, and instructions for registering with AZTaxes.gov for online services.

-

What are the fees associated with the JT-1 application?

Fees vary based on several factors such as the number of business locations and cities they operate in, the type of business, and specific city and county requirements. You will need to complete the State/County & City License Fee Worksheet included with the JT-1 form to calculate your total fees due. Remember to check for fee updates on www.azdor.gov.

-

How long does it take to process the JT-1 form?

Processing times can vary. To ensure a quicker processing time, ensure your application is complete, accurate, and includes all the necessary documentation and payment for fees. Incomplete applications will not be processed. You may contact Customer Care and Outreach at the Arizona Department of Revenue for specific inquiries regarding processing times.

-

Where should I send my completed JT-1 form?

The completed JT-1 form, along with any applicable fees, should be mailed to the Arizona Department of Revenue at the address provided on the form: P.O. Box 29032, Phoenix, AZ 85038-9032. Alternatively, when applicable, the form and payment can be submitted online at www.AZTaxes.gov.

Common mistakes

Filling out the JT-1 Arizona Tax form is crucial for businesses in Arizona, but there are common mistakes that can delay the process. Being aware of these errors can help ensure your application is processed efficiently. Here are six mistakes to avoid:

- Not providing all required information marked with an asterisk (*). This includes everything from your Federal Employer Identification Number or Social Security Number if you're a sole proprietor to your business description and NAICS codes.

- Overlooking the need to check appropriate boxes for License Type, particularly if your business will be dealing with Transaction Privilege Tax (TPT), Use Tax, Withholding/Unemployment Tax, or TPT for Cities Only.

- Failing to accurately state your Type of Organization/Ownership. Tax-exempt organizations, for instance, must provide a copy of the Internal Revenue Service’s letter of determination.

- Omitting bonding information for new or out-of-state contractors, which is a crucial step for businesses in the construction sector. Not adhering to bonding requirements can lead to application denial.

- Incorrectly completing Section E for Withholding & Unemployment Tax Applicants, especially regarding dates of employment and tax liabilities. This can significantly affect your business operations and compliance with Arizona law.

- Miscalculating or not correctly filling out the State/County & City License Fee Worksheet in Section I. This can result in either an underpayment or overpayment of fees.

These mistakes not only delay the processing of your JT-1 Arizona Tax form but can also lead to a rocky start for your business compliance. Double-checking your form before submission can save a lot of time and hassle.

It is also recommended to visit www.azdor.gov for additional information, updates, and to ensure that all the required documentation is in order for your application.

Documents used along the form

When individuals and businesses set out to complete the Arizona Joint Tax Application (JT-1), they're embarking on an important step to ensure compliance with state and local tax obligations. Alongside this pivotal document, several other forms and documents often come into play, each serving a distinct purpose in the broader spectrum of tax and employment regulation. Understanding these forms can help to streamline the process, ensuring that all necessary legal and procedural bases are covered.

- Form 285 - Power of Attorney: This form grants another individual the authority to represent you before the Arizona Department of Revenue. It's crucial when you cannot handle tax matters personally.

- Employer Identification Number (EIN) Application: Obtained from the IRS, this document is not specific to Arizona but is a prerequisite for the JT-1 if you're registering a new business or hiring employees.

- Transaction Privilege Tax Exemption Certificate (Form 5000): This form is necessary for businesses that purchase goods for resale. It allows them to buy items without paying sales tax at the point of purchase.

- Business Account Update Form: This document is used to report any changes to your business information, including adding or closing locations or changing your business name or address.

- Unemployment Tax and Employer Quarterly Wage Reporting Form (UC-018): This is necessary for reporting quarterly wages and calculating unemployment insurance tax for employees, a requirement if your business hires employees.

- License Fee Worksheet: This worksheet, found within the JT-1 booklet, helps calculate the total amount due for state, county, and city license fees based on the number and type of business locations.

- Application for Arizona Withholding Number: This form is for businesses that need to withhold taxes from employees' wages. It is a critical step in managing your payroll tax responsibilities.

- Taxpayer Bond for Contractors: A prerequisite for contractors needing a Transaction Privilege Tax license, ensuring compliance with the state's bonding requirements.

- Additional Business Locations Form: For businesses operating in more than one location, this form allows them to register additional sites under their existing tax account.

The nuanced pathway of tax compliance involves a network of forms and processes that go beyond the initial JT-1 application. Furnishing accurate details and staying abreast of associated requirements not only facilitates smoother interactions with state departments but also furthers a culture of responsible and informed business operation. Whether you're a new entrepreneur in Arizona or looking to adjust to new circumstances, these documents form the cornerstone of a well-managed business's regulatory obligations.

Similar forms

The Arizona Joint Tax Application (JT-1) shares similarities with several other tax and business registration documents across the United States due to its comprehensive nature in registering for multiple tax responsibilities and business information with state agencies. A key parallel document is the IRS Form SS-4, used to apply for an Employer Identification Number (EIN). Both forms are foundational steps for new businesses, with the JT-1 focusing on state-level tax obligations in Arizona and the SS-4 serving as a federal requirement for tax identification.

Another related document is the State Business License Application found in various states, which similarly requires businesses to register before operating. Like the JT-1, these state applications typically collect detailed information about the business, including the legal structure, type of business activity, and owner information. However, the JT-1 is unique to Arizona and combines tax registrations for multiple taxes into one application.

Form UC-001, often used for Unemployment Insurance (UI) Tax registration, mirrors the JT-1 in its section for Withholding & Unemployment Tax Applicants. Both forms collect employer and business information to establish accounts for unemployment tax purposes, but the JT-1 is distinctive in combining this with other tax registrations.

Similar to the JT-1, the Uniform Sales & Use Tax Certificate - Multijurisdiction, facilitates a streamlined process for businesses to register for sales and use taxes across multiple states. While the Multijurisdiction form allows for use in various states, the JT-1 is specific to Arizona, incorporating the state's Transaction Privilege Tax and use tax within one document.

The Business License, LLC, or Corporate Filings commonly required by state and local governments also have similarities to the JT-1. These filings include registering the business entity and applying for a business license. However, the JT-1 specifically incorporates tax registration aspects alongside the business information gathering, which may not be the case with all state-specific business filing procedures.

Employer's Quarterly Federal Tax Return (IRS Form 941) is another document related to the JT-1, as both involve reporting related to employment. While the Form 941 is focused on federal tax withholdings and FICA taxes quarterly, the JT-1 includes sections pertaining to both Withholding Tax and Unemployment Insurance as part of the initial tax and business registration in Arizona.

The Application for Registration under the Controlled Substance Act of 1970 (DEA Form 224) shares a nominal similarity with the JT-1 due to the necessity of registering before starting certain types of business activities. However, the DEA Form 224 is specific to businesses in the pharmaceutical field dealing with controlled substances, whereas the JT-1 addresses a broader range of businesses for tax purposes.

Lastly, the Local Business Tax Receipt (LBTR) applications, required by many local governments for businesses operating within their jurisdictions, resemble the JT-1 in that they are both prerequisites for business operation. While LBTRs focus more on granting permission to operate at the municipal level, the JT-1 facilitates state tax registrations and business information recording in one consolidated application.

Dos and Don'ts

When filling out the JT-1 Arizona Tax form, it is important to carefully follow the instructions and provide accurate information to avoid processing delays. Below are things you should and shouldn't do to ensure your application is completed correctly.

- Do read the form instructions thoroughly before and while completing the application to avoid mistakes.

- Do use black ink if filling out the form by hand to ensure legibility.

- Do provide all required information marked with an asterisk (*) to avoid incomplete application issues.

- Do visit www.azdor.gov or www.AZTaxes.gov for additional information, forms, publications, and online services.

- Do fill out the State/County & City License Fee Worksheet in Section I accurately to calculate the total amount due.

- Don't leave any fields blank. If a question does not apply, indicate with "N/A" (Not Applicable).

- Don't use PO Box, PMB, or route numbers for the physical location addresses required in the form.

- Don't send cash for payment of fees. Make checks payable to Arizona Department of Revenue and include the FEIN or SSN on the payment.

- Don't forget to sign the application. It needs to be signed by a legally responsible individual such as a sole owner, managing member, corporate officer, etc.

By following these guidelines, you can ensure a smoother processing of your JT-1 Arizona Tax form. Remember, an accurately and fully completed form helps in faster processing and avoids unnecessary delays.

Misconceptions

There are several common misconceptions about the JT-1 Arizona Tax Form, also known as the Arizona Joint Tax Application. Correcting these misunderstandings is crucial for businesses to ensure they comply with state tax laws and regulations. Here are eight misconceptions and their true explanations:

- Online Registration is Optional: Many believe that registering via www.AZTaxes.gov is just an alternative to paper registration. However, online registration is highly encouraged for its efficiency, security, and speed in processing.

- Application is Only for New Businesses: The JT-1 form isn't just for new business entities. It's also required when a business changes ownership or undergoes a change in its legal structure.

- All Businesses Must Pay a License Fee: While most businesses are subject to licensing fees, specific types, like those under Class 213 for Commercial Lease, may be exempt. Always check the current fee structure as it applies to your business specifics.

- One Size Fits All: Some assume the JT-1 form covers all tax registrations needed for a business. In reality, this form applies to Transaction Privilege Tax, Use Tax, and Employer Withholding and Unemployment Insurance but may not cover all industry-specific tax obligations.

- No Urgency in Completion: There's a misconception that since many businesses operate without immediate intervention from the Arizona Department of Revenue, completing the JT-1 lacks urgency. Timely registration is crucial to avoid penalties and ensure business operations are legally compliant.

- Construction Contractors Can Register Online: Due to specific bonding requirements, construction contractors cannot use the online registration process for transaction privilege tax licensing and must apply through other means provided by the Arizona Department of Revenue.

- Application is Only for Transaction Privilege Tax (TPT) License: The JT-1 form indeed is used to apply for a TPT License. However, it is also utilized for registering for Use Tax, Withholding Tax, and Unemployment Insurance, making it a comprehensive tax application form for many business needs.

- Information Provided Can Be Approximate: Some believe that approximate information is sufficient when filling out the JT-1 form. In truth, accuracy is paramount as this information affects tax liability, compliance, and contact details used by the Arizona Department of Revenue and the Department of Economic Security.

Understanding these misconceptions and ensuring accurate completion of the JT-1 Arizona Tax Form can help businesses smoothly navigate tax regulations and maintain compliance. It's advisable for business owners to consult the form's instructions and seek clarification from the Arizona Department of Revenue when in doubt.

Key takeaways

Filling out and using the JT-1 Arizona Tax form, a comprehensive document designed for the registration of several tax responsibilities in Arizona, requires attention to detail and an understanding of its various sections. Businesses operating within Arizona territory navigate through requirements that ensure compliance with state tax laws, specifically focusing on transaction privilege tax (TPT), use tax, and employer withholding and unemployment insurance. To assist in this process, here are four key takeaways:

- Complete and accurate information is critical. The JT-1 form mandates specific details marked with an asterisk (*), indicating mandatory fields that must be filled. Providing accurate, legible, and complete information across all applicable sections ensures efficient processing and avoids delays or rejection. In particular, sections relating to business information, tax details, and any applicable bond requirements demand careful attention.

- Understanding the scope of required licensing is essential. The form caters to multiple tax liabilities, including transaction privilege tax (TPT) and use tax, alongside employer obligations for withholding and unemployment tax. Each license type checked applies different sections of the form, which must be completed accurately. For example, construction contractors must navigate specific bonding requirements, reflecting the tailored approach the form takes to different business activities.

- Online registration offers a streamlined alternative. While the paper JT-1 form is comprehensive, Arizona provides an online platform, AZTaxes.gov, which facilitates a faster, more secure way to register, file, and remit payments. However, construction contractors should note the bonding requirements must be addressed directly, as the online system does not permit licensing for transaction privilege tax in their case.

- Fee calculation and payment are critical final steps. Section I on page 4 of the form requires careful completion to determine the total amount due, encompassing state, county, and city license fees. These fees vary based on the number of business locations and specific city rates, including separate calculations for residential rental license fees in particular jurisdictions. Accurate calculation and timely payment of these fees ensure the issuance of the necessary licenses without delay.

By adhering to these guidelines, businesses can navigate the complexities of tax registration through the JT-1 Arizona Tax form more effectively. This ensures compliance with Arizona tax laws, securing the necessary licenses to operate lawfully within the state. Attention to detail, along with an appreciation for the specific requirements of each tax and license type, streamlines this essential administrative process.

Popular PDF Documents

How to Get Your Bank Statement Online - The form's comprehensive approach ensures that every aspect of your financial life is considered in the bank's credit decision process.

Form 4506 - The 4506 form is a tool for taxpayers to retrieve documentation for audits and tax resolution services.

Formulario 1028 - The cooperative sector receives a boost with the BIR's streamlined guidelines for tax exemption, encouraging compliance and ensuring these organizations can focus more on their core mission rather than bureaucratic hurdles.